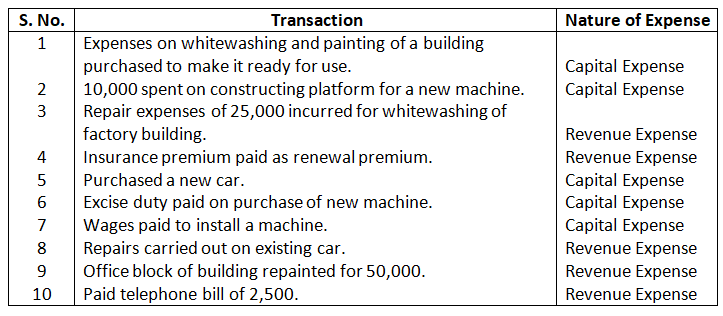

Classification of Capital and Revenue Expenditures:

Q1. State whether the following expenses are capital or revenue in nature:

- Expenses on whitewashing and painting of a building purchased to make it ready for use.

- 10,000 spent on constructing platform for a new machine.

- Repair expenses of 25,000 incurred for whitewashing of factory building.

- Insurance premium paid as renewal premium.

- Purchased a new car.

- Excise duty paid on purchase of new machine.

- Wages paid to install a machine.

- Repairs carried out on existing car.

- Office block of building repainted for 50,000.

- Paid telephone bill of 2,500.

Solution –

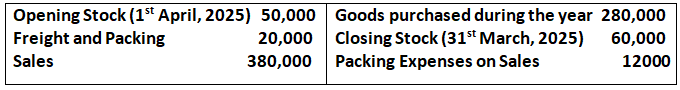

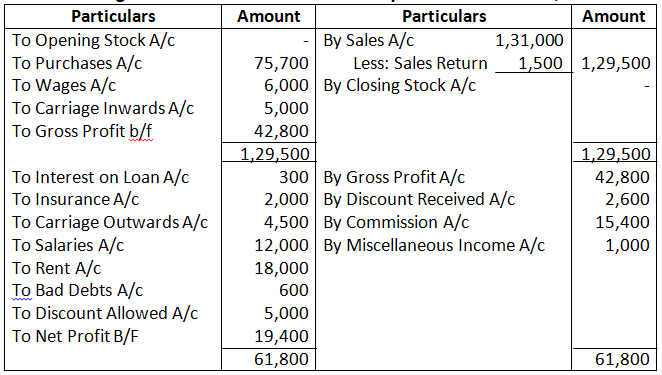

Trading Account:

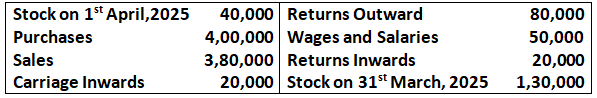

Q2. From the following information, determine Gross Profit for the year ended 31st March, 2025:

Solution – Trading Account

Dr As at March 31, 2025 Cr

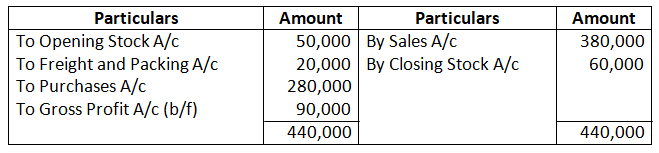

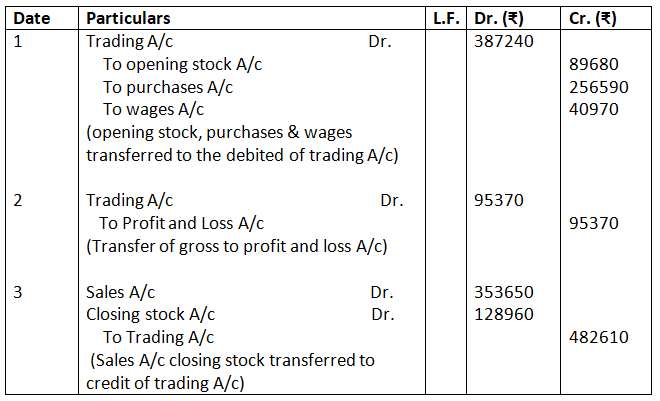

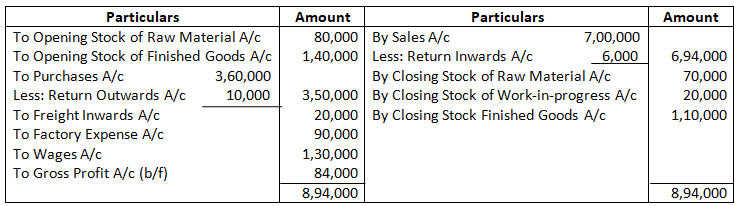

Q3. Trading Account of Premier Trading Co. is given below:

Dr. Trading Account for the year ended 31st March, 2025 Cr.

Pass Closing Journal entries on the basis of the above Trading Account. Also, transfer the Gross Profit to Profit & Loss Account.

Solution:-

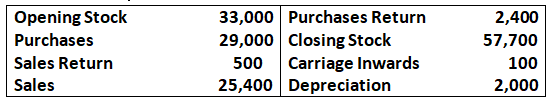

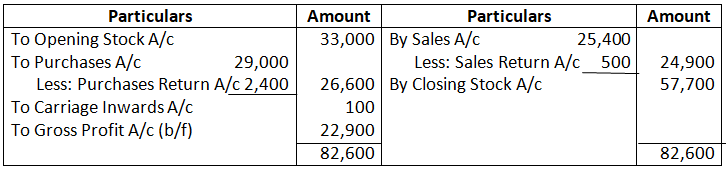

Q4. Prepare Trading Account from the transactions given below:

Also pass the Journal entries.

Solution – In the Books of……

Dr Trading Account for the Year Cr

Journal Entries

Q5. From the following information, prepare Trading Account for the year ended 31st March, 2025:

Net Realisable Value (Market Value) of stock as on 31st March, 2025 was 1, 20,000.

Solution – In the Books of……

Dr Trading Account for the Year Cr

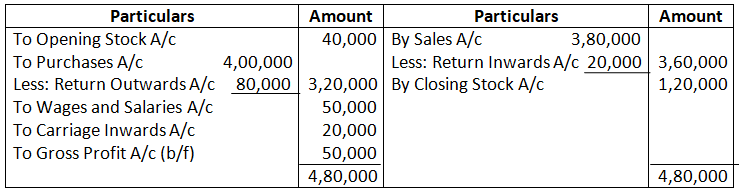

Q6. From the following information, prepare Trading Account for the year ended 31st March, 2025:

Adjusted Purchases 6, 60,000; Sales 7, 44,000; Closing Stock 50,400; Freight and Carriage Inwards 3,600; Wages 6,000; Freight and Cartage Outwards 2,000

Solution – In the Books of…..

Dr Trading Account for the Year ended March 31, 2025 Cr

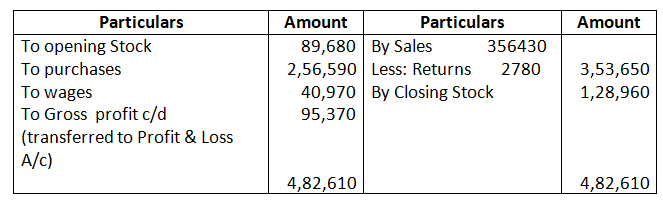

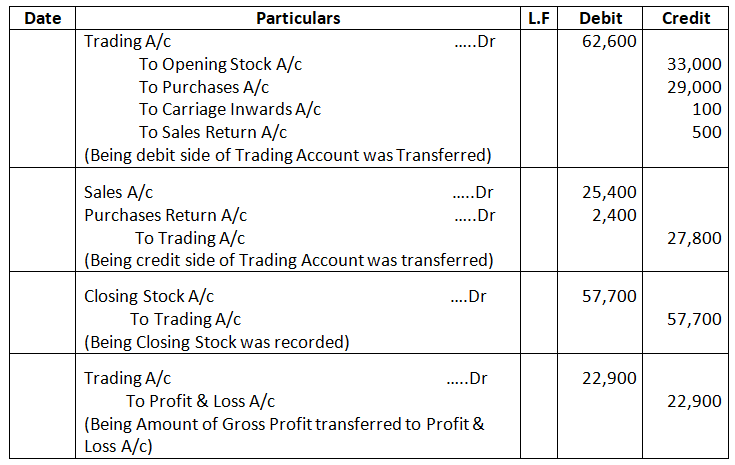

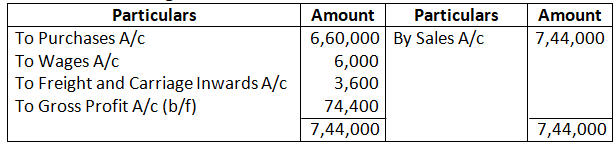

Q7. Following balances appear in the Trial Balance of a firm as on 31st March, 2025:

Prepare Trading Account of the firm.

Solution – Financial Statement of…..

Dr Trading Account for the Year ended March 31, 2025 Cr

Calculate of Gross Profit, Opening Stock, Closing Stock and cost of goods sold

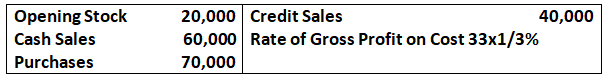

Q8. Calculate Closing Stock from the following details:

Solution –

Total Sales = Cash Sales + Credit Sales

= 60,000 + 40,000

= 1, 00,000

the rate of gross profit is 33 1/2% on cost. this is equivalent to 1/3 of the cost of goods sold(COGS)

Gross profit = 1/3 X COGS

Also sales =COGS + 1/3 X COGS

sales= (1 +1/3) COGS

sales= 4/3 x COGS

COGS=sales X 3/4

=100,000 X 3/4

=75000

Cost of Goods Sold = Opening Stock + Purchase – Closing Stock

75,000 = 20,000 + 70,000 – Closing Stock

75,000 = 90,000 – Closing Stock

Closing Stock = 90,000 – 75,000

= 15,000

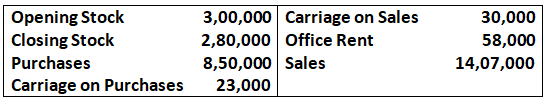

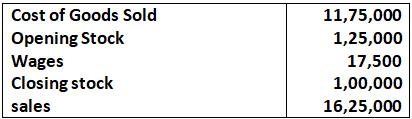

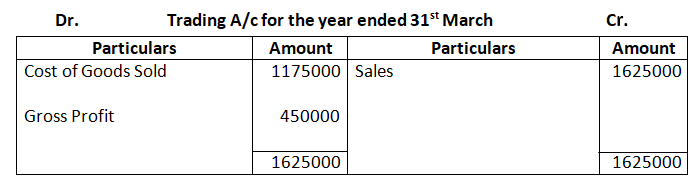

Q9. Ascertain Gross Profit from the following information:

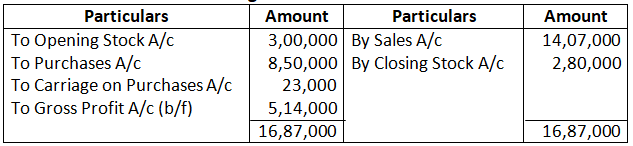

Solution – In the Books of……

Dr Trading Account for the Year Cr

Q10. Calculate Gross Profit when:

Total Purchases During the year are Rs.20,00,000;

Return Outward : Rs.50,000

Direct Expenses : Rs.1,50,000

2/3rd goods are sold for Rs.15,25,000.

Solution:-

Calculation of cost of Goods sold

Total purchases during the year = Rs.20,00,000

Return outward = Rs.50,000

Net purchases = Rs.20,00,000 – 50,000

= 19,50,000

Direct expenses = 150,000

Total cost of Goods Available for sale:

Net purchases + Direct expenses

19,50,000 + 1,50,000

= 21,00,000

Thus, cost of goods sold for 2/3rd goods sold

Cost of Goods sold = 2/3 x 21,00,000

= Rs.14,00,000

Calculation of Gross Profit

Gross profit = Sales – Cost of Goods sold

= 15,25,000 – 1400000

= 1,25,000

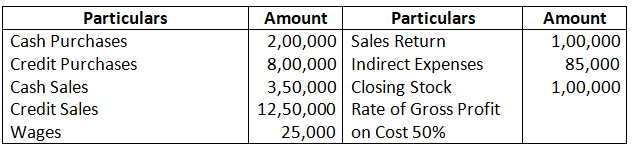

Q11. Calculate Opening Stock from the following information:

Solution:-

Calculate of opening stock

Net purchases = Cash purchases + Credit Purchases – Purchase return

= 2,00,000 + 8,000 – 0

= Rs.10,00,000

Net Sales = Cash sales + Credit Sales – Sales Return

= 3,50,000 + 12,50,000 – 1,00,000

= 15,00,000

Cost of Goods Sold = Opening stock + Net purchases + wages – closing stock

10,00,000 = opening stock = 10,00,000 + 2500 – 1,00,000

Opening stock = 10,00,000 – 10,00,000 – 2500 + 1,00,000

Opening stock = 75,000

Working Notes:-

Calculation of cost of goods sold

Gross Profit = Net Sales – cost of Goods Sold

50x/100 = 1500,000 – x

X + 50x/100 = 15,00,000

150x/100 = 15,00,000

X = 15,00,000 x 100 /150

Cost of goods sold = Rs.10,00,000

Q12. (a) Net Sales for the year ended 31st March, 2025 is Rs.4,50,000. If Gross Profit is 30% on Sales, find Cost of Goods Sold.

(b) Net Sales for the year ended 31st March, 2025 is Rs.4,50,000. If Gross Profit is 25% of cost, find Gross Profit and cost of Goods Sold.

Solution:-

Case – (a)

Given : Net Sales = RS.4,50,000

Gross Profit = 30% on sales

Cost of Goods Sold = ?

Gross Profit = 30% of sales

= 30/100 x 4,50,000

= 1,35,000

Cost of Goods sold = Net Sales – Gross Profit

= 4,50,000 – 1,35,000

= 3,15,000

Case – (b)

Calculate of cost of Goods sold

Given : Net sales = Rs.4,50,000

Gross profit = 25% of cost

Let cost of goods sold be Rs.x

Gross profit = net sales – cost of goods sold

25/100x = 4,50,000 – x

25x/100 + x = 4,50,000

125x /100 = 4,50,000

Cost of goods sold (x) = 4,50,000 x 100/125

= Rs.3,60,000

Calculate of Gross Profit

Gross profit = Net Sales – Cost of Goods Sold

= 4,50,000 – 3,60,000

= 90,000

Q13. Calculate Net Sales and Gross Profit from the following information:

Cost of Goods Sold : Rs.2,50,000%, Gross Profit 20% on Sales.

Solution:-

Calculation of Net Sales

Given : cost of Goods Sold = Rs.2,50,000

Gross Profit = 20% on sales

Let the Net sales be Rs.x

Gross Profit = Net Sales – Cost of goods sold

20x/100 = x – 2,50,000

X – 20x/1000 = 2,50,000

100x – 20x /100 = 2,50,000

80x/100 = 2,50,000

Net Sales (x) = 2,50,000 x 100 / 80

= 312500

Calculate of Gross Profit

Gross Profit = Net Sales – Cost of Goods sold

= 3,12,500 – 2,50,000

= 62,500

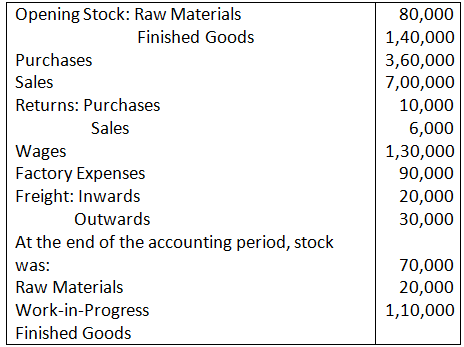

Q14. From the following information, prepare Trading Account for the year ended 31st March, 2025:

Solution:-

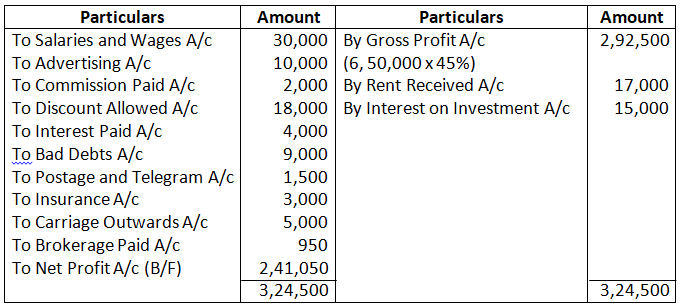

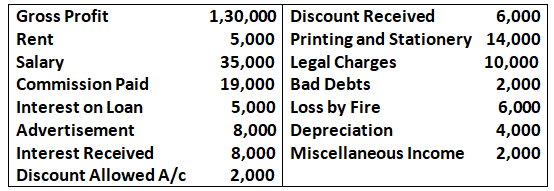

Q15. From the following prepare Profit and Loss Account of Sohan Lal as it would appear in the 1st year that ended 31st March, 2025:

The Gross Profit was 45% of Sales, which amounted to 6, 50,000.

Also pass the Journal entries.

Solution – In the Books of Sohan Lal

Dr Profit and Loss Account for the Year ended March 31, 2025 Cr

Working Note 1:-

Gross Profit = Sales x Percentage

= 6, 50,000 x 45%

= 2, 92,500

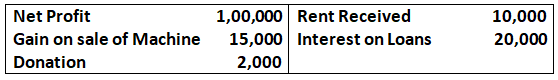

Q16. From the following information, prepare Profit and Loss Account for the year ended 31st March, 2025:

Solution – In the Books of…..

Dr Profit and Loss Account for the Year ended March 31, 2025 Cr

Calculation of Operation Profit

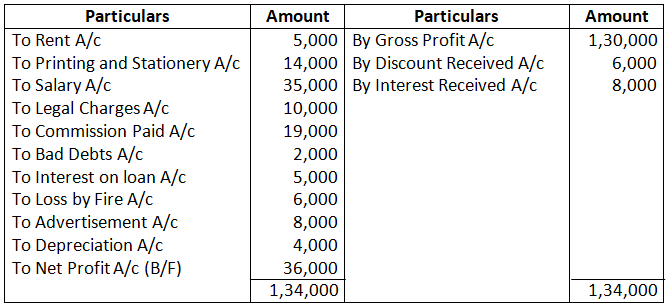

Q17. From the following figures, calculated Operating Profit:

Solution –

Operating Profit = Net Profit – Rent Received – Gain on Sale of Machine + Interest on loan +Donation

= 1, 00,000 – 10,000 – 15,000 + 20,000 + 2,000

= 97,000

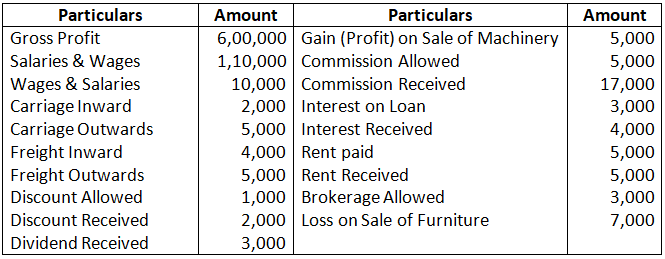

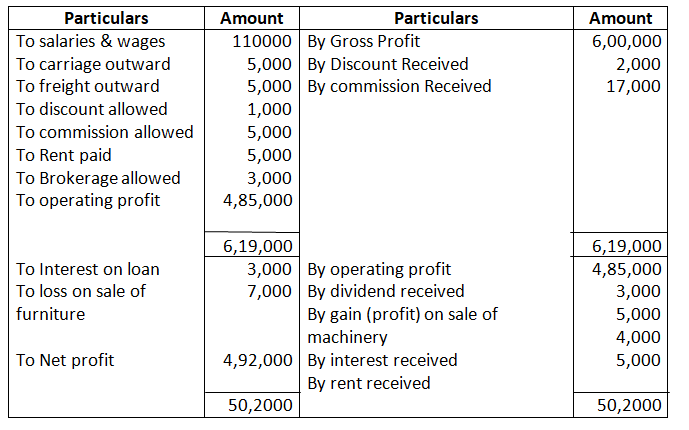

Preparation of Profit & Loss Account showing Operating Profit separately

Q18. From the following information, prepare Profit & Loss Account showing Operating Profit separately in the account itself of Manoj Traders for the year ending on 31st March, 2025:

Solution:-

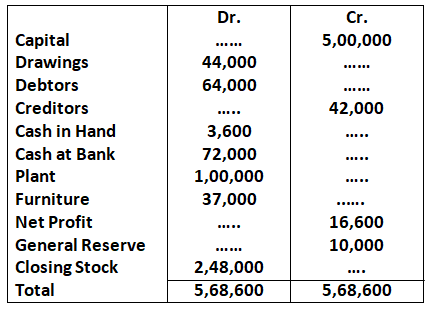

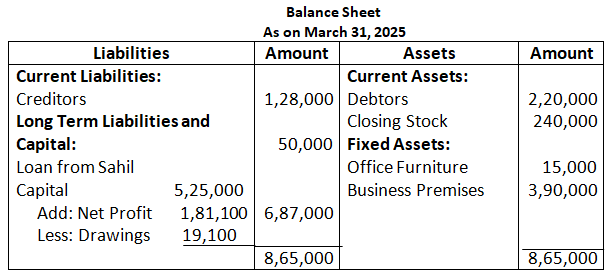

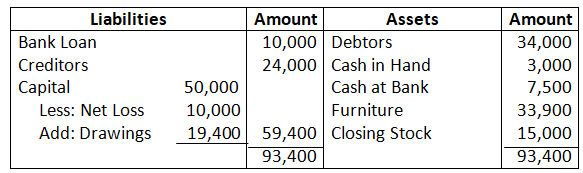

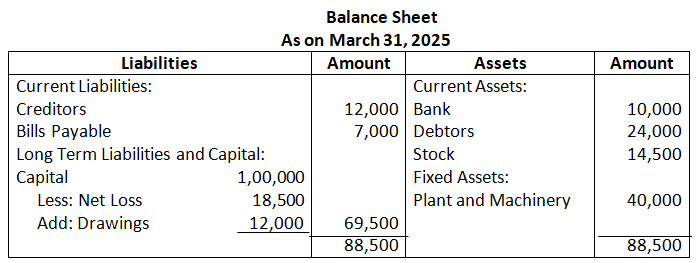

Balance Sheet:

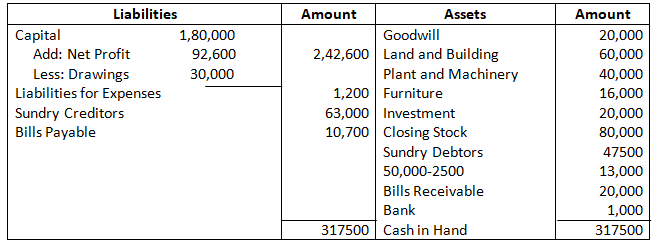

Q19. From the following particulars, prepare Balance Sheet as at 31st March, 2025:

Solution – Balance Sheet

As on March 31 2025

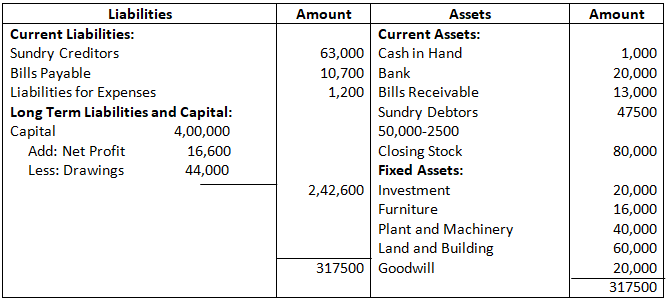

Q20. From the following information, prepare Balance Sheet of a trader as at 31st March, 2024 arranging the assets and liabilities – (i) in order of permanence and (ii) in order of liquidity:

Solution – in order Permanence Balance Sheet

As on March 31, 2025

In order of Liquidity Balance Sheet

As on March 31 2025

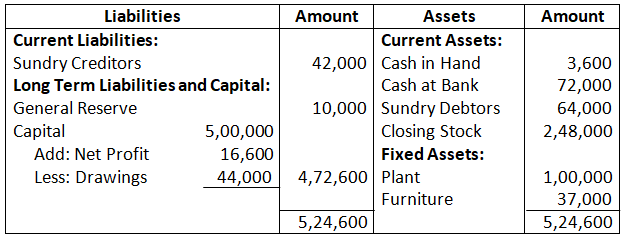

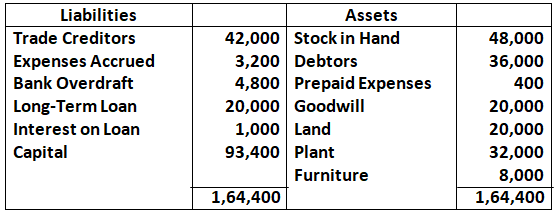

Q21. From the Balance Sheet given below, calculate:

- Fixed Assets

- Current Assets

- Current Liabilities

- Working Capital

Balance Sheet as at 31st March, 2025

Solution –

- Fixed Assets = Goodwill + Land + Plant + Furniture

= 20,000 + 20,000 + 32,000 + 8,000

= 80,000

- Current Assets = Stock in Hand + Debtors + Prepaid Expenses

= 48,000 + 36,000 + 400

= 84,400

- Current Liabilities = Trade Creditors + Expenses Accrued + Bank Overdraft + Interest on loan

= 42,000 + 3,200 + 4,800 + 1,000

= 51,000

- Working Capital = Current Assets – Current Liabilities

= 84,400 – 51,000

= 33,400

Preparation of Final Accounts:

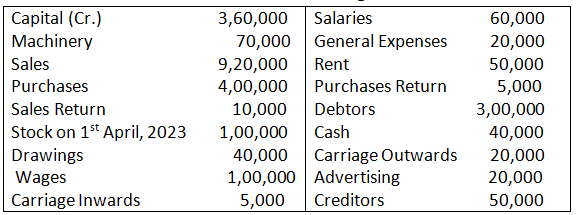

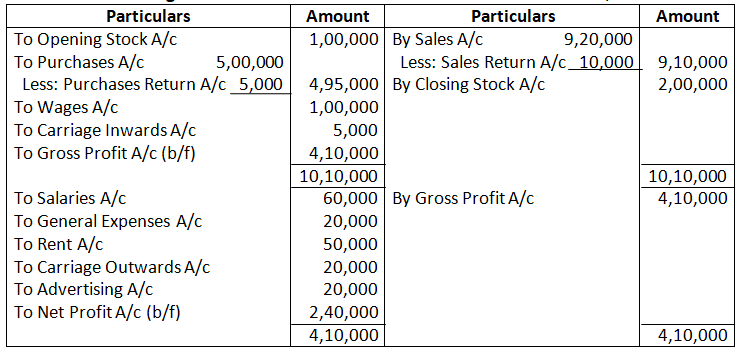

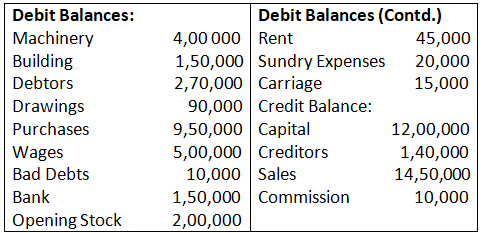

Q22. Prepare Trading and Profit and Loss Account and Balance Sheet of Jagat Shah as at 31st March, 2025 from the following balances:

Closing Stock was valued at 2, 00,000

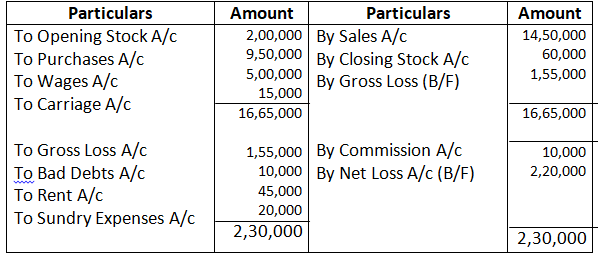

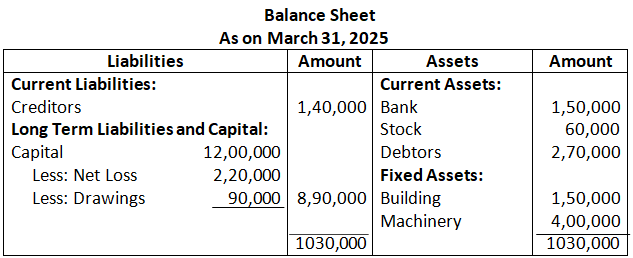

Solution – In the Books of Jagat Shah

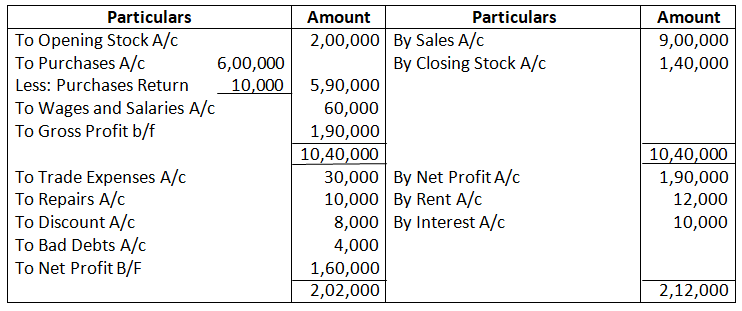

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

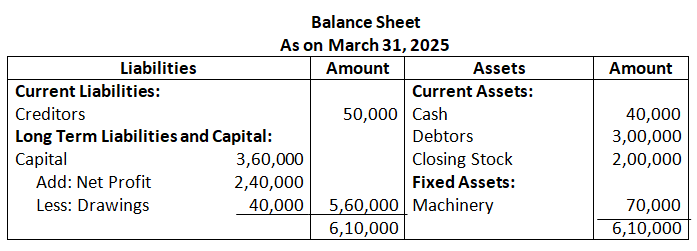

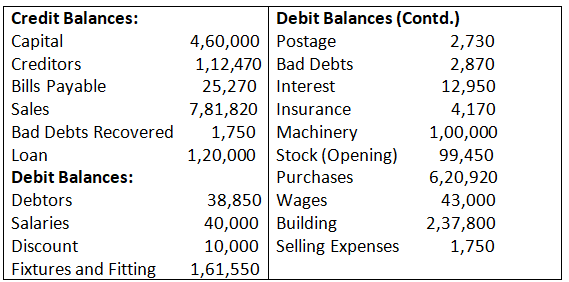

Q23. The following are the balances as on 31st March, 2025 extracted from the books of Dass:

The stock on 31st March, 2025 was valued at 2, 40,000.

You are required to prepare Trading Account, Profit and Loss Account and Balance Sheet as at 31st March, 2025.

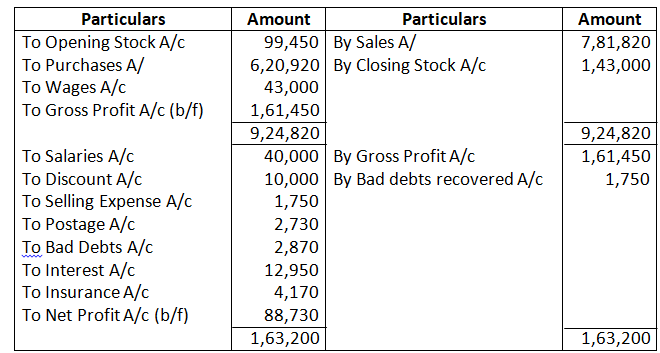

Solution – In the Books of Bhagwan Dass

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

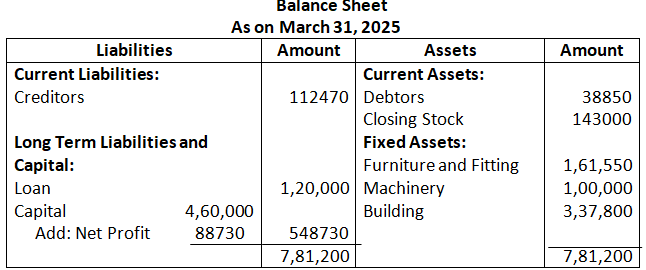

Q24. From the following balances of Anand, prepare Trading Account, Profit and Loss Account and Balance Sheet as at 31st March, 2025:

Value of goods on hand (31st March, 2025) was 1,43,000.

Solution – In the Books of Ananda

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

Q25. From the following balances, prepare Trading and Profit and Loss Account for the year ending 31st March, 2025 and the Balance Sheet as on that date:

Closing Stock was of 70,000 but its net realisable value (market value) is 60,000

Solution – In the Books of……

Dr Trading and Profit & Loss Account as on Cr

Q26. The following is the Trial Balance of Atul as at 31st March, 2025:

Prepare Trading and Profit and Loss Account for the year ending on 31st March, 2025 and Balance Sheet as on that date.

Solution – In the Books of …

Dr Trading and Profit & Loss Account for the year ended March 31, 2025 Cr

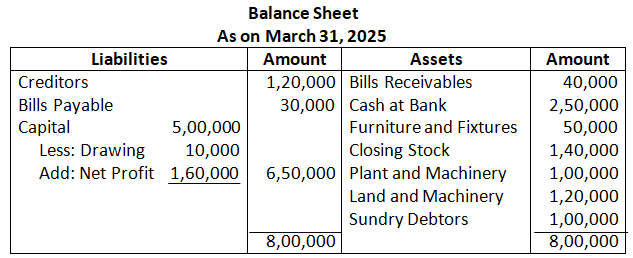

Balance Sheet

As on March 31, 2025

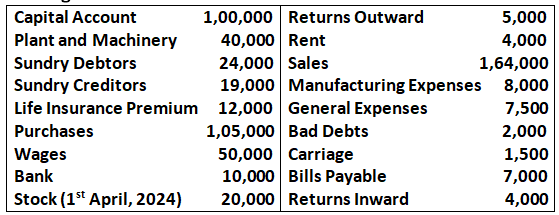

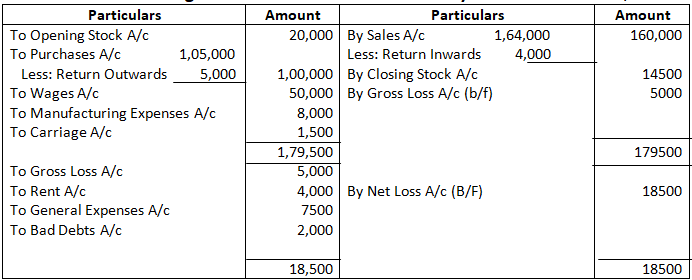

Q27. From the following balances as on 31st March, 2025, prepare Trading and Profit and Loss Account and Balance Sheet:

Closing Stock on 31st March, 2025 was valued at 14,500.

Solution – In the Books of

Dr Trading and Profit & Loss Account for the year ended March 31, 2025 Cr

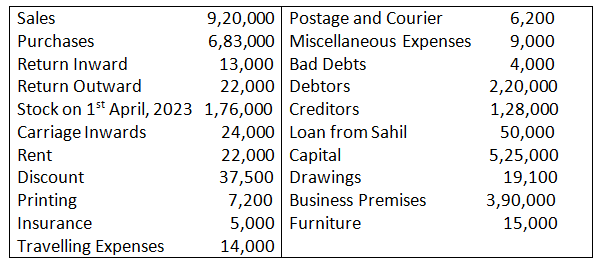

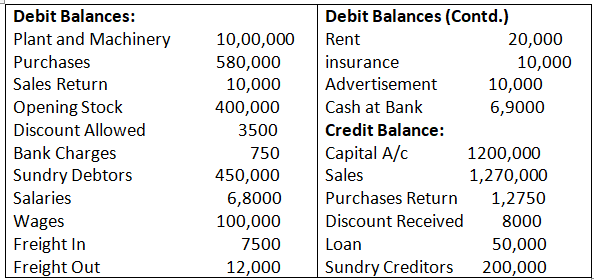

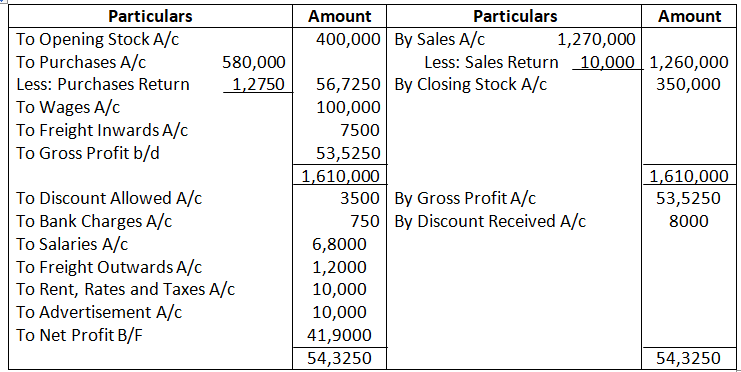

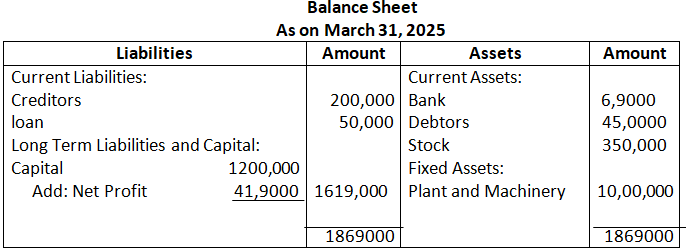

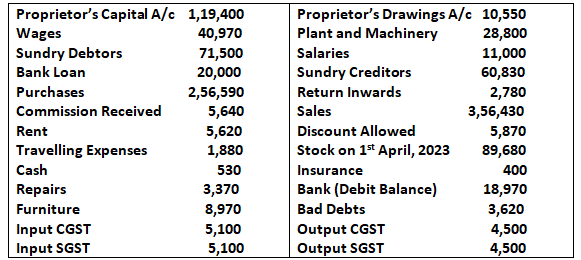

Q28. Trial Balance of Chatter Sen on 31st March, 2025 revealed the following balance:

Stock on 31st March, 2025 was 350,000 at cost and its net realisable value (market value) was 4,00,000

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2025 and Balance Sheet as at that date.

Solution – In the Books of Chatter Sen

Dr Trading and Profit & Loss Account for the year ended March 31, 2025 Cr

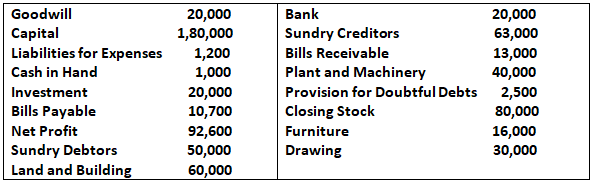

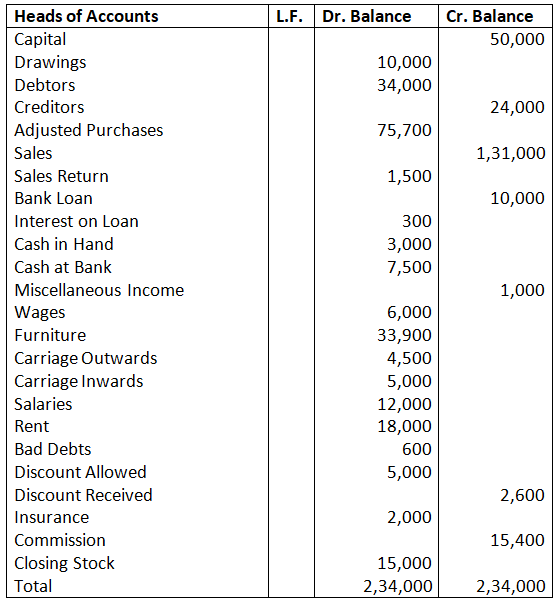

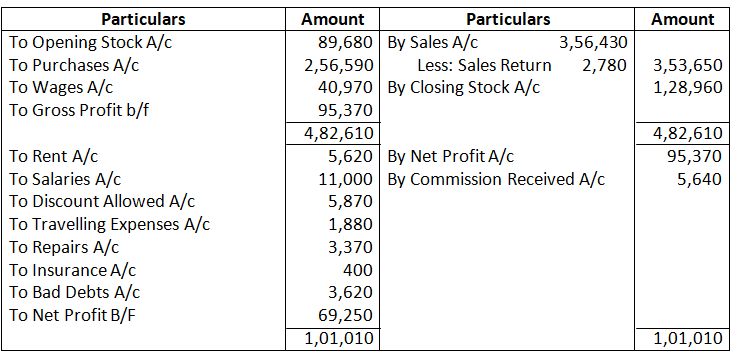

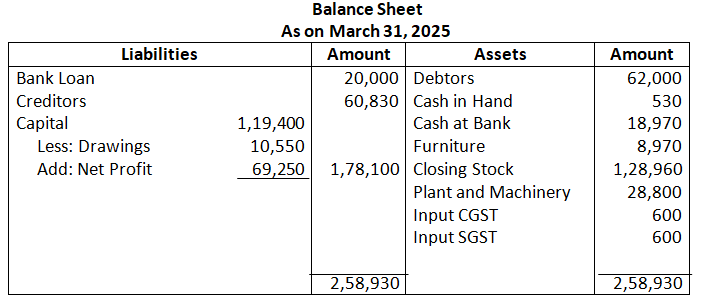

Q29. Prepare Trial Balance, Trading and Profit and Loss Account for the year ended 31st March, 2025 and Balance Sheet of the Premier Trading Company as at that date, from the following extracts of Ledger balances:

Stock in Hand on 31st March, 2025 was valued at 1, 28,960.

Solution – In the Books of

Dr Trading and Profit & Loss Account for the year ended March 31, 2025 Cr

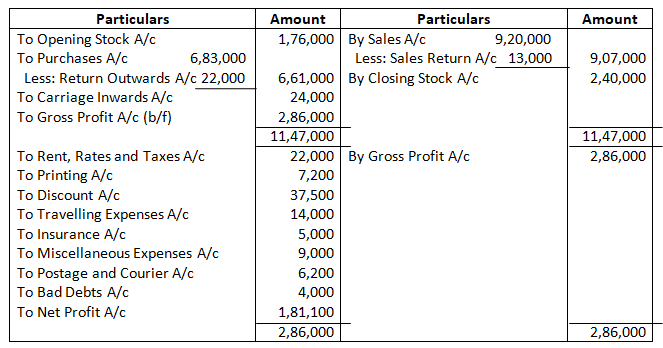

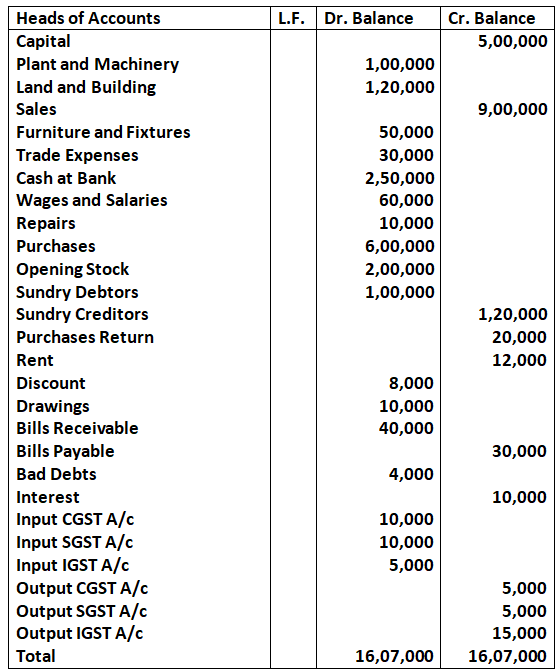

Q30. From the following Trial Balance, Prepare Trading and Profit and Loss Account for the year ended 31st March,2025 and Balance Sheet as at that date:

The stock on 31st March, 2025 was valued at 1, 40,000.

Solution in the Books of

Dr Trading and Profit & Loss Account for the year ended March 31, 2025 Cr

“Very informative. The structured format and simplified language made complex concepts like final accounts much easier to grasp.”

Good for use