Short Answers

- State the four basic requirements of a database application.

Ans. The four basic requirements of a database application are:

- Front-end interface:- This is the user-facing part of the application, providing a way for users to interact with the database. It handles input, displays information, and allows users to make requests to the database.

- Back-end database:- This component is the core data storage system that holds all the information. It responds to user queries and provides authorized access to the stored data.

- Data Processing:- The application needs a system to process raw data, transforming it into meaningful and useful information.

- Reporting system:- This element generates integrated reports and outputs, presenting the process information in a clear, understandable format for the user.

2. Name the various categories of accounting package.

Ans. The various categories of accounting package:

- Ready-to-use Software or Readymade Software:- this is a general software which has a less number of the features which are of the basic in nature.

- Customized Software:- The software can be customized based upon the type of the industry or the segment.

- Tailor-made Software or Tailored Software:- the tailor made sore are based on the specifications and requirements of any particular company.

3. Give example of two types of operating systems.

Ans. The following are the two types of Operating System along with their examples

- Single-User Operating System for example, Dos, Windows 95/97

- Multi-User Operating System for example, UNIX, LINUX

4. List the various advantages of computerized accounting systems.

Ans. The various advantages of computerized accounting systems as follows:

- Accuracy:- Automated calculation and built-in-error-checking minimize mathematical errors and data entry mistakes, leading to more reliable financial records.

- Speed :- Task like data entry and report generation are much faster than manual methods, saving significant time and resources.

- Real-Time data and reporting:- Systems provide instant, up-to-date information and allow for the quick generation of various financial reports, enabling timely decision-making.

- Scalability:- Computerized systems can easily adapt and scale to handle increased transaction volumes as a business grows.

- Data Security:- Features like password protection, encryption, and audit trails enhance data security and protect sensitive financial information.

5. Give two examples each of the organizations where ‘ready-to-use’, ‘customized’, and ‘tailored’ accounting packages respectively suitable to perform the accounting activity.

Ans. Ready-to-use accounting packages are basically used by the small-sized enterprises. For example, grocery stores, medical stores, etc.

On the other hand, ‘Customized’ accounting packages are basically used by the medium and large business. For example, shopping malls, hospitals, etc.

Tailored accounting packages are basically used by the geographically scattered businesses. For example, MNC’s, Communication Industries, etc.

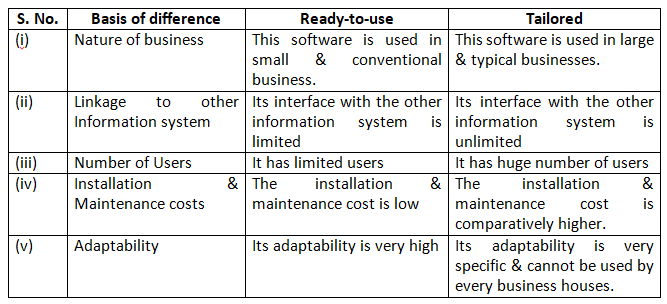

6. Distinguish between a ‘ready-to-use’ and ‘tailored’ accounting software.

Ans.

Long Answers

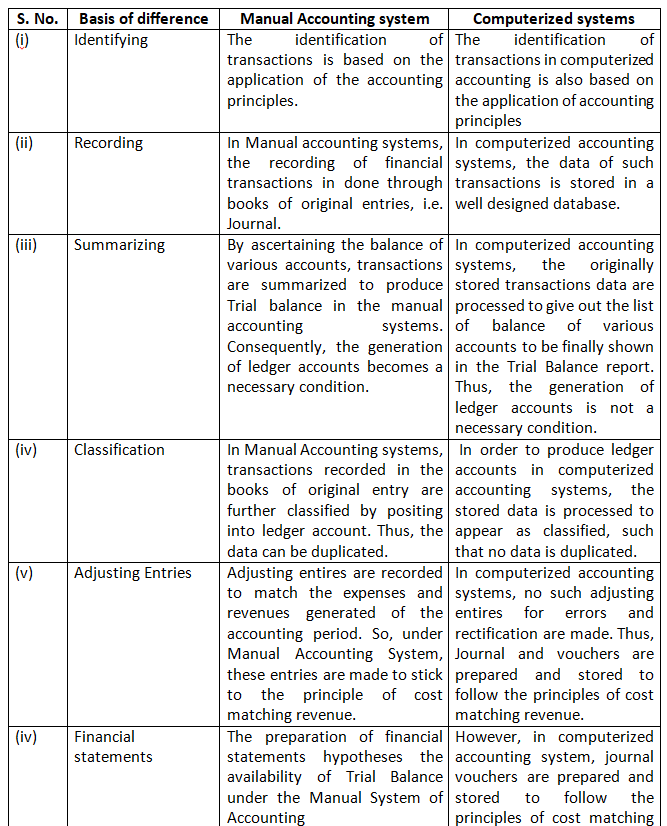

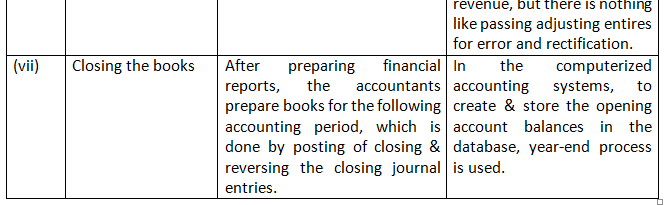

- Define a computerized accounting system. Distinguish between a manual and computerized accounting system.

Ans. Computerized accounting system:- A computerized accounting system is an accounting information system that processes the financial transactions and events as per Generally Accepted Accounting Principles (GAAP) to produce reports as per users requirements. Every accounting system, manual or computerized, has two aspects.

The following are some point of differences between Manual are computerized Accounting Systems.

2. Discuss the advantages of computerized accounting system over the manual accounting system.

Ans.

- Speed and Efficiency: Computerized systems process large volumes of transactions significantly faster than manual methods, as software handles repetitive tasks automatically, saving both time and labor.

- Accuracy and Reduced Errors: By automating calculations and other processes, computerized systems minimize human error, leading to highly accurate financial records and reports.

- Automation of Tasks: Many tasks, such as invoicing, payroll, and supplier account updates, are automated, freeing up accountants for more strategic work.

- Up-to-Date, Accessible Information: Financial data is automatically updated in real-time, and reports can be generated instantly, providing instant access to up-to-date information for better decision-making.

- Enhanced Reporting: The ability to quickly produce various financial reports, from cash books to detailed statements, and to visualize data in formats like graphs and charts, offers better financial insights.

- Improved Compliance: Software can help ensure compliance with tax laws, like GST, by automating correct calculations and generating necessary returns, reducing penalties for errors and delays.

- Scalability: Computerized systems are highly scalable, allowing businesses to easily manage increasing volumes and complexity of transactions as they grow.

- Better Data Security: Data can be stored securely, with options for offsite storage and backups, protecting against data loss from disasters and improving overall safety.

- Cost-Effectiveness: While there’s an initial investment, the long-term savings from reduced labor, fewer errors, and increased efficiency make computerized accounting more cost-effective.

3. Describe the various types of accounting software along with their advantages and limitations.

Ans. The various types of accounting software :

- Ready-in-use software- This type of software is readily available in the market with prescribed and standard features. This accounting software is basically used by the small-size business enterprises, where the number of transactions is not so large. The cost of its installation and maintenance is also low.It has limited number of users. Its adaptability is very high as it is relatively easier to learn and operate. It does not have a wide scope to link it with other information systems.

Advantages of Ready-made Accounting Software

The advantages of Ready-made Accounting Software are enlisted below.

- This software is easily available in the market.

- It is less expensive, as it comes with basic and standard features.

- It involves a lesser need for training.

- It is less sophisticated.

- Its adaptability is very high as it is relatively easier to learn and operate.

- It is suitable for small-size business enterprises.

Disadvantages of Ready-made Accounting Software

The disadvantages of Ready-made Accounting Software are enlisted below.

- It has limited number of users.

- It I not suitable for medium and large business organization, where the number of transactions is very large.

- It fails to cater the specific needs of the users.

- It suffers from the low level of data secrecy.

- It does not have a wide scope to link it with other information systems.

b. Customized Software- Customized software is the software that has standardized features to meet the special requirements of the users. It provides the scope of changing the features of accounting software. The functions of this software can be programmed as per the needs and requirements of the users. This type of software best suits the needs of medium and large businesses. Its cost of installation and maintenance is comparatively higher.

Advantages of Customized and Tailor-made Accounting Software

The following are the advantage of Customized and Tailor-made Accounting Software.

- This software is suitable for medium and large business organization.

- It caters the specific requirements and needs of the users.

- It can be modified as per the needs of the organizations.

- It has level of security and minimizes the loss and unauthorized access of data.

- It cannot be easily imitated or duplicated in the market due to difference in the needs and requirements of different users.

- It can be easily linked to the other information systems.

- It forms an integral part of the organizational MIS.

Disadvantages of Customized and Tailor-made Accounting Software

The following are the disadvantages of Customized and Tailor-made Accounting Software.

- It involves high cost of installation and maintenance.

- Developing customized software is a time-consuming process and involves high cost of development.

- Maintenance of this software is difficult as there exists limited availability of knowledge to the developers.

- It lacks standard training module.

Tailored Software- Tailored or Tailor-made accounting software is the software that is developed as per the specifications and requirements of the users. This accounting software is generally used in the large business organizations with multi-users and geographically scattered locations.

4. ‘Accounting software is an integral part of the computerized accounting system’ Explain. Briefly list the generic considerations before sourcing an accounting software.

Ans. An Accounting software plays an important role in the computerized accounting system and hence it should and hence it should meet upon the generic needs of any company in the following manner:

- Cost of Installation and Maintenance:- The accounting software must fulfill the need of the maintenance and the installation of the company. Thus it is important the accounting system evaluates the software against the cost and the benefits it offers to the company.

- Training Requirement:- Training requirement is a crucial factor which the companies should consider while selecting any accounting software. If the accounting software is user-friendly, it will be less complex or them to use.

- Flexibility:- The accounting software must offer flexibility when it come to the aspect of the generation of the reports, entering, retrieving and processing the data.

- Size of company:- The Accounting software must be meet the need of the size of the company. For instance, if the company in small in scale and size, the accounting software must be concerned to meet its specific need in this case.In another instance, if the company is a multi-national company, then the accounting software must meet the general need of the large number of the users.

- Exchanging Data Facility:- The data through the accounting software must be easily transferrable to another accounting system. Whether if the accounting software is able to transfer the data or not is another aspect which the companies should consider while talking the decision for the accounting software.

- Level of Secrecy:- The companies should consider the level of secrecy as an important aspect while selecting any accounting software.

5. ‘Computerized Accounting Systems are best form of accounting system’. Do you agree? Comment.

Ans. Yes, the claim that computerized accounting systems are the best form of accounting is largely accurate due to their superior speed, accuracy, reliability, and efficiency in data processing and reporting, which are critical for modern businesses. However, “best” depends on the business’s scale, complexity, and budget, as manual systems may be more suitable for very small or simple operations.

- Speed and Efficiency: Computers process information significantly faster than humans, allowing for rapid data entry, processing, and report generation.

- Accuracy and Reliability: Automation minimizes errors common in manual systems, ensuring data integrity and consistent, reliable reports.

- Real-time Data: Financial records are automatically updated, providing up-to-date information for informed decision-making.

- Scalability: As a business grows, a computerized system can handle increased transaction volume without needing a proportional increase in manual labor.

- Automated Document Production: Under computerised accounting systems, the accounting reports such as, cash book, Trial Balance, statement of Accounts, etc. are very easy to obtain. This is because most of the computerised systems have standardised and user-defined format of accounting reports that are generated automatically. On the other hand, such an ease cannot be enjoyed under manual system. This is because the accounts books are prepared by different employees, thereby subjected to vary from person to person.

- Legibility: In Computerised Accounting Systems, the accounting records are typed and presented in standard fonts. The various characters especially number, alphabets, graphics, etc. are more clear and can be read without any difficulty and ambiguity. But, in the manual system, the writing of different personnel varies; consequently, reading and interpreting the written materials involve errors due to misinterpretation.