One sided Errors

Q.1 Rectify the following errors identified in the

- Sales Book of March is undercast by Rs.15,000.

- Purchases Book is overcast by Rs.10,000.

- Rs.5,000 written off as depreciation on machinery was not debited to Depreciation account.

- Sales of goods to Vijay for Rs.500 was posted to the wrong side of his account.

- Sale of good to Rajesh for Rs.3,300 has been omitted to be posted to his account.

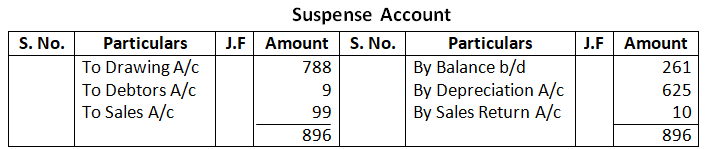

Solution:-

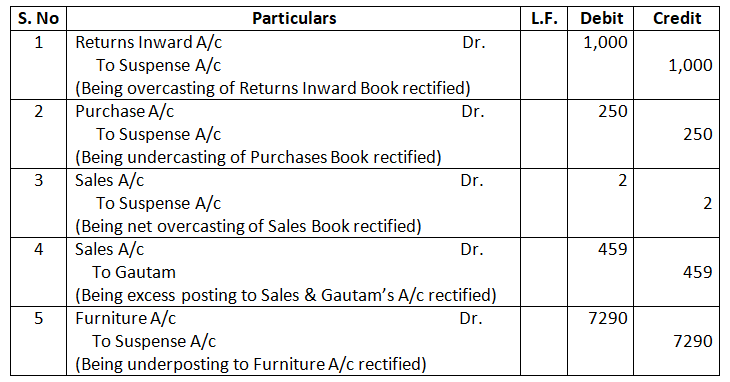

Q.2 Rectify the following errors:

- Returns Inward Book has been overcast by Rs.1,000.

- Total of Purchases Book was carried forward Rs.250 less.

- Total of Sales Book was carried forward Rs.41 less on Page 10 and Rs.43 more on Page 12.

- Goods sold to Gautam were posted as Rs.615 instead of Rs.156.

- Furniture purchased for Rs.8,100 was entered in the Furniture Account as Rs.810.

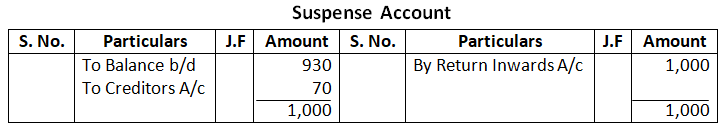

Solution:-

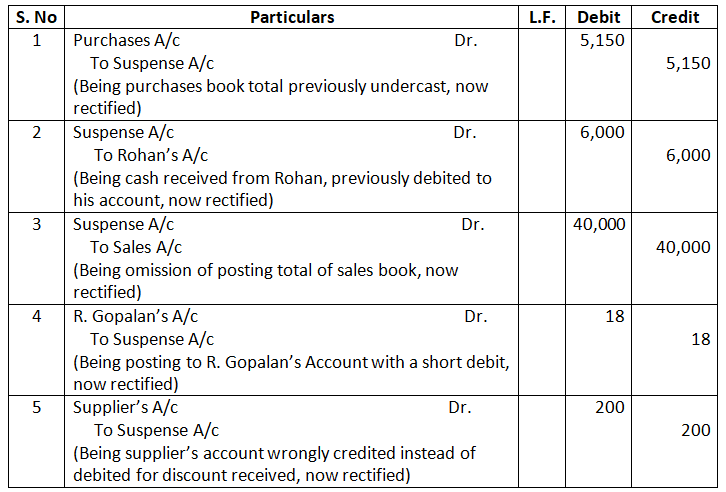

Q.3 The following errors are identified in the books of Sanjay, pass the necessary entries to rectify them:

- Purchase Journal was undercast by Rs.5,150.

- Rs.3,000 received from Rohan was debited to his account.

- Total of Sales Book of Rs.40,000 omitted to be posted.

- An amount of Rs.175 for a credit sale to R. Gopalan correctly entered in the Sales Book, has been debited to his account as Rs.157.

- Discount allowed by a supplier Rs.100, was credited to his account though correctly posted to Discount Received Account.

Solution:-

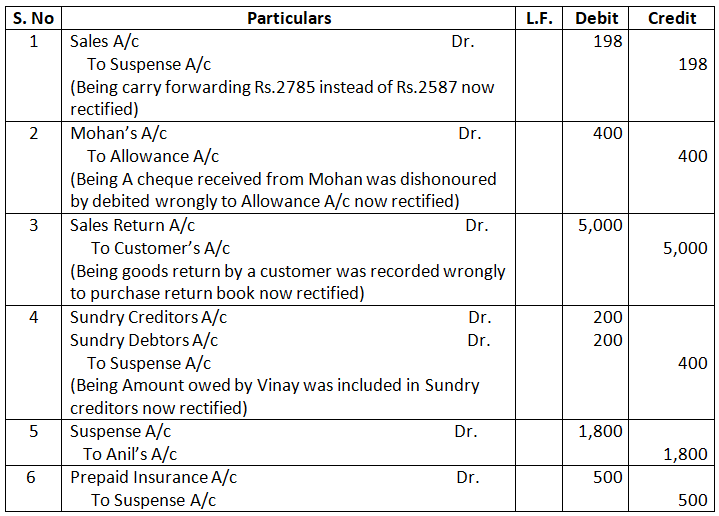

Q.4 Rectify the following errors:

- Total of one page of the Sales Book was carried forward to the next page as Rs.2,785 instead of Rs.2,587.

- A cheque of Rs.400 received from Mohan was dishonoured and had been posted to the debit side of the Allowance Account.

- A return of goods of Rs.5,000 by a customer was entered in the Purchased Return Book.

- Rs.200 owed by Vinay has been included in the list of Sundry Creditors.

- Discount allowed of Rs.200 to Anil was posted to his account as Rs.2,000.

- Rs.500 being Prepaid Insurance Account was omitted to be brought forward from the previous year’s books.

Solution:-

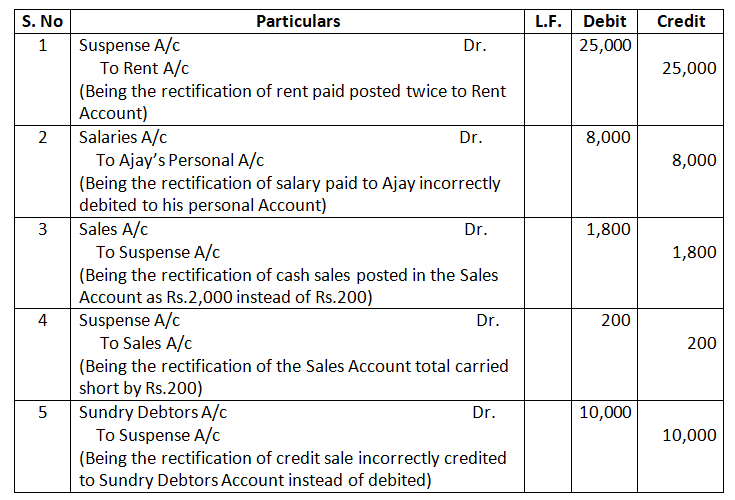

Q.5 Rectify the following errors:

- Rent paid of Rs.25,000 posted twice in the Rent Account.

- Salary paid to an employee, Ajay, is debited to his Personal Account Rs.8,000.

- Cash sale of Rs.200 was posted in Sales Account as Rs.2,000.

- Sales Account totalled short by Rs.200.

- Credit sale of Rs.5,000 is credited to the Sales Account and also to the Sundry Debtors Account.

Solution:-

Two Sided Errors: Errors of Recording

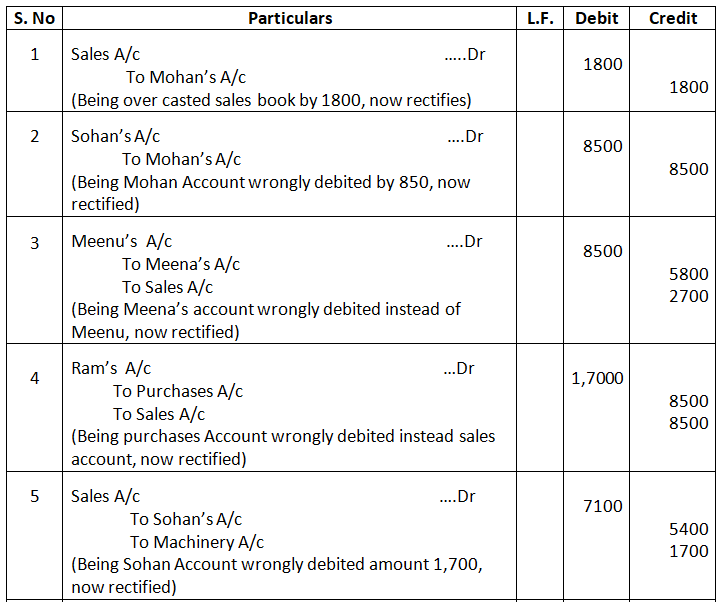

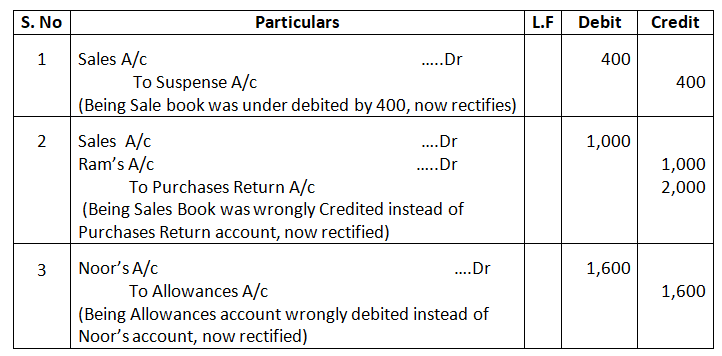

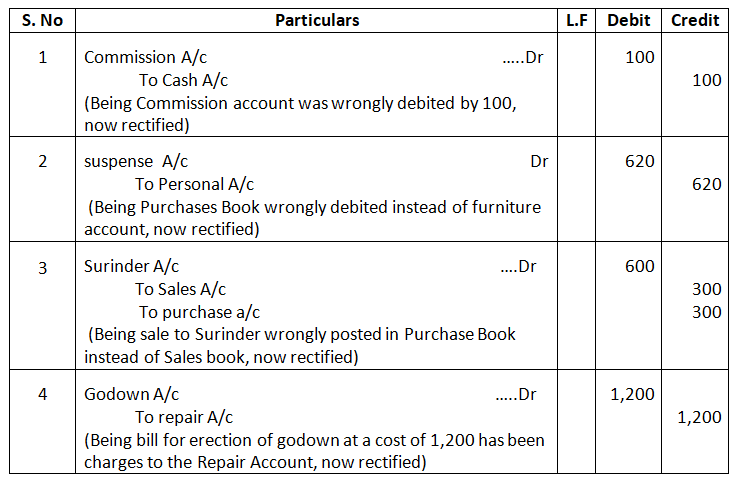

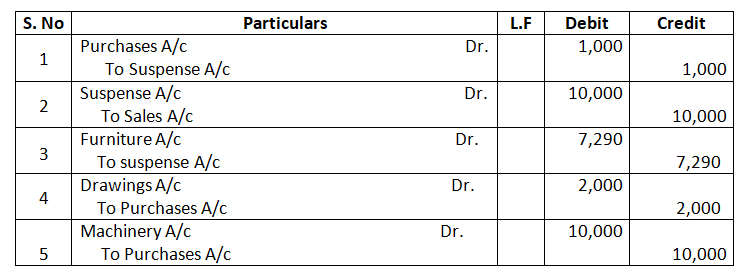

Q6. Pass the necessary Journal entries to rectify the following errors:

- Credit sale of 5700 to Mohan was recorded as 7500.

- Credit sale of 8500 to Sohan was recorded as sale to Mohan.

- Credit sale of 8500 to Meenu was recorded as sale to Meena as 5800.

- Credit sale of 8500 to Ram was recorded in the Purchases Book.

- Credit sale of old machinery to Sohan for 1,700 was entered in the Sales Book as 7,100.

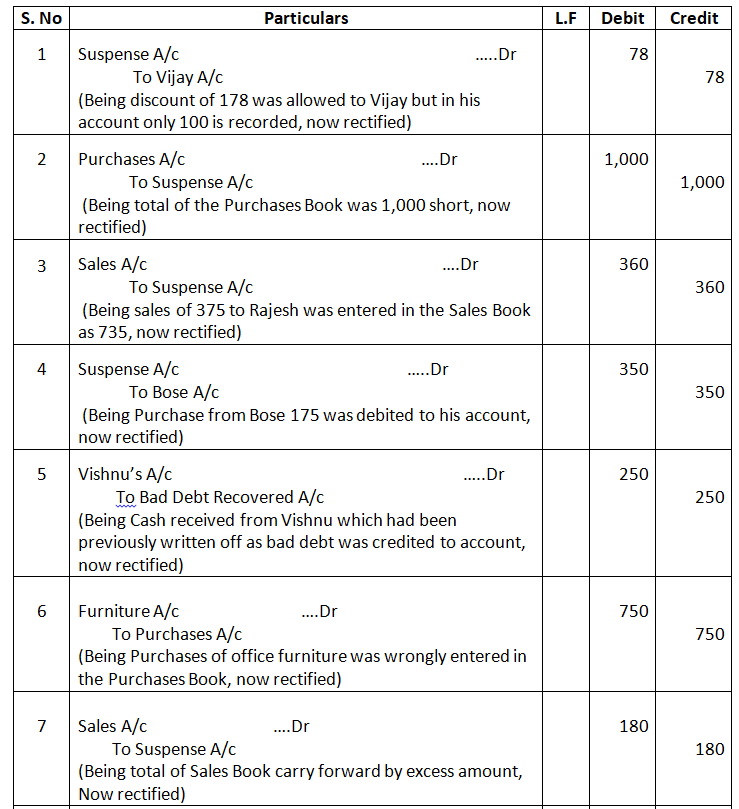

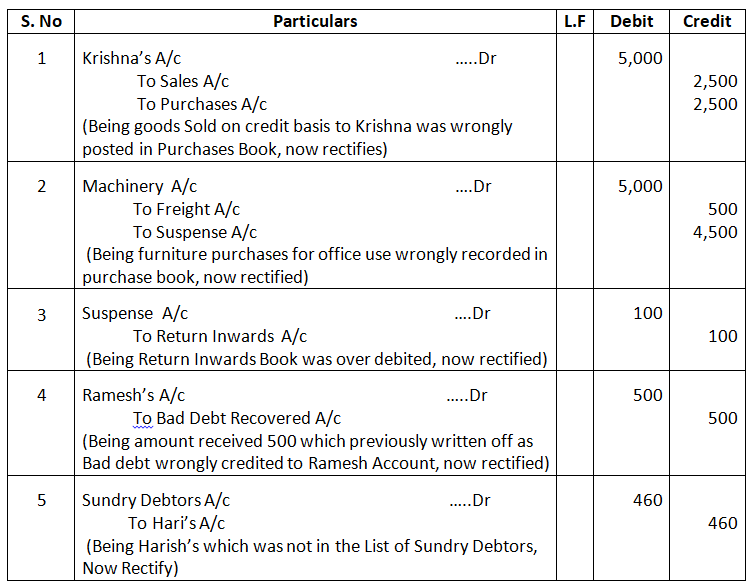

Solution – Journal Entries

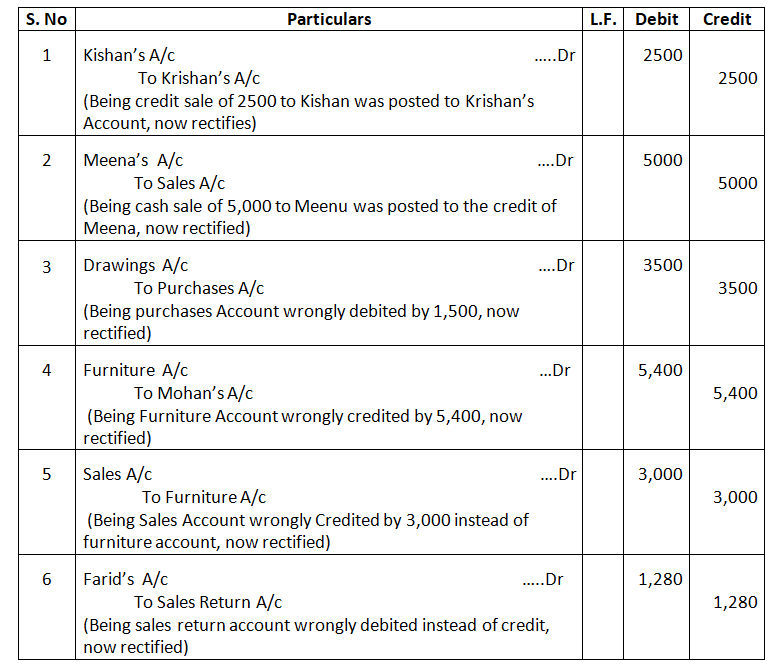

Errors of Posting:

Q7. Pass the necessary Journal entries to rectify the following errors:

- Credit sale of 2500 to Kishan was posted to Krishan’s Account.

- Cash sale of 5000 to Meenu was posted to the credit of Meena.

- Amount of 3500 withdrawn from bank by the proprietor for his personal use was debited to Purchases Account.

- Credit sale of old furniture to Mohan for 1,700 was posted as 7,100.

- Credit sale of old furniture to Babu Ram for 3,000 was credited to Sales Account.

- Cheque of 1,280 received from Farid was dishonoured and has been posted to the debit of Sales Return Account.

Solution- – Journal Entries

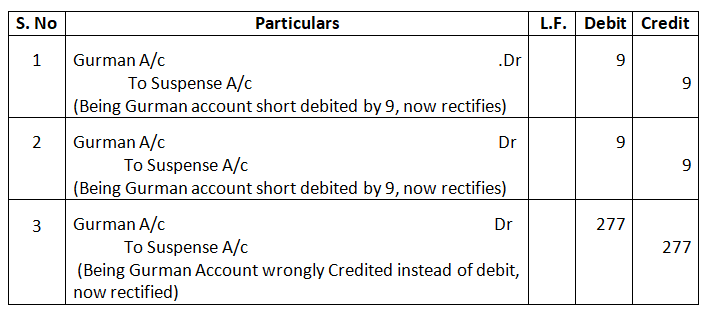

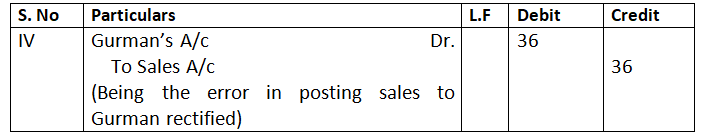

Q8. Rectify the following errors:

- Sales to Gurman of 143 posted to his account as 134.

- Sales to Gurman of 143 debited to his account as 134.

- Sales to Gurman of 143 credited to his account as 134.

Solution – Journal Entries

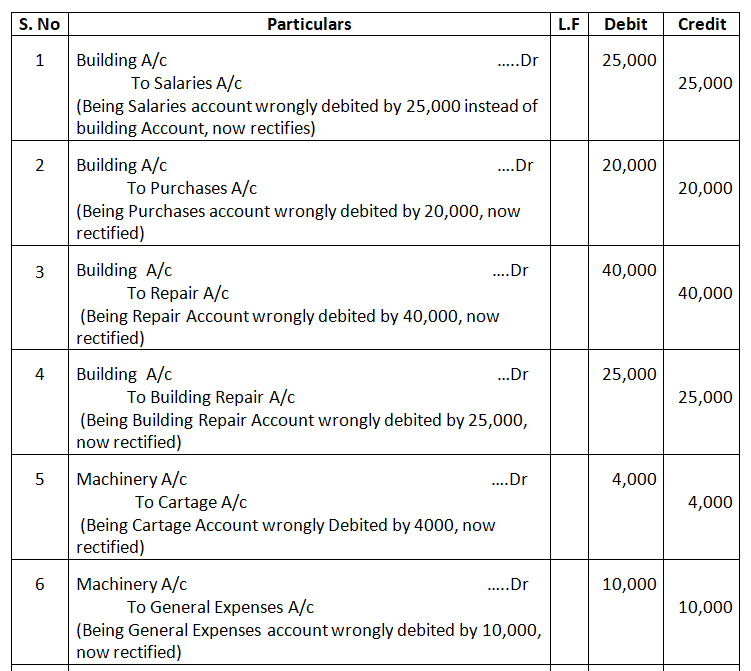

Errors of Principle:

Q9. Pass the necessary Journal entries to rectify the following errors:

- 25,000 paid as wages for the construction of office building debited to Salaries Account.

- 20,000 spent on the purchases of material for the construction of building debited to Purchases Account.

- 40,000 spent on the extension of building were debited to Building Repairs Account.

- 25,000 spent on Whitewash of a new building were charged to Building Repairs Account.

- 4000 paid as installation charges for newly purchased second hand machinery posted to cartage Account.

- 10,000 paid as repairing charges on the reconditioning of newly purchased second hand machinery debited to General Expenses Account.

- 6000 paid as repairing charges of an existing machine in use charged to Machinery Account.

- 10,000 paid by cheque for a printer was charged to the Office Expenses Account.

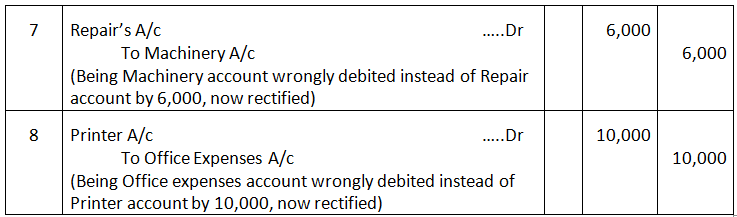

Solution – Journal Entries

Errors of Complete Omission:

Q10. Give rectifying Journal entries for the following errors:

- Goods returned by Mohan of 2500 not recorded in books.

- Goods distributed as free samples for 8000 not recorded.

- Depreciation of machinery of 10,000 not charged.

- Goods costing 7800, selling price 10,000 given as charity not recorded.

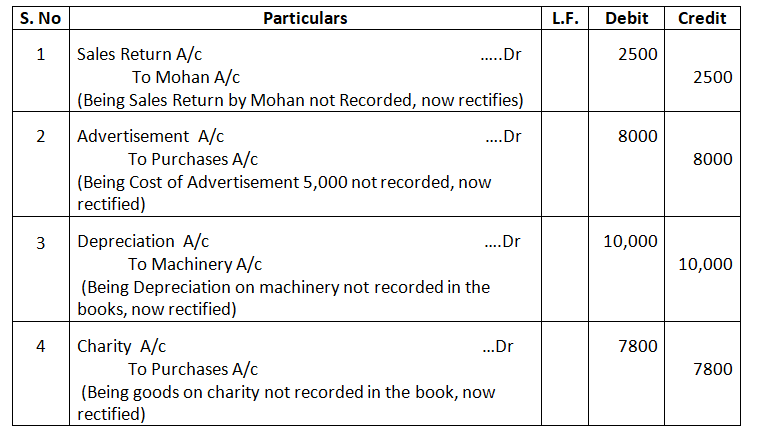

Solution – Journal Entries

Compensating Errors:

Q11. Rectify the following errors:

- Anil’s Account was excess debited by 500 while Suraj’s Account was short debited by 500.

- Goods purchased from Kunal for 8,000 and from Kapil of 9,000 recorded correctly in the Purchases Book. However, 9,000 were posted to Kunal and 8,000 to Kapil.

- Parkar’s Account was short credited by 700 while Manisha’s Account was excess credited by 700.

- Goods sold to Roopak for 1,000 and to Sagar for 1,800 recorded correctly in the Sales Book. However, 1,800 were posted to Roopak and 1,000 to Sagar.

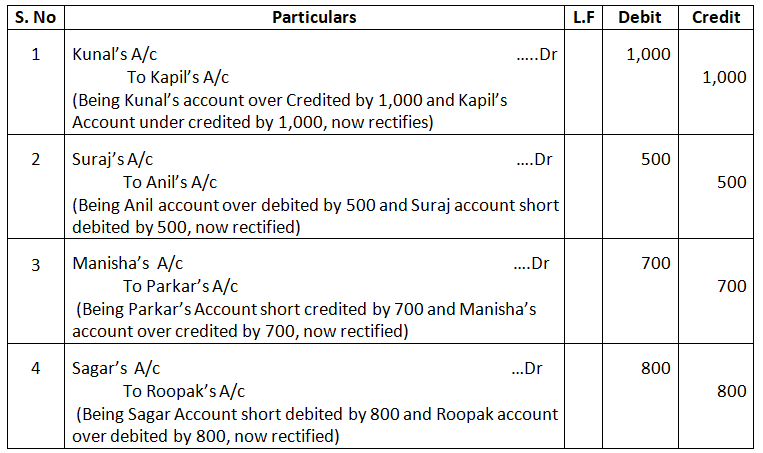

Solution – Journal Entries

Identification of Types of Errors:

Q.12 Identify the types of error from the following:

(i) Sale of Ram not recorded.

(ii) Purchase of office furniture accounted a purchases.

(iii) Purchases Book and Sales Book overcast by Rs.10,000.

(iv) Undercasting of Salaries Account by Rs.5,000 while overcasting of Stationery Account by Rs.5,000.

(v) Wages paid for installation on machinery accounted as wages.

Solution:-

- (error of omission)

- (error of principle)

- ( compensating)

- ( compensating)

- (error of principle)

Errors which affect and not affect the Trial Balance

Q.13 Which of the following errors will affect and which will not affect the Trial Balance.

(i) Total of the Sales Book has not been posted to the Sales Account.

(ii) Rs.5,000 paid for installation charges of a new machine is debited to Repair Account.

(iii) Good costing Rs.10,000 taken by the proprietor for personal use are debited to Debtors Account.

(iv) Rs.7,000 paid for repair to building is debited to Building Account.

(v) Sales Book is under casted by Rs.20,000.

(vi) Wages paid Rs.20,000 recorded in the Wages Account as Rs.2,000.

Solution:-

- Effect on Trial Balance

- No effect on Trial Balance,

- No effect on Trial Balance

- No effect on Trial Balance

- Effect on Trial Balance

- Effect on Trial Balance

Miscellaneous Transactions:

Q14. Following errors affecting the accounts for the year ended 31st March, 2025 were detected in the books of Das & Co., Meerut:

- Sale of old furniture for 8000 was treated as sales of goods.

- Rent of proprietor’s residence 6,000 was debited to Rent Account.

- Cash received from Rajesh 7150 was credited to Brajesh.

Pass the rectifying Journal Entries. State the nature of each of these mistakes.

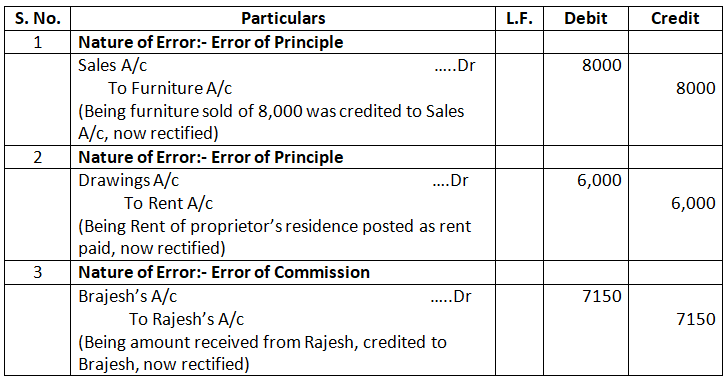

Solution – In the Books of Das & Co. Meerut

Journal

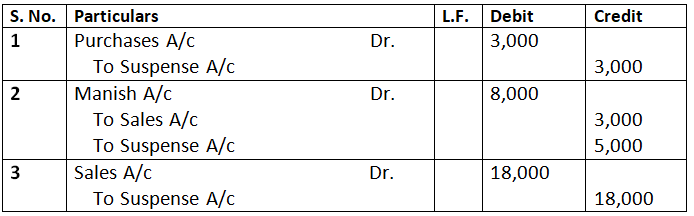

Q.15 Rectify the following errors:

(i) Purchases book under cast by Rs.3,000.

(ii) Manish’s Account was credited with Rs.8,000 instead of debiting it with Rs.3,000.

(iii) Cash Sale of Rs.2,000 was posted to Sales Account as Rs.20,000.

Solution:-

Journal

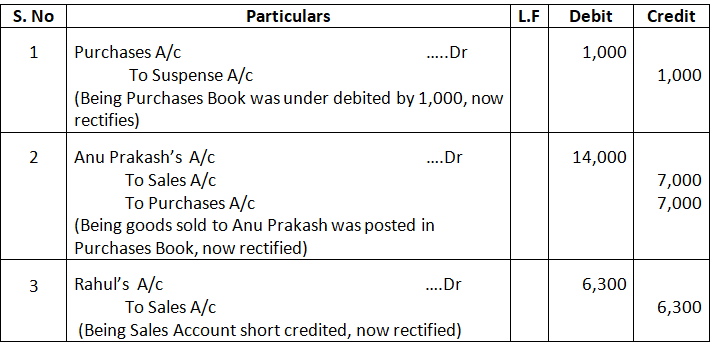

Q16. Rectify the following errors:

- Purchases Book has been undercast by 1,000.

- Credit sale to Anu Prakash 7,000 was recorded in Purchases Book.

- Credit sale to Rahul 7,000 was recorded as 700.

Solution – Journal Entries

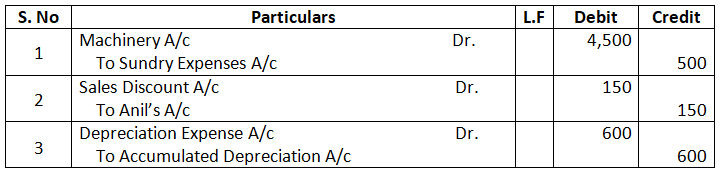

Q17. Rectify the following errors:

- Installation charges Rs.5,000 on new machinery purchased were debited to Sundry Expenses Account as Rs.500.

- Discount allowed of Rs.200 to Anil was posted in his account Rs.50.

- Depreciation of Rs.600 charged on machinery not posted to Depreciation Account.

Solution:-

Journal Entries

Q18. Which of the following errors will affect the Trial Balance?

- The total of the Sales Book has not been posted to the Sales Account.

- 1,000 paid as installation charges of a new machine have been debited to Repairs Account.

- Goods costing 4,000 taken by the proprietor for personal use have been debited to Debtor’s Account.

- 1,000 paid for repairs to building have been debited to Building Account.

Solution –

- Sales book total not posted to sales account

This means one side (credit side) of

This will affect the Trial Balance.

- Installation charges wrongly debited to Repairs A/c instead of Machinery A/c

Both debit and credit have been recorded, but in the wrong account.

Does not affect Trial Balance.

- Drawing treated as debtor

Again, both sides recorded but in wrong accounts.

Does not affect Trial Balance.

- Repairs wrongly debited to Building A/c

Wrong account but both sides recorded.

Does not affect Trial Balance.

Only error (i) will affect the Trial Balance

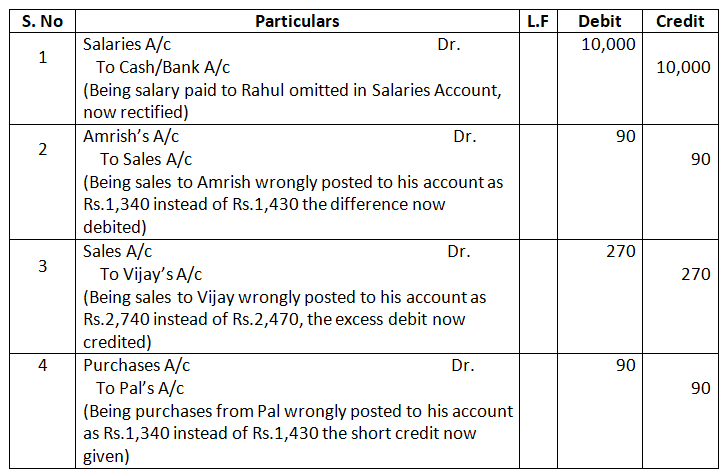

Q.19 Rectify the following errors assuming that there is no Suspense Account:

- Salary of 10,000 paid to Rahul was not posted to Salaries Account.

- Sales to Amrish of 1,430 posted to his account as 1,340.

- Sales to Vijay of 2,470 posted to his account as 2,740.

- Purchases from Pal of 1,430 posted to his account as 1,340.

Solution –

Journal Entries

Q.20 Rectify the following errors if Suspense Account does not exist:

- The Returns Inward Book has been overcastted by 200.

- Purchases Book carried forward 75 less.

- Sales Book carried forward 41 less on Pages 10 and 43 more on Page 12.

- Goods sold to Gurman were posted as 215 instead of 251.

Solution –

- In return inward a/c (credit side) over coasting of return Inward book, now rectified

- In purchase a/c (debit side) carry forward in purchase book less, now rectified.

- In Sales a/c (debit side) carry forward in sales book excess, now rectified.

- In sales a/c (credit side)difference in amount posted, Now rectified.

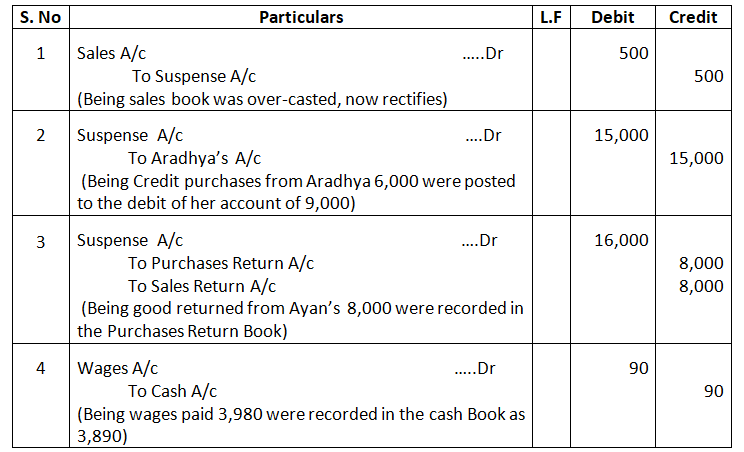

Q21. Pass Journal entries to rectify the following errors which were identified after preparing the Trial Balance:

- The Sales Book was overcast by 500

- Credit purchases from Aradhya 6,000 were posted to the debit of her account of 9,000.

- Goods returned from Ayan 8,000 were recorded in Purchases Return Book.

- Wages paid 3,980 were recorded in the Cash Book as 3,890.

Solution – In the Books of Sh. Ram Lal

Journal Entries

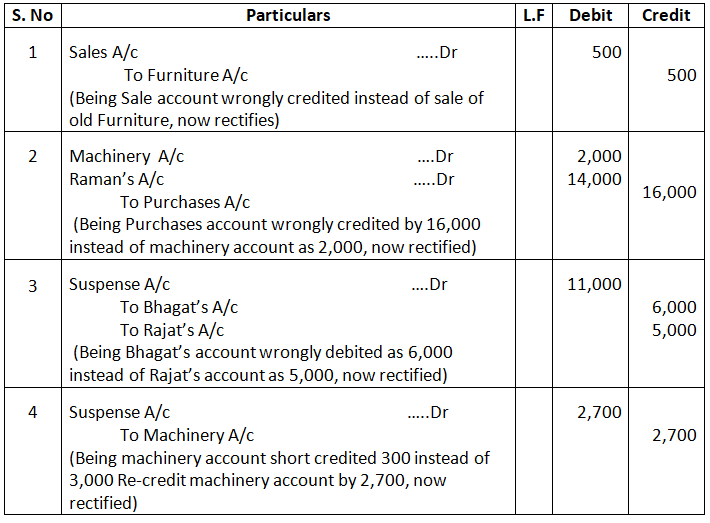

Q22. Rectify the following errors by passing Journal entries:

- Old furniture sold for 500 has been credited to Sale Account.

- Machinery purchased on credit from Raman for 2,000 recorded through Purchases Book as 16,000.

- Cash received from Rajat 5,000 was posted to the debit of Bhagat as 6,000.

- Depreciation provided on machinery 3,000 was posted to Machinery Account as 300.

Solution – Journal Entries

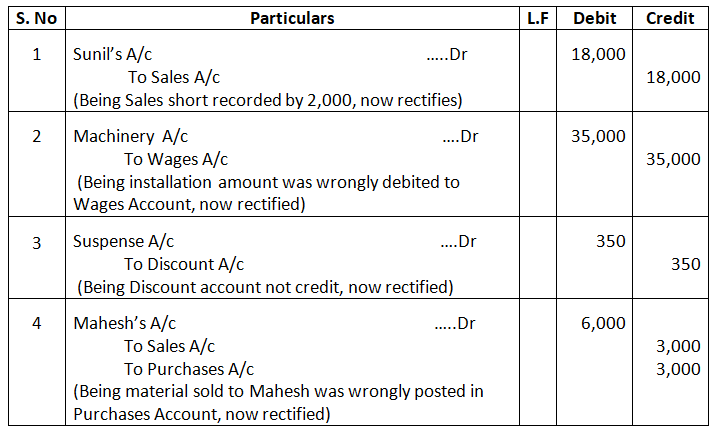

Q23. Give the rectifying entries of the following:

- Sales of Rs.20,000 to Sunil was recorded as 2,000 in the Sales Book.

- An amount of 35,000 spent for the extension of machinery has been debited to the Wages Account.

- Discount received from Ram & Co. 350 has not been entered in the discount column of the Cash Book.

- Goods of 3,000 sold to Mahesh were recorded in the Purchases Book.

Solution – Journal Entries

Q24. Pass Journal entires to rectify the following errors:

- An old plant sold for Rs.4,000 had been entered in the Sales Account.

- Credit purchases from Shyam for Rs.1,700 were recorded in the Sales Book. However, Shyam’s Account was correctly credited.

- Discount received of Rs.400 from a creditor had been duly entered in his account but not posted in the discount received account.

- A credit purchase of old machinery form Sohan for Rs.17,000 was entered in the Purchases Book as purchase from Mohan for Rs.71,000. Rs.3,000 repair charges of this machinery were debited to General Expenses Account.

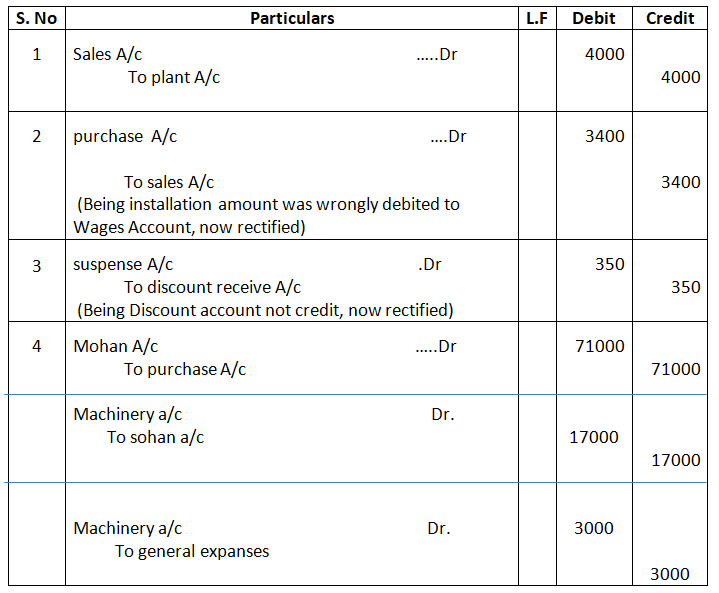

Solution:-

Q25. Rectify the following errors:

- Total of one page of the Sales Book was carried forward to the next page as 2,785 instead of 2,587.

- A cheque of 400 received from Mohan was dishonoured and had been posted to the debit side of the ‘Allowance Account’.

- Return of goods worth 5,000 by a customer was entered in the Purchases Return Book.

- Sum of 200 owed by ‘X’ has been included in the list of Sundry Creditors.

- Sale of old furniture worth 430 was credited to the Sales Account as 340.

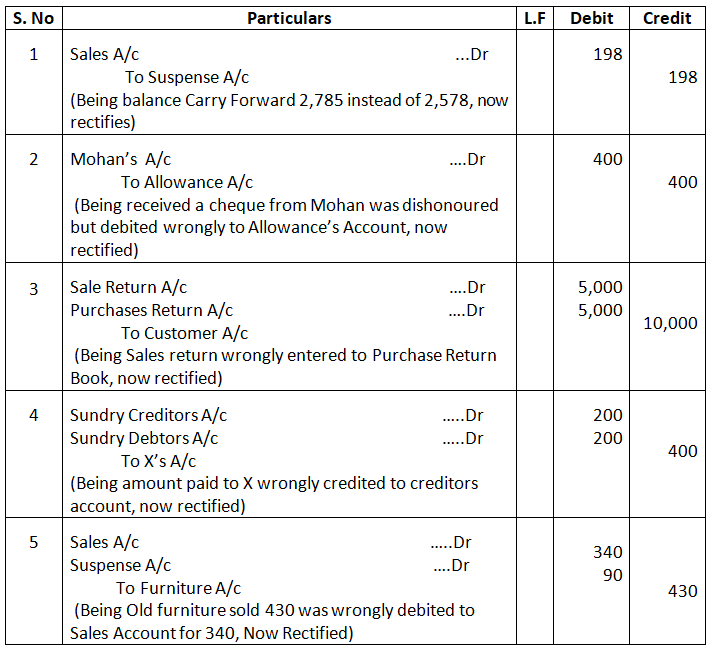

Solution – Journal Entries

Q26. Rectify the following errors:

- Purchases Book is overcast by 500.

- Salary paid to an employee, Mr. Ajay, is debited to his Personal Account 3,000.

- Goods sold to Shashi on credit 300 have been wrongly passed through the Purchases Book.

- Total of Returns Inward Book has been added 9 short.

- Purchases of Chair from Happy Traders for 35 have been entered in the Purchases Book as 53.

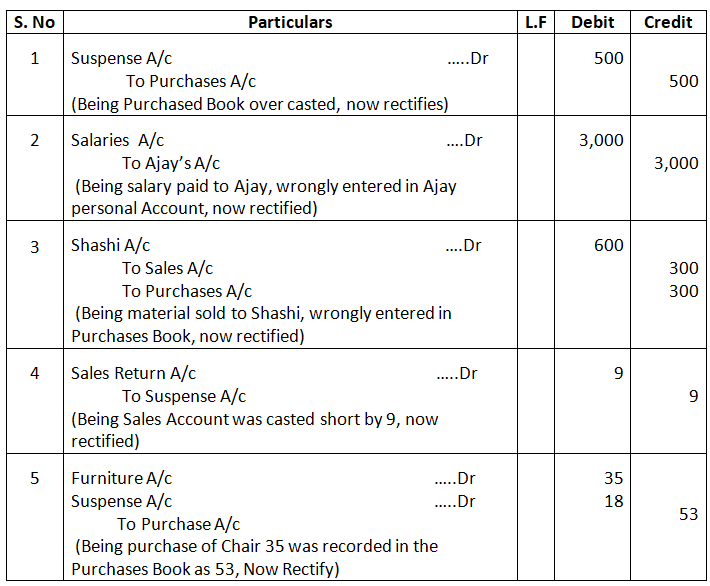

Solution – Journal Entries

Q27. Pass the Journal entries rectifying the following errors:

- Purchases of 20,000 was omitted to be recorded.

- Purchases of office furniture of 10,000 were recorded in Purchases Book.

- Office Rent of 15,000 was debited to the Personal Account of the landlord.

- Old machine sold for 7,000 was credited to Sales Account.

- Bill for 800 received from Mukesh for repair of machinery was entered in the Purchases Book as 700.

- A purchase of goods from Nthan amounting to Rs.5,000 had been entered through the Sales Book.

Solution – In the Books of Sh. Ram Lal

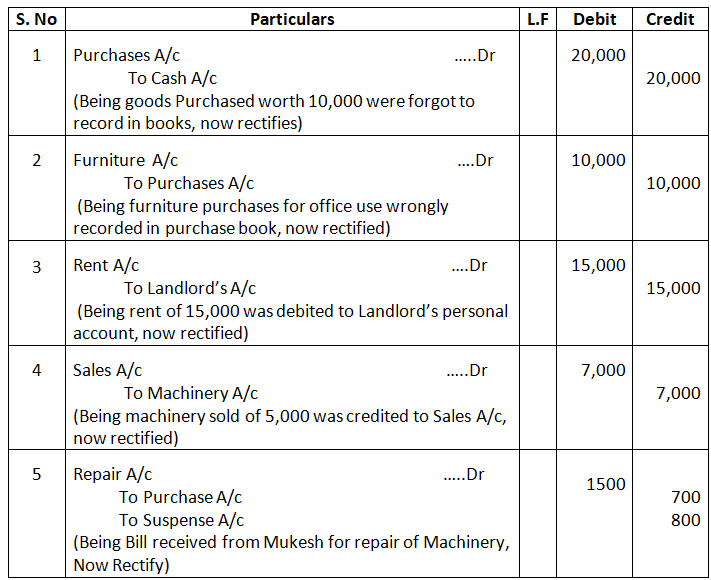

Journal Entries

Q28. Give the rectifying Journal entries for the following errors:

- Sales of goods to Madan 6,000 were entered in the Sales Book as 600.

- Credit purchase of 1,500 from Ajay has been wrongly passed through the Sales Book.

- Repairs to Building 300 were debited to Building Account.

- 2,050 paid to Rohit are posted to the debit of Mohit’s Account as 5,020.

- Purchases Return Book is overcastted by 400.

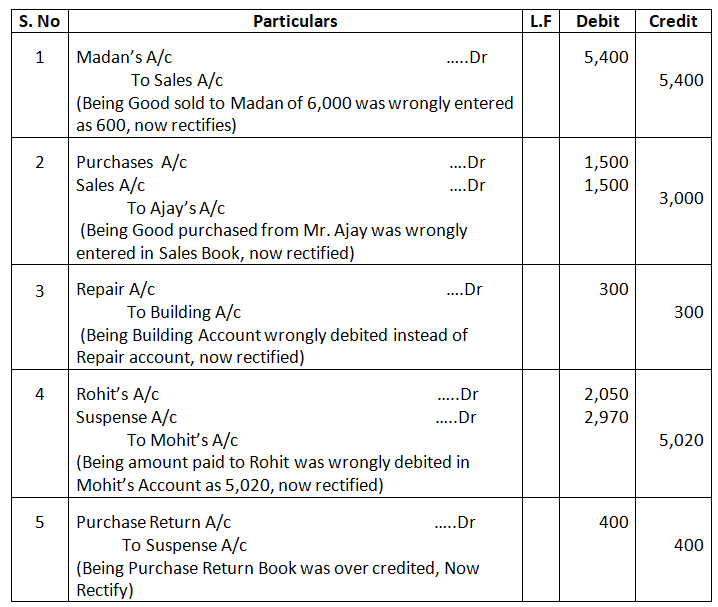

Solution – Journal Entries

Q29. Give rectifying entries for the following:

- 5,400 received from A was posted to the debit of his account.

- The total of Sales Return Book overcasted by 800.

- 2,740 paid for repairs to motor car were debited to Motor Car Account as 1,740.

- Returned goods to Shyam 1,500 were passed through Returns Inward Book.

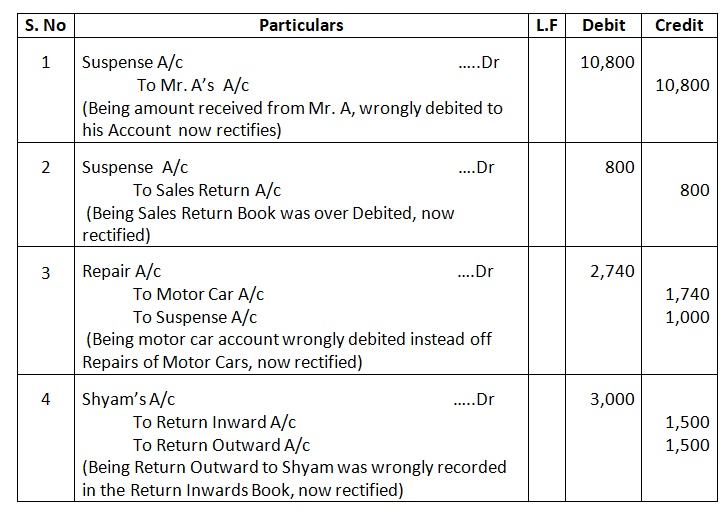

Solution – Journal Entries

Q30. Pass Journal entries rectifying the following errors:

- A cheque for 20,000 was received from Ranjan on which 200 Cash Discount was allowed. The cheque was not honoured on due date and the amount of discount was credited to Discount Received Account.

- 5,000 paid as wages for machinery installation was debited to Wages Account.

- 10,000 received from Rakesh were credited to his Personal Account. The amount had been written off as bad debts earlier.

- Repair bill of machinery was recorded as 500 against the bill amount of 5,000.

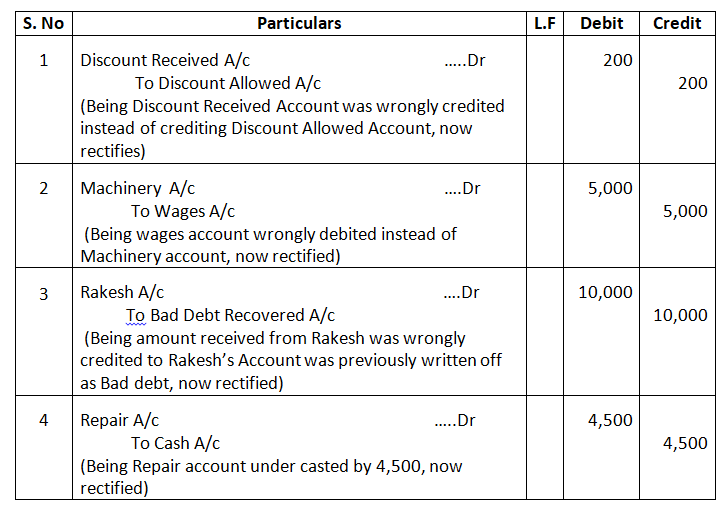

Solution – Journal Entries

Q31. Rectify the following errors:

- Sales Book has been totalled 1,000 short.

- Goods worth 1,500 returned by Green & Co. have not been recorded anywhere.

- Goods Purchased worth 2,500 have been posted to the debit of the supplier, Gupta & Co.

- Furniture purchased from Gulab & Co worth 10,000 has been entered in purchase book

- Cash received from A 2,500 has not been posted in his account.

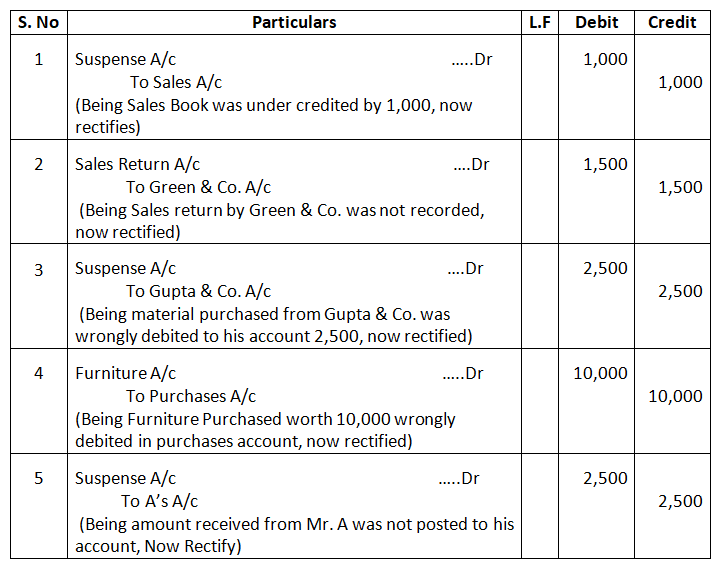

Solution – Journal Entries

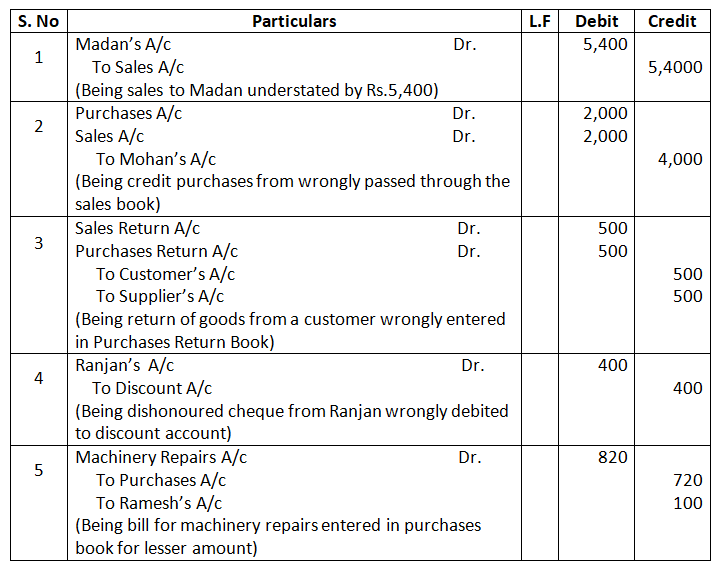

Q32. Pass the rectifying entries for the following:

- Sales of goods Rs.6,000 to Madan were recorded as Rs.600 in the Sales Book.

- Credit purchases of goods from Mohan amounting to Rs.2,000 has been wrongly passed through the Sales Book.

- Return of goods worth Rs.500 by a customer was entered in ‘Purchases Return Book’.

- Cheque of Rs.400 received from Ranjan was dishonoured and debited to the Discount Account.

- Bill for Rs.820 received from Ramesh for repair of machinery was entered in the Purchases Book as Rs.720.

Solution:-

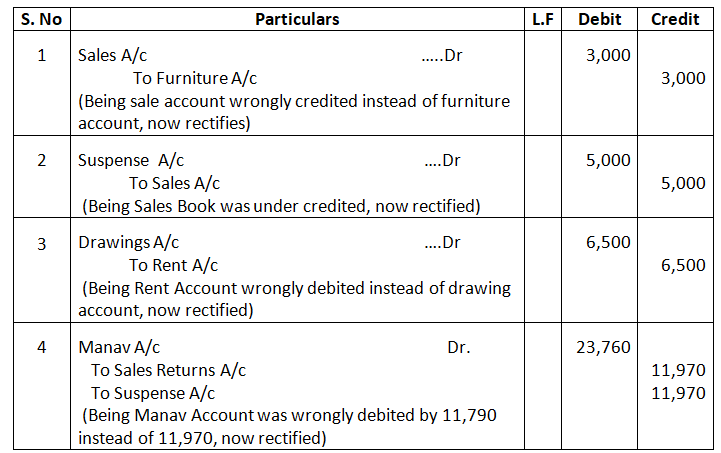

Q33. Rectify the following errors:

- Sale of old furniture worth 3,000 treated as Sales of goods.

- Sales Book added 5,000 short.

- Rent of Proprietor’s residence, 6,500 debited to Rent Account.

- Goods worth 11,970 returned by Manav posted to his debit as 11,790.

Solution – Journal Entries

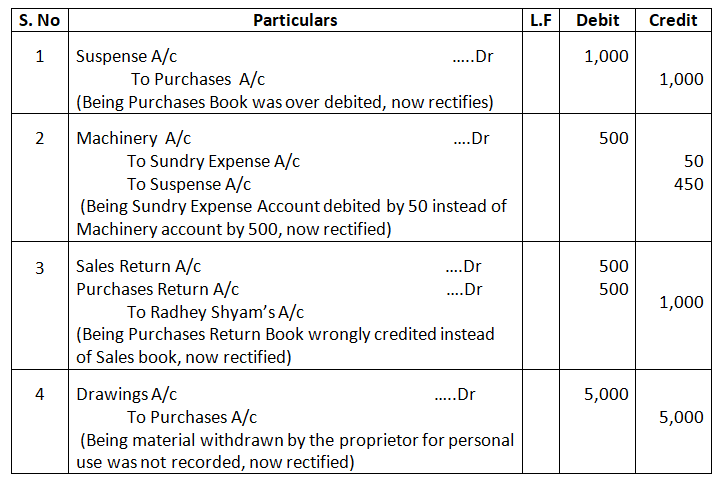

Q34. Give the Journal entries to rectify the following errors:

- Purchases Book was overcast by 1,000.

- Installation charges on new machinery purchased 500 were debited to Sundry Expenses Account as 50.

- Radhey Shyam returned goods worth 500 which were entered in the Purchases Return Book.

- Goods taken by the proprietor for 5,000 have not been entered in the books at all.

Solution – Journal Entries

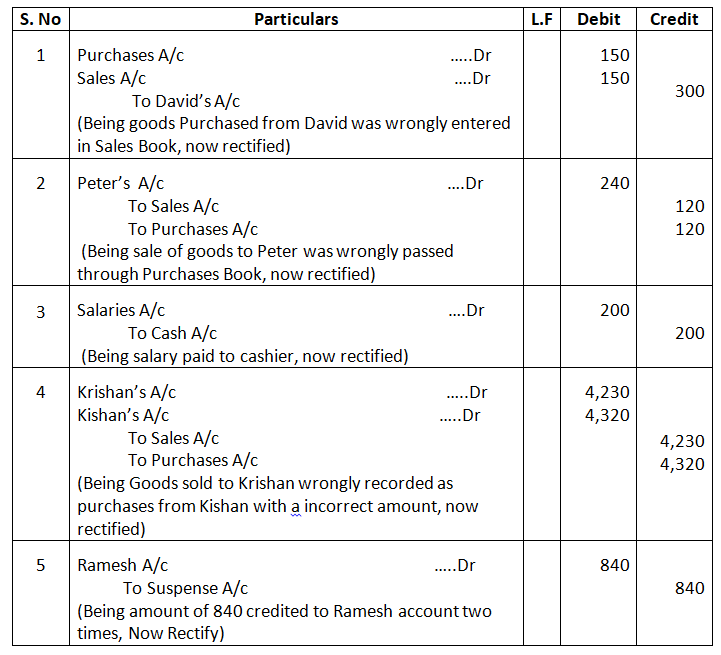

Q35. Pass Journal entries to rectify the errors in the following cases:

- A purchase of goods from David amounting to 150 has been wrongly passed through the Sales Book.

- A credit sale of goods of 120 to peter has been wrongly passed through the Purchases Book.

- 200, salary paid to Cashier, Bimal, stand wrongly debited to his Personal Account.

- A credit sale of 4,230 to Krishan entered as purchase from Kishan 4,320.

- Ramesh’s Account was credited with 840 twice instead of once.

Solution – Journal Entries

Q36. (i) What are the different causes that make a Trial Balance incorrect?

(ii) Pass the rectifying Journal entries:

- A credit sale of goods for 2,500 to Krishna has been wrongly passed through the Purchases Book.

- 5,000 paid for freight on machinery purchased was debited to the Freight Account as 500.

- The Returns Inward Book has been wrongly overcastted by 100.

- An amount of 500 due from Ramesh which had been written off as bad debt in previous year was recovered and had been posted to the Personal Account of Ramesh.

- A sum of 460 owed by Hari has not been included in the list of debtors.

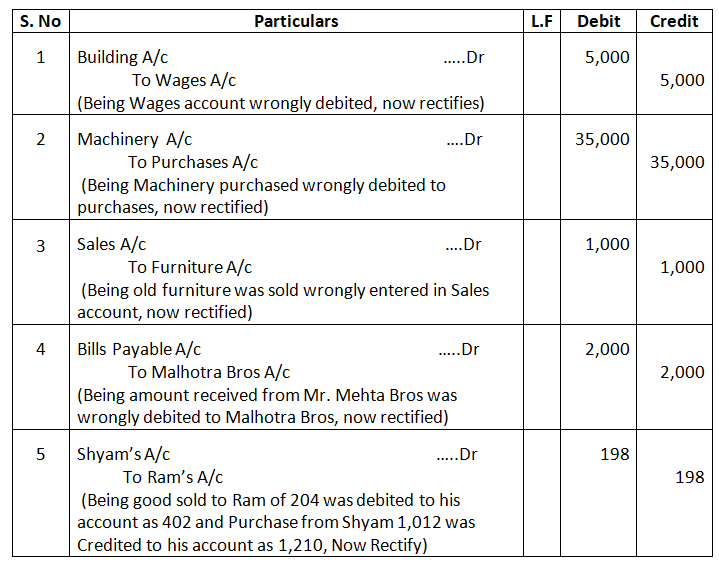

Solution – Journal Entries

Q37. Rectify the following errors:

- Wages paid for the construction of office debited to the Wages Account 5,000.

- Machinery purchased for 35,000 was passed through the Purchases Book.

- Old Furniture sold for 1,000 passed through the Sales Book.

- 2,000 paid to Mehta Bros. against acceptance were debited to Malhotra Bros. account.

- Sales of 204 to Ram debited to his account as 402 and purchases of 1,012 from Shyam credited to his account as 1,210.

Solution – Journal Entries

Q38. Rectify the following errors:

- The total of one page of Sales Book was carried forward as 371 instead of 317.

- 540 received from Yatin were posted to the debit of his Account.

- Purchases Return Book was overcast by 300.

- An item of 1,062 entered in Sales Return Book had been posted to the debit of customer who returned the goods.

- 1,500 paid for furniture purchased had been charged to ordinary Purchase Account.

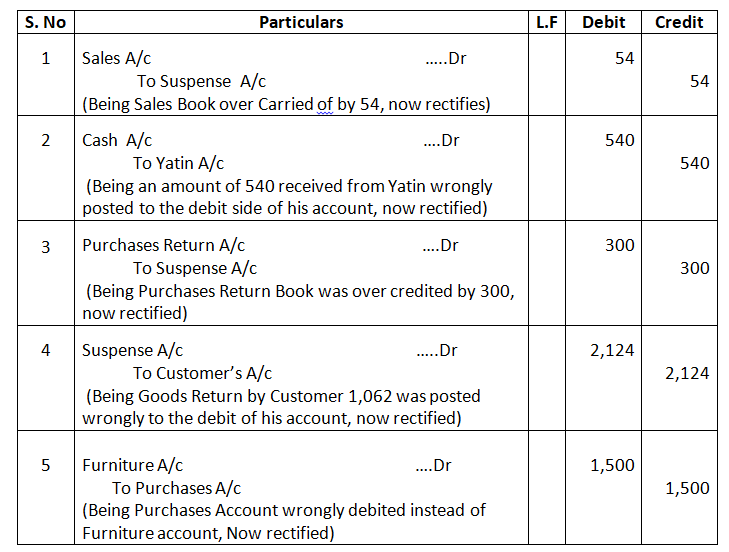

Solution – Journal Entries

Q39. Rectify the following errors by passing Journal entries:

- A sum of 470 received from Ganga was posted to her debit as 740.

- A debit balance of 550 in the personal account of Mr. Jhon was undercast.

- Bills Receivable from Brown for 3,000 posted to the credit of Bills Payable Account and credited to Brown’s Account.

- Goods returned by Mridul 225 have been entered in the Returns Outward Book.

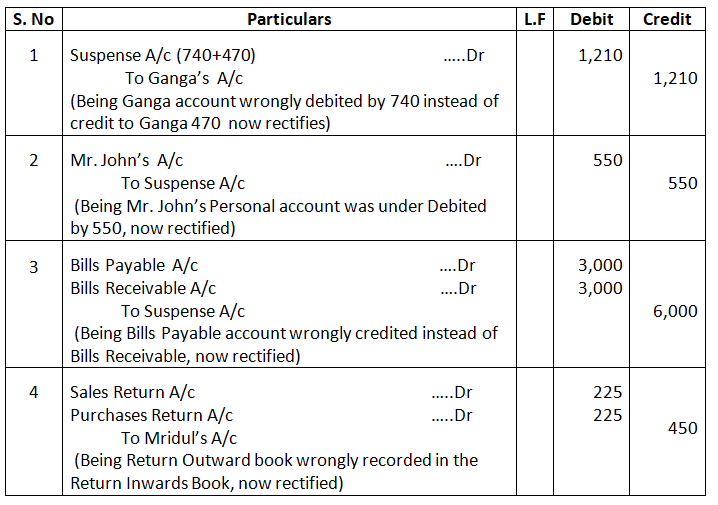

Solution – Journal Entries

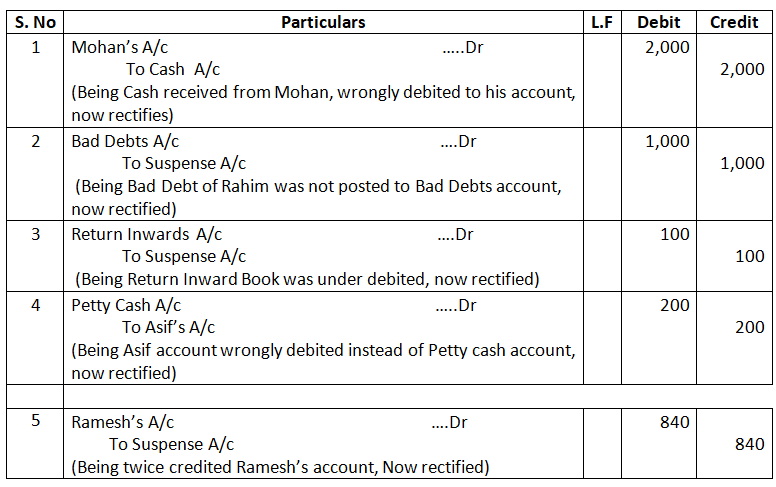

Q40. While closing his books for the year ended 31st March, 2025, Mahesh found that the Trial Balance did not agree. He traced the following errors:

- In the Sales Book for the month of January total of page no. 2 was carried forward to Page No. 3 as 1,000 instead of 1,200 and total of Page No. 6 was carried forward to Page No. 7 as 5,600 instead of 5,000.

- Goods returned to Ram 1,000 were recorded in the Sales Book.

- Bill Receivable for 1,600 from Noor was Dishonoured and posted to debit of Allowances Account.

Solution – In the Books of Mr. Mahesh

Journal Entries

Q41. Pass the rectification entries for the following transaction:

- An Amount of 2,000 received from Mohan on 1st April, 2025 had been entered in the Cash Book as having been received on 31st March, 2025.

- The balance in the account of Rahim 1,000 had been written off as bad but no other account has been debited.

- An addition in the Returns Inward Book has been cast 100 short.

- A cheque for 200 drawn for the Petty Cash Account has been posted in the account of Asif.

- Ramesh’s Account was credited with 840 twice instead of once.

Solution – Journal Entries

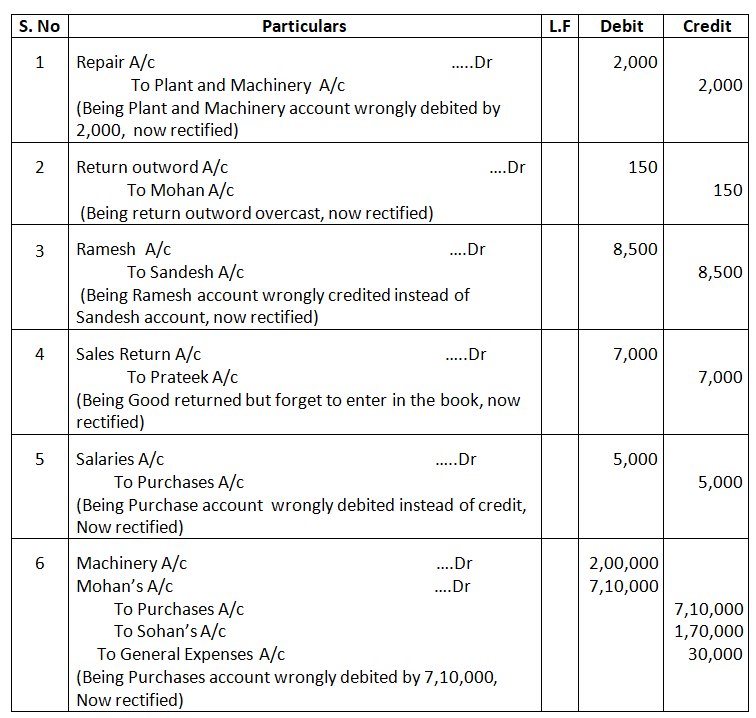

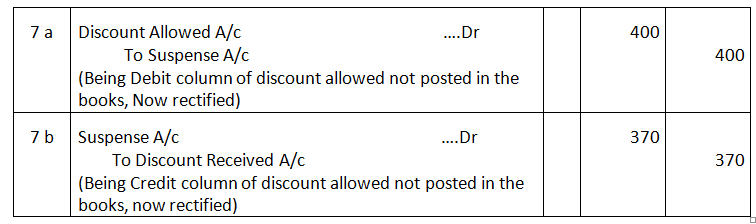

Q42. Pass the rectification entries for the following transaction:

- Repairs to plant amounting to 2,000 had been charged to plant and machinery account.

- An entry of ₹ 1,450 representing the selling price of goods returned to Mohan had been made in Return Outwards Book and posted. The amount should have been ₹ 1,300, the invoice value of the good in question.

- A cheque for 8,500 received from Sandesh was credited to the account of Ramesh.

- Goods to the value of 7,000 returned by Prateek were included in closing stock, but no entry was made in the books.

- Goods costing 5,000 were purchased for various members of the staff and the cost was included in ‘Purchases’. A similar amount was deducted from the salaries of the staff members concerned and the net payments to them debited to Salaries Account.

- Credit purchase of old machinery from Sohan for 1, 70,000 was entered in the Purchase Book as purchase from Mohan for 7, 10,000. 30,000 paid as repairing charges on the reconditioning of a newly purchased second had machinery were debited to General Expenses Account.

- Debit and Credit totals of discount columns in the Cash Book which come to 400 and 370 respectively have not been posted to Discount Account.

Solution – Journal Entries

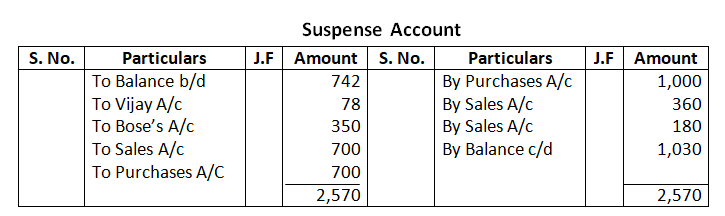

Preparation of Suspense Account

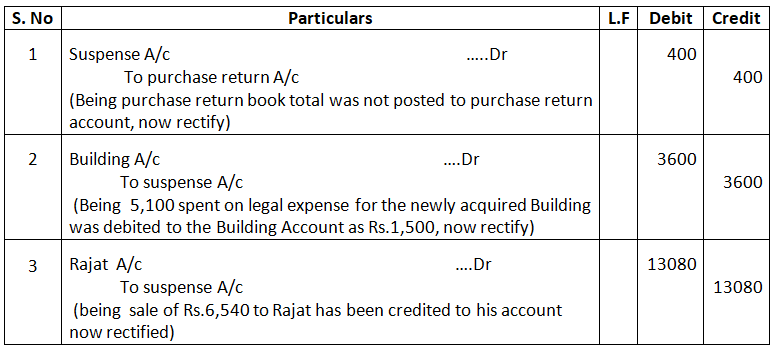

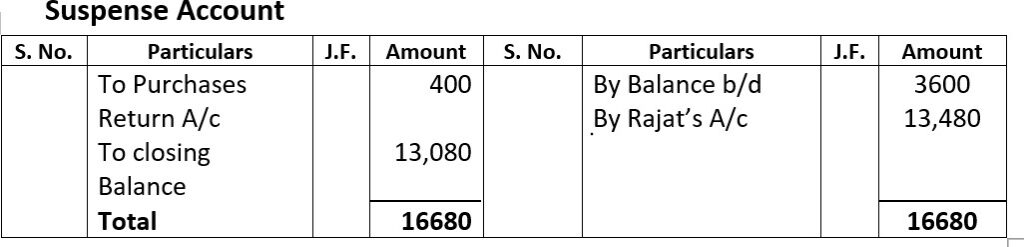

Q43. There was a difference in the Trial Balance of M/s. Jain & Sons, prepared for the year ended 31st March, 2025. The accountant put the difference in Suspense Account. The following errors were found:

(i) Purchases Return Book total Rs.400 has not been posted to Ledger Account.

(ii) Rs.5,100 spent on legal expense for the newly acquired Building was debited to the Building Account as Rs.1,500.

(iii) A sale of Rs.6,540 to Rajat has been credited to his account.

Rectify the errors and show the Suspense Account with Nil closing balance.

Solution – Journal Entries

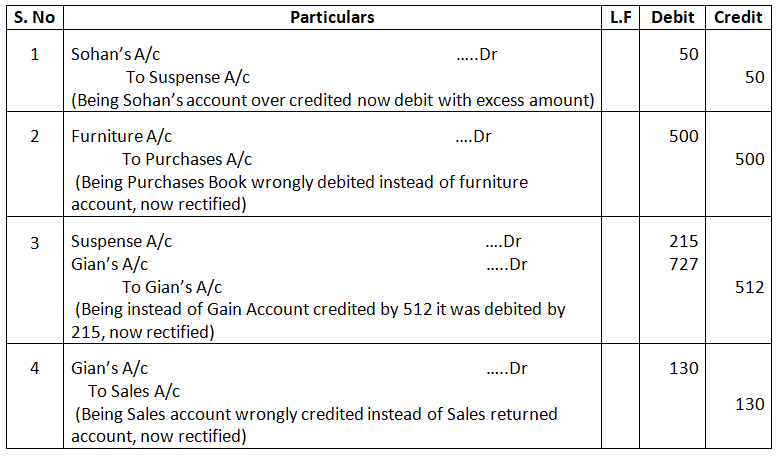

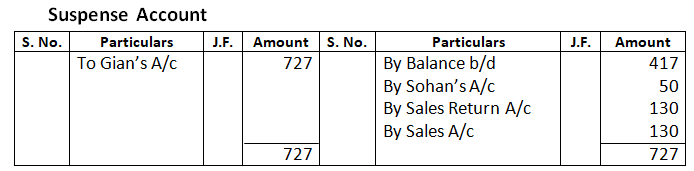

Q44. A Trial Balance disclosed a difference of 417 placed on the credit side of the Suspense Account. Later on the following errors were located:

- Goods worth 200 purchased from Sohan had been posted to his account as 250.

- A purchase of furniture for 500 was recorded in the Purchases Book.

- Instead of crediting Gian’s Account with 512, it was debited with 215.

- Goods worth 130 returned by Gian were entered in the Sales Book and posted there from to the credit of Gian’s Personal Account.

Pass the rectifying entries and prepare a Suspense Account.

Solution – Journal Entries

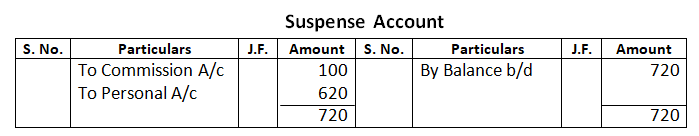

Q45. There was a difference of 720 in the Trial Balance which has been transferred to the credit side of the Suspense Account. Pass the Rectifying entries and prepare a Suspense Account to rectify the following errors:

- An amount of 375 now posted on the debit side of the Commission Account instead of 275.

- Credit amount of 260 posted to the debit of the Personal Account as 360.

- Goods sold to Surinder recorded in Purchases Book 300.

- D’s bill for erection of godown at a cost of 1,200 has been charged to the Repairs Account.

Solution – Journal Entries

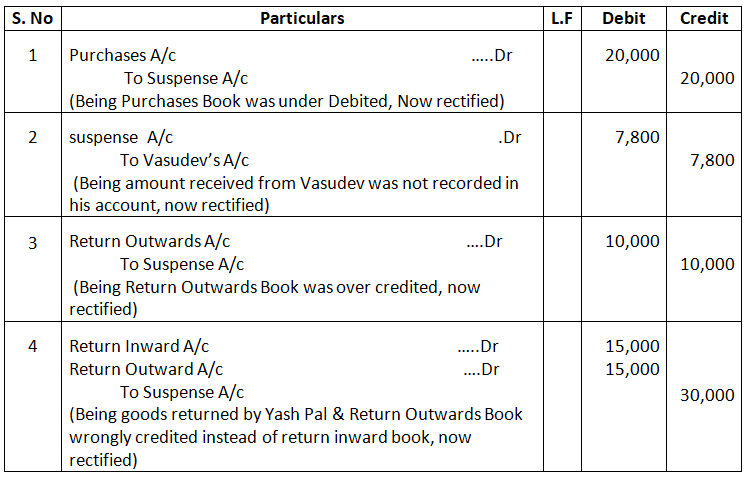

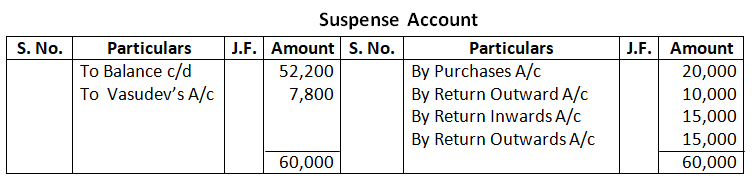

Q46. The Trial Balance of Ajay & Sons has difference of 52,200. To prepare the Final Account on 31st March, 2025, this difference is placed in a Suspense Account. Afterwards the following errors were disclosed. Pass the necessary entries to rectify them and show the Suspense Account.

- Purchases Book total had been undercasted by 20,000.

- A cheque received from Vasudev for 7,800 had been debited in the Cash Book but not posted in Vasudev’s Personal Account.

- Returns Outward Book had been overcastted by 10,000.

- Goods returned by Yash Pal’s worth 15,000 have been entered in Returns Outward Book. However, Yash Pal’s Account is correctly posted.

Solution – Journal Entries

Q47. Sanjay drew a Trial Balance for the year ended 31st March, 2024, There was a difference which closed through Suspense Account. On a scrutiny, through following errors were found:

(i) Purchase Book for the month of April, 2024 was undercasted by ₹ 1,000.

(ii) Sales Book of October, 2024 was overcasted by ₹10,000.

(iii) A furniture purchased for₹8,100 was entered in the Furniture Account as₹ 810.

(iv) Goods taken by the proprietor₹2,000 for gift of his daughter were not recorded.

(v) Machinery purchased for₹10,000 was entered in the Purchases Book.

Pass necessary Journal entries to rectify the same and ascertain the difference in the Trial Balance that was shown under Suspense Account in respect of the above items.

[Ans.: Difference in Trial Balance- 18,290

Solution:-

Calculate the new balance of the suspense Account

Original Suspense Account balance (assume it was a credit balance) – (1,000 + 7,290) + 10,000 + 2,000 – 10,000 = 8,290

Therefore, the adjusted difference in the Trial Balance under the suspense account is Rs.8,290.

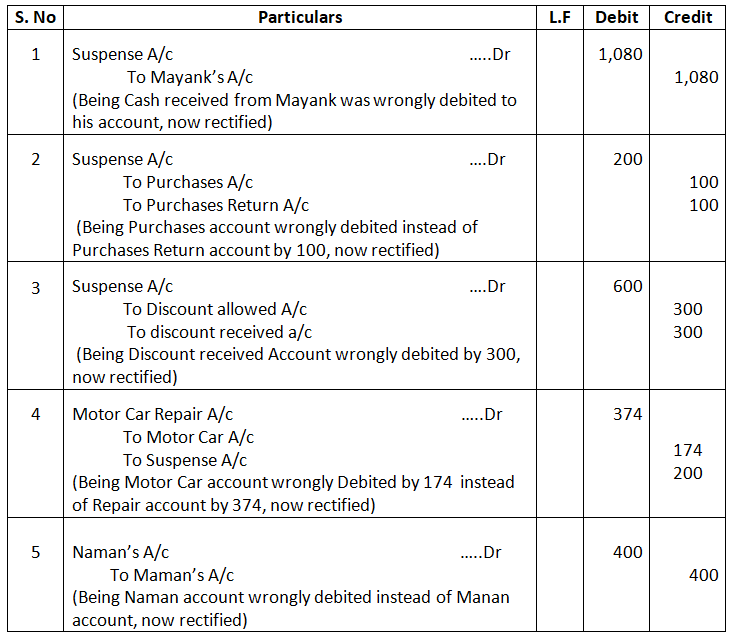

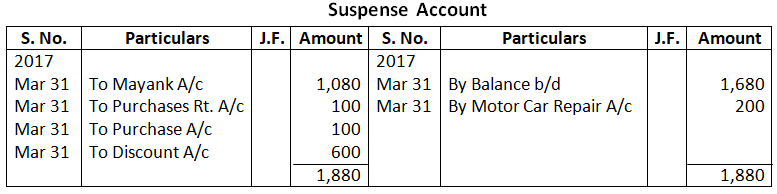

Q48. There was an error in the Trial Balance of Ram Gopal on 31st March, 2025 and the difference in books was carried to the Suspense Account. On perusing the books, following errors were identified:

- Rs.540 received from Mayank was posted to the debit side of his account.

- Rs.100 being purchases return was posted to the debit of the Purchases Account.

- Discount of 300 received was posted to the debit of the Discount allowed Account.

- 374 paid for motor car repairs were debited to the Motor Car Account as 174.

- 400 paid to Naman were debited to the account of Manan.

Pass the Journal entries to rectify the above errors and state what amount was carried to the Suspense Account.

Solution – Journal Entries

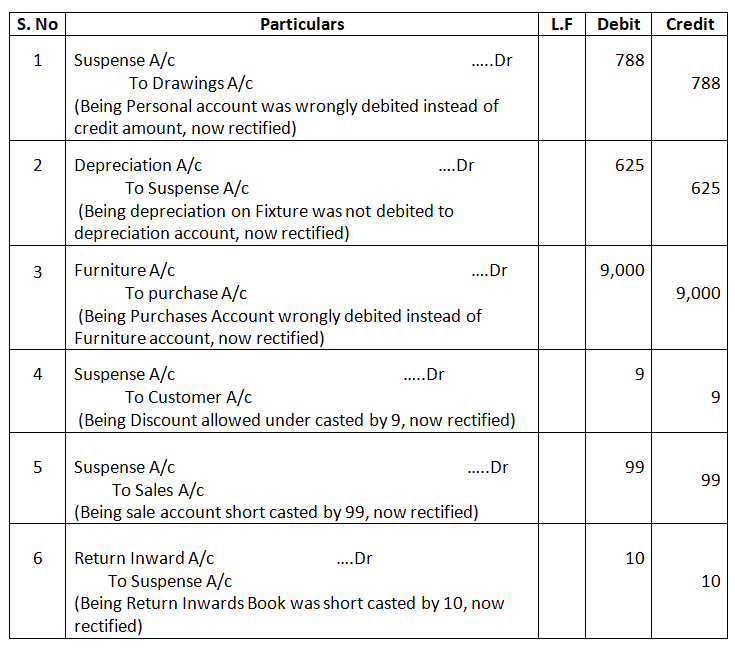

Q49. Trial Balance of a bookkeeper shows an excess of debits over credits by 261. This difference is placed in a Suspense Account to facilitate books closure. Later on the following errors were discovered:

- A credit item of 349 has been debited to a Personal Account as 439.

- A sum of 625 written off from fixtures as depreciation has not been posted to the Depreciation Account.

- 9,000 paid for Furniture bought have been charged to the Purchases Account.

- A discount allowed to a customer has been credited to him as 145 in place of 154.

- A sale of 594 was posted as 495 in the Sales Account.

- The total of Returns Inward Book has been added 10 short.

Pass the Journal entries to correct these errors and prepare the Suspense Account.

Solution – Journal Entries

Q50. Rectify the following errors found in the books of Bheem. Trial Balance had 930 excess credits. The difference has been posted to a Suspense Account:

- The total of Returns Inward Book has been cast 1,000 short.

- The purchase of an office table costing 3,000 has been passed through the Purchases Book.

- Cartage paid for the newly purchased machinery 3750 posted to cartage account

- A Purchase of 670 had been posted to the Creditors Account as 600.

- A cheque for 2,000 received from Nakul had been dishonoured and was passed to the debit of the Allowances Account.

- An amount of 15,720 due from Prasad written off as had in a previous year, was recovered and credited to the Personal Account of Prasad.

After rectification reflect the transactions in the Suspense Account.

Solution – Journal Entries

Q51. A proprietor of a firm while balancing his books finds difference in the Trial Balance. To avoid delay in the preparation of financial statement, he places the difference to ‘Suspense Account’ which he carries forward to the next year. In the next year, following errors were identified:

- Sales Book was undercast by Rs.160.

- Purchases Book total was carried forward as Rs.400 instead of Rs.720.

- Credit sales to Gaurav Rs.640 posted as Rs.6,400.

- Sales to Kabir Rs.640 recorded in the Sales Book as Rs.6,400.

- Purchases of a furniture of Rs.16,000 passed through the invoice book.

- Sale of a furniture of Rs.1,600 to Shiv not entered anywhere.

You are required to:

- Find the difference in the Trial Balance.

- Rectify the errors.

- Prepare Suspense Account.

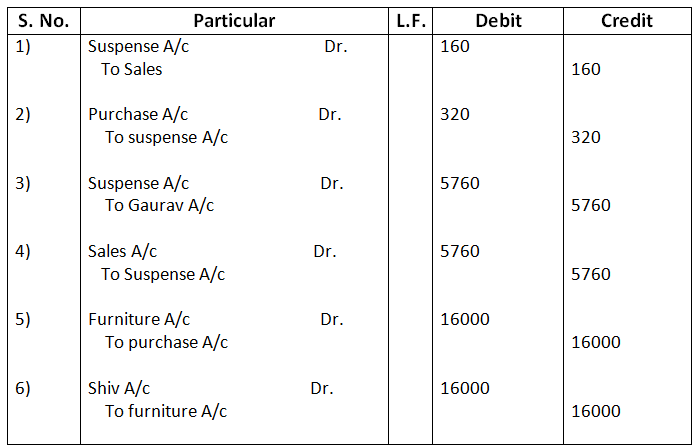

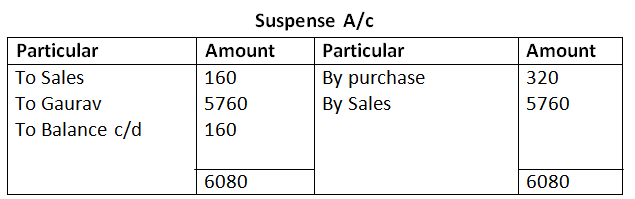

Solution:-

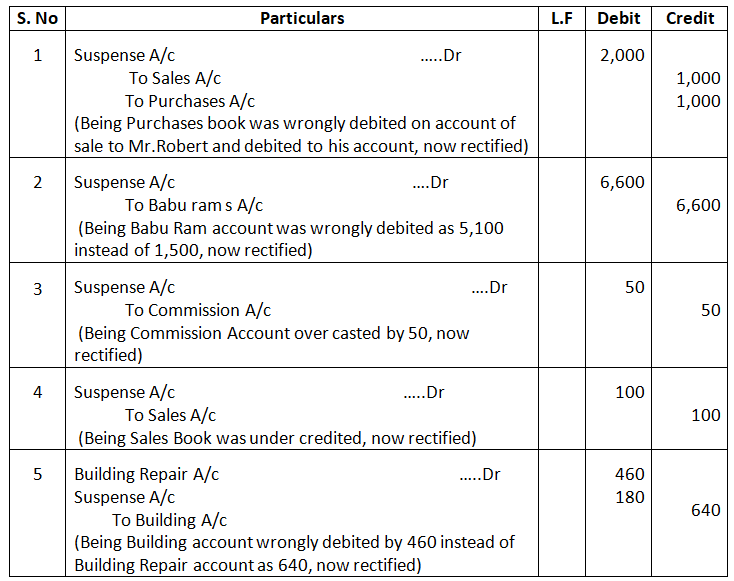

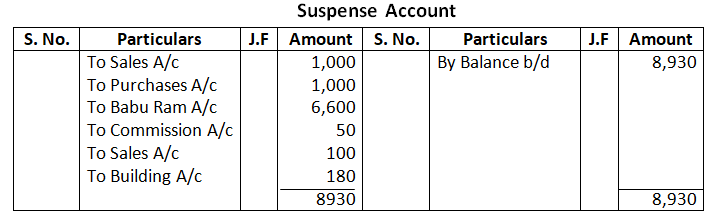

Q52. The Trial Balance of Ramdass did not match and the difference was carried to a Suspense Account. Pass the entries required to rectify the following errors which accounted for the difference. Also, prepare the Suspense Account:

- A Sales Invoice for 1,000 for goods sold on credit to Mr. Robert was entered in the Purchases Book but in the Ledger, the amount was correctly debited to the account of Mr. Robert.

- Goods bought on credit from Babu Ram for 1,500 were wrongly debited to his account as 5,100.

- An amount of 275 was posted as 325 to the debit side of the Commission Account.

- The Sales Book for the month of April was undercasted by 100.

- 460 paid for building repairs was debited to the Building Account as 640.

Solution – In the Books of Ramdass

Journal Entries

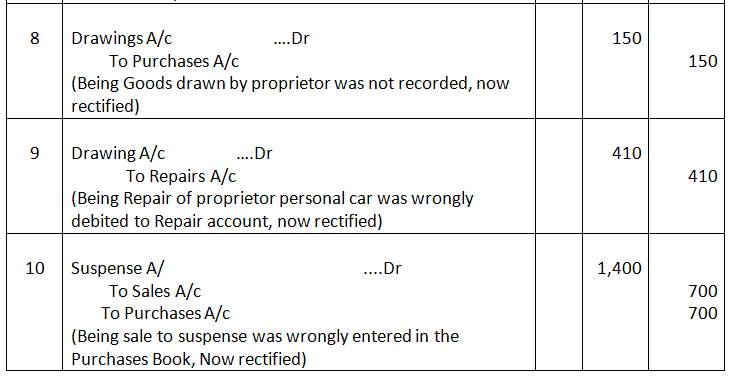

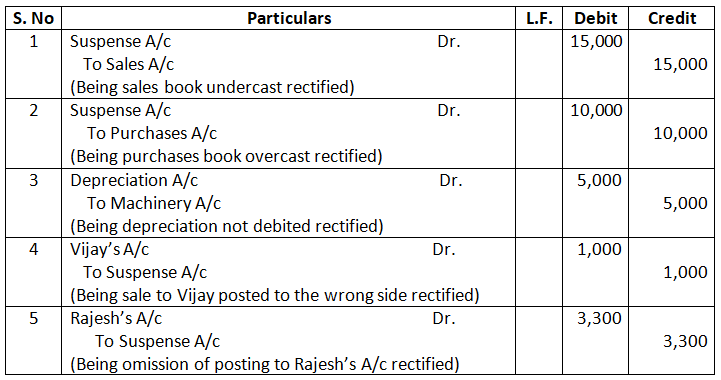

Q53. The accountant of a firm found that his Trial Balance was out (excess credit) by 742. He placed the amount in a Suspense Account and subsequently found the following errors:

- A discount of 178 was allowed to Vijay but in his account only 100 is recorded.

- The total of the Purchases Book was 1,000 short.

- A sale of 375 to Rajesh was entered in the Sales Book as 735.

- From the Purchases Book, Bose’s Account was debited with 175.

- Cash 250 received from Vishnu against debt previously written off was credited to his account.

- Purchase of office furniture worth 750 on credit from Delhi Furniture was entered in the Purchases Book.

- While carrying forward the total of the Sales Book from one page to another the amount of 11,358 was written as 11,538.

- The proprietor took goods of the value of 150 for his domestic consumption. No record of it has been made in the Books.

- Repairs bill of 410 for the proprietor’s personal car has been paid by the firm and debited to the Repairs Account.

- A sale of 700 to Shri Arihant has been entered in the Purchases Book.

Give Journal entries to rectify the errors and prepare Suspense Account.

Solution – Journal Entries