Adjustments

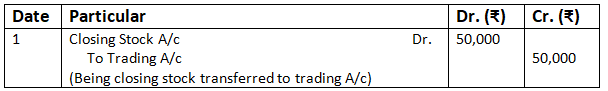

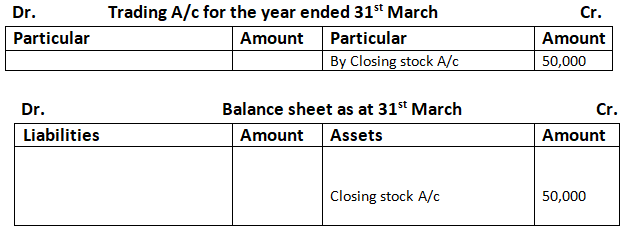

Q.1 Closing Stock as at 31st March, 2025 of Rs.50,000 appears the Trial Balance. Accounts are closed on 31st March. Pass an Adjusting Entry and show how this will appear in the Final Accounts.

Solution:-

Note:-

Closing stock of Rs.50,000 will be transferred to the credit side of trading Account and it will be shown on the asset side of balance sheet.

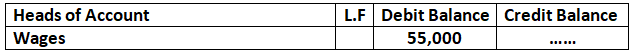

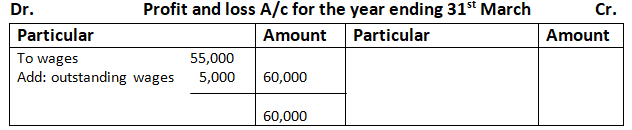

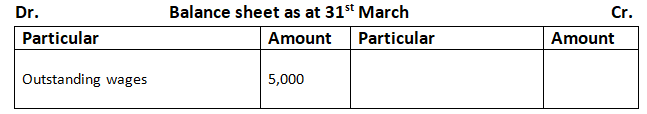

Q2. Following is the extract of Trial Balance as at 31st March, 2025:

Additional Information:

Wages outstanding for 1 month.

Show the treatment of Wages in the Final Accounts.

Solution:-

Working Notes:-

Calculation of outstanding wages for 1 month

Outstanding wages for 1 month = wages paid for 11 months / 11

= 55,000 / 11

= 5,000

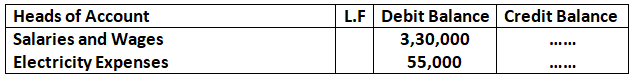

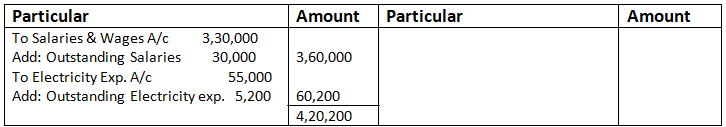

Q3. Rahul’s Trial Balance as on 31st March, 2025 has following information:

Additional Information:

- Salary for the month of March, 2025 is yet to be paid.

- Electricity Bill for March, 2025 amounted to RS.5,200 was received on 2nd April, 2025.

Determine the amount of Salary and Electricity Expenses to be provided and show how the two amount will be show in the final Account?

Solution:-

In the Books of Rahul

Profit & Loss Account for the year ended 31st March

Working Note –

Calculation of o/s salaries for the month of March

Outstanding salary of the month of March = 330000 / 11

= Rs.30,000

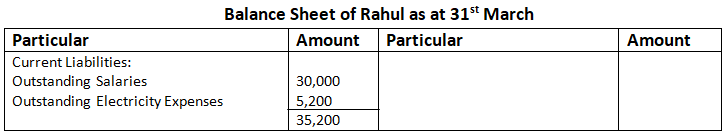

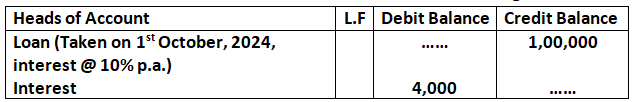

Q4. Ravi’s Trial Balance as on 31st March, 2025 has the following information:

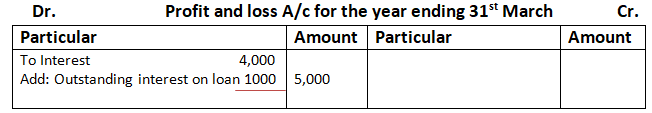

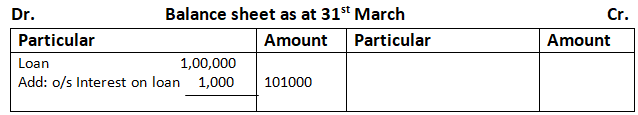

What is the amount of outstanding interest to be provided?

Solution:-

The Amount of outstanding interest to be provided

= Total Interest – Interest paid during the year

= 1,00,000 x 10/100 x 6/12 – 4,000

= 5,000 – 4,000

= Rs.1,000

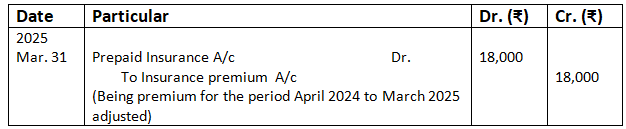

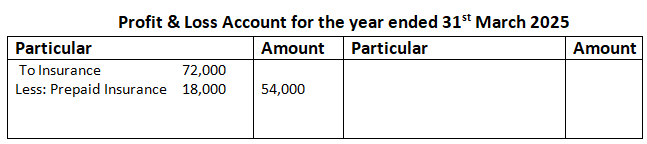

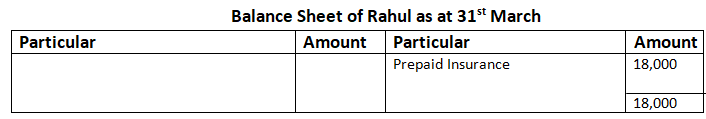

Q5. On 1st July, 2024, fire insurance premium of Rs.72,000 was paid on a policy on a policy which will expire on 30th June, 2025. Accounts are closed on 31st March. Pass an adjusting entry and show how this will appear in the Final Accounts.

Solution:-

Working Note-

Calculation of prepaid Insurance

Insurance paid from 1st July 2024 = 72,000

Insurance for 1 month = 72,000 / 12 = 6,000

Prepaid Insurance from 1st April 2025 to 30th June 2025 = 6,000 x 3

= 18,000

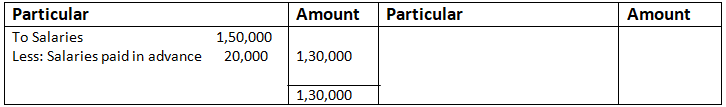

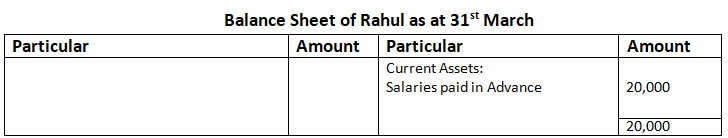

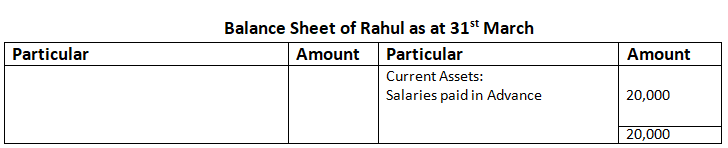

Q6. Manish has paid salaries of Rs.1,50,000 for the year ended 31st March, 2025. Salaries include Rs.20,000 paid in advance for the year ending 31st March, 2026. Show how it will be show in the Profit & Loss Account and the Balance Sheet.

Solution:-

In the Books of Manish

Profit & Loss Account for the year ended 31st March

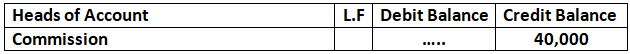

Q7. Following is the extract of Trial Balance as at 31st March, 2025:

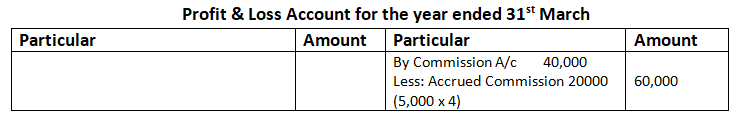

Additional Information: Commission is receivable @ Rs.5,000 per month for four months. Show the treatment of Commission in the Final Accounts.

Solution:-

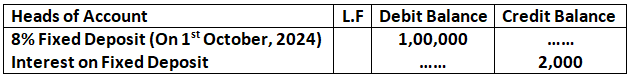

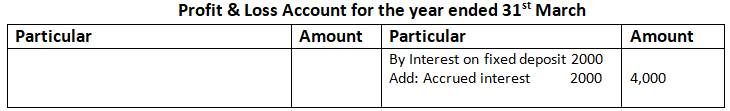

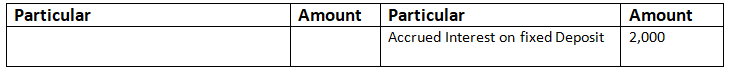

Q8. From the following Trial Balance as at 31st March, 2025, show the relevant extract from the Profit & Loss Account and the Balance Sheet:

Solution:-

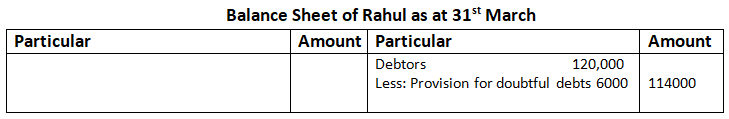

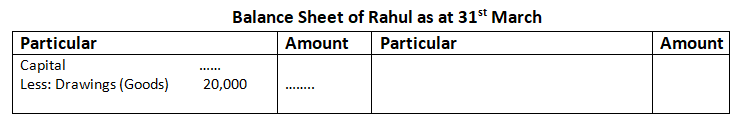

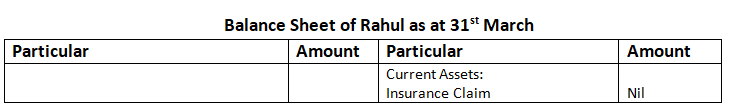

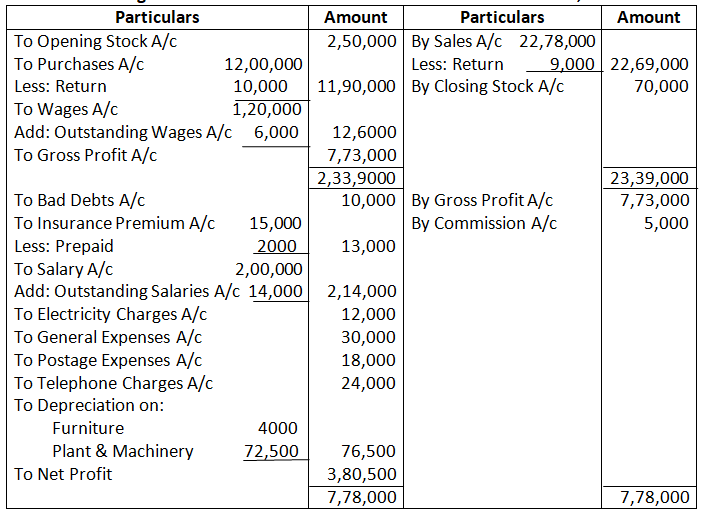

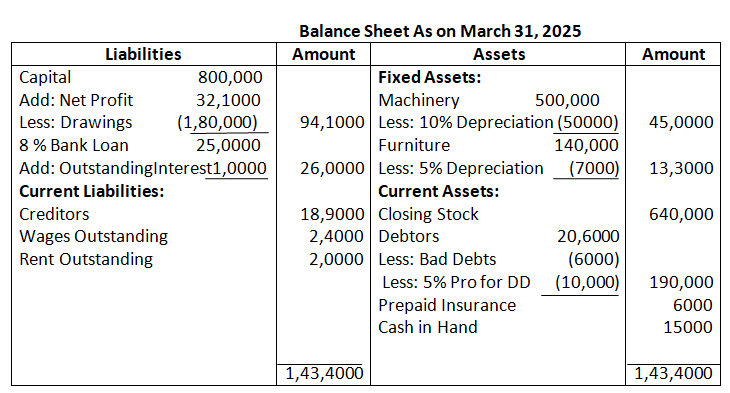

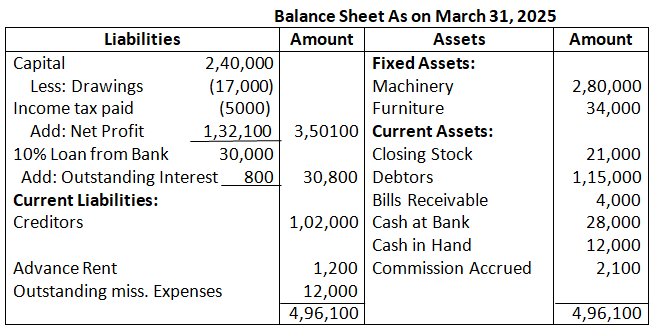

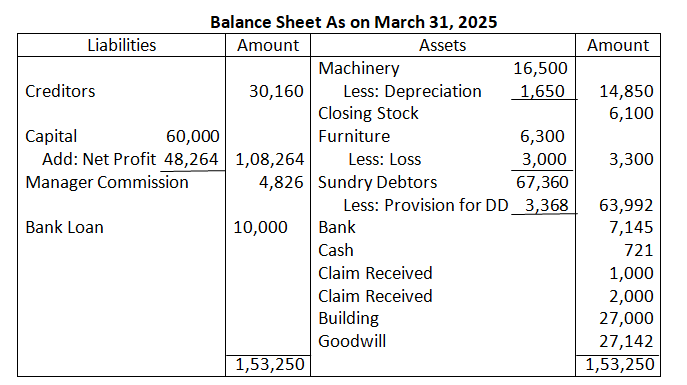

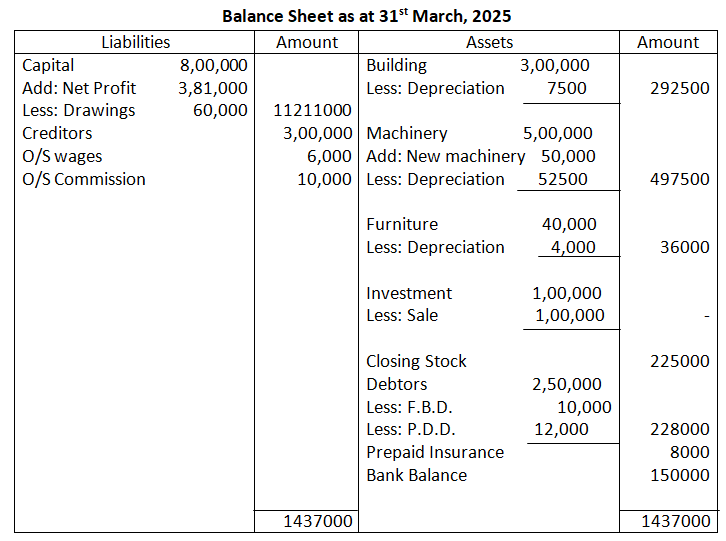

Balance Sheet of Rahul as at 31st March

Working Note:

Calculate of Accrued Interest on fixed Deposit

Accrued Interest on Fixed Deposit = Interest on fixed deposit – Interest on fixed Deposit

= 100,000 x 8% x 6/12 – 2000

= 4000 – 2000

= Rs.2,000

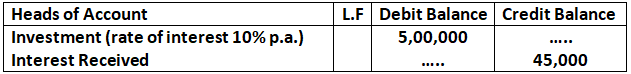

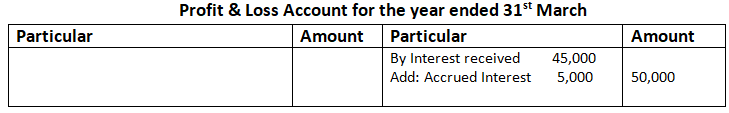

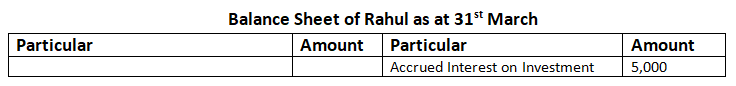

Q9. Ramesh’s Trial Balance as on 31st March, 2025 gives the following information:

Show how the above items will be shown in the Profit & Loss Account and Balance Sheet.

Solution:-

Working Note:-

Calculate of Accrued Interest on

Accrued Interest on Investment = Interest on Investment – Interest Received

= 50,000x 10% – 45,000

= 50,000 – 45,000

= Rs.5,000

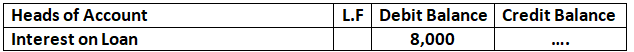

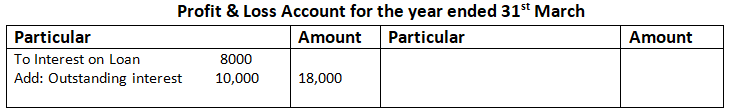

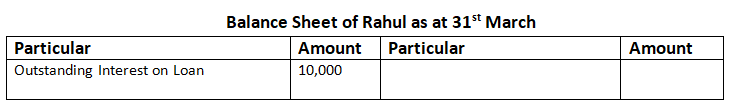

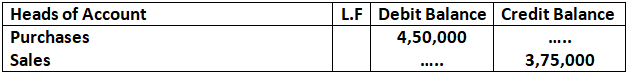

Q10. Following is the extract of Trial Balance as at 31st March, 2025:

Additional Information:

Loan of Rs.6,00,000 was taken from State Bank of India at an interest rate of 12% p.a. on 1st July, 2024 and it was repaid on 1st October, 2024.

Show the treatment of ‘Interest on Loan’ in Final Accounts.

Solution:-

Working Notes:

Calculate of outstanding Interest on loan

Outstanding Interest on Loan = Interest on loan – Interest paid on loan

= 600000 x 12% 3/12 – 8,000

= 18,000 – 8,000

= 10,000

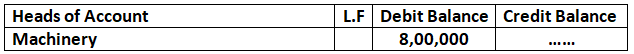

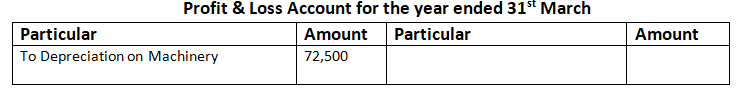

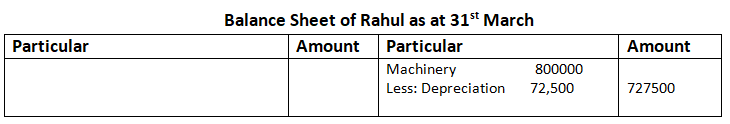

Q11. Following is the extract of Trial Balance as at 31st March, 2025:

Additional Information:

Machinery includes a machinery purchased on 1st July, 2024 for Rs.3,00,000. Depreciate machinery @ 10% p.a.

Calculate the amount of depreciation to be charged on Machinery.

Solution: –

Working Notes:

Calculate of Depreciation of Machinery

Depreciation on existing machinery from 1st April to 31st March Rs.50,000

(5,00,000 x 10%)

Depreciation on new machinery from 1st July to 31st March Rs.22,500

(3,00,000 x 10% 9/12)

Total Depreciation for the year Rs.72,500

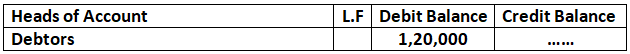

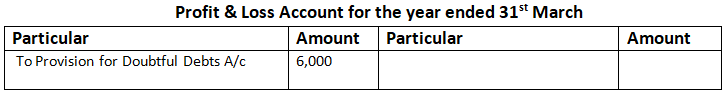

Q12. Following is the extract of Trial Balance as on 31st March, 2025:

Adjustment: Create a Provision for Doubtful Debts @ 5% on Debtors.

Pass necessary entries and show these items in the Profit & Loss Account and the Balance Sheet.

Solution:-

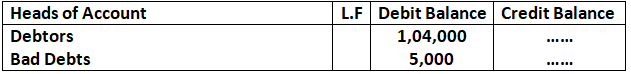

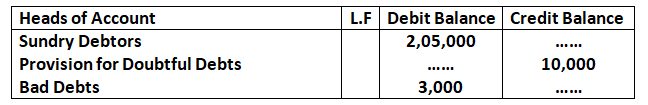

Q13. Following is the extract of Trial Balance as at 31st March, 2025:

Additional Information: One of the debtors who owed us Rs.10,000 became insolvent and nothing could be recovered.

Show the relevant extract from the Profit & Loss Account and Balance Sheet.

Solution:-

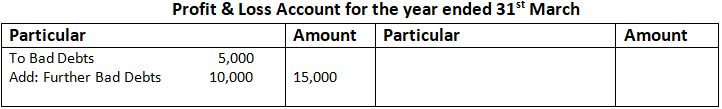

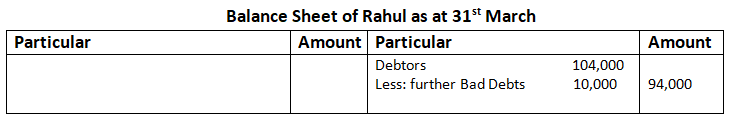

Q14. Following is the extract of M/s. A & N’s Trial Balance as at 31st March, 2025:

Additional Information:

- Further Bad Debts Rs.5,000.

- Maintain the Provision for Doubtful Debts @ 10% on Debtors.

On the basis of above information, answer the following questions:

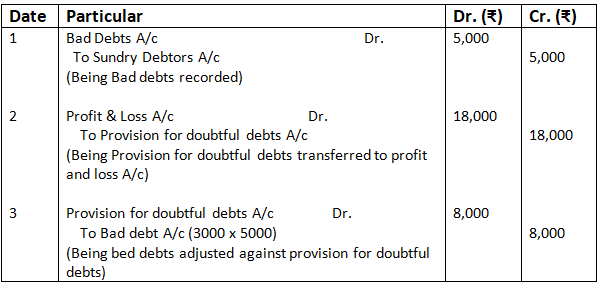

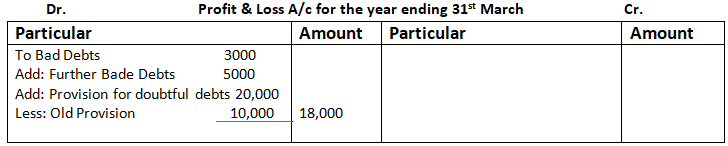

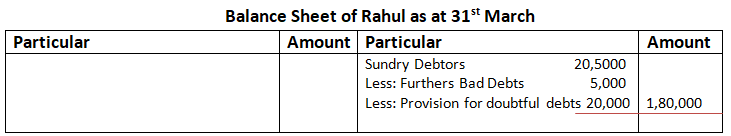

- Pass the necessary Journal entries.

- How these items will be shown in the Final Accounts?

Solution:-

Working Notes:

Calculate of Provision for doubtful debts

Sundry Debtors – Further Bad Debts

20,5000 – 5,000

Provision for doubtful Debts = 2,00,000 x 10%

= 20,000

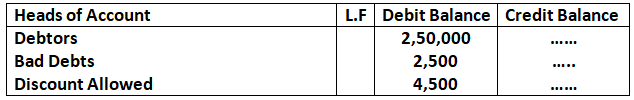

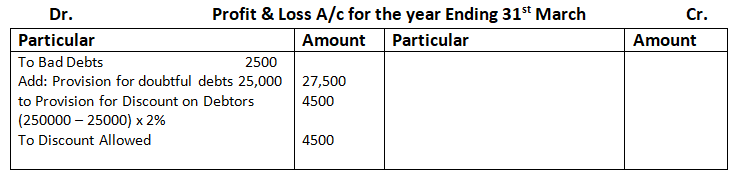

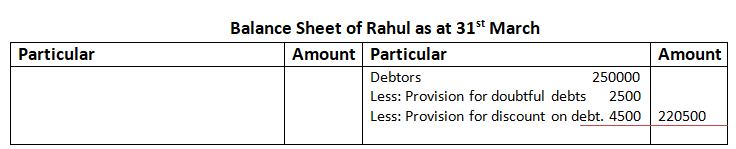

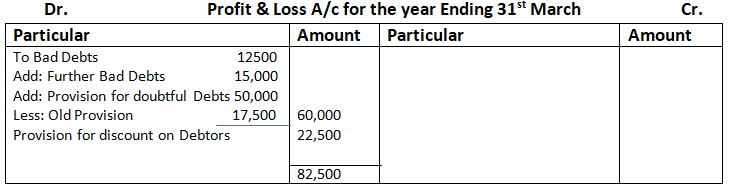

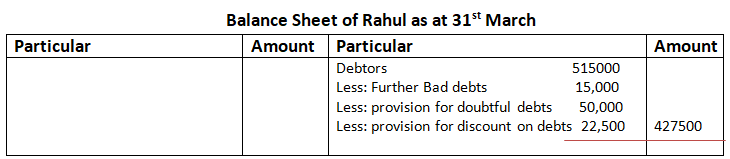

Q15. Trial Balance of Manish gives the following information:

Provision for Doubtful Debts is to be @ 10% on debtors and a provision for Discount @ 2% on debtors. Show how the adjustment will be shown in the Final Accounts.

Solution:-

Working Notes:

Calculate of Provision for Doubtful Debts and Provision for discount on debtors

Provision for Doubtful Debts = 250000 x 10%

= Rs.25,000

Provision for Discount on Debtors = (250000 – 25000) x 2%

= Rs.4500

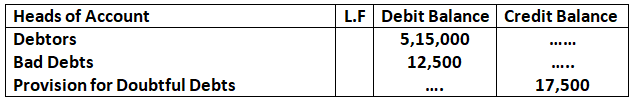

Q16. Following is the extract of Trial Balance as at 31st March, 2025:

Additional Information:

- An amount of Rs.15,000 due from a party, the recovery of which was doubtful before preparing the Trial Balance, thereafter proved bad debt and required to be written off.

- Create Provision for Doubtful Debts @ 10% on Debtors.

- Create Provision for Discount on Debtors @ 5% on Debtors.

Show the relevant extract from the Profit & Loss Account and the Balance Sheet.

Solution:-

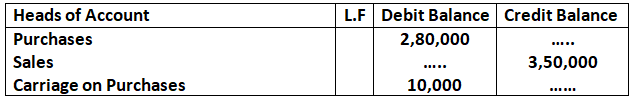

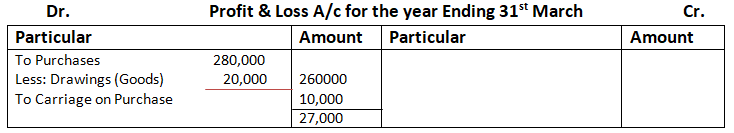

Q17. Sanjiv’s Trial Balance as on 31st March, 2025 shows the following information:

Sanjiv took goods costing Rs.20,000 for his personal use but entry was not passed in the books of account. Show the treatment in the Final Accounts.

Solution:-

Q18. Mohan’s Profit & Loss Account shows net profit of Rs.1,76,000 before charging commission of manager. Provide for manager’s commission at 10% on the profit after charging such commission.

Solution:-

Manager’s Commission = 176,000 x 10/100

= Rs.16,000

Explain –

Let the manager’s commission be A

Manager commission at 10% on the profit after charging such commission

= A = (176,000 – A) x 10/100

= A = 176,000 x 10/100 – 10/100x

= A + 10A/100 = 176,000 x 10/100

= 100A/100 = 176,000 x 10/100

= A = 176,000 x 10/100

= A = 176,000 x 10/100 x 100/10

= A = 176,000 x 10/100

= A = 16,000

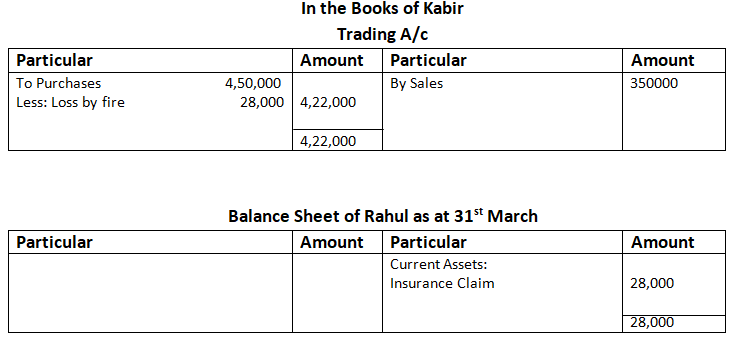

Q19. Following extract is taken from the Trial Balance of Kabir as on 31st March, 2025:

A fire broke out on 31st March, 2025 and stock of Rs.28,000 was destroyed. It was fully insured and the insurance company admitted the claim full. Show the treatment in final accounts.

Solution:-

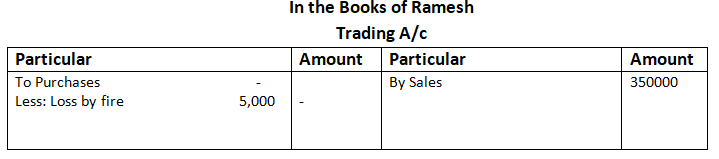

Q20. Ramesh valued stock at the end of the year at Rs.1,00,000. Goods costing Rs.5,000 were destroyed by fire during the accounting period. Show the treatment if the goods are not insured.

Solution:-

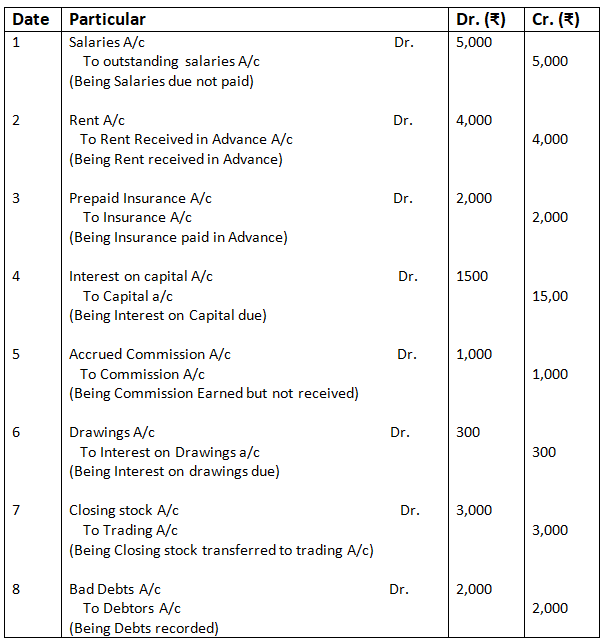

Q21. Give Journal entries for the following adjustments in final accounts:

- Salaries Rs.5,000 are outstanding.

- Insurance amounting to Rs.2,000 is paid in advance.

- Rs.4,000 for rent have been received in advance.

- Commission earned but not received Rs.1,000.

- Interest on Capital Rs.1,500.

- Interest on Drawings Rs.300.

- Write off Rs.2,000 as further debts.

- Closing Stock Rs.3,000.

Solution:-

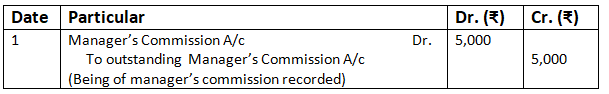

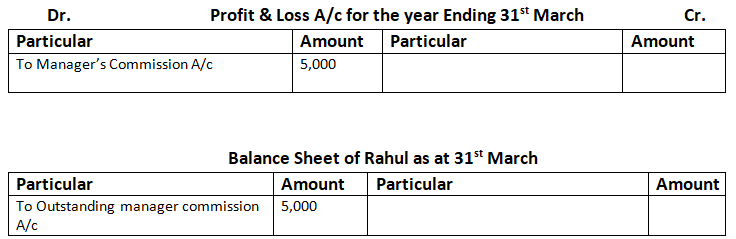

Q22. Net Profit of a firm is Rs.1,05,000 before charging commission. Manager of the firm is to be paid commission of 5% on the Net Profit after charging his commission. Calculate the commission payable to the manager. Pass an adjusting entry. Also, show its treatment in Final Account ending on 31st march, 2025.

Solution:-

Working Notes:

Manager’s Commission = Net Profit before charging x Rate of commission / (100 + Rate of commission)

= 105000 x 5/105

= Rs.5,000

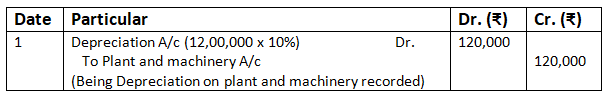

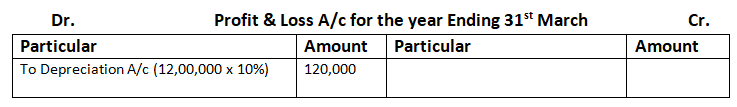

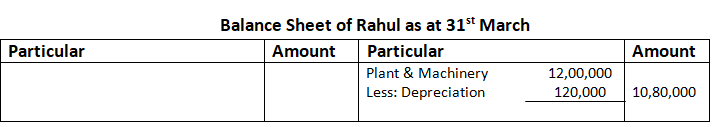

Q23. Following balance of asset is taken from the books of Dhrve as on 1st April, 2024:

Plant and Machinery Rs.12,00,000

Depreciation is to be provided on Plant & Machinery @ 10% p.a.

Pass the adjusting entry and show the accounting treatment of depreciation in the final accounts for the year ending 31st March, 2025.

Solution:-

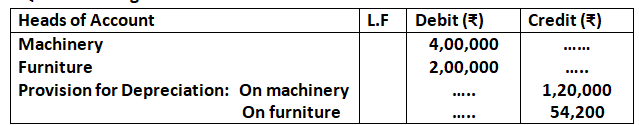

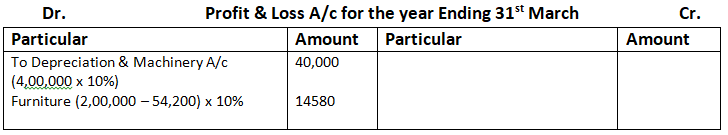

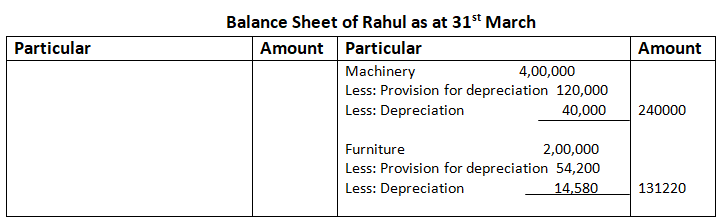

Q24. Following is the extract from a Trial Balance:

Additional Information:

Depreciation is to be charged on machinery at 10% p.a. on original cost and on furniture on book value.

Show the treatment of depreciation is Final Accounts.

Solution:-

Preparation of Final Accounts

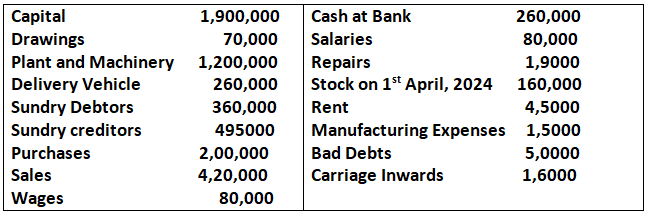

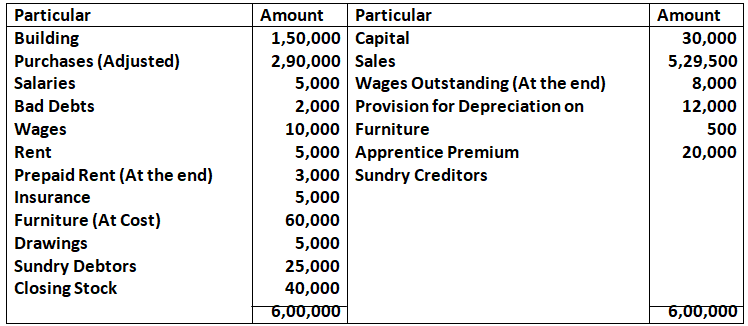

Q25. Following are the balances extracted from the books of Gurman on 31st March, 2025:

Prepare Trading and Profit and Loss Account and Balance Sheet as at 31st March, 2025 after following adjustments are made:

- Closing Stock was 160,000.

- Depreciate Plant and Machinery @ 10% and Delivery Vehicle @ 15%.

- Rent outstanding at the year end Rs.5000

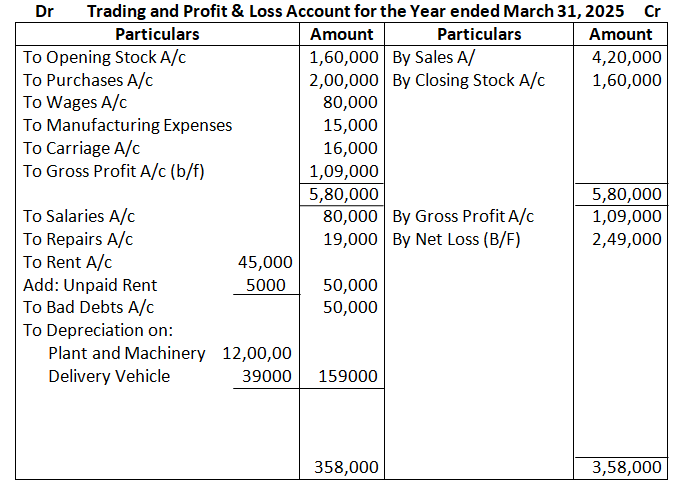

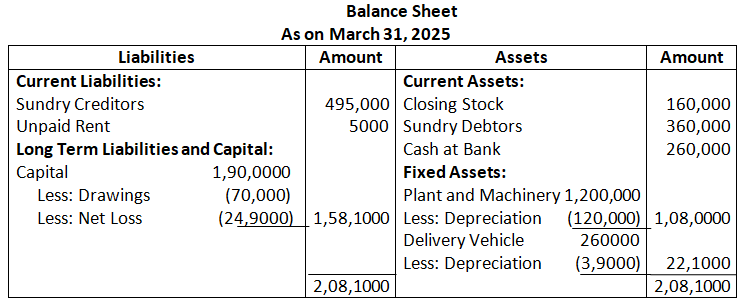

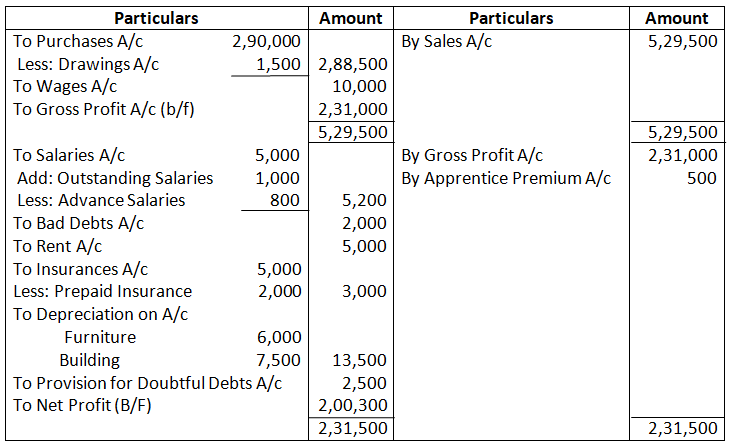

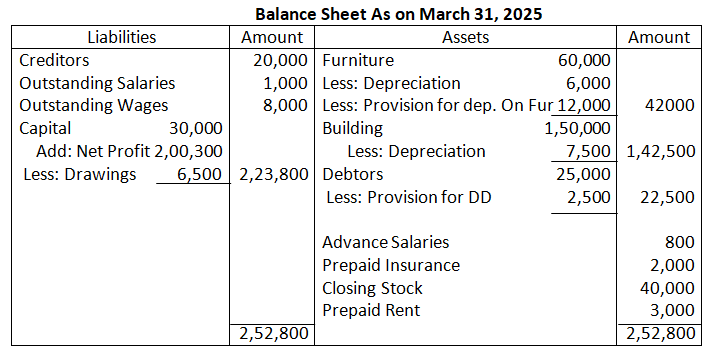

Solution – In the Books of Manish Gupta

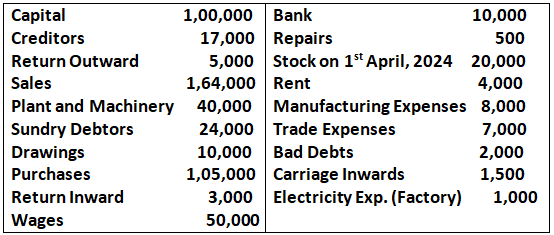

Q26. Prepare Trading and Profit and Loss Account and Balance Sheet from the following balances, relating to the year ended 31st March, 2025:

Additional Information:

- Closing Stock was valued at 14,500

- Depreciate Plant and Machinery by 4,000

- Write off Bad Debts 5,000

- 400 are due for repairs.

Solution – In the Books of……

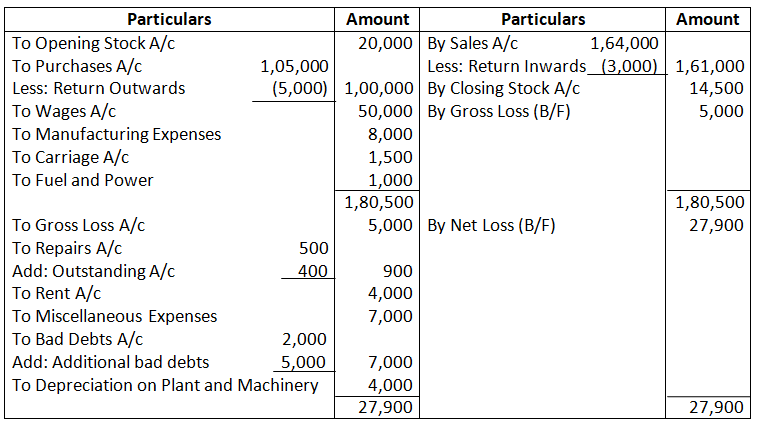

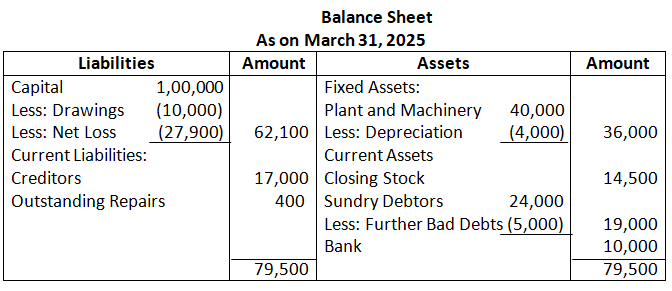

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

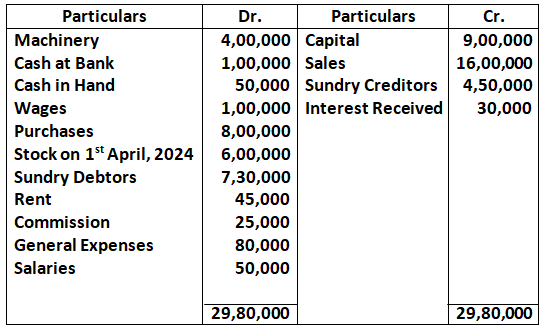

Q27. Following Trial Balance has been extracted from the books of Pawan as on 31st March, 2024:

Additional Information:

- Salaries Rs.45,000 and Wages Rs.5,000 were outstanding.

- Depreciate Machinery at 10%

- Rent Prepaid 10,000

- Provide for interest on capital @ 5% per annum

- Stock on 31st March, 2024 8,00,000

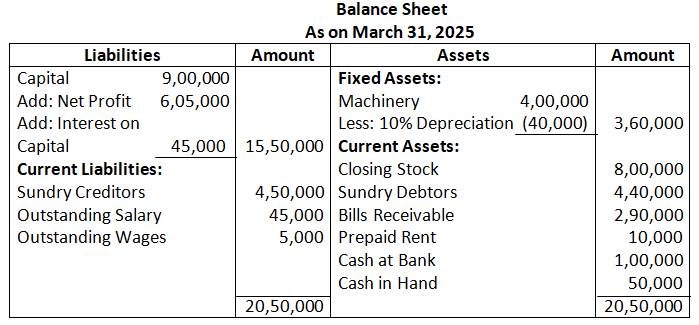

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2025 and Balance Sheet as at that date.

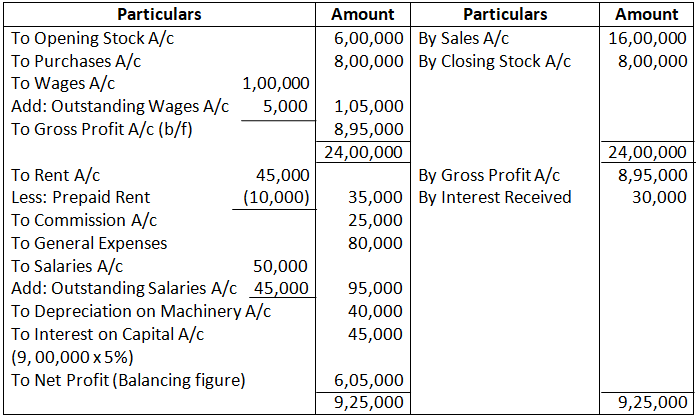

Solution – In the Books of M/s Ram Prasad & Sons

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

Q28. Trial Balance of a business as at 31st March, 2025 is given below:

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2025 and Balance Sheet as at that date after taking into account the following adjustments:

- Closing Stock was valued at 7,000

- Outstanding liabilities for wages were 6000 and salaries 1,4000

- Depreciation is to be provided @ 5% p.a. on fixed assets.

- Plant and Machinery includes a machine purchased for 100,000 on 1st October, 2024.

- Insurance Premium paid in advance 2000.

Solution – In the Books of……

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

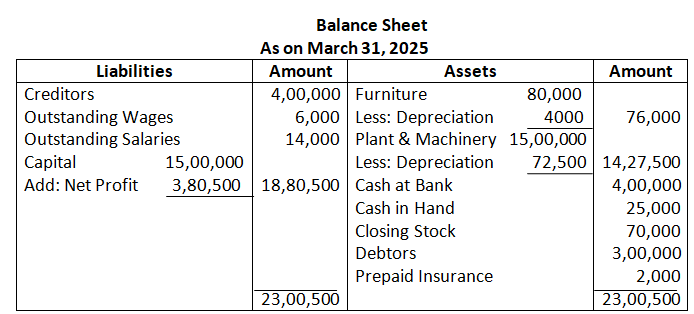

Q29. From the following Trial Balance of Sunil as on 31st March, 2025, prepare Trading and Profit and Loss Account for the year ended 31st March, 2024 and Balance Sheet as at that date:

Adjustments:

- Closing Stock 64,0000

- Wages outstanding 2,4000

- Interest rate of Bank Loan is 8% p.a.

- Bad Debts 6000

- Provision for Doubtful Debts to be 5%

- Rent is paid for 11 months

- Insurance premium is paid per annum, ended 31st May, 2025

- Loan from the bank was taken on 1st October, 2024.

- Provide Depreciation on machinery @ 10% and on Furniture @ 5%

Solution – In the Books of……

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

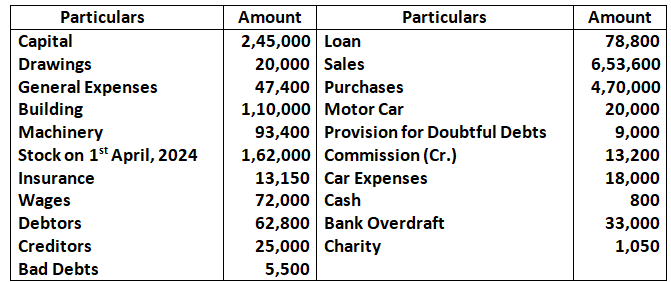

Q30. Prepare Trading and Profit and Loss Account for the year ended 31st March, 2025 and Balance Sheet as at that date from following balance taken from the books of Vijay on 31st March, 2025 after giving effect to the following adjustment:

- Stock as on 31st March, 2025 was valued at 2,30,000

- Write off further 1,800 as Bad Debts and maintain the Provision for Doubtful Debts at 5%

- Depreciate Machinery at 10%

- Provide 7,000 as outstanding interest on loan.

Solution – In the Books of Vijay

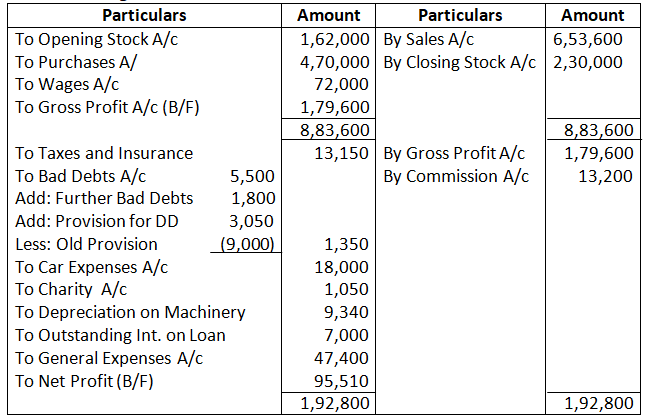

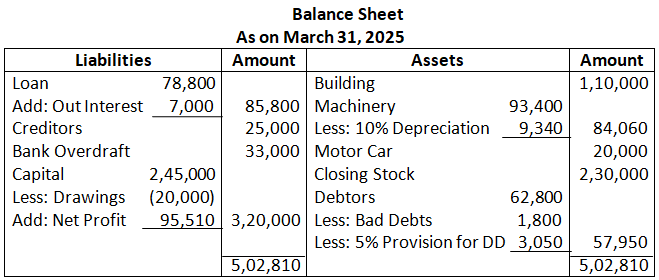

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

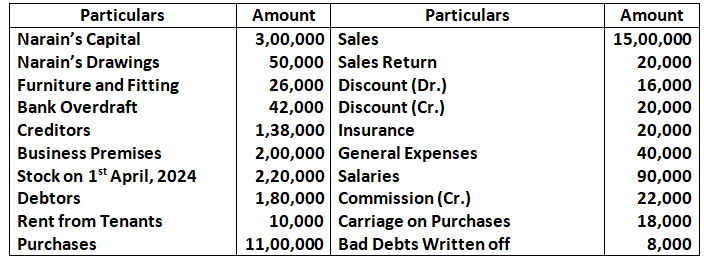

Q31. Following are the balances taken from the books of Narain on 31st March, 2025:

Additional Information:

- Closing Stock at cost as on 31st March, 2025 was 2,00,600, whereas it’s Net Realisable value (Market Value) was 2,05,000.

- Depreciate: Building by Rs.3,000 and Furniture and Fittings by 2,500.

- Make a provision of 5% on debtors for Doubtful debts.

- Carry forward 2,000 for unexpired insurance.

- Outstanding salary was 15,000.

Prepare Trading and Profit and Loss Account for the year and Balance Sheet as at that date.

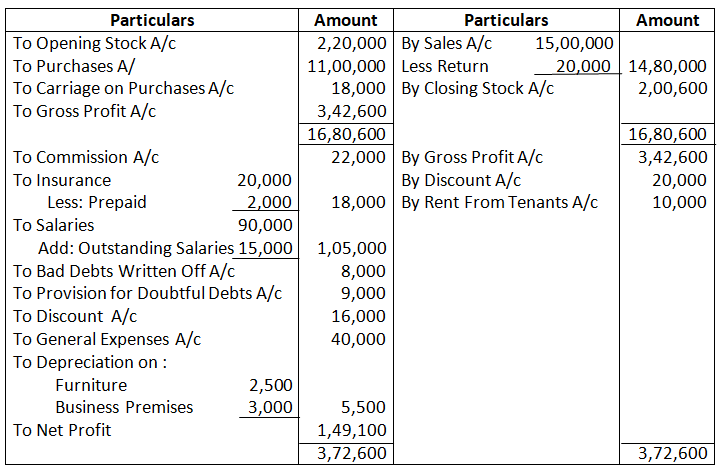

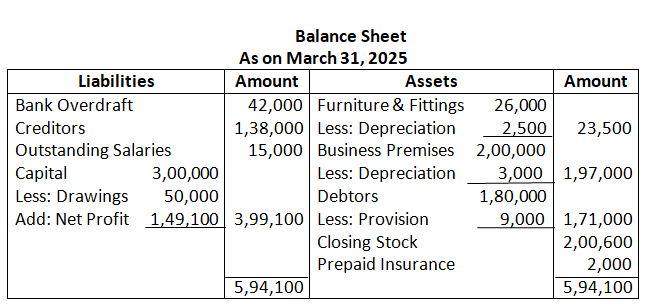

Solution – In the Books of Narain

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

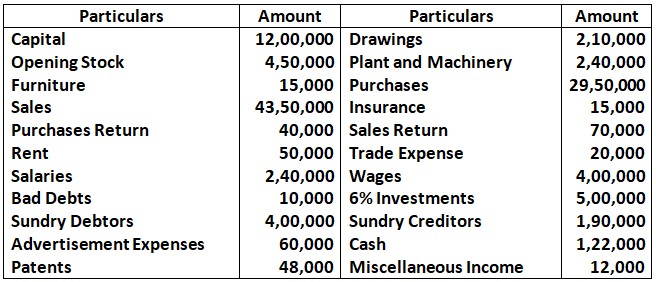

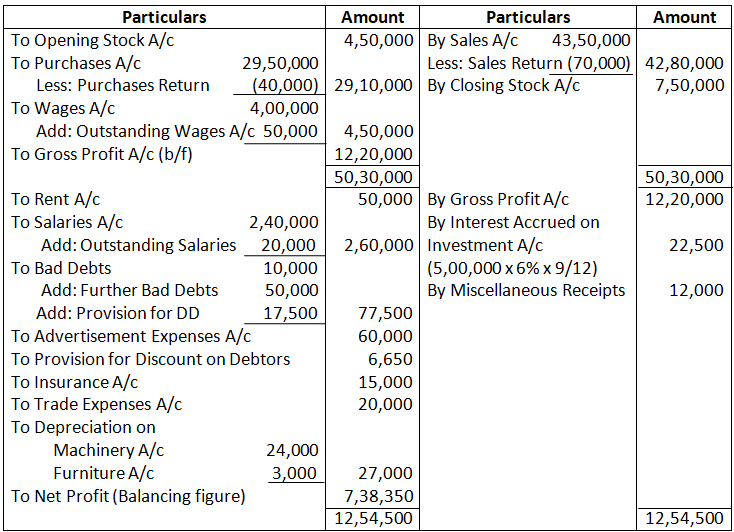

Q32. Following balances are taken from the books of Ramesh. Prepare Trading and Profit and Loss Account for the year ended 31st March, 2025 and Balance Sheet as on that date:

Adjustment:

- Closing Stock Rs.7,50,000

- Depreciate Machinery by 10% and Furniture by 20%.

- Wages 50,000 and Salaries 20,000 are outstanding.

- Write off 50,000 as further Bad Debts and create 5% Provision for Doubtful Debts. Also, create Provision for Discount on Debtors @ 2%

- Investments were made on 1st July, 2024 and no interest has been received so far.

Solution – In the Books of Niranjan

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

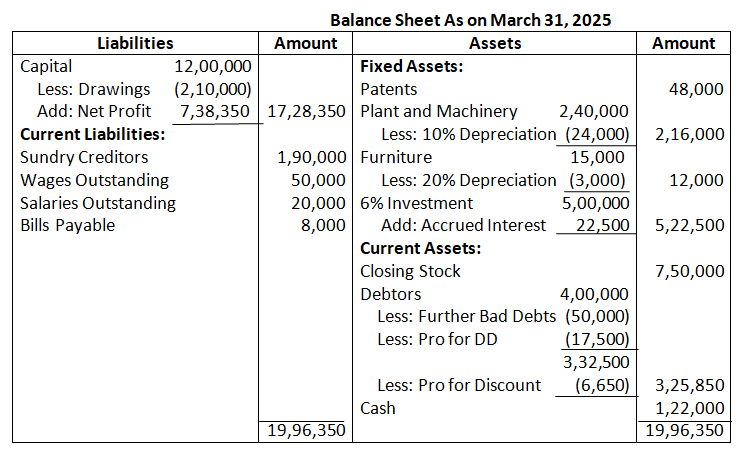

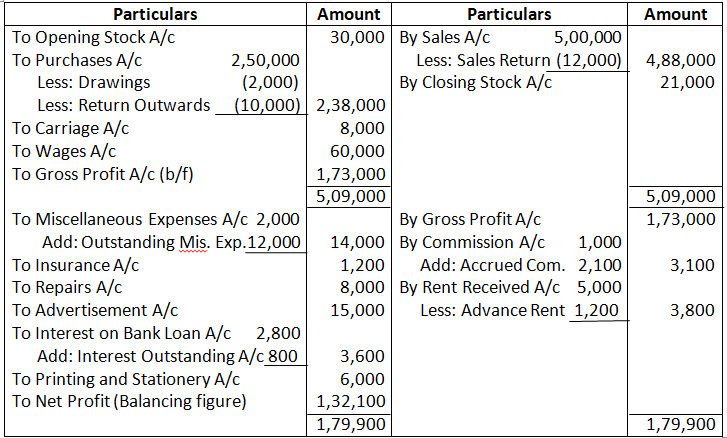

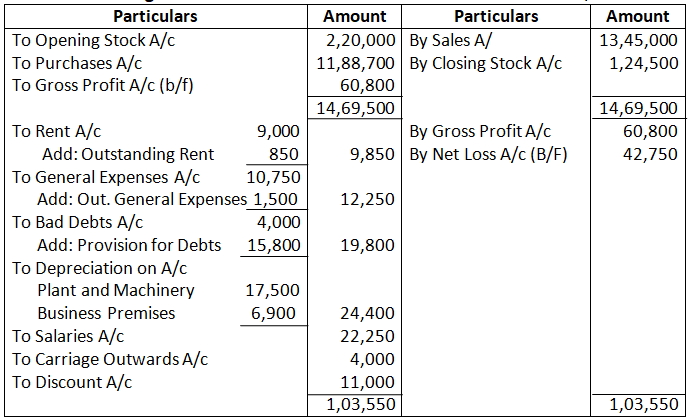

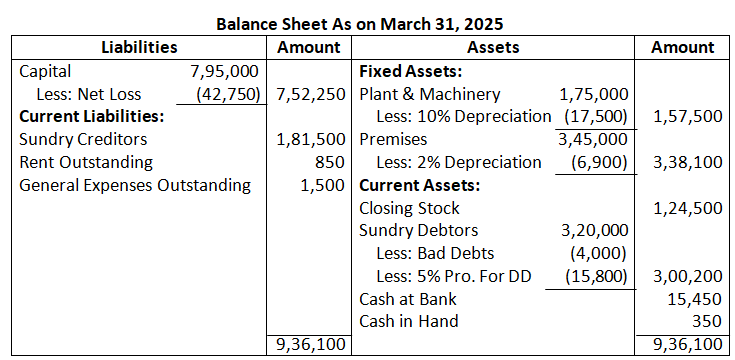

Q33. From the following information of Menal, prepare his Final Accounts for the year ended 31st March, 2024:

Additional Information:

- Closing Stock on 31st March, 2025 was 21,000.

- Rent of 1,200 has been received in advance.

- Outstanding liability for Miscellaneous Expenses is 12,000.

- Commission earned during the year but not received was 2,100.

- Goods costing 2,000 were taken by the proprietor for his personal use but entry was not passed in the books of account.

Solution – In the Books of Mahesh

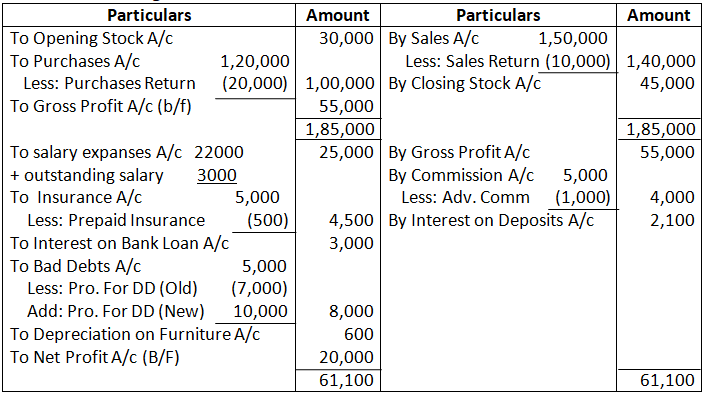

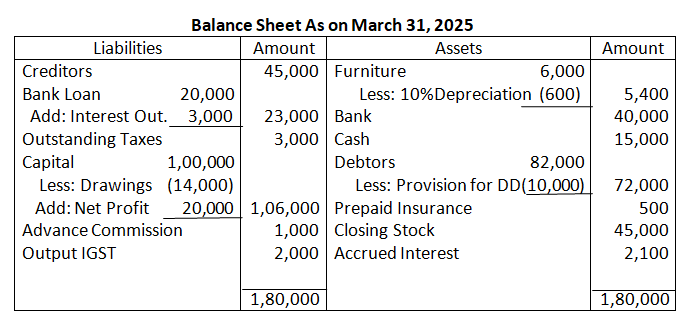

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

Working Note 1:

Calculation of Outstanding Interest on Loan

Interest on Loan (30,000 x 12%) 3,600

Less: Interest (2,800)

Interest Outstanding on Loan 800

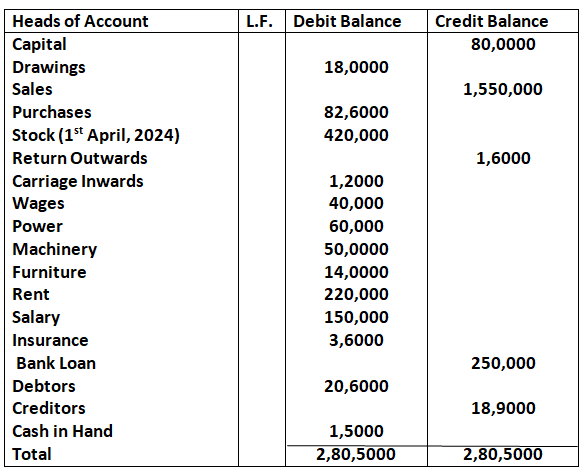

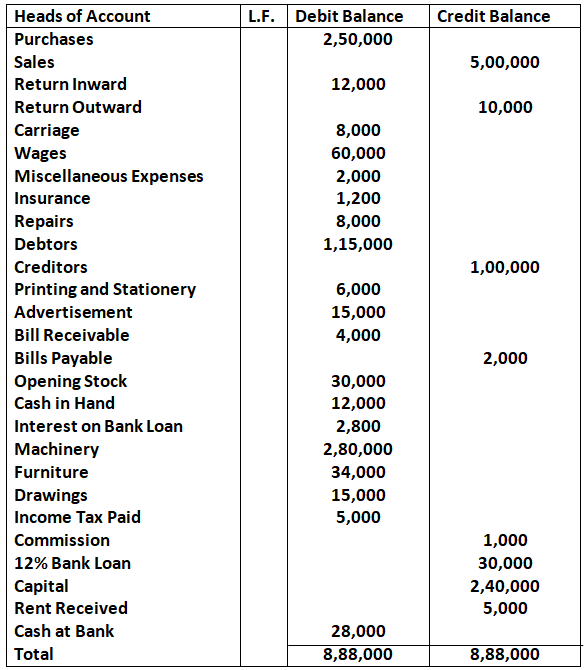

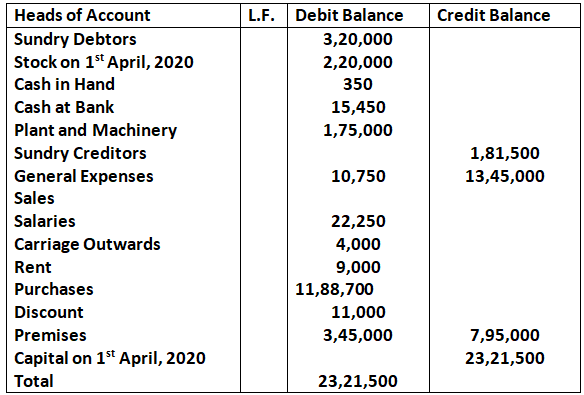

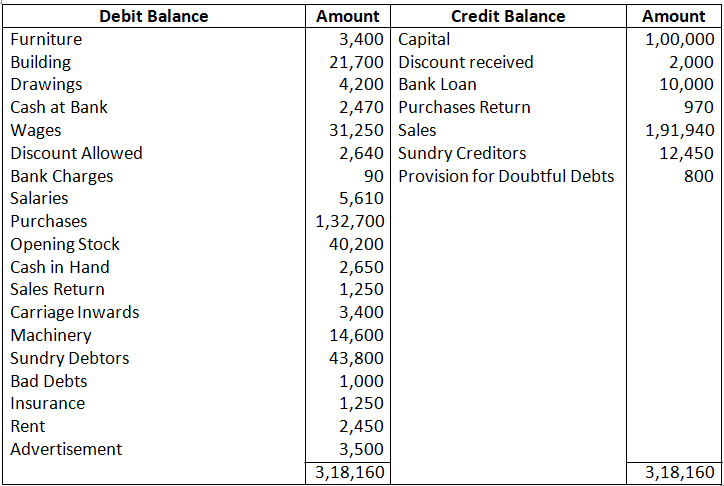

Q34. From the Following Trial Balance and other information, prepare Trading and Profit and Loss Account for the year ended 31st March, 2025 and Balance Sheet as at that date:

Additional Information:

- Stock on 31st March, 2025 was Rs.1,24,500.

- Rent was unpaid to the extent of 850 and 1,500 were outstanding for General Expenses.

- 4,000 are to be written off as bad debts out of the above debtors and 5% is to be provided for doubtful debts.

- Depreciate Plant and Machinery by 10% and Premises by 2%

- Manager is entitled to a Commission of 5% on net profit after charging his commission.

- A fire broke our on 1st April, 2025 destroying goods costing 20,000.

Solution – In the Books of…..

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

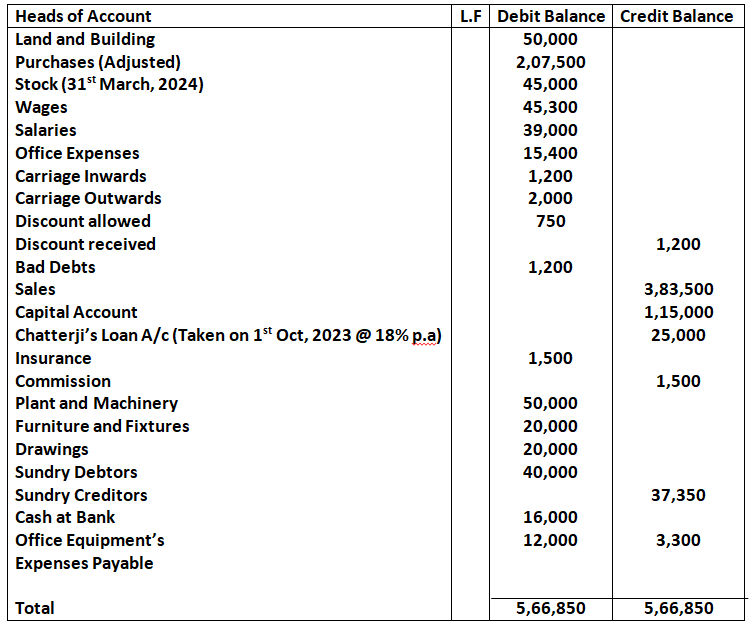

Q35. From the following Trial Balance of Shubho, Prepare Trading and Profit and Loss Accounts for the year ended 31st March, 2025 and Balance Sheet as at that date:

The Following Adjustments be taken care of:

- Depreciate Land and Building @ 6% Plant and Machinery @ 10% Office equipment’s @ 20% and Furniture and Fixtures @ 15%

- Create Provision for Doubtful Debts at 2% on Sundry Debtors

- Insurance includes 250 Insurance Premium paid in advance

- Provide salary to Shubho 15,000 P.A.

- Outstanding Salaries 11,500

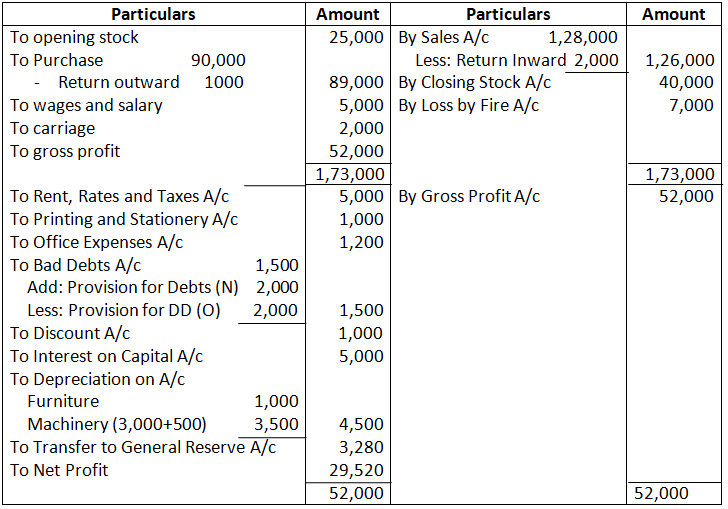

- 10% of the final profit is to be transferred to General Reserve.

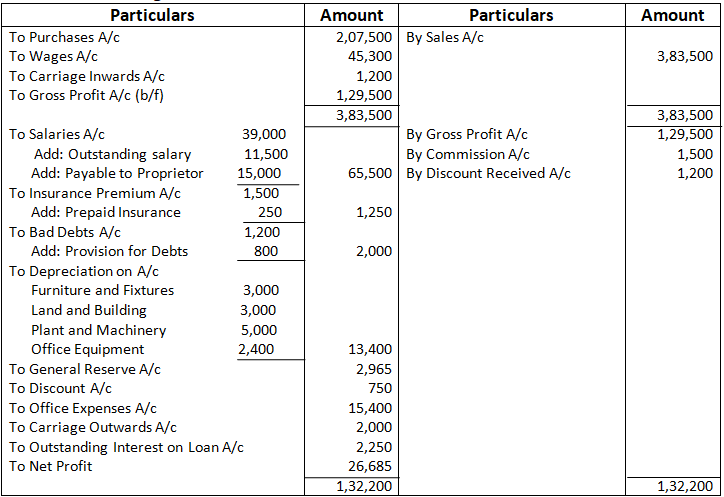

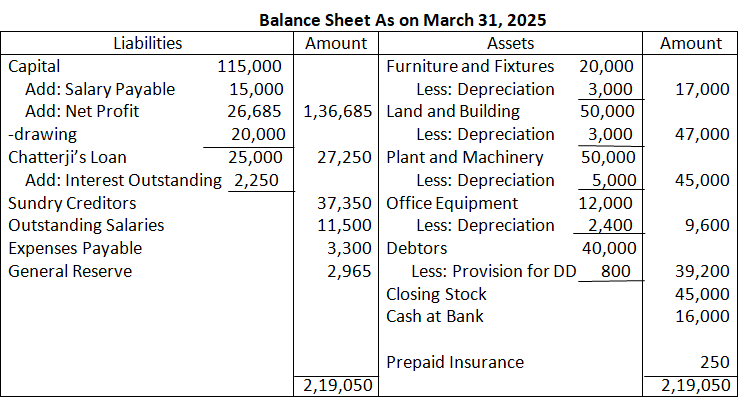

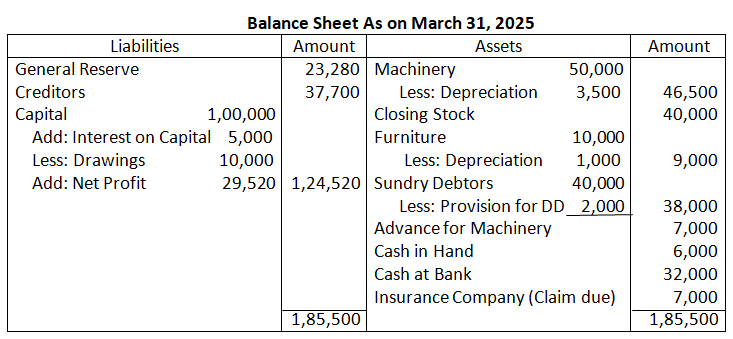

Solution – In the Books of…..

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

Q36. Prepare Trading and Profit and Loss Account for the year ending on 31st March, 2025 and Balance Sheet as on that sate from the following balances of Trial Balance:

Adjustments:

- The value of stock on 31st March, 2025 Rs.40,000

- Provision for Doubtful Debts is to be maintained at 5% on Sundry Debtors

- Charge Depreciation on both Furniture and Machinery @ 10% p.a.

- Machinery costing 20,000 was purchased on 1st January 2025

- Allow interest on capital @ 5% p.a.

- A fire occurred on 20th March, 2025 and stock of the value of 7,000 was destroyed it was fully insured and the insurance company admitted the claim in full

- 10% of net profit to be carried to General Reserve.

Solution – In the Books of…..

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

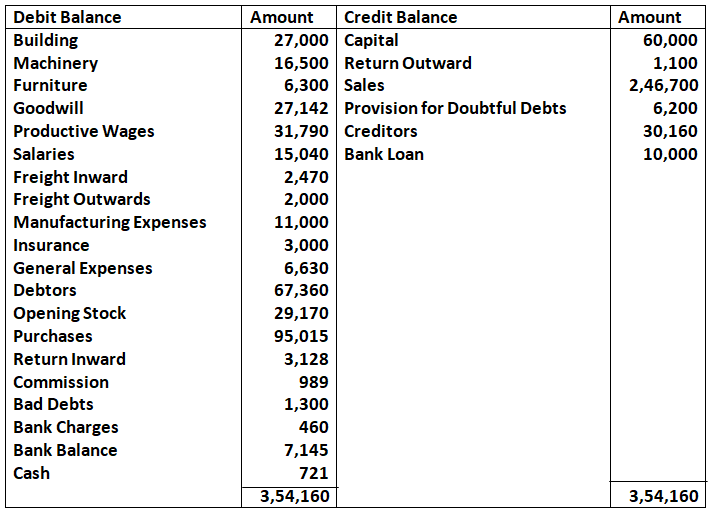

Q37. Following is the Trial Balance of Indramani as on 31st March, 2025:

Prepare Trading and Profit and Loss Account for the year ending 31st March, 2025 and Balance Sheet as on that date after making the following adjustment:

- Value of Closing Stock Rs.6,100

- Depreciate machinery @ 10% p.a.

- Create Provision for Doubtful Debts at 5% on debtors.

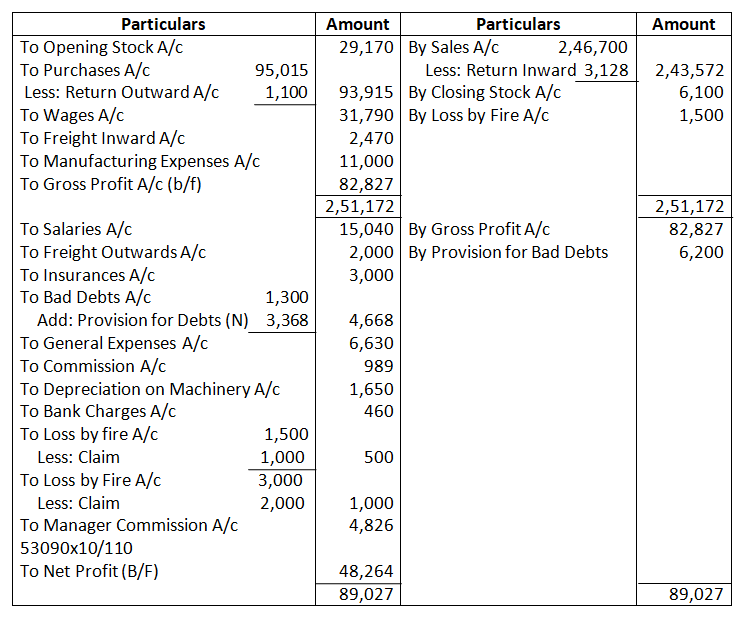

- Commission payable to manager at 10% on net profit.

- On 25th March, 2025, good costing 1,500 and furniture costing Rs.3,000 were destroyed by fire; insurance company has accepted claims of 1,000 for goods and 2,000 for furniture.

Solution – In the Books of…..

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

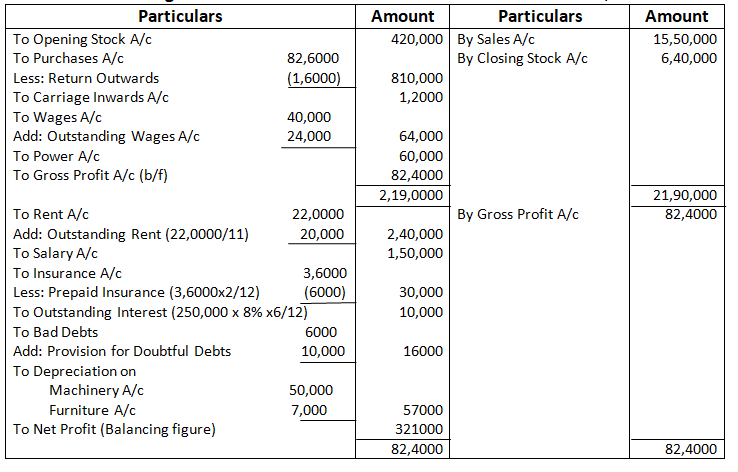

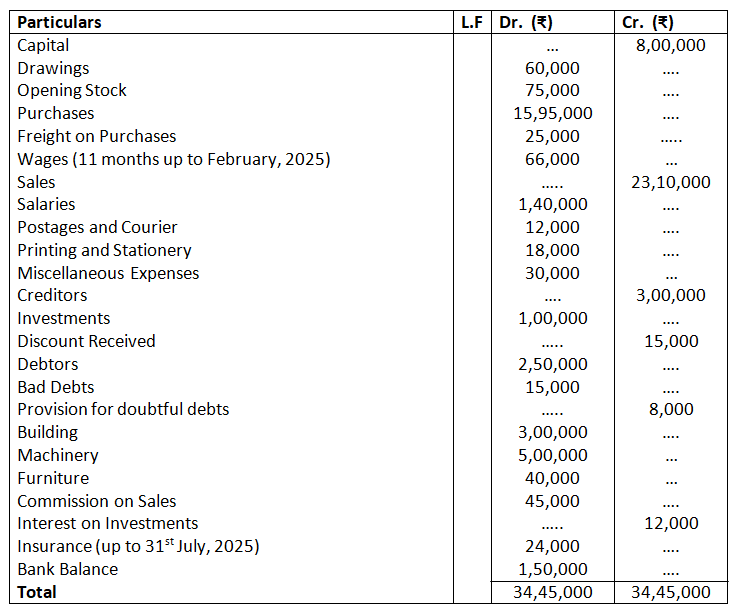

Q38. Following is the Trial Balance of Karman on 31st March, 2025:

Adjustments:

- Closing Stock Rs.2,25,000.

- Machinery of Rs.45,000 purchased on 1st October, 2024 was shown as Purchases. Freight paid on the Machinery was Rs.5,000 which in included in Freight on Purchases.

- Commission is payable at 2 ½ % on sales.

- Investments were sold at 10% profit, but the proceeds were credited to Sales Accounts.

- Writer off further Bad Debts Rs.10,000 and maintain Provision of Doubtful Debts at 5% of Debtors.

- Depreciate Building by 2 ½ % p.a. and Machinery and Furniture at 10% p.a.

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2025 and Balance Sheet as at that date.

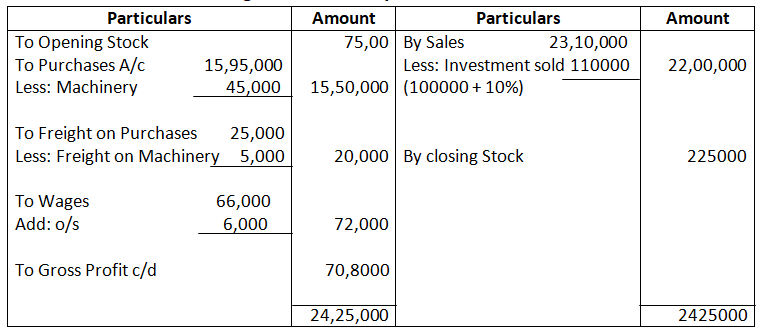

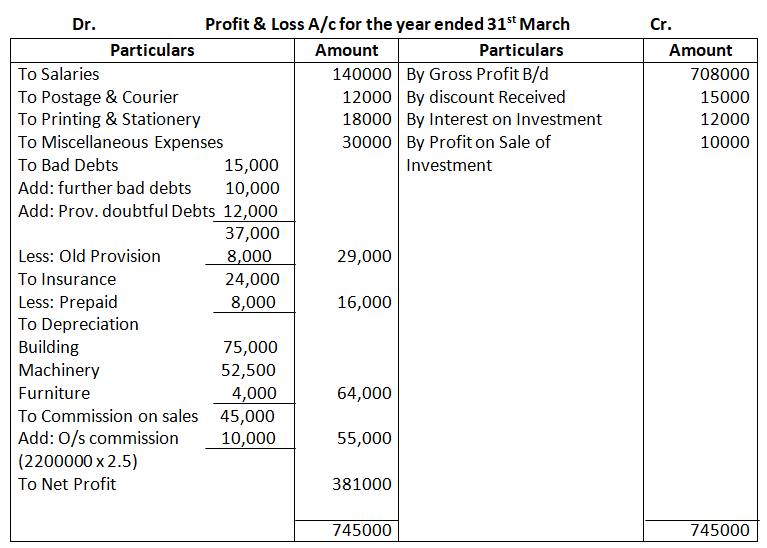

Solution:-

Trading Account for the year ended 31st March, 2025

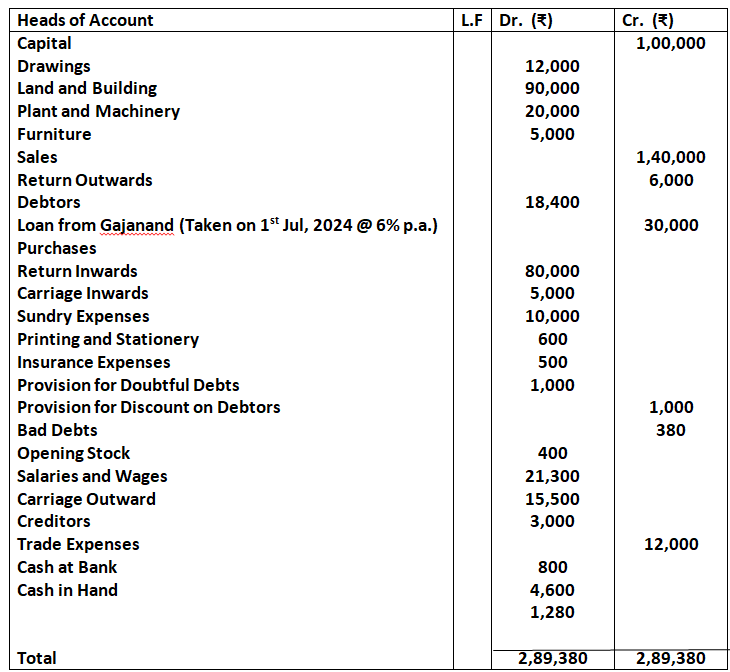

Q39. From the following Trial Balance and information, prepare Trading and Profit and Loss Account of Gurman for the year ended 31st March, 2025 and Balance Sheet as on that date:

Additional Information:

- Value of Closing Stock on 31st March, 2025 at cost was 27,300 and its net realisable value (market value) was 30,000.

- Fire occurred on 23rd March, 2025 and goods costing 10,000 were destroyed Insurance Company accepted claim of 6,000 only and paid the claim money on 10th April, 2025.

- Bad Debts amounting to 400 are to be written off. Provision for Doubtful Debts is to be maintained at 5% and Provision for Discount on Debtors at 2%

- Received goods costing 6,000 on 27th March, 2024 but the purchases were not recorded.

- Rishabh took goods of 2,000 for his personal use but was not recorded.

- Charge depreciation @ 2% on Land and Building @ 20% on Plant and Machinery and @ 5% on Furniture.

Solution – In the Books of…..

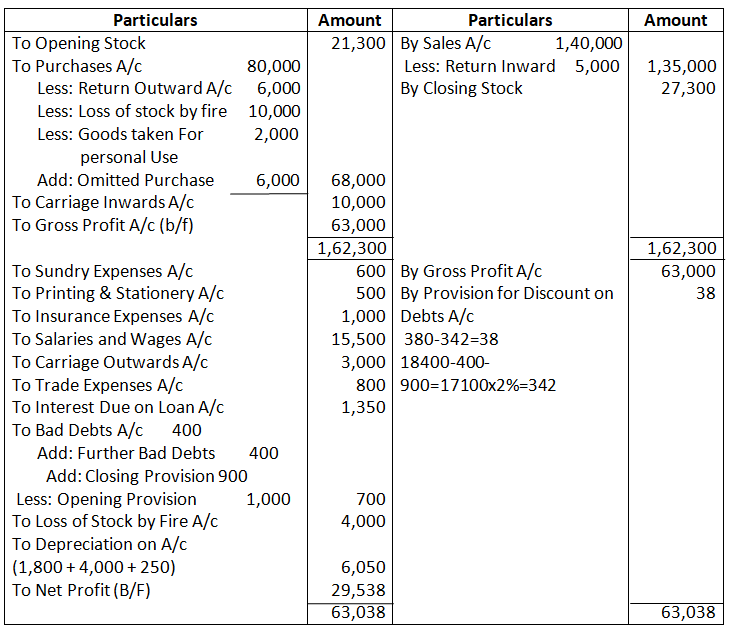

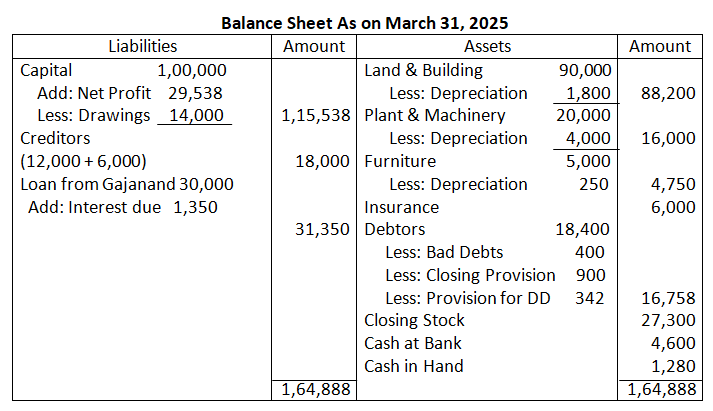

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

Q40. The following is the Trial Balance of Ashok as on 31st March, 2025:

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2025 and Balance Sheet as on that date after making the following adjustment:

- Salaries for the month of March, 2025 of 1,000 were unpaid which are to be provided Balance in the account included 800 paid in advance

- Insurance is Prepaid to the extent of 2,000.

- Depreciate Furniture by 10% on original cost and Building by 5%

- Stock of 1,500 was taken by Ashok for his personal use.

- Make a Provision for Doubtful Debts equal to 10% of Sundry Debtors.

Solution – In the Books of…..

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

Q41. On 31st March, 2025, the following Trial Balance was prepared from the books of Manpreet:

Prepare Trading and profit & Loss Account for the year ended 31st March, 2025 and also the Balance Sheet as at that date after making the following adjustments:

- Closing Stock at cost was Rs.35,000 whereas its net realisable value (market value) was Rs.30,000.

- A new machine was purchased for Rs.3,000 on 1st April, 2024 but it was not paid for and entry was not recorded in the books.

- Wages include Rs.500 paid for the installation of machinery.

- Provision for Doubtful Debts was raised to Rs.1,400 and further bad debts of Rs.300 were written off.

- Fire broke out on 20th March, 2025 and destroyed stock to the value of Rs.8,000. The insurance company admitted claim for loss of stock of Rs.5,000 and the amount was paid on 15th April, 2025.

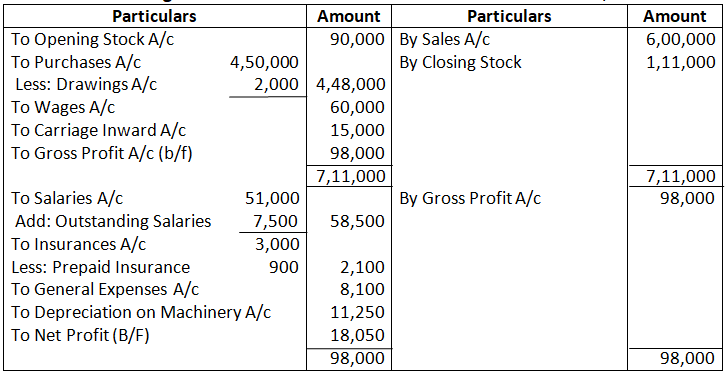

- Outstanding wages were Rs.700 while outstanding salaries were Rs.500.

- Prepaid insurance was Rs.250 and prepaid advertisement Rs.500.

- Machinery was depreciated by 10% and furniture by 15%.

Solution:-

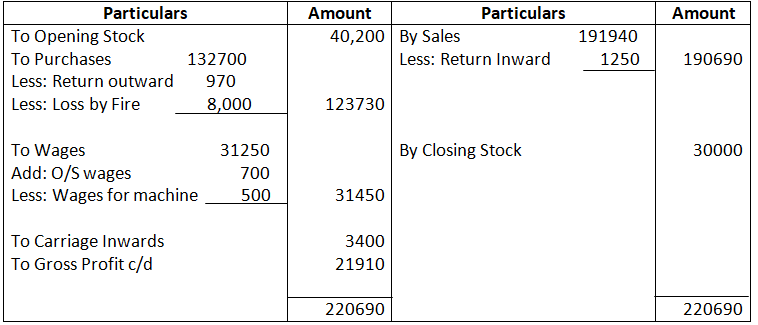

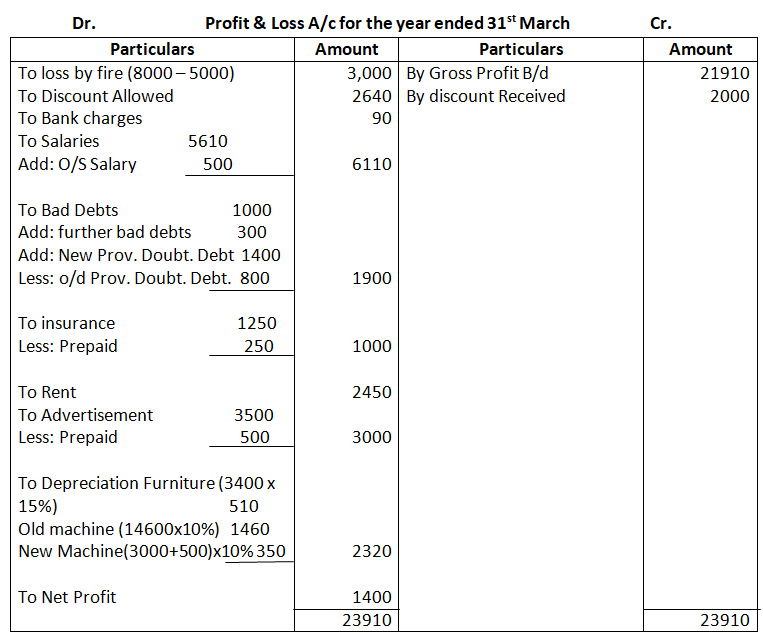

Trading Account for the year ended 31st March, 2025

Q42. From the following Trial Balance and additional information of Bharat, a proprietor prepare Trading and Profit and Loss Account for the year ending 31st March, 2024 and the Balance Sheet as at that date:

Additional Information:

- Salaries outstanding for the month of March, 2025 is 7,500

- Prepare Insurance is 900

- Depreciate Machinery @ 15% p.a.

- Value of Closing Stock is 1,11,000

- Bharat took goods of 2,000 for personal use which was not recorded (Ignore GST).

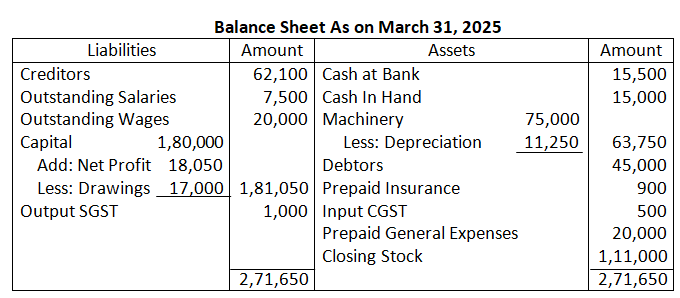

Solution – In the Books of Bharat

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr

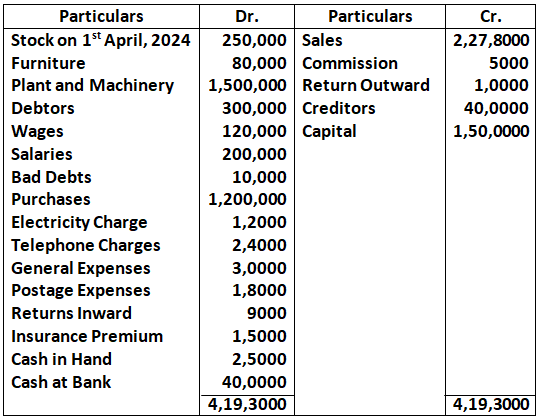

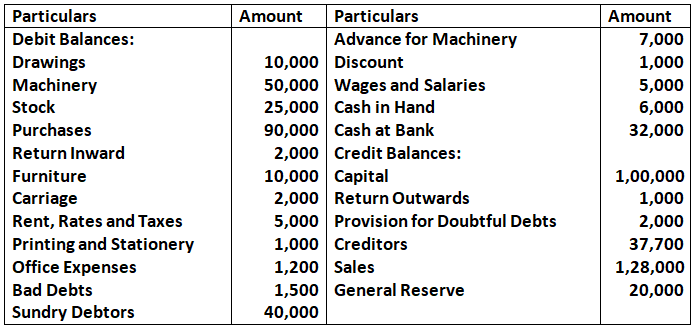

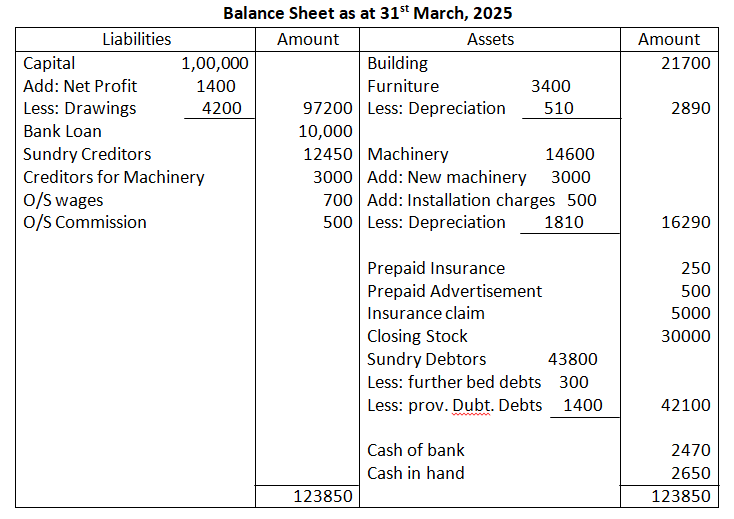

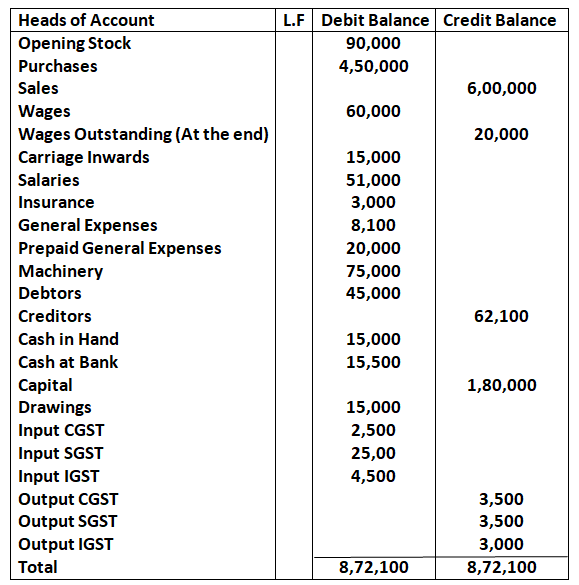

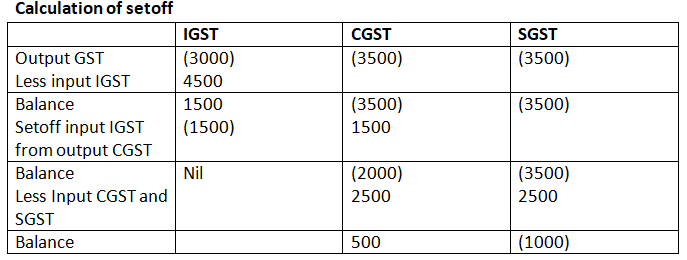

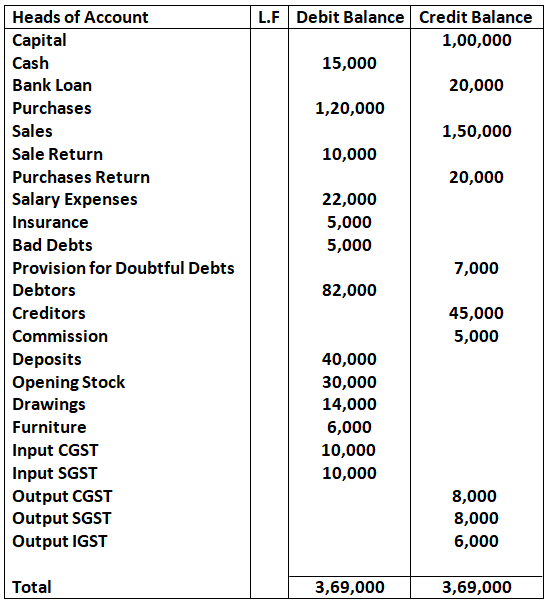

Q43. Prepare Trading and Profit and Loss Account for the year ended 31st March, 2024 and Balance Sheet as at that date from the following Trial Balance:

Adjustments:

- Salaries of Rs.3,000 are outstanding but Insurance 500 is prepaid.

- Commission 1,000 received in advance for the next year.

- Interest 2,100 is to be received on Deposits and Interest on Bank Loan 3,000 is to be paid.

- Provision for Doubtful Debts to be maintained at 10,000.

- Depreciate Furniture by 10%.

- The cost of Closing Stock as on 31st March, 2025 was 45,000 but its Net Realisable value (Market Value) was 50,000.

- A fire occurred on 1st April, 2025 destroying goods costing 10,000. The Stock was fully insured (Ignore GST).

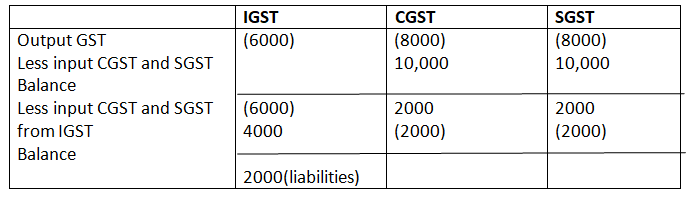

Solution – In the Books of…..

Dr Trading and Profit & Loss Account for the Year ended March 31, 2025 Cr