Death of a Partner (New Profit-sharing Ratio & Gaining Ratio)

Q1. Deepak, Ram & Saurav were partners sharing profits in the ratio of 1/2, 2/5 & 1/10. Find the new profit-sharing ratio of the remaining partners if Saurav dies.

Solution – Old Ratio = 1/2:2/5:1/10

= 1/2×5/5:2/5×2/2:1/10

= 5:4:1

Shanti died so new profit sharing ratio = 5:4

Q2. From the following particulars, calculate new profit-sharing ratio of the partners:

- Shiv, Mohan & Hari was partners in a firm sharing profits in the ratio of 5:5:4. Mohan died and his share was taken equally by Shiv & Hari.

- P, Q & R were partners sharing profits in the ratio of 5:4:1. P died.

Solution –

- Old ratio = 5:5:4

Mohan’s Profit Share – 5/14

Share divided equally shiv & Hari – 1:1

Shiv – 5/14 x 1/2 – 5/28

Hari – 5/14 x 1/2 – 5/28

New Profit Share = Old Profit Share + Share taken from Mohan

Shiv new share – 5/14 + 5/28 = 15/28

Hari new share – 4/14 + 5/28 = 13/28

: New Profit Ratio = 15:13

b. Old ratio – 5:4:1

New ratio – 4:1

Q3. Keshav, Nirmal & Pankaj are partners sharing profits in the ratio of 5:3:2. Pankaj died and his share is taken by Keshav. Calculate new profit-sharing ratio of Keshav and Nirmal.

Solution – Old Ratio – 5:3:2

Pankaj died from the firm – 2/10

New Ratio = Old Ratio + Share acquired from Pankaj

Keshav’s – 5/10 + 2/10 – 7/10

Nirmal’s – 3/10 + 0 – 3/10

New Profit Ratio Keshav & Nirmal – 7:3

Q4. A, B & C were partners sharing profits in the ratio of 4:3:2. A died. B & C will share profits in the ratio of 2:1. Determine the gaining ratio.

Solution – Old ratio – 4:3:2

New Ratio – 2:1

Gaining Ratio = New Ratio – Old Ratio

B gain – 2/3 – 3/9 = 3/9

C gain – 1/3 – 2/9 = 1/9

Gaining Ratio – 3:1

Q5. (a) W, X, Y & Z are partners sharing profits & losses in the ratio of 1/3, 1/6, 1/3 & 1/6 respectively. Y died and W, X & Z decide to share the profits and losses equally in future. Calculate gaining ratio.

(b) A, B & C are partners sharing profits and losses in the ratio of 4:3:2. C died. A takes 4/9 of C’s share and balance is taken by B. calculate the new profit-sharing ratio & gaining ratio.

Solution –

- Old Ratio – 2:1

New Ratio – 1:1:1

Gaining Ratio = New Ratio – Old Ratio

W’s Gain – 1/3 – 2/6 = 0/6

X’s Gain – 1/3 – 1/6 = 1/6

Z’s Gain – 1/3 – 1/6 = 1/6

Gaining Ratio – 0:1:1

b. Old Ratio – 4:3:1

C’s Profit – 2/9

A – 4/9 of C’s Share & Remaining share is by B

A – 2/9 x 4/9 – 8/81

New Profit Share = Old Profit Share + Share acquired from C

A – 4/9 + 8/81 = 44/81

B – 3/9 + 10/81 = 37/81

New Profit Ratio A & B – 44:37

Gaining Ratio = New Ratio – Old Ratio

A’s – 44/81 – 4/9 = 8/81

B’s – 37/81 – 3/9 = 10/81

Gaining Ratio – 4:5

Deceased Partner’s Share of Goodwill:-

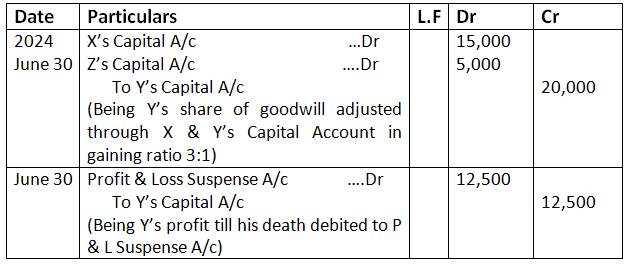

Q6. X, Y & Z were partners in a firm sharing profit in the ratio of 3:2:1. The firm closes its books on 31st March every year. Y died on 30th June, 2024. On Y’s death, goodwill of the firm was values at 60,000. Y’s share in the profit of the firm till the date of his death was to be calculated on the basis of previous year’s profit which was 1, 50,000. Pass necessary Journal entries for goodwill and Y’s share of profit at the time of his death.

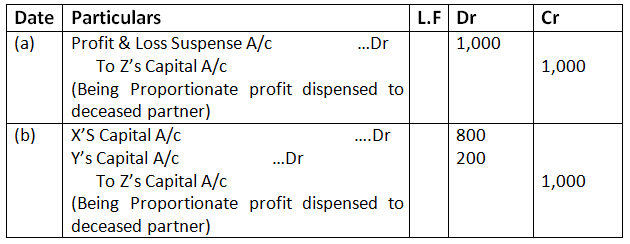

Solution –– Journal Entry

Working Note:-

Calculation of Y’s Share of Goodwill:-

Goodwill of the firm – 60,000

Y’s Share of Goodwill – 60,000 x 2/6 – 20,000

X & Z capital A/c is gaining ratio is 3:1

X – 20,000 x 3/4 – 15,000

Z – 20,000 x 1/4 – 5,000

Calculation of Y’s Share of Profit:-

Previous year profit – 1, 50,000

Y’s share of profit till death = Previous year Profit x Y’s Profit Share x 3 months 1 April 2021 to 30 June, 2021

Y’s share – 1, 50,000 x 2/6 x 3/12 = 12,500

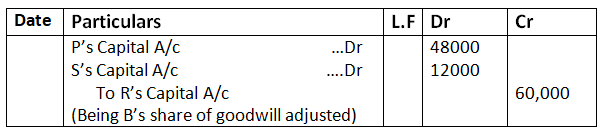

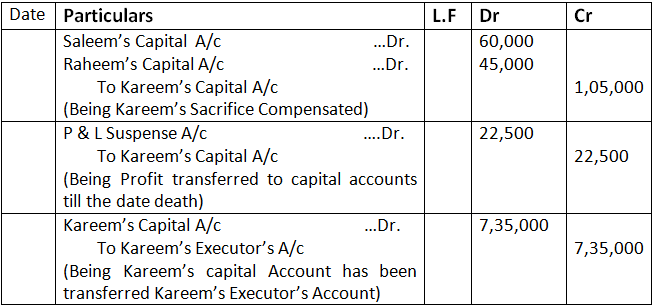

Q7. P, R & S are in partnership sharing profits 4/8, 3/8 & 1/8 respectively. It is provided in the Partnership Deed that on the death of any partner his share of goodwill is to be valued at one-half of the net profit credited to his account during the last four completed years.

R died on 1st April, 2025. The firm’s profits for the last four years ended 31st December were as:

2022 – 1, 20,000: 2023 – 80,000: 2024 – 40,000: 2025 – 80,000

- Determine the amount that should be credited to R in respect of his share of Goodwill.

- Pass Journal entry for adjustment of Goodwill.

Solution –

a. Calculation of R’s Share of Goodwill:-

Profit credited to R’s Capital A/c in 4 year = Net profit for last four year x R’s share

= 1, 20,000 + 80,000 + 80,000 + 4,000 x 3/8 – 1, 20,000

b. Journal Entry

Working Note:-

R’s Share of Goodwill – 60,000

Old Ratio – 4:3:1

R died

Gaining ratio – 4:1

P – 60,000 x 4/5 – 48,000

S – 60,000 x 1/5 – 12,000

Q-8 P, Q and R were partners in a firm sharing profits in the ratio of 3:2:1. P died and the new profit-sharing ratio of Q and R was agreed to be equal. On P’s death, goodwill of the firm was valued at 60,000: Pass the necessary entries for the treatment of goodwill under the following conditions:

a. When Goodwill does not exist in the books of account; and

b. When Goodwill exists in the books of account at 30,000.

Solution –

(a) Q’s Capital A/c Dr. 10,00

R’s Capital A/c Dr. 20,000

To P’s capital A/c 30,000

(b)

(i) P’s capital A/c Dr. 15,000

Q’s capital A/c Dr. 10,000

R’s capital A/c Dr. 5,000

To Goodwill A/c 30,000

(ii) Q’s Capital A/c Dr. 10,000

R’s Capital A/c Dr. 20,000

To P’s Capital A/c 30,000

Calculation of Profit Share of a Deceased Partner:-

Q9. Dinkar, Navita & Vani were partners sharing profits & losses in the ratio of 3:2:1. Navita died on 30th June, 2024. Her share of profit for the intervening period was based on the sales during that period, which were 6, 00,000. The rate of profit during the past four years had been 10% on sales. The firm closes its books on 31st March every year. Calculate Navita’s share of profit.

Solution –

1st April, 2024 to 30th June, 2024 – 6, 00,000

The past four year rate – 10% on sales

Profit of the firm 1st April, 2024 to 30th June, 01 – 6, 00,000 x 1/100 – 60,000

Navita’s profit – 60,000 x2/6 – 20,000

Q10. Juhi, Riya and Pari are partners sharing profits and losses in the ratio of 3:2:1. Riya died on 30th June, 2024. For the year ended 31st March, 2025, proportionate profit of 2024 is to be taken into consideration. During the year ended 31st March, 2025, bad debts of Rs.2000 had to be adjusted. Profit for the year ended 31st March, k2024 was Rs.14,000 before adjustment of bad debts. Calculate Riya’s share of profit till the date of her death.

Solution- Given

Partners: Juhi , Riya, Pari

Profit sharing ratio : 3 : 2 : 1

Riya died on : 30th June 2024

Profit for the year ending 31st March 2025: Rs.14,000

(Before adjustment)

Bad debts of Rs.2,000 to be adjusted

Net profit = Rs.14,000 – Rs.2,000

= Rs.12,000

Proportionate profit till Riya’s death

(i.e. from 1st April to 30th June = 3 months out of 12)

1. Calculate for 3 months

Profit for 3 months = 3/12 x 12,000

= Rs.3,000

2. Divide profit in the ratio 3: 2 : 1

Total parts = 3 + 2 + 1

= 6

Riya’s share = 2/6 x 3,000

= Rs.1,000

Final Answer:

Riyas’ share of profit = 1,000

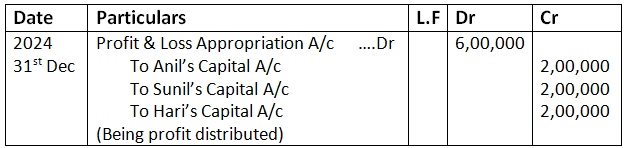

Q11. Anil, Sunil & Hari was partners sharing profits equally. Sunil died on 31st December, 2024. In terms of the partnership deed, accounts were prepared for the period ended 31st December, 2024 and net profit was determined at 6, 00,000. Pass the Journal entry for the profit share of the partners.

Solution – Journal Entry

Working Note:-

Share of each partner is equal – 1:1:1

Partner’s – 6, 00,000 x 1/3 – 2, 00,000

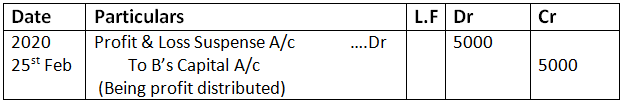

Q12. A, B & C were partners in a firm sharing profits and losses in the ratio of 2:2:1. On 25th February, 2019, B died. B’s share of profit till the date of his death was calculated at 5,000. Pass the necessary Journal entry for the same in the books of the firm.

Solution – Journal Entries

Q13. Ram, Manu & Hari were partners in a firm. Hari died on 30th June, 2024. His share of profit from the closure of the last accounting year till the date of death was to be calculated on the basis of the average of three completed financial years of profits before death. Profits for the years ended 31st March, 2022,2023 & 2024 were 1,10,000: 1,20,000 & 1,30,000 respectively. Calculate Hari’s share of profit till the date of his death and pass necessary Journal entry for the same.

Solution –

Previous three year total profit – 1, 10,000 + 1, 20,000 + 1, 30,000 = 3, 60,000

Previous Three Year Average Profit – 3, 60,000/3 = 1, 20,000

Hari died on 30th June, 2024 after 3 month of start of the year 1st April, 2024 to 30th June, 2024

Hari’s share of profit for 3 month – 1, 20,000 x 3 x 1/12 x 3 – 10,000

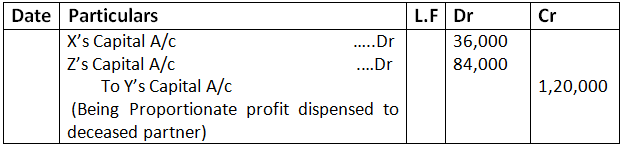

Q14. X, Y & Z were partners sharing profits and losses in the ratio of 3:2:1. Y died on 30th June, 2025. Profit from 1st April, 2025 to 30th June, 2025 was 3, 60,000. X & Z decided to share future profits in the ratio of 3:2 with effect from 1st July, 2025. Pass the necessary Journal entries to record Y’s share of profit up to the date of death.

Solution – Journal Entry

Working Note:-

Calculation of Y’s Share of Profit:-

Y’s share – Firm’s Profit x Y’s Profit Share

Y’s Share – 3, 60,000 x 2/6 – 1, 20,000

Calculation of Gaining Ratio:-

Gaining Ratio = New Ratio – Old Ratio

X’s – 3/5 – 3/6 = 3/30

Z’s – 2/5 – 1/6 = 7/30

Gaining Ratio = 3:7

X’s Share – 1, 20,000 x 3/10 – 36,000

Z’s Share – 1, 20,000 x 7/10 – 84,000

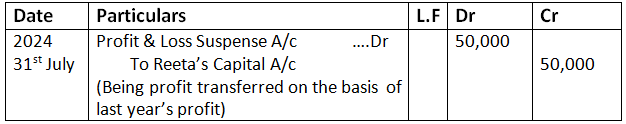

Q15. Radha, Tina and Reeta were partners sharing profits equally. Reeta died on 31st July, 2024. Radha and Tina decided to continue the business. Share of profit of loss of the deceased partner from the beginning of the year up to the date of death was to be determined on the basis of last year profit, which was 4, 50,000. Pass Journal entry to record Reeta’s share of profit/loss up to the date of death.

Solution – Journal Entry

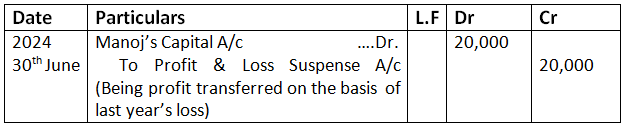

Q16. Manoj, Rakesh and Harsh were partners sharing profits in the ratio of 2:2:1 .Manoj died on 30th June, 2024. Rakesh and Harsh decided to continue the business share of profit or loss of the deceased partner from the beginning of the year up to the date of death was to be determined on the basis of last year’s profit. Last year’s loss was 2, 00,000. Pass necessary Journal entry to record Manoj’s share of profit/loss up to the date of death.

Solution – Journal Entry

Working Note:-

Partners Sharing Profit – 2:2:1

Manoj died on 30th June, 2023 after 3 month of start of the year’s 1st April, 2024 to 31st June, 2024

Last year loss – 2, 00,000

Manoj’s share of loss for 3 month – 2, 00,000 x3 x 2/12 x 5 – 20,000

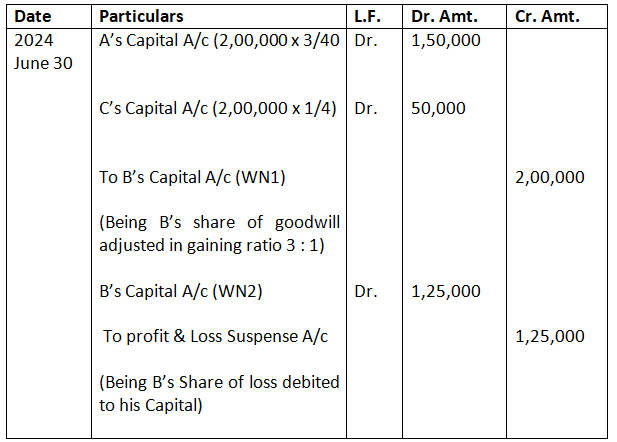

Q17. A, B and C were partners sharing profits in the ratio of 3:2:1. The firm closes its books on 31st March every year. B died on 30th June, 2024. On his death, Goodwill of the firm was valued at 6,00,000. B’s share in profit or loss till the date of death was to be calculated on the basis of previous year’s profit which was 15,00,000 (Loss). Pass necessary Journal entries for goodwill and his share of loss.

Solution-

Working Notes:

- Calculation of B’s Share of Goodwill

Goodwill = 6,00,000

B’s Share of Goodwill = 6,00,000 x 2/6) =2,00,000

2. Calculation of B’s Share of Loss till the date of his death i.e. 30th June, 2024

Previous year’s loss = 15,00,000

B’s shar of loss till the = Previous year’s loss x B’s Share of Loss x Months

Date of death till the date of his death/12

= (15,00,000 x 2/6 x 3/12)

= 1,25,000

Q18. X, Y & Z were partners in a firm. Z died on 31st May, 2025. His share of profit from the closure of the last accounting year till the date of death was to be calculated on the basis of the average of three completed years of profits before death. Profits for the year ended 31st March, 2023, 2024 & 2025 were 18,000: 19,000 & 17,000 respectively.

Calculate Z’s share of profit till his death and pass necessary Journal entry for the same when:

- Profit-sharing ratio of remaining partners does not change

- Profit-sharing ratio of remaining partners changes and new ratio being 3:2

Solution – Journal Entry

Working Note:-

Calculation of Z’s Share of Profit:-

Z’s share = Firm’s Average Profit x Z’s Profit Share x Period for which Z remained in the Business

Average Profit = Total Profits Number of year

= 18,000 + 19,000 + 17,000/3 = 54,000/3 = 18,000

Z’s Share – 18,000 x 13 x 2/12 – 1,000

Calculation of Gaining Ratio:-

Gaining Ratio = New Ratio – Old Ratio

X’s – 3/5 – 1/3 – 4/15

Y’s – 2/5 – 1/3 – 1/15

Gaining Ratio = 4:1

X’s Share – 18,000 x 4/5 – 800

Y’s Share – 18,000 x 1/5 – 200

Q19. A, B & C were partners sharing profits and losses in the ratio of 2:2:1. C died on 30th June, 2025. Profit and Sales for the year ended 31st March, 2025 were 1, 00,000 & 10, 00,000 respectively. Sales during April to June, 2023 were 1, 50,000. You are required to calculate share of profit of C till the date of his death.

Solution – Partners Sharing Profit – 2:2:1

C died on 30th June, 2025 after 3 month of started of the year from 1st April, 2025 to 31st June, 2025

Profit for the year ended 31st March, 2025 – 1, 00,000

Sales for the year ended 31st March, 2025 – 10, 00,000

Percentage of Profit ended 31st Mar, 2025 – 10, 00,000 x 100/1, 00,000 = 10%

Sales during April to June, 2025 – 1, 50,000

Profit from April to June, 2025 – 1, 50,000 x 10/100 – 15,000

C’s share of loss for 3 month – 15,000 x 1/5 = 3,000

Q20. Ajay, Bhawan & Shreya were partners sharing profits in the ratio of 2:2:1. On 1st July, 2024, Shreya died. The books of accounts are closed on 31st March every year. Sales for the year 2023-24 5, 00,000 and that from 1st April to 30th June, 2024 were 1, 40,000. Rate of profit during the past three years had been 10% on sales. Since Shreya’s legal representative was her only son, who is especially abled, it was decided that the profit for the purpose of setting Shreya’s account is to be calculated as 20% on sales.

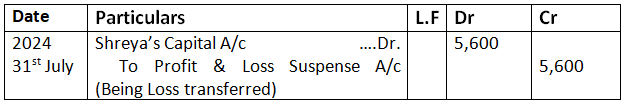

Calculate Shreya’s share of profit till the date of her death and pass necessary Journal entry for the same.

Solution –

Journal Entry

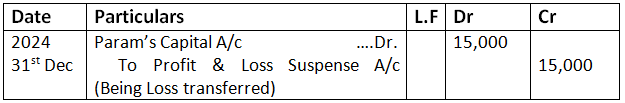

Q21. Raman, Param & Karan were partners sharing profits & losses in the ratio of 3:2:1. Param died on 31st December, 2024. Accounts of the firm are closed on 31st March every year. Sales for the year ended 31st March, 2024 was 12,00,000 and Sales for the nine months ended 31st December, 2024 was 6,00,000. Loss for the year ended 31st March, 2024 was 90,000. Calculated deceased partner’s share of profit/loss from the beginning of the accounting year up to 31st December, 2024.

Solution – Journal Entry

Working Note:-

Sales for the year ended 31st March, 2024 – 12, 00,000

Loss for the year ended 31st March, 2024 – 90,000

Percentage of Loss for the year ended 31st March, 2024 – 90,000 x 100/12, 00,000 – 7.5%

Sales for the nine months ended 31st Dec, 2024 – 6, 00,000

Param’s share of loss for nine month ended 31st Dec, 2024 – 6, 00,000 x 7.5/100 – 15,000

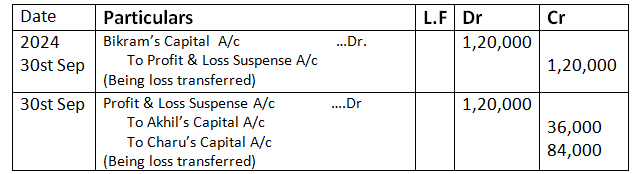

Q22. Akhil, Bikram and charu were partners sharing profits & Losses in the ratio of 3:2:1. Bikram died on 30th September, 2024. Loss from the beginning of the accounting year till the date of death was estimated at 3, 60,000. Akhil and charu decided to share future profits in the ratio of 3:2 i.e. 1st October, 2024.

Pass the necessary Journal entry to record Bhuwan’s share of profit/loss up to the date of death.

Solution – Journal Entry

Loss for the Beginning of the accounting year till the date of death – 3, 60,000

Bikram’s share of loss – 3, 60,000 x 2/6 – 1, 20,000

Old share of Akhil & Charu – 3/6:1/6

Akhil & Charu New share future profit in the ratio – 3:2

Akhil – 3/6 – 3/5 = -3/30

Charu – 1/6 – 2/5 = -7/30

Gaining Ratio of Akhil & Charu is 3:7

Akhil – 1, 20,000 x 3/10 – 36,000

Charu – 1, 20,000 x 7/10 – 84,000

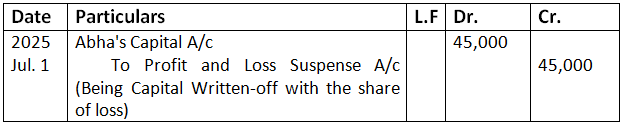

Q.23 Abha, Beena and Chanda were partners in a firm sharing profits and losses in the ratio of 5:3:2. Abha died on 1st July, 2025. The Partnership Deed provided that Abha’s executors are entitled to her share of profit till the date of death calculated on the basis of sales for the immediate previous year. Sales for the year ended 31st March, 2025 was 12,00,000 and the profit for the same year was 3,00,000. Sales shows a growth trend of 20% and percentage of profit earning remains the same.

Journalise the transaction along with working notes.

Ans.-

Working note:

Profit 3,00,000 Grows as Sales shows a growth trend of 20% =

Profit for the current year = 3,00,000×120/100=3,60,000

Abha’s share of profit for 3 Month = 3,60,000×3/12×5/10=45,000

Deceased Partner’s Share of Goodwill and Profit:-

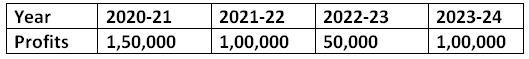

Q24. X, Y & Z were partners in firm sharing profits in the ratio of 4:3:1. The firm closes its books on 31st March every year. On 1st February, 2025, Y died and it was decided that the new profit-sharing ratio between X & Z will be equal. Partnership Deed provided for the following on the death of a partner:

a. His share of goodwill is calculated on the basis of half of the profit credited to his account during the previous four completed years. The firm’s profits for the last four years were:

b. His share of profit in the year of his death was to be computed on the basis of average profit of past two years.

Pass necessary Journal entries relating to goodwill & profit to be transferred to Y’s Capital Account.

Solution – Journal Entry

Working Note:-

Calculation of Gaining Ratio:-

Old ratio – 4:3:1

New ratio – 1:1

Gaining Ratio = New Ratio – Old Ratio

X’s – 1/2 – 4/8 = 0

Z’s – 1/2 – 1/8 = 3/8

X: Z – 0:3

Calculation of Retiring Partners Share of Goodwill:-

Y’s share of goodwill – 4, 00,000 x 3/8 x 1/2 – 75,000

Calculation of Retiring Partner Share of Profit:-

Y’s share of profit – 75,000 x 3/8 – 23,438

Average profit for last two years – 75,000

Determination of Amount Payable to Executors of A Deceased Partner:-

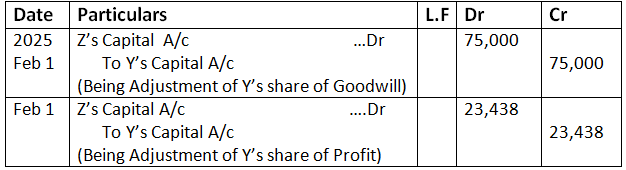

Q25. Karim, Saleem & Raheem were partners in a firm sharing profits & losses in the ratio of 3:4:3. The firm closes its books on 31st march every year. On 1st October, 2019, Karim died. On Karim’s death, the goodwill of the firm was valued at 3, 50,000. Karim’s share in the profits of the firm in the year of his death was to be calculated on the basis of average profits of last four years. The profits for the last four years were 2015-16 – 1, 70,000: 2016 – 17 – 1, 30,000: 2017-18- 1, 90,000 & 2018-19 – 1, 10,000. The total amount payable to Karim’s executors on his death was 7, 35,000. It was paid on 15th October, 2019. Pass necessary Journal entries for the above transactions on the books of the firm.

Solution – Journal Entry

Working Note:-

Calculation of goodwill:-

Goodwill – 3, 50,000

Karim’s share of Goodwill – 3, 50,000 x 3/10 – 1, 05,000

Goodwill share of Karim distributed in Saleem & Raheem in 4:3

Saleem – 1, 05,000 x 4/7 – 60,000

Raheem – 1, 05,000 x 3/7 – 45,000

Karim’s share of Profit till the date of death:-

The average profits – 1,70,000 + 1,30,000 + 1,90,000 + 1,10,000/4 – 1,50,000

Karim’s share of profit – 1, 50,000 x 3 x 6/10 x 12 – 22,500

Q26. Iqbal & Kamal are in partnership sharing profits & Losses in 3:2. Kamal died three months after the date of the last Balance Sheet. According to the Partnership Deed, his legal heir is entitled to the following:

- His capital as per the last Balance Sheet.

- Interest on above capital @ 3% p.a. till the date of death.

- His share of profit till the date of death calculated on the basis of last year’s profits.

His drawings are to bear interest at an average rate of 2% on the amount irrespective of the period.

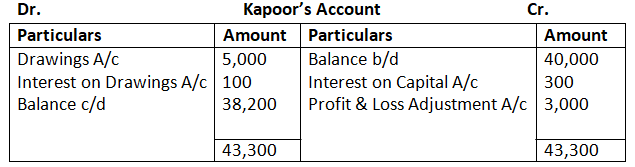

The net profits for the last three years after charging insurance premium were 20,000: 25,000 & 30,000 respectively. Kamal’s capital as per Balance sheet was 40,000 and his drawing till the date of death were 5,000 .Draw Kamal’s Capital Account to be rendered to his representatives.

Solution –

Working Note:-

Calculation of Interest on Capital of Kapoor till date of his death:-

Interest = Capital x Rate 100 x Time/12

= 40,000 x 3/100 x 3/12 – 300

Calculation of Share of Profit of Kapoor till date of his death:-

Profit = Last year profit x time/12 x share of profit

= 30,000 x 3/12 x 3/5 – 3,000

Calculation of Interest on Drawings:-

Interest – Drawing x 2%

= 5,000 x 2% – 100

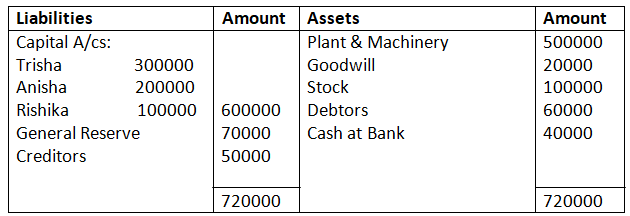

Q.27 Trisha, Anisha and Rishika were partners in a firm sharing profits and losses in the ratio of 2:2:1. Their Balance Sheet as at 31st March, 2025 was as follows:

BALANCE SHEET OF TRISHA AND RISHIKA

as at 31st March, 2025

Trisha died on 31st July, 2025 According to the partnership deed, the executors of the deceased partner were entitled to:

) Balance in Partner’s Capital Account.

(b) Salary @ 15,000 per quarter.

(c) Share of goodwill calculated on the basis of twice the average of past three year’s profits.

(d) Share of profits from the closure of the last accounting year till the date of death on the basis of last year’s profit. Profit for 2022-23, 2023-24 and 2024-25 were 1,00,000, 2,00,000 and 1,50,000 respectively.

(e) Trisha withdrew 20,000 on 1st May, 2025 for her personal use.

Showing your working clearly, prepare Trisha’s Capital Account to be rendered to her executors.

Dr. Trish’s Capital A/c Cr.

Calculation of Goodwill of the firm

Average profit of past 3years =1,00,000+2,00,000+1,50,000/3

= 4,50,000/3

= 1,50,000

Goodwill of the Firm = Average profit of last *2

3years

= 1,50,000*2

= 3,00,000

Calculation of partner’s share in goodwill

Trisha’s share in Goodwill = 3,00,000*2/5

= 1,20,000

Anisha’s Rishika will contribute in it their profit sharing ratio of 2:1

Anish will contribut = 1,20,000*1/3

= 40,000

JOURNAL

Rishika’s capital A/c Dr. 40,000

Anisha’s capital A/c Dr. 80,000

To Trisha’s capital A/c 1,20,000

Calculation of Trisha’s share in profit up to 31st July

Profit for the year = last year profit = 1,50,000

Trisha’s share in profit = 1,50,000*2/5*4/12

= 20,000

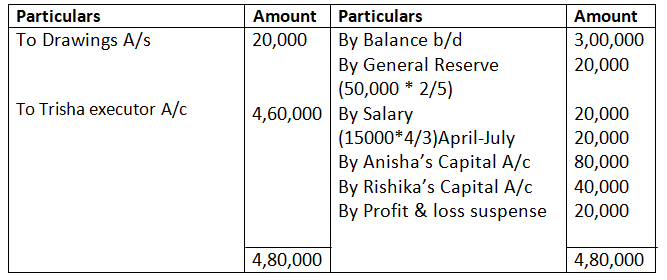

Q28. X & Y are partners. The Partnership Deed provided inter alia:

- That the accounts be balanced on 31st March every year.

- That the profits be divided as: X one-half, Y one-third and carried to a Reserve one-sixth.

- That in the event of the death of a partner, his Executors be entitled to be paid:

- The Capital to his credit till the date of death.

- His proportion of profits till the date of death based on the average profits of the last three completed years.

- By way of Goodwill, his proportion of the total profits for the three preceding years.

d. Balance Sheet as at 31st March, 2024

Profits for three years ended 31st March, were: 2022 – 4,200: 2023 – 3,900: 2024 – 4,500. Y died on 1st August, 2024. Prepare necessary accounts.

Solution –

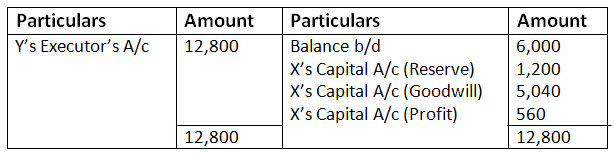

Dr Y’s Capital Account Cr

Working Note:-

Old ratio – 3:2

Y’s share of reserve – 3,000 x 2/5 – 1,200

Calculation Y’s Share of Profit:-

Average profit – total profit of past given years/number of years

Average profit – 4,200 + 3,900 + 4,500/3 – 4,500

Y’s share of profit 1 April, 2024 to 1 August, 2024 – 4,200 x 2/5 x 4/12 – 560

Calculation of Y’s share of Goodwill:-

Y’s share of Goodwill – Y’s Profit Share in last three year

Profit for last three years – 4,200 + 3,900 + 4,500 – 12,600

Y’s share of Goodwill – 12,600 x 2/5 – 5,040

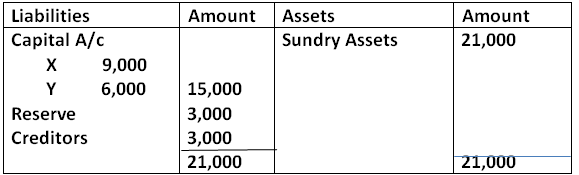

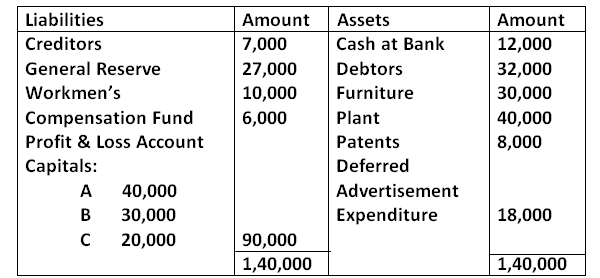

Q29. A, B & C were partners in a firm. A died on 31st March, 2025 and the Balance Sheet of the firm on that date was as under:

Balance Sheet of A, B & C as at 31st March, 2025

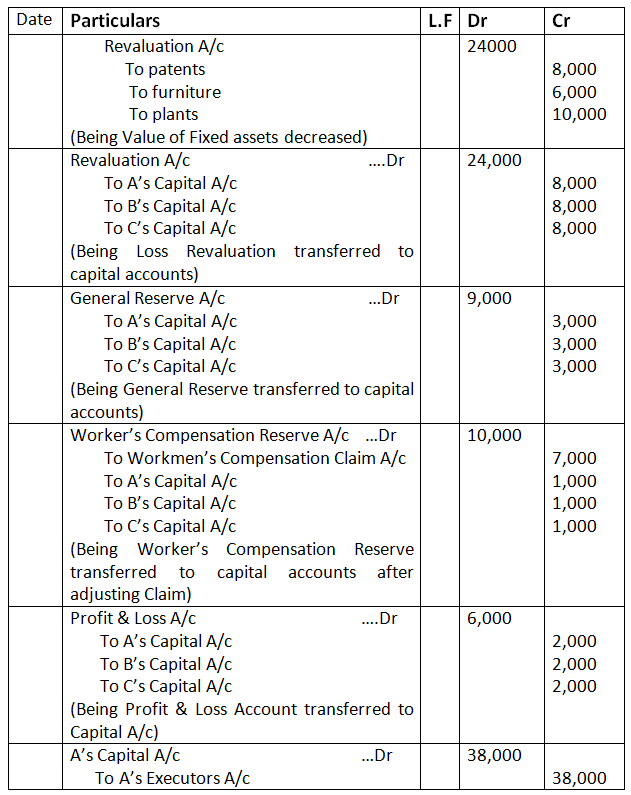

On A’s death it was found that patents were valueless, furniture was to be brought down to 24,000. Plant was to be reduced by 10,000 and there was a liability of 7,000 on account of workmen’s compensation. Pass the necessary Journal entries for the above at the time of A’s death.

Solution – Journal Entry

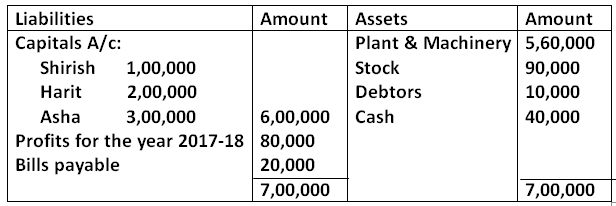

Q30. Shirish, Harit & Asha were partners in a firm sharing profits in the ratio of 5:4:1. Shirish died on 30th June, 2018. On this date, their Balance Sheet was follows:

Balance Sheet of Shirish, Harit & Asha as at 31st March, 2018

According to the Partnership Deed, in addition to deceased partner’s capital, his executor is entitled to:

- Share in profits in the year of death on the basis of average of last two years profit. Profit for the year 2016-17 was 60,000.

- Goodwill of the firm was to be valued at 2 years purchase of average of last two years profits.

Prepare Shirish’s capital Account to be presented to his executor.

Solution –

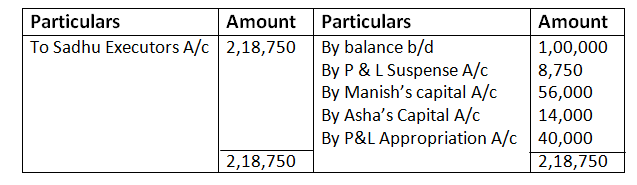

Dr. Shirish’s Capital A/c Cr.

Working Note:-

Calculation of Sadhu’s Share of profit:-

Average Profit of last two years – 80,000 + 60,000/2 – 70,000

Shirish’s Share of Profit – 70,000 x 5 x 3/10 x 12 – 8,750

Calculation of Goodwill:-

The average profits of the two years – 70,000

Goodwill – 70,000 x 2 – 1, 40,000

Share of Shirish – 1, 40,000 x 5/10 – 70,000

Goodwill share of Shirish is in Goodwill will be compensated by Harish & Asha – 4:1

Harish – 70,000 x 4/5 – 56,000

Asha – 70,000 x 1/5 – 14,000

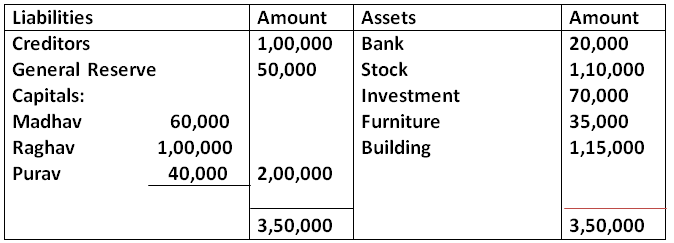

Q31. Madhav, Raghav and Purva were partners in a firm sharing profit and losses in the ratio of 3:1:1. Their Balance sheet as at 31st March, 2023 was as follows:

Balance Sheet Of Madhav, Raghav and Purva

As at 31st March, 2023

Purav died on 30th September, 2023. According to Partnership deed, his legal representatives are entitled to the following:

- Balance in his Capital Account.

- Share of profit up to the date to be calculated on the basis of last year’s profit.

- Share of goodwill calculate on the basis of three years purchases of average profits of last four years.

- Interest on capital @ 12% p.a.

Purav’s share of profit was Rs.3,000 and the average profit of last four year was Rs.50,000. Purav’s drawings up to the date of death were Rs.10,000.

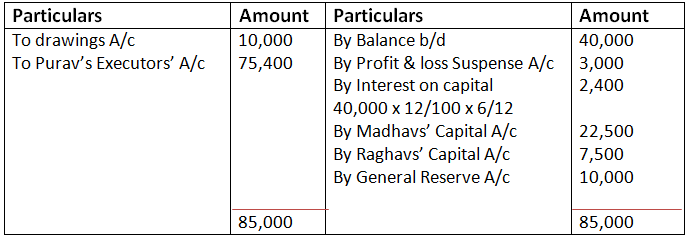

Prepare Purvas’ Capital Account to be rendered to his legal representatives.

Solution-

Dr. Purav’s Capital Account Cr.

Firms’ Goodwill = 50,000 x 3

= Rs.1,50,000

Purav’s share in goodwill = 150,000 x 1/5 = Rs.30,000

To be compensated by Madhav and Raghav in 3:1.

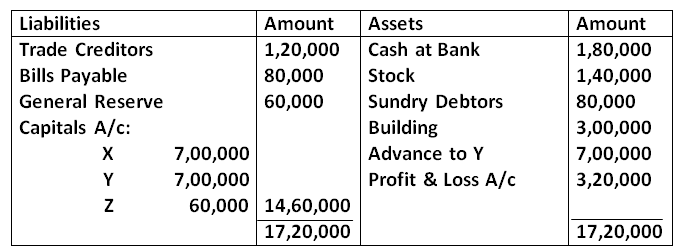

Q32. X, Y & Z were partners in firm sharing profits in the ratio of 2:2:1. On 31st March, 2025, their Balance Sheet was as follows:

Y died on 30th June, 2025, Partnership Deed provided for the following on the death of a partner:

- Goodwill of the business was to be calculated on the basis of 2 times the average profit of the past 5 years. Profits for the years ended 31st March, 2025, 31st March, 2024, 31st March, 2023, 31st March, 2022 & 31st March, 2021 were 3,20,000 (Loss) 1,00,000; 1,60,000; 2,20,000 & 4,40,000 respectively

- Y’s share of profit or loss from 1st April, 2025 till his death was to be calculated on the basis of the profit or loss for the year ended 31st March, 2025.

You are required to calculate the following:

- Goodwill of the firm & Y’s share of goodwill at the time of his death.

- Y’s share in the profit or loss of the firm till the date of his death.

- Prepare Y’s Capital Account at the time of his death to be presented to his executors.

Solution –

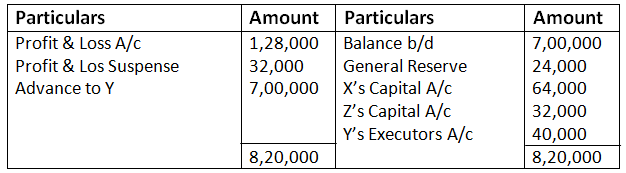

Dr Y’s Capital Account Cr

Working Note:-

Calculation of Share in General Reserve:-

General Reserve – 60,000 x 2/5 – 24,000

Calculation of Share in Goodwill:-

Goodwill = Average Profit x No. of years Purchase

= 1, 20,000 x 2 – 2, 40,000

Y’s share in Goodwill – 2, 40,000 x 2/5 – 96,000

Average Profit = Total Profits of Past years given/Number of year = 1,00,000 + 1,60,000 + 2,20,000 + 4,40,000 – 3,20 000/5 – 1,20,000

Calculation of Profit & Loss Suspense:-

Profit & Loss Suspense (Loss) – 3, 20,000 x 2 x 3/5 x 12 – 32,000

Q-33 Arun, Bhim & Nakul are partners in firm sharing profits in the ratio of 1:1:3. Their capital accounts showed the following balances on 1st April, 2022:

Arun – 2, 00,000; Bhim – 1, 50,000 & Nakul – 4, 50,000

Firm closes its accounts every year on 31st March. Bhim died on 31st March, 2023. In event of death of any partner, the Partnership Deed provides for the following:

- Interest on capital will be allowed to deceased partner only from the first of day of the accounting year till the date of his death @ 10% p.a.

- The deceased partner’s share in the Goodwill of the firm will be calculated on the basis of 2 years purchase of the average profit of the last three years. The profits of the firm for the last three years ended 31st March were: 2021 – 90,000; 2022 – 2, 00,000 & 2023 – 1, 60,000.

- His share of profits till the date of death: the profit of the firm for the year ended 31st March, 2023 was 1, 60,000 before providing for interest on capital. Bhim’s Executor was paid the sum due in two equal annual installments with interest @ 10% p.a.

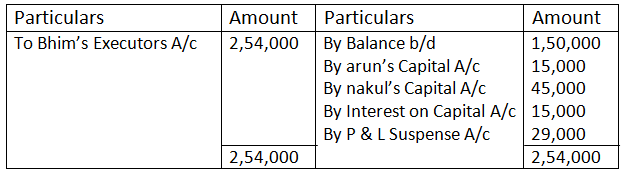

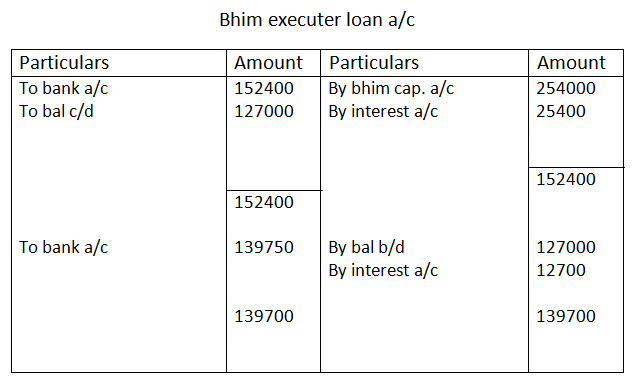

Prepare Bhim’s Capital Account as on 31st March, 2023 to be presented to his executor and his Executors Loan Account for the year ending 31st March, 2024 and 31st March, 2025.

Solution –

Dr Bhim’s Capital Account Cr

Working Note:-

Calculation of goodwill:-

Average Profit – 90,000 + 2, 00,000 + 1, 60,000/3 – 1, 50,000

Firm’s Goodwill – 1, 50,000 x 2 – 3, 00,000

Bhim’s Share of Goodwill – 3, 00,000 x 1/5 – 60,000

Average Profit distributed in Arun & Nakul – 1:3

Arun – 1, 05,000 x 1/4 – 15,000

Nakul – 1, 05,000 x 3/4 – 45,000

Bhim’s share of Profit till the date of death:-

Interest on capital – 1, 50,000 x 10/100 – 15,000

Profit after Interest on Capital – 1, 60,000 – 15,000 – 1, 45,000 Bhim’s share of profit – 1, 45,000 x 1/5 – 29,000

Adjustment of capital:

ADJUSTMENT OF CAPITAL

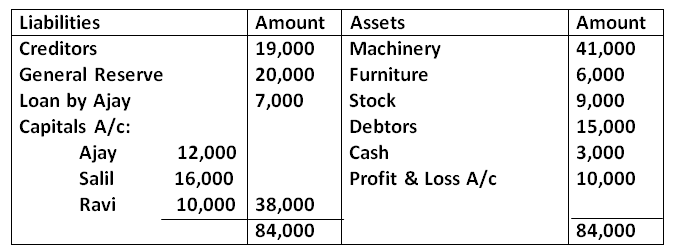

Q34. Ajay, Salil & Ravi partners in a firm sharing profits in the ratio of 5:3:2. Ajay died on 20th February, 2025. The balance sheet of the firm on that date was as follows:

According to the Partnership Deed, on the death on the death of a partner, the executor of the deceased partner will be entitled to:

- Balance in Capital Account.

- His share in profit/loss on revaluation of assets and reassessment of liabilities which were as follows:

- Machinery is to be revalued at 45,000 and furniture at 7,000.

- A provision of 10% was to be created for Doubtful Debts.

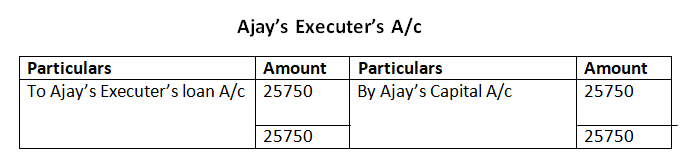

- The amount payable to Ajay was transferred to his Executor’s Loan Account which was to be paid later.

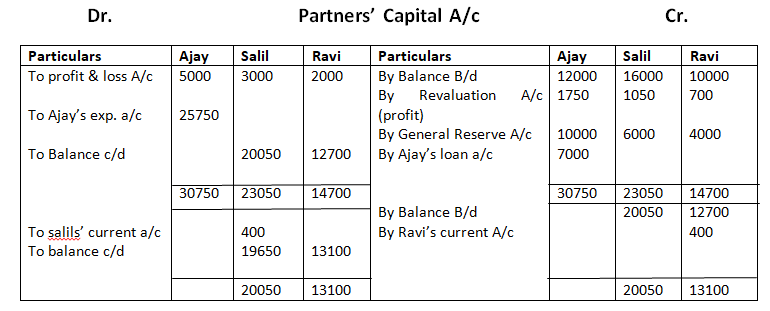

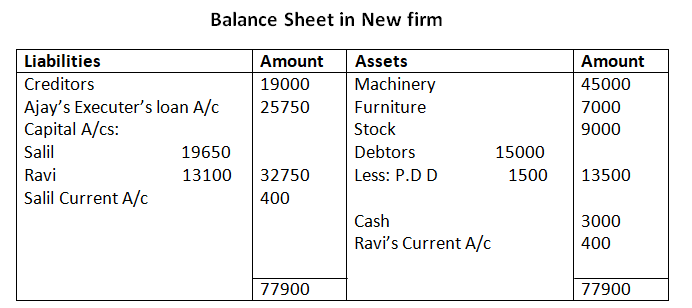

Prepare Revaluation Account, Partner’s Capital Accounts, Ajay’s Executors Account and the Balance Sheet of Salil & Ravi who decided to continue the business keeping their capital balances in their new profit sharing ratio. Any surplus or deficit was to be transferred to Current Accounts of the partners.

Solution –

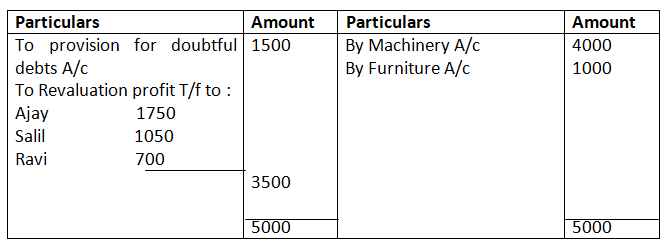

Dr. Revaluation A/c Cr.

Calculation of partner’s Capital in New firm

Total capital of the new firm = Salil’s Capital + Ravi Capital

= 20050 + 12700

= 32750

Salil & Ravi would maintain their capital in new profit sharing ratio i.e. 3:2

Salil’s Capital in New Firm = 32750 x 3/5 = 19650

Ravi’s Capital in New Firm = 32750 x 2/5 = 13100

SECTION 37 OF THE INDIAN PARTNERSHIP ACT

Q.35 Ramesh, Suresh and Dinesh were partners sharing profits and losses in the ratio of 3:2:1. Dinesh died on 1st May, 2024 on which date the capitals of Ramesh, Suresh and Dinesh after all necessary adjustments stood at 1,20,000, 80,000 and 50,000 respectively. Ramesh and Suresh decide to carry on the business for 8 months without setting the account of Dinesh. During the period of 8 months ended 31st December, 2024, profit of 40,000 is earned by the firm.

State which of the two options available with Dinesh’s Executor under Section 37 of the Indian Partnership Act, 1932 should be exercised.

Also calculate the total amount payable to Dinesh’s Executor if Ramesh and Suresh clear the dues of Dinesh on 31st December, 2024 .

Ans.: Dinesh’s Executor has the following options:

(1) Interest @ 6% p.a. on balance amount= 50,000*6/100*8/12= 2,000;

(2) Share in profit earned proportionate to his amount outstanding to total capital

50,000/2,50,000*40,000 = 8,000

2,50,000 = 1,20,000 + 80,000 + 50,000

Dinesh’s Executor should exercise option (2),

Total amount payable to Dinesh’s Executor = 50,000+8,000=58,000.