Retirement of a Partner (New Profit-sharing Ratio & Gaining ratio)

Q1. Tushar, Radha and Garv were partners sharing profits in the ratio of 1/2, 2/5 and 1/10. Find the new ratio of the remaining partners if Garv retires.

Solution – Old Ratio = 1/2:2/5:1/10 – 5:4:1

As we can see, there is no information given that how Tushar & Radha are

Acquiring Garv’s profit share after his retirement

So, the new profit sharing ratio of Tushar and Radha is – 5:4

Q2. From the following particulars, calculate new profit-sharing ratio of the partners:

- Paras, Mohan and Hari were partners in a firm sharing profits in the ratio of 5:5:4. Mohan retired and his share was divided equally between Shiv and Hari.

- P, Q and R were partners sharing profits in the ratio of 5:4:1. P retires from the firm.

Solution –

- Old Ratio – 5:5:4

Mohan’s Profit Share – 5/14

Mohan share divided between Paras & Hari equally – 1:1

Mohan taken by Paras – 5/14 x 1/2 = 5/28 Mohan taken by Hari – 5/14 x 1/2 = 5/28

New Profit Share = Old Profit Share + Share taken From Mohan

Paras’s new share – 5/14 + 5/28 = 15/28 Hari’s new Share = 4/14 + 5/28 = 13/28 New Profit Ratio – 15:13

b. Old Ratio = 5:4:1

P’s Profit Share = 5/10

As we can see, there is no information given that how Q & R are acquiring P’s profit share after his retirement.

So, the new profit sharing ratio of Q and R is – 4:1

Q3. R, S and M are partners sharing profits in the ratio of 2/5, 2/5 & 1/5. M decides to retire from the business and his share is taken by R and S in the ratio of 1:2. Calculate the new profit-sharing ratio.

Solution – Old Ratio – 2:2:1

M retires from the firm his profit share – 1/5

M’s Share taken by R & S in ratio – 1:2 R – 1/5 x 1/3 – 1/15

S – 1/5 x 2/3 – 2/15

New Ratio = Old Ratio + Share Acquired from M R – 2/5 + 1/15 = 7/15

S – 2/5 + 2/15 = 8/15

New ratio – 7:8

Q4. X, Y and Z are partners sharing profits in the ratio of 1/2, 3/10 and 1/5. Calculate the gaining ratio of remaining partners when Y retires from the firm.

Solution – Calculation of Gaining Ratio:- Old Ratio – 1/2:3/10:1/5 – 5:3:2

New ratio – 5:2

Gaining Share = New Share – Old Share

X’s = 5/7 – 5/10 = 15/70

Z’s = 2/7 – 2/10 = 6/70

Gaining ratio between x and y 15:6=5:2

Q5. Sarthak, Vansh and Mansi were partners sharing profits in the ratio of 4:3:2. Sarthak retires. Vansh and Mansi will share future profits in the ratio of 2:1. Determine the gaining ratio.

Solution – Old ratio – 4:3:2

New Ratio – 2:1

Gaining Ratio = New Ratio – Old Ratio

Vansh’s = 2/3 – 3/9 = 3/9 Mansi’s = 1/3 – 2/9 = 1/9 Gaining Profit – 3:1

Q6. (a) W, X, Y & Z are partners sharing profits and losses in the ratio of 1/3, 1/6, 1/3 & 1/6 respectively. Y retires and W, X & Z decide to share the profits and losses equally in future. Calculate gaining ratio.

(b) A, B & C are partners sharing profits and losses in the ratio of 4:3:2. C retire from the business A takes 4/9 of C’s share and balance is taken by B. calculate the new profit-sharing ratio and gaining ratio.

Solution –

- Old Ratio = 2:1:2:1 New Ratio = 1:1:1

Gaining Ratio = New Ratio – Old Ratio

W’s = 1/3 – 2/6 = 0/6 X’s = 1/3 – 1/6 = 1/6 Z’s = 1/3 – 1/6 = 1/6

Gaining Ratio – 0:1:1

b. Old Ratio = 4:3:2

C profit share – 2/9

A – 4/9 of C’s Share & remaining share is by B

A – 2/9 x 4/9 = 8/81

B – C’s Share – Share by A

= 2/9 – 8/81 = 10/81

New Profit Share = Old Profit Share + Share acquired from C

A’s new share – 4/9 + 8/81 = 44/81 B’s New Share – 3/9 + 10/81 = 37/81 New profit Ratio A & B – 44:37

Gaining Ratio = New Ratio – Old Ratio

A’s = 44/81 – 4/9 = 8/81

B’s = 37/81 – 3/9 = 10/81

Gaining Ratio – 8:10 or 4:5

Q7. Kumar, Lakshya, Manoj and Naresh are partners sharing profits in the ratio of 3:2:1:4. Kumar retires and his share is taken by Lakshya and Manoj in the ratio of 3:2. Calculate new profit-sharing ratio and gaining ratio of the remaining partners.

Solution – Kumar’s Share – 3/10 Lakshya & Manoj – 3:2

Lakshya – 3/10 x 3/5 = 9/50 Manoj – 3/10 x 2/5 = 6/50

New share of Lakshya’s – 2/10 + 9/50 = 19/50 new share of Manoj’s – 1/10 + 6/50 = 11/50 Naresh’s share – 4/10 or 20/50

New Profit Sharing Ratio – 19:11:20 Gaining Ratio – 3:2

Q8. A, B & C were partners in a firm sharing profits in the ratio of 8:4:3. B retires and his share is taken up equally by A & C. find the new profit-sharing ratio.

Solution – Old Ratio – 8:4:3

B retires form the firm & profit share – 4/15

B’s share taken by A & C in ratio – 1:1 A – 4/15 x 1/2 = 2/15

C – 4/15 x 1/2 = 2/15

New Ratio = Old Ratio – Share acquired from B

A’s new share – 8/15 + 2/15 – 10/15 = 2/3 C’s New share – 3/15 + 2/15 – 5/15 = 1/3 New profit ratio – 2:1

Q9. A, B & C are partners sharing profits in the ratio of 5:3:2. C retires and his share is taken by A. Calculate new profit-sharing ratio of A & B.

Solution – Old Ratio – 5:3:2

C retire from the firm his profit share – 2/10

C’s share is taken by A

New Ratio = Old Ratio + Share Acquired from C

A’s new share – 5/10 + 2/10 = 7/10 B’s New Share – 3/10 + 0 = 3/10 New Profit Ratio – 7:3

Q10. Murli, Naveen and Omprakash are partners sharing profits in the ratio of 3/8, 1/2 & 1/8. Murli retires & surrenders 2/3rd of his share in favour of Naveen and remaining share in favour of omprakash. Calculate new profit-sharing ratio and gaining ratio of the remaining partners.

Solution – Old Ratio – 3:4:1

Murli’s share – 3/8

Naveen share acquired – 3/8 x 2/3 = 2/8 Omprakash share acquired – 3/8 – 2/8 = 1/8 Gaining ratio – 28:18 – 2:1

Naveen’s new share – 4/8 + 2/8 = 6/8 Omprakash’s New share – 1/8 + 1/8 = 2/8 new profit sharing ratio – 3:1

Q11. P, Q & R are partners sharing profits in the ratio of 7:5:3. P retires and it is decided that profit-sharing ratio between Q & R will be same as existing between P & Q. calculate New Profit-sharing ratio & Gaining Ratio.

Solution – Calculation of Gaining Ratio Old Ratio – 7:5:3 (P, Q, R)

New Ratio – 7:5 (Q, R)

Gaining Ratio = New Ratio – Old Ratio

Q’s – 7/12 – 5/15 = 15/60

R’s – 5/12 – 3/15 = 13/60

Gaining Ratio – 15:13

TREATMENT OF GOODWILL:-

Q12. Sunil, Shahid and David are partners sharing profits & Losses in the ratio of 4:3:2. Shahid retires and the goodwill is valued at 72,000. Calculate Shahid’s share of goodwill and pass the Journal entry for Goodwill. Sunil and David decided to share future profits and losses in the ratio of 5:3.

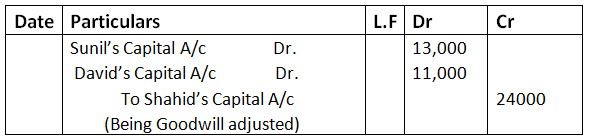

Solution – Journal

Working Note:-

Calculation of gaining & sacrificing ratio

Old ratio – 4:3:2

New ratio – 5:3

Sunil – 4/9 – 5/8 = 13/72 David – 2/9 – 3/8 = -11/72 Gaining ratio – 13:11

Firm Goodwill – 72,000

Share of retiring partner Shahid – 3/9 Shahid share – 72,000 x 3/9 – 24,000

Sunil & David will compensate 24,000 in their gaining ratio 13:11

Sunil – 24,000 x 13/24 – 13,000

David – 24,000 x 11/24 = 11,000

Q13. P, Q, R & S were partners in a firm sharing profits in the ratio of 5:3:1:1. On 1st January, 2025, S retired from the firm. On S’s retirement, goodwill of the firm was valued at 4, 20,000. New profit-sharing ratio among P, Q & R will be 4:3:3.

Showing your working notes clearly, pass necessary Journal entry for the treatment of goodwill in the books of the firm on S’s retirement

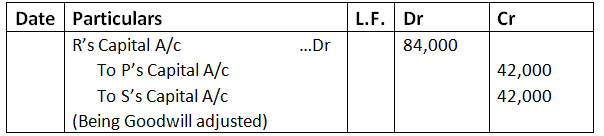

Solution – Journal

Working Note:-

Gaining Ratio = New Ratio – Old Ratio P = 4/10 – 5/10 = -1/10 (sacrifice)

Q = 3/10 – 3/10 = 0

R = 3/10 – 1/10 = 2/10

P’s share – 4, 20,000 x 1/10 = 42,000

R’s share – 4, 20,000 x 2/10 – 84,000

S’s Share – 4, 20,000 x 1/10 – 42,000

Q14. Aparna, Manisha & Sonia are partners sharing profits in the ratio of 3:2:1. Manisha retired and goodwill of the firm is valued at 1, 80,000. Aparna and Sonia decided to share future profits in the ratio of 3:2. Pass necessary Journal entries.

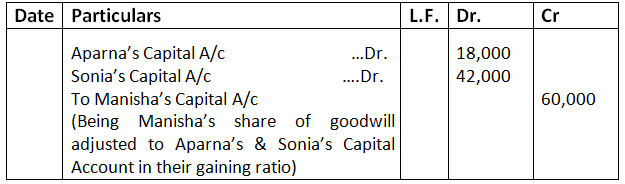

Solution – Journal

Working Note:-

Calculation of Manisha’s Share in Goodwill

Manisha’s share = Firm Goodwill x Manisha’s Profit Share Manisha’s Share

= 1, 80,000 x 13 – 60,000

Calculation of Gaining Ratio:-

Gaining ratio = New Ratio – Old Ratio

Aparna’s = 3/5 – 3/6 = 3/30

Sonia’s = 2/5 – 1/6 = 7/30

Gaining ratio – 3:7

Aparna’s share – 60,000 x 3/10 – 18,000

Sonia’s Share – 60,000 x 7/10 – 42,000

Q15. A, B & C are partners sharing profits in the ratio of 3:2:1. B retired and the new profit-sharing ratio between A & C was 2:1. On B’s retirement, the goodwill of the firm was valued at 90,000. Pass necessary Journal entry for the treatment of goodwill on B’s retirement.

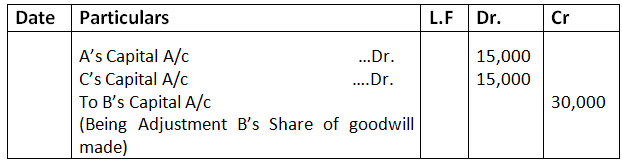

Solution – Journal

Calculation of Gaining Ratio:-

Old Ratio – 3:2:1

B retires from the firm. New Ratio – 2:1

Gaining Ratio = New Ratio – Old Ratio

A’s share – 2/3 – 3/6 = 1/6

B’s share – 1/3 – 1/6 = 1/6

Gaining ratio – 1:1

Adjustment of Goodwill:-

Goodwill of the firm = 90,000

B’s share = 90,000 x 2/3 – 30,000

A’s & C’s Capital will be debited – 30,000 x 1/2 – 15,000

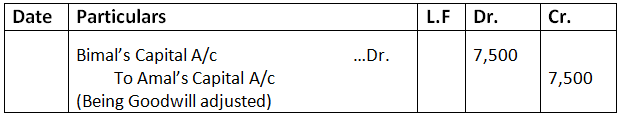

Q16. Aman, Bimal and Deepak are partners sharing profits in the ratio of 2:3:5. The goodwill of the firm has been valued at 37,500. Aman retired. Bimal and Deepak decided to share profits equally in future. Calculate gain/sacrifice of Bimal and Deepak on Aman’s retirement and also pass necessary Journal entry for the treatment of goodwill.

Solution – Journal

Working Note:-

Calculation of gaining & sacrificing ratio:-

Old ratio – 2:3:5

New ratio – 1:1

Bimal – 3/10 – 1/2 = -2/10

Deepak – 5/10 – 1/2 = 0/10

Gaining ratio of Sunil & David – 13:11

Firm goodwill – 37,500

Share of retiring partner Amal – 2/10

Amal share – 37,500 x 2/10 – 7,500

Bimal will compensate – 7,500

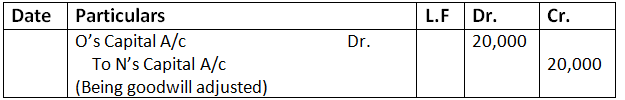

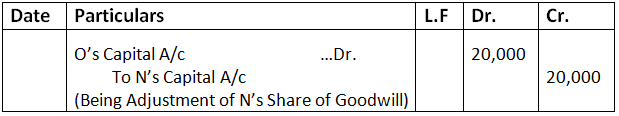

Q17. M, N and O who are partners in a firm sharing profits in the ratio of 3:2:1. Goodwill has been valued at Rs.60,000. On N’s retirement, M and O agree to share profits equally.

Pass necessary journal entry for treatment of N’s share of goodwill.

Solution:-

Journal

Calculation of Gain/Sacrifice share

Old Profit sharing ratio of M, N & O = 3:2:1

N Retired

New profit sharing Ratio of M & S = 1:1

M’s gain = 1/2 – 3/6 = 3 – 3 /6 = 0/6

O’s gain = 1/2 – 1/6 = 3 – 1/6 = 2/6

Calculation of Partner’s share in Goodwill

Goodwill of the firm = Rs.60,000

N’s Share in Goodwill = 60,000 x 2/6 = Rs.20,000 (Cr.)

O’s share in Goodwill = 60,000 x 2/6 = Rs.20,000 (Dr.)

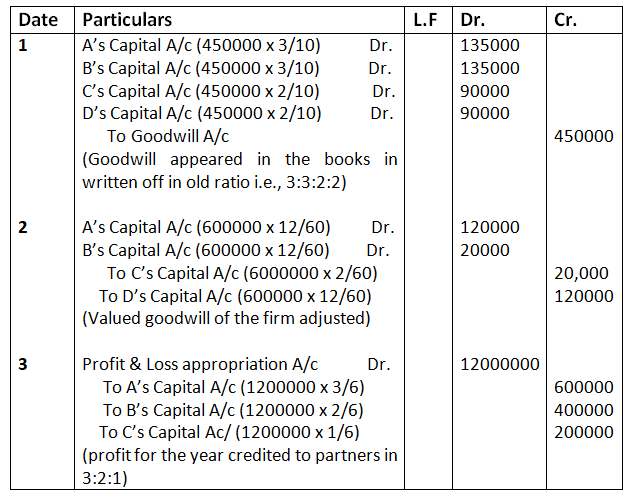

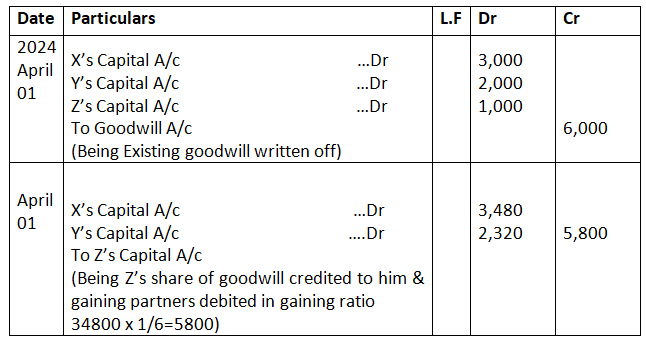

Q.18 A, B and C are partners sharing profits in the ratio of 3:3:2:2 respectively. D retires and A, B and C decide to share future profits in the ratio of 3:2:1. Goodwill of the firm is valued at Rs.6,00,000. Goodwill existed Journal entires to record Goodwill and to distribute the profits. Show your calculations.

Solution:-

Journal

Calculation of gaining ratio of A, B and C after retirement of partner

Old profit sharing ratio of A, B, C and D is 3:3:2:2

D retires,

New profit sharing ratio of A, B and C is 3:2:1

A’s gain = 3/6 – 3/10 = 30 – 18/60 = 12/60 (gain)

B’s gain = 2/6 – 3/10 = 20 – 18/60 = 2/60 (gain)

C’s sacrifices = 1/6 – 2/10 = 10 – 12/60 = -2/60 (Sacrifices)

Calculation of Partner’s share in valued Goodwill of the firm

Goodwill of the firm = Rs.600000

D’s share in Goodwill = 600000 x2/10 = Rs.120000 (Cr.)

A would contribute = 600000 x 2/60 = Rs.120000 (Dr.)

B would contribute = 600000 x 2/60 = Rs.20,000 (Dr.)

C’s share in goodwill = 600000 x 2/60 = Rs.20,000 (Cr.)

Hidden Goodwill:-

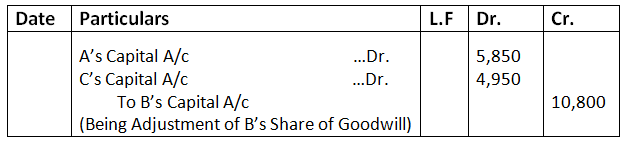

Q19. A, B & C are partners sharing profits in the ratio of 4/9:3/9:2/9. B retire and his capital after making adjustments for reserves and gain (profit) on revaluation stands at 1, 39,200. A & C agreed to pay him 1, 50,000 in full settlement of his claim. Record necessary Journal entry for adjustment of goodwill if the new profit-sharing ratio is decided at 5:3

Solution – Journal

Working Notes:-

Calculation of B’s Share of Goodwill:-

Sharing Profit ratio – 4/9:3/9:2/9

B retires from the firm – 1, 50,000

B’s capital after making adjustment – 1, 39,200

Hidden Goodwill = 1, 50,000 – 1, 39,200 = 10,800

Gaining Ratio:-

New profit Sharing ratio A & B – 5:3

A – 5/8 – 5/9 = 13/72

C – 3/8 – 2/9 = 11/72

Gaining ratio – 13:11

A’s capital – 10,800 x 13/24 – 5,850

C’s Capital – 10,800 x 11/24 – 4,950

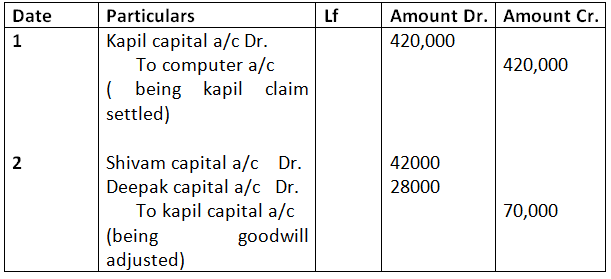

Q20. Shivam, Kapil & Deepak are partners sharing profits in the ratio of 3:1:2. On 31st March, 2024, Kapil retired and his capital account after adjustments of reserve and profit on revaluation was 3, 50,000. Shivam & Deepak paid him 4, 20,000 in settlement of his claim. To settle his account, a computer of 4, 20,000 were given to Kapil. Pass the necessary Journal entries in the books of the firm.

Solution –

Old ratio= 3:1:2

New ratio of remaining partner=3:2

Hidden goodwill=420,000-350,000

=7000

Shivam will contribute=7000x 3/5=42000

Deepak will contribute= 7000x 2/5=28000

When One/More of the Remaining Partner Gain:-

Q-21. M, N & O are partners in a firm sharing profits in the ratio of 3:2:1. Goodwill has been valued at 60,000. On N’s retirement, M & O agree to share profits equally. Pass the necessary Journal entry for treatment of N’s share of goodwill.

Solution – Journal

Working Note:-

Calculation of Gaining Ratio:-

Old ratio – 3:2:1

New Ratio – 1:1

Gaining Ratio = New Ratio – Old Ratio

M’s – 1/2 – 3/6 = 0

O’s – 1/2 – 1/6 = 2/6

Calculation of Retiring Partners Share of Goodwill:-

N’s share – 60,000 x 2/6 = 20,000

Q22. A, B, C & D are partners in a firm sharing profits, in the ratio of 2:1:2:1. On the retirement of C, Goodwill was valued 1, 80,000. A, B & D decide to share future profits equally .Pass the necessary Journal entry for the treatment of goodwill

Solution – Journal

Working Note:-

Calculation of Gaining Ratio:-

Old Ratio – 2:1:2:1

New Ratio – 1:1:1

Gaining Ratio = New Ratio – Old Ratio

A’s = 1/3 – 2/6 = 0

B’s = 1/3 – 1/6 = 1/6

D’s = 1/3 – 1/6 = 1/6

Gaining Ratio – 0:1:1

Calculation of Retiring Partner’s Share of Goodwill:-

C’s = 1, 80,000 x 2/6 = 60,000

B’s = 60,000 x 1/2 = 30,000

D’s = 60,000 x 1/2 = 30,000

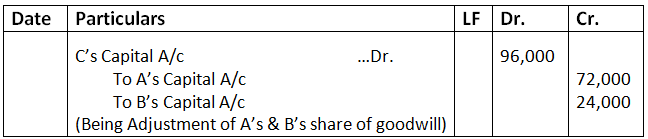

When One/More of the Remaining Partners also Sacrifice:-

Q23. A, B & C were partners in a firm sharing profits in the ratio of 6:5:4. Their capitals were A – 1, 00,000, B – 80,000 & C – 60,000 respectively. On 1st April, 2009, a retired from the firm & the new profit-sharing ratio between B & C was decided as 1:4. On A’s retirement, the goodwill of the firm was valued at 1, 80,000. Showing your calculations clearly, Pass the necessary Journal entry for the treatment of goodwill on A’s retirement.

Solution – Journal

Working Note:-

Calculation of Gaining Ratio:-

Old Ratio – 6:5:4

New Ratio – 1:4

Gaining Ratio = New Ratio – Old Ratio

B’s = 1/5 – 5/15 = -2/15 (sacrificing partner)

C’s = 4/5 – 4/15 = 8/15 (gaining partner)

Calculation of Retiring Partner’s Share of Goodwill:-

A’s – 1, 80,000 x 6/15 = 72,000

B’s – 1, 80,000 x 2/15 = 24,000 (in sacrificing ratio)

So, 72,000 + 24,000 = 96,000

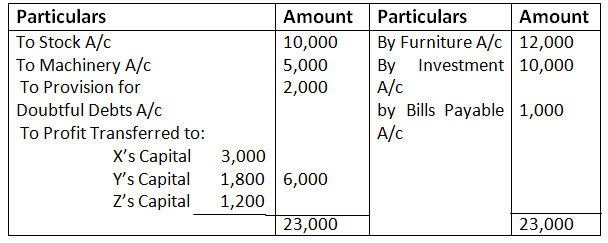

Revaluation of Assets & Reassessment of Liabilities:-

Q24. Sangeeta, Saroj and Shanti are partners sharing profits and losses in the ratio of 5:3:2. Shanti retired and on the date of her retirement, following adjustments were agreed:

- The value of Furniture is to be increased by 12,000.

- The value of stock to be decreased by 10,000.

- Machinery of the book value of 50,000 is to be reduced by 10%

- A Provision for Doubtful Debts @ 5% is to be created on debtors of book value of 40,000.

- Unrecorded investment worth 10,000.

- An item of 1,000 included in bills payable is not likely to be claimed, hence, should be written back.

Pass necessary Journal entries.

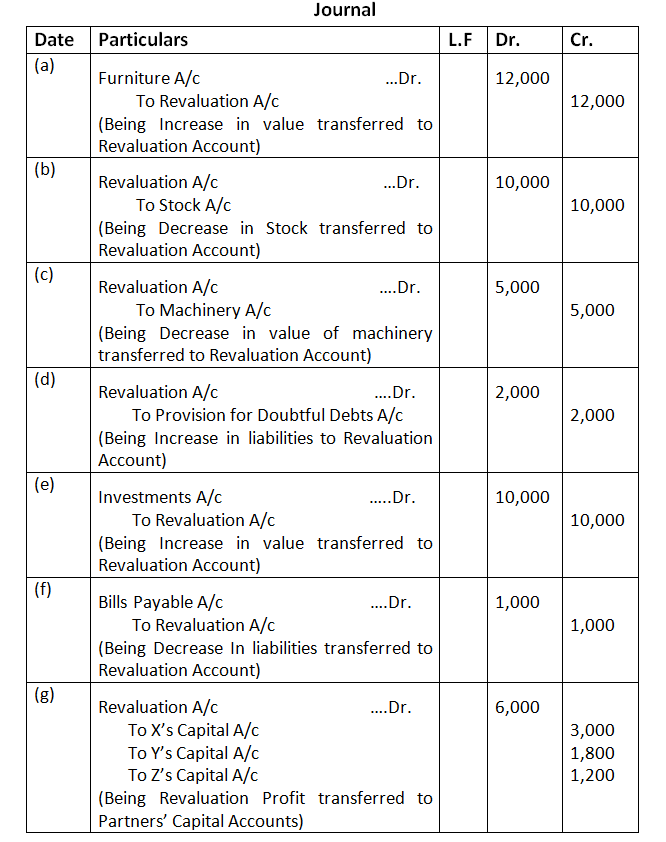

Solution –

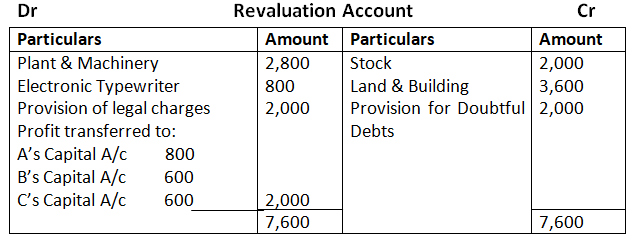

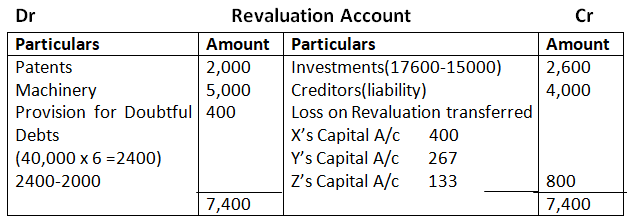

Dr Revaluation Account Cr

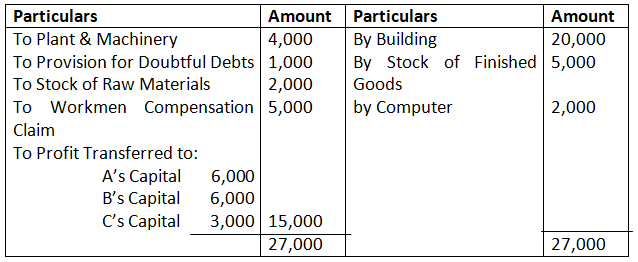

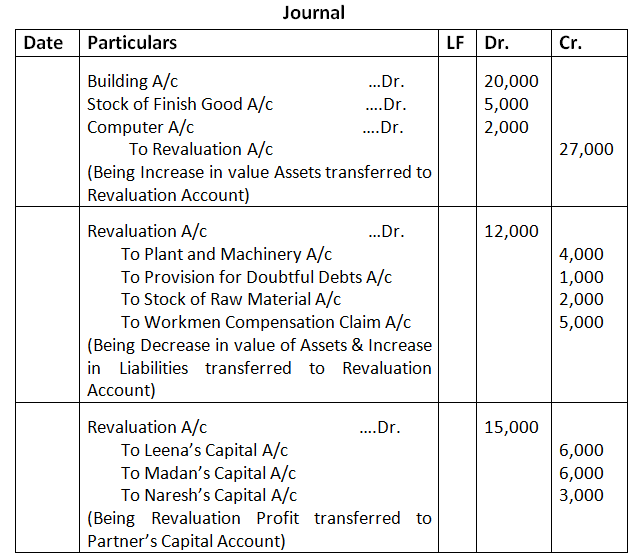

Q23. Leena, Madan & Naresh were partners, sharing profits and losses in the ratio of 2:2:1. Madan retired on 31st March, 2025. On the date of his retirement, some of the assets and liabilities appeared in the books as follows:

Creditors 70,000; Building 1,00,000; Plant & Machinery 40,000; Stock of Raw Material 20,000; Stock of Finished Goods 30,000 & Debtors 20,000.

Following was agreed among the partners on B’s retirement:

- Building to be appreciated by 20%.

- Plant & Machinery to be reduced by 10%.

- A Provision of 5% on Debtors to be created for Doubtful Debts.

- Stock of Raw Materials to be valued at 18,000 & Finished Goods at 35,000.

- An Old Computer previously written off was sold for 2,000 as scrap.

- Firm had to pay 5,000 to an injured employee.

Pass necessary Journal entries to record the above adjustments and prepare the Revaluation Account.

Solution –

Dr Revaluation Account Cr

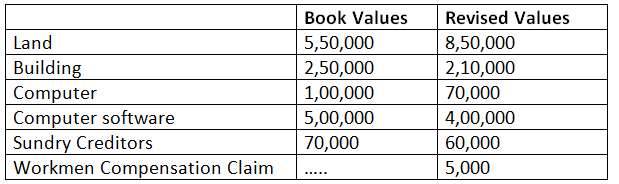

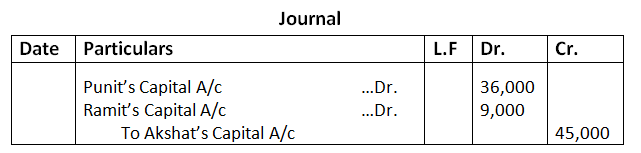

Q25. Punit, Ramit & Akshit were partners sharing profits equally. Akshit retired on 1st April, 2025. Punit & Ramit decided to continue the business and share profits in the ratio of 3:2. They also decided to give effect to the change in values of assets and liabilities without changing their book values.

The book values and their revised were as follows:

Pass an Adjustment entry

Solution –Old Ratio – 1:1:1

New Ratio – 3:2 & c retired

Punit = 1/3 – 3/5 = -4/15 (Gain)

Ramit = 1/3 – 2/5 = -1/15 (Gain)

Akshat = 1/3 – 0/5 = 1/3 (Sacrifice)

Sacrificing Ratio of Akshat – 1/3

= 1, 35,000 x 1/3 – 45,000

Share of Compensating Amount by Punit & Ramit in sacrificing ratio (4:1)

Punit – 45,000 x 4/5 – 36,000

Ramit – 45,000 x 1/5 – 9,000

Old ratio+1: 1: 1

New ratio=3:2

Punit share 3/5-1/3=4/15

Ramit share 2/5-1/3=1/15

Gaining ratio=4:1

Revaluation profit=135000

Akshat share=135000 x 1/3=45000

Punit will contribute =45000x 4/5=36000

Ramit will contribute=45000×1/5=9000

Treatment of Reserve & Accumulated Profit/Losses:-

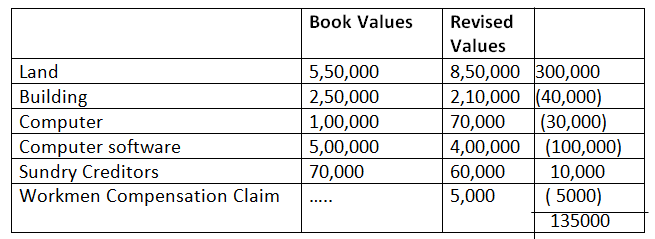

Q27. X, Y & Z are partners in a firm sharing profits and losses in the ratio of 3:2:1, Z retired from the firm on 1st April, 2025. On the date of Z’s retirement, following balances existed in the books of the firm:

General Reserve 1, 80,000

Profit & Loss Account (Dr.) 30,000

Workmen Compensation Reserve 24,000 which was no more required

Employees Provident Fund 20,000

Pass necessary Journal entries for the adjustment of these items on Z’s retirement.

Solution – Journal

Working Note:-

Calculation of Share in Credit Balance of Reserve:-

Total Credit Balance of = General Reserve + Workmen Compensation Fund

Reserve = 1, 80,000 + 24,000 = 2, 04000

X’ Share – 2, 04000 x 3/6 = 1, 02000

Y’ Share – 2, 04000 x 2/6 = 68,000

Z’s Share – 2, 04000 x 1/6 = 34,000

Calculation of share in Debit Balance of Profit & Loss A/c:-

X’s Share – 30,000 x 3/6 = 15,000

Y’s Share – 30,000 x 2/6 = 10,000

Z’s Share – 30,000 x 1/6 = 5,000

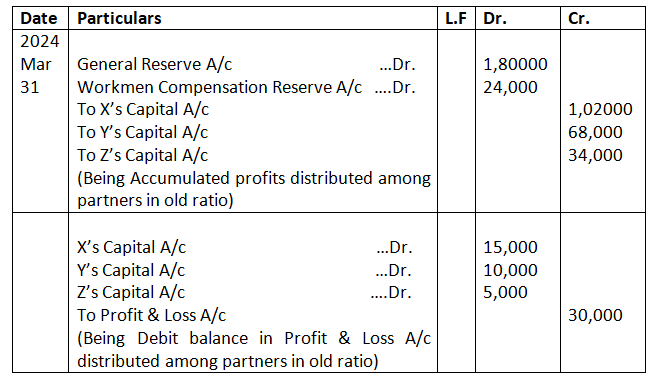

Q28. Asha, Naveen & Shalini were partners in a firm sharing profit in the ratio of 5:3:2. Goodwill appeared in their books at a value of 80,000 and General Reserve at 40,000. Naveen decided to retire from the firm. On the date of his retirement, goodwill of the firm was valued at 1, 20,000. The new profit-sharing ratio decided among Asha & Shalini is 2:3

Recard necessary journal entries

Solution – Journal

Working Note:-

Calculation of Gaining Ratio:-

Gaining ratio = New Share – Old Shares

Asha’s = 2/5 – 5/10 = -1/10(sacrificing partner)

Shalini’s = 3/5 – 2/10 = 4/10(Gaining partner)

So, Both Asha & Naveen are compensated by Shalini in the ratio of 1:3

Asha’s = 1, 20,000 x 1/10 = 12,000

Naveen’s – 1, 20,000 x 3/10 = 36,000

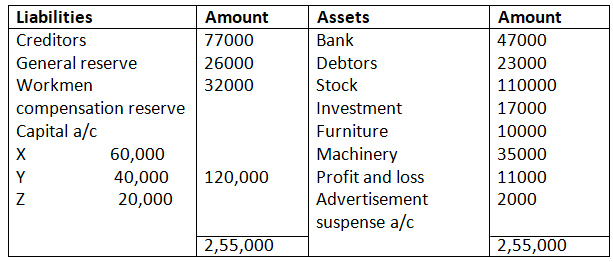

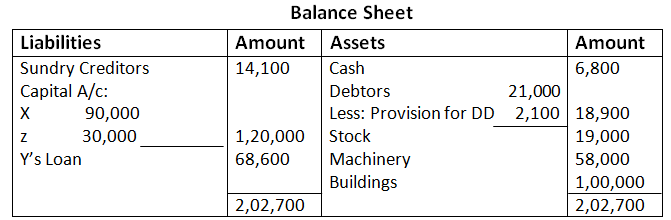

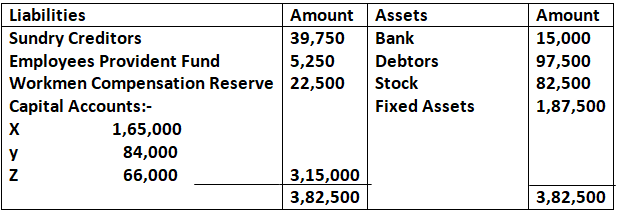

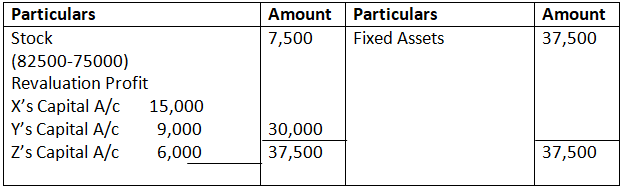

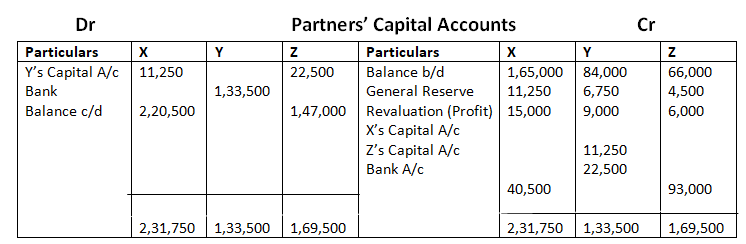

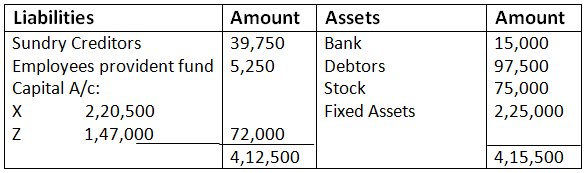

Q29. X, Y & Z were equal partner in a firm on 31st March 2025 their balance sheet as follow

On the above date Z retire from the firm and x and y decided to share future profit in the ratio of 3:2 partner decide to show accumulated profit losses and reserve in the balance sheet of the reconstituted firm of their original values.

Pass a adjustment entry for the accumulated profit loss and reserve.

Solution

Working note

Calculation of net effect

General reserve 26000

Workmen compensation 32000

Reserve 58000

Less p/l a/c 11000 (13000)

Advertisement 2000

Suspense a/c

Net accumulated profit 45000

Gain/sacrificing ratio

Old ratio 1:1:1

Z retire

New profit sharing ratio

3:2

Gaining ratio= new ratio-old ratio

x 3/5-1/3=4/15

y 2/5-1/3=1/16

Gaining ratio=4:1

Accumulated profit=45000x 1/3=15000

X will contribute= 15000×4/5=12000

Y will contribute= 15000×1/5=3000

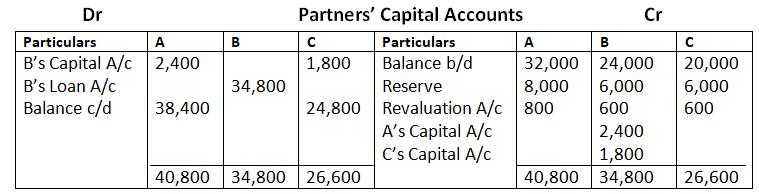

Reparation of the Capital Accounts and Balance Sheet:-

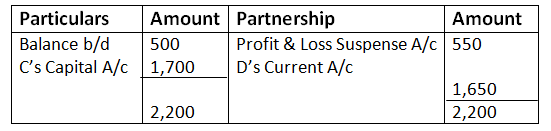

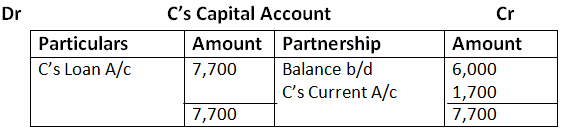

Q30. Partnership Deed of C & D, who is equal partners, has a clause that any partner may retire from the firm on the following terms by giving a six-month notice in Writing:

- The amount standing to the credit of his Capital Account and Current Account.

- His share of profit to the date of retirement, calculated on the basis of the average profit of the three preceding completed years.

- Half the amount of the goodwill of the firm calculated at 1 ½ times the average profit the three preceding complete years. C gave a notice on 31st March, 2024 to retire on 30th September, 2024, when the balance of his Capital Account was 6,000 and his Current Account (Dr.) 500. Profit for the three preceding completed years ended 31st March, were: 2022- 2,800; 2023-2,201 & 2024-1,600.

Determine the amount due to C as per the partnership agreement.

Solution –

Dr C’s Current Account Cr

Working Note:-

Calculation of Profit (from April 01, 2024 to Sep. 30, 2024)

Average Profit = Total Profit of past given years/Number of years

Average profit = 2,800 + 2,200 + 1,600/3 = 2,200

C’s Share of Profit (last 6 months) = Average profit x C’s Share x 6/12

= 2,200 x 1/2 x 6/12 = 550

Calculation of Goodwill:-

Goodwill = Average Profit x 1.5

= 2,200 x 1.5 =3,300

C’s share = 3,300 x 1/2 = 1,650

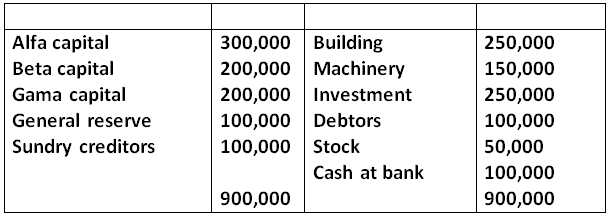

Q31. Alfa Beta Gama are in partnership sharing profit in the ratio 5:3:2 their balance sheet on 1st April 2025 the day Beta decided to retire from firm was as follow

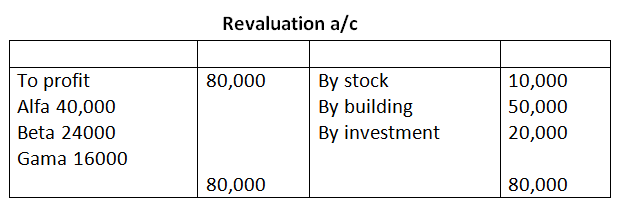

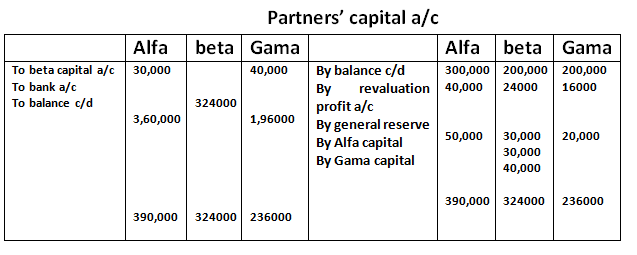

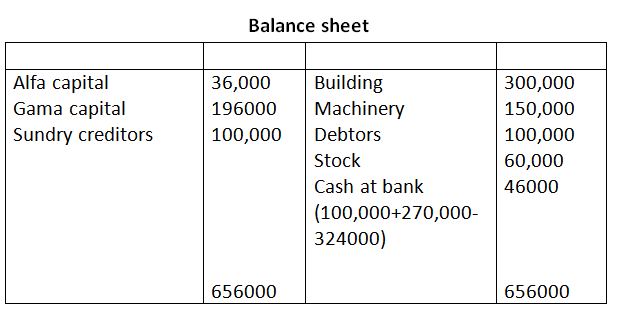

The terms of retirement were:

(i) Beta takes goodwill from Alfa for₹ 30,000 and from Gama for 40,000 for foregoing his share of profits.

(ii) Stock to be appreciated by 20% and building by 50,000.

( iii) Investments were sold for ₹2,70,000.

(iv) Beta is paid by bank draft.

Prepare Revaluation Account, Partners’ Capital Accounts and Balance Sheet of the new firm.

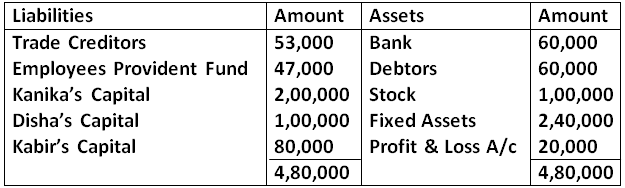

Q32. Kanika, Disha and Kabir were partners sharing profits in the ratio of 2:1:1. On 31st March, 2025, their Balance Sheet was as under:

Kanika retired on 1st April, 2025. For this purpose, the following adjustments were agreed upon:

- Goodwill of the firm was valued at 2 years purchase of average profits of three completed years preceding the date of retirement. The profits for the years:

2023-44 were 1, 00,000 & for 2024-25 were 1, 30,000

b. Fixed Assets were to be increased to 3,00,000

c. Stock was to be valued at 120%

d. The amount payable to Kanika was transferred to her Loan Account.

Prepare Revaluation Account, Capital Accounts of the partners and the Balance Sheet of the reconstituted firm.

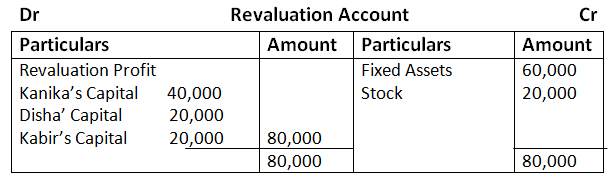

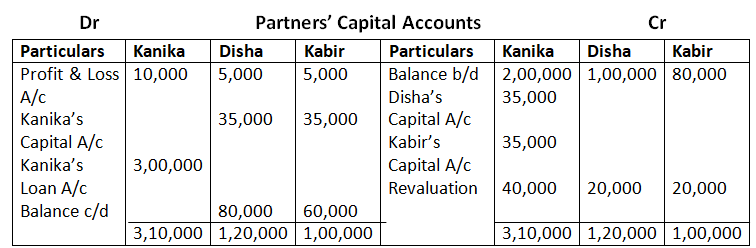

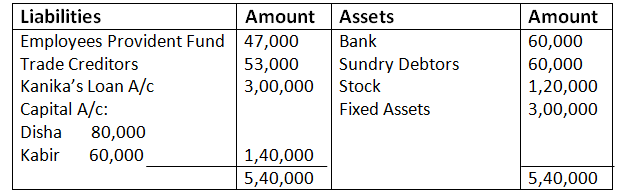

Solution –

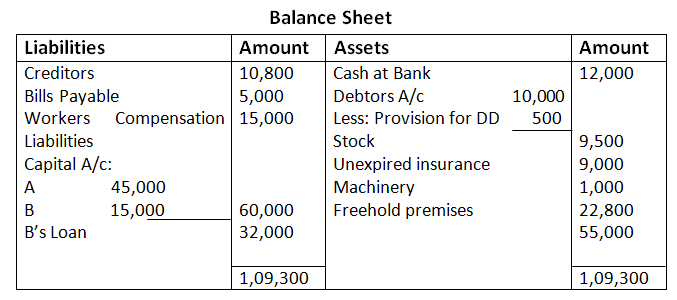

Balance Sheet

As on March 31, 2023

Working Note:-

Calculation of Goodwill:-

Average Profits = Total Profit Number of Years =

1, 00,000 + 1, 30,000 – 20,000 /3 = 2, 10,000/3 –=70,000

Goodwill = Average Profits x Number of Years Purchase

Goodwill = 70,000 x 2 =1,40,000

Gaining ratio=

Old ratio= 2:1:1

New ratio=1:1

New- old ratio=

Disha =1/2-1/4=1/4

Kabir=1/2-1/4=1/4

Gaining share =1:1

Kanika’s share = 1, 40,000 x 2/4 =70,000

Disha share=70,000 x1/2=35000

Kabir share= 70,000x ½=35000

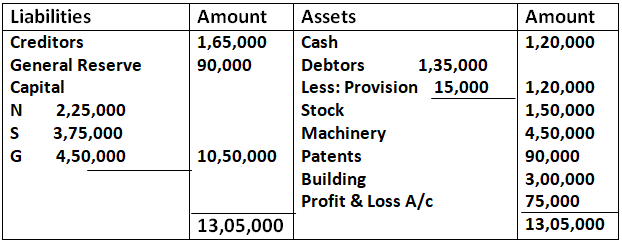

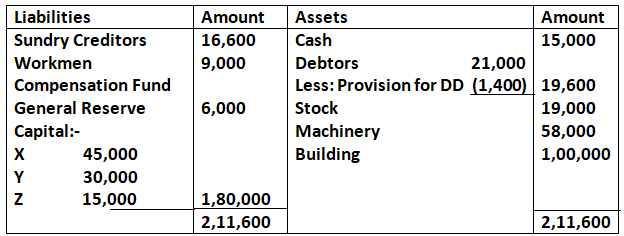

Q33. N, S & G were partners in a firm sharing profits and losses in the ratio of 2:3:5. On 31st March, 2016 their Balance Sheet was as under:

G retired on the above date and it was agreed that:

- Debtors of 6,000 will be written off as bad debts and a provision of 5% on debtors for bad and doubtful debts will be maintained.

- Patents will be completely written off and stock, machinery and building will be depreciated by 5%

- An unrecorded creditor of 30,000 will be taken into account.

- N & S will share the future profits in 2:3 ratio

- Goodwill of the firm on G’s retirement was valued at 90,000

Pass necessary Journal entries for the above transactions in the books of the firm on G’s retirement.

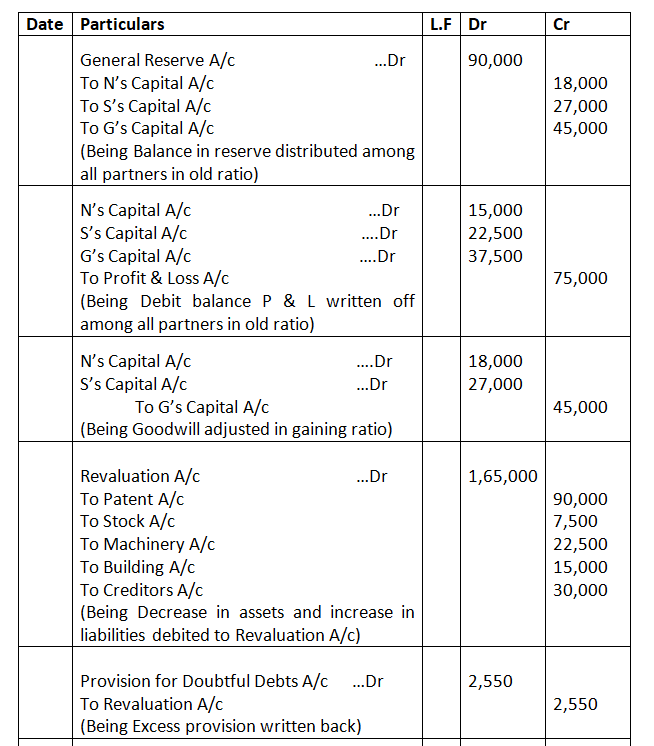

Solution – Journal

Working Note:-

Calculation of G’s Share of Goodwill:-

G’s share = Firm Goodwill x G’s Profit Share

G’s Share = 90,000 x 5/10 – 45,000

Calculation of Gaining Ratio:-

Gaining Ratio = New Ratio – Old Ratio

N’s = 2/5 – 2/10 = 2/10

S’s = 3/5 – 3/10 = 3/10

Gaining Ratio – 2:3

N’s = 45,000 x 2/5 – 18,000

S’s = 45,000 x 3/5 – 27,000

Calculation of Excess/Deficit Provision for Doubtful Debts:-

Provision @ 5% = 1, 35,000 – 6,000 =129000 x 5 % = 6,450

Provision after written bad debts 15000-6000= 9,000

= 6,450 – 9,000 = 2,550

Revaluation balance= total of all assets increased value=

165000-2550=162450

Loss on revaluation distributed between partners in their old profit sharing ratio(2:3:5)

N=162450 X 2/10=32490

S=162450 X 3/5=48735

G=162450 X 5/10=81225

Calculation of G’s Loan Balance:-

Amount due to G = (Opening Capital +Goodwill+ General Reserve) – (debit balance of P/L a/c +loss on revaluation)

= (4, 50,000 + 45,000 +45000) – (37,500 +81,225) = 4, 21,275

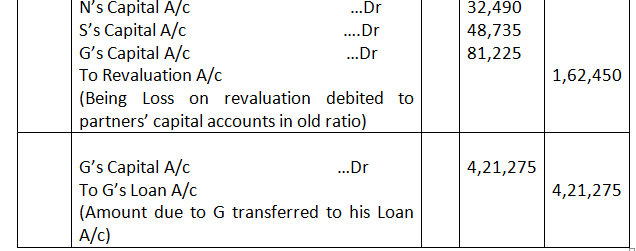

Q34. Ashok, Bhaskar and Chaman are partners in a firm, sharing profits and losses as Ashok 1/3, Bhaskar 1/2 & Chaman 1/6 respectively. The Balance Sheet of the firm as at 31st March, 2025 was:

Chaman retired on 1st April, 2025 subject to the following adjustments:

- Goodwill of the firm be valued at 2, 40,000. Chaman’s share of goodwill be adjusted into the Capital Account of Ashok and Bhaskar who will share future profits in the ratio of 3:2

- Plant & Machinery to be reduced by 10% and Furniture by 5%

- Stock to be increased by 15% and Building by 10%

- Provision for Doubtful Debts to be raised to 20,000

Prepare Revaluation Account, capital Account of Chaman and the Balance Sheet of the firm after Chaman’s retirement.

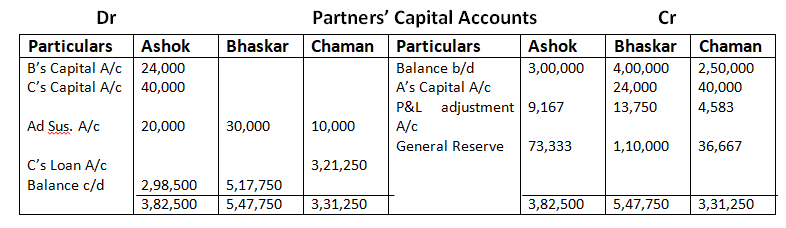

Solution –

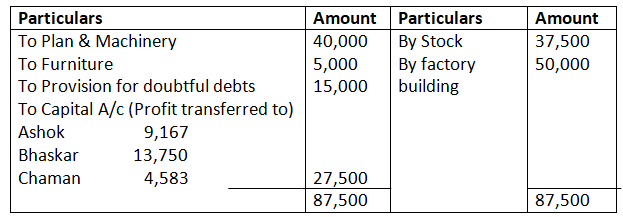

Dr Profit & Loss Adjustment Account Cr

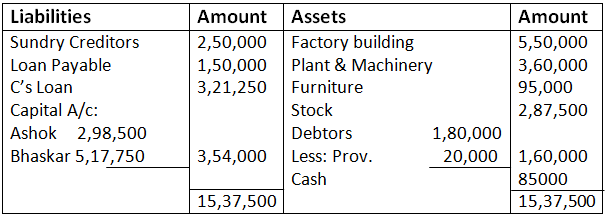

Balance Sheet

As on April 1, 2025 (after C’s retirement)

Working note

Old ratio= 1/3 :1/2 :1/6

=2:3:1

New ratio=3:2

Gaining ratio=

Ashok=3/5-2/6=8/30= gain

Bhasker=2/5-3/6=-3/30 =sacrifice

Calculation of goodwill=

Chaman=240,000 x 1/6=40,000(old ratio)

Bhasker =240,000 x 3/30=24000 (sacrificing ratio)

Ashok 240,000 x8/30 =64000 (gaining ratio)

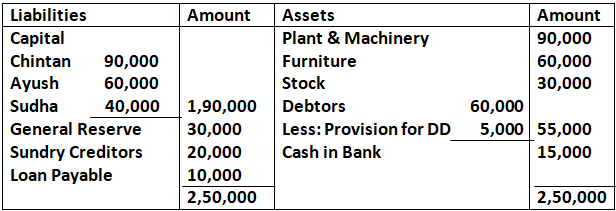

Q35. Chintan, Ayush and Sudha were partners in a firm sharing profits and losses in the ratio of 5:3:2. On 31st March, 2019, their Balance Sheet was as follows:

Balance Sheet of Chintan, Ayush & Sudha as at 31st March, 2019

Chintan retired on the above date and it was agreed that:

- Debtors of 5,000 were to be written off as bad debts and a provision of 5% on debtors for bad and doubtful debts was to be created.

- Goodwill of the firm on Chintan’s retirement was valued at 1, 00,000 and Chintan’s share of the same will be adjusted by debiting the Capital Accounts of Ayush & Sudha.

- Stock was revalued at 36,000.

- Furniture was undervalued by 9,000.

- Liability for Workmen’s Compensation of 2,000 was to be created.

- Chintan was to be paid 20,000 by cheque and the balance was to be transferred to his loan account

Pass the necessary Journal entries in the books of the firm on Chintan’s retirement.

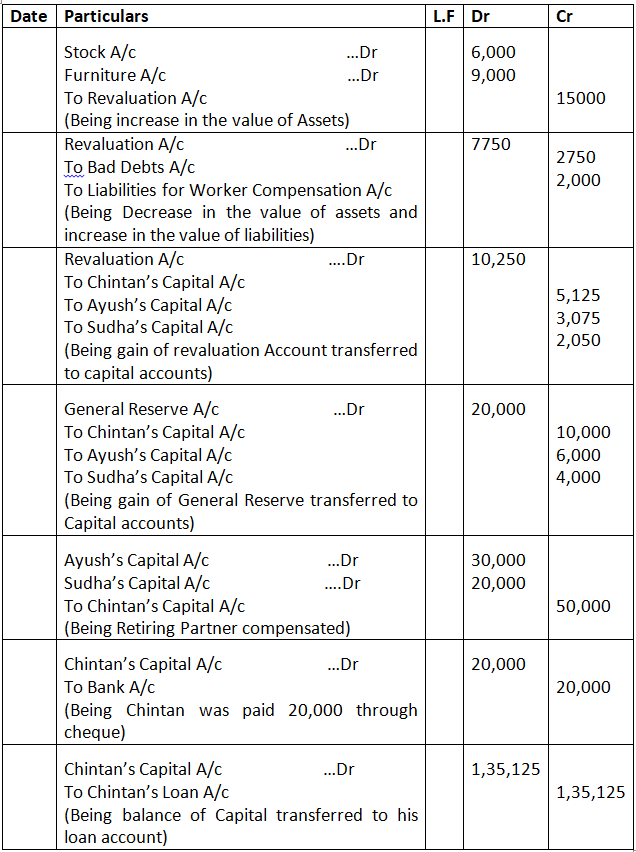

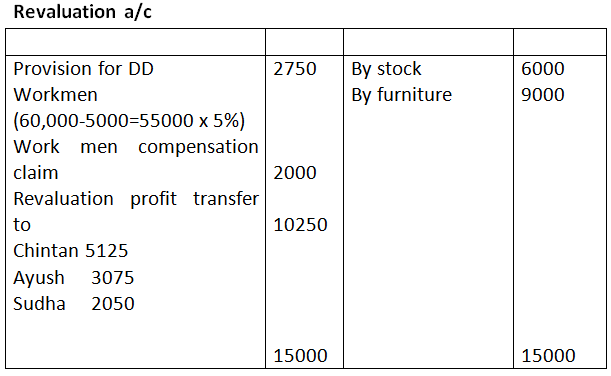

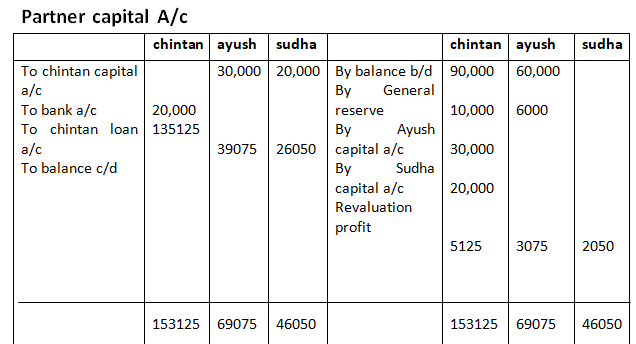

Solution – Journal

Old ratio=5:3:2

New ratio=3:2

Calculation of gaining ratio=

Ayush =3/5-3/10=3/10

Sudha=2/5-2/10=2/10

Gaining ratio=3:2

Chintan share of goodwill in old ratio=100,00 x 5/10=50,000

Ayush will contribute=50,000 x 3/5=30,000

Sudha will contribute50,000 x 2/5= 20,000

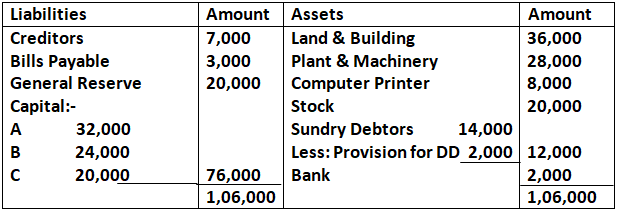

Q36. A, B & C are partners sharing profits and losses in the ratio of 4:3:3. Their Balance Sheet as at 31st March, 2025 is:

On 1st April, 2025, B retired from the firm on the following terms:

- Goodwill of the firm is to be valued at 14,000

- Stock, Land & Building are to be appreciated by 10%

- Plant & Machinery and Computer Printer are to be reduced by 10%

- Sundry Debtors are considered to be good

- Provision for legal charges to be made at 2,000.

- Amount payable to B is to be transferred to his Loan Account.

Prepare Revaluation Account, Partners’ Capital Account and the Balance Sheet of A & C after B’s retirement.

Solution-

Balance Sheet

As on April 1, 2025(after B’s Retirement)

Working Note:-

Adjustment of Goodwill:-

Old ratio – 4:3:3

B retires from the firm

Gaining ratio – 4:3

Goodwill of the firm – 14,000

B’s share – 14,000 x 3/10 – 4200

Goodwill distributed between A & C in their gaining ratio – 4:3

A’s – 4,200 x 4/7 – 2,400

C’s – 4,200 x 3/7 – 1,800

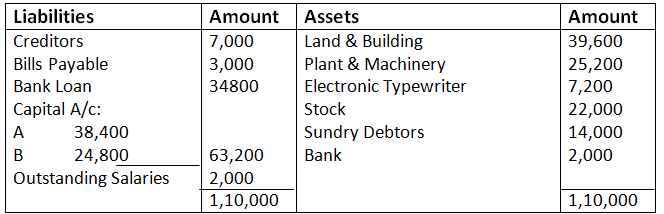

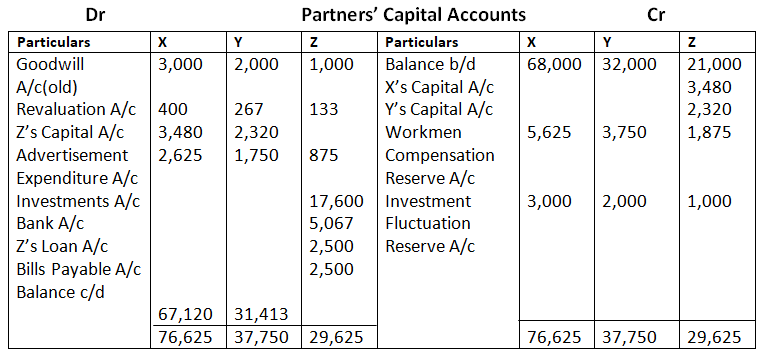

Q35. X, Y and Z are partners sharing profits and losses in the ratio of 3:2:1. Balance Sheet of the firm as at 31st March, 2025 was as follows:

Z retired on 1st April, 2025 on the following terms:

- Goodwill of the firm is to be valued at Rs.34,800.

- Value of Patents is to be reduced by 20% and that of machinery to 90%.

- Provision of Doubtful Debts is to be @ 6% on Debtors.

- Z took the investment at market value.

- Liability for Workmen Compensation to the extent of Rs.750 is to be created.

- A liability of Rs.4,000 included in credited is not to be paid.

- Amount due to Z to be paid as follows:

Rs.5067 immediately, 50% of the balance within one year and the balance by a draft for 3 Months.

Give necessary Journal entries for the treatment of goodwill, prepare Revaluation Account, Capital Accounts and the Balance Sheet of the new firm.

Solution – Journal

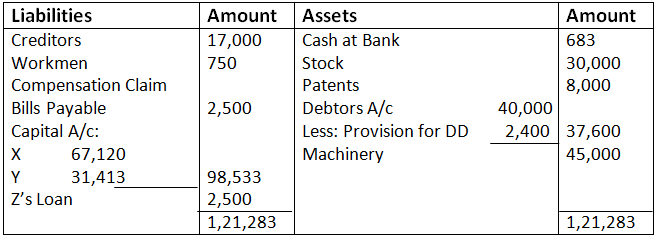

Balance Sheet

As on April 1, 2024 (after Z’s Retirement)

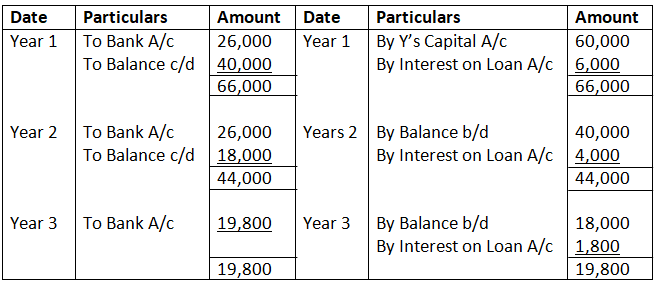

Settlement of Loan Account of the Retiring Partner:-

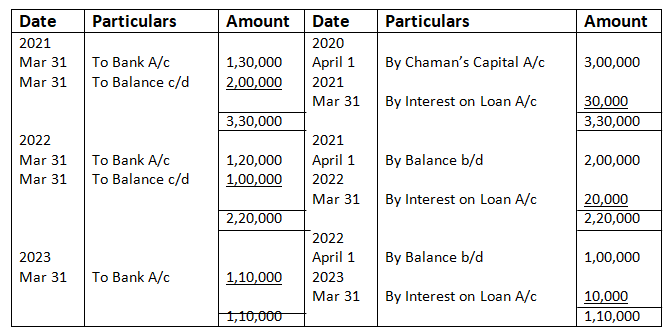

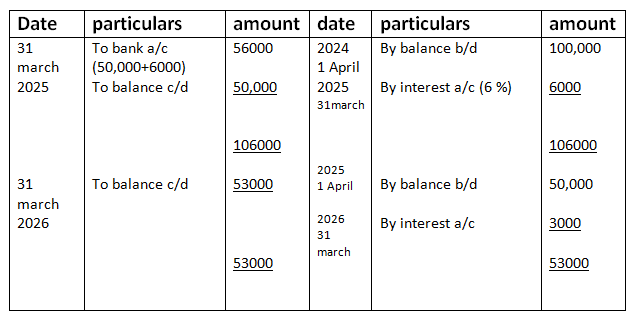

Q38. Ashok, Bhaskar and Chaman were in partnership sharing profits and losses equally. ‘Bhaskar’ retires from the firm. After adjustments, his Capital Account shows a credit balance of 3, 00,000 as on 1st April, 2020. Balance due to ‘Bhaskar’ is to be paid in three equal annual installments along with interest @ 10% p.a. prepare Bhaskar’s Loan Account until he is paid the amount due to him. The firm closes its books on 31st March every year.

Solution –

Dr Chaman’s Loan A/c Cr

Q39. Rakesh retired from the firm. The amount due to him was determined at 90,000. It was decided to pay the due amount as follows:

On the date of retirement – 30,000

Balance in three yearly installments – First two installments being of 26,000, including interest; and Balance amount as last installment. Interest was payable @ 10% p.a. Prepare Retiring Partners Loan Account.

Solution –

Dr Rakesh’s Loan A/c Cr

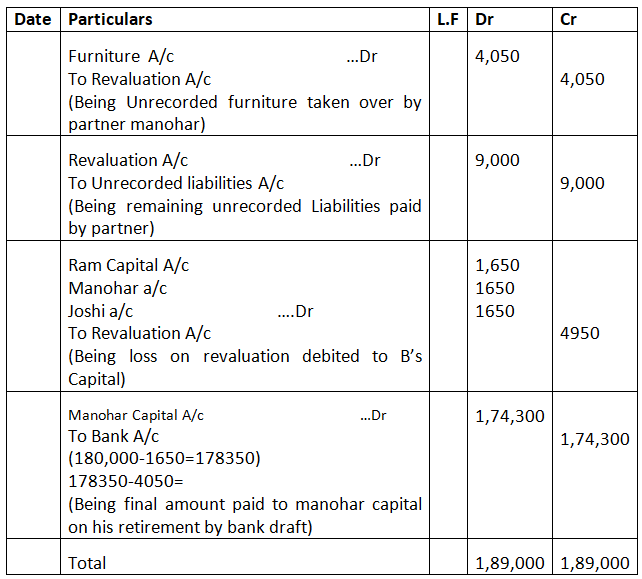

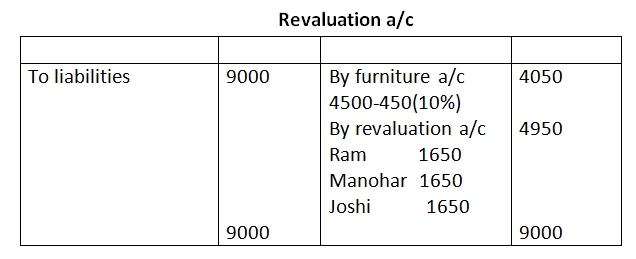

Q40. Ram, Manohar and Joshi were partners in a firm. Manohar retired and his claim including his capital and share of goodwill was 1, 80,000. There was an unrecorded furniture estimated at 9,000, half of which was given for an unrecorded liability of 18,000 in settlement of claim of 9,000 and remaining half was taken by Manohar at a discount of 10% in part satisfaction of his claim. Balance of Manohar’s claim was discharged by bank draft. Pass necessary Journal entries to record the above transactions.

Solution – Journal

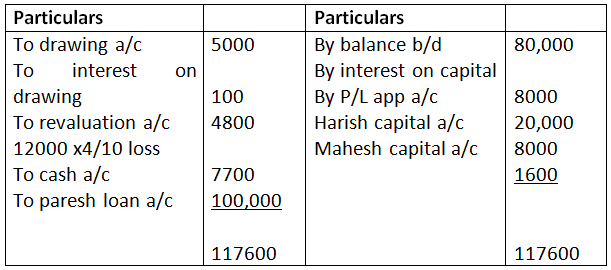

Q41. Harish, Paresh and Mahesh were three partners sharing profits and losses in the ratio of 5 : 4 : 1.

Paresh retired on 31st March, 2025. His capital as on 1st April, 2024, was 80,000. During the year 2024-25, he withdrew 5,000. He was to be charged interest of 100 on drawings.

The Partnership Deed provides that on the retirement of a partner, he will be entitled to:

(i) His share of capital.

(ii) Interest on capital @ 10% per annum.

(iii) His share of profit in the year of retirement.

(iv) His share of goodwill of the firm.

(v) His share in the profit/loss on revaluation of assets and liabilities.

Additional Information:

(a) Paresh’s share in the profit of the firm for the year 2024-25 was 20,000.

(b) Goodwill of the firm was valued at 24,000.

(c) The firm incurred loss of 12,000 on the revaluation of assets and liabilities.

(d) Paresh was to be paid 7,700 in cash and the balance was to be transferred to his Loan Account bearing interest @ 6% per annum. Loan was to be repaid in two equal annual instalments, the first instalment to be paid on 31st March, 2025.

You are required to prepare:

(i) Paresh’s Capital Account.

(ii) Paresh’s Loan Account till it is finally closed.

[Ans.: Paresh’s Loan-₹ 1,00,000.]

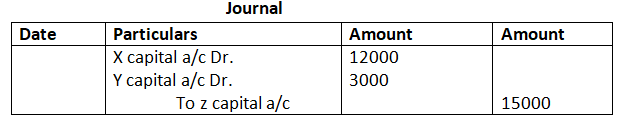

Paresh capital a/c

Goodwill share of paresh

=24000 x 4/10=9600

Contribution ratio=5:1

Harish will contribute=9600 x5/6=8000

Mahesh will contribute=9600 x 1/6=1600

Adjustment of Capitals When Total Capital of the New Firm is Given:-

Q42. X, Y & Z are partners in a firm sharing profit in the ratio of 3:2:1. On 1st April, 2009, Y retires from the firm. X & Z agree that the capital of the new firm shall be fixed at 2, 10,000 in the profit-sharing ratio. The Capital Accounts of X & Z after all adjustments on the date of retirement showed balance of 1, 45,000 & 63,000 respectively. State the amount of actual cash to be brought in or to be paid to the partners.

Solution – Old ratio – 3:2:1

Y retires from the firm

New Ratio – 3:1

Total Capital of the new firm – 2, 10,000

X’s – 2, 10,000 x 3/4 – 1, 57,200

Z’s – 2, 10,000 x 1/4 – 52,500

Ascertainment of Actual cash:-

Cash paid/Brought in =New Capital – Existing Capital

X = 1, 57,500 – 1, 45,000 = (12,500) Brought in

Z = 52,500 – 63,000 = (10,500) Paid

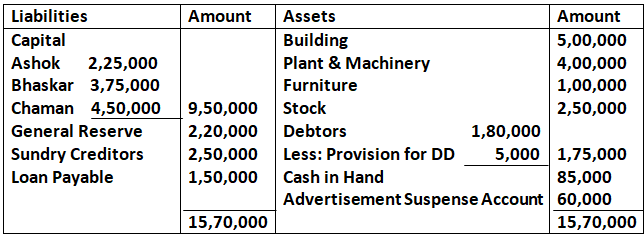

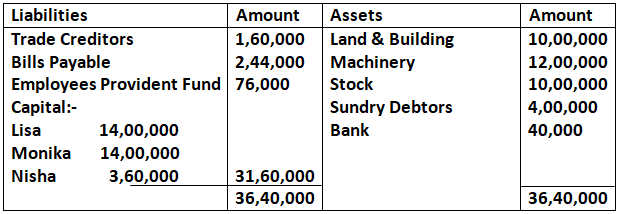

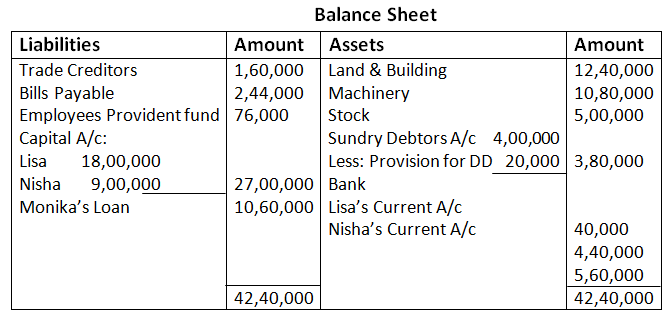

Q43. Lisa, Monika & Nisha were partners in a firm sharing profits and losses in the ratio of 2:2:1. On 31st March, 2025, their Balance Sheet was as follows:

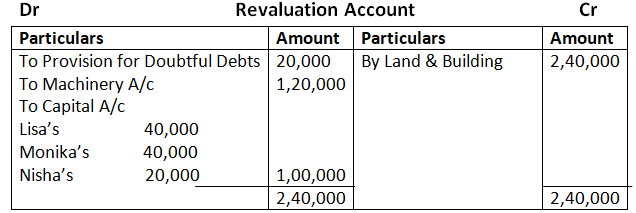

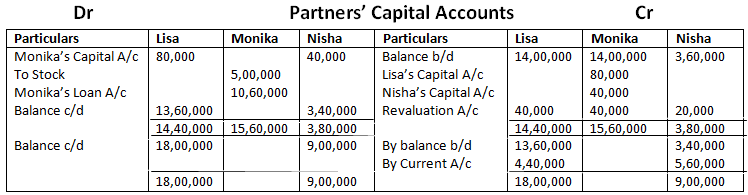

On 31st March, 2025, Monika retired from the firm and the remaining partners decided to carry on the business. It was agreed that:

- Land & Building be appreciated by 2,40,000 and machinery be depreciated by 10%

- 50% of the stock was taken over by the retiring partner at book value.

- Provision for doubtful debts was to be made at 5% on debtors.

- Goodwill of the firm be valued at 3, 00,000 and Monika’s share of goodwill be adjusted in the accounts of Lisa & Nisha.

- The total capital of the new firm be fixed at 27, 00,000 which will be in the proportion of the new profit-sharing ratio of Lisa & Nisha. For this purpose, current Accounts of the partners were to be opened.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of the reconstituted firm on Monika’s retirement.

Solution –

Working Note:-

Calculation of gaining & Sacrificing Ratio:-

Old ratio – 2:2:1

New ratio – 2:1

Gaining ratio = New ratio – Old Ratio

Lisa’s – 2/3 – 2/5 = 4/15

Nisha’s – 1/3 – 1/5 = 2/15

Gaining ratio – 2:1

Treatment of goodwill:-

Firm goodwill – 3, 00,000

Monika share– 1, 20,000 x 2/5 – 1, 20,000

Lisa’s Compensated – 1, 20,000 x 2/3 – 80,000

Nisha Compensated – 1, 20,000 x 1/3 – 40,000

Lisa’s Capital – 27, 00,000 x 2/3 – 18, 00,000

Nisha’s Capital – 27, 00,000 x 1/3 – 9, 00,000

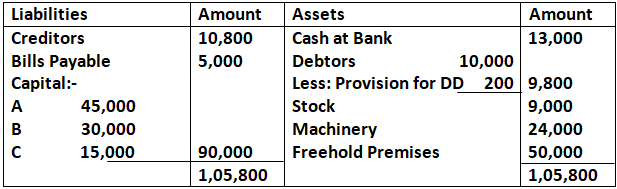

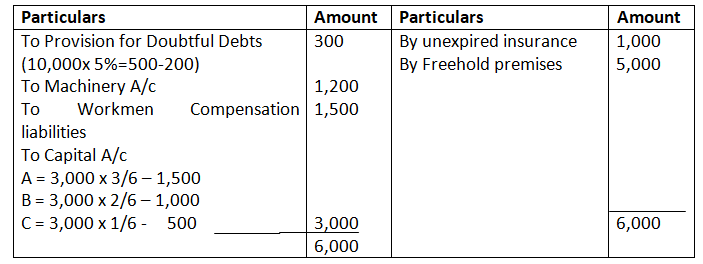

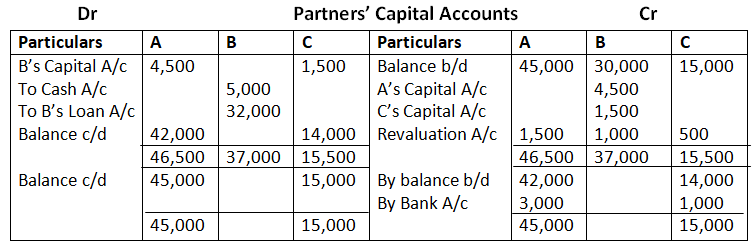

Q44. On 31st March, 2025, the Balance Sheet of A, B & C who were sharing profits and losses in proportion to their capitals stood as:

B retired on 1st April, 2025 and following adjustments were agreed to determine the amount payable to B:

- Out of the amount of Insurance premium debited to Profit & Loss Account, 1,000 be carried forward as prepaid insurance.

- Freehold Premises be appreciated by 10%

- Provision for Doubtful Debts is brought up to 5% on Debtors

- Machinery be reduced by 5%

- Liabilities for Workmen Compensation to the extent of 1,500 would be created

- Goodwill of the firm be fixed at 18,000 and B’s share of the same be adjusted into the Capital Accounts of A & C who will share future profits in the ratio of 3/4th & 1/4th

- Total capital of the firm as newly constituted b fixed at 60,000 between A & C in the Proportion of 3/4th and 1/4th after passing entries in their accounts for adjustment, i.e., actual cash to be paid or to be brought in by continuing partners as the case may be.

- B is paid 5,000 in cash and the balance be transferred to his Loan Account.

Prepare Capital Accounts of Partners and the Balance Sheet of the firm of A & C.

Solution –

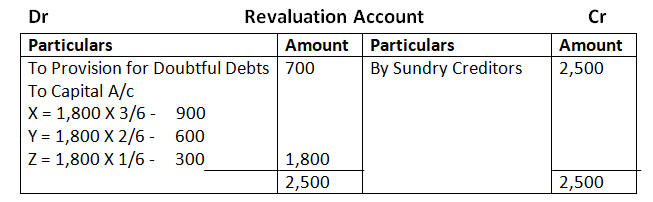

Dr Revaluation Account Cr

Working Note:

Calculation of New & Gaining Ratio:-

Old ratio – 3:2:1

New ratio – 3:1

Gaining ratio = New ratio – Old ratio

A’s = 3/4 – 3/6 – 6/24

C’s = 1/4 – 1/6 – 2/24

Gaining ratio – 3:1

Treatment of Goodwill:-

Goodwill of the firm – 18,000

B share– 18,000 x 2/6 – 6,000

A compensated – 6,000 x 3/4 – 4,500

C compensated – 6,000 x 3/4 – 1,500

Capital Adjustment:-

A capital – 60,000 x 3/4 – 45,000

C’s capital – 60,000 x 1/4 – 15,000

Closing bank balance = 13,000 – 5,000 + 3,000 + 1,000 = 12,000

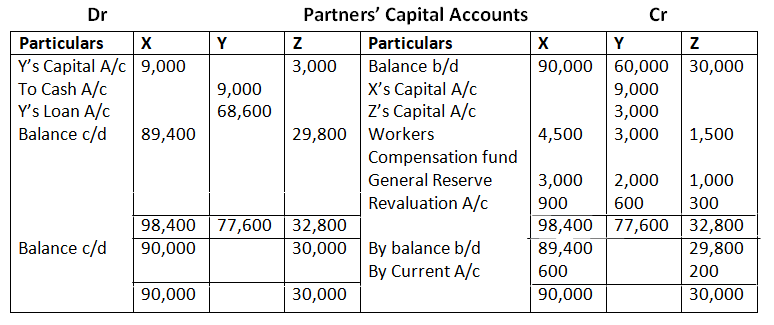

Q45. X, Y & Z were in partnership sharing profits in proportion to their capitals. Their Balance Sheet as on 31st March, 2018 was as follows:

On the above date, Y retired owing to all health, the following adjustments were agreed upon for calculation of amount due to Y:

- Provision for Doubtful Debts to be increase to 10% of Debtors

- Goodwill of the firm be valued at 36,00 and be adjusted into the Capital Accounts of X & Z, who will share profits in future in the ratio of 3:1

- Included in the value of Sundry Creditors was 2,500 for an outstanding legal claim, which will not arise

- X & Z also decided that the total capital of the new firm will be 1, 20,000 in their profit-sharing ratio. Actual cash to be brought in or to be paid off as the case may be.

- Y to be paid 9,000 immediately and balance to be transferred to his Loan Account.

Prepare Revaluation Account, Partners’ Capital Accounts and Balance Sheet of the new firm after Y’s retirement.

Solution –

Working Note:-

Calculation of New & Gaining ratio:-

Old ratio – 3:2:1

New ratio – 3:1

Gaining ratio = New ratio – Old ratio

X’s – 3/4 – 3/6 – 6/24

Z’s – 1/4 – 1/6 – 2/24

Gaining ratio – 3:1

Treatment of Goodwill:-

Goodwill of the firm – 36,000

Y share – 36,000 x 2/6 – 12,000

X compensated – 12,000 x 3/4 – 9,000

Z compensated – 12,000 x 1/4 – 3,000

Capital adjustment:-

X’s capital – 1, 20,000 x 3/4 – 90,000

Z’s Capital – 1, 20,000 x 1/4 – 30,000

When existing total capital of remaining partners is to be in new profit sharing ratio

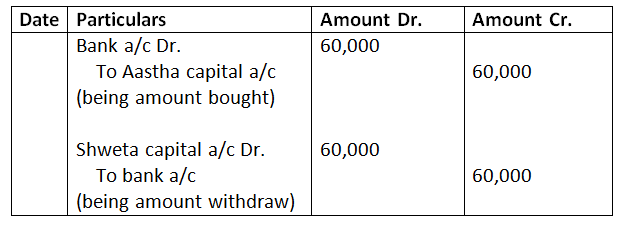

Q46. Shweta, Meenu and Asha were partners in a firm sharing profits and losses in the ratio of 3:5:2. Meenu retired on 1st April, 2022. After making all adjustments relating to revaluation, goodwill and accumulated profits, etc., Capital Accounts of Shweta and Asha showed credit balance of 3,00,000 and 1,00,000 respectively. It was decided to adjust the capitals of Shweta and Asha in their new profit- sharing ratio. Pass necessary Journal entries for bringing in or withdrawal of the necessary amounts involved. Show your working clearly.

Total capital of Asha and Shweta=300,000+100,000=400,000

New ratio=3:2

Sweta=400,000 x3/5

Asha =400,000 x 2/5

Sweta capital=300,000-240,000=60,000(amount withdraw)

Astha capital=100,000-160,000=60,000(amount brought)

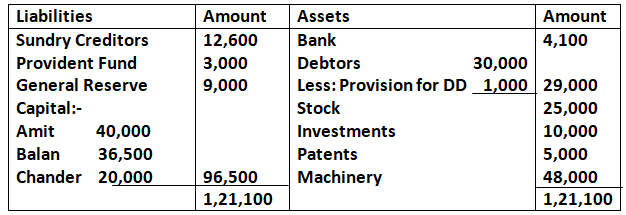

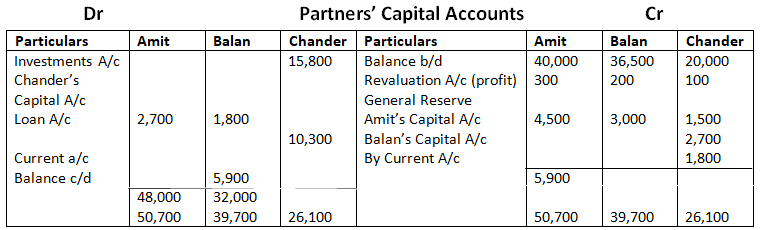

47. Amit, Balan and Chander were partners in a firm sharing profits in the proportion of 1/2, 1/3 & 1/6 respectively. Chander retired on 1st April, 2014, the Balance Sheet of the firm on the date of Chander’s retirement was as follows:

It was agreed that:

- Goodwill will be valued at 27,000

- Depreciation of 10% was to be provided on machinery

- Patents were to be reduced by 20%

- An old photocopier previously written off was sold for 600

- Chander took over investments for 15,800

- Amit and Balan decided to adjust their capitals in proportion of their profit-sharing ratio by opening Current Accounts.

Prepare Revaluation Account and Partners’ Capital Accounts on Chander’s retirement.

Solution –

Dr Revaluation Account Cr

Working Note:-

Adjustment of Goodwill:-

Chander’s goodwill – 27,000 x 1/6 – 4,500

Amit – 4,500 x 3/5 – 2,700

Balan – 4,500 x 2/5 – 1,800

Adjustment of Capital

Old capitals of Amit = 44,800 (40,000 + 4,500 + 300) – 2,700 = 42,100

Old capitals of Balan = 39,700 (36,500 + 3,000 + 200) – 1,800 = 37,900

Total adjusted capital – 42,100 + 37,900 = 80,000

New profit sharing ratio – 3:2

Amit’s – 80,000 x 3/5 – 48,000

Balan’s – 80,000 x 2/5 – 32,000

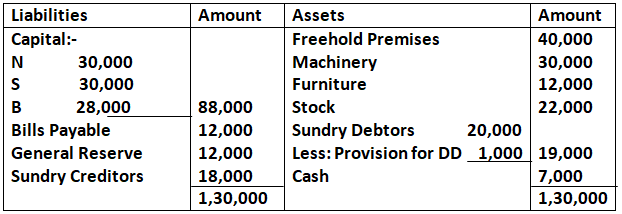

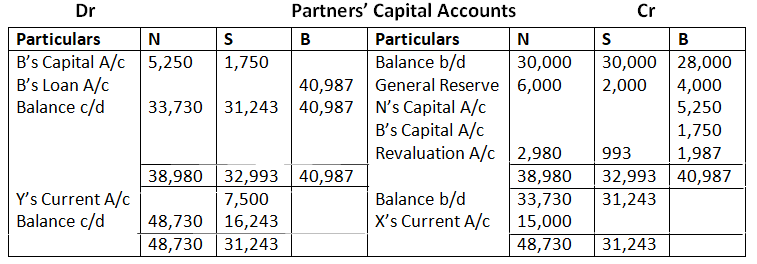

Q48. N, S & B were partners in a firm sharing profits & Losses in proportion of 1/2, 1/6 & 1/3 respectively. The balance Sheet of the firm as at 31st March, 2017 was as follows:

B retired from the business on the above date and the partners agreed to the following:

- Freehold premises and stock were to be appreciated by 20% & 15% respectively.

- Machinery and furniture were to be depreciated by 10% & 7% respectively.

- Provision for bad debts was to be increased by 1,500.

- On B’s retirement goodwill of the firm was valued at 21,000.

- The continuing partners decided to adjust their capitals in their new profit-sharing ratio after retirement of B. Surplus/deficit, if any, in their Capital Accounts was to be adjusted through their Current Accounts.

Prepare Revaluation Account, Partners’ Capital Accounts & the Balance Sheet of the reconstituted firm.

Solution –

Dr Revaluation Account Cr

Balance Sheet

As on April 1, 2017

Working Note:-

Calculation of Profit Sharing Ratio:-

Old Ratio – 3:1:2

B retires from the firm

New ratio – 3:1

Gaining ratio – 3:1

Adjustment of Goodwill:-

Goodwill of the firm – 21,000

B’s Goodwill – 21,000 x 2/6 – 7,000

When total capital of new firm is equal to total capital before retirement of a partner

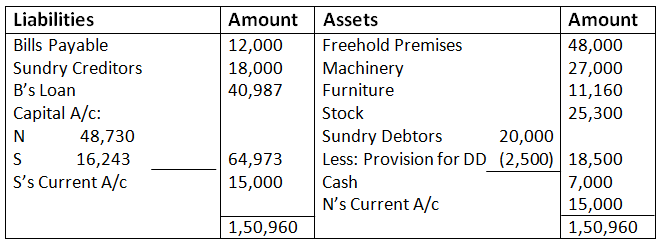

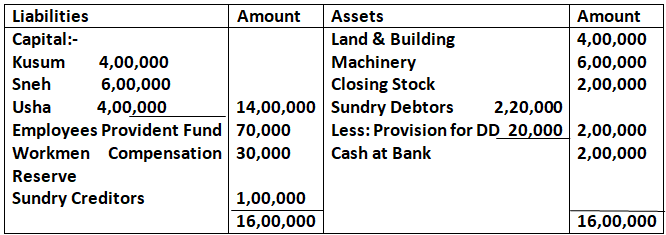

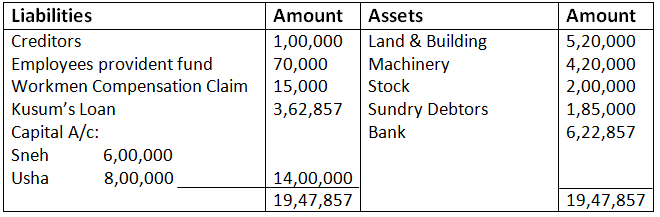

Q49. Following is the Balance Sheet of Kusum, Sneh & Usha as on 31st March, 2025, who have agreed to share profits & losses in proportion of their capitals:

On 1st April, 2025, Kusum retired from the firm and the remaining partners decided to carry on the business. It was agreed to revalue the assets and reassess the liabilities on that date, on that date, on the following basis:

- Land & Building be appreciated by 30%

- Machinery be depreciated by 30%

- There were Bad Debts of 35,000

- The Claim against Workmen Compensation Reserve was estimated at 15,000

- Goodwill of the firm was valued at 2, 80,000 and Kusum’s share of goodwill was adjusted against the capital accounts of the continuing partners Sneh & Usha who have decided to share future profits in the ratio of 3:4 respectively.

- Capital of the new firm in total will be the same as before the retirement of Kusum and will be in the new profit-sharing ratio of the continuing partners.

- Amount due to Kusum be settled by paying 1, 00,000 in cash and balance by transferring to her Loan Account which will be paid later on.

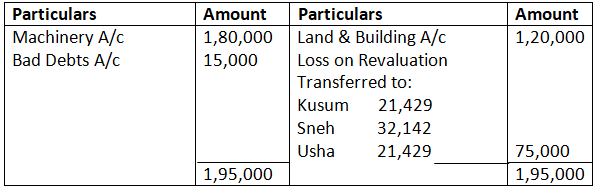

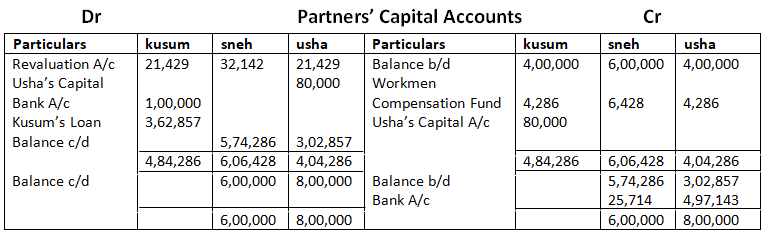

Prepare Revaluation Account, Capital Accounts of Partners and Balance Sheet of the new fir after Kusum’s retirement.

Solution –

Dr Revaluation Account Cr

Balance Sheet

As on March 31, 2025

Working Note:-

Calculation of Gaining Ratio:-

Old Ratio – 2:3:2

New Ratio – 3:4

Gaining Ratio = New Ratio – Old Ratio

Sneh’s – 3/7 – 3/7 = Nil

Usha’s – 4/7 – 2/7 = 2/7

Adjustment of Goodwill

Total Goodwill of the firm – 2, 80,000

Kusum’s = 2, 80,000 x 2/7 – 80,000

Only usha compensate to kusum full amount 80,000

Adjustment of Capital

Firm capital before Kusum’s retirement – 14, 00,000

New ratio – 3:4

Sneh’s – 14, 00,000 x 3/7 – 6, 00,000

Usha – 14, 00,000 x 4/7 – 8, 00,000

When the Retiring Partner is to be paid from amount brought by the remaining partners in a manner to make their capitals Proportionate to New Profit-Sharing Ratio

Q50. Lal, Bal & Pal are partners sharing profits in the ratio of 5:3:7. Lal retired from the firm. Bal & Pal decided to share future profits in the ratio of 2:3. The adjusted Capital Accounts of Bal & Pal showed balances of 49,500 & 1, 05,750 respectively. The total amount to be paid to Lal is 1, 35,750. This amount is to be paid by Bal & Pal in a manner that their capitals become proportionate to their new profit-sharing ratio.

Calculation the amount to be brought or to be paid to partners

Solution –

New Capital = 49,500 + 1, 05,750 + 1, 35,750 = 2, 91,000

BAL’s New Capital = 2, 91,000 x 2/5 = 1, 16,400

Pal’s New Capital = 2, 91,000 x 3/5 =1, 74,600

BAL = 1, 16,400 – 49,500 = 66,900

Pal = 1, 74,600 – 1, 05,750 = 68,850

Both bring the capital

Q51. Balance Sheet of X, Y & Z who shared profits in the ratio of 5:3:2, as on 31st March, 2025 was as follows:

Y retired on 1st April, 2025 and it was agreed that:

- Goodwill of the firm is valued at 1,12,500 & Y’s share of it be adjusted into the Capital Accounts of X & Z who are going to share future profits in the ratio of 3:2

- Fixed Assets be appreciated by 20%

- Stock is reduced to 75,000.

- Y is paid amount brought by X & Z so as to make their capital proportionate to their new profit-sharing ratio.

Prepare Revaluation Account, Capital Accounts of all partners and the balance Sheet of the New Firm.

Solution –

Dr Revaluation Account Cr

Balance Sheet

As on March 31, 2025

Working Note:-

New Capital = 1, 80,000 + 54,000 + 1, 33,500 = 3, 67,500

X’s – 3, 67,500 x 3/5 – 2, 20,500

Z’s – 3, 67,500 x 2/5 – 1, 47,500

X’s = 2, 20,500 – 1, 80,000 = 40,500

Z’s = 1, 47,500 – 54,000 = 93,000

Calculation of gaining ratio=

Old ratio=5:3:2

New profit sharing ratio=3:2

X=3/5-5/10=1/10

Z=2/5-2/10=2/10

Gaining ratio=2:1

Goodwill of the firm=112500 x 3/10=33750

X contribute=33750 x 1/3=11250

Y contribute= 33750 X 2/3=22500

When the Retiring Partner is to be paid from amount brought by the remaining partners in a manner to make their Capital Proportionate to New Profit-sharing Ratio and also leave a desired cash/bank Balance

Q52. Sushil, Satish and Samir are partners sharing profits in the ratio of 5:3:2. Satish retires on 1st April, 2025 from the firm, on which date capitals of Sushil, Satish and Samir after all adjustments are 1, 03,680, 87,840 & 26,880 respectively. The Cash and Bank Balance on that date was 9,600. Satish is to be paid through amount brought by Sushil and Samir in such a way as to make their capitals proportionate to their new profit-sharing ratio which will be Sushil 3/5 & Samir 2/5. Calculate the amount to be paid or to be brought by the continuing partners if minimum Cash and Bank balance of 7,200 was to be maintained and pass the necessary Journal entries.

Solution –

Capital of firm before retirement – 1, 03,680 + 87,840 + 26,880 = 2,18,400

Availability of cash =9,600 – 7,200 = 2,400

Combined new capital of Sushil & Samir = 2, 16,000(218400-2400)

Sushil’s new capital = 2, 16,000 x 3/5 = 1, 29,600

Existing capital = 1, 03,680

So, Sushil’s new capital = 2, 16,000 – 1, 03,680 = 25,920

Samir’s new capital = 2, 16,000 x 2/5 – 86,400

Existing capital = 26,880

So, Samir has to bring = 86,400 – 26,880 = 59,520

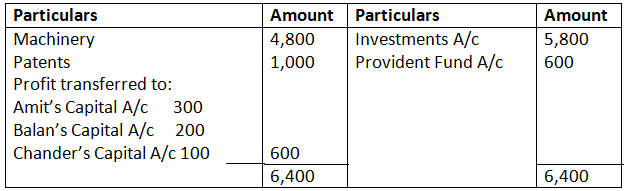

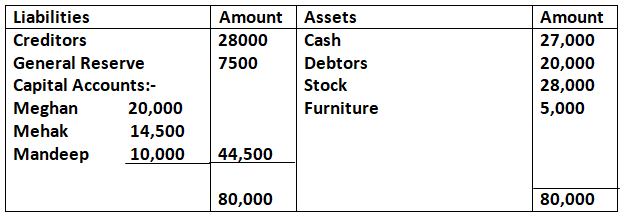

Q53. Meghna, Mehak and Mandeep were partners in a firm whose Balance Sheet as on 31st March 2023 was as under:

Balance Sheet

Mehak retired on this date under following terms:

- To reduce stock and furniture by 5% and 10% respectively.

- To provide for doubtful debts at 10% on debtors.

- Goodwill was valued at Rs.12,000.

- Creditors of Rs.8,000 were settled at Rs.7,100.

- Mehak should be paid off and the entire sum payable to Mehak shall be brought in by Meghna and Mandeep in such a way theat their capitals should be in their new profit-sharing ratio and a balance of Rs.25,000 is maintained in the Cash Account.

Prepare Revaluation Account and Partners’ Capital Accounts of the new firm.

Solution:-

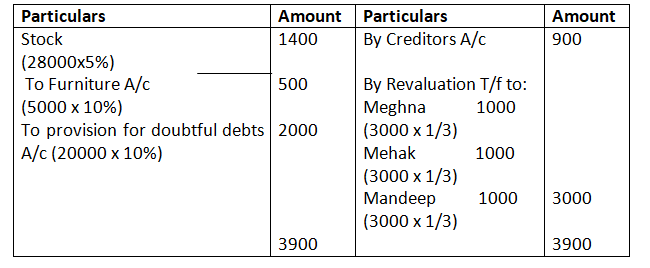

Dr Revaluation Account Cr

Calculation of Partners’ share in valued Goodwill of the firm

Goodwill of the firm = Rs.12,000

Mehak share in Goodwill = 12000 x 1/3 = Rs.4000

It would be contributed by Meghan and mandeep in their gaining ratio i.e., 1:1

Meghna would contribute = 4000 x 1/2 = Rs.2000

Mandeep would contribute = 4000 x 1/2 = Rs.2000

Journal Entry

Meghna capital A/c Dr. 2,000

Mandeep Capital A/c Dr. 2,000

To Mehak Capital A/c 4000

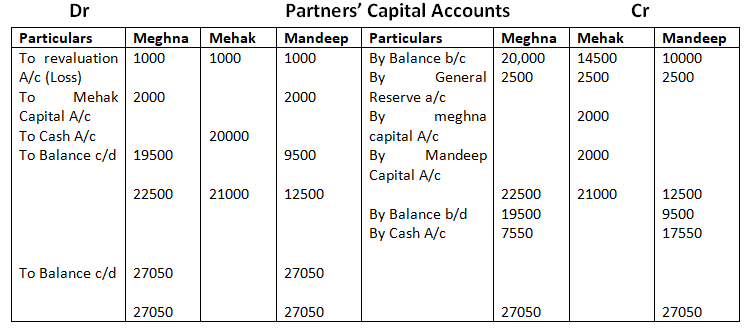

Calculation of partners’ capital in the new firm

Total capital in the new firm

= Adjusted capital of meghna + Adjusted capital of mandeep + Final payment to mehak + Deficit in cash Balance

= 19500 + 9500 + 20000 + 5100

= 34100

It would be maintained by meghna & mendeep in their new profit sharing ratio i.e., 1:1

= Meghna’s Captial in new firm = 34100 x 1/2 = 27050

= Mandeep’s Capital in new firm = 34100 x 1/2 = 27050

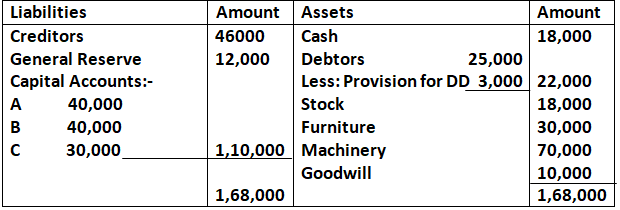

Q54. Suraj ,kamal and pawan are partners in a firm sharing profits and losses in the ratio of 3:2:1 .Their Balance Sheet as at 31st March, 2025 is:

B retired on 1st April, 2025 on the following terms:

- Provision for Doubtful Debts is raised by 1,000.

- Stock to be reduced by 10% and Furniture by 5%

- There is an outstanding claim of damages of 1,100 and it is to be provided for.

- Creditors will be written back by 6,000

- Goodwill of the firm is valued at 22,000

- B is paid in full with the cash brought in by A & C in such a manner that their capitals are in proportion to their profit-sharing ratio and cash in hand remains at 10,000

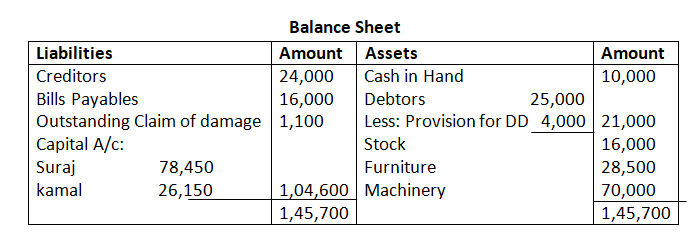

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of suraj and kamal.

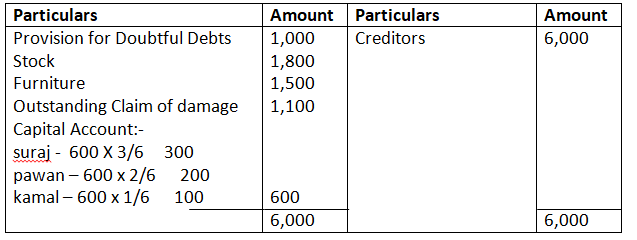

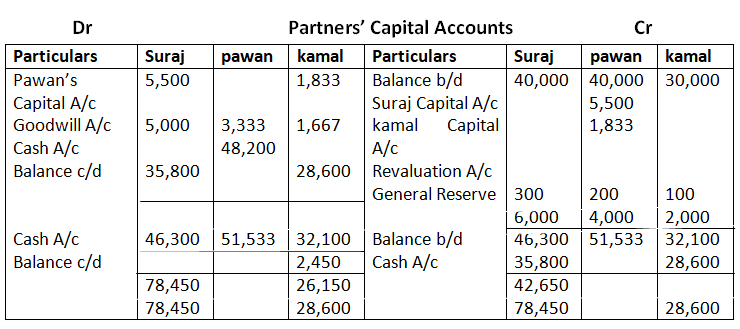

Solution –

Dr Revaluation Account Cr

Working Note:-

Calculation of New & Gaining Ratio:-

Old Ratio – 3:2:1

New Ratio – 3:1

Gaining Ratio = New Ratio – Old Ratio

Suraj – 3/4 – 3/6 = 6/24

kamal– 1/4 – 1/6 = 2/24

Gaining ratio – 3:1

Adjustment of Goodwill:-

Total goodwill of the firm – 22,000

pawan – 22,000 x 2/6 – 7,333

suraj compensated – 7,333 x 3/4 – 5,500

kamal compensated – 7,333 x 1/4 – 1,833

Adjustment of Capital:-

Total capital – 35,800 + 48,200 + 28,600 – (18,000 – 10,000) = 1, 04,600

suraj – 1, 04,600 x 3/4 – 78,450

kamal– 1, 04,600 x 1/4 – 26,150

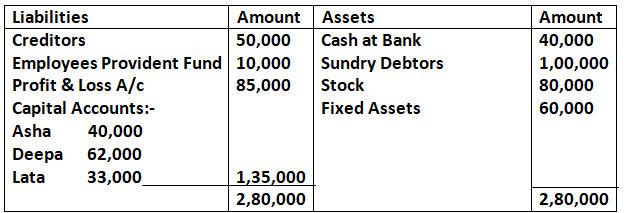

Q55. The Balance Sheet of Asha, Deepa & Lata who was were sharing profits in the ratio of 5:3:2 as at 31st March, 2025 are as follows:

Asha retired on 1st April, 2025 & Deepa & Lata decided to share profits in future in the ratio of 3:2 respectively.

The other terms on retirement were:

- Goodwill of the firm is to be valued at 80,000.

- Fixed Assets are to be depreciated to 57,500.

- Make a Provision for Doubtful Debts at 5% on Debtors.

- A liability for claim, included in Creditors for 10,000, is settled at 8,000.

The amount to be paid to Asha by Deepa & Lata in such a way that their Capitals are proportionate to their profit-sharing ratio & leave a balance of 15,000 in the Bank Account. Prepare Revaluation Account and Partners’ Capital Accounts.

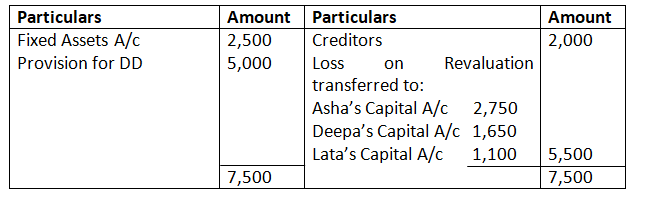

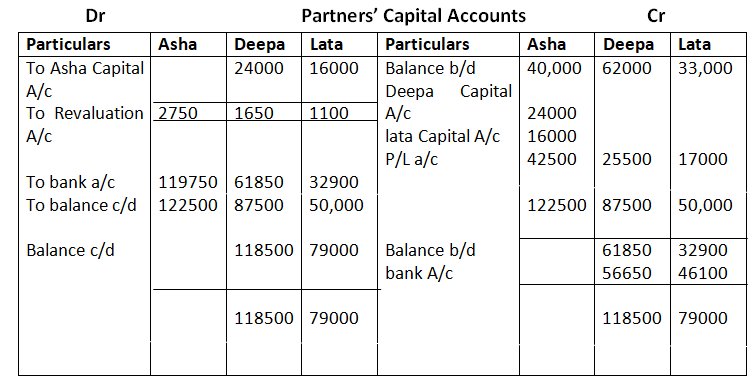

Solution –

Dr Revaluation Account Cr

Retirement of Partner in between the year

Q56. Amrit, Bhanu & Charu were partners in firm sharing profits equally. Bhanu retired on 30th September, 2024. Profit till the date of retirement was to be estimated based on last year profit. Profit for the year ended 31st March, 2024 was 3, 60,000.

Calculate Bhanu’s share of profit till his retirement and pass Journal entry/entries for the same when:

- The profit-sharing ratio between Amrit & Charu does not change

- The new profit-sharing ratio between Amrit & Charu changes to 3:2.

Solution –

1.

Profits for the year = ₹ 3,60,000

Bhanu retired on 30th September

Bhanu share in profit = 3,60,000 x 1/3 x 6/12

= ₹ 60,000

Case – I

Profit & loss suspense A/c Dr. 60,000

To Bhanu capital A/c 60,000

(Being profit credited to Bhanu)

Case – II

Old ratio of Amrit, Bhanu, charu = 1:1:1

New ratio of Amrit, charu = 3:2

Amrit = 3/5 – 1/3 = 9 – 5/15 = 4/15

Charu = 2/5 – 1/3 = 6 – 5/15 = 1/15

Gaining ratio= 4:1

Bhanu share in profit 3,60,000 x 1/3 x 6/12 = 60,000

Amrit will contribute = 60,000 x 4/5 = ₹ 48,000

Charu will contribute = 60,000 x 1/5 = ₹ 12,000

Journal Entry

Amrit’s capital A/c Dr. 48,000

Charu’s capital A/c Dr. 12,000

To Bhanu’s capital A/c 60,000

(Being Bhanu’s share in profit adjusted)

Q57. Amar, Bhuvi & Charan were partners in firm sharing profits equally. Bhuvi retired on 30th September, 2024. Profit or loss till the date of retirement was to be estimated based on last year’s profit. Loss for the year ended 31st March, 2024 was 1, 80,000.

Calculate Bhuvi’s share of loss till her retirement & Pass Journal entry/ entries for the same when:

- The profit-sharing ratio between Amar & Charan does not change

- The new profit-sharing ratio between Amar & Charan changes to 3:2

Solution –

Loss for the year = 1,80,000 Bhuvi retired on 30th September

Bhuvi’s ‘share in loss = 1,80,000 x 1/3 – 6/12

= ₹ 30,000

Case – I

Bhuvi capital A/c Dr. 30,000

To profit & loss suspense A/c 30,000

(Being Bhuvi share is debited)

Case – II

Old ratio of Amar, Bhuvi, charan = 1:1:1

New ratio of Amar, charan = 3:2

Amar = 3/5 – 1/3 = 9 – 5/15 = 4/15

Charan = 2/5 – 1/3 = 6 – 5/15 = 1/15

4:1

Bhuvi share in loss 1,80,000 x 1/3 x 6/12 = 30,000

Amar will get = 30,000 x 4/5 = ₹ 24,000

Charan will get = 30,000 x 1/5 = ₹ 6,000

Journal Entry

Bhuvi’s capital A/c Dr. 30,000

To Aman’s capital A/c 24,000

To Charan’s capital A/c 6,000

(Being Bhuvi’s share in loss adjusted)

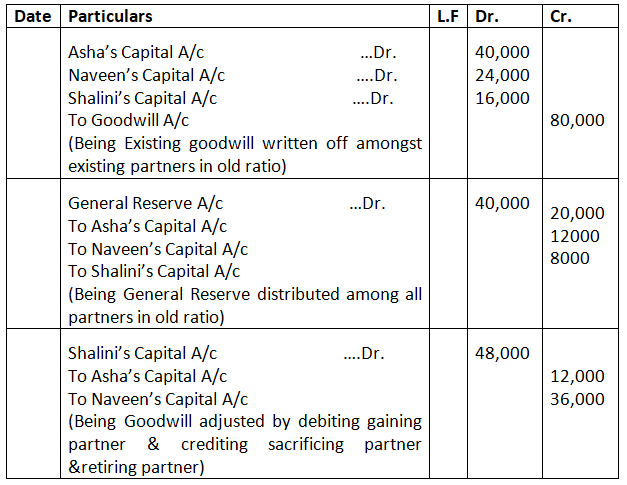

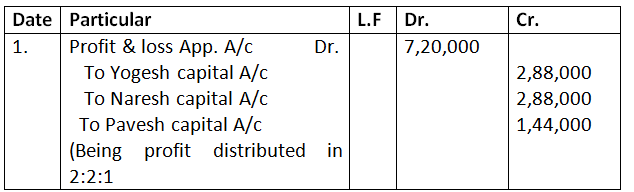

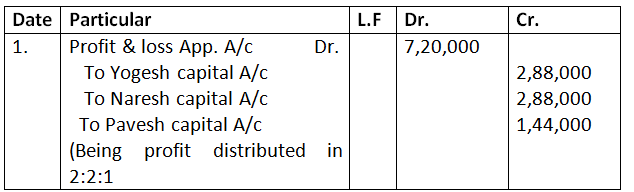

Q58. Yogesh, Naresh & Pavesh were partners in firm sharing profits in the ratio 2:2:1. Naresh retired on 1st October, 2024. In terms of the Partnership Deed, financial statements were prepared as on date of retirement and profit was determined as 7, 20,000.

- Pass the Journal entries for distribution of profit for the period

- Pass the Journal entries if loss of 3, 60,000 was incurred.

Solution –

Case-a Journal Entry

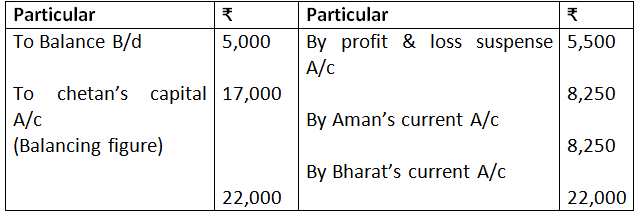

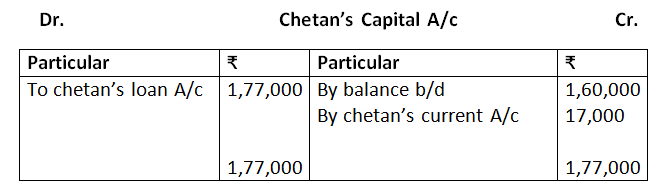

Q59. The Partnership Deed of Aman, Bharat & Chetan as a clause that any partner may retire from the firm on the following terms by giving six months’ notice in writing .The retiring partner shall be paid:

- The amount standing to the credit of his Capital Account and Current Account

- His share of profit to the date of retirement, calculated on the basis of the average profit of the three preceding completed years, if he retires in-between the year.

- His share of Goodwill of the firm calculated on the basis of 1 ½ times the average profit of the three preceding completed years.

- Assets shall be revalued and liabilities re-assessed. Retiring partner will get his share in the gain (profit) and will bear loss, if any.

Chetan gave notice on 31st March, 2024 to retire with effect from 30th September, 2024. On that date, the balance of his capital was 1, 60,000 &* his Current Accounts (in debit) 5,000. The profits for the three preceding completed years were: 1 – 45,000; 2 – 30,000 & 3 – 24,000.

Revaluation of assets & reassessment of liabilities resulted in neither gain (profit) nor loss. What amount is due to Chetan in accordance with the partnership agreement?

Solution –

Dr. Chetan’s Current A/c Cr.

Calculation of Chetan’s share in profit of the firm

Avg. profit of cast = 45,000 + 30,000 + 24,000 / 3

= 99,000 / 3= ₹ 33,000

Chetan’s share in 6 month = 33,000 x 6/12 x 1/3

= 5,500

Calculation of chetan’s share in goodwill

Goodwill of the = Avg. profit of cast x 3/2

3 year

= 33,000 x 3/2

= ₹ 49,500

Chetan’s share in goodwill = 49,500 x 1/3

= ₹ 16,500

It is contributed by aman & bhart in theier ganing ratio i.e = 1:1

Aman contributes = 16,500 x 1/2 = ₹ 8,250

Bhart contributes = 16,500 x 1/2 = ₹ 8,250

Journal Entry

Aman’s current A/c Dr. 8,250

Bhart’s current A/c Dr. 8,250

To chetan’s current A/c 16,500

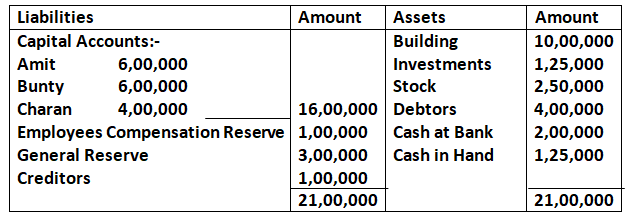

Q60. Amit, Bunty & Charan are partners sharing profits & losses in the ratio of 2:2:1. Charan retired on 30th June, 2025. The Balance Sheet of the firm on 31st March, 2025 was as follows:

It was agreed that amount payable to Charan will be determined by making following adjustments:

- Building be valued at 12,00,000

- Investment be valued at 1,00,000

- Stock to be valued at 3,00,000

- Goodwill of the firm be valued at 2 years purchase of average profit of last 5 years

- Charan’s share of profit up to the date of retirement is calculated on the basis of average profit of the preceding three years.

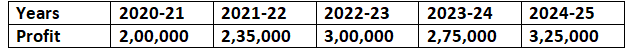

Profits of the preceding five years were as under:

Prepare Revaluation Account, Partners’ Capital Accounts & Balance Sheet after Charan’s retirement.

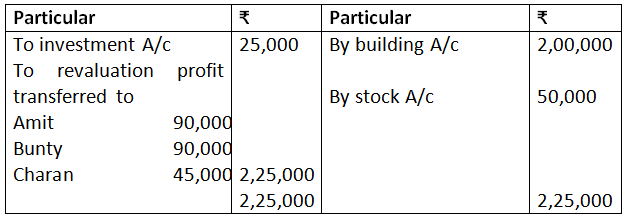

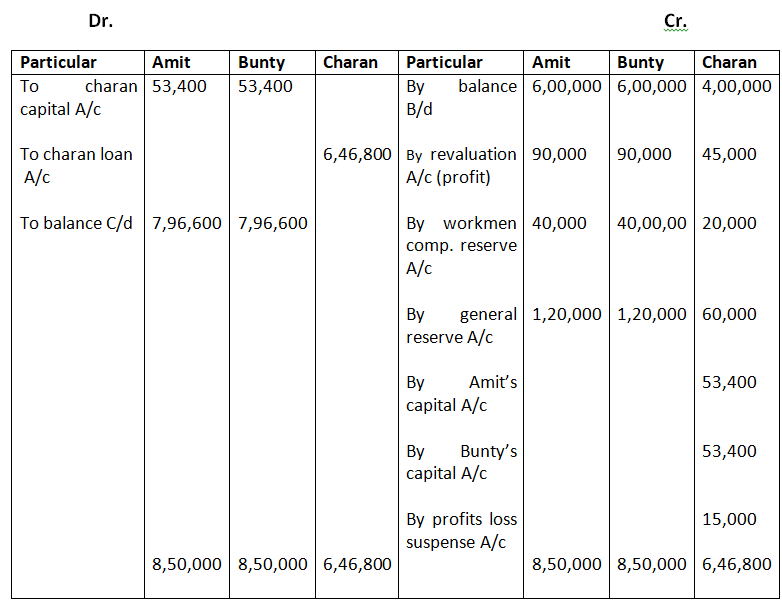

Solution –

Dr. Revaluation A/c Cr.

Calculation of goodwill of the firm

Avg. profit of cost = 2,00,000 + 2,35,000 + 3,00,000 + 27,500 + 3,25,000 / 5

= 13,35,000/5

= ₹ 2,67,000

Goodwill of the firm = Avg. profit of cast x 2 year purchase 5 year

= 2,67,000 x 2

= 5,34,000

Charan’s share in goodwill = 5,34,000 x 1/5

= ₹ 106800

Charan will be compensated by Amit & Bunty in 1:1

Amit will contribute = 106800 x ½ = ₹ 53,400

Bunty will contribute = 106800 x ½ = ₹ 53,400

Calculation of charan’s share in profit

Avg. profit of cost 3 year = 3,00,000 + 27,500 + 3,25,000 / 3

= 90,00,000 / 3 = ₹ 3,00,000

Charan’s share in profit = 3,00,000 x 3/2 x 1/5

= 15,000