Without Goods and Services Tax (GST)

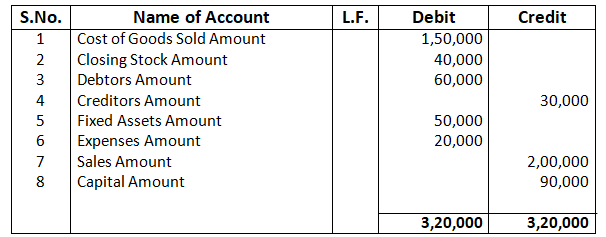

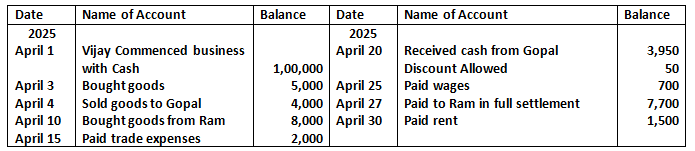

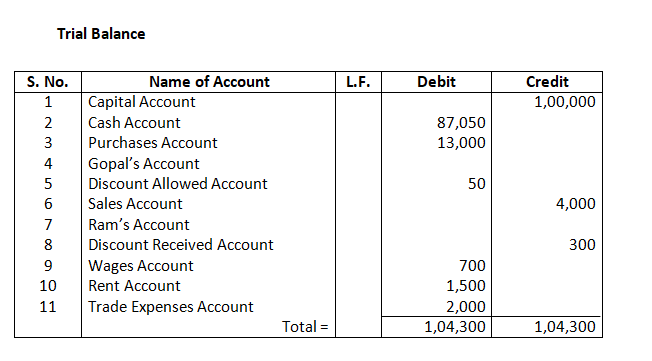

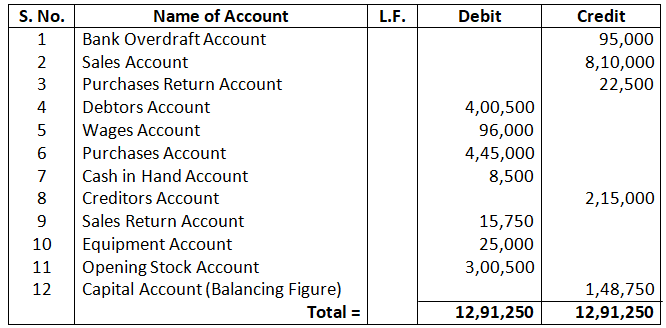

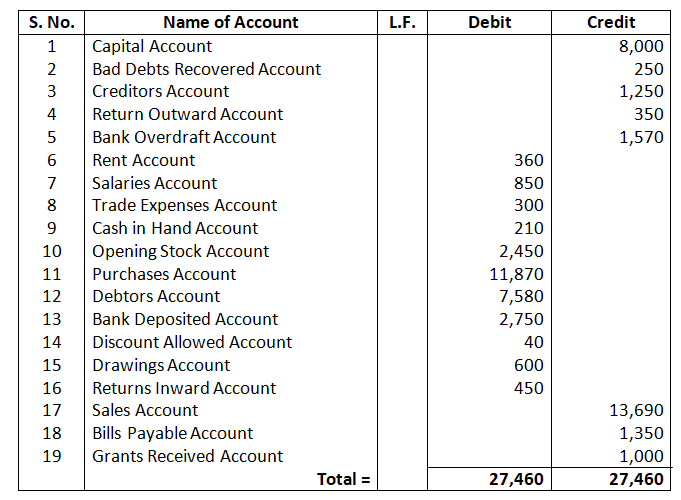

Q1. Prepare a Trial Balance with the following information:

Solution-

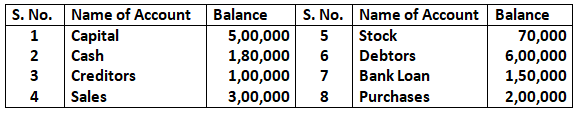

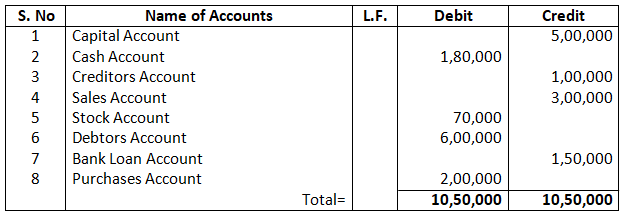

Q2. From the following ledger balances, prepare Trial Balance:

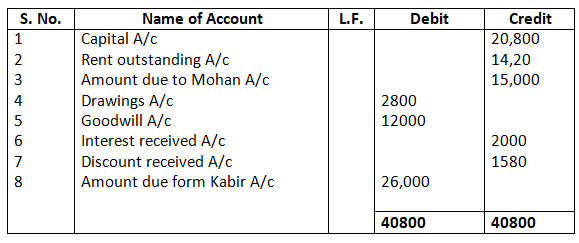

Capital Rs.20,800; Rent outstanding Rs.1,420; Amount due to Mohan Rs.15,000; Drawings Rs.2,800; Goodwill Rs.12,000; Interest received Rs.2,000; Discount received Rs.1,580; Amount due from Kabir rs.26,000.

Solution:-

Trial Balance

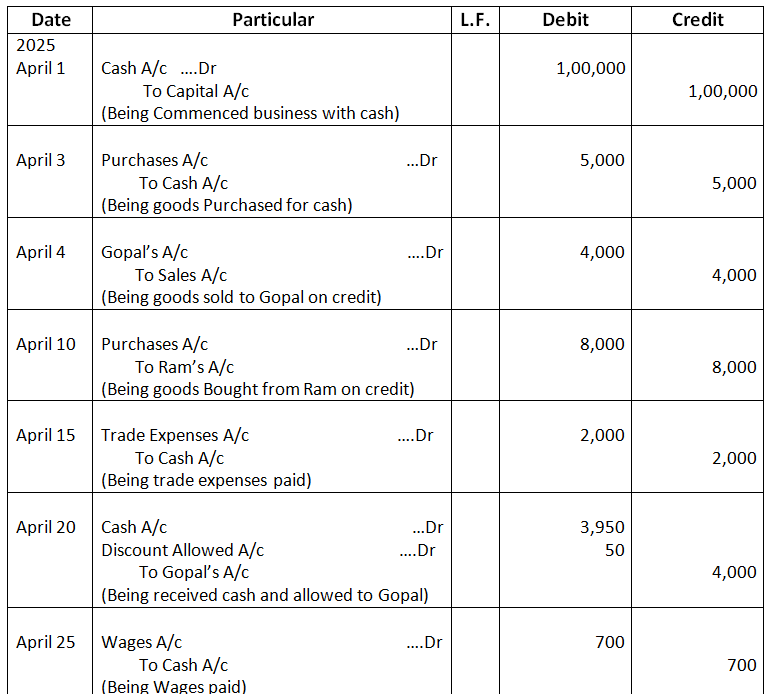

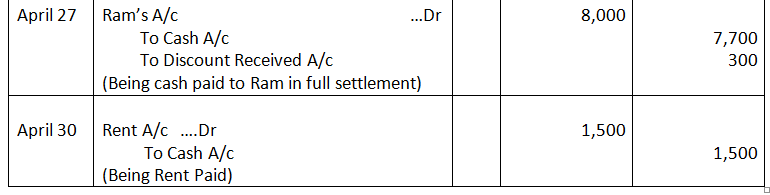

Q3. Journalise the following transactions, post them into Ledger and Prepare a Trial Balance:

Solution – Following are the Journal Entries

Books of Mohan

Journal

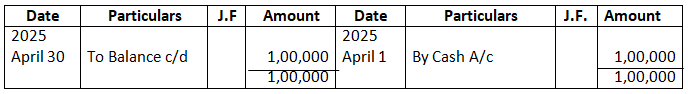

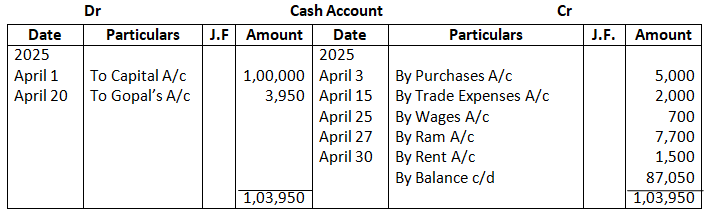

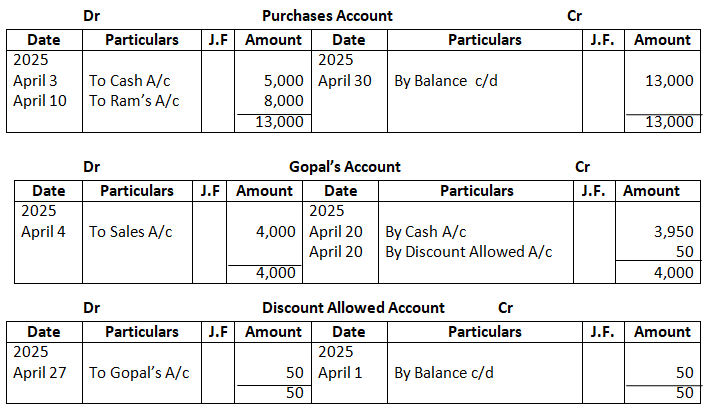

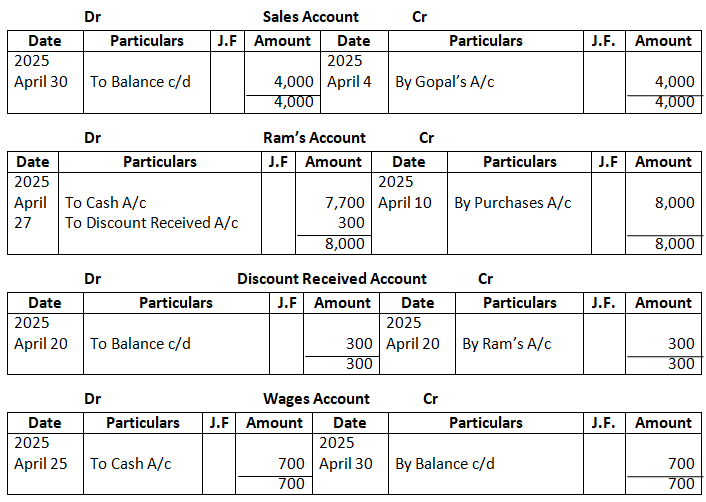

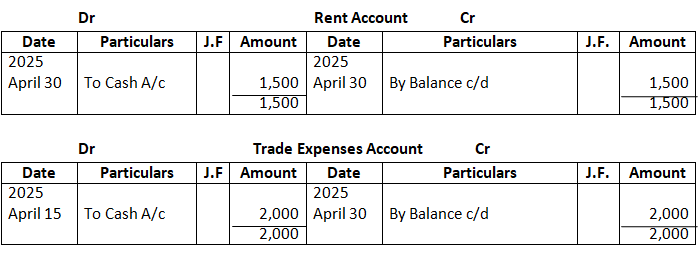

Ledger

Dr Capital Account Cr

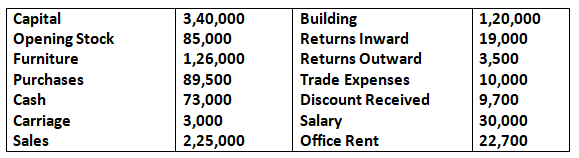

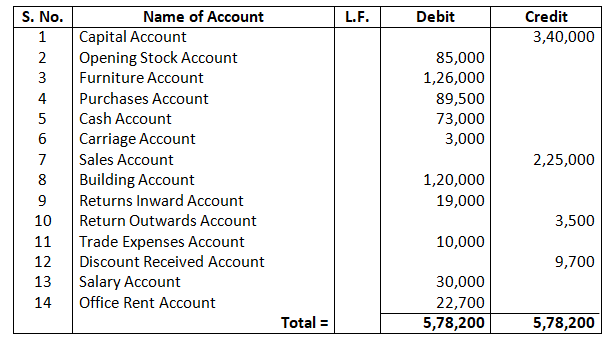

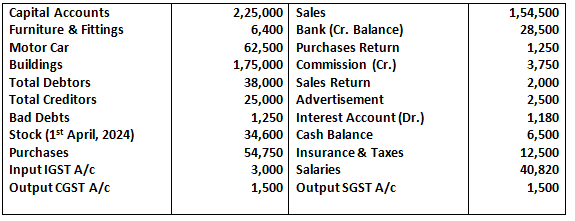

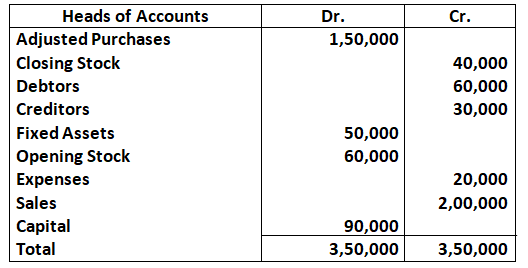

Q4. Prepare a Trial Balance from the following items:

Solution– Trial Balance

As on March 31, 2025

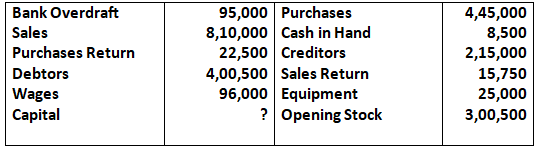

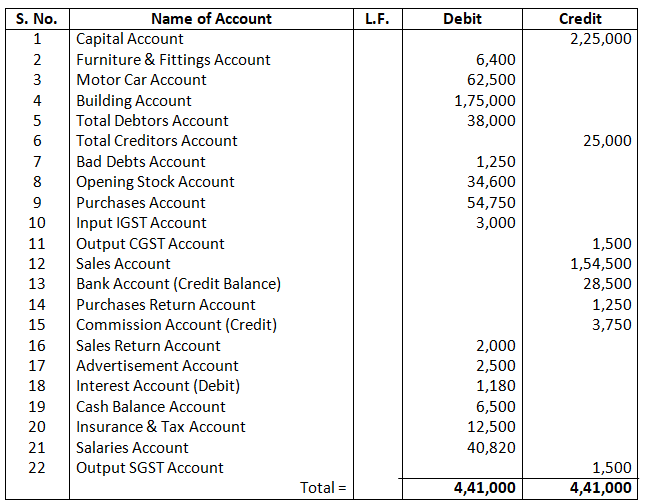

Q5. Prepare the Trial Balance of Mahesh as on 31st March, 2025. He has omitted to open a Capital Account:

Solution – Trial Balance of Ankit

As on March 31, 2025

With Goods and Services Tax (GST)

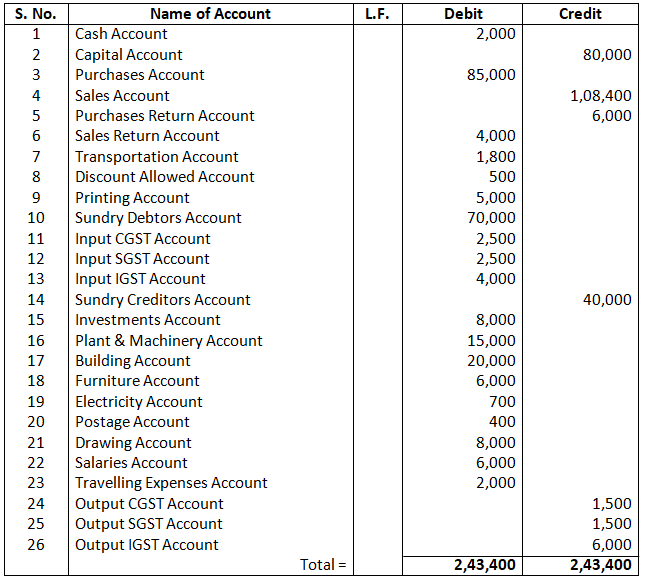

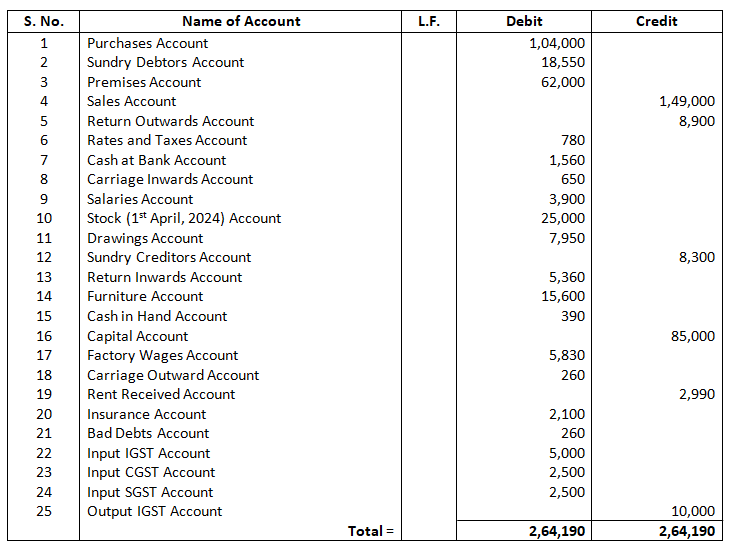

Q6. Form the following information, prepare Trial Balance of Gurman for the year ended 31st March, 2025:

Solution:-

Trial Balance of M/s. Gurman

As on March 31, 2025

Q7. Following are the balances extracted from the books of Arvind. Prepare Trial Balance as on 31st March, 2025:

Solution –

Trial Balance of Arvind

As on March 31, 2025

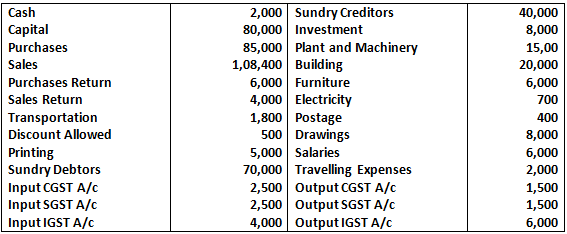

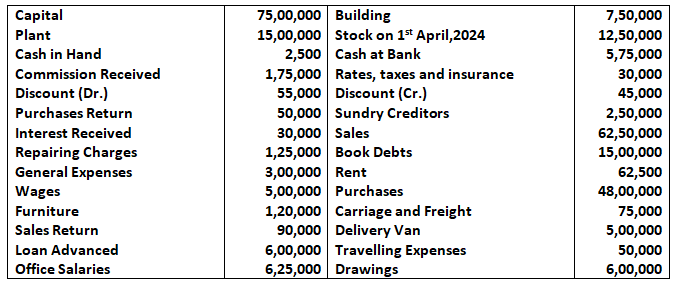

Q8. From the following balances extracted from the Ledger of Nagrath, prepare Trial Balance as on 31st March, 2025:

Solution –

Trial Balance of Nagrath

As on March 31, 2025

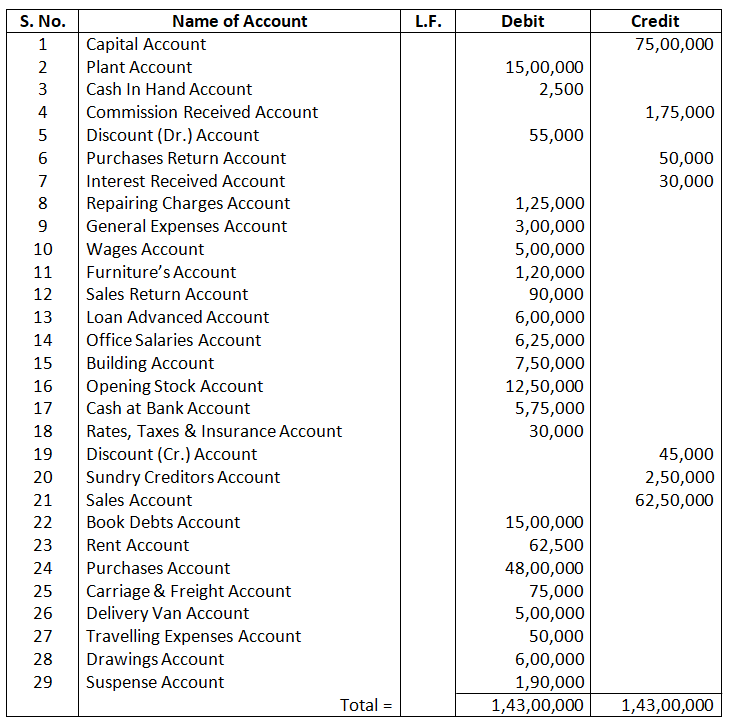

Q9. From the following Ledger account balances extracted from the books of Shivam, prepare a Trial Balance as on 31st March, 2025:

Solution – Trial Balance of Shivam

As on March 31, 2025

Redrafting of a Trial Balance

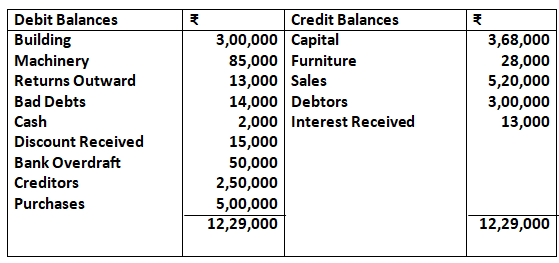

Q10. Following Trial Balance is given but it is not correct. Prepare correct Trial Balance.

Solution – Trial Balance

As on March 31, 2025

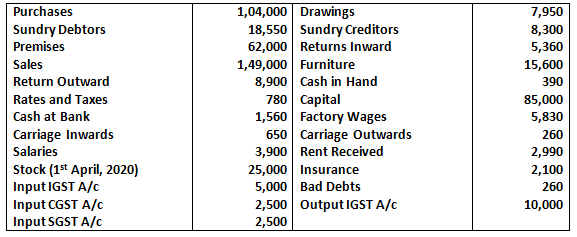

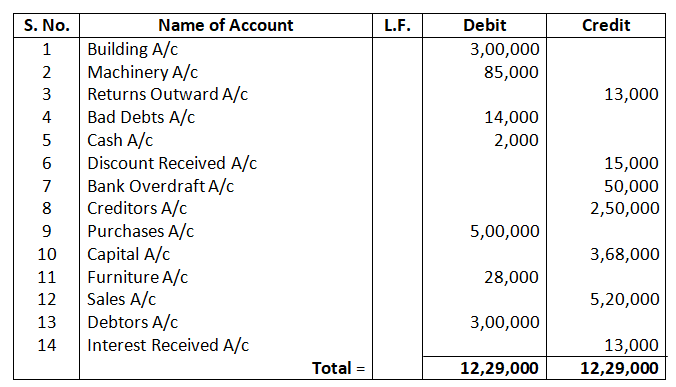

Q11. Redraft correctly the Trial Balance given below:

Solution – Trial Balance

As on March 31, 2025

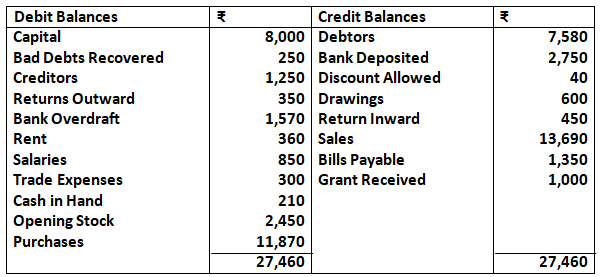

Q12. Prepare correct Trial Balance from the following Trial Balance in which there are certain mistakes:

Solution – Trial Balance

As on March 31, 2025