Introduction of Depreciation

“Depreciation is the reduction in value of asset due to its wear and tear or with efflux of time or due to obsolescence or accident.”

Characteristic of Depreciation:-

- Depreciation is a fall in the book value of tangible fixed assets except freehold land.

- It is a process of allocating cost of the asset over its expected useful life.

- Fall in the book value of an asset is permanent, gradual and of continuing nature.

- It is a fall in the book value of an asset either due to use or with the efflux of time.

- It occurs gradually unless it becomes obsolete due to technological developments.

- Depreciation is an expense which does not involve cash.

- Depreciation is an indirect expense and therefore, it is debited to Profit and Loss Account, whether the business earns profit or incurs loss.

Depreciation:-

Depreciation is a measure of wearing out of asset because of its use, efflux of time or obsolescence. It is allocation of cost of asset as expense over its estimated useful life in a systematic manner. Depreciation is applicable on all tangible long-term assets whose useful life is limited and thus is estimated. For example, useful life of a machine is estimated and cost of the machine is written off over its estimated useful life. On the other hand, useful life of freehold land is infinite. As a result, it is not depreciated.

Amortisation:-

Amortisation is a gradual and systematic writing-off of cost of intangible asset over its estimated useful life. For example, patents, purchased goodwill, copyrights are amortised over their useful life being intangible assets.

Depletion:-

Depletion charge is a measure of exhaustion of wasting asset such as extraction of material from quary, mine, etc. Extraction reduces the available quantity of material. For example, extraction of coal from a coal mine is depletion of coal stock.

Causes or Reasons of Depreciation:-

- Uses of Asset – Use of asset leads to its wear and tear and thus falls in its value.

- Efflux of Time – Some assets have a finite life period like lease; on the expiry of the life period, the asset will cease to exist. Other assets, like plant and machinery may not have a finite life; in their case the life is estimated.

- Obsolescence – If a better and cost effective machine becomes available. Old machine may have to be discarded even through it is capable of being used. Thus, it leads to reduction of useful life of the asset.

- Accidents – Accidental loss may be permanent but is not continuing and gradual

Of the above, only the first two factors are considered relevant to Depreciation. Factors third and fourth are considered only when they occur; they do not happen to all the assets.

Objectives or Need For Providing Depreciation:-

- To Determine Correct Profit or Loss – Depreciation is an expense of the business and, therefore, is a charge against revenue. If it is not accounted as an expense, Profit and Loss Account for the Accounting period will not show correct profit of the business.

- To show True and Fair View of the Financial Position – Depreciation, if not charged, would result in assets being stated at a higher value. As a result of this the Position Statement (Balance Sheet) would not present a true and fair view of the financial position.

- To determine the cost of Production – Depreciation is taken into consideration for calculating the cost of production. If it is not taken into account, cost of the production will be lower by the amount of depreciation.

- To provide finds for replacement – Depreciation is a non-cash expense and when charged the amount of depreciation is retained in the business and can be used for the replacement of fixed assets after the expiry of their estimated useful life.

- To comply with legal provisions – it is necessary to charge depreciation to comply with the provisions of the Companies Act and the Income Tax Act.

Factors or Basis of Providing Depreciation:-

- Cost of the Asset – Cost includes all expenses incurred for making the asset ready for use such as freight and installation charges.

Cost = Purchase Price + Freight and Other Costs = Installation Cost

- Estimated Residual or Scrap value – Residual value is an estimated realisable value of the asset at the end of its estimated useful life. Difference between the cost and residual or scrap value is the amount that is written off over the estimated useful life of the asset.

Amount to be written off = Cost of Asset – Residual or Scrap Value.

- Useful or Economic Life of the Asset – Useful life of the asset means the period for which the asset is estimated to be productively used.

- Legal Provisions – Law (company Law or Income Tax Act) prescribes the method and rate of charging depreciation. While determining the amount of depreciation, legal provisions are kept in mind. Depreciation is provided each year so that the book value of the asset is reduced to its estimated residual value at the end of its estimated useful life.

Methods of Depreciation:-

Straight Line Method

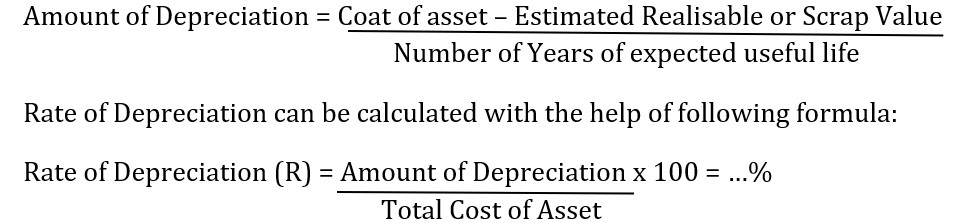

Amount of depreciation each year remains same unless there is addition to or deletion from the asset.

Under Straight Line Method, a percentage of original cost of the asset is written off every year as depreciation. As a result of this, the amount of Depreciation is uniform every year.

Suppose, if an asset costs 1, 00,000 and 10% Depreciation is thought appropriate, 10,000 will be written off every year as depreciation. The assumption is that the useful life of the asset is 10 years and that at the end of 10 years it will not have scrap or residual value. In case the asset has a residua; value at the end of its useful life, the amount to be written off every year is arrived at as under:

Important Note

Depreciation may also be expressed as a percentage of the original cost. If the estimated useful life of an asset is ten years (assuming scrap value to be nil), we may say that the depreciation is 10% p.a. of the cost every year. Therefore, if the cost is 20,000, the depreciation will be 2,000. In the first year, the asset may have been used for a part of the year, in that case only a proportionate amount will be provided as depreciation. Suppose, in the above case the asset is installed on 1st July, 2020 and the accounts are closed on 31st March, 2021 then the depreciation will be charged for 9 months and not for full year. Depreciation for the year ended 31st March, 2021 will be 1,500, i.e., 2,000 x 9/12.

Merits of the Straight Line Method:-

- It is a simple method of calculating the Depreciation.

- In this method, asset can be depreciated up to the estimated scrap value.

- In this method, it is easy to know the amount of Depreciation.

- Every year, Profit and Loss Account is debited by the same amount of Depreciation. So there is same effect on the Profit and Loss Account every year.

Demerits of the Straight Line Method:-

- With the passage of time, work efficiency of asset decreases and repair expenses increase. As a result, in later years, there are more loads on the Profit and Loss Account.

- Sometimes in this method, the book value of asset becomes nil, still the assets are used in the business.

Written Down Value Method –

Amount of depreciation is charged on the book value of the asset at the prescribed rate. Under this method, Depreciation is charged at a fixed rate on the book value, i.e., reducing balance (cost less Depreciation) every year. Stating it differently, fixed rate on the written down value of the asset is charged as depreciation every year over the expected useful life of the asset. A percentage Known as Rate of Depreciation is applied to the book value (i.e., Cost less Depreciation till date) and not to the cost of the asset.

For example, cost of the asset is 20,000 and the percentage to be written off each year is 10. In the first year, the amount of depreciation will be 2,000; this will reduce the book value to 18,000. Next year, the depreciation amount will keep on reducing.

Merits of the Written Down Value Method:-

- Practically, this method is more easy

- There is same weightage on Profit and Loss Account of depreciation and repair expenses put together.

- On the expansion and increase in assets, depreciation can be computed easily by this method.

- This method is accepted under the Income Tax Act.

Demerits of the Written Down Value Method:-

- In this method, the value of asset cannot become zero.

- It is not simple to ascertain proper rate of Depreciation.

practical problems