Meaning of Provision

A provision is a charge against profit for the purpose of providing for any liability or loss. Provision for Depreciation, Provision for Doubtful Debts, Provision for Repairs and Provision for Tax are few examples of provisions.

There are certain expenses/ losses which are related to the current accounting period but amount of which is not known with certainty because they are not yet incurred. It is necessary to make provision for such items for ascertaining true net profit. For example, a trader who sells on credit basis knows that some of the debtors of the current period would default and would not pay or would pay only partially. It is necessary to take into account such an expected loss while calculating true and fair profit/loss according to the principle of Prudence or conservatism. Therefore, the trader creates a Provision for Doubtful Debts to take care of expected loss at the time of realization from debtors. In a similar way, Provision for repairs and renewals may also be created to provide for expected repair and renewal of the fixed assets. Examples of Provisions are:

- Provision for depreciation;

- Provision for bad and doubtful debts;

- Provision for taxation;

- Provision for discount on debtors; and

- Provision for repairs and renewals.

It must be noted that the amount of provision for expense and loss is a charge against the revenue of the current period. Creation of provision ensures proper matching of revenue and expenses and hence the calculation of true profits. Provisions are created by debiting the profit and loss account. In the balance sheet, the amount of provision may be shown either:

- By way of deduction from the concerned asset on the assets side. For example, provision for doubtful debts is shown as deduction from the amount of sundry debtors and provision for depreciation as a deduction from the concerned fixed assets;

- On the liabilities side of the balance sheet along with current liabilities, for example provision for taxes and provision for repairs and renewals.

Accounting Treatment for Provisions

The accounting treatment of all types of provisions is almost similar. Therefore, the accounting treatment is explained here taking up the case of provision for doubtful debts.

As already stated that when business transaction takes place on credit basis, debtors account is created and its balance is shown on the asset-side of the balance sheet. These debtors may be of three types:

- Good Debtors are those from where collection of debts is certain.

- Bad Debts are those debtors from where collection of money is not possible and the amount of credit given is a certain loss.

- Doubtful Debts are those debtors who may pay but business firm is not sure about the collection of full amount from them. The provision for doubtful debts is usually calculated as a certain percentage of the total amount due from sundry debtors after deducting deducting/writing-off all known bad debts. Provision for doubtful debts is also called ‘Provision for bad and doubtful debts’. It is created by debiting the amount of required provision to the profit and loss account and crediting it to provision for doubtful debts account.

For creating a provision for doubtful debts the following journal entry is recorded:

Profit and loss A/c Dr. (with the amount of provision)

To Provision for doubtful debts A/c

Feature of Provision

- It is an amount set aside out of income or profits. It is a retention of profit, made temporarily, for a specific purpose.

- The purposes for creating provision are

- To account anticipated losses;

- To account depletion or diminution in the value of an asset; and

- To account liabilities which may arise.

- The amount of anticipated loss or the depletion in the value of the asset, or the liability is estimated, at the time of accounting.

- It is a charge against profits, hence is debited to Profit & Loss Account.

Importance of Provision

- To Determine Correct Profit or Loss: It is necessary to determine correct profit or loss for the year. Correct profit or loss cannot be determined unless expenses for the year whether paid or not are accounted. Expenses, when amount is not known, are estimated and provided. For example, electricity bill is received up to February, 2023. Bill for March, 2023 is yet to be received. The electricity expense for March, 2023 will be estimated and accounted as expense.

- To Ascertain True and Fair Financial Position: Balance Sheet will not give a true and fair view of the financial position unless anticipated losses and expenses are provided.

- Prudence Concept: Provision is made following the Prudence Concept of accounting which holds “provide for all anticipated expenses and losses but do not provide for anticipated incomes and gains.” By making a provision, a part of the profits and corresponding assets are retained, which otherwise could have been distributed as profits.

- To maintain the Capital Intact: Any loss or depletion in the value of an asset or any liability as may not have been provided against income or profit would effectively erode the capital of a business. Creation of Provisions is an attempt to maintain the capital of business intact.

RESERVES

Meaning and Concept

A part of the profit may be set aside and retained in the business ot provide for certain future needs like growth and expansion or to meet future contingencies such as workmen compensation. Unlike provisions, reserve are the appropriations of profit to strengthen the financial position of the business. Reserve is not a charge against profit as it is not meant to cover any known liability or expected loss in future. However, retention of profits in the form of reserves reduces the amount of profits available for distribution among the owners of the business. It is shown under the head Reserves and Surpluses on the liabilities side of the balance sheet after capital. Examples of reserves are:

- General reserve;

- Workmen compensation fund;

- Investment fluctuation fund;

- Capital reserve;

- Dividend equalization reserve;

- Reserve for redemption of debenture.

Importance of Reserves

Reserves are important in a business to strengthen the financial position of the enterprise. The creation of Reserves enables the enterprise to sail through difficult financial period in future. The purpose of transferring profit to Reserve can be:

- Expansion of business,

- Improvement of financial position,

- Redemption of liabilities,

- Meeting unforeseen contingencies, and

- Meeting legal requirements such as Debentures Redemption Reserve under the Companies Act, 2013 required by the Income Tax Law.

Types of Reserve

To have a better understanding of the nature and purpose of Reserve, let us classify them into different types. Reserve are generally classified into:

- Revenue Reserves

- Capital Reserves.

- Revenue Reserves: Are set aside out of revenue profits which are available for distribution as dividend.

Revenue reserves can be classified into:

- General Reserve: General Reserve is the amount set aside out of profits not for any for any specific purpose. It can be used for any purpose as is considered appropriate such as in the event of contingency or expansion of business. Such reserve strengthens the financial position of the business.

- Specific Reserve: Specific Reserve is that reserve which is set aside out of profits for a specific purpose and can be utilized only for that purpose. For example, Workmen Compensation Reserve is a specific reserve because it is maintained to pay compensation to workmen. Debentures Redemption Reserve, Capital Redemption Reserve, Investment Fluctuation Reserve, etc., are other examples of Specific Reserve.

It should be kept in mind that both General Reserve and Specific Reserve are set aside as appropriation of profits.

2. Capital Reserves: Capital Reserve are set aside out of capital profits and are normally not available for distribution. In other words, reserve created out of capital profits and which is not readily available for distribution is Capital Reserve. Examples or Capital Reserves are:

- Profit on sale of fixed assets,

- Premium on issue of shares or debentures,

- Profit on redemption of debentures,

- Profit on reissue of forfeited shares, and

- Profit on revaluation of fixed assets and liabilities.

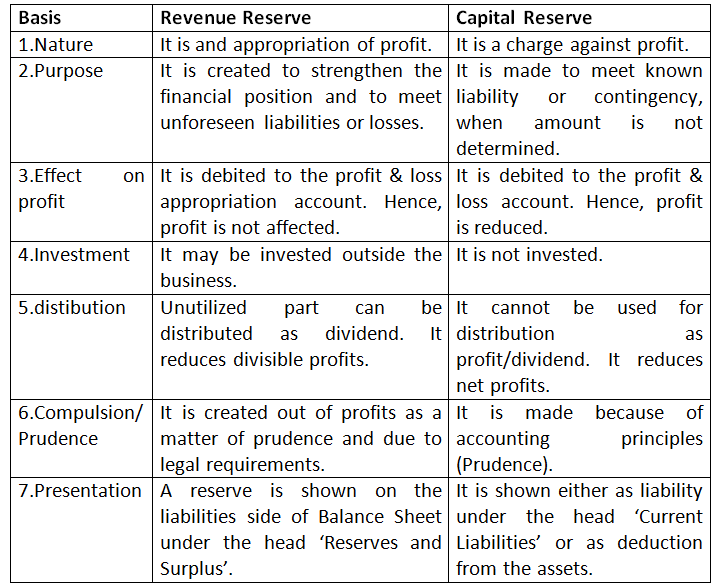

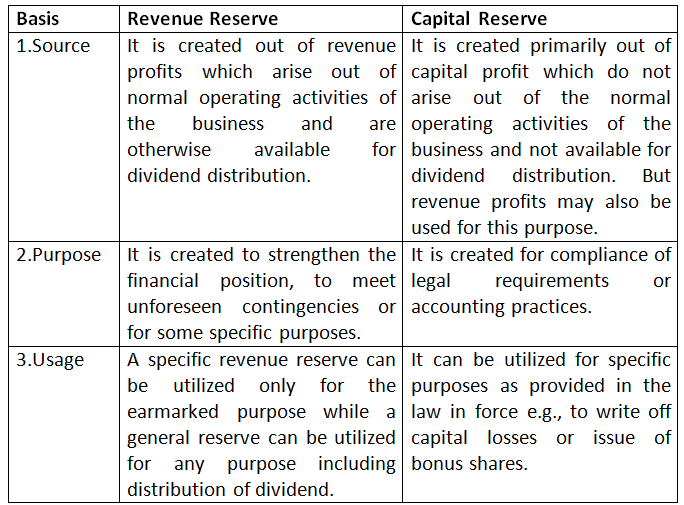

Difference between Revenue and Capital Reserve

SECRET RESERVE

Secret reserve is a reserve the existence and/or the amount of which is not shown in the Balance Sheet. It is also called Hidden Reserve. It can be said that there is a surplus of assets over liabilities and that the surplus is not disclosed or shown by the Balance Sheet. Such reserves are created by showing the assets at a lower amount and liabilities at a higher amount.

Creation of a Secret Reserve

Some of the ways in which Secret Reserve can come into existence are:

- By charging excessive depreciation,

- By undervaluing stock-in-trade,

- By creating excessive provision for bad debts and other contingencies,

- By charging capital expenditure to Profit & Loss Account,

- By showing a contingent liability as a real liability, and

- By suppression of accrued incomes and prepaid expenses.

Advantages of a Secret Reserve

- It increases the working capital of the concern and also strengthens its financial position.

- It enables the directors to tide over unfavorable time. As and when profit reduces, the directors can maintain the rate of dividend by utilizing it.

- Heavy losses of an exceptional nature can be met without disclosing the fact in the published statements and without disturbing the normal business profit.

Disadvantages of a Secret Reserve

- The Balance Sheet will not disclose true and fair position of the affairs of the business.

- It may negatively affect market value of company’s share.

- The shareholders do not get their due share of profit from the business.

Difference between Reserve and Provision