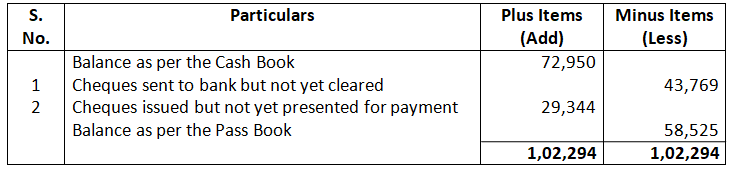

Debit (Favourable) Balance as per Cash Book

Solution – Bank Reconciliation Statement

As on March 31, 2025

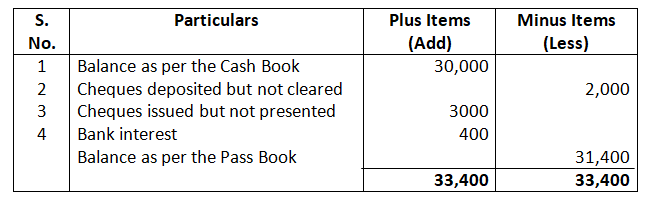

Q.2 Prepare Bank Reconciliation Statement from the following:

- Debit balance as per the Cash Book. 30,000

- Cheques deposited but not cleared. 2,000

- Cheques issued but not presented for payment 3000

- Bank interest. 400

Solution – Bank Reconciliation Statement

Credit Balance as per the Pass Book is 31400.

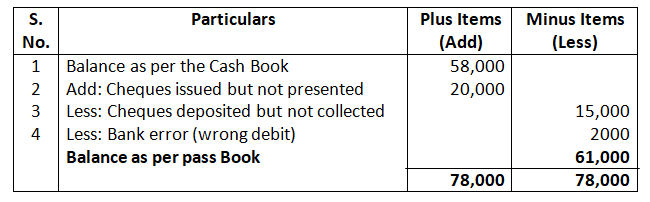

Q3. From the following particulars, prepare Bank Reconciliation Statement of Sunil as on 31st March, 2025:

(i) Balance as per Cash Book. Rs.58,000

(ii) Cheque issued but not presented for payment. Rs.20,000

(iii) Cheques deposited but not collected up to 31st March, 2025 Rs.15,000

(iv) The bank had wrongly debited Rs.2,000 which was rectified after 31st March, 2025.

Solution:-

Bank Reconciliation Statement

Balance as per pass book is 61,000

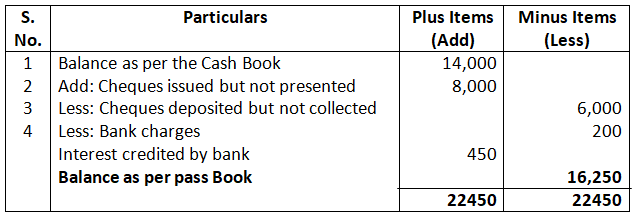

Q.4 Form the following particulars, ascertain the balance in the Pass Book as on 31st January, 2025:

(i) Balance as per Cash Book as on 31st January, 2025 Rs.14,000.

(ii) Out of the total cheques drawn amounting to Rs.12,000, cheques aggregating Rs.4,000 were presented for payment in January, 2025, cheque aggregating Rs.5,000 were presented in February, 2025 and the rest have not been presented.

(iii) Out of the total cheques deposited amounting to Rs.8,000, cheques aggregating Rs.2,000 were credited in January, 2025, cheques aggregating Rs.3,000 were credited in February, 2025 and the rest have not been collected.

(iv) Bank has debited Rs.200 as bank charges and has credited Rs.450 on account of interest.

Solution:-

Bank Reconciliation Statement

Balance as per Pass Book as on 31st January, 2025: Rs.16250

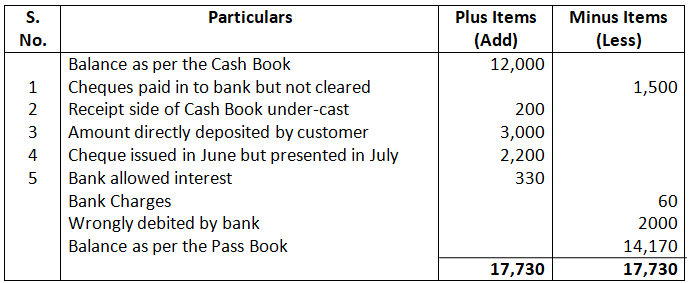

Q.5 On 31st December, 2024, bank column of the Cash Book showed balance of 12,000 but the Pass Book showed a different balance due to the following reasons:

- Cheques paid into bank 8,000 but out of these only cheques of 6,500 credited by bankers.

- The receipts column of the Cash Book undercast by 200

- On 29th December, a customer deposited 3,000 directly in the Bank Account but it was entered in the Pass Book only.

- Cheques of 9,200 were issued of which 2,200 were presented for payment on 15th January 2025.

- Pass Book shows a credit of 330 as interest and a debit of 60 as bank charges.

- The bank had wrongly debited the account of Gurman by 2000 which was rectified after 31st December, 2024.

Prepare Bank Reconciliation Statement as on 30th December 2024.

Solution – Bank Reconciliation Statement

As on 31th December 2024

Credit Balance as per the Pass Book is 14,170

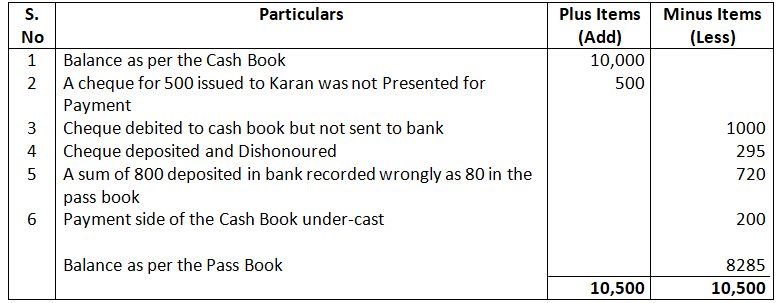

Q6. From the following Particulars, Prepare Bank Reconciliation Statement as on 31st December, 2024:

- Debit balance as per Cash Book 10,000.

- A cheque for 500 issued in favour of Karan has not been presented for payment.

- A post-dated cheque 1000 debited in the bank column of the cash book but not sent to bank.

- A cheque for 295 deposited in the bank has been dishonoured.

- A sum of 800 deposited in the Bank has been credited as 80 in the Pass Book.

- Payments side of the Cash Book has been undercast by 200.

Solution – Bank Reconciliation Statement

As on 31st December 2024

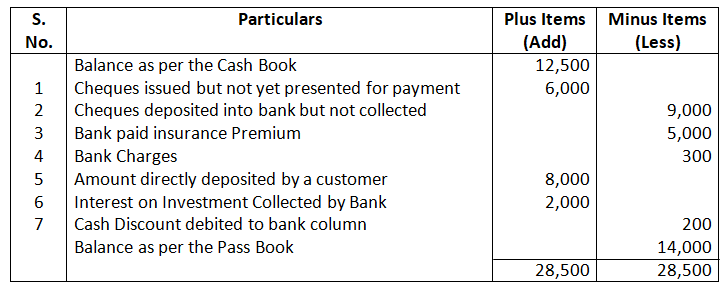

- Cheques issued but not yet presented for payment 6,000

- Cheques deposited in the bank but not collected 9,000

- Bank paid insurance premium. 5,000

- Bank charges. 300

- Directly deposited by a customer. 8,000

- Interest on investment collected by bank. 2,000

- Cash discount allowed of 200 was recorded on the debit side of the Bank column.

Prepare Bank Reconciliation Statement.

Solution – Bank Reconciliation Statement

Credit Balance as per the Pass Book is 14,000.

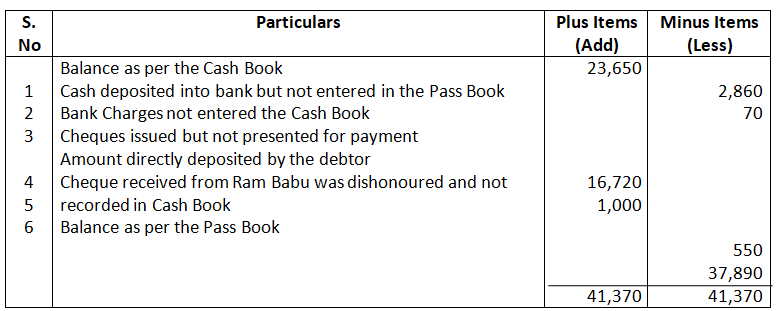

- 2,860 are entered in the Cash Book as paid into the bank on 31st March, 2025 but not credited by the bank until the following day.

- Bank charges of 70 on 31st March, 2025 are not entered in the Cash Book.

- Cheques totalling 16,720 were issued by the company and duly recorded in the Cash Book before 31st March, 2025 but had not been presented at the Bank for payment until after that date.

- On 25th March, 2025, a debtor paid 1,000 into the Company’s Bank in settlement of his account but no entry was made in the Cash Book of the company in respect of this.

- No entry has been made in the Cash Book to record the dishonour on 15th March, 2025, of a cheque for 550 received from Ram Babu.

Prepare a Bank Reconciliation Statement as on 31st March, 2025.

Solution – Bank Reconciliation Statement

As on 31st March 2025

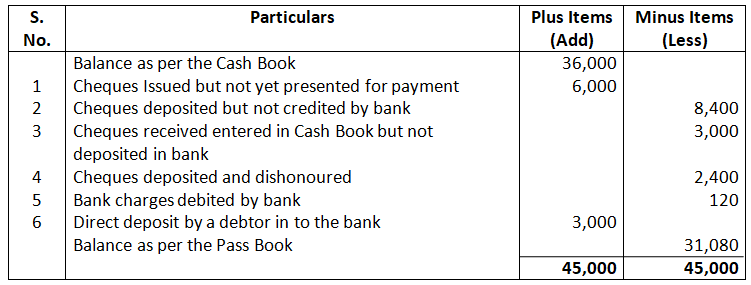

Q9.Prepare a Bank Reconciliation Statement as on 31st March, 2025 from the following:

- On 31st March, 2025, Cash Book of a firm showed bank balance of 36,000 (Dr.).

- Cheques had been issued for 30,000, out of which cheques of 24,000 were presented for payment.

- Cheques of 8,400 were deposited in the bank on 28th March, 2025 but had not been credited by the bank. Also, a cheque of 3,000 entered in the Cash Book on 30th March, 2025 was banked on 3rd April.

- A cheque from Suresh for 2,400 was deposited in the bank on 26th March, 2025 was dishonoured, advice was received on 2nd April 2025.

- Pass Book showed bank charges of 120 debited by the bank.

- One of the debtors deposited 3,000 in the bank account of the firm on 26th March, 2025, but the intimation in this respect was received from the bank on 2nd April, 2025.

Solution – Bank Reconciliation Statement

As on 31st March 2025

(i) Bank had wrongly debited the account by ₹25,000 on 1st March, 2025 and reversed on 3rd April, 2025.

(ii) Receipts Side of the Cash Book was overcast by ₹ 500.

(iii) Payments Side of the Cash Book was overcast by ₹ 5,000.

(iv) Receipts Side of the Cash Book was undercast by ₹ 5,000.

(v) Payments Side of the Cash Book was undercast by 20,000.

(vi) Cheque for₹10,000 issued but was not recorded in the Cash Book.

(vii) A cheque of₹ 5,000 deposited was not recorded in the Cash Book.

[Ans.: Transactions to be added: (iii), (iv), (vii); Transactions to be deducted: (i), (ii), (v), (vi).]

Credit (favourable) balance as per the pass book

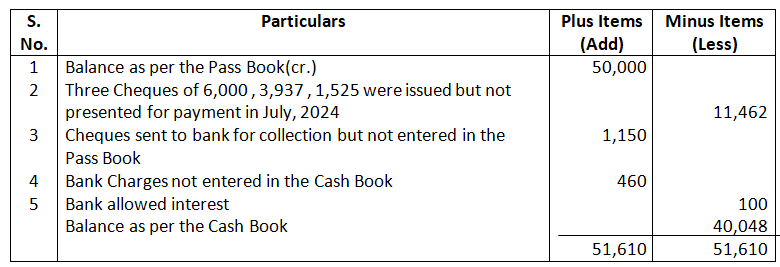

Q11. Prepare Bank Reconciliation Statement from the following particulars on 31st July, 2024:

- Balance as per the Pass Book 50,000.

- Three cheques for₹ 6,000, ₹3,937 and ₹1,525 issued in last week of July, 2024 were presented for payment to the bank in August, 2024.

- Two cheques of 500 and 650 sent to the bank for collection were not entered in the Pass Book by 31st July, 2024.

- The bank charged 460 for its commission and allowed interest of 100 which were not mentioned in the Bank Column of the Cash Book.

Solution – – Bank Reconciliation Statement

As on 31st July 2024

Debit Balance as per the Cash Book is 40,048.

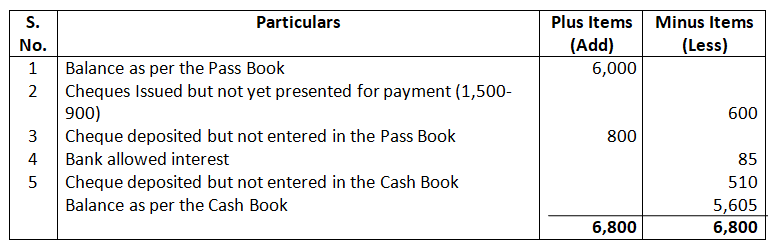

- On 31st March, 2025 your pass book showed a balance of 6,000 to your credit.

- Before that date, you had issued cheque amounting to 1,500 of which cheques of 900 have been presented for payment.

- A cheque of 800 paid by you into the bank on 29th March, 2025 is not yet credit in pass book.

- There was a credit of 85 for interest on current Account in the pass book.

- On 31st March, 2025, a cheque for 510 received by you and was paid into bank but the same was omitted to be entered in cash book.

Solution – Bank Reconciliation Statement

As on 31st March 2025

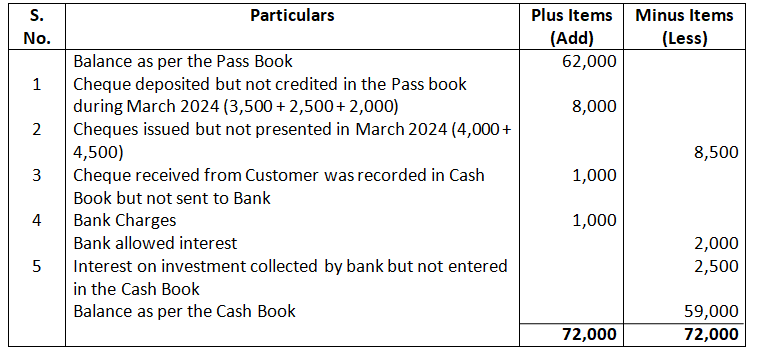

Q13. Bank statement of a customer shows bank balance of 62,000 on 31st March, 2025. On comparing it with the Cash Book the following discrepancies were noted:

- Cheques were paid into the bank in March, 2025 but were credited in April, 2025: P-3,500; Q-2,500; R-2,000.

- Cheques issued in March, 2025 were presented in April, 2025: X-4,000 Y-4,500

- Cheque for 1,000 received from a customer entered in the Cash Book but was not banked.

- Pass Book shows a debit of 1,000 for bank charges and credit of 2,000 as interest.

- Interest on investment 2,500 collected by the bank appeared in the Pass Book.

Prepare Bank Reconciliation Statement showing the balance as per Cash Book on 31st March, 2025.

Solution Bank Reconciliation Statement

As on 31st March 2025

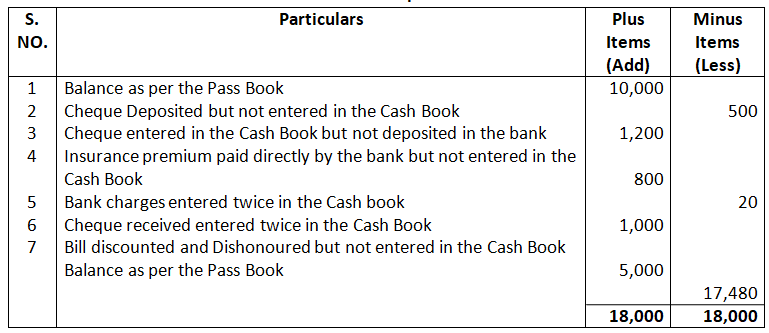

Bank Balance as per Pass Book. 10,000

Cheque deposited into bank but no entry was passed in Cash Book. 500

Cheque received and entered in Cash Book but not sent to bank 1,200

Insurance premium paid directly by the bank. 800

Bank charges entered twice in the Cash Book. 20

Cheque received entered twice in Cash Book 1,000

Bill discounted dishonoured not recorded in the cash book. 5000

Solution – Bank Reconciliation Statement

As on 30th September 2024

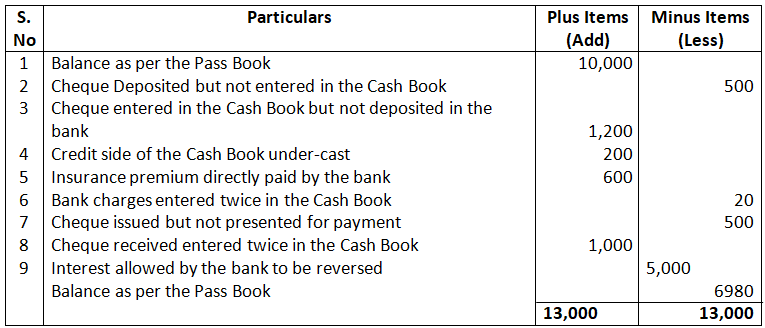

Q15. Prepare Bank Reconciliation Statement as on 31st March, 2025 from the following particulars:

- Bank Balance as per Pass Book. 10,000

- Cheque deposited into bank, but no entry was passed in the Cash Book. 500

- Cheque received and entered in the Cash Book but not sent to bank. 1,200

- Credit side of the Cash Book bank Column cast short. 200

- Insurance premium paid directly by the bank under the standing advice. 600

- Bank Charges entered twice in the Cash Book 20

- Cheque issued but not presented to the bank for payment. 500

- Cheque received entered twice in the Cash Book. 1,000

- Bank had wrongly allowed interest of 5,000 which was reversed by it on 5th April, 2025.

Solution – – Bank Reconciliation Statement

As on 31st March 2025

- Bank had allowed interest and credited the account by 5,000.

- Cheque of 10,000 deposited by a customer in the bank was not recorded in Cash Book.

- Bank Charges charged by the bank 5,000.

- Cheques of 25,000 issued not recorded in the Cash Book were paid and debited to the account by the bank.

- Receipts Side of the Cash Book was overcast by 2,000.

- Payments Side of the Cash Book was undercast by 5,000.

Ans- Transactions to be added: (iii), (iv), (v), (vi); Transactions to be deducted: (i), (ii).]

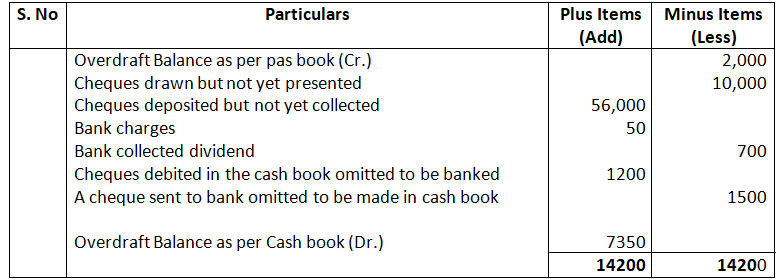

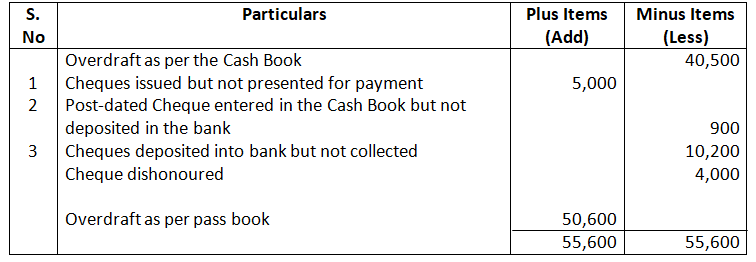

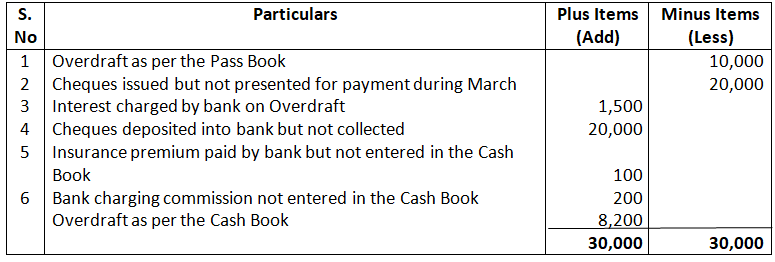

Credit i.e. overdraft (unfavourable) balance as per cash book

Prepare a Bank Reconciliation Statement.

Solution – Bank Reconciliation Statement

As on 1st January 2025

(i) Cheque of 10,000 deposited was dishonored.

(ii) Cheque of 20,000 was recorded in Cash Book but was not deposited.

(iii) Post-dated cheque of ₹20,000 discounted from Bank was dishonored.

(iv) A cheque issued to Ramesh for₹5,500 was not recorded in Cash Book.

(v) Payments Side of the Cash Book was undercast by 4,000.

[ Ans.: Transactions to be added: (i), (ii), (iii), (iv), (υ).]

- A cheque for 5,000 drawn in favour of Manohar has not yet been presented for payment.

- A post-dated cheque for 900 has been debited in the bank column of the Cash Book but it could not have been presented in any case.

- Cheques totalling 10,200 deposited with the bank has not yet been collected and a cheque for 4,000 has been dishonoured.

Prepare Bank Reconciliation Statement and Find out the balance as per Pass Book.

Solution – Bank Reconciliation Statement

As on 31st March 2025

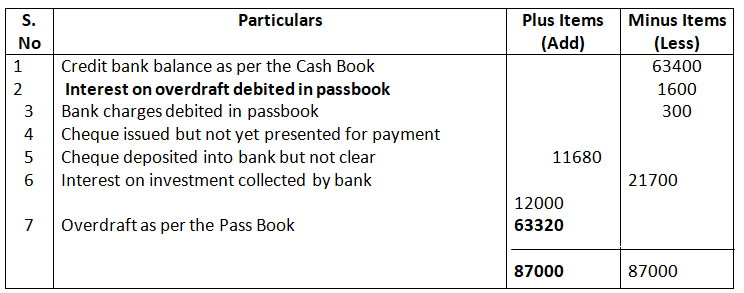

(i) Bank overdraft as per Cash Book on 31st March, 2025 ₹63,400.

(ii) Interest on overdraft for 6 months ending 31st March, 2025,₹ 1,600 is entered in the Pass Book.

(iii) Bank charges of ₹300 for the above period are debited in the Pass Book.

(iv) Cheques issued but not presented for payment before 31st March, 2025 amounted to 11,680.

(v) Cheques deposited into bank but not cleared before 31st March, 2025 were for₹ 21,700.

(vi) Interest on Investments collected by the bank is credited in the Pass Book 12,000.

Solution – Bank Reconciliation Statement

As on 31st March 2025

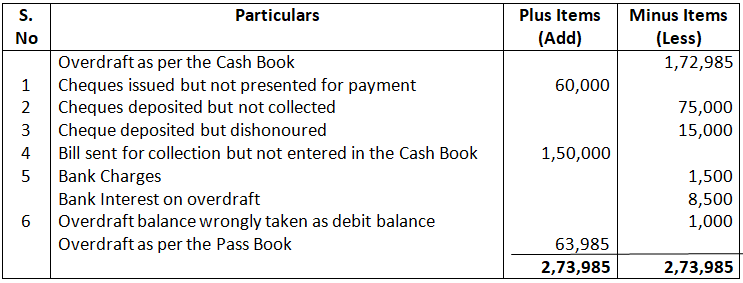

- Cheques issued for 60,000 were not presented in the bank till 7th April, 2025.

- Cheques amounting to 75,000 were deposited in the bank but were not collected.

- A cheque of 15,000 received from Mahesh Chand and deposited in the bank was dishonoured but the non-payment advice was not received from the bank till 1st April, 2025.

- 1, 50,000 entered in Pass Book for cheque realised but not in the Cash Book.

- Bank charges 1,500 and interest on overdraft 8,500 appeared in the Pass Book but not in the Cash Book.

- Overdraft balance as per Cash Book of 500 on 28th February, 2025 was wrongly carried forward as debit balance. The error was noted at the time of preparing the Bank Reconciliation Statement as on 31st March, 2025.

Prepare Bank Reconciliation Statement.

Solution – Bank Reconciliation Statement

As on 31st March 2025

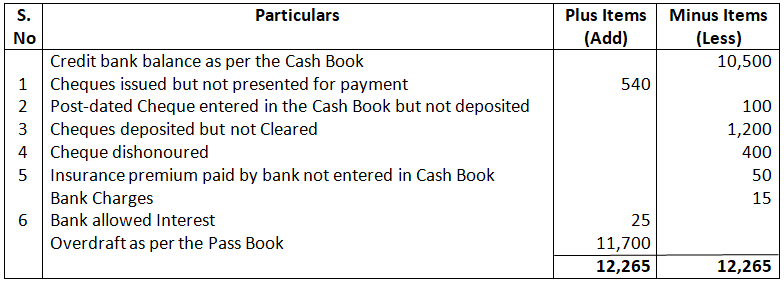

Q22. Prepare Bank Reconciliation Statement from the following:

On 31st March, 2025, a merchant’s Cash Book showed a credit bank balance of 10,500 but due to the following reasons the Pass Book showed a difference.

- A cheque of 540 issued to Mohan has not been presented for payment.

- A post-dated cheque for 100 has been debited in the bank column of the Cash Book but under no circumstances was it possible to present it.

- Four cheques of 1,200 sent to the bank have not been collected so far. A cheque of 400 deposited in the bank has been dishonoured.

- As per instructions, the bank paid 50 as Fire Insurance Premium but the entry has not been made in the Cash Book.

- There was a debit in the Pass Book of 15 in respect of banks charges and a credit of 25 for interest on current Account but no record exists in the Cash Book.

- Cheque of 5,000 dated 15th April, 2025 issued to M & Co. was dishonoured being post -dated. It was also not recorded in the books of account yet.

Solution – Bank Reconciliation Statement

As on 31st March 2025

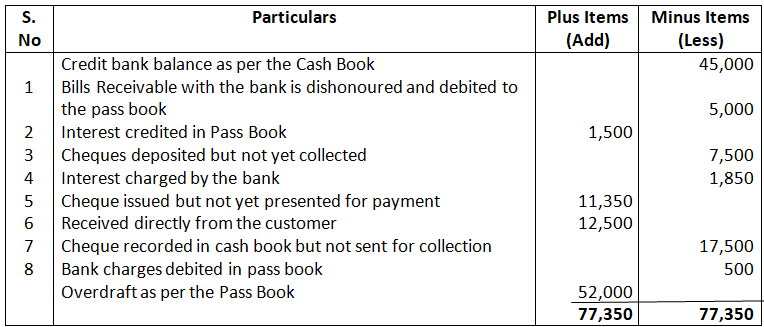

- A post-dated cheque 5,000 previously discounted with the bank had been dishonoured and debited in the Pass Book.

- Interest on Investment collected by the bank and credited in the Pass Book 1,500.

- Cheques deposited into bank but not yet collected 7,500

- Interest charged by the bank on overdraft balance 1,850.

- Cheques issued but not yet presented for payment 11,350.

- Received a payment directly from a customer into bank account 12,500

- Cheques recorded in the Cash Book but not sent to the bank for collection was 17,500.

- Bank charges debited as per Pass Book 500.

Solution – Bank Reconciliation Statement

As on 31st March 2025

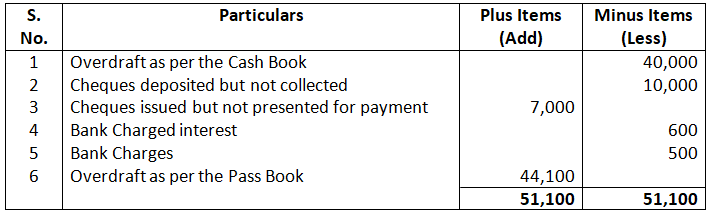

Debit overdraft (unfavourable)balance as per pass bank

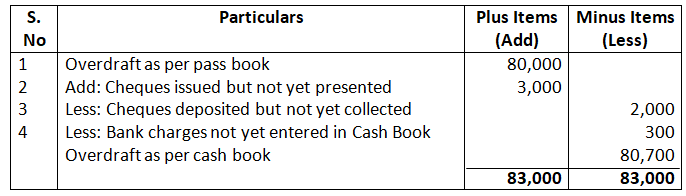

Q24. Prepare a Bank Reconciliation Statement from the following:

- Bank overdraft as per Pass Book Rs.80,000

- Cheques issued but not presented for payment Rs.3,000

- Cheques deposited but not yet collected by the bank Rs.2,000

- Bank charges not yet recorded in Cash Book Rs.300

Solution:-

Bank Reconciliation Statement

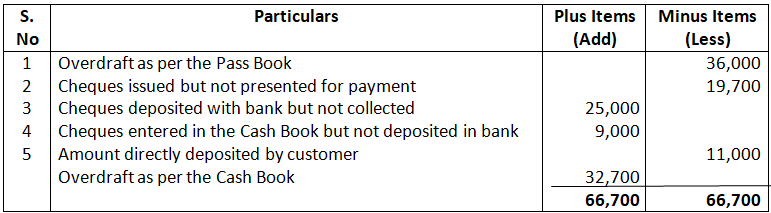

Q25. From the following information, prepare Bank Reconciliation Statement as on 31st March, 2025:

- Bank Overdraft as per Pass Book. 36,000

- Cheques issued but not presented for payment. 19,700

- Cheques deposited with Bank but not collected. 25,000

- Cheques entered in Cash Book but not banked. 9,000

- Directly deposited to bank by a customer. 11,000

Solution – Bank Reconciliation Statement

As on 31st March 2025

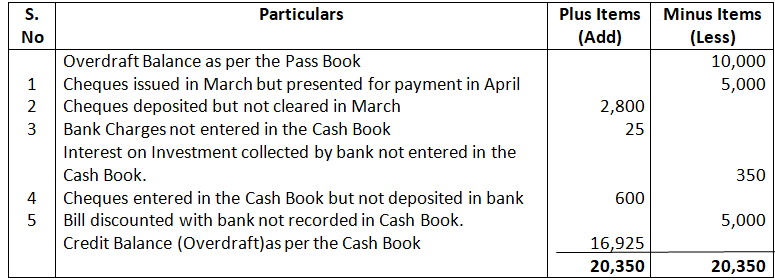

- Cheques amounting to 8,000 drawn on 25th March of which cheques of 5,000 cashed in April, 2025.

- Cheques paid into bank for collection of 5,000 but cheques of 2,200 could only be collected in March, 2025.

- Bank charges 25 and dividend of 350 on investment collected by bank could not be shown in the Cash Book.

- A cheque of 600 debited in the Cash Book omitted to be banked.

- Bank draft of 5,000 received from a customer was deposited but not recorded in the Cash Book.

Solution – Bank Reconciliation Statement

As on 31st March 2025

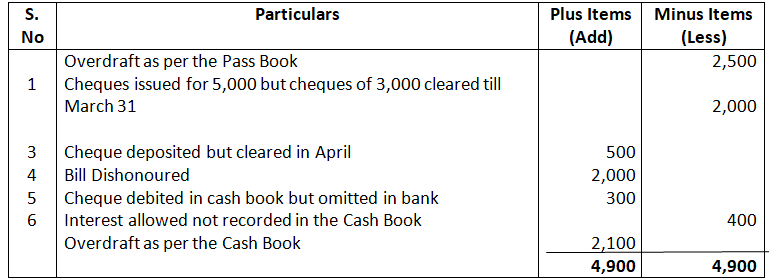

Q27. Prepare Bank Reconciliation Statement from the following particulars as on 31st March, 2025, when Pass Book Shows a Debit Balance of 2,500:

- Cheque issued for 5,000 but up to 31st March, 2025 only 3,000 could be cleared.

- Cheques deposited for 5,500 but cheques for 500 were collected on 10th April, 2025.

- Cheque for 2000 was dishonoured but was not record on cash book.

- A cheque of 300 debited in Cash Book but omitted to be banked.

- Interest allowed by bank 400 but no entry was passed in the Cash Book.

Solution – Bank Reconciliation Statement

As on 31st March 2025

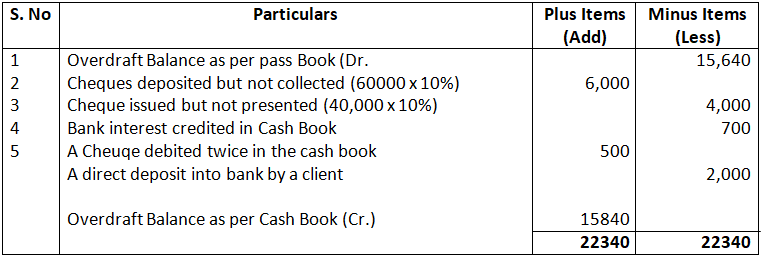

Q28. Komal needs help in preparing the Bank Reconciliation Statement as on 31st May, 2025, based on the following information reported by his cashier:

(i) Bank balance as per the Bank Statement received is ₹ 15,640 (Dr.)

(ii) of the total cheques deposited for₹ 60,000 and issued for ₹ 40,000, 10% of each were cleared and encashed in the month of June, 2025, respectively.

(iii) Bank interest₹350 allowed and ₹840 charged, as reflected in the Pass Book, were both credited in the Cash Book, in the last week of May.

(iv) A cheque for₹500 was debited twice in the Cash Book.

(v) A direct deposit into bank of₹ 2,000 by client Lalita, was not recorded in the Cash Book.

[Ans.: Overdraft as per Cash Book- 15,840.]

Bank Reconciliation Statement

As on 31st March 2025

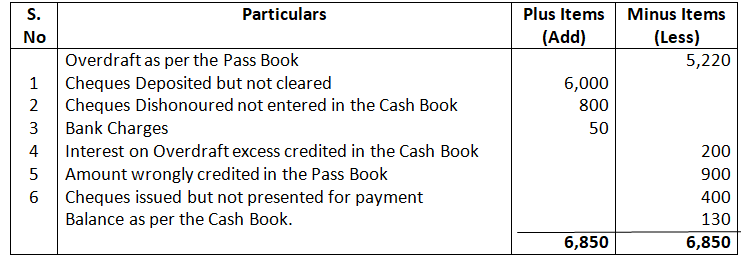

Q29. On checking the Bank Pass Book it was found that it showed on overdraft of 5,220 as on 31st March, 2025, while as per Ledger it was different. The following differences were noted:

- Cheques deposited but not yet credited by the bank 6,000

- Cheques dishonoured and debited by the bank but not given effect to it in the Ledger 800

- Bank charges debited by the bank but Debit Memo not received from the bank 50.

- Interest on overdraft excess credited in the Ledger 200.

- Wrongly credited by the bank to account, deposit of some other party 900.

- Cheques issued but not presented for payment 400.

Solution – Bank Reconciliation Statement

As on 31st March 2025

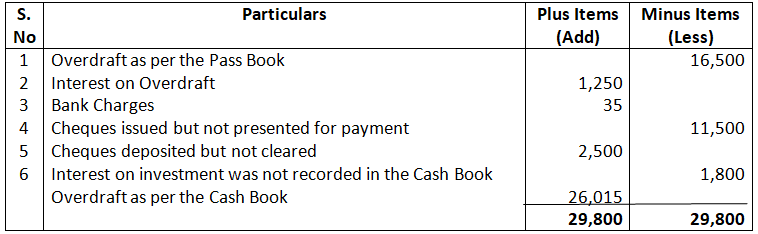

- Bank Pass Book showed an overdraft of 16,500 on 31st October.

- Interest of 1,250 on overdraft up to 31st October, 2024 has been debited in the Bank Pass Book but it has not been entered in the Cash Book.

- Bank Charges debited in the Bank Pass Book amounted to 35.

- Cheques issued prior to 31st October, 2024 but not presented till that date, amounted to 11,500.

- Cheques paid into bank before 31st October, but not collected and credit up to that date, were for 2,500.

- Interest on investment collected by the bankers and credited in the Bank Pass Book amounted to 1,800.

Solution – Bank Reconciliation Statement

As on 31st October 2024

- Balance as per Pass Book on 31st ,March, 2025 overdrawn 10,000

- Cheques drawn in the last week of March, 2025 but not cleared till 3rd April, 2025, 20,000.

- Interest on bank overdraft not entered in the Cash Book 1,500.

- Cheques of 20,000 deposited in the bank in March, 2025 but not collected and credited till 3rd April, 2025.

- 100 Insurance Premium paid by the bank under a standing order has not been entered in the Cash Book.

- A draft of 10,000 favouring Vijay & Co. was issued by the bank charging commission of 200. However, in the Cash Book entry was passed by 10,000.

Solution – Bank Reconciliation Statement

As on 31st March 2025

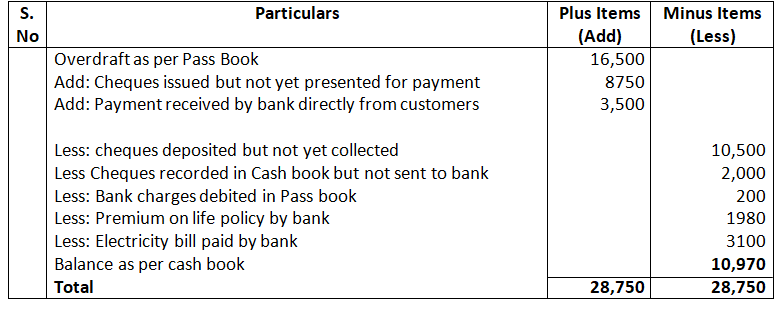

Q32. From the following information supplied by Rajesh, prepare his Bank Reconciliation Statement as on 31st March, 2025:

- Bank overdraft as per Pass book. Rs.16,500

- Cheques issued but not presented for payment. Rs.8,750

- Cheques deposited with the Bank but not collected.Rs.10,500

- Cheques recorded in the Cash Book but not sent to the for collection. Rs.2,000

- Payment received from customers directly by the bank. Rs.3,500

- Premium on life policy of Rajesh paid by the bank on standing advice. Rs.1980

- Bank had debited Rs.3,100 for payment of electricity bill. It was not recorded in cash Book.

Solution:-

Bank Reconciliation Statement

As on 31st March 2025

Calculation:

Addition: 16500 + 8750 +3500 = 28,750

Total deduction: 10500 + 2000 + 200 + 1980 + 3100 = 17,780

Final Balance: 28750 – 17780 = 10970

Q33. On 31st March, 2025, the pass book of a businessman shows a debit balance of Rs.2,000. You are required to prepare Bank Reconciliation Statement as on 31st March, 2025 from the following particulars:

- Cheques amounting to Rs.16,000 drawn on 25th March of which cheques of Rs.6,000 were encashed up to 31st March.

- Cheque worth Rs.10,000 were deposited in March, 2025, out of which cheques of Rs.4,400 could only be collected.

- Bank charges Rs.50 and divided of Rs.700 on shares collected by bank could not be shown in the Cash Book.

- A cheque of Rs.1,200 debited in the Cash Book was omitted to be banked.

- A cheque of Rs.1,500 was sent to the bank but its entry was omitted to be made in Cash Book.

Solution:-

Bank Reconciliation Statement

As on 31st March 2025