Introduction of Accounting Procedures- Rules of Debit and Credit

STUDYNATIC

Transactions are recorded in the books of account on the basis of evidences, i.e., source documents, such as invoices for purchases, invoices for sales, debit and credit notes, etc. Rules of debit and credit are applied to each transaction and recorded in the book of original entry, i.e., Journal.

The transactions recorded in the books of account are transferred to the specific account maintained in the Ledger.

At this stage, it is appropriate to define and understand the term ‘account’.Account is a record of transactions under a particular head. It records not only the amount of transactions but also their effect and direction.

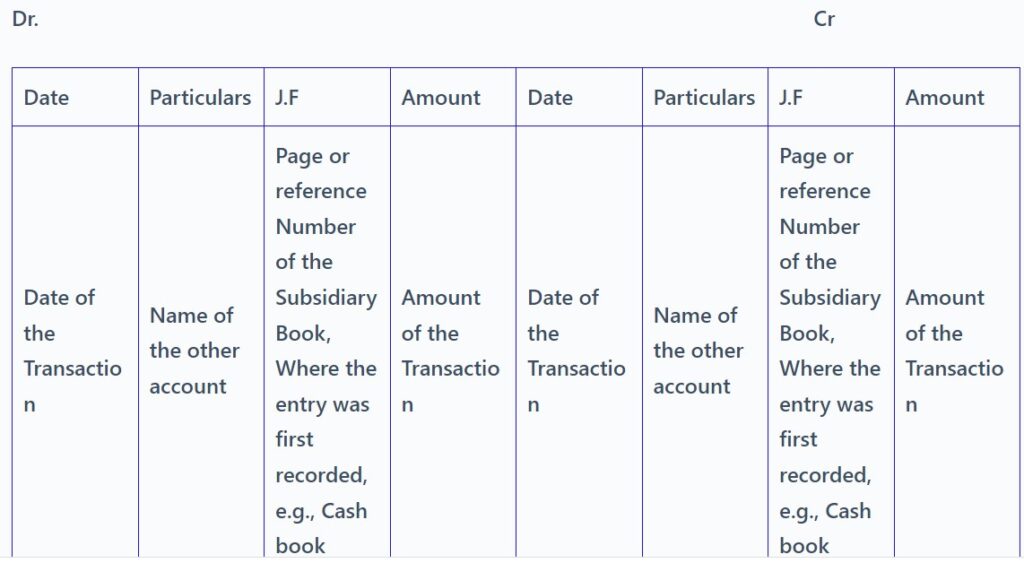

An Account is divided into two parts, i.e., debit and credit. It is usually in a “T” from and the commonly used layout of an account is as follows:

Name of the Account, e.g., salary Account

STUDYNATIC

What is Debit and Credit;-

Debit refers to the left side of an account and credit refers to the right side of an account. In the abbreviated form Dr. Stands for debit and Cr. stands for credit. An item recorded on the debit side of an account is said to be debited to the account. An item recorded on the credit side of an account is said to be credited to the account.

Both debit and credit may represent either increase or decrease depending upon the nature of an account. The rules of debit and credit depend on the nature of account.

Rules of Debit and Credit:-

Under Double Entry System of accounting each transaction has two aspects. One aspect is debit, i.e., receiving or incoming aspect. Another aspect is credit, i.e., giving or outgoing aspect. Debit and Credit aspects of a transaction form the basis of Double Entry System.

Classification of Accounts:-

STUDYNATIC

Account can be classified in two ways:

- Traditional Classification

- Modern Classification

- Traditional Classification – Under this classification, account are classified into two groups as shown below:

Personal Accounts – Accounts which relate to persons, i.e., individuals, firms, companies, debtors or creditors, etc., are Personal Account. Examples of Personal Accounts are the account of Ram & Co., a customer (debtor), or the account of Jhaveri & Co., a supplier of goods (Creditor), Capital Account and Drawings Account of the proprietor. The main purpose of preparing a Personal Account is to determine the balance due to or due from persons or organisation.

Personal Account can be classified into three categories:

- Natural Personal Accounts – the term ‘Natural Personal’ means persons who are creations of God. Therefore, these will include accounts in individual name. For example, ram account, asha account, etc.

- Artificial Personal Account – These accounts include accounts of corporate bodies or institutions which are recognised as persons in business dealings. For example, the accounts of a limited company, the account of a club or a cooperative society, etc.

- Representative Personal Accounts – These are accounts which represent a certain person or a group of persons. For example, if rent is due to the landlord, an outstanding Rent Account will be opened in the books. The outstanding Rent Account represents the amount of rent payable to the landlord.

STUDYNATIC

Rule of Debit and Credit – Debit the receiver, Credit the giver.

Impersonal Accounts – Accounts which are not personal such as Machinery Account, Cash Account, Rent Account, etc., are termed as Impersonal Accounts. These can be further sub-divided into two accounts:

- Real Accounts – Real Account are the Accounts which relate to tangible or intangible assets of the firm (excluding debtors). Examples of tangible assets are: Land, Building, Investments, Plant and Machinery, Stock or cash in hand. Example of intangible assets is: Goodwill, Patents and Trademarks

Rule of Debit and Credit – Debit what comes in, credit what goes out.

- Nominal Account – Accounts which relate to expenses, Losses, Gains, Revenue, etc., are termed as Nominal Accounts. These are Salary Account, Purchases Account, Interest Paid Account, Sales Account and Commission Received Account.

Rule of Debit and Credit – Debit all expenses and losses, Credit all income and Gains.

Rules of Debit and Credit (Traditional Classification) at a Glance:-

STUDYNATIC

| Types of Account | Account to be Debited | Account to be Credited |

| Personal Account | Receiver | Giver |

| Real Account | What Comes in | What Goes Out |

| Nominal Account | Expense and Loss | Income and Gain |

STUDYNATIC

Examples:-

- Classify the following accounts into Personal, Real and Nominal Accounts:

| Cash | 10. Purchases |

| Bank | 11. Bad Debts Recovered |

| Outstanding Salaries | 12. Plant and Machinery |

| Sales | 13. Capital |

| Accrued Interest | 14. Interest (Paid) |

| Leasehold Property | 15. Bank Overdraft |

| Drawings | 16. Prepaid Rent |

| Discount Received Bad debts Written off | 17. Carriage Inwards 18. Goodwill |

STUDYNATIC

Solution:

| Personal Account | Real Account | Nominal Account |

| Bank | Cash | Sales |

| Outstanding Salaries | Leasehold Property | Discount Received |

| Accrued Interest | Plant and Machinery | Bad Debts Written off |

| Drawings | Goodwill | Purchases |

| Capital | Bad Debts Recovered | |

| Bank overdraft | Interest (Paid) | |

| Prepaid Rent | Carriage Inwards |

STUDYNATIC

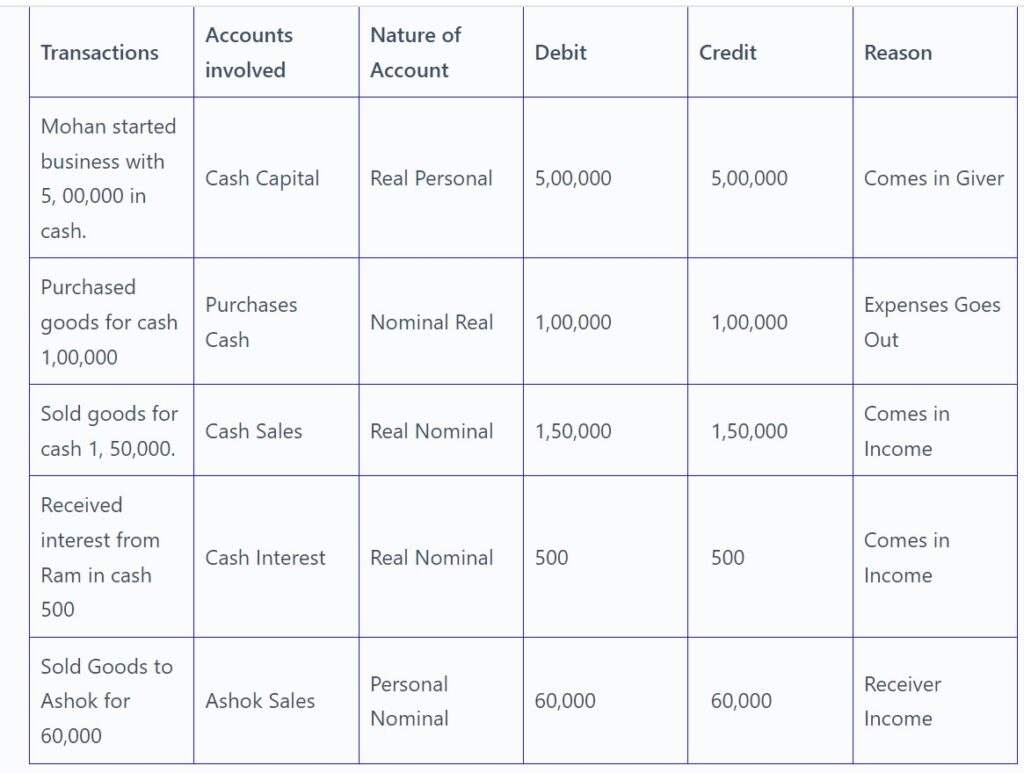

- From the following transaction, state the nature of accounts and state which account will be debited and which account will be credited:

- Mohan started business with cash 5,00,000

- Purchased goods for cash 1,00,000

- Sold goods for cash 1,50,000

- Received interest from Ram in cash 500

- Sold goods to Ashok 60,000

STUDYNATIC

Solution: Analysis of Transactions

- Modern Classification – Under this Classification, all the accounts are Classified into the following five Categories:

- Asset Accounts – Asset accounts are those accounts which relate to the economic resources of an enterprise such as Land and Building, Plant and Machinery, Furniture, Patents, Inventory, Bank and Cash, etc.

STUDYNATIC

Rule of Debit and Credit – Debit the increases and Credit the Decreases.

- Liability Accounts – Liability Account Are accounts of Lenders, Creditors for goods, outstanding expenses, etc.

Rule of Debit and Credit- Debit the decreases and Credit the increases.

- Capital Accounts – These are the accounts of Proprietors/Partners who have invested amount in the business. It includes both Capital and Drawings Account.

Rule of Debit and Credit – Debit the decreases and credit the increases.

- Revenue Accounts – These are accounts of incomes and gains. Examples are: Sales, Discount received, Interest received, commission received, bad debts recovered, etc.

Rule of Debit and Credit – Debit the decreases and Credit the increases.

- Expense Accounts – These are the accounts of expenses or Losses incurred in carrying the business. Examples are: Purchases, Wages, Salaries, and Depreciation, Discount allowed and rent, etc.

Rule of Debit and Credit – Debit the increases and credit the decreases.

STUDYNATIC

Rules for Debit and Credit (Modern Classification) at a Glance

| Types of Account | Accounts to be Debited | Accounts to be Credited |

| Asset Accounts | Increase | Decrease |

| Liability Accounts | Decrease | Increase |

| Capital Accounts | Decrease | Increase |

| Revenue Accounts | Decrease | Increase |

| Expense Accounts | Increase | Decrease |

STUDYNATIC

Example:-

- On which side will the increase in following accounts be recorded? Also, mention the nature of the account on the basis of Modern Classification of Accounts:

| Buildings Account | VII. Rent Received Account |

| Creditors Account | VIII. Interest Payable Account |

| Abhishek (Proprietor) | IX. Bills Payable Account |

| Purchases Account | X. Debtors Account |

| Carriage Inwards Account | Xi. Accrued Commission Account |

| Cash Account | Xii. Bills Receivable Account |

Solution –

| Debit – Asset | VII. Credit – Revenue |

| Credit – Liability | VIII. Credit – Liability |

| Credit – Capital | IX. Credit – Liability |

| Debit – Expense | X. Debit – Asset |

| Debit – Expense | Xi. Debit – Asset |

| Debit – Asset | Xii. Debit – Asset |

STUDYNATIC

- Analyse the following Transactions, state the nature of accounts and state which account will be debited and which account will be credited on the basis of modern Classification of Account;

- Dinesh Started business with cash 5,00,000

- Borrowed from Naresh1,00,000

- Purchased furniture for cash from Raj Furniture House20,000

- Purchased furniture from Delhi Safe40,000

- Purchased goods for cash15,000

Solution: –

Analysis of Transaction

| Transactions | Accounts Involved | Nature of Account | How Affected | Debit | Credit |

| Dinesh Started business with Cash 5,00,000 | Cash Capital | Asset Capital | Increased Increased | 5,00,000 | 5,00,000 |

| Borrowed from Naresh 1,00,000 | Cash Loan from Naresh | Asset Liability | Increased Increased | 1,00,000 | 1,00,000 |

| Purchased furniture for 20,000 in cash from Raj furniture House | Furniture Cash | Asset Asset | Increased Decreased | 20,000 | 20,000 |

| Purchased furniture from Delhi Safe for 40,000 | Furniture Delhi Safe | Asset Liability | Increased Increased | 40,000 | 40,000 |

| Purchased goods for cash 15,000 | Purchases Cash | Expense Asset | Increased Decreased | 15,000 | 15,000 |

STUDYNATIC

Balancing an Account:-

AT the end of a period (Say a day, month or year), it may be necessary to know the balance in an account. A balance of an account is the difference between the total of its debit and credit sides. If the total of debit side is more than the total of credit side, the account is said to have a debit balance. It has a credit balance when total of credit side is more than the total of debit side.