Calculation of New Profit-Sharing Ratio and Sacrificing Ratio:-

Q1. Jiten and Rajiv are partners sharing profits in the ratio of 3;2. They admit Bikram as a partner for 1/5th profit share.

Determine profit-sharing ratio after admission of Bikram.

Solution-

Old Ratio – 3:2

bikram is admitted for 1/5 share of profit

Let the combined share of profit for all partners after Bikram’s admission be = 1

Combined share of jiten and rajiv after bikram’s admission = 1 – bikram share = 1 – 1/5 =4/5

New Ratio = Old Ratio x Combined Share of jiten and rajiv and bikram

Jiten=3/5×4/5=12/25

Rajiv=2/5×4/5=8/25

Bikram=1/5

New profit sharing Ratio:-

Jiten : rajiv : Bikram

12:8:5

Q2. Girija ,Yatin ,Zubin are partners sharing profits and losses in the ratio of 5:3:2. They admit Suresh into partnership and give him 1/5th share of profits. Find the new profit-sharing ratio.

Solution – Old Ratio – 5:3:2

Suresh is admitted for 1/5 share of profit

Let the combined share of profit for all partners after Suresh’s admission be = 1

Combined share of Raj, Ram and Ramesh after Suresh’s admission = 1 – Suresh share = 1 – 1/5 =4/5

New Ratio = Old Ratio x Combined Share of Raj, Ram and Ramesh

Girija = 5/10 x 4/5 = 20/50

Yatin = 3/10 x 4/5 = 12/50

Zubin = 2/10 x 4/5 = 8/50

New profit sharing Ratio:-

Girija

Yatin

Zubin

Suresh

10:6:4:5

Q3 . A & B are partners sharing profits and losses in the proportion of 7:5. They agree to admit C. their manager, into partnership that is to get 1/6th share in the profits. He takes this share as 1/24th from A and 1/8th from B. calculate new profit-sharing ratio.

Solution – Old Ratio – 7:5

C admits for 1/6 share of profit

A sacrifices his share of profit in favour of C – 1/24

B sacrifices his share of profit in favour of C – 1/8

New Ratio = Old Ratio – Sacrificing Ratio

A’s = 7/12 – 1/24 = 13/24

B’s = 5/12 – 1/8 = 7/24

New Profit-sharing ratio

A

B

C

13:7:4

Q4. X, Y and Z were partners in a firm sharing profits in the ratio of 3:2:1. They admitted A as a new partner for 1/8th share in the profits, which he acquired 1/16th from Y and 1/16th from Z. Calculate the new profit-sharing ratio of X, Y, Z and A.

Solution – X, Y, Z, shares profits in the ratio of 3:2:1

a’s share – 1/8 (he acquire 1/16 from y and 1/16 from z)

x’s Share – 3/6

y’s new share – 2/6 – 1/16 =13/48

x’s new share – 1/6 – 1/16 =5/48

New profit sharing ratio of X, Y, Z and after making base equal

= 3/6 x 8/8 : 13/48 : 1/6 x 8/8 : 1/8 x 6/6

= 24 : 13 : 5 : 6

Q5. Bharati and Astha were partners sharing profits in the ratio of 3:2. They admitted Dinkar as a partner for 1/5th share in the future profits of the firm which he got equally from Bharati and Astha. Calculate the new-sharing ratio of Bharati, Astha and Dinkar.

Solution – Calculation of New Profit Sharing Ratio:-

Bharti: Astha – 3:2 (Old Ratio)

Dinkar – 1/5

Bharti’s Sacrifice – 1/5 x 1/2 = 1/10

Astha’s Sacrifice – 1/5 x 1/2 = 1/10

Bharti’s New share – 3/5 – 1/10 = 6-1 = 5/10

Astha’s new share – 2/5 – 1/10 = 4 – 1/10 = 3/10

Dinkar’s new share – 1/5 x 2/2 = 2/10

Bharti: Astha: Dinkar – 5:3:2 (New Ratio)

Q6. Mohan and Mahesh are partners sharing profits and losses in the ratio of 3:2. Nusrat is admitted as partner with 1/4 shares in profit. Nusrat takes his share from Mohan and Mahesh in the ratio of 2:1. Calculate new profit-sharing ratio.

Solution – Old Profit Sharing Ratio amongst Partners (Mohan & Mahesh) is 3:2

Nusrat is admitted for 1/4th share in Profits

Sacrificing Ratio of Mohan and Mahesh is 2:1

Nusrat acquires = 2/3 x 1/4 = 2/12 from Mohan

Nusrat acquires = 1/3 x 1/4 =1/12 from Mahesh

New ratio – old ratio – new ratio

Mohan’s new share -=3/5 – 2/12 = 36-10/60 -=26/60

Mahesh’s new share = 2/5 – 1/12 =24-5/60 = 19/60

Nusrat’s share =1/4 – 15/60

New profit sharing ratio of partners after making base equal

= 26/60 : 19/60 : 1/4 x 15/15

= 26:19:15

Q7. S, B and J were partners in a firm. T was admitted as a partner in the partnership firm for 1/5th share of profit. Calculate the sacrificing ratio of S, B and J.

Solution – Old ratio: S: J: B – 1:1:1

T is admitted for 1/5 share

Let the total Profit of firm be 1

Remaining share of the S J B after T’s admission – 1-1/5 = 5-1/5 = 4/5

New share

S – 4/5 × 1/3 – 4/15

S – 4/5 × 1/3 – 4/15

S – 4/5 × 1/3 – 4/15

T – 1/5 × 3/3 – 3/15

New profit sharing ratio of all partners S: J: B: T – 4:4:4:3

Sacrificing ratio – Old ratio – new ratio

S = 1 /3 – 4/15 = 5-4/15 = 1/15

J = 1 / 3 – 4/15 = 5-4/15 = 1/15

B = 1 / 3 – 4/15 = 5-4/15 = 1/15

Sacrificing ratio of S: J: B

= 1/21 : 1/21 : 1/21

= 1:1:1

Q8. P and Q were partners in a firm sharing profits in the ratio of 5:3. R was admitted for 1/4th share in the profit of which he took 75% from P and the remaining from Q. calculate the sacrificing ratio of P and Q.

Solution –

Calculation of New Profit sharing ratio

R’s share in profit = ¼

R received form Q = 1/4 x 75/100

= 75/400

R received from Q = 1/4 x 25/100

= 25/400

P’s New share in profit = 5/8 – 75/400

= 250 – 75/400

= 175/400

Q’s New share in profit = 3/8 – 25/400

= 150 – 25/400

= 125/400

Partners’ New profit sharing ratio after making base equal

= 175/400 : 125/400 : ¼ x 100/100

= 175 : 125 : 100

= 7 : 5 : 4

Calculation of Sacrificing Ratio of partners

Sacrificing Ratio of P & Q

P’s Sacrifice = 5/8 – 7/16

= 10 – 7/16

= 3/16

Q’s Sacrifice = 3/8 – 5/16

= 6 – 5/15

= 1/16

Sacrificing Ratio of P & Q = 3:1

Q9. Adil and Suresh are partners in a firm sharing profits and losses in the ratio of 7:3. Adil gave 2/10th from his share and Suresh gave 1/10th from his share to Jagan, the new partner. Calculate new profit-sharing ratio and sacrificing ratio.

Solution – Calculation of New Ratio Old Ratio of Kabir and Farid 7:3

Kabir sacrifices his share of profit in favour of Jyoti = 2/10

Farid sacrifices his share of profit in favour of Jyoti =1/10

Jyoti’s Share = 2/10 + 1/10 = 3/10

New Ratio = Old Share – Share Sacrificed

Kabir’s New Share = 7/10 – 2/10 = 5/10

Farid’s New Share =3/10 – 1/10 = 2/10

New Profit Sharing Ratio

= 5/10 : 2/10 : 3/10

= 5:2:3

Calculation of Sacrificing Ratio

Adil’s Sacrifice = 7/10 – 5/10 = 2/10

Suresh’s Sacrifice = 3/10 – 2/10 = 1/10

Sacrificing Ratio of Adil’s Suresh

= 2: 1.

Q10. Find New Profit-sharing Ratio:

Solution –

- R and T are partners in a firm sharing profits in the ratio of 3:2. S joins the firm. R surrenders 1/4th of his share and T 1/5th of his share in favour of S.

- Old Ratio – 3:2

Sacrificing Ratio = Old share x Surrender Ratio

R’s share=3/5 x 1/4 = 3/20

T’s share= 2/5 x 1/5 = 2/25

New Ratio = Old Ratio – Sacrificing Ratio

R share 3/5 – 3/20 = 9/20

T share 2/5 – 2/25 = 8/25

S’s Share = R’s Sacrificing + S’s Sacrifice

-=3/20 + 2/25 = 23/100

New Profit-sharing ratio

R = 9/20 x 5/5= 45/100 = 45

T = 8/25x 4/4 = 32/100 = 32

S – 23/100 = 23/100 = 23

New profit sharing ratio

45:32:23

ii. A & B are partners. They admit C for 1/4th share. In future, the ratio between A & B would be 2:1.

II. Old Ratio – 1:1

C admits for 1/4th share of profit

Let the combined share of A, B and C be = 1

Combined share of A and B -=1 – C’s share

= 1 – 1/4 = 3/4

New Ratio = Combined share of A and B x 2:1

A’s = 3/4 x 2/3 – 6/12

B’s = 3/4 x 1/3 – 3/12

New Profit sharing ratio

A = 6/12

B = 3/12

C = 1/4 x 3/3=3/12

New profit share

6:3:3

2:1:1

iii. A & B are partners sharing profits and losses in the ratio of 3:2. They admit C for 1/5th share in the profit. C acquires 1/5th of his share from A and 4/5th share from B.

III. Old Ratio – 3:2

C admits for 1/5th share of profit

A’s sacrifice = C’s share x 1/5

= 1/5 x 1/5 = 1/25

B’s sacrifice = C’s share x 4/5

= 1/5 x 4/5 = 4/25

New Ratio = Old Ratio – Sacrificing Ratio

A’s share 3/5 – 1/25 = 14/25

B’s share 2/5 – 4/25 = 6/25

New Profit sharing ratio

A – 14/25

B – 6/25

C – 1/5 x 5/5 = 5/25

14:6:5

IV. A, B and C are partners in the ratio of 1/2:1/3:1/6. D joins the firm as a new partner for 1/6th share in profits. C would retain his original share.

IV. Old Ratio = 3:2:1

D admits for 1/6th share of profit

Let combined share of all partner after D’s admission be = 1

Combined share of A and B in the new firm = 1 – Cs share – D’s share

= 1 – 1/6 – 1/6 = 4/6

New Ratio = Old Ratio x Combined share of A and B

A’s = 3/5 x 4/6 = 12/30

B’s = 2/5 x 4/6 = 8/30

New Profit sharing ratio

A = 12/30 = 12/30 = 12

B = 8/30 = 8/30 = 8

C = 1/6 = 5/30 = 5

D = 1/6 = 5/30 = 5

V. A & B are equal partners. They admit C and D as partners with 1/5th and 1/6th share respectively.

V. Old Ratio = 1:1

C admits for 1/5th share

D admits for 1/6th share

Let combined share of all partner after C’s and D’s admission be = 1

Combined share of profit A and B after C and D’s admission = 1 – C’s share – D’s share

= 1 – 1/5 – 1/6 = 19/30

New Ratio = Old Ratio x Combined share of A and B

A’s = 1/2 x 19/30 = 19/60

B’s = 1/2 x 19/30 = 19/60

New Profit sharing ratio

A = 19/60 = 19/60 = 19

B = 19/60 = 19/60 = 19

C = 1/5 = 12/60 = 12

D = 1/6 = 10/60 = 10

VI. A & B are partners sharing profits in the ratio of 5:3. C is admitted for 3/10th share of profit half of which was gifted by A & the remaining share was taken by C equally from A & B.

VI. A and B are partners sharing profits in the ratio of 5:3

C’s share is 3/10th

Gift by A to C = 3/10 x 1/2 = 3/20

Remaining half taken by C from A and B equally

From A and B = 3/20 x 1/2 = 3/40

Given by A in total = 3/20 + 3/40 = 6 + 3/40 = 9/40

Remaining Share of A and B

A = 5/8 – 9/40 = 25 – 9/40 = 16/40

B = 3/8 – 3/40 = 15 = 3/40 = 12/40

New Ratio of A, B and C

= 16/40: 12/40: 3/10

= 4: 3: 3

Q11. Mahi and Rajat were in partnership sharing profits and losses in the ratio of 4:3. They admitted Kripa as a new partner. Kripa brought 60,000 as her share of goodwill premium which was entirely credited to Mahi’s Capital Account. On the date of admission, goodwill of the firm was valued at 420,000. Calculated the new profit-sharing ratio of Mahi, Rajat and Kripa

Solution – Kripa brought 60,000 as her share of goodwill premium

Share of Kripa = 60,000 / 4, 20,000 = 1/7 given by Mahi

Remaining share of Mahi = 4/7 – 1/7 = 3/7

New Ratio of

Mahi – 3/7

Rajat – 3/7

Kripa – 1/7

New ratio

3:3:1

Q12. Rakesh and Suresh are sharing profits in the ratio of 4:3. Zaheer joins and the new ratio among Rakesh, Suresh and Zaheer is 7:4:3. Find out the sacrificing ratio.

Solution –

Old Ratio = 4:3

New Ratio = 7:4:3

Sacrificing Ratio = Old Ratio – New Ratio

Rakesh’s = 4/7 – 7/14 = 1/14

Suresh’s = 3/7 – 4/14 = 2/14

Sacrificing sharing Ratio

Rakesh = 1/14

Suresh = 2/14

Sacrificing Ratio of Rakesh & Suresh = 1:2

Q13. A, B and C are partners sharing profits in the ratio of 4:3:2. D is admitted for 1/3rd share in future profits. What is the sacrificing ratio?

Solution – Old Ratio = 4:3:2

D is admitted for 1/3rd share of profit

Let the combined share of profit of A, B, C and D be – 1

Combined share of A, B and C after D’s admission = 1 – D’s share

= 1 – 1/3 = 2/3

New Ratio = Old Ratio x Combined share of A, B and C

A’s = 4/9 x 2/3 = 8/27

B’s = 3/9 x 2/3 = 6/27

C’s = 2/9 x 2/3 = 4/27

Sacrificing Ratio = Old Ratio – New Ratio

A’s – 4/9 – 8/27 – 4/27

B’s – 3/9 – 6/27 – 3/27

C’s – 2/7 – 4/27 – 2/27

Sacrificing sharing ratio

A = 4/27 = 4

B = 3/27 = 3

C = 2/27 = 2

Sacrificing Ratio = 4:3:2

Q14. Gautam and Yashica are partners sharing profits and losses in the ratio of 3:2. They admit Asma into partnership. Gautam gives 1/3rd of his share while Yashica gives 1/10th from his share to Asma. Calculate new profit-sharing ratio and sacrificing ratio.

Solution – Old Ratio of Gautam and Yashica is 3:2

Gautam’s sacrifice – 1/3 x 3/5 = 3/15 Yashica’s sacrifice = 1/10

Sacrificing Ratio – 3/15: 1/10 or 2:1

New ratio = Old ratio – Share Sacrificed

Gautam’s new share – 3/5 – 3/15 = 6/15

Yashica’s new share – 2/5 – 1/10 = 3/10

Asma’s share – 3/15 + 1/10 = 9/30

New Ratio – 6/15: 3/10: 9/30 = 4:3:3

Calculation of Sacrificing Ratio of Gautam & Yashica

Gautam = 3/5 – 4/10 = 6 – 4/10 = 2/10

Yashica = 2/5 – 3/10 = 4 – 3 /10 = 1/10

Sacrificing Ratio = 2 : 1

Q15. A, B and C are partners sharing profits in the ratio of 2:2:1. D is admitted as a new partner for 1/6th share. C will retain his original share. Calculate the new profit-sharing ratio and sacrificing ratio.

Solution – Calculation of New Profit Sharing Ratio:-

Old Ratio of A, B and C is 2:2:1

D is admitted for 1/6th share while. C will retain his 1/5 original share

Combine share of A,B,C=1

Remaining share of A and B=1-1/6-1/5=19/30

Remaining share will be shared by A and B in 2:2 (old)

A’s – 19/30 x 2/4 – 38/120

B’s – 19/30 x 2/4 – 38/120

C’s – 1/5 x 24/24 – 24/120

D’s – 1/6 x 20/20 – 20/120

A = 38 or 19

B = 38 or 19

C = 24 or 12

D 20 or 10

Calculation of Sacrificing Ratio:-

Sacrificing Ratio = Old ratio – new ratio

A’s = 2/5 – 19/60 = 24 – 19/60 = 5/60

B’s = 2/5 – 19/60 = 24 – 19/60 = 5/60

A: B = 5:5 = 1:1

Q16. A, B, C and D are in partnership sharing profits and losses in the ratio of 36:24:20:20 respectively. E joins the partnership for 20% share and A, B, C and D in future would share profit among them as 3/10:4/10:2/10:1/10. Calculated new profit-sharing ratio after E’s admission

Solution – Old ratio = 36: 24: 20: 20

E is admitted for 20/100 share means 1/5 share

Let combined share of profit of all partners = 1

Remaining share=1-1/5=4/5

Remaining share shared with A,B,C,D in

3/10 : 4/10 : 2/10 : 1/10

A’s New Share = 4/5 X 3/10 = 12/50

B’s New Share = 4/5 X 4/10 = 16/50

C’s New Share = 4/5 X 2/10 = 8/50

D’s New Share = 4/5 X 1/10 = 4/50

E’s share = 1/5 X 10/10 = 10/50

New profit sharing ratio after making base equal

12/50 : 16/50 : 8/50 : 4/50 : 1/5 x 10/10

= 12 : 16 : 8 : 4 : 10

= 6 : 8 : 4 : 2 : 5

Q17. Amit and Vidhya are partner sharing profits in the ratio of 3:2. They admit Chintan into partnership who acquires 1/5th of his share from Amit and 4/25th share from Vidya. Calculate new profit-sharing Ratio and Sacrificing ratio.

Solution – Calculation of New Profit Sharing Ratio:-

Amit: Vidya = 3:2 (Old Ratio)

Assume combine share=1

Chintan acquires 1/5th of his share from Amit and,

Remaining 4/5th (1 – 1/5) of his share from Vidya

If 4/5th share of Chintan = 4/25

Amit’s sacrifice = 1/5 x 1/5 = 1/25

Vidya’s sacrifice = 4/25

Chintan’s share = 4/25 +1/25 = 5/25

New share=old share-sacrificing share

Amit’s new share = 3/5 – 1/25 = 14/25

Vidya’s new share = 2/5 – 4/25 = 6/25

Chintan’s new share = 5/25

Amit: Vidya: R = 14:6:5

Sacrificing Ratio = 1:4

Q18. Anil and Bimal are partners. They admit Raman as a partner for 1/4th share. You are required to determine.

- Profit-sharing ratio between Anil and Bimal before Raman’s admission as a partner.

- Profit-sharing ratio after Raman’s admission and

- Sacrificing Ratio.

Solution-

I. Profit-sharing ratio between Anil and Bimal before Raman’s admission as a partner.(1:1)

II. Profit-sharing ratio after Raman’s admission

Lets assume profit=1

1-1/4=3/4

Anil share=3/4×1/2=3/8

Bimal share=3/4×1/2=3/8

Raman share=1/4

New share =3:3:2

III. Sacrificing Ratio.

Anil = old ratio- new ratio

1/2-3/8=1/8

Bimal = old ratio- new ratio

½-3/8=1/8

Sacrificing ratio=1:1

Admission of a partner and treatment of goodwill

Q19. Gold and silver are partners sharing profits and losses in the ratio of 2:5. They admit copper on the condition that he will bring 14,000 as his share of goodwill to be distributed between Gold and Silver. Copper’s share in the future profit or losses will be 1/4th. What will be the new profit-sharing ratio and what amount of goodwill brought in by Copper will be received by Gold and Silver?

Solution – Old Ratio = 2:5

Copper is admitted for 1/4 share

Let the combined share of gold, silver and Copper be = 1

Combined share gold, silver and Copper admission = 1 – Copper’s share

= 1 – 1/4 = 3/4

New Ratio = Old Ratio – Combined share of gold & silver

gold’s = 2/7 x 3/4 = 6/28

silver’s = 5/7 x 3/4 = 15/28

New profit sharing ratio:-

gold = 6/28 = 6/28 = 6

silver = 15/28 = 15/28 = 15

Copper = 1/4 = 7/28 = 7

= 6 : 15 : 7

Calculation of Sacrificing Ratio of Gold & silver

Gold Sacrifices = 2/7 – 6/28 = 8 – 6/28 = 2/28

Silver Sacrifices = 5/7 – 15/28 = 20 – 15/28 = 5/28

Sacrificing Ratio = 2:5

Distribution of Copper’s share of Goodwill or gold & silver will be covered

Copper’s share of Goodwill = 14,000

gold will get = 14,000 x 2/7 = 4,000

silver will get = 14,000 x 5/7 = 10,000

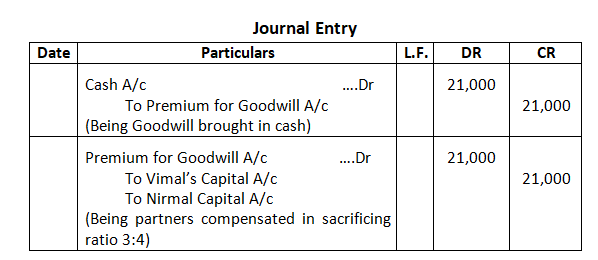

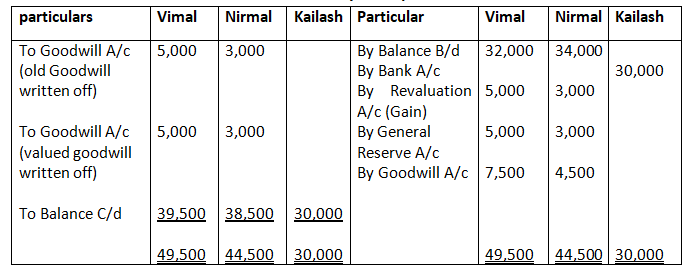

Q20. Vimal and Nirmal are partners in a firm sharing profits and losses in the ratio of 3:2. A new partner Kailash is admitted. Vimal gives 1/5th of his share and Nirmal gives 2/5th of his share in favour of Kailash. For the purpose of kailash’s admission, goodwill of the firm is valued at 75,000 and kailash bring his share of goodwill in cash which is retained in the business. Journalise the above transactions.

Solution – Old Ratio of Vimal & Nirmal is 3:2

Share of Profits Kailash will get from Vimal 1/5th

= 3/5 x 1/5 = 3/25

Share of Profits Kailash will get from Nirmal 2/5th of his share 2/5 = 2/5 x 2/5 = 4/25

Remaining of

Vimal = 3/5 – 3/25 = 12/25

Nirmal = 2/5 – 4/25 = 6/25

Share of Kailash = 3/25 + 4/25 = 3 + 4/25 = 7/25

= 12 : 6 : 7

New Profit sharing ratio of Vimal, Nirmal and Kailash = 12/25: 6/25: 7/25

Kailash bring his share of goodwill in cash = 75,000 x 7/25 = 21,000

Vimal and Nirmal will be compensated in sacrificing = 3:4

Vimal = 21,000 x 3/7 = 9,000

Nirmal = 21,000 x 4/7 = 12,000

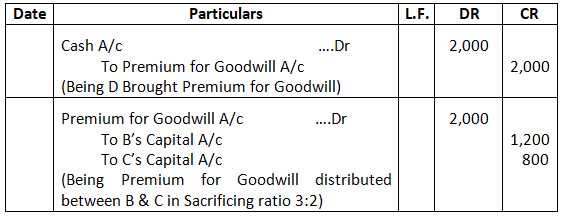

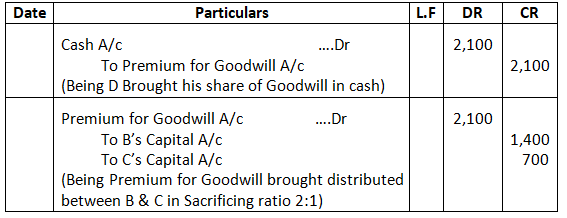

Q21. Pass Journal entries to record the following arrangements in the books of the firm:

- B & C are partners sharing profits in the ratio of 3:2. D is admitted paying a premium (goodwill) of 2,000 for 1/4th share of the profits, shares of B and C remain as before.

- B and C are partners sharing profits in the ratio of 3:2. D is admitted paying a premium of 2,100 for 1/4th share of profits which he acquires 1/6th from B and 1/12th from C.

Solution – (a) Journal Entry

(b) Journal Entry

Working Note (a):-

Calculation of New profit sharing ratio of B, C & D

Old Ratio of B & C = 3:2

D is admitted for = 1/4th share

Remaining share = 1 – 1/4 = 3/4

Remaining share would be distributed by B & C in 3:2

B’s New share = ¾ x 3/5 = 9/2-

C’s New share = 3/4 x 2/5 = 6/20

New profit sharing ratio after making base equal

9/20 : 6/20 : 1/4 x 5/5

9 : 6 : 5

Calculation of Sacrificing Ratio of B & C

B’s = 3/5 – 9/20 = 12 – 9 /20 = 3/20

C’s = 2/5 – 6/20 = 8 – 6/20 = 2/20

Sacrificing Ratio = 3 :2

Treatment of Goodwill

Premium of Goodwill brought in by D in Rs.20,000

It would be divided by B & C in their Sacrificing Ratio

B’s Share in Goodwill = 20,000 x 3/5 = 12000

C’s Share in Goodwill = 20,000 x 2/5 = 8,000

Working Note (b):-

Calculation of New profit sharing ratio of B, C & D

Old Ratio of B & C = 3:2

D’s share = 1/4

D received his share 1/6 from B & 1/12 from C

B’s New share = 3/5 – 1/6 = 18 – 5/30 = 13 /30

C’s New share = 2/5 – 1/12 = 24 – 5/60 = 19 /60

New profit sharing ratio after making base equal

13/30 x 2/2 : 19/60 : 1/4 x 15/15

26 : 19 : 15

Calculation of Sacrificing Ratio of B & C

B’s = 3/5 – 26/60 = 36 – 26/60 10/60

C’s = 2/5 – 19/60 24 – 19/60 = 5/60

Sacrificing Ratio of B & C = 10 : 5 = 2 : 1

Treatment of Goodwill

Premium of Goodwill brought in by D = 21,000

It in distributed by B & C in their Sacrificing Ratio

B’s share in premium of Goodwill = 21000 x 2/3 = 14000

C’s share in premium of Goodwill = 21000 x 1/3 = 7,000

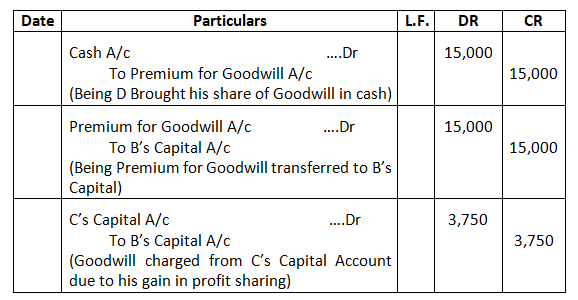

Q22. B & C are in partnership sharing profits and losses as 3:1. They admit D as partner in the firm, D pays premium of 15,000 for 1/3rd share of the profits. As between themselves, B and C agree to share future profits and losses equally. Draft Journal entries showing appropriations of the premium money.

Solution – Journal Entry

Working Note 1:-

Calculation of New profit sharing ratio of B, C & D

Old Ratio of B & C = 3 : 1

D is admitted for 1/3rd share

Remaining share = 1 – 1/3 = 2/3

Remaining share in distributed by B & C in 1 : 1

B’s New Share = 2/3 x 1/2 = 2/6

C’s New share = 2/3 x 1/2 = 2/6

New profit sharing ratio after making base equal

= 2/6 : 2/6 : 1/3 x 2/2

= 2 : 2 : 2 = 1 : 1 : 1

Calculation of Sacrificing Ratio

B = 3/4 – 1/3 = 9 – 4 /12 = 5/12 (Sacrifice)

C = 1/4 – 1/3 = 3 – 4 /12 = – 1/4 (Gain)

Calculation of Goodwill Treatment

Goodwill of the firm = 15000 x 3 =m 45,000

As c in also gaining he will also bring premium of Goodwill

C’s will bring = 45,000 x 1/12 = Rs.3750 (Debit0

B’s share in goodwill = 45,000 x 5/12 = Rs.18,750 (Credit)

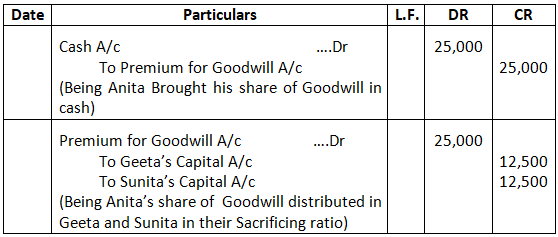

Q23. Geeta and Meeta are partners in a firm sharing profits in the ratio of 3:2. They admit Anita as a new partner. The new profit-sharing ratio between Geeta, Meeta and Anita will be 5:3:2. Anita brought in 25,000 for her share of premium for goodwill. Pass necessary Journal entries for the treatment of goodwill.

Solution – Journal Entry

Working Note 1:-

Calculating of Sacrificing Ratio

Sacrificing Ratio = Old ratio – new ratio

Geeta’s = 3/5 – 5/10 = 1/10

Sunita’s = 2/5 – 3/10 = 1/10

1:1

Working Note 2:-

Calculation of Treatment of Goodwill

Premium for Goodwill Brought in by Anita is Rs.25,000

Geeta share in Goodwill = 25,000 x 1/2 = Rs.12500

Meeta share in Goodwill = 25,000 x 1/2 = Rs.12500

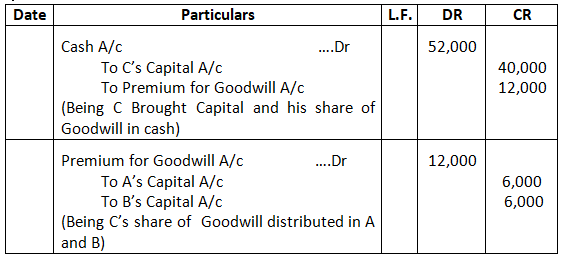

Q24. A & B are in partnership sharing profits and losses in the ratio of 5:3. C is admitted as a partner who pays 40,000 as capital and the necessary amount of goodwill which is valued at 60,000 for the firm. His share of profits will be 1/5th which he takes 1/10th from A and 1/10th from B. Pass Journal entries and also calculate future profit-sharing ratio of the partners.

Solution – Journal Entry

Working Note:-

Sacrificing Ratio = 1:1

Calculation of new profit sharing ratio:-

Old ratio = 5:3

New ratio = old ratio – sacrificing ratio

A’s = 5/8 – 1/10 = 21/40

B’s = 3/8 – 1/10 = 11/40

New profit sharing ratio after making base equal

= 21/40 : 11/40 : 1/5 x 8/8

= 21 : 11 : 8

Calculation of Sacrificing Ratio

A = 5/8 – 21/40 = 25 – 21/40 = 4/40

B = 3/8 – 11/40 = 15 – 11/40 = 4/40

Sacrificing Ratio = 4 : 4 = 1 : 1

Calculation of Amount of Goodwill

Premium for Goodwill brought in by C

= 60,000 x 1/5 = 12000

Rs.12000 is distributed by A & B in their profit sharing Ratio

A’s share in Goodwill = 12000 x 1/2 = 6000

B’s share in Goodwill = 12000 x 1/2 = 6000

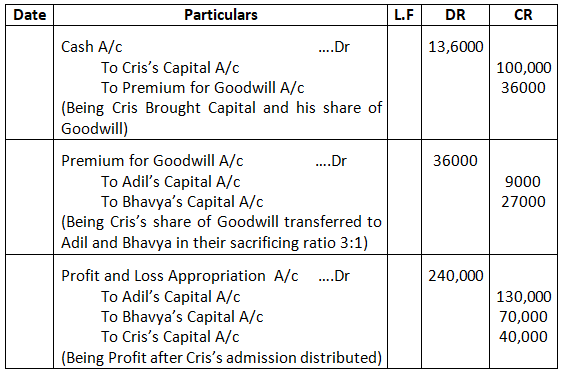

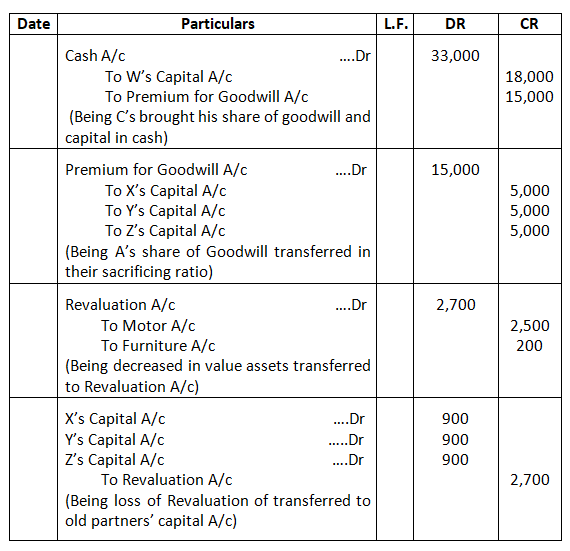

Q25. Adil and Bhavya are partners sharing profits and losses in the ratio of 7:5. They admit Kamal, their Manager, into partnership that is to get 1/6th share in the business. Kamal brings 1, 00,000 for his capital and 36,000 for the 1/6th share of goodwill which he acquires 1/24th from Adil and 1/8th from Bhavya. Profit for the first year of the new partnership was 2, 40,000. Pass necessary Journal entries for Kamal’s admission and apportion the profit between the partners.

Solution – Journal Entry

Working Note:-

Sacrificing Ratio:-

Adil – 1/24 = 1

Bhavya – 1/8 = 3

Distribution of Cris’s share of Goodwill (in sacrificing ratio):-

Adil – 3,6000 x 1/4 = 9000

Bhavya – 3,6000 x 3/4 = 27000

Calculation of New Profit Sharing Ratio

New ratio = old ratio – Sacrificing Ratio

Adil’s = 7/12 – 1/24 = 13/24

Bhavya’s = 5/12 – 1/8 = 7/24

New profit sharing ratio:-

Adil – 13/24 = 13/24 = 13

Bhavya – 7/24 = 7/24 = 7

Cris – 1/6 = 4/24 = 4

Distribution of Profit earned after Cris’s admission (in new ratio)

Adil – 240,000 x 13/24 = 130,000

Bhavya – 240,000 x 7/24 = 70,000

Cris – 240,000 x 4/24 = 40,000

Q26. Aayush and Aarushi are partners sharing profits and losses in the ratio of 3: 2. They admitted Naveen into partnership for 1/4th share. Goodwill of the firm was to be valued at three years’ purchase of super profit .Average net profit of the firm was 20,000. Capital Investment in the business was 50,000 and Normal Rate of Return was 10%. Calculate the amount of Goodwill premium brought by Naveen

Ans.-

Calculation of Goodwill of the firm

Normal Profit = Capital employed x Normal Rate of Return

= 50,000 x 10%

= Rs.5,000

Super profit = Average profit – Normal profit

= Rs.20,000 – Rs.5,000

= Rs.15,000

Goodwill = Super profit x 3 years of purchase

= 15,000 x 3

= Rs.45,000

Calculation the Amount of premium of Goodwill brought in by Naveen

Premium of Goodwill of Naveen = 45,000 x 1/4

= Rs.11250

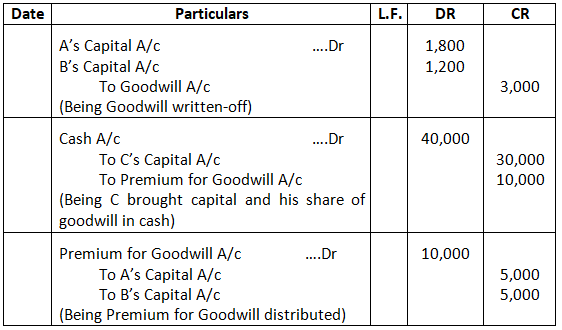

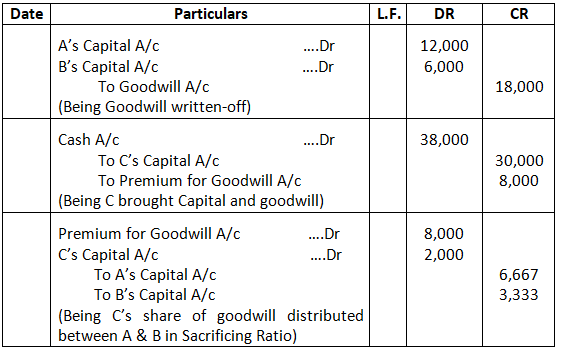

Q27. A & B are partners in a firm sharing profits and losses in the ratio of 3:2. They admit C into partnership for 1/5th share. C brings 30,000 as capital and 10,000 as goodwill. At the time of admission of C, goodwill appeared in the Balance Sheet of A & B at 3,000. New profit-sharing ratio of the partners will be 5:3:2. Pass necessary Journal entries.

Solution – Journal Entry

Working Note 1:-

Old Ratio = A: B: C – 3:2:3

New Ratio – A: B: C – 5:3:2

Sacrificing Ratio = Old Ratio – New Ratio

A’s = 3/5 – 5/10 = 1/10

B’s = 2/5 – 3/10 = 1/10

Sacrificing Ratio = X: Y – 1:1

Distribution of Premium for Goodwill C’s share of Goodwill:-

A = 10,000 x 1/2 = 5,000

B = 10,000 x 1/2 = 5,000

Goodwill written-off:-

A’s capital will be debited = 3,000 x 3/5 = 1,800

B’s Capital will be credited = 3,000 x 2/5 = 1,200

Q28. X and Y are partners sharing profits in the ratio of 5:3. Z is admitted as a partner for 3/10th share of profit, half of which was gifted by X and remaining share was taken by Z equally, form X and Y. The goodwill of the firm is valued at Rs.54,000. Z brings in his requisite share of firm’s goodwill. The profit for the first year of new partnership amounts to Rs.60,000.

Pass the necessary Journal entries to adjust goodwill and to distribute profits.

Solution-

Step 1: Calculation Sacrificing ratio

Old Ratio = X : Y

= 5 : 3

= 8

X’s old share = 5/8

Y’s od share = 3/8

Z’s new share = 3/10

Given:

Half of Z’s share = 3/20 gifted by X

Remaining 3/20 taken equally from X and Y = 3/40 each

Z’s share:

From X = 3/20 + 3/40

= 9/40

From Y = 3/40

Therefore:

X’s sacrifice = 9/40

Y’s sacrifice = 3/40

Let’s calculate their new shares

X’s new share = 5/8 – 9/40

= (25 – 9 )/ 40

= 16/ 40

Y’s new share = 3/8 – 3/40

= (15 – 3) / 40

= 12/40

Z’s new share = 3/10

= 12/40

New Ratio = X : Y : Z

= 16 : 12 : 12

= 4 : 3 : 3

Step 2 : Goodwill Adjustment

Goodwill of firm = Rs.54,000

Z’s share in goodwill = 3/10 x 54,000

= Rs.16,200

But:

Gifted portion (Rs.8,100) is not brought by Z (i.e., 3/20 x Rs.54,000)

Remaining goodwill Rs.8,100 is purchased, so brought in cash

Gifted Rs.8,100 is adjusted in capital accounts, not through cash.

Step 3 : Journal Entries

- Fore goodwill brought is cash by Z

Cash A/c Dr. 8,100

To premium for goodwill A/c 8,100

(Being goodwill brought by Z for 3/20 purchased share)

- Distribute goodwill (purchased part) to sacrificing partners

Sacrificing Ratio = X : Y

= 3:1

(As 9 /40 : 3/40)

X gets = Rs.8,100 x 3/4

= Rs.6.075

Y gets = 8,100 x 1/4

= Rs.2,025

Premium for goodwill A/c Dr. 8,100

To X’s Capital A/c 6,075

To Y’s Capital A/c 2,025

(Being goodwill distributed in sacrificing ratio)

- Adjust goodwill (gifted portion) in capital accounts

Z is receiving Rs.8,100 worth goodwill as a gift from X.

X’s Capital A/c Dr. 8,100

To Z’s Capital A/c 8,100

(Being goodwill gifted by X to Z adjusted)

Premium for Goodwill Brought in Kind:-

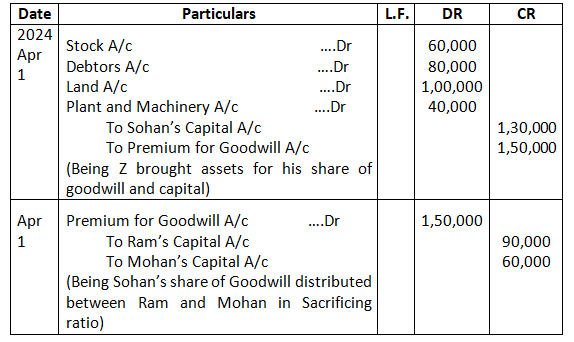

Q29. Ram and Mohan are partners in a firm sharing profits in the ratio of 3:2. On 1st April, 2024, they admit Sohan as a partner for 1/4th share in the profits. Sohan contributed following assets towards his capital and for his share of goodwill:

Stock 60,000; Debtor 80,000: Land 1, 00,000; Plant and Machinery 40,000.

On the date of admission of Sohan, the goodwill of the firm was valued at 600,000.Pass necessary Journal entries in the books of the firm on Sohan’s admission if:

- Partners do not withdraw the share of goodwill.

- Partners withdraw half of their share of goodwill.

Case-I

Solution – Journal Entry

Working Note:-

Sohan’s share of goodwill = 6, 00,000 x 1/4 = 1, 50,000

Distribution of Z’s Goodwill:-

Ram = 1, 50,000 x 3/5 = 90,000

Mohan = 1, 50,000 x 2/5 = 60,000

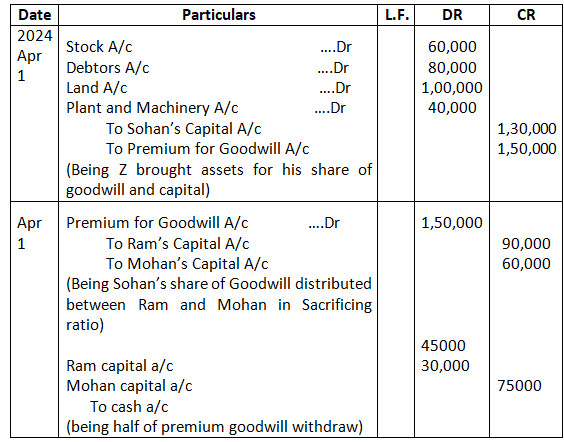

Case – II

When Premium for Goodwill is Brought in by New or Incoming Partner and is Withdrawn by Old Partners Fully or partly:-

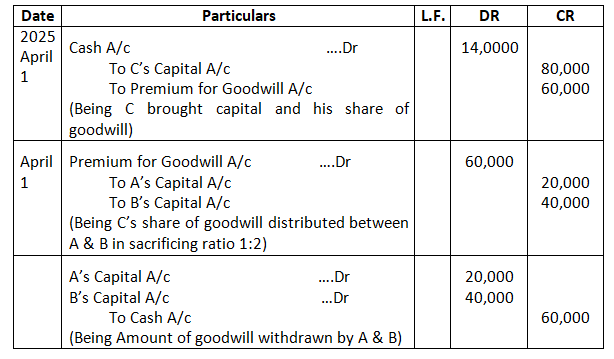

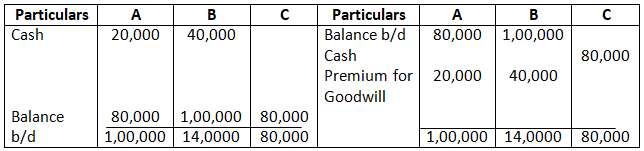

Q30. A & B are partners in a business sharing profits and losses in the ratio of 1/3rd and 2/3rd. on 1st April, 2025, their capitals were 80,000 and 1,00,000 respectively. On that date, they admit C in partnership and give him 1/4th share in the future profits. C brings 80,000 as his capital and 60,000 as goodwill. The amount of goodwill is withdrawn by the old partners in cash. Pass the Journal entries and show the capital Accounts of all the partners. Calculate proportion in which partners would share profits and losses in future.

Solution – Journal Entry

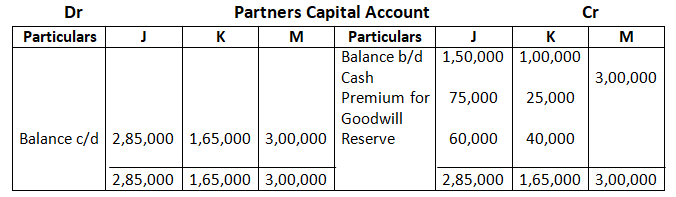

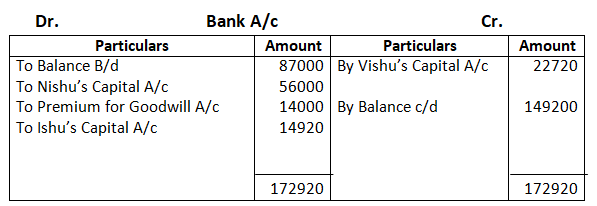

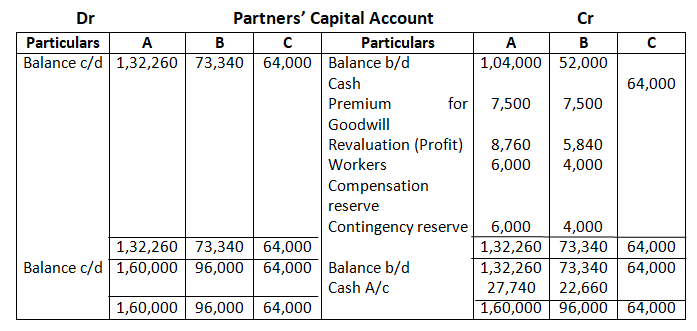

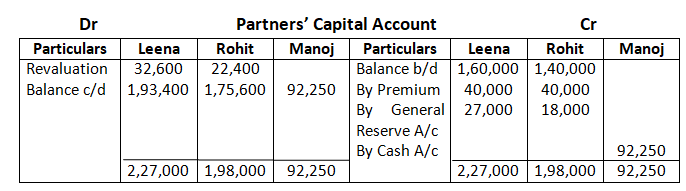

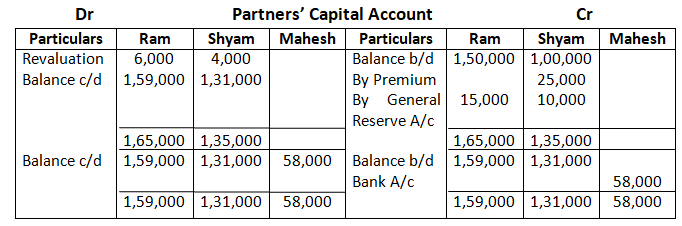

Dr Partners’ Capital Accounts Cr

Calculation of New (Future) Ratio:-

Old Ratio = A: B – 1:2

C is admitted for 1/4 share of profit

Let combined share of all partners after C’s admission be = 1

Combined share of A & B after C’s admission = 1 – C’s share = 1 – 1/4 = 3/4

New ratio = Old ratio x Combined share of A & B in the new firm

A’s = 1/3 x 3/4 = 3/12

B’s = 2/3 x 3/4 = 6/12

New profit sharing ratio = A: B: C – 1:2:1

Calculation of Sacrificing Ratio of A & B

A = 1/3 – 1/4 = 4 – 3/12 = 1/12

B = 2/3 – 2/4 = 8 – 6/12 = 2/12

Sacrificing Ratio = 1 : 2

Distribution of Premium for Goodwill:-

A = 6,000 x 1/3 = 2,000

B = 6,000 x 2/3 = 4,000

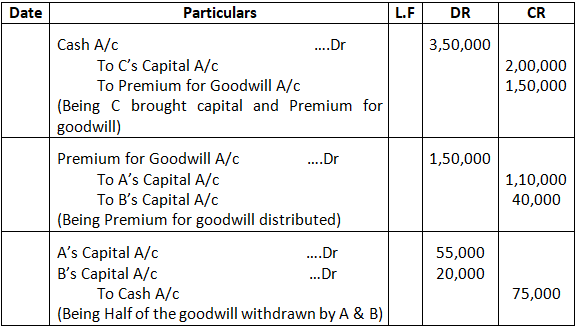

Q31. A & B were partners in a firm sharing profits and losses in the ratio of 3:2. They admitted C as a new partner for 3/7th share in the profit and the new profit-sharing ratio will be 2:2:3. C brought 2, 00,000 as his capital and 1, 50,000 as premium for goodwill. Half of their share of premium was withdrawn by A & B from the firm. Calculate sacrificing ratio and pass necessary Journal entries for the above transactions in the books of the firm.

Solution – Journal Entry

Calculation of Sacrificing Ratio:-

Sacrificing Ratio = Old ratio – new ratio

A’s = 3/5 – 2/7 = 11/35

B’s = 2/5 – 2/7 = 4/35

Sacrificing Ratio = A: B – 11:4

Working Note:-

Distribution of Premium for Goodwill

A = 1, 50,000 x 11/15 = 1, 10,000

B = 1, 50,000 x 4/15 = 40,000

Amount of Premium for Goodwill withdrawn

A = 1, 10,000 x 1/2 = 55,000

B = 40,000 x 1/2 = 20,000

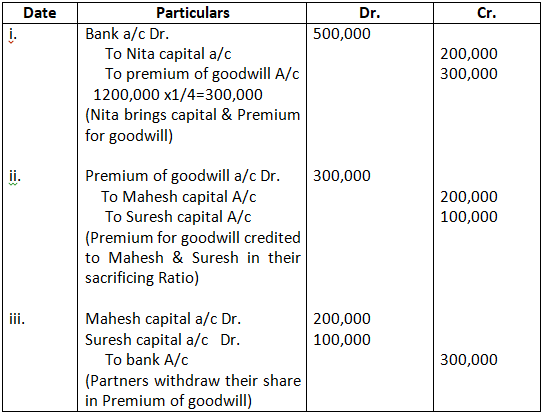

Q32. Mahesh and Suresh were partners in a firm sharing profits and losses in the ratio o of 2: 1. They decided to admit Nita into partnership with 1/4th share in the profits. Nita brought 2,00,000 0 for her capital and the requisite amount of goodwill premium in cash. The goodwill of the firm is valued at 12,00,000. The new profit-sharing ratio of the partners is 2: 1: 1. Mahesh and Suresh withdraw their share of goodwill

Ans.-

Journal

Calculation Sacrificing Ratio of Mahesh & Suresh

Old P.S.R. of Mahesh & Suresh 2 : 1

New P.S.R of Mahesh, Suresh & Nita = 2 : 1 : 1

Mahesh = 2/3 – 2/4 = 8 – 6/12 = 2/12 (Sacrifice)

Suresh = 1/3 – 1/4 = 4 – 3 /12 = 1/12 (Sacrifice)

Sacrificing Ratio of Mahesh & Suresh is 2 : 1

When Only Part of Premium for Goodwill is brought by New Partner in Cash:-

Q33. A & B are partners sharing profits in the ratio of 2:1. They admit C for 1/4th share in profits, C brings in 30,000 for his capital and 8,000 out of his share of 10,000 for goodwill. Before admission, goodwill existed in the books at 18,000. Pass Journal entries to give effect to the above arrangement.

Solution – Journal Entry

Working Note:-

Calculation of New profit sharing ratio of A, B & C

Old Ratio of A & B = 2 : 1

C’s share = 1/ 4

Remaining share = 1 – 1/4 = 3/4

Remaining share will be distributed among A & B is their profit sharing ratio i.e., 2 : 1

A’s New share = 3/4 x 2/3 = 6/12

B’s New share = 3/4 x 1/3 = 3/12

New profit sharing ratio after making base equal

6/12 : 3/12 : 1/4 x 3/3

= 6 : 3 : 3

= 2 : 1 : 1

Calculation of Sacrificing Ratio of A & B

A = 2/3 – 2/4 = 8 – 6/12 = 2/12

B = 1/3 – 1/4 = 4 – 3 /12 = 1/12

Sacrificing Ratio of A & B = 2 : 1.

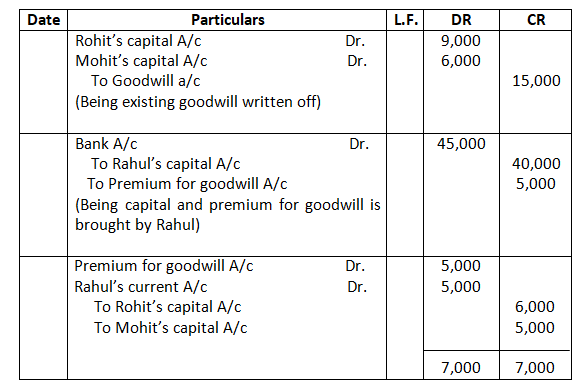

Q34. Rohit and Mohit were partners in a firm sharing profits and losses in the ratio of 3:2. Rahul was admitted into partnership for 1/3 share in profits. Goodwill of the firm was valued at Rs.30,000. Rahul brought Rs.40,000 as capital and Rs.5,000 out of his share of goodwill premium in cash. At the time of Rahul’s admission, goodwill was appearing in the books of the firm at Rs.15,000.

Pass necessary journal entries for the above transactions in the books of the firm on Rahul’s admission.

Solution-

Journal

Calculation of new profit sharing ratio of partners

Old profit sharing ratio of Rohit and Mohit is 3:2

Rahul admitted for 1/3 share

Remaining share = 1 – 1/3

= 2/3

Remaining share would be distributed by old Partners in there old profit sharing ratio i.e., 3:2

Rohit’s new share = 2/3 x 3/5

= 6/15

Mohit’s new share = 2/3 x 2/5

= 4/15

New profit sharing ratio of Rohit, Mohit and Rahul after making base equal

= 6/15 : 4/15 : 1/3 x 5/5

= 6 : 4: 5

Calculation of Sacrificing ratio of Rohit and mohit

Old profit sharing ratio of Rohit and Mohit is 3 : 2

New Profit sharing ratio of Rohit, Mohit and Rahil is 6 : 4: 5

Rohit Sacrifices = 3/5 – 6/15

= 9 – 6 / 15

= 3/15

Mohit Sacrifices = 2/5 – 4/15

= 6 – 4 /15

= 2/15

Sacrificing Ratio of Rohit and Mohit is 3:2

Calculation of Partners share in firm’s Goodwill

Goodwill of the firm = Rs.30,000

Rahul’s premium for Goodwill = 30,000 x 1/3

= Rs.10,000

It would be credited to Sacrificing Partners (Rohit and mohit) in their sacrificing ratio i.e., 3:2

Rohit’s will be credited = 10,000 x 3/5

= Rs.6,000

Mohit’s will be credited = 10,000 x 2/5

= Rs.4,000

When New or Incoming Partner is not able to bring his Share of Premium for Goodwill:-

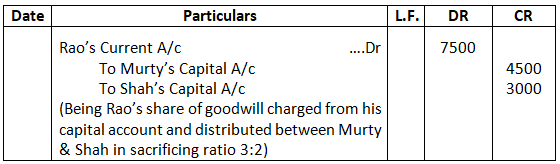

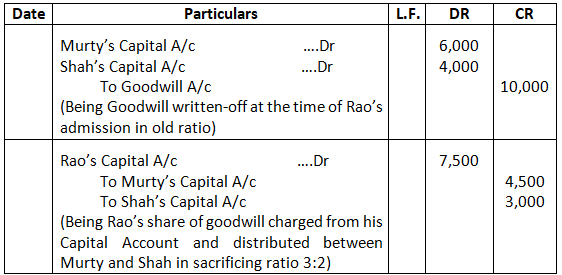

Q35. On the admission of Ritu, goodwill of Murty and Shah is valued at 30,000. Ritu is to get 1/4th share of profits. Previously Murty and Shah shared profits in the ratio of 3:2. Ritu is unable to bring amount of goodwill. Give Journal entries in the books of Murty and Shah when: (a) Goodwill does not exist in the books; and (b) Goodwill exists in the books at 10,000.

Solution – Goodwill does not exist in the books:-

Journal Entry

(b) Goodwill Exists in the books at 10,000

Journal Entry

Working Note:-

Calculation of Rao’s share of Goodwill:-

Rao’s share of goodwill = 30,000 x 1/4 = 7,500

Adjustment of Rao’s share of Goodwill:-

Murty = 7,500 x 3/5 = 4,500

Shah = 7,500 x 2/5 = 3,000

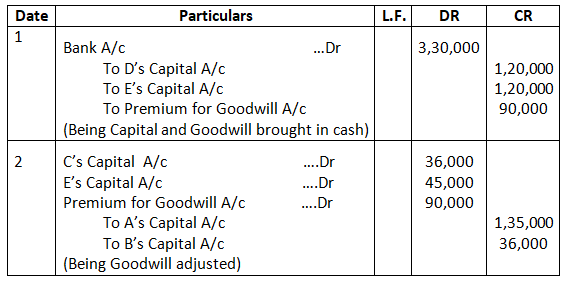

Q36. A, B and C are in partnership sharing profits in the ratio of 5:4:1. Two new partners D and E are admitted and the new profit-sharing ratio is 3:4:2:2:1. D is to pay 90,000 for his share of Goodwill but E is unable to bring his share of Goodwill. Both the new partners introduced 1,20,000 each as their capital. You are required to pass necessary Journal entries.

Solution – Journal Entry

Working Note:-

Calculation of Sacrificing Ratio:-

Old Ratio – A: B: C – 5:4:1

New Ratio – A: B: C: D: E – 3:4:2:2:1

Sacrificing (or Gaining) Ratio = Old Ratio – New Share

A’s = 5/10 – 3/12 = 30 – 15/60 = 15/60 (Share of Sacrifice)

B’s = 4/10 – 4/12 = 24 – 20/60 = 4/60 (share of sacrifice)

C’s = 1/10 – 2/12 = 6 – 10/60 = -4/60 (share of gain)

Adjustment of Goodwill:-

D’s share in goodwill for 2/12th share = 90,000

Total goodwill of the firm = 90,000 x 12/2 = 5, 40,000

E’s Share in goodwill = 5, 40,000 x 1/12 = 45,000

C’s share in goodwill = 5, 40,000 x 4/60 = 36,000

Hidden Goodwill:-

Q37. A & B are partners in a firm with capital of 60,000 and 1, 20,000 respectively. They decide to admit C into the partnership for 1/4th share in the future profits. C is to bring in a sum of 70,000 as his capital. Calculate amount of goodwill.

Solution – Actual Capital of the firm after admission of C

= A’s Capital + B’s Capital + C’s Capital

= 60,000 + 1, 20,000 + 70,000 = 2,50,000

Capitalized value of the firm on the basis C’s share = 70,000 x 4/1 = 2, 80,000

Goodwill = Capitalized value of the firm – actual capital of the firm

= 2, 80,000 – 2, 50,000 = 30,000

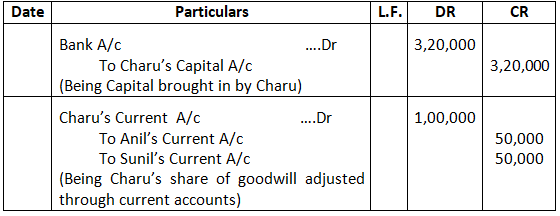

Q38. Anil and Sunil are partners in a firm with fixed capitals of 3, 20,000 and 2, 40,000 respectively. They admitted Charu as a new partner for 1/4th share in the profits of the firm on 1st April 2025. Charu brought 3,20,000 as her share of capital. Calculate value of goodwill and record necessary Journal entries.

Solution – Journal Entry

Working Note:-

Calculation of Hidden Goodwill:-

Total capital of the firm on the basis of Charu’ Capital

= 3, 20,000 x 4/1 = 12, 80,000

Less – Adjusted capital of partners + new partners’ capital = (8, 80,000)

= 4, 00,000

Charu’s share of goodwill = 4, 00,000 x 1/4 = 1, 00,000

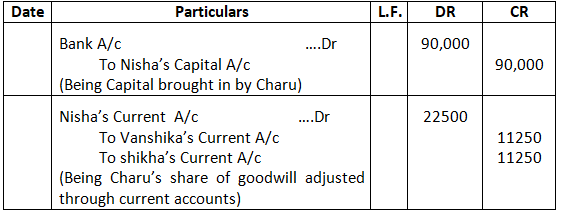

Q39. Vanshika and shikha were partner in a firm with capital of 100,000 and 80,000 respectively. They admitted Nisha on 1st April 2022 as a new partner for 1/4 share in a future profit of the firm. Nisha brought 90,000 as her capital. Nisha acquire her share equally from Vanshika and shikha. Calculate the value of goodwill of the firm and pass necessary journal entry on Nisha’s admission assuming that Nisha did not bring her share of goodwill premium in cash. Show the working clearly.

Working Note:-

Calculation of Hidden Goodwill:-

Total capital of the firm on the basis of Charu’ Capital

= 90,000 x 4/1 = 3,60,000

Less – Adjusted capital of partners + new partners’ capital (180,000+90,000) = (2,70,000)

= 90,000

Charu’s share of goodwill = 90,000 x 1/4 = 22500

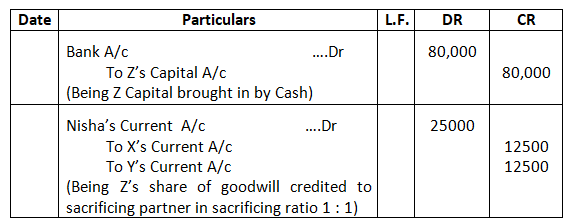

Q40. X and Y are partners with capitals of 50,000 each. They admit Z as a partner for 1/4th share in the profits of the firm. Z brigs in 80,000 as his share of capital .Profit & Loss Account showed a credit balance of 40,000 as on date of admission of Z. give necessary Journal entries to record the goodwill.

Solution –

Total Capital of the firm after Z’s admission

= X’s capital + Y’s Capital + Undistributed Profit + Z’s Capital

= 50,000 + 50,000 + 40,000 + 80,000 = 2, 20,000

Capitalised value of the firm on the basis Z’s share = 80,000 x 4/1 = 3, 20,000

Goodwill = Capitalised value of the firm – Total capital after Z’s admission

= 3, 20,000 – 2, 20,000 = 1, 00,000

Calculation of Z’s premium of Goodwill

Z’s premium for Goodwill = 1,00,000 x 1/4

= Rs.25,000

X’s will get = 25,000 x 1/2 = Rs.12500

Y’s will get = 25,000 x 1/2 = Rs.12,500

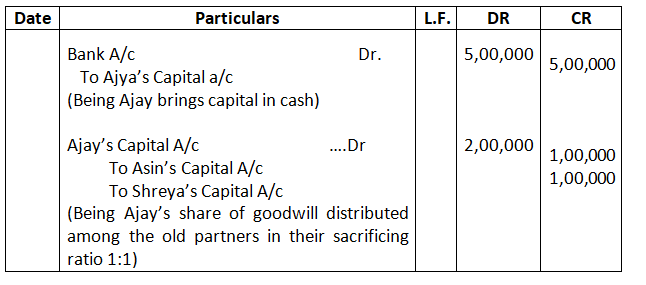

Q41. Asin and Shreyas are partners in a firm. They admit Ajay as a new partner with 1/5th share in the profits of the firm. Ajay brings 5, 00,000 as his share of capital. The value of total assets of the firm was 15, 00,000 and outside liabilities were valued at 5, 00,000 on that date. Give necessary Journal entry to record goodwill at the time of Ajay’s admission. Also show your workings.

Solution – Journal Entry

Working Note:-

Calculation of Goodwill brought in by Ajay:-

Value of firm’s goodwill = Capitalized value of the firm – Net worth

Capitalized value of firm = Share of Ajay’s capital x Reciprocal of Ajay’s share

= 5, 00,000 x 5/1 = 25, 00,000

Net worth of the new firm = Total assets – Outside liabilities + Ajay’s capital

= 15, 00,000 – 5, 00,000 + 5, 00,000 = 15, 00 000

Value of firm goodwill = Capitalized value of firm – net worth of the new firm

= 25, 00,000 – 15, 00,000 = 10, 00,000

Calculation of Ajay’s premium for goodwill

Ajay’s share of goodwill = 10, 00,000 x 1/5 = 2, 00,000

Asin will get = 2,00,000 x 1/2 = 1,00,000

Shreyas will get = 2,00,000 x 1/2 = 1,00,000

Revaluation of Assets and Reassessment of Liabilities:-

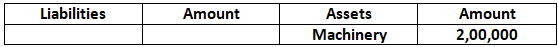

Q42. Arun and Vijay are partners in a firm sharing profit & Loss in the ratio of 3:2

Balance Sheet (Extract)

If the value of machinery in the Balance Sheet is excess by 33 1/3 %, find the value of machinery to be shown in the New Balance Sheet.

Solution:-

Calculation of Correct Book value of Machinery

Let the correct value of Machinery be x

The Recorded value is 33 1/3 % Excess than the Book value

Thus According to the Question

X + 33 1/3% x = 2,00,000

X + 100/3 x 1/100x = 2,00,000

4x /3 = 2,00,000

X = 2,00,000 x 3/4

X = Rs.1,50,000

The machinery should be shown with Rs.150,000 Book value in New Balance Sheet.

Q43. Pass entries in the firm’s Journal for the following on admission of a partner:

- Machinery is reduced by 16,000 and Building be appreciated by 40,000.

- A provision be created for Doubtful Debts @ 5% Debtors amounting to 80,000.

- Provision for warranty claims is increased by 12,000.

- Furniture (Book value 50,000) is to be reduced by 40%.

- Furniture (Book Value 50,000) is to be reduced to 40%.

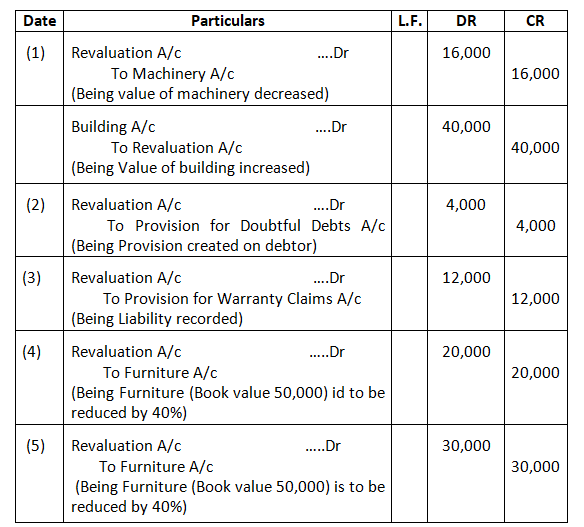

Solution – Journal Entry

Q44. Pass entries in firm’s Journal for the following on admission of a partner:

- Unrecorded Investments of 20,000 are to be accounted.

- Unrecorded liability towards suppliers for 5,000 is to be accounted.

- An item of 1,600 included in Sundry Creditors is not likely to be claimed and hence should be written back.

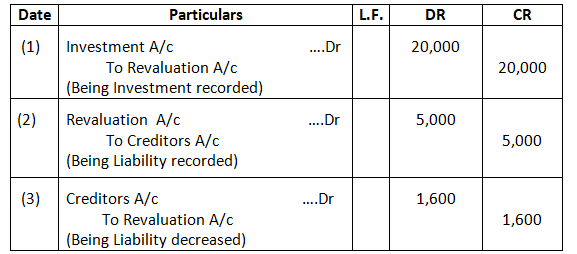

Solution – Journal Entry

Q45. X and Y are partners sharing profits in the ratio of 3:2. They admitted Z as partner for 1/4th share of profits. At the time of admission of Z, investments appeared at 80,000. Half of the investments to be taken by X and Y in their profit-sharing ratio at book value .Remaining investments were valued at 50,000. Pass the necessary Journal entries.

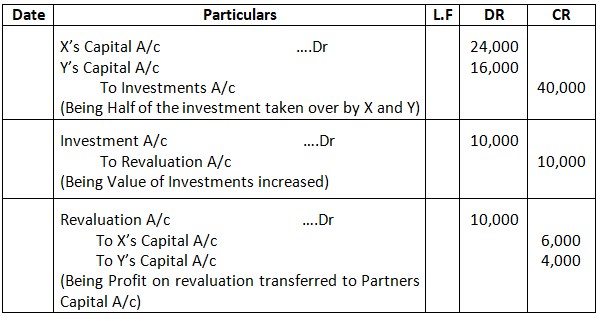

Solution – Journal Entry

Q46. X and Y are partners in a firm sharing profits in the ratio of 3:2. They admitted Z as a partner and fixed new profit-sharing ratio as 3:2:1. At the time of admission of Z, Debtors and Provision for Doubtful Debts existed at 50,000 and 5,000 respectively. All debtors are good. Pass the necessary Journal entries.

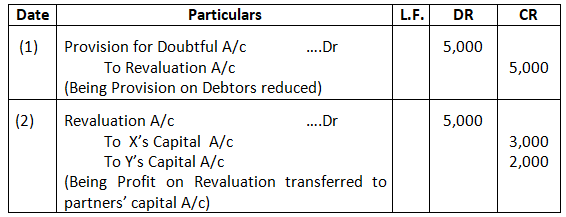

Solution – Journal Entry

Q47. Ashok and Bhaskar are partners in a firm sharing profits in the ratio of 3:2. They admitted Chaman as a partner for 1/4th share of profits. At the time of admission of Chaman, Sundry Debtors and provision for doubtful debts existing at 76000 and 8000 respectively. 6000 debtors proved bad. A provision of 5% is to be created on Sundry Debtors for Doubtful debts. Pass the necessary Journal entries.

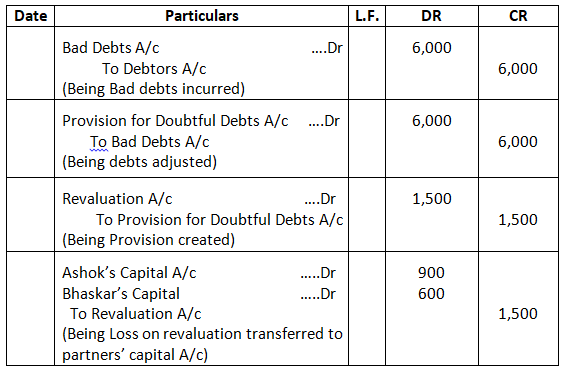

Solution – Journal Entry

Working Note:-

Calculation of Provision for Doubtful Debts

Provision to be created = (76,000 – 6,000) x 5/100 = 3,500

Old Provision = 2,000

New Provision to be created = 3,500 – 2,000 = 1,500

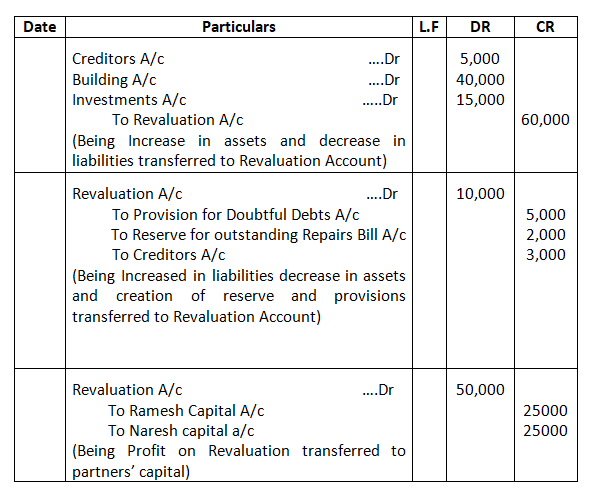

Q48. At the time of admission of a partner Suresh, assets and liabilities of Ramesh and Naresh were revalued as follows:

- A Provision for Doubtful Debts @ 10% was made on Sundry Debtors (Sundry Debtors 50,000).

- Creditors were written back by 5,000.

- Building was appreciated by 20% (Book value of Building 2, 00,000).

- Unrecorded Investments were valued at 15,000.

- A Provision of 2,000 was made for an Outstanding Bill for repairs.

- Unrecorded Liability towards suppliers was 3,000.

Pass necessary Journal entries.

Solution – Journal Entry

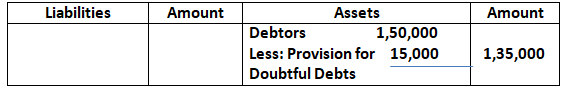

Q49. Om and Shiv are partners in a firm sharing profits equally.

Balance Sheet (Extract)

| Debtors 1,50,000 | 1,35,000 |

An amount of 12,000 due from Mohan, a debtor, is to be written off as no longer receivable. Provision for Doubtful Debts on remaining debtors is to be maintained at the current rate.

What amount of Provision for Doubtful Debts should be credited to maintain its current rate?

Solution – Debtors – 1, 50,000

Provision for Doubtful Debts – 15,000

Current rate of provision=15,000 x100/ 1, 50,000= 10% (Predict)

Debtors = 1, 50,000

Bad Debts = – 12,000

= 1, 38,000

10% Provision = 13,800

= 1, 24,200

Provision For Doubtful Debts = 15,000

– New Bad debts = 12,000

Remaining Bad debts = 3,000

Amount of Provision for Doubtful Debts to be credited to maintain its current rate 10%

New Provision for Bad Debts = 13,800

– Remaining Bad Debts = 3,000

= 10,800

So Provision of Only 10,800 is required to be Credited through Revaluation.

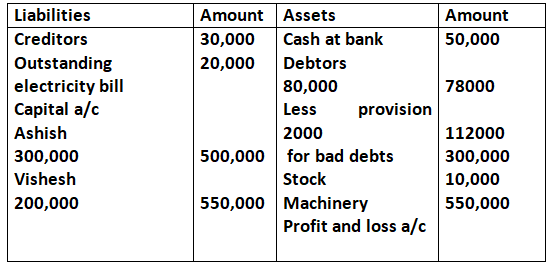

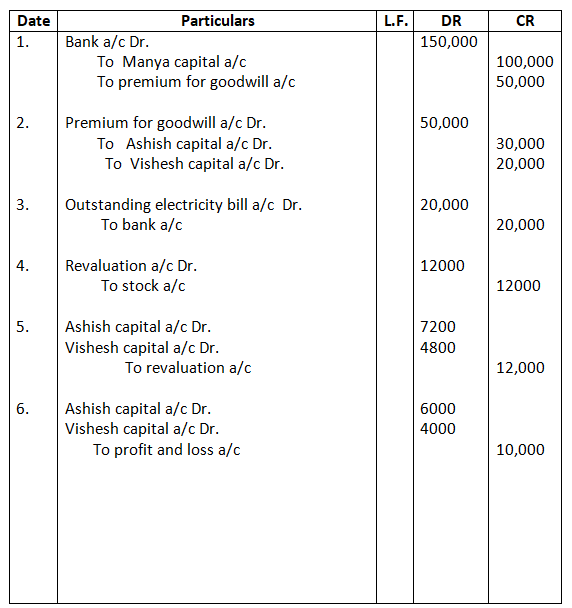

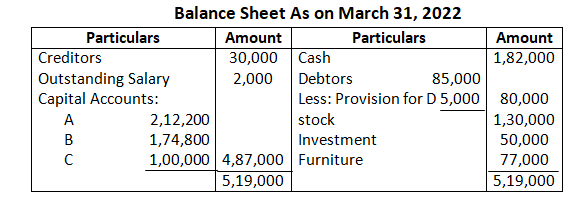

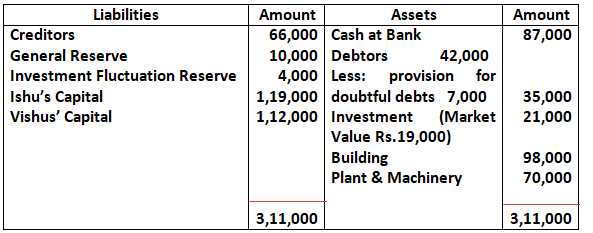

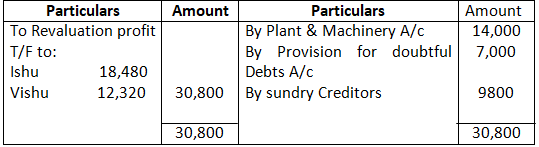

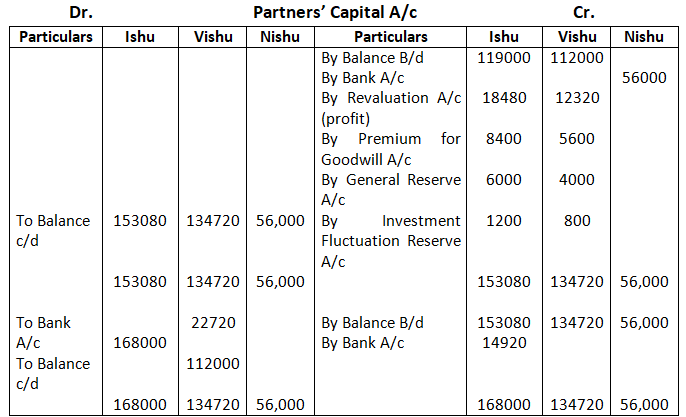

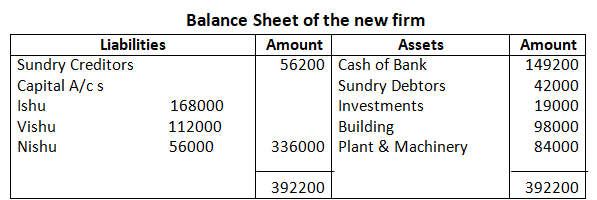

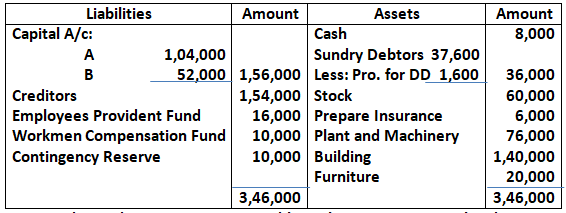

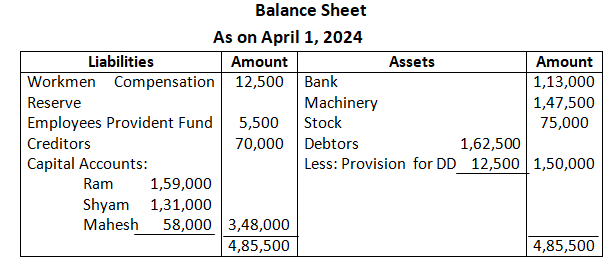

Q50. Ashish and vishesh were partners sharing profit and losses in the ratio of 3:2 their balance sheet as at 31st march 2022 was as under

Balance sheet of Ashish and Vishesh as at 31st march 2022

On 1st April 2022 Manya was admitted into the firm with 1/4th share in the profit on the following term

- Manya will bring 100,000 as her capital and 50,000 as her share of goodwill premium in cash

- Outstanding electricity bill will be paid off

- Stock was found over valued 12000

Pass necessary journal entry in the books of the firm on Manya admission.

Reserves and Accumulated Profit/Losses and Preparation of Revaluation Account:-

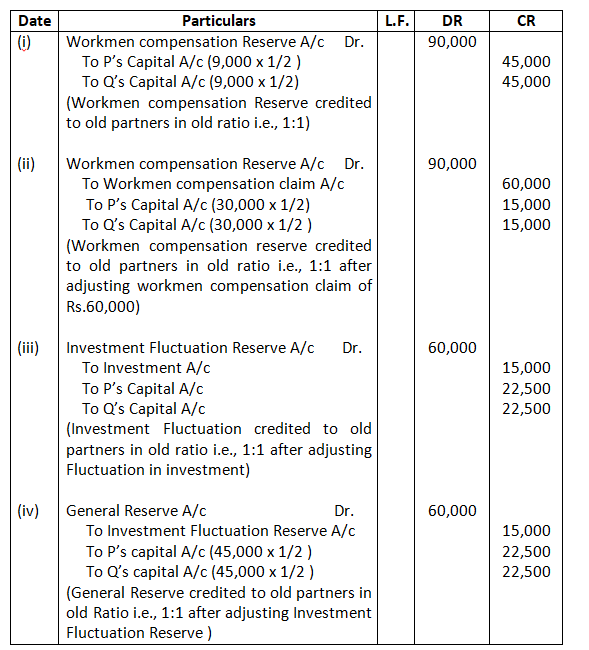

Q51. Give the Journal entry in the following cases:

- To distribute ‘Workmen Compensation Reserve’ of Rs.90,000 a the time of admission of R, when there is no claim against it. The firm has two partners P and Q.

- To distribute ‘Workmen Compensation Reserve’ of Rs.90000 at the time of admission of R, when there is a claim of Rs.60,000 against it. The firm has two partners P and Q.

- To distribute ‘Investment Fluctuation Reserve’ of Rs.60,000 at the time of admission of R, when Investments (mark value Rs.2,85,000) exists at Rs.3,00,000. The firm has two partners P and Q.

- To distribute ‘General Reserve’ of Rs.60,000 at the time of admission of R, when Rs.15,000 from General Reserve is to be transferred to Investment Fluctuation Reserve. The firm has two partners P and Q.

Solution-

Journal

Working Note:-

Calculation of Share of General Reserve & P & L A/c

Ram’s share = 3, 00,000 x 2/3 = 2, 00,000

Shyam’s share = 3, 00,000 x 1/3 = 1, 00,000

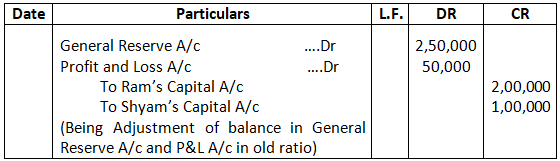

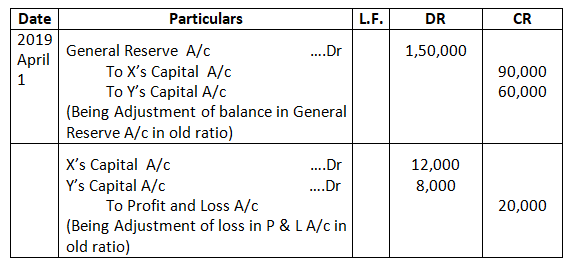

Q53. X and Y are partners in a firm sharing profits and losses in the ratio of 3:2. On 1st April, 2024, they admit Z as a partner for 1/5th share in profits. On that date, there was a balance of 1, 50,000 in General Reserve and a debit balance of 20,000 in the Profit & Loss Account of the firm. Pass necessary Journal entries regarding adjustment of reserve and accumulated profit/loss.

Solution – Journal Entry

Working Note:-

Calculation of Share of General Reserve:-

X’s share = 1, 50,000 x 3/5 = 90,000

Y’s share = 1, 50,000 x 2/5 = 60,000

Calculation of Share of Debit Balance in P & L A/c:-

X’s share = 20,000 x 3/5 = 12,000

Y’s Share = 20,000 x 2/5 = 8,0

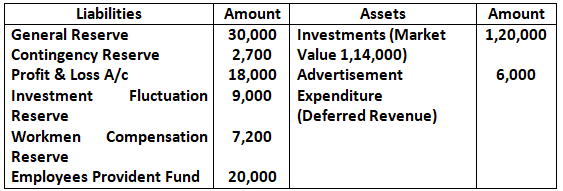

Q54. (a) An extract of the Balance Sheet of Murari and Vohra sharing profits & Losses in the ratio of 3:2 was as under:

New Partner Krishna was admitted for 1/5th share of profits. A claim on account of Workmen Compensation Reserve is estimated for 900. Pass the necessary Journal entries to adjust accumulated profits and losses.

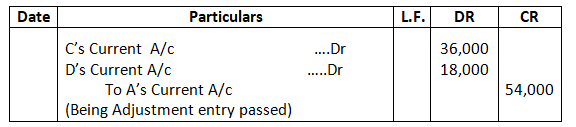

(b) A, B and C were partners sharing profits and losses in the ratio of 6:3:1. They take D into partnership with effect from 1st April, 2022. The new profit-sharing ratio between A, B, C and D will be 3:3:3:1. They also decide to record the effect of the following without affecting their book values, by passing an adjustment entry:

General Reserve 1, 50,000

Contingency Reserve 60,000

Profit & Loss A/c (Cr.) 90,000

Advertisement Suspense A/c (Dr.) 1, 20,000

Pass the necessary adjustment entry through the Partner’s Current Account.

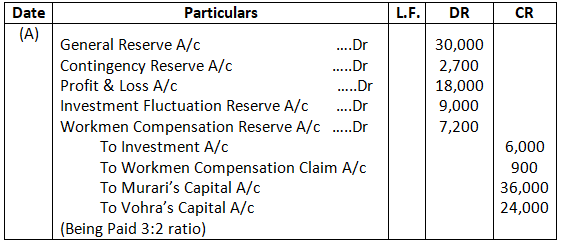

Solution – Journal Entry

(b) A: B: C – 6:3:1

A: B: C: D – 3:3:3:1

Sacrificing Ratio = Opening Ratio – New Ratio

A = 6/10 – 3/10 = 3/10 sacrifice

B = 3/10 – 3/10 = NIL

C = 1/10 – 3/10 = -2/10 gain

D = 0 – 1/10 = -10/10 gain

A = 1, 50,000 X 3/10 – 54,000 (Cr)

C = 1, 80,000 X -2/10 – 36,000 (Dr)

D = 0 – 1/10 -1/10 X 1, 80,000 – 18,000 (Dr)

Journal Entry

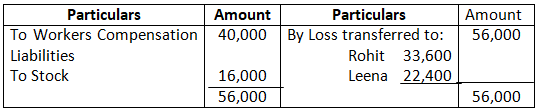

Preparation on Revaluation Account and partner’s Capital Accounts

Q55. Amit and Anil are partners sharing profits and losses in the ration of 2:1. Their Balance Sheet as on 31st March, 2025 was as follows:

Ankit is admitted as a partner on the date of the Balance Sheet on the following terms:

- Ankit will bring in 1,00,000 as his capital and 60,000 as his share of goodwill for 1/4th share in profits.

- Machinery is to be appreciated to 1,20,000 and the value of building is to be appreciated by 10%.

- Stock is found overvalued by 4,000

- General Reserve will continue to appear in the books of the reconstituted firm as its original value

- A provision for Doubtful Debts is to be created at 5% of debtors.

- Creditors were unrecorded t to the extent of 1,000.

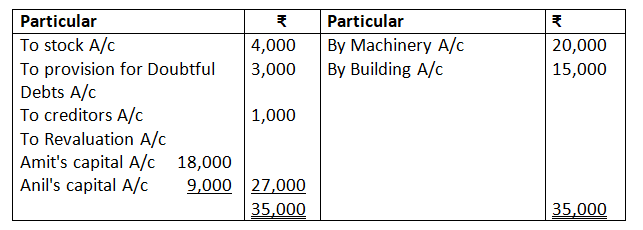

Prepare Revaluation Account and partner’s Capital Accounts.

Solution:-

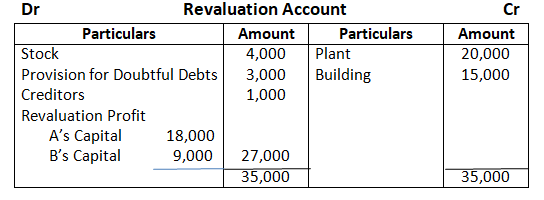

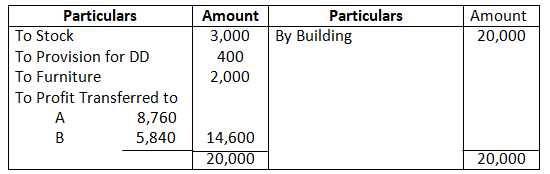

Dr. Revaluation A/c Cr.

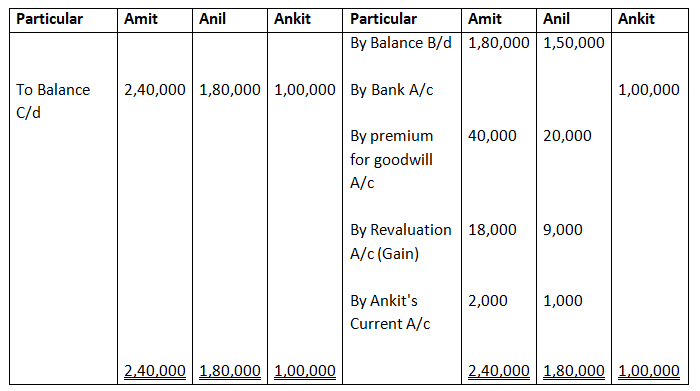

Partner’s Capital A/c

Calculation of Treatment of General Reserve

Ankit share in General = 12000 x 1/4 = 3,000

Amit & Anil will share Ankit’s share in G.R in their sacrificing Ratio 2:1

Amit will Get = 3000 x 2/3 = 2,000

Anil will Get = 3000 x 1/3 = 1,000

Journal

Ankit’s capital A/c Dr. 3,000

To Amit’s capital A/c 20,000

To Anil’s capital A/c 1,000

(Being General Reserve Adjusted)

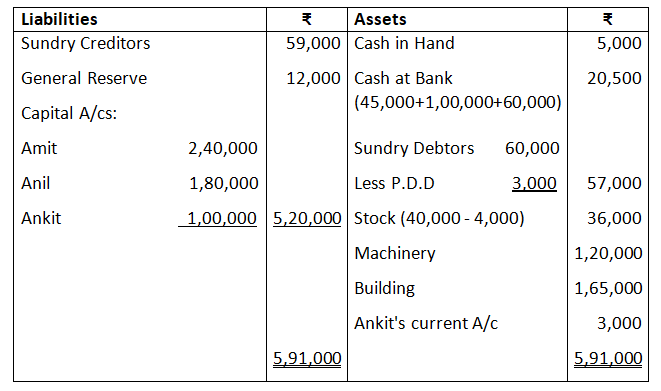

Balance Sheet of the New firm as at 1st April

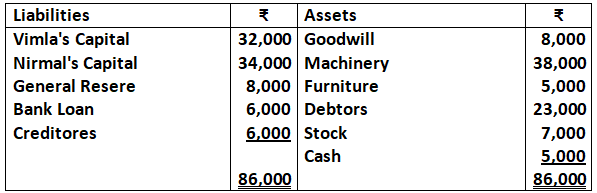

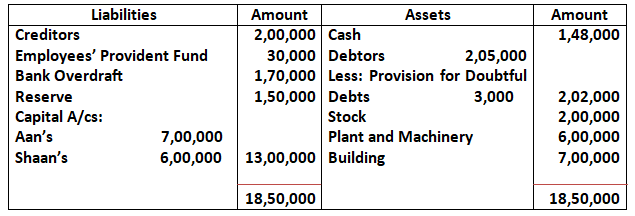

Q56. Vimal and Nirmal are partners in a firm, sharing profits and losses In the ratio of 5:3. they admit kailash into the firm on 1st April, 2025, when their Balance Sheet was as follows:

Terms of Kailash’s admission were as follows:

- Kailash will bring 30,000 as his share of capital and will be entitle to 1/3rd share in the profits.

- Kailash is not to bring goodwill in cash.

- Goodwill of the firm is valued on the basis of 2 year’s purchase of the average profit of the last three years. Average profit of the last three year’s is 6,000.

- Machinery and stock are revalued at 45,000 and 8,000 respectively.

Prepare a Revaluation Account and partners’ Capital incorporating the above adjustments.

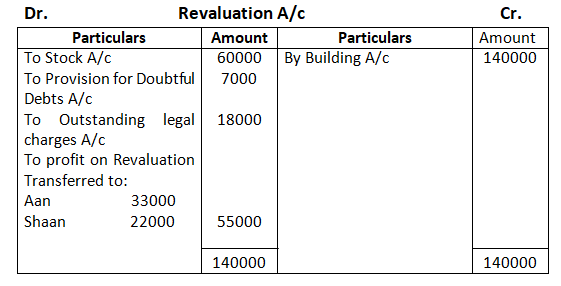

Solution:

Dr. Revaluation A/c Cr.

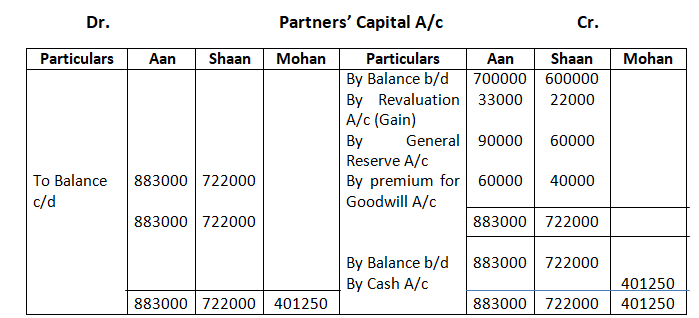

Dr. Partner’s Capital A/c Cr.

Calculation of New Profit Sharing Ratio

Old profit sharing Ratio of Vimal & Nirmal in 5:3

Kailash admitted for 1/3rd Share

Remaining share = =

Vimal’s new share = x

=

Nirmal’s new share = x

=

New Profit Sharing Ratio of After making base equal

:

:

x

= 10: 6: 8

= 5:3:4

Calculation of the Goodwill of the firm

Goodwill of the firm

= Avg. profit of cost three years x 2 year purchase

= 6,000 x 2

= ₹ 12,000

For Raising the Goodwill

Goodwill A/c Dr. 12,000

To vimal’s capital A/c 7,500

To Nirmal’s capital A/c 4,500

(Being Goodwill raised in 5 : 3)

For writing off the Goodwill

Vimal’s capital A/c Dr. 5,000

Nirmal’s capital A/c Dr. 3,000

Kailash current A/c Dr. 4,000

To Goodwill A/c 12,000

(Being Goodwill written off in new ratio 5:3:7)

Preparation of Capital Accounts and Balance Sheet:-

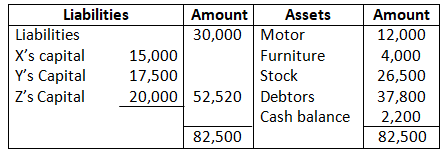

Q57. X, Y and Z are equal partners with capitals of 15,000; 17,500 and 20,000 respectively. They agree to admit W into equal partnership upon payment in cash 15,000 for 1/4th share of the goodwill and 18,000 as his capital, both sums to remain in the business. The liabilities of the old firm were 30,000 and the assets, apart from cash, consist of Motors 12,000, Furniture 4,000, stock 26,500 and Debtors 37,800. The Motors and Furniture were revalued at 9,500 and 3,800 respectively. Pass Journal entries to give effect to the above arrangement and also show Balance Sheet of the new firm.

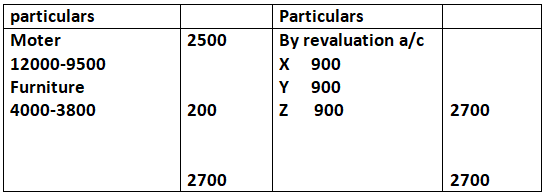

Solution –

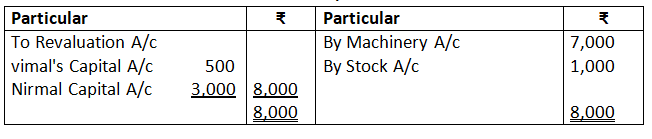

Revaluation a/c

Journal Entry

Working Notes:-

Opening balance sheet

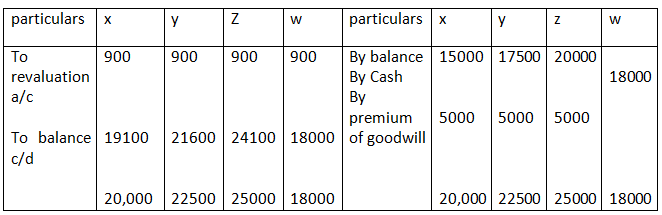

Partner capital a/c

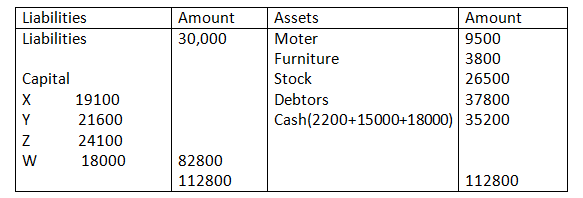

Balance sheet of the new firm

Old ratio of X: Y: Z = 1:1:1

W is admitted for 1/4 share

Let total profit – 1

Remaining profit after W admission – 1 – 1/4 = ¾

X – 3/4 x 1/3 – 3/12

Y – 3/4 x 1/3 – 3/12

Z – 3/4 x 1/3 – 3/12

W – 1/4 x 3/3 – 3/12

Therefore share of X, Y, Z and W = 3:3:3:3 = 1:1:1:1

Sacrificing ratio = Old ratio – New ratio

X = 1/3 – 1/4 = 1/12

Y =1/3 – 1/4 = 1/12

Z = 1/3 – 1/4 = 1/12

Sacrificing ratio of X, Y, Z = 1:1:1

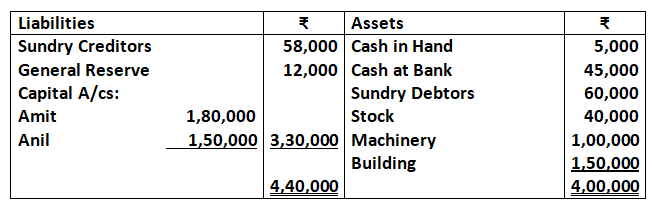

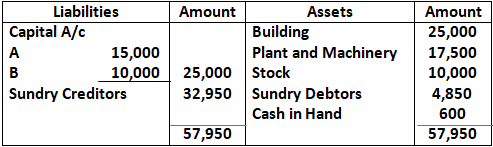

Q58. Following was the Balance Sheet of A & B, who was sharing profits in the ratio of 2:1 as at 31st March, 2025:

They admit C into partnership on 1st April, 2025 on the following terms:

- C was to bring 7,500 as his capital and 3,000 as goodwill for 1/4th share in the firm.

- Value of the Stock and Plant and Machinery were to be reduced by 5%

- A Provision for Doubtful Debts was to be created in respect of Sundry Debtors 375.

- Building was to be appreciated by 10%

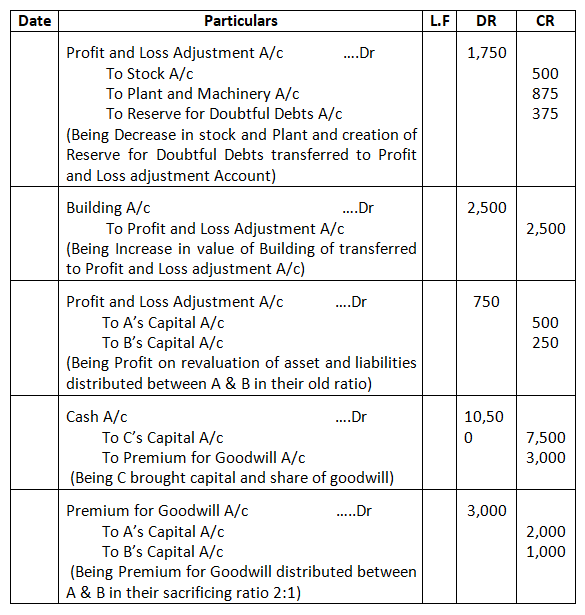

Pass necessary Journal entries to give effect to the arrangements. Prepare Profit & Loss Adjustment Account (or Revaluation Account), Partners Capital Accounts and Balance Sheet of the new firm.

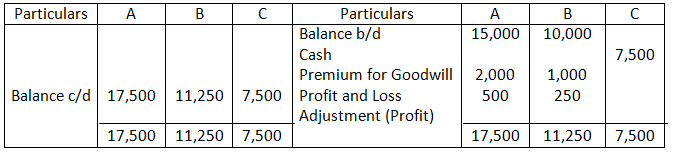

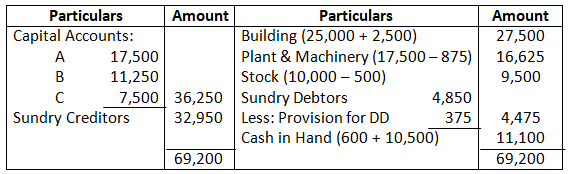

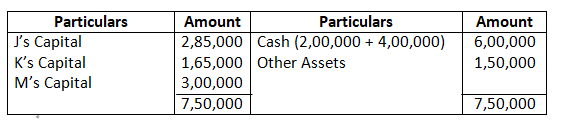

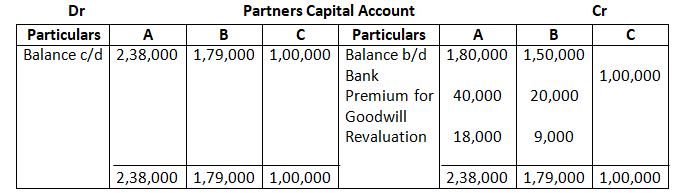

Solution – Journal Entry

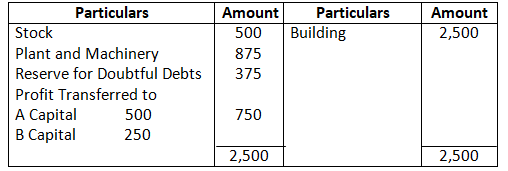

Dr Profit and Loss Adjustment Account Cr

Dr Partners Capital Account Cr

Balance Sheet As on March 31, 2021

Working Note:-

Sacrificing ratio- A: B – 2:1

Distribution of Premium for Goodwill (in sacrificing ratio)

A – 3,000 x 2/3 – 2,000

B – 3,000 x 1/3 – 1,000

Distribution of Profit from Profit and loss Adjustment Account (in old ratio)

A – 750 x 2/3 – 500

B – 750 x 1/3 – 250

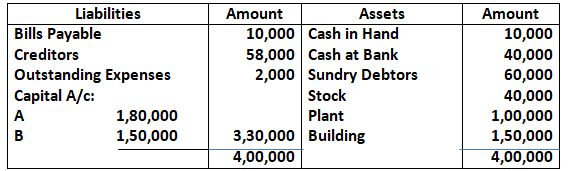

Q58. A & B are carrying on business in partnership and sharing profits and losses in the ratio of 3:2. Their Balance Sheet as at 31st March, 2024 stood as:

The admit C into partnership on 1st April, 2024 and give him 1/8th share in future profits on the following terms:

- Goodwill of the firm is valued at twice the average of the last three years profits which amounted to 21,000; 24,000 and 25,560.

- C is to bring cash for the amount of his share of goodwill.

- C is to bring cash 15,000 as his capital.

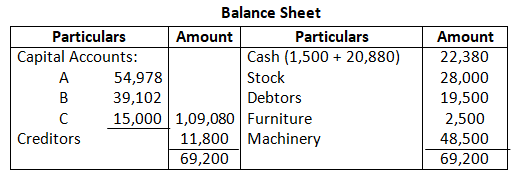

Pass Journal entries recording these transactions, draw out the Balance Sheet of the new firm and determine new profit-sharing ratio.(Old Book)

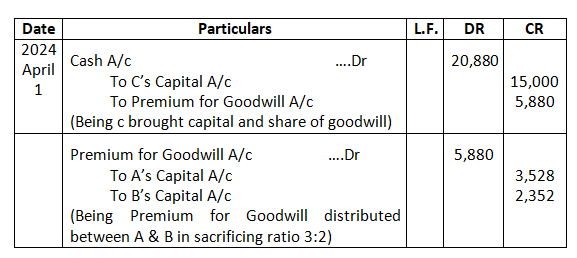

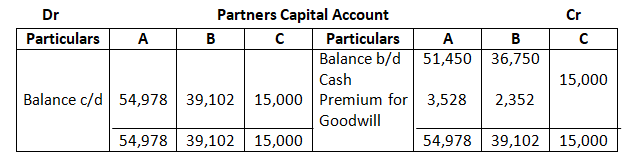

Solution – Journal Entry

Calculation of New Profit Sharing Ratio:-

Old ratio – A: B – 3:2

C is admitted for 1/8 share of profit

Let combined share of all partners after admission of C be – 1

Combined share of A & B after C’s admission – 1-C’s share = 1-1/8 = 7/8

New ratio = old ratio x combined share of X and Y

A’s = 3/5 x 7/8 – 21/40

B’s = 2/5 x 7/8 – 14/40

New profit sharing ratio – X: Y: Z – 21:14:5

Working Note:-

Calculation of goodwill:-

Average profit – 21,000 + 25,000 + 25,560/3 = 23,520

Goodwill – Average profit x no of purchase years

Goodwill – 23,520 x 2 = 47,040

C’s of goodwill – 47,070 x 1/8 = 5,880

Distribution of premium of goodwill:-

A =5,880 x 3/5 – 3,528

B = 5,880 x 2/5 – 2,352

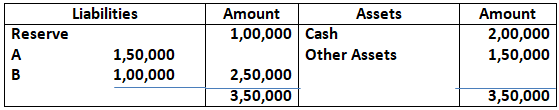

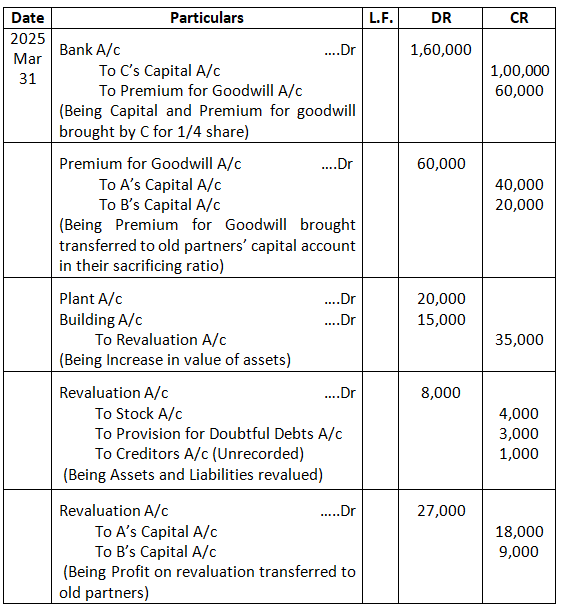

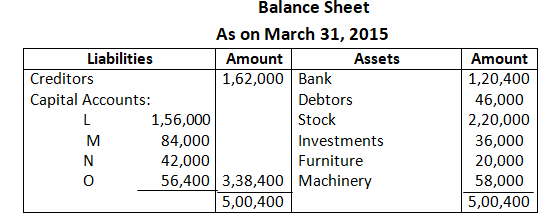

Q59. Balance Sheet of J and K who share profits in the ratio of 3:2 is as follows:

Balance Sheet As at 31st March, 2022

M joins the firm from 1st April, 2022 for half share in the future profits. He is to pay 1, 00,000 as goodwill and 3, 00,000 for capital. Draft the Journal entries and prepare Balance Sheet in each of the following cases:

- If M gets his share of profits in the profit-sharing ratio of the old partners.

- If M gets his share of profits in equal proportion from the old partners.

- If M gets his share of profits in the ratio of 3:1from the old partners, determine the future profit-sharing ratio of the partners in each case.

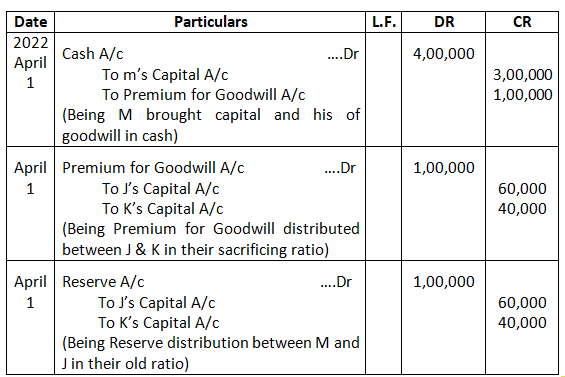

Solution –

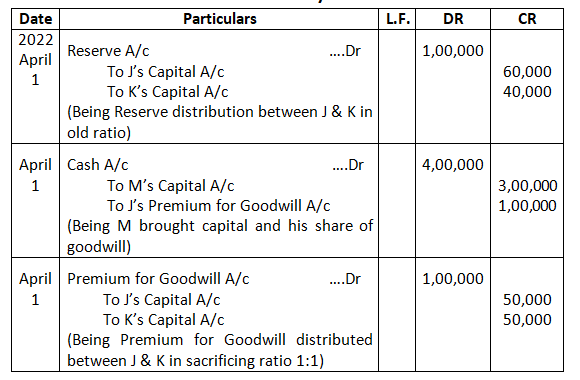

- If M gets his share of profits in the profit-sharing ratio of the old partners

Journal Entry

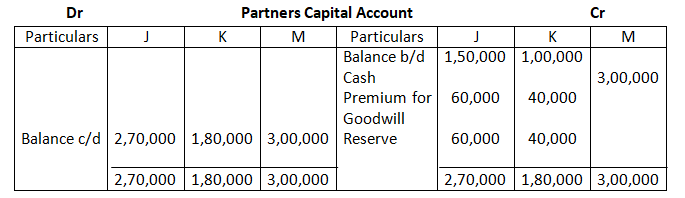

Calculation of Future (New Profit Sharing Ratio)

Old Ratio – M: J – 3:2

M is admitted for 1/2 share of profit

Let the combined share of all partners after admission of M be – 1

Combined share of J & K after M’s admission – 1-M’s share = 1-1/2 = ½

New ratio = Old ratio – Combined share of B and C

J – 3/5 x 1/2 – 3/10

K – 2/5 x 1/2 – 2/10

New profit sharing ratio = J: K: M – 3:2:5

Distribution of premium for Goodwill (in sacrificing ratio)

J – 1, 00,000 X 3/5 – 60,000

K – 1, 00,000 X 2/5 – 40,000

Distribution of General Reserve (in old ratio)

J – 1, 00,000 X 3/5 – 60,000

K – 1, 00,000 X 2/5 – 40,000

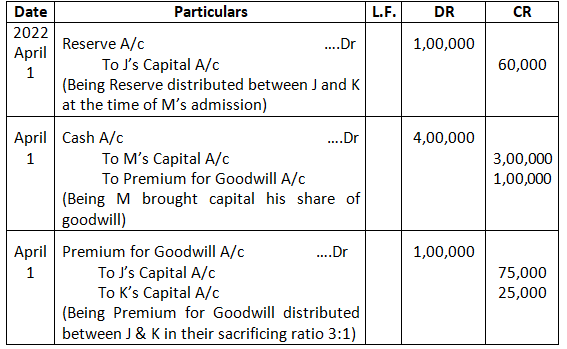

- If M gets his share of profits in equal proportion from the old partners.

Journal EntryCalculation of Future (New Profit Sharing Ratio)

Old Ratio – M: J – 3:2

M is admitted for 1/2 share of profit

Let the combined share of all partners after admission of M be – 1

Combined share of J & K after M’s admission – 1-M’s share = 1-1/2 = ½

New ratio = Old ratio – Combined share of B and C

J – 3/5 x 1/2 – 3/10

K – 2/5 x 1/2 – 2/10

New profit sharing ratio = J: K: M – 3:2:5

Distribution of premium for Goodwill (in sacrificing ratio)

J – 1, 00,000 X 3/5 – 60,000

K – 1, 00,000 X 2/5 – 40,000

Distribution of General Reserve (in old ratio)

J – 1, 00,000 X 3/5 – 60,000

K – 1, 00,000 X 2/5 – 40,000

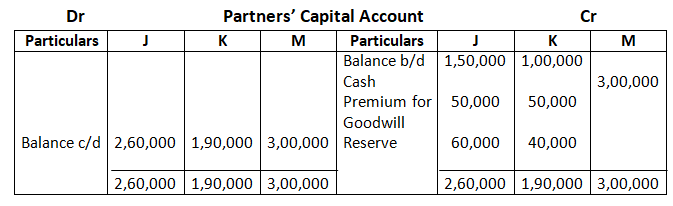

b. If M gets his share of profits in equal proportion from the old partners.

Journal Entry

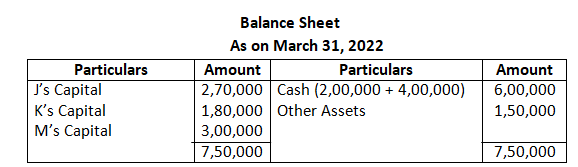

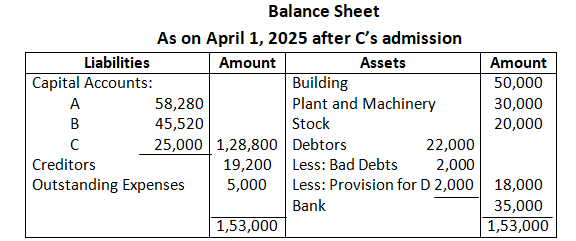

Balance Sheet

As on April 01, 2022 after M’s admission

Calculation of Future (New Profit Sharing Ratio)

Old Ratio – J: K – 3:2

M is admitted for 1/2 share of profit

J & k each will sacrifice in favour of M = 1/2 x 1/2 = 1/4

New ratio = Old ratio – Sacrificing Ratio

J = 3/5 – 1/4 = 7/20

K = 2/5 – 1/4 = 3/20

New profit sharing ratio = J: K: M = 7:3:10

Sacrificing ratio = J: K = 1:1

Distribution of premium for Goodwill (in sacrificing ratio)

J = 1, 00,000 X 1/2 = 50,000

K = 1, 00,000 X 1/2 = 50,000

Distribution of General Reserve (in old ratio)

J = 1, 00,000 X 3/5 = 60,000

K = 1, 00,000 X 2/5 = 40,000

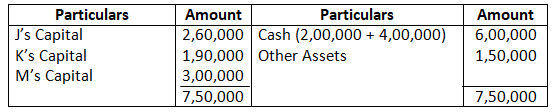

c. If M acquires his share of profit in ratio of 3:1 from the original partner

Journal Entry

Balance Sheet

As on March 31, 2022

Calculation of Future (New Profit Sharing Ratio)

Old Ratio – J: K – 3:2

M is admitted for 1/2 share of profit

J’s sacrificing ratio = 1/2 x 3/4 =2/8

K’s sacrificing ratio = 1/2 x 1/4 = 1/8

New ratio = Old ratio – Sacrificing Ratio

J – 3/5 – 3/8 – 9/40

K – 2/5 – 1/8 – 11/40

New profit sharing ratio = J: K: M – 9:11:20

Distribution of premium for Goodwill (in sacrificing ratio)

J – 1, 00,000 X 3/4 – 75,000

K – 1, 00,000 X 1/4 – 25,000

Distribution of Reserve (in old ratio)

J – 1, 00,000 X 3/5 – 60,000

K – 1, 00,000 X 2/5 – 40,000

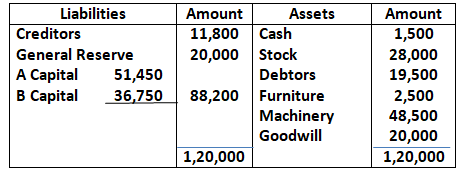

Q60. Given below is the Balance Sheet of A & B on 31st March, 2025, who is carrying on partnership business. A & B share profits and losses in the ratio of 2:1.

Balance Sheet of A & B as at 31st March, 2025

C is admitted as a partner on 1st April, 2025 on the following terms:

- C will bring 1, 00,000 as his capital and 60,000 as his share of goodwill for 1/4th share in the profits.

- Plant is to be appreciated to 1, 20,000 and the value of building is to be appreciated by 10%.

- Stock is found overvalued by 4,000.

- A provision for doubtful debts is to be created at 5% of sundry debtors.

- Creditors were unrecorded to the extent of 1,000.

Pass the necessary Journal entries, prepare the Revaluation Account and Partners Capital Accounts and show the Balance Sheet after the admission of C.

Solution – Journal Entry

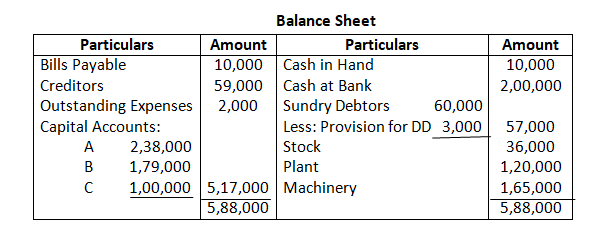

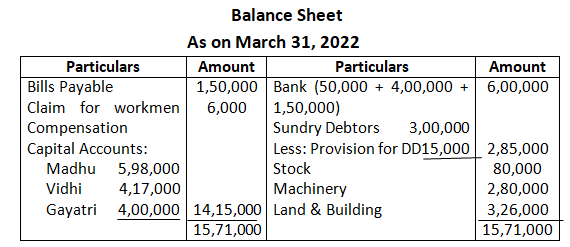

Q61. Balance Sheet of Madhu and Vidhi, who are sharing profits in the ratio of 2:3 as at 31st March, 2016 is given below:

Madhu and Vidhi decided to admit Gayatri as a new partner from 1st April, 2016 and their new profit-sharing ratio will be 2:3:5. Gayatri brought 4, 00,000 as her capital and her share of goodwill premium in cash.

- Goodwill of the firm was valued at 3, 00,000.

- Land and Building was found undervalued by 26,000.

- Provision for Doubtful Debts was to be made equal to 5% of the debtors.

- There was a claim of 6,000 on account of workmen compensation.

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the reconstituted firm.

Solution –

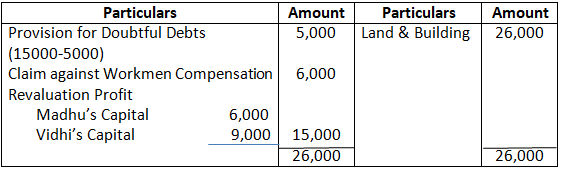

Dr Revaluation Account Cr

Working Note:

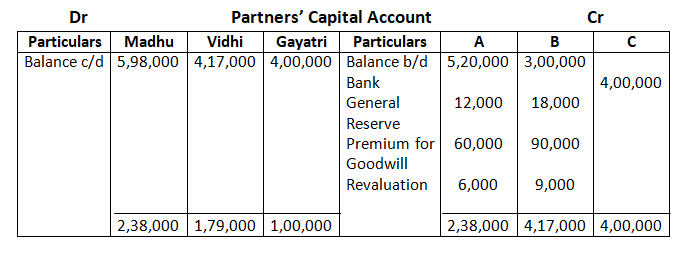

Calculation of Gayatri’s share of Goodwill

Gayatri share – 3, 00,000 x 5/10 – 1, 50,000 to be share in 2:3

Calculation of sacrificing ratio

Sacrificing ratio = old ratio – New Ratio

Madhu = 2/5 – 2/10 = 2/10

Vidhi = 3/5 – 3/10 = 3/10

Q62. X and Y share profits in the ratio of 5:3. Their Balance Sheet as at 31st March, 2025 was:

They admit Z into partnership with 1/8th share in profits on 1st April, 2024. Z brings 20,000 as his capital and 12,000 for goodwill in cash. Z acquires his share from X. following revaluation are also made.

- Employees Provident Fund liability is to be increased by 5,000.

- All Debtors are good.

- Stock includes 3,000 for obsolete items. Hence are to be written off.

- Creditors are to be paid 1,000 more.

- Fixed Assets are to be revalued at 70,000.

Prepare Journal entries, necessary accounts and new Balance Sheet. Also calculate new profit-sharing ratio.

Solution –

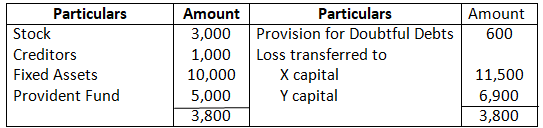

Dr Revaluation Account Cr

Working Note:-

Distribution of Revaluation Loss:-

X’s capital – 18,400 x 5/8 – 11,500

Y’s Capital – 18,400 x 3/8 – 6,900

Distribution Accumulated Loss:-

X’s Capital – 2,400 x 5/8 – 1,500

Y’s capital – 2,400 x 3/8 – 900

Distribution of Workmen Compensation Fund:-

X’s capital – 5,800 x 5/8 – 3,625

Y’s capital – 5,800 x 3/8 – 2,175

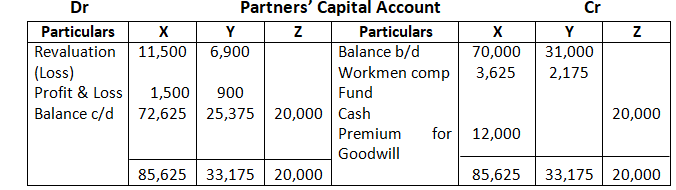

Calculation of New Profit Sharing Ratio:-

Z acquired 1/8th share from X

New share of X – 5/8 – 1/8 – 4/8

New share of Y – 3/8

New share of Z – 1/8

New profit sharing ratio – 4:3:1

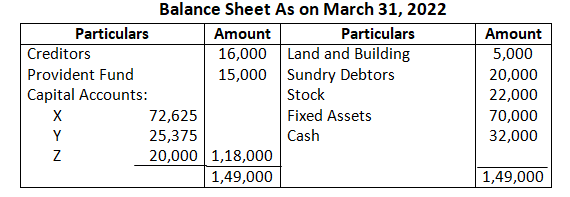

Q63. Rajesh and Ravi are partners sharing profits in the ratio of 3: 2. Their Balance sheet at 31st March, 2025 stood as:

Raman is admitted as a new partner introducing a capital of 16,000. The new profit-sharing ratio is decided as 5: 3: 2. Raman is unable to bring in any cash for goodwill. So, it is decided to value the goodwill on the basis of Raman’s Share in the profits and the capital contributed by him. Following revaluation is made:

- Stock to decrease by 5%;

- Provision for Doubtful Debts is to be 500;

- Furniture to decrease by 10%;

- Building is valued at 40,000.

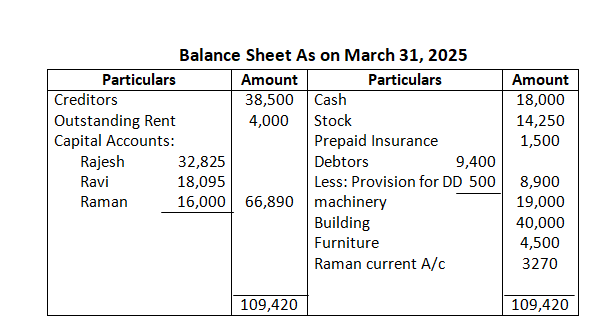

Show Necessary Ledger Accounts & Balance Sheet of New firm.

Solution:-

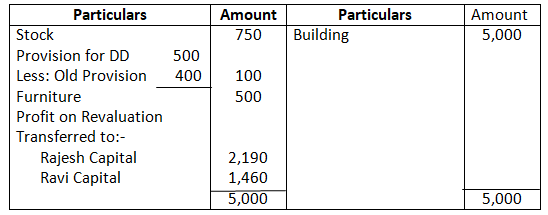

Dr Revaluation Account Cr

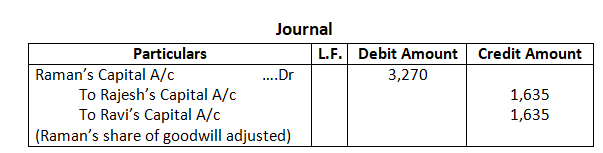

Working Note:-

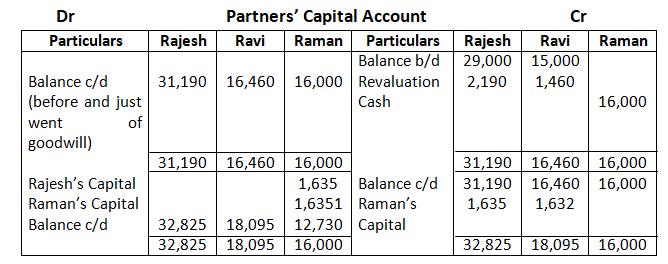

Calculation of Sacrificing Ratio:-

Old Ratio – 3:2

New ratio – 5:3:2

Sacrificing Ratio = Old Ratio – New Ratio

Rajesh’s – 3/5 – 5/10 = 1/10

Ravi’s – 2/5 – 3/10 = 1/10

Sacrificing ratio – 1:1

Calculation of Goodwill:-

Actual capital of all Partners before adjustment of goodwill – Rajesh Capital + Ravi’s Capital + Raman’s Capital

= 31,190 + 16,460 + 16,000 = 63,650

Capitalised value on the basis of Raman’s share – 16,000 x 10/2 – 80,000

Goodwill of the firm – Capitalised value of the firm – Actual capital of the firm (before adjustment of the goodwill)

= 80,000 – 63,650 = 16,350

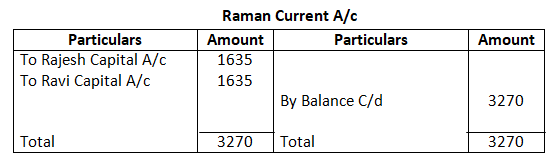

Raman’s share of Goodwill – 16,350 x 2/10 – 3,270

Adjustment of Raman’s share of goodwill:-

Rajesh and Ravi each capital Accounts – 3,270 x 1/2 – 1,635

Distribution of Profit on Revaluation (in old ratio)

Rajesh – 3,650 x 3/5 – 2,190

Ravi – 3,650 x 2/5 – 1,460

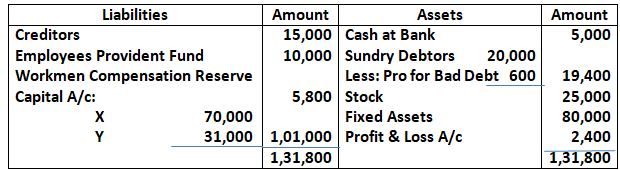

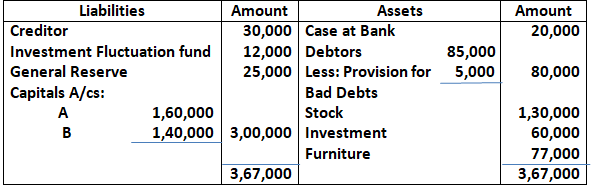

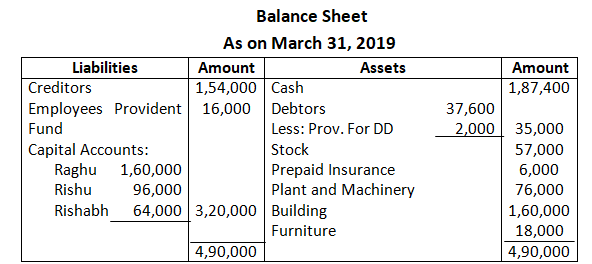

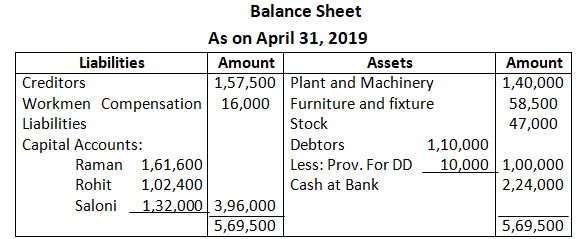

Q64. On 31st March, 2019, The Balance Sheet of A and B, Who were Sharing profits in the ratio of 3: 2 was as follow:

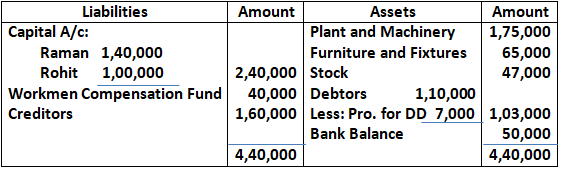

On 1st April, 2019, they decided to admit C as a new partner for 1/5th share in the profits on the following terms;

- C brought 1, 00,000 as his capital and 50,000 as his share of premium for goodwill.

- Outstanding salaries of 2,000 be provided for:

- The Market Value of Investment was 50,000.

- A debtor whose dues of 18,000 were written off as bad debts paid 12,000 in full settlement.

Prepare Revaluation Account, Partners’ Capital Account and the Balance sheet of the new firm.

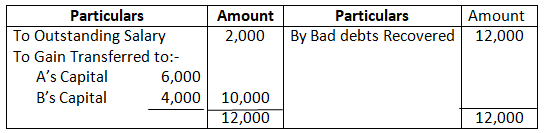

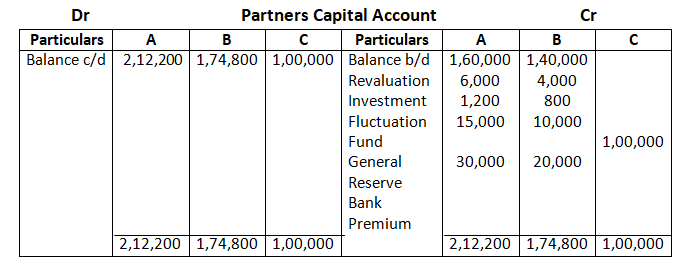

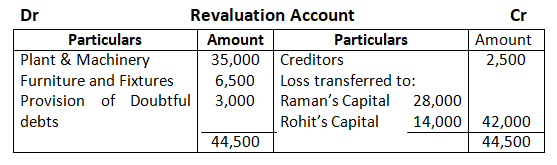

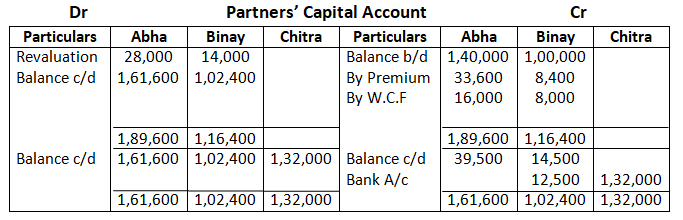

Solution:-

Dr Revaluation Account Cr

Working Note:-

Distribution of Revaluation Gain in 3:2

A – 10,000 x 3/5 = 6,000

B – 10,000 x 2/5 = 4,000

Investment Fluctuation Reserve in 3:2

A – 2,000 x 3/5 – 1,200

B – 2,000 x 2/5 = 800

General Reserve in 3:2

A – 25,000 x 3/5 – 15,000

B – 25,000 x 2/5 – 10,000

Distribution of Premium in Sacrificing Ratio 3:2

A – 50,000 x 3/5 – 30,000

B – 50,000 x 2/5 – 20,000

Cash balance

Cash balance – 20,000 + 1, 00,000 + 50,000 + 12,000 = 1, 82,000

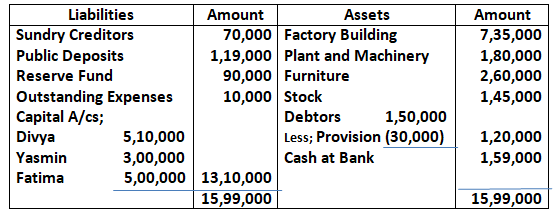

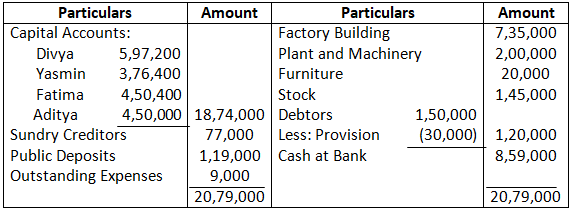

Q65. Divya, Yasmin and Fatima are partners in a firm, Sharing Profits and losses in 11: 7: 2 respectively. The Balance Sheet of the Firm on 31st March, 2018 was as follows:

On 1st April, 2018, Aditya is admitted as a partner for one-fifth share in the profits with a capital of 4, 50,000 and necessary amount for his share of goodwill on the following terms;

- Furniture of 2, 40,000 were to be taken over Divya, Yasmin and Fatima Equally.

- A creditor of 7,000 not recoded in books to be taken into account.

- Goodwill of the firm is to be valued at 2.5 years purchase of average profits of last two years. The profits of the last Three years were. 2015-16 -6,00,000; 2016-17 -2,00,000; 2017-18 -6,00,000;

- At time of Aditya’s admission. Yasmin also brought in 50,000 as fresh capital.

- Plant and Machinery is re-valued to 2, 00,000 and expenses outstanding were brought down to 9,000.

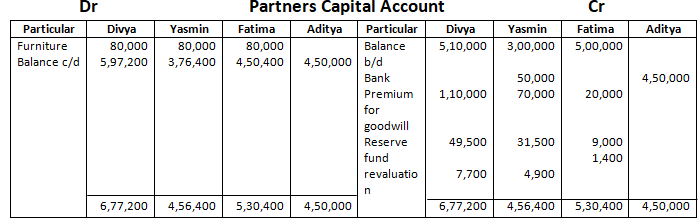

Prepare Revaluation Account, Partner’s Account and Balance Sheet of the reconstituted firm.

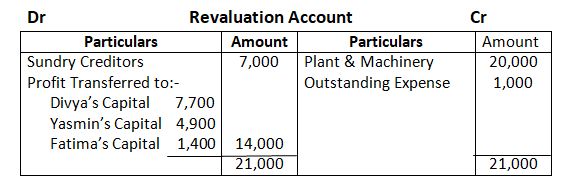

Solution:-

Working note:-

Calculation of Goodwill brought in by Aditya

Average Profits – (Normal profits from 31st March, 2017 to 31st March, 2018)/2

- (2,00,000 + 6,00,000)/2 – 4,00,000

Goodwill – Average Profits X No. of years of Purchase

- (4,00,000 x 2.5) – 10,00,000

Goodwill brought in by Aditya – (10, 00,000 x 1/5) – 2, 00,000

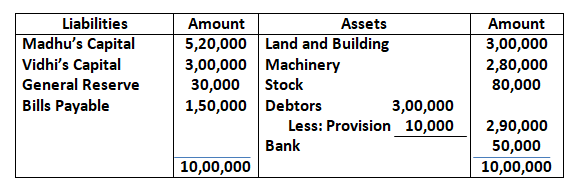

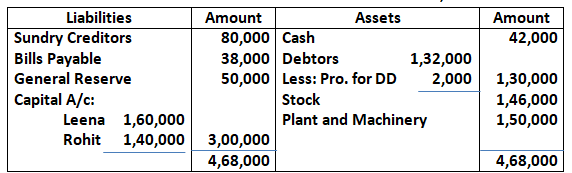

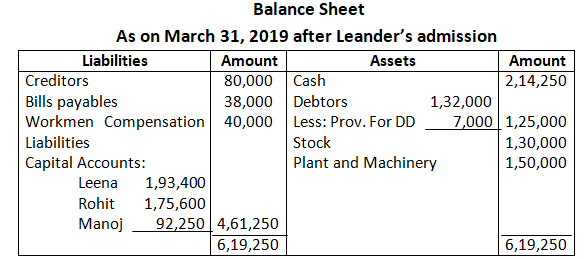

Balance Sheet As on March 31, 2022

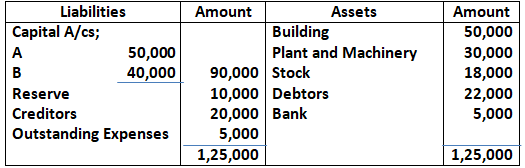

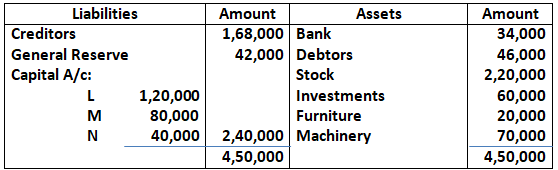

Q66. A and B are Partner in a firm. Net profit of the firm is divided as follows; 1/2to A, 1/3 to B and 1/6 carried to a Reserve. They admit C as partner on 1st April, 2025 on which date, the Balance Sheet of the firm was;

Following are the required adjustment on admission of C.

- C brings in 25,000 toward his capital.

- C also brings in 5,000 for 1/5th share of goodwill.

- Stock is undervalued by 10%.

- Creditors include a liability of 4,000, which has been decided by the court at 3,200.

- In regard to the Debtors, the following Debts Proved bad or Doubtful-

2,000 Due from X-bad to the full extent;

4,000 due from Y-insolvent, estate expected to pay only 50%.

You are required to prepare Revaluation Account, Partners Capital Account and Balance Sheet of the new firm.

Solution:-

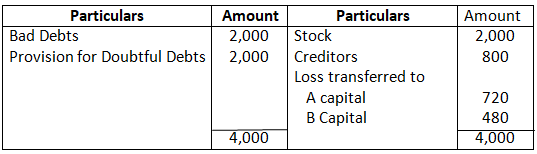

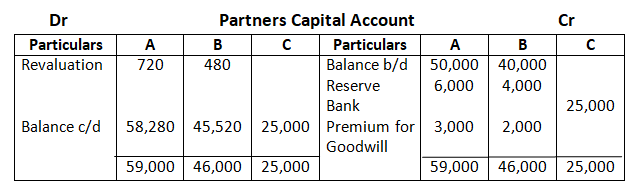

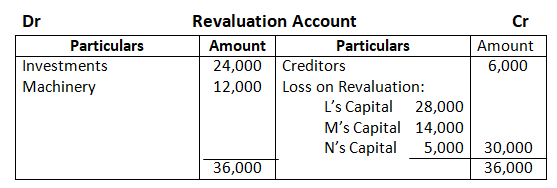

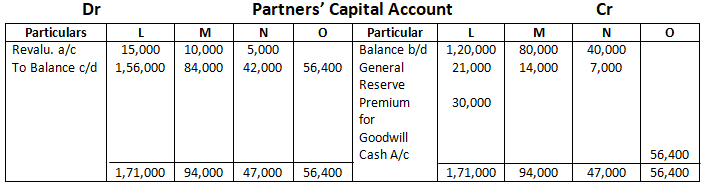

Dr Revaluation Account Cr

Working Notes:-

Old Ratio – 1/2: 1/3 – 3:2

Sacrificing Ratio – 3:2

Distribution of Reserve:-

A – 10,000 x 3/5 – 6,000

B – 10,000 x 2/5 – 4,000

Distribution of Premium for Goodwill:-

A – 5,000 x 3/5 – 3,000

B – 5,000 x 2/5 – 2,000

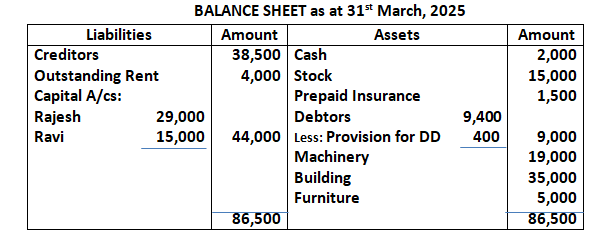

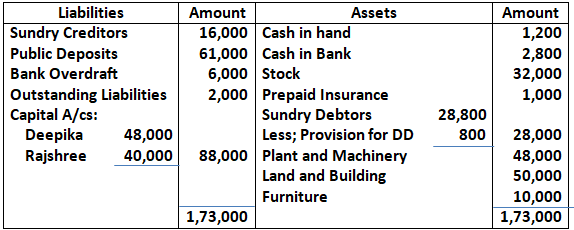

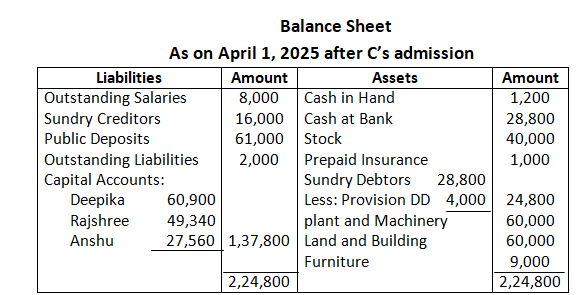

Q67. Deepika and Rajshree are partners in a firm sharing profits and losses in the ratio of 3: 2. On 31st March, 2025 their Balance Sheet was:

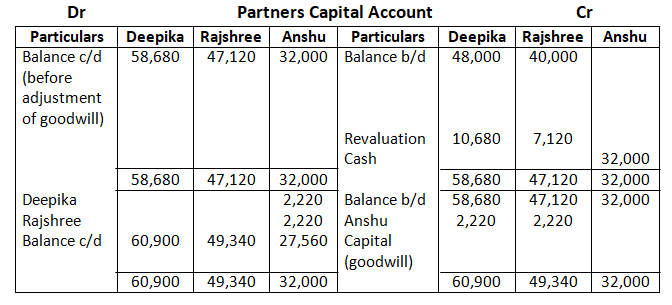

On 1st April, 2025, the partners admit Anshu as a partner on the following terms:

- New profit-sharing ratio of Deepika, Rajshree and Anshu will be 5:3:2.

- Anshu shall bring in 32,000 as his capital.

- Anshu is unable to bring his share of goodwill. Partners, therefore, decided to calculate the goodwill on the basis of Anshu’s share in the profits and the capital contribution made by her to the firm.

- Plant and Machinery is to be valued at 60,000, stock at 40,000 and the Provision for Doubtful Debts is to be maintained at 4,000. Value of Land and Building has appreciated by 20%. Furniture has been depreciated by 10%.

- There is an additional liability of 8,000 being outstanding salary payable to employees of the firm. This liability is not included in the outstanding liabilities, stated in the above Balance Sheet. Partners decided to show this liability in the books of account of the reconstituted firm.

Prepare Revaluation Account, Partners Capital Accounts and Balance Sheet of Deepika, Rajshree and Anshu.

Solution –

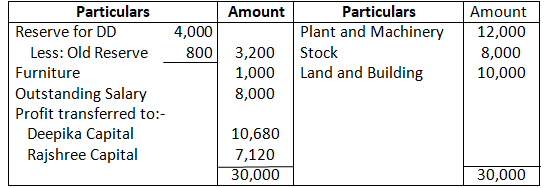

Dr Revaluation Account Cr

Working Notes:-

Calculation of Sacrificing Ratio:-

Old Ratio – Deepika: Rajshree – 3:2

New Ratio – Deepika: Rajshree: Anshu – 5:3:2

Sacrificing Ratio = Old ratio – New Ratio

Deepika – 3/5 – 5/10 – 1/10

Rajshree – 2/5 – 3/10 – 1/10

Sacrificing ratio – 1:1

Valuation of Goodwill:-

Capitalized value on the basis of Anshu’s share – 32,000 x 10/2 – 1, 60,000

Actual capital of all partners before adjustment of Goodwill

– 58,680 + 47,120 + 32000 – 1, 37,800 = 22,200

Anshu’s share of Goodwill – 22,200 x 2/10 – 4,440

Deepika and Rajshree each will entitle for Goodwill – 4,440 x 1/2 – 2,220

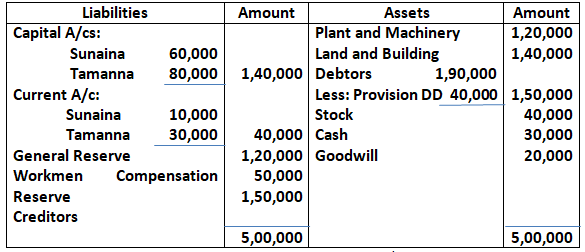

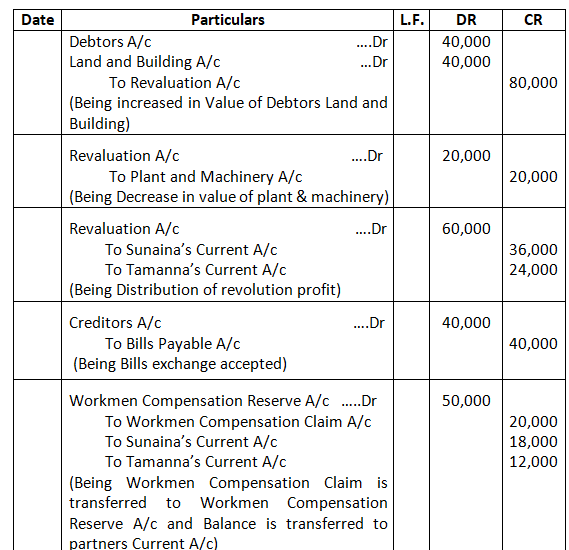

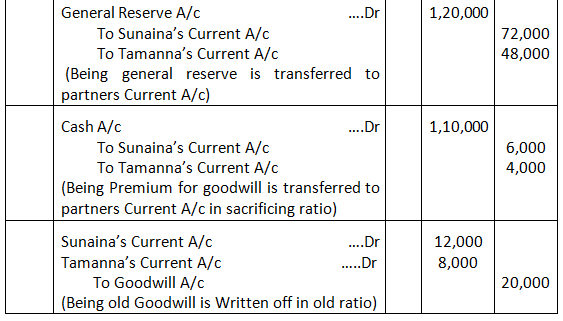

Q68. Sunaina and Tamanna are partners in a firm sharing profits and losses in the ratio of 3:2. Their Balance Sheet as at 31st March, 2020 stood as follow:

They agreed to admit Pranav into partnership for 1/5th share of profits on 1st April, 2020, on the following terms:

- All Debtors are good.

- Value of Land and Building to be increased to 1, 80,000.

- Value of Plant and Machinery to be reduced by 20,000.

- The liability against Workmen’s Compensation Fund is determined at 20,000 which are to be paid later in the year.

- Anil, to whom 40,000 were payable (already included in above creditors), drew a bill of exchange for 3 months which was duly accepted.

- Pranav to bring in capital of 1, 00,000 and 10,000 as premium for goodwill in cash.

Journalise.

Solution – Journal Entry

Adjustment of the Old Partners Capital on the Basis of New or Incoming Partners’ Capital:-

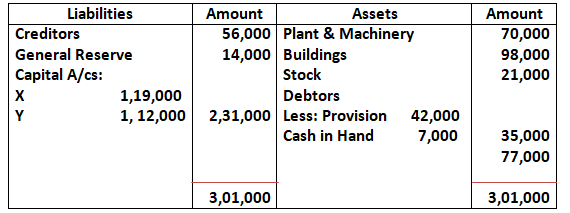

Q69. X and Y were partners in the profit-sharing ratio of 3:2. Their balance sheet as at 31st March, 2022 was as follows:

Balance Sheet as at 31st March, 2022

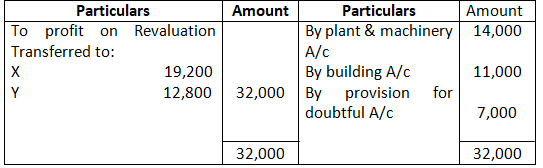

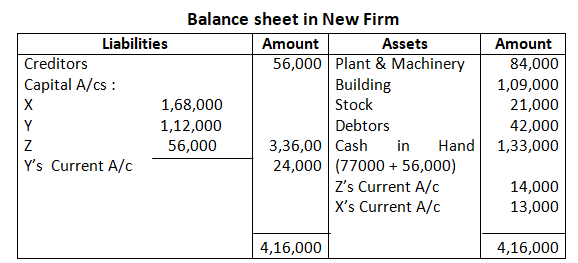

Z was admitted for 1/6th share on the following terms:

- Z will bring Rs.56,000 as his share of capital, but was not able to bring any amount to compensate the sacrificing partners.

- Goodwill of the firm is valued at Rs.84,000.

- Plant and Machinery were found to be undervalued by Rs.14,000 Building was to brought up to Rs.1,09,000.

- All debtors are good.

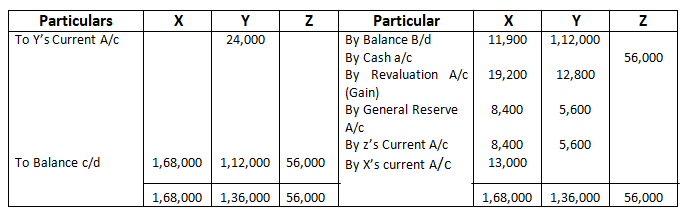

- Capital of X and Y will be adjusted on the basis of Z’s share and adjustments will be done by opening necessary current accounts.

You are required to prepare Revaluation Account and Partners’ Capital Accounts.

Solution-

Dr. Revaluation A/c Cr.

Dr. Partner’s Capital A/c Cr.

Working Notes

Calculation of partner’s Capital in New Firm

Total Capital of the Firm = Z’s Capital x Reciprocal of his share

= 56,000 x 6

= Rs.3,36,000

The Partners will maintain this Capital in their New Profit sharing ratio

X’s Capital in New firm = 3,36,000 x 3/6

= Rs.1,68,000

Y’s Capital in New firm = 3,36,000 x 2/6

= Rs.1,12,000

Z’s Capital in New firm = 3,36,000 x 1/6

= 56,000

Calculation of Partner’s Share in Goodwill

Z’s Premium for Goodwill = 84,000 x 1/6

= Rs.14,000

X & Y will share it in their Sacrificing Ratio i.e., 3:2

X will get = 14,000 x 3/5

= 8400

Y will get = 14,000 x 2/5

= 5600

Calculation of New profit sharing ratio

Old Ratio of X & Y = 3:2

Z admitted for 1/6the share

Remaining share = 1 – 1/6th

= 5/6th

This remaining share would be distributed in old partners in their profit sharing ratio i.e., 3:2

X’s New share = 5/6 x 3/5

= 15/30

Y’s New share = 5/6 x 2/5

= 10/30

New profit sharing ratio after making base equal

= 15/30 : 10/30 : 1/6 x 5/5

= 15 : 10 : 5

= 3 : 2 : 1

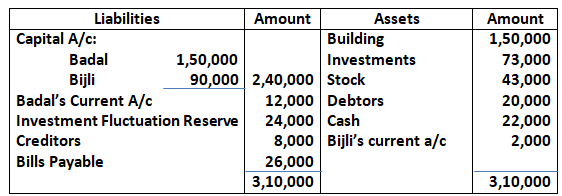

Q70. Badal and Bijli were partners in a firm sharing profits in the ratio of 3:2. Their Balance Sheet as at 31st March, 2019 was as follows:

Balance Sheet as on 31st March, 2019 is given below:

Raina was admitted on the above date as a new partner for 1/6th share in the profits of the firm. The terms of agreement were as follows:

- Raina will bring 40,000 as her capital and capitals of Badal and Bijli will be adjusted on the basis of Raina’s capital by opening Current Accounts.

- Raina will bring her share of goodwill premium for 12,000 in cash.

- The building was overvalued by 15,000 and stock by 3,000.

- A provision of 10% was to be created on debtor for bad debts.

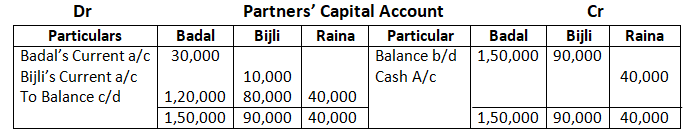

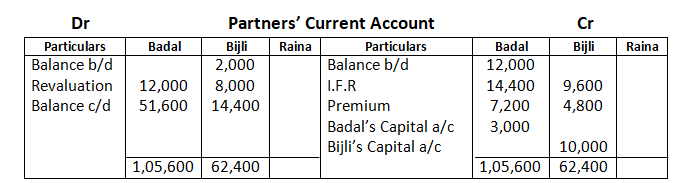

Prepare the Revaluation Account and Current and Capital Accounts of Badal, Bijli and Raina.

Solution –

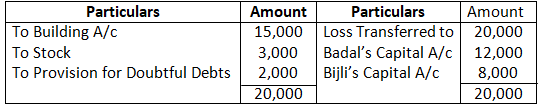

Dr Revaluation Account Cr

Working Notes:-

Calculation of Sacrificing Ratio:-

Sacrifice = Old Profit Share – New Profit Share

Old Ratio of Badal and Bijli = 3:2

Share of Raina is 1/6

Calculation of new profit sharing ratio:-

Profit sharing ratio is 1/1

Remaining profit sharing ratio is 1/1 – 1/6 = 5/6

Share of Badal & Bijli in Remaining share

Badal = 5/6 x 3/5 = 15/30

Bijli = 5/6 x 2/5 = 10/30

New ratio – Badal: Bijli: Raina – 3:2:1

Goodwill for 1/6th share of Raina = 12,000

Goodwill payable to Badal & Bijli

Badal = 12,000 x 3/5 – 7,200

Bijli = 12,000 x 2/5 – 4,800

Capital of the Partners in the New firm on the basis of Raina’s Capital:-

Raina’s capital – 40,000

Raina’s Share of Profit 1/6 for that he brings – 40,000

Total capital of the firm = 40,000 x 6/1 – 2, 40,000

Thus,

Badal’s Capital – 2, 40,000 x 3/6 – 1, 20,000

Bijli’s Capital = 2, 40,000 x 2/6 – 80,000

Raina’s Capital = 2, 40,000 x 1/6 – 40,000

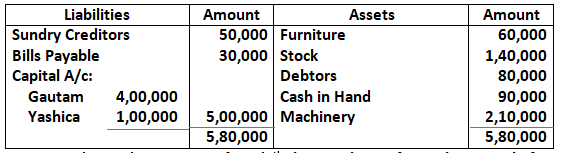

Q71. Gautam and Yashica are partners in a firm, sharing profits and losses in 3:1 respectively. The Balance Sheet of the firm as on 31st March, 2018 was as follows:

Balance Sheet as on 31st March, 2018

Asma is admitted as a partner for 3/8th share in the profits with a capital of 2, 10,000 and 50,000 for her share of goodwill. It was decided that:

- New profit-sharing ratio will be 3:2:3.

- Machinery will depreciated by 10% and Furniture by 5,000.

- Stock was revalued at 2, 10,000.

- Provision for Doubtful debts is to be created at 10% of debtors.

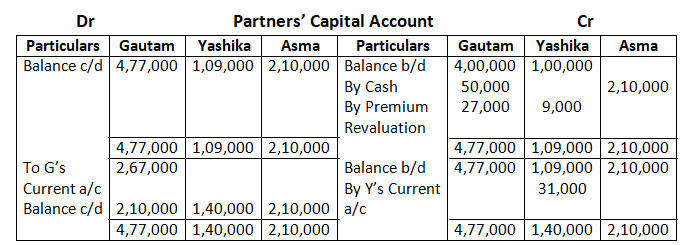

- The capitals of all the partners were to be in the new profit-sharing ratio on basis of capital of new partner. Any adjustment to be done through Current Accounts.

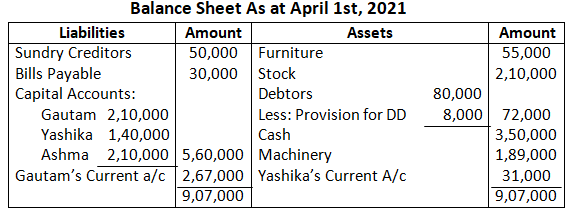

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the new firm.

Solution –

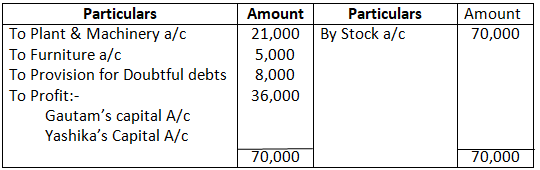

Dr Revaluation Account Cr

Working Notes:-

Calculation of old ratio & sacrificing ratio:-

Old ratio Gautam: Yashika = 3:1

New ratio Gautam: Yashika: Asma – 3:2:3