Short Answers

- Why is it necessary to record the adjusting entires in the preparation of final accounts?

Ans. It is extremely important to record the adjusting entries in the preparation of final accounts.

- This is done in order to assess the true net profit or net loss of the business organization.

- It helps us record those adjustments which were left or omitted and were not recorded in the accounts.

- It assists us to separate all the financial transactions into a year-wise category.

The financial statements include only those entries which belong to the current year.

It rules out the previous and forthcoming year’s entries which are basic for accrual basis of accounting .

d. Further, it provides us the room for making various provisions which are made at the end of the year, after assessing the entire year’s performance.

2. What is meant by closing stock? Show its treatment in final accounts?

Ans. The closing stock is referred to as the goods which remains unsold at the end of an accounting year. It is evaluated at the price of its cost of or its realizable value whichever is lower.

For example:- if cost of goods unsold is Rs.5,000 and net realizable value is Rs.45,000 then the closing stock is valued at Rs.4,500.

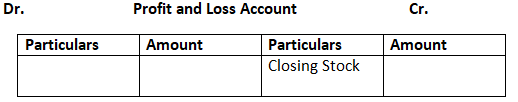

The treatment of closing stock is done in the final accounts in the following manner:

- In the case when the closing stock appears in the Trail balance then it shown ass asset in the Balance Sheet.

- It the case when the closing stock appears as an adjustment then it shown on the credit side of the Trading account and at the side of the asset in the balance sheet.

3. State the meaning of:

- Outstanding expenses

- Prepaid expenses

- Income received in advance

- Accrued income

Ans.

I. Outstanding expenses:- Theses refer to those expenses which belong to and are incurred in the current accounting period but are left unpaid. It other words, we can say that the services in exchange of these payments have been realized but the payments are not made.

For example, if Rs.1,000 wages are outstanding, then this labour worth Rs.1,000 has been used but has not been paid for till the end of the year.

II. Prepaid expenses:- These refer to those expenses for which the benefits have not been realized but the payments have already been made in advance. These are basically the advance payments for the next year, which are made in the current accounting period.

Example: Prepaid insurance premium of Rs.1,000 means that the payment of Rs.1,000 is made in advance for the next accounting period.

III. Income received in advance:- This refers to the income received whose actual realization of benefits will occur in the next accounting period. The are also called unearned incomes.

Example: Commission of Rs.1,200 for the year 2011 – 2012 is received in 2010 – 2022.

This are also called unearned incomes.

Example: commission of Rs.1,200 for the year 2011 – 2012 is received in 2010 – 2011. This commission does not belong to the current year as it is related with the work to be done in the next accounting year i.e., 2011 – 2012.

IV. Accrued income:- This refers to those income which have been earned during an accounting period but have not been actually realized in the current period. These are also called earned incomes

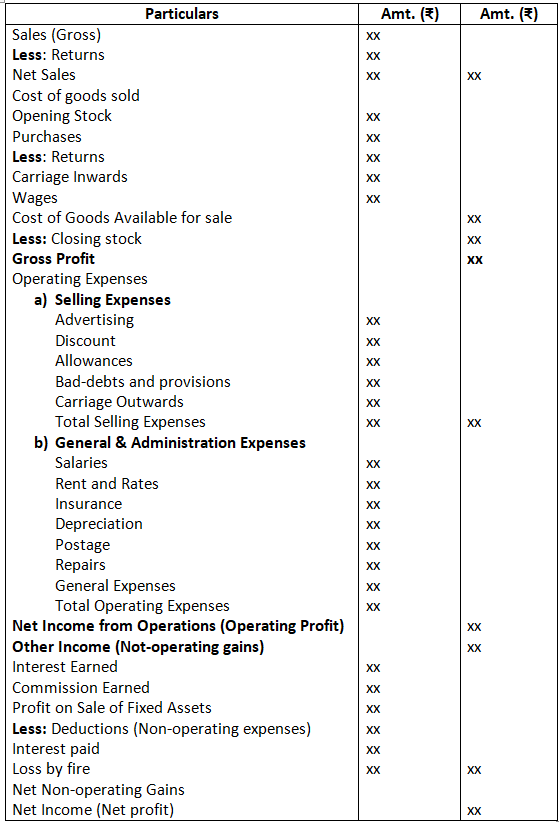

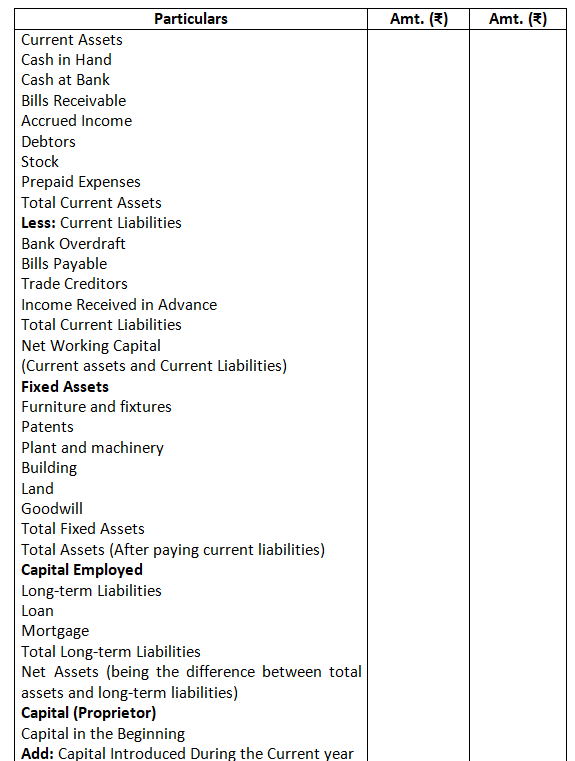

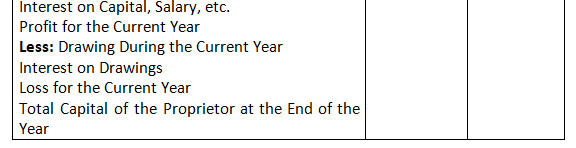

4. Give the Performa of income statement and balance in vertical form.

Ans.

Income statement for the period ended…….

Income statement for the period ended……………..

5. Why is necessary to create a provision for doubtful debts at the time of preparation of final accounts?

Ans. The creation of the provision of doubtful debt is made in order to make the prediction of the bad or doubtful debt the business when the accurate position for the same can be made or determine in the next year only. It is considered to be the prudent practice for any business organization as it reduces the scope of actual loss by the business.

6. What adjusting entries would you record for the following:

- Depreciation

- Discount on debtors

- Interest on capital

- Manager’s commission

Ans.

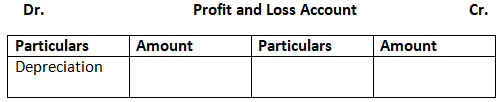

- Depreciation:-

Dr. Profit & Loss Account Cr.

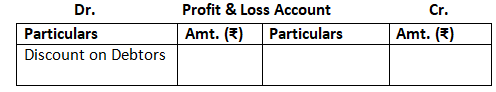

b. Discount on debtors:-

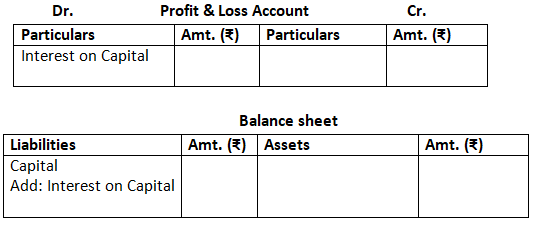

c. Interest on capital:-

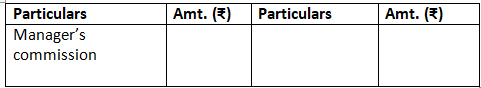

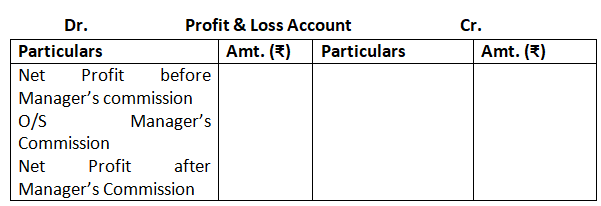

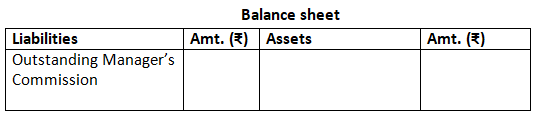

d. Manager’s commission:-

Case 1: Manager’s commission based on profits before charging the manager’s commission.

Dr. Profit & Loss Account Cr.

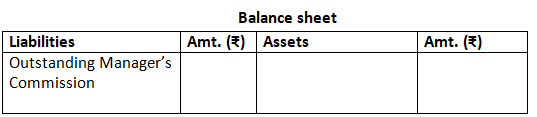

Cash 2: Manager’s commission based on profits after charging the manager’s commission.

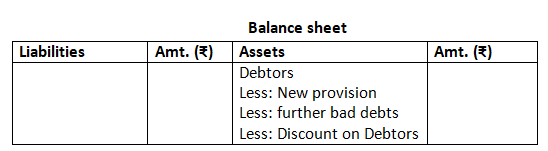

7. What is meant by provision for discount on debtors?

Ans. The maintenance of the provision for discount on debtors is done in order to encourage the payment from the debtors of the business before the date which is due. The discount is hence made to encourage the timely payment by the debtors especially the ones who have a bad record for doing so. This provision is maintained in the side of the debit of the profit and loss account and is shown as the deduction from the debtors on the side of the assets in the balance sheet.

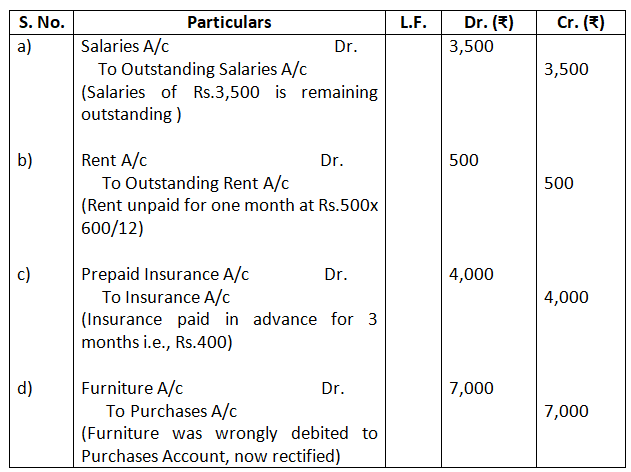

8. Give the journal entries for the following adjustments:

- Outstanding salary Rs.3,500.

- Rent unpaid for one month at Rs.6,000 per annum.

- Insurance prepaid for a quarter at Rs.16,000 per annum.

- Purchases of furniture costing Rs.7,000 entered in the purchases book.

Ans.

Long Answers

- What are adjusting entries? Why are they necessary for preparing final accounts?

Ans. The adjusting entries are considered to be the entire which are made in the end of the accounting period to determine the true and the fair position of the business. There are called as the adjusting entries as they are made out of the items in the trial balance. The adjustments are made in two place as per the adherence the double entry system if book keeping.

It is necessary to make the adjusting entires while preparing the final accounts as:

- It depicts the true and fair position and the performance of the business of the current year.

- In case of the omission of any entires while the process of recording, the adjusting entires for the same are passé in the end of the account period.

- After going through all the accounts, provision is created in the year end wherever necessary.

- It eliminates the entires which were already made in the prior year or which have to be made in the forthcoming years.

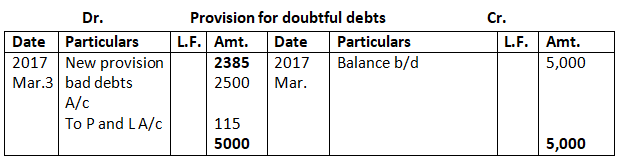

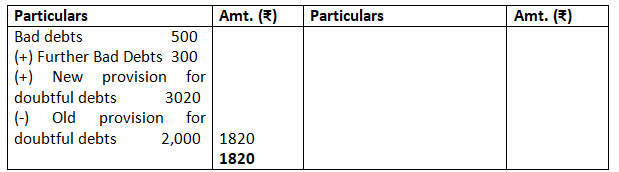

2. What is meant by provision for doubtful debts? How are the relevant accounts prepared and what journal entries are recorded in final accounts? How is the amount for provision for doubtful debts calculated?

Ans.-

The maintenance of the provision for discount on debtors is done in order to encourage the payment from the debtors of the business before the date which is due. The discount is hence made to encourage the timely payment by the debtors especially the ones who have a bad record for doing so. It is considered to be the prudent practice for any business organization as it reduces the scope of actual loss by the business.

Whenever the provision for bad debts is made, the bad debts which arise after the provision is made shall be adjusted firstly against the provision so made and not the debtors.

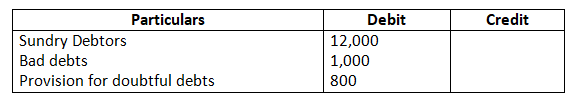

For example:

The trial Balance of a company is extracted as follows-

Adjustment:

- Further Bad debt amounting to Rs.400

- Create a provision for doubtful debts @ 8% on debtors.

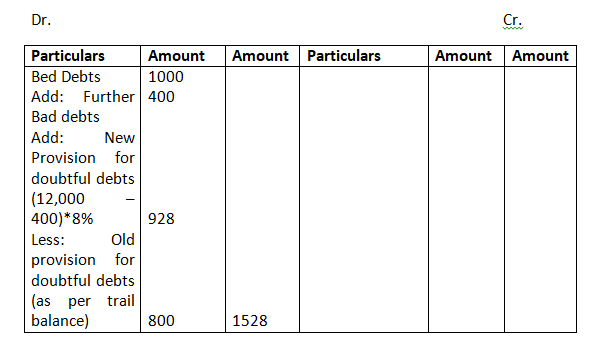

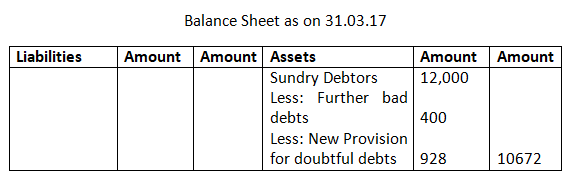

In the above example the Bad debts is Rs.1,000 and further Bad debts Rs.400 is known at the year end. Provision for doubtful debts is created after deducting the further bad debts from the debtors. It is shown as addition to Bad debts in Profit & Loss account and as a deduction from debtors. It is illustrated below:

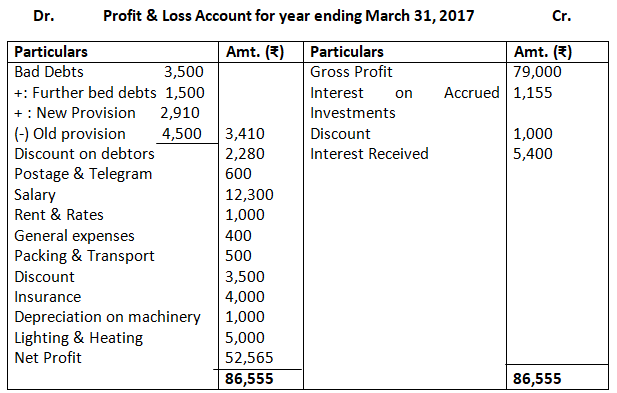

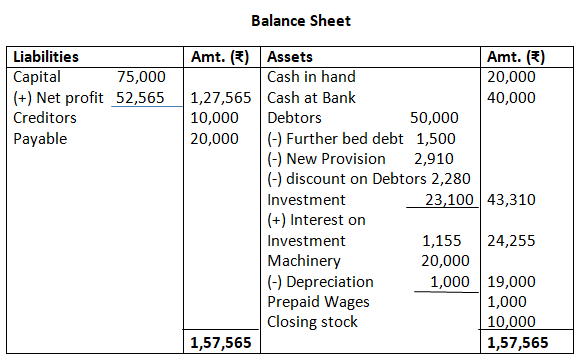

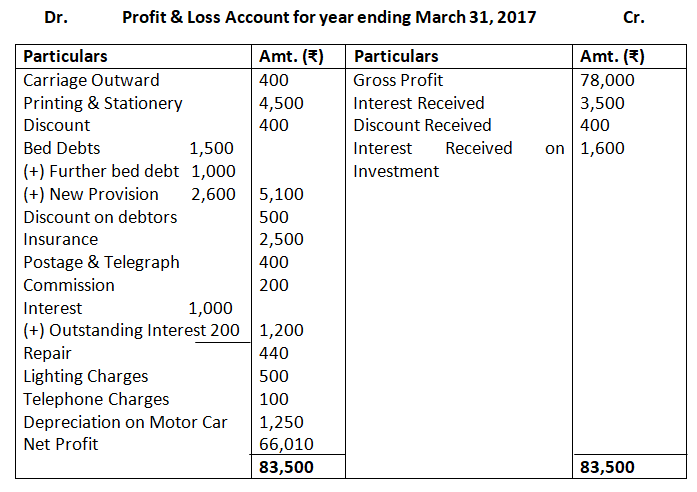

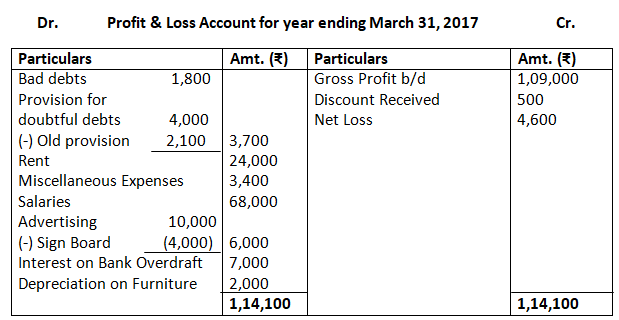

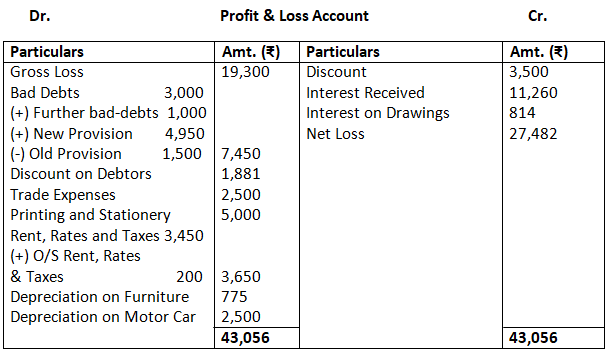

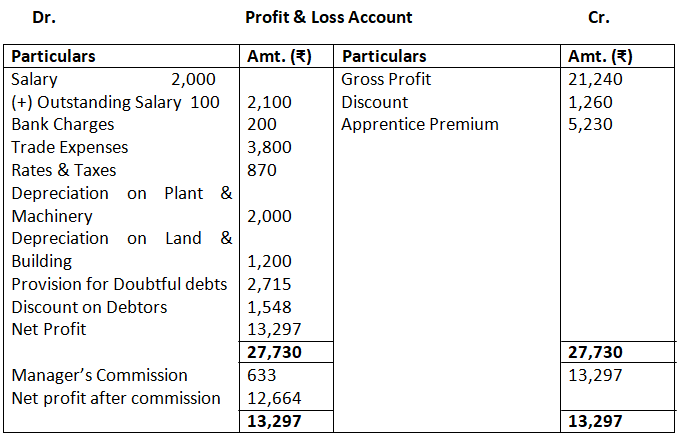

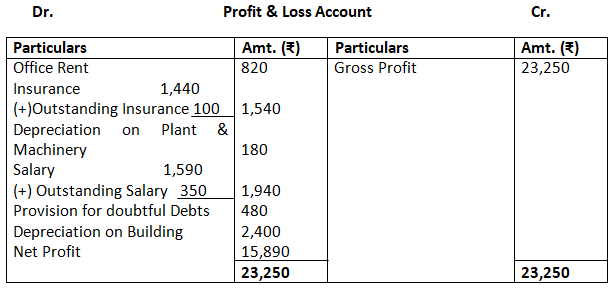

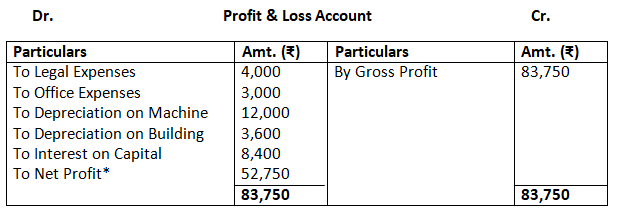

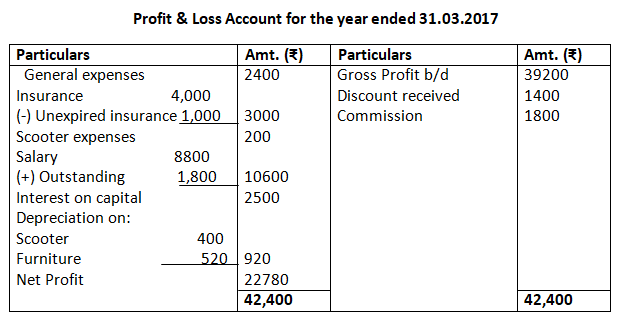

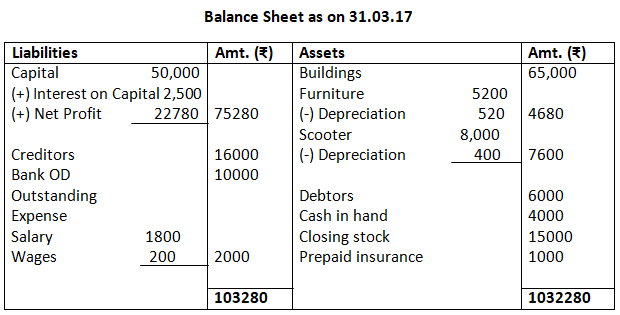

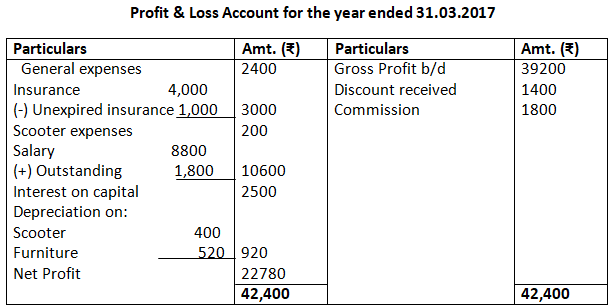

Profit & Loss Account for the year ended 31.03.2017

3. Show the treatment of prepaid expenses depreciation, closing stock at the time of preparation of final accounts when:

- When given inside the trial balance?

- When given outside the trial balance?

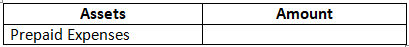

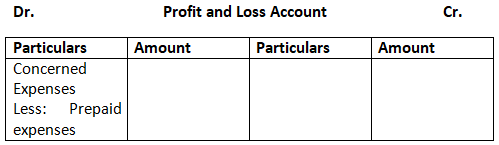

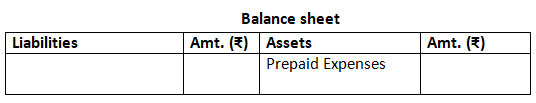

(i) Prepaid expenses

a. When given inside the Trial Balance: It will be posted only in the Assets side of the Balance Sheet.

b. When given outside the Trial Balance:

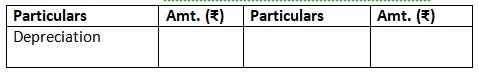

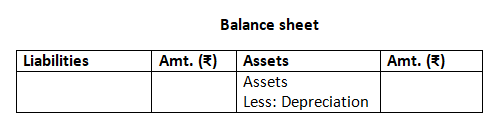

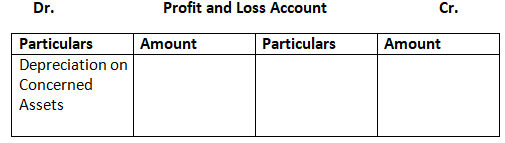

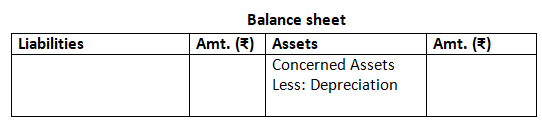

(ii) Depreciation

- If depreciation is given inside the Trial Balance, then it can be shown in the Debit side of the Profit and Loss A/c.

If means that this depreciation amount has already been deducted from the concerned assets in the Balance Sheet.

b. If Depreciation is given outside the Trial Balance, i.e., in the adjustments, then it is shown in the debit side of the Profit and Loss Account and deducted from the concerned assets in the Assets side of Balance Sheet.

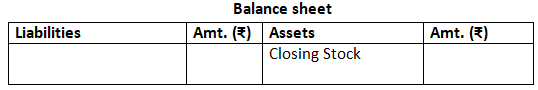

(iii) Closing Stock

a. The closing stock is valued at cost price or realizable value, whichever of the two is lesser. If given inside the Trial Balance, then it will be posted only in the Assets side of the Balance Sheet.

If the closing stock is given outside the Trial Balance then, it needs to be posted at two places.

Numerical Questions

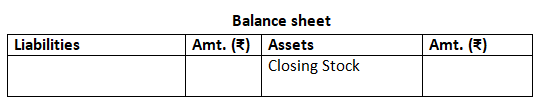

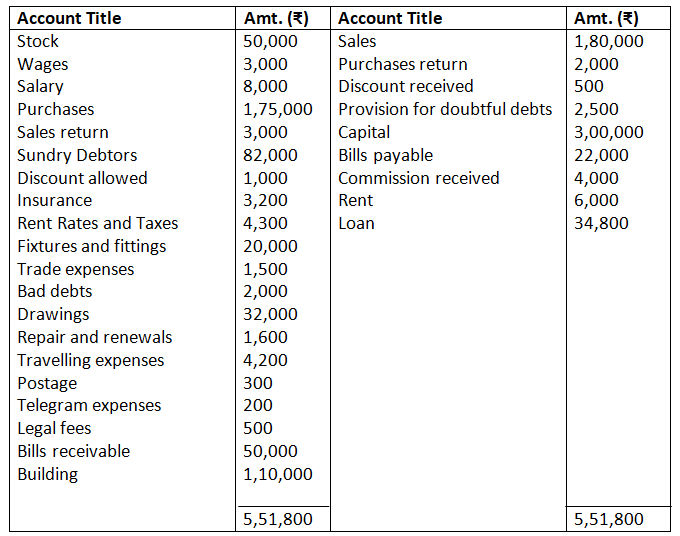

- Prepare a trading and profit and loss account for the year ending March 31, 2017, from the balance extracted of M/s Rahul Sons. Also prepare a balance sheet at the end of the year.

Adjustments

- Commission received in advance Rs.1,000.

- Rent receivable Rs.2,000.

- Salary outstanding Rs.1,000 and insurance prepaid Rs.800.

- Further bad debts Rs.1,000 and provision for doubtful debts @ 5% on debtors and discount on debtors @ 2%.

- Closing stock Rs.32,000.

- Depreciation on building @ 6% p.a.

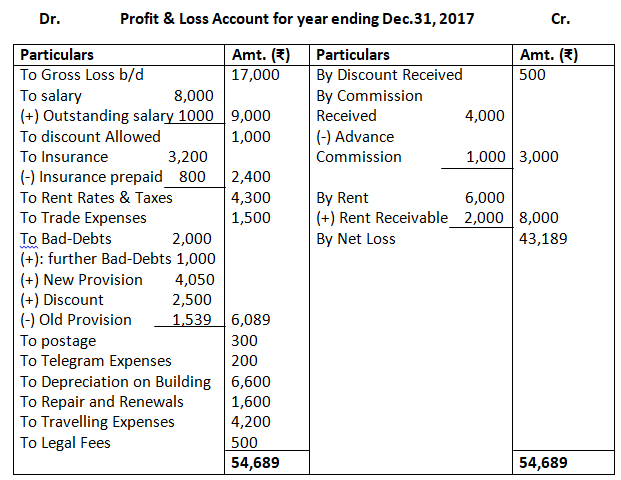

Books of M/s. Rahul Sons. Dec. 31, 2017

Dr. Trading Account Cr.

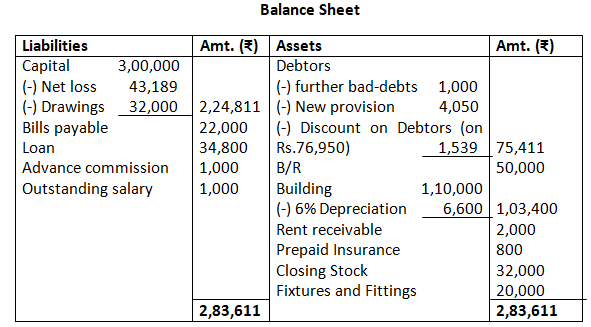

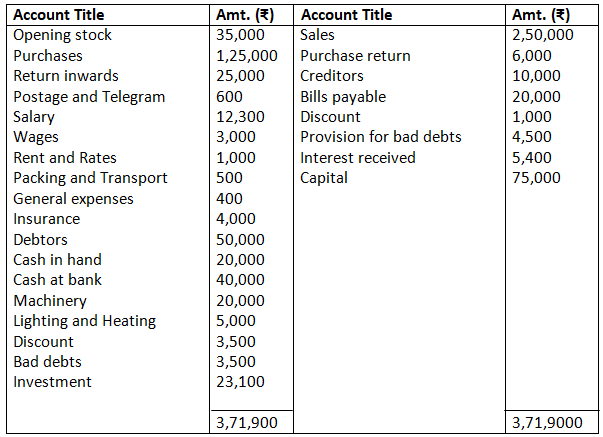

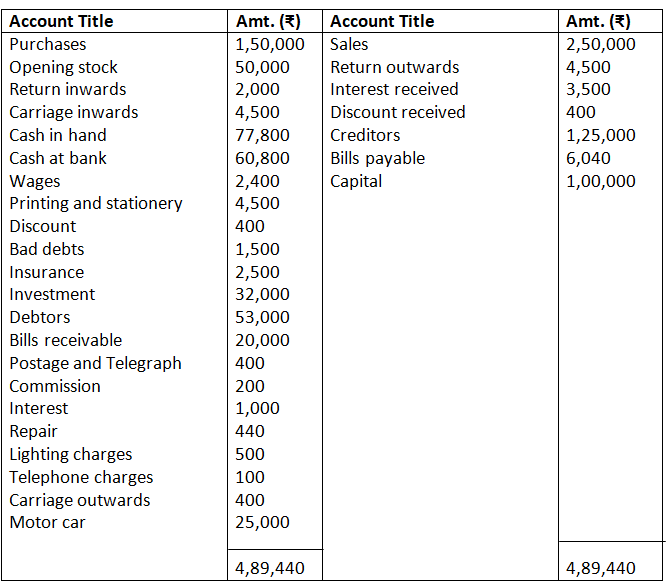

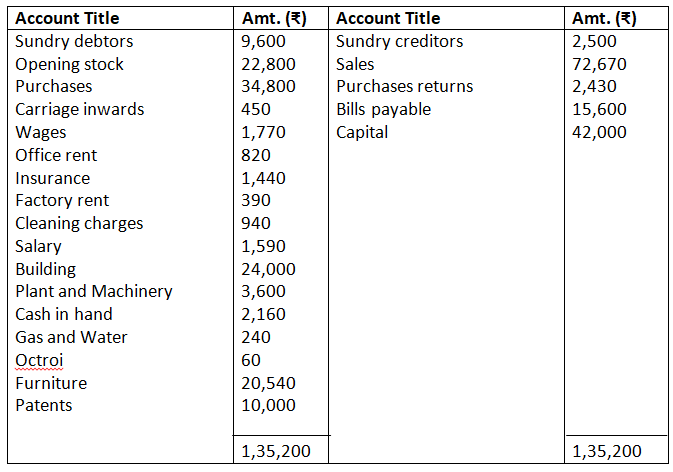

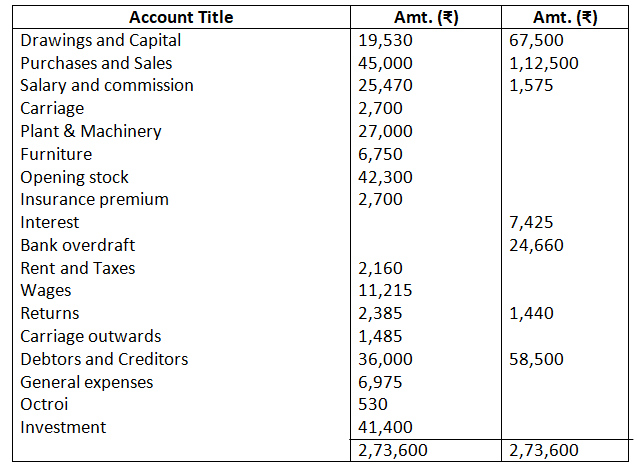

2. Prepare a trading and profit and loss account of M/s Green Club Ltd. For the year ending March 31, 2017. From the following figures taken from this trial balance:

Adjustments

- Depreciation charged on machinery @ 5% p.a.

- Further bad debts Rs.1,500, discount on debtors @ 5% and make a provision on debtors @ 6%.

- Wages prepaid Rs.1,000.

- Interest on investment @ 5% p.a.

- Closing stock 10,000.

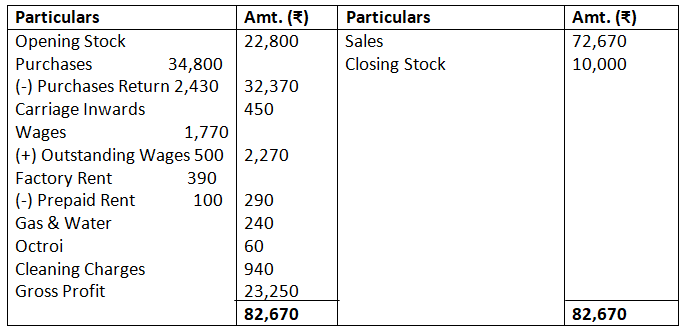

Solution:-

Dr. Trading Account March 31, 2017 Cr.

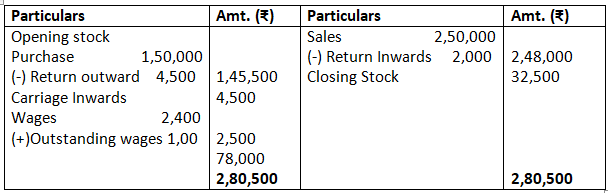

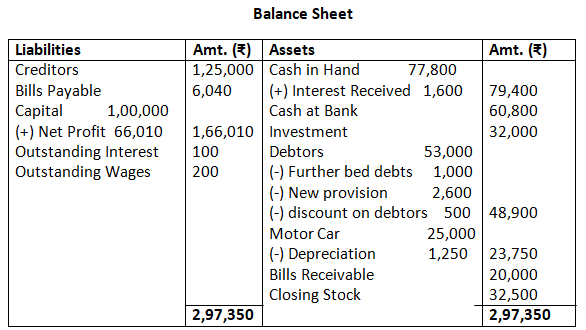

3. The following balances had been extracted from the trial of M/s Runway Shine Ltd. Prepare a trading and profit and loss account and a balance sheet as on March 31, 2017.

Adjustments

- Further bad debts Rs.1,000. Discount on debtors Rs.500 and make a provision on debtors @ 5%.

- Interest received on investment @ 5%.

- Wages and interest outstanding Rs.100 and Rs.200 respectely.

- Depreciation charged on motor car @ 5% p.a.

- Closing Stock Rs.32,500.

Solution:-

Dr. Trading Account Cr.

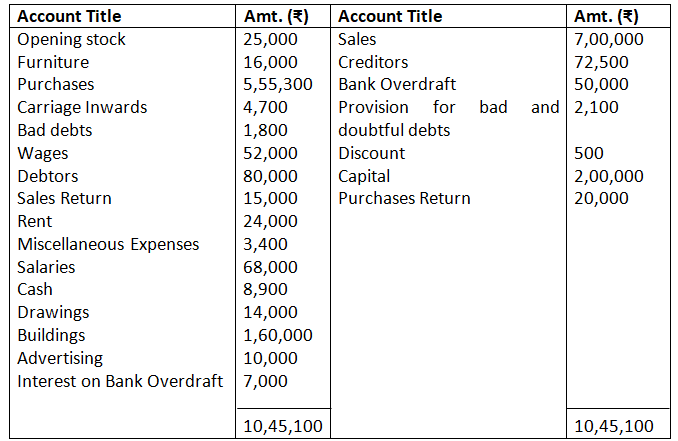

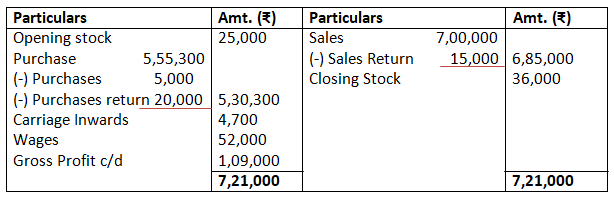

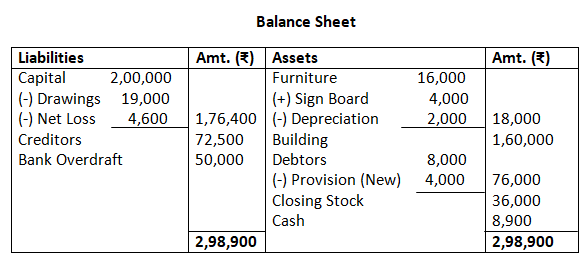

4. From the following Trial Balance you are required to prepare trading and profit and loss account for the year ending March 31, 2017 and Balance Sheet on that date.

Adjustments

- Closing stock valued at Rs.36,000.

- Private purchases amounting to Rs.5000 debited to purchases account.

- Provision for doubtful debts @ 5% on debtors.

- Sign board costing Rs.4,000 includes in advertising.

- Depreciate furniture by 10%.

Solution:-

Dr. Trading Account 31st March, 2017 Cr.

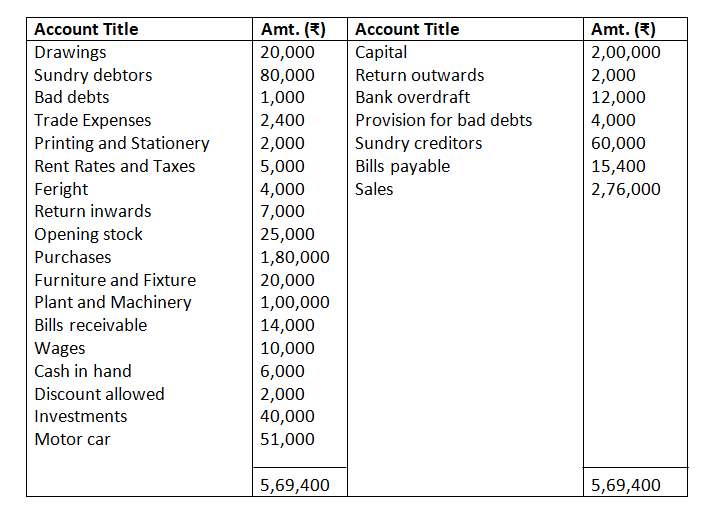

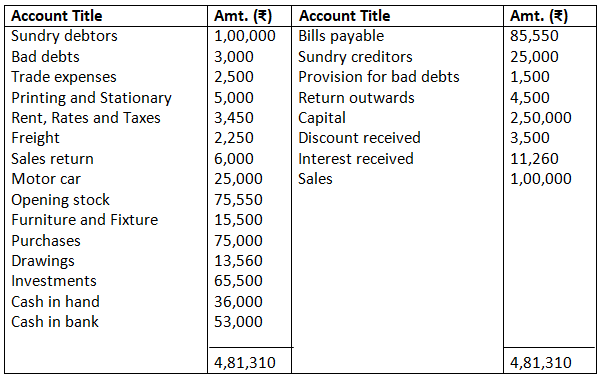

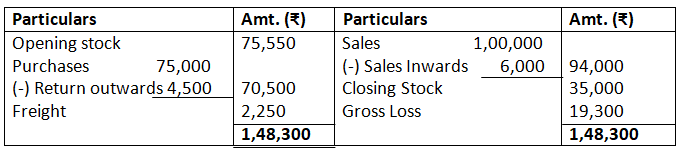

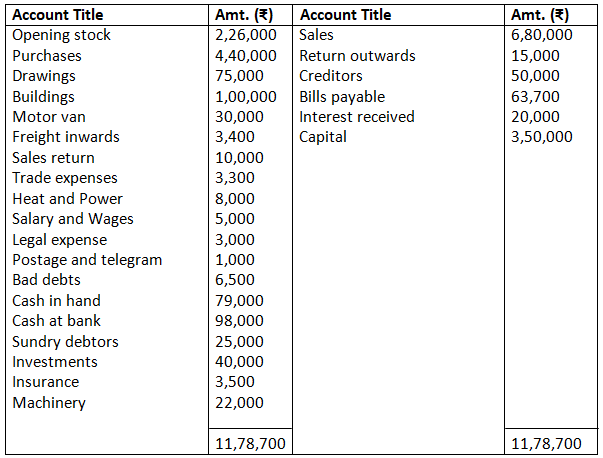

5. From the following information prepare trading and profit and loss account of M/s Indian sports house for the year ending March 31, 2017.

Adjustments

- Closing stock was Rs.45,000.

- Provision for doubtful debts is to be maintained @ 2% on debtors.

- Depreciation charged on : furniture and fixture @ 5%, plant and Machinery @ 6% and motor car @ 10%.

- A Machine of Rs.30,000 was purchased on October 01, 2016.

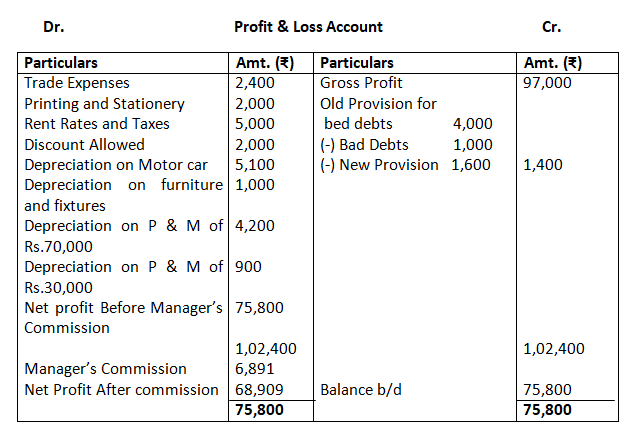

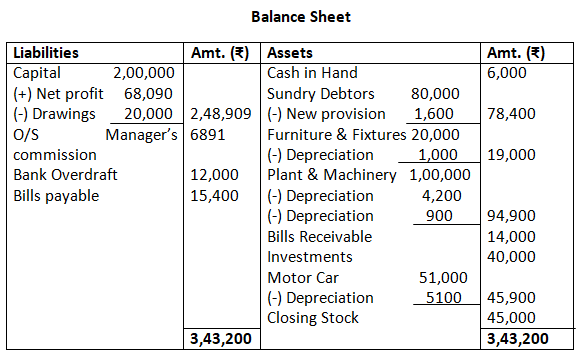

- The manager is entitle to a commission of @ 10% of the net profit after charging such commission.

Solution:-

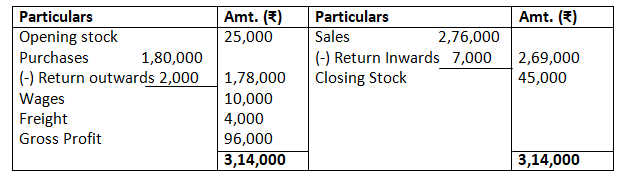

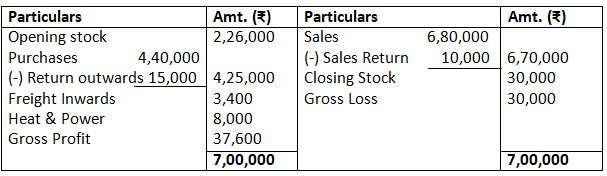

Dr. Trading Account 31st March, 2017 Cr.

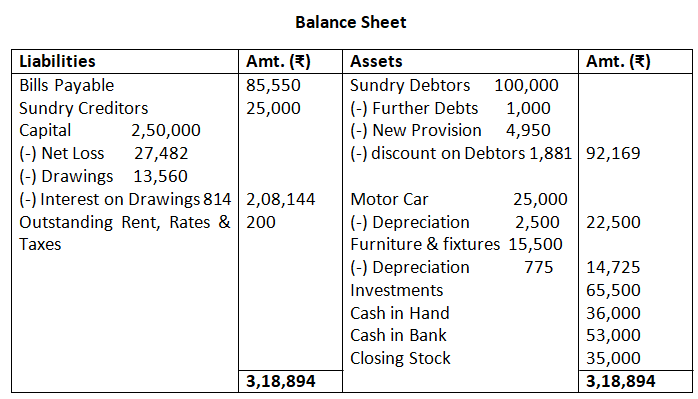

6. Prepare the trading and profit and loss account and balance sheet of M/s Shine Ltd. From the following particulars.

Adjustments

- Closing stock was valued Rs.35,000.

- Depreciation charged on furniture and fixture @ 5%.

- Further bad debts Rs.1,000. Make a provision for bad debts @ 5% on sundry debtors.

- Depreciation charged on motor car @ 10%.

- Interest on drawing @ 6%.

- Rent, rates and taxes was outstanding Rs.200.

- Discount on debtors 2%.

Solution:-

Dr. Trading Account 31st March, 2017 Cr.

7. Following balance have been extracted from the trial balancer of M/s Keshav Electronics Ltd. You are required to prepare the trading and profit and loss account and a balance sheet as on March 31, 2017.

The following additional information is available:

- Stock on March 31, 2017 was Rs.30,000.

- Depreciation is to be charged on building at 5% and motor van at 10%.

- Provision for doubtful debts is to be maintained at 5% on Sundry Debtors.

- Unexpired insurance was Rs.600.

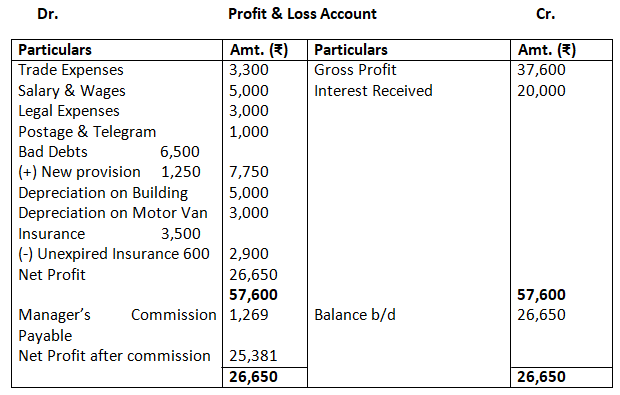

- The manager is entitled to a commission @ 5% on net profit after charging such commission.

Solution:-

Dr. Trading Account 31st March, 2017 Cr.

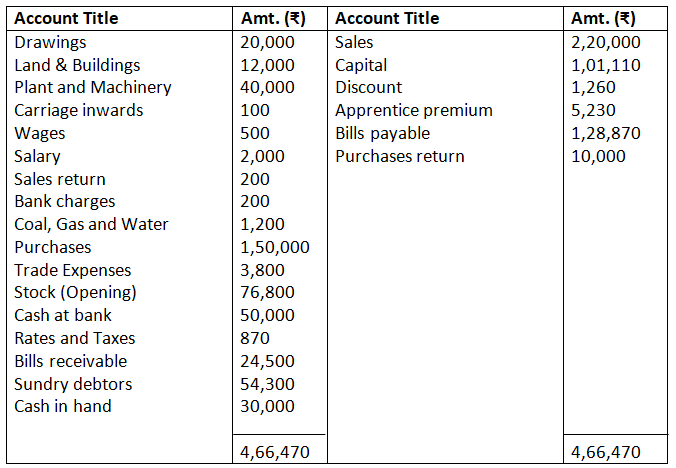

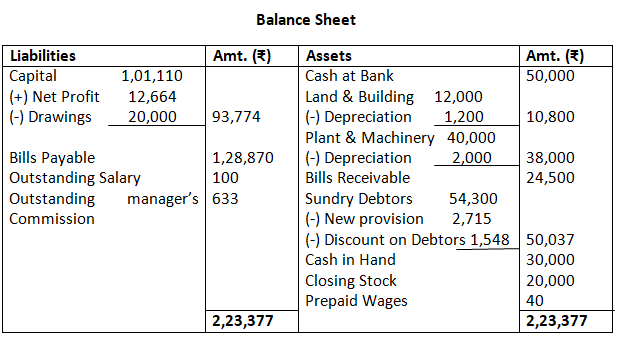

8. From the following balances extracted from the books of Raga Ltd. Prepare a trading and profit and loss account for the year ended March 31, 2017 and a balance sheet as on that date.

The additional information is as under:

- Closing stock was valued at the end of the year Rs.20,000.

- Depreciation on plant and machinery charged at 5% and land and building at 10%.

- Discount on debtors at 3%.

- Make a provision at 5% on debtors for doubtful debts.

- Salary outstanding was Rs.100 and Wages prepaid was Rs.40.

- The manager is entitled a commission on 5% on net profit after charging such commission.

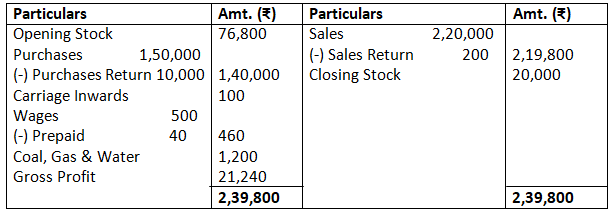

Solution:-

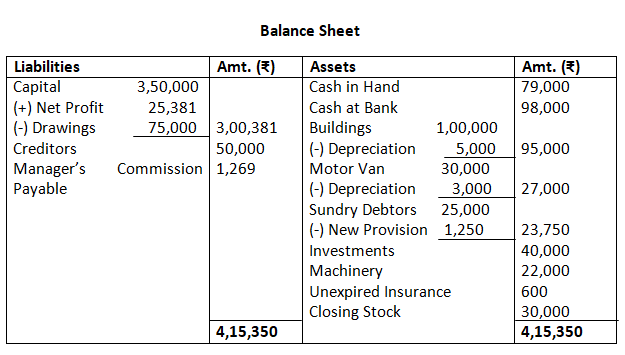

Dr. Trading Account Cr.

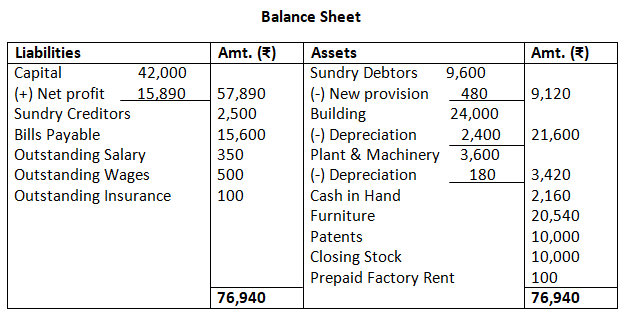

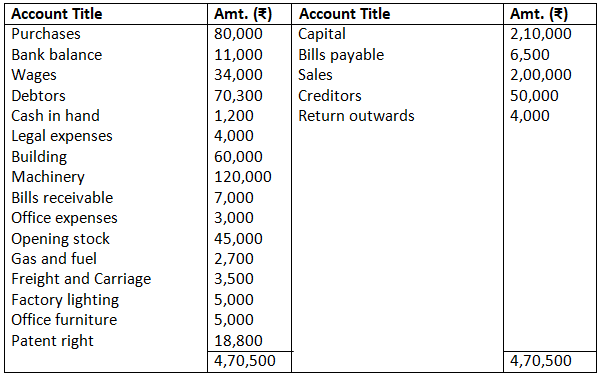

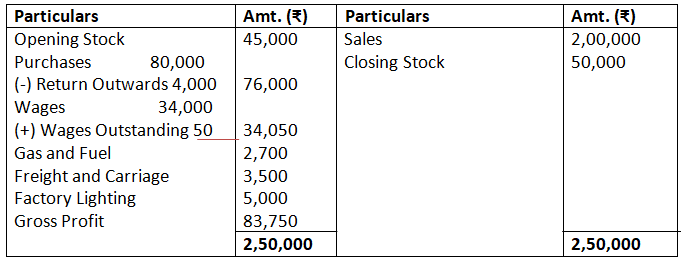

9. Form the following balance of M/d Jyoti Exports, prepare trading and profit and loss account for the year ended March 31, 2017 and balance sheet as on this date.

Closing stock Rs.10,000.

- To provision for doubtful debts is to be maintained at 5% on sundry debtors.

- Wages amounting to Rs.500 and salary amounting to Rs.350 are outstanding.

- Factory rent prepaid Rs.100.

- Depreciation charged on Plant & Machinery @ 5% and building @ 10% .

- Outstanding insurance Rs.100.

Solution:-

Dr. Trading Account Cr.

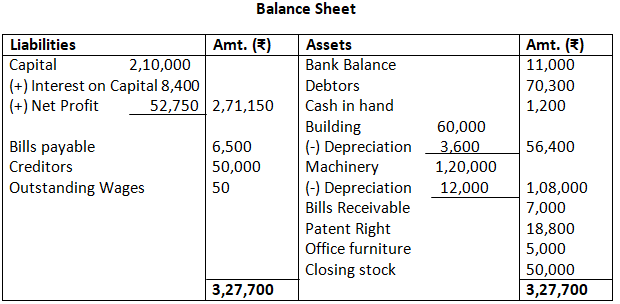

10. The following balance have been extracted from the books of M/s Green House for the year ended March 31, 2017, prepare trading and profit and loss account and balance sheet as on this date.

Adjustments:

- Machinery is depreciated at 10% and buildings depreciated at 6%.

- Interest on capital @ 4%.

- Outstanding wages Rs.50.

- Closing stock Rs.50,000.

Solution:-

Dr. Trading Account Cr.

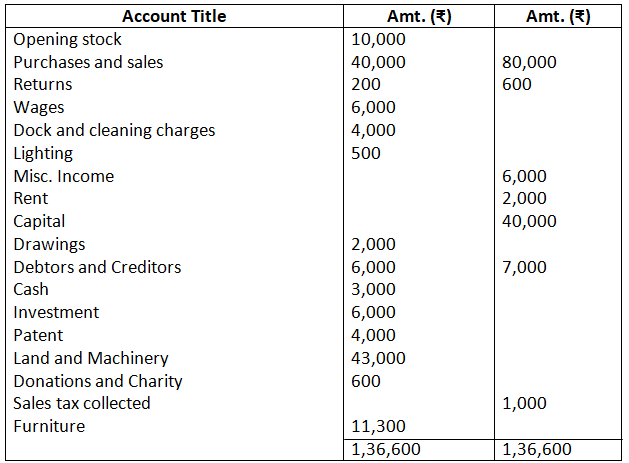

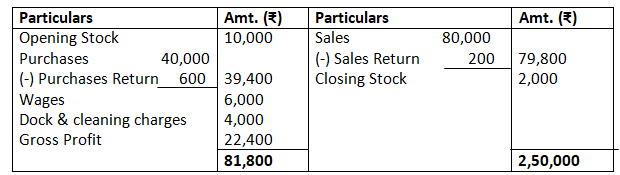

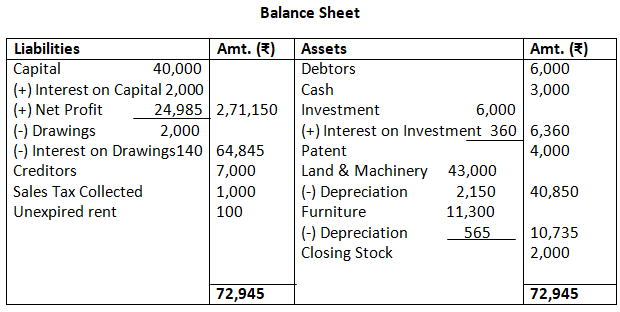

11. From the following balance extracted from the book of M/s Manju Chawla on March 31, 2017. You are requested to prepare the trading and profit and loss account and a balance sheet as on this date.

Closing stock was Rs.2,000.

- Interest on drawings @ 7% and interest on capital @ 5%.

- Land and Machinery is depreciated at 5%.

- Interest on investment @ 6%.

- Unexpired rent Rs.100.

- Charge 5% depreciation on furniture.

Solution:-

Dr. Trading Account Cr.

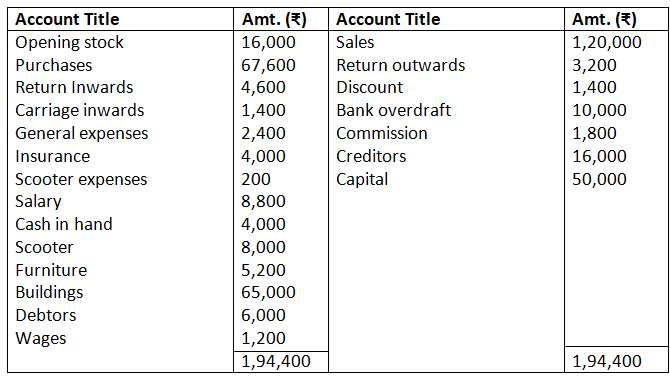

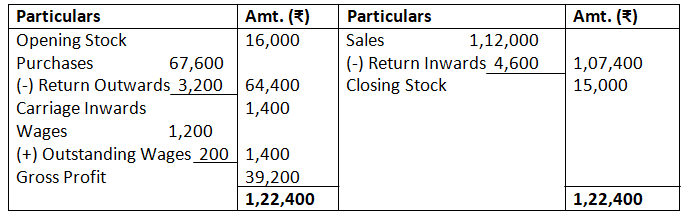

12. The following balances were extracted from the books of M/s Panchsheel Garments on march 31, 2017.

Prepare the trading and profit and loss account for the year ended March 31, 2017 and a balance sheet as on that date.

- Unexpired insurance Rs.1,000.

- Salary due but not paid Rs.1800.

- Wages outstanding Rs.200.

- Interest on capital 5%.

- Scooter is depreciated @ 5%.

- Furniture is depreciated @ 10%.

- Closing stock was Rs.15,000.

Solution:-

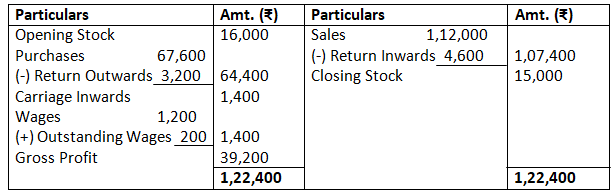

Books of M/s Panchsheel Garments

Dr. Trading Account Cr.

13. Prepare the trading and profit and loss account and balance sheet of M/s Control Device India on March 31, 2017 from the following balance as on that date.

Closing stock was valued Rs.20,000.

- Interest on capital @ 10%.

- Interest on drawings @ 5%.

- Wages outstanding Rs.50.

- Outstanding salary Rs.20.

- Provide a depreciation @ 5% on plant and machinery.

- Make a 5% provision on debtors.

Solution:-

Books of M/s Control Device India

Dr. Trading Account Cr.

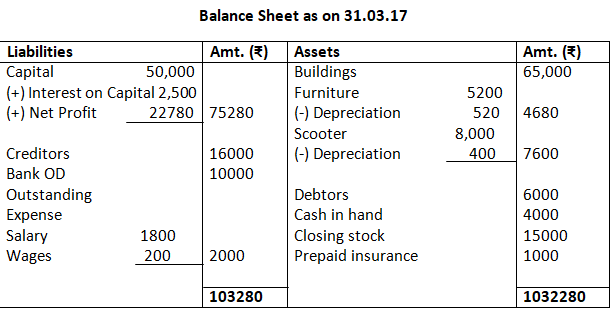

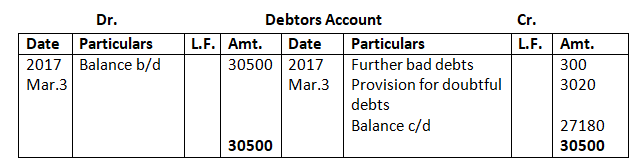

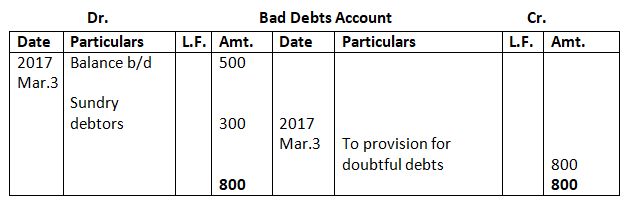

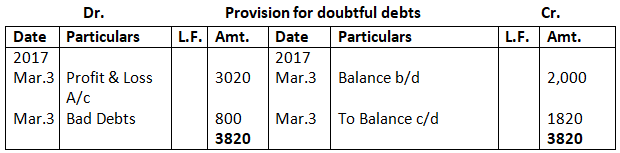

14. The following balances speared in the trial balance of M/s Kapil Traders as on March 31, 2017.

Sundry debtors Rs.30,500

Bad debts Rs.500

Provision for doubtful debts Rs.2,000

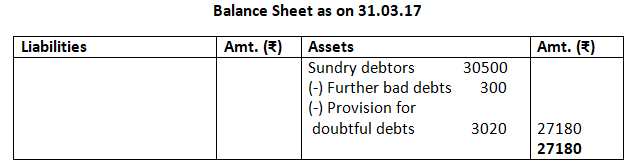

The partners of the firm agreed to records the following adjustments in the books of the Firm: Further bad debts Rs.300. Maintain provision for bad debts 10%. Show the following adjustments in the bad debts account, provision account, debtors account, profit and loss account and balance sheet.

Solution:-

Books of M/s Kapil Traders

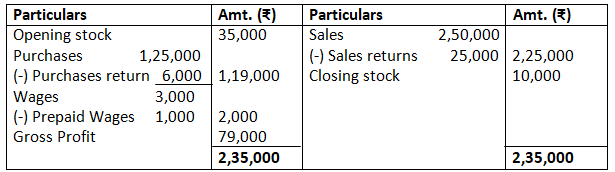

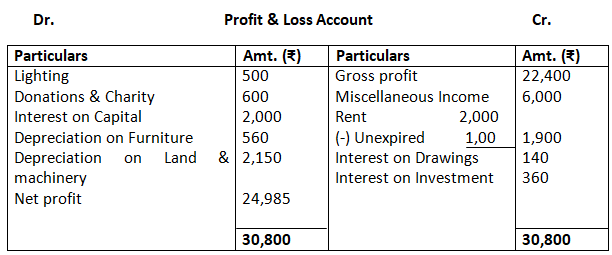

Profit & Loss Account for the year ended 31.03.2017

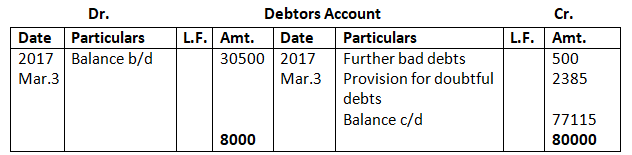

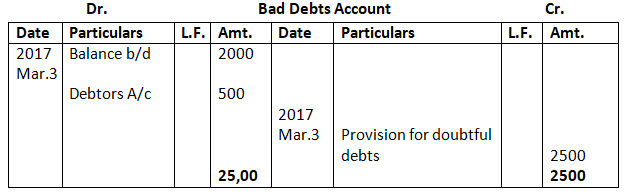

15. Prepare the bad debts account, provision for account, profit and loss account and balance sheet from the following information as on March 31, 2017.

Debtors Rs.80,000

Bad debts Rs.2,000

Provision for doubtful debts Rs.5,000

Adjustments:

Bad debts 500 provision on debtors @ 3%.

Solution:-

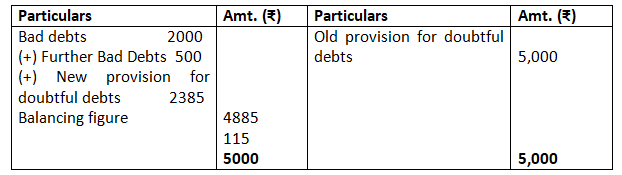

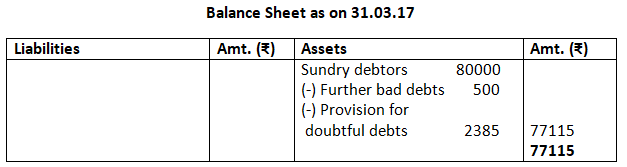

Profit & Loss Account for the year ended 31.03.2017