Ledger is the collection of different accounts of assets, liabilities, capital, revenue and expenses. When transaction are recorded in the journal (Book of original Entry), these are transferred or posted to their respective accounts in Ledger. These are called Book of Secondary or Final Entry. Ledger contains all accounts of a business enterprise, irrespective of whether they are personal, real or nominal.

Features of Ledger:-

- Ledger is a master record of all accounts of the business.

- It is prepared from Journal.

- Ledger Accounts show the current balance in all accounts.

- Trial Balance and Final Accounts are prepared from Ledger Accounts.

- Ledger Accounts summarise the effect of transactions upon assets, liabilities, capital, incomes and expenditures.

studynatic

Utilities of Ledger:-

- Provides Complete Information of a Particular Account – Complete information relating to a particular account is available at one place in the Ledger.

- Information of income and Expenses – In Ledger, a separate account is maintained for each income and expense. The amount of total income and total expenses are Known from the Ledger Account.

- Preparation of Trial Balance – Ledger helps in preparing Trail Balance which ensures arithmetical accuracy of the transactions recorded in books of account.

- Helpful in Preparing Final Accounts – After preparing Trial Balance, Final Accounts are prepared to know the profitability and financial position of the business.

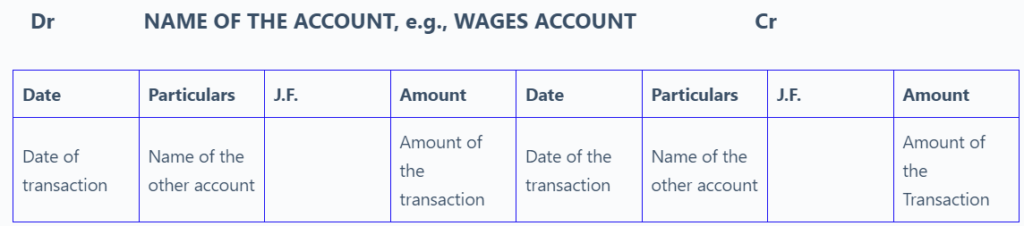

Formate of Ledger Account:-

The format of Ledger account has been explained in an earlier Chapter. For convenience it is being repeated here.

Question 1 to 8