Introduction of Trial Balance

Trial balance is prepared after having posted the Journal entries into the Ledger and balancing the accounts. The balance of an account is the difference between the total of the debit entries and the total of the credit entries in an account. If the total of debit entries is greater, it is called a Debit Balance. Likewise, if the total of credit entries is greater, it is called a Credit Balance.

According to J.R. Batliboi

“A Trial Balance is a statement, prepared with the debit and credit balances of the Ledger Accounts to test the arithmetical accuracy of the books.”

Characteristics of Features of Trial Balance:-

- It is a list of balances of Ledger Accounts and Cash Book.

- It is not a part of the Double Entry System of Book Keeping. It is a result of Double Entry System of Book Keeping. It is only a working paper.

- It can be prepared on any date if the accounts are balanced.

- It verifies the arithmetical correctness of posting of entries from the Journal to the Ledger.

- It is not a Conclusive proof of the accuracy of the books of account since some errors are not disclosed by the Trial Balance, for example, error of principle and compensating errors are not shown (disclosed) by Trial Balance.

Objectives or Functions of Trial Balance:-

- To Ascertain the Arithmetical Correctness of Ledger Accounts – The Trial Balance enables to establish whether posting and other accounting processes have been carried out without committing arithmetical errors.

- To Help Prepare the Final Accounts (Financial Statements) – Trial Balance is the list of the Ledger Accounts and Cash and Bank Balance. It is the base document to prepare Financial Statements, i.e., Final Account.

- Summary of Each Account – Trial Balance is a summary of each Ledger Account. The ledger account may have to be referred only when more details is required in respect of an account.

- To Help in Identifying Errors – Trial Balance helps in identifying errors in maintaining Book of Account. It should however, kept in mind that it does not disclose, i.e., show all the errors in Book Keeping except the arithmetical inaccuracies.

Limitations of Trial Balance:-

- Errors of Principle, i.e., errors which arise due to incorrect application of the principle of accounting are not disclosed by the Trial Balance.

- Compensating errors, i.e., group of errors which are committed in such a way that one mistake is compensated by the other and the Trial Balance still agrees.

- Transactions completely omitted from recording in the books of account cannot be detected.

- Recording both aspects of a transaction twice in the books of account.

- Posting correct amount on the correct side but in the wrong account is not reflected by the Trial Balance.

- Wrong amount recorded in the books of original entry and same amount is debited and credited, is not brought out by the Trial Balance.

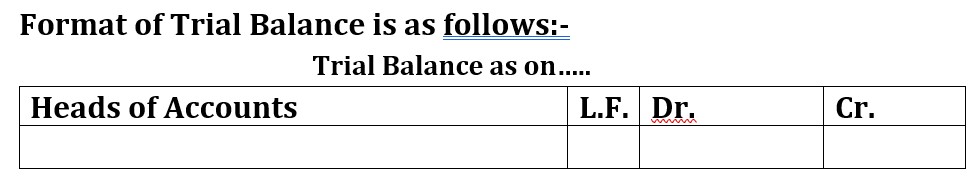

Preparing A Trial Balance:-

Trial Balance is prepared by taking the debit and credit balances of all the accounts (including Cash and Bank Accounts). These balances are entered separately in two columns for amount. Debit balances are placed in the ‘Debit Column’ and credit balances in the ‘Credit Column’. It is known as preparation of Trial Balance by ‘Balance Method’.

practical problems