- Identify the transactions as belonging to

- Operating Activities,

- Investing Activities,

- Financing Activities and

- Cash and Cash Equivalents:

Solution:-

- Operating activities

- Cash sale of Goods :- It is the Operating Activity as it is the principal revenue activity of the business.

- Cash Received against Revenue from Services Rendered:- It is the operating activity as it is the principal revenue activity of the business.

- Cash Purchase of Goods:- It is the operating activity as it is the principal revenue activity of the business.

- Cash paid against Services Taken:- It is the operating activity as it is the principal revenue activity of the business.

- Commission Received: Operation Activity

- Income tax paid: Operating Activity

- Cash received form debtors: Operating Activity

- Cash paid to creditors: Operating Activity

II. Investing activity

- Patents Purchased:- It is the Investing activity of the firm, as selling and purchasing assets are the investing activities of the firm.

- Purchase of shares:-The issue of shares is the financing activity.

- Interest on investments: Investing Activity

- Income paid on gain (profit) on sale of assets: investing Activity

III. Financing activity

- Bank Overdraft – It is the loan taken to finance the business activities. It considered a financing activity.

- Proceeds from issue of debentures:- It is a loan raised from the public. It is considered a financing activity.

- Repayment of long-term: Financing Activity.

- Redemption of Debentures: Financing Activity

- Interest on Debentures: Financing Activity

IV. Cash and Cash Equivalents

Marketable Securities:- marketable securities are cash equivalents that can be readily converted into cash on demand.

2. Classify the following transaction as operating activities for a finance and a non-finance company:

- Purchase of shares on a stock exchange

- Dividend received on shares

- Dividend paid on shares

- Loans given

- Loans taken

- Interest paid on borrowings

Solution:

- Purchase of shares on a stock exchange:- Operating for a finance company

- Dividend received on shares:- Opening activity for a finance company

- Loans given:- Operating activity for finance company

- Loans taken:- Operating activity for finance company

- Interest paid on borrowings:- Operating activities for finance company

3. State which of the following would result in inflow or outflow or no flow cash and equivalents:

- Sale of fixed Assets, Book value 1,00,000 at a profit of 10,000.

- Sale of goods against cash.

- Purchase of machinery for cash.

- Purchase of land and building for 10,00,000 consideration paid by issue of debentures.

- Issued fully paid Bonus shares.

- Cash withdrawn from bank.

- Payment of interim dividend.

Solution:

- Inflow

- Inflow

- Outflow

- No flow

- No flow

- No flow

- Outflow

4. For each of the following transactions, calculate the resulting cash flow and state the nature of cash flow, i.e., whether it is operating, investing or financing Activity:

- Acquired machinery for 2,50,000 paying 20% by cheque and executing a bond for the balance payable.

- Paid 2,50,000 to acquire shares in informs tech Ltd. and received a dividend of 50,000 after acquisition.

- Sold machinery of original cost of 2,00,000 with an accumulated depreciation of 1,60,000 for 60,000.

Solution:

- 2,50,000 x 20% = 50,000 investing Activity Outflow

- 2,50,000-50,000 = 2,00,000 investing Activity Outflow

- 60,000 Investing inflow

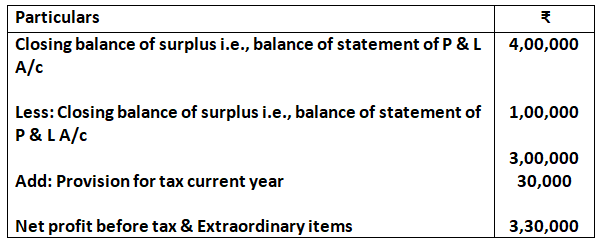

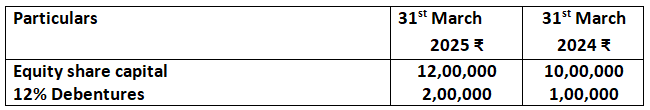

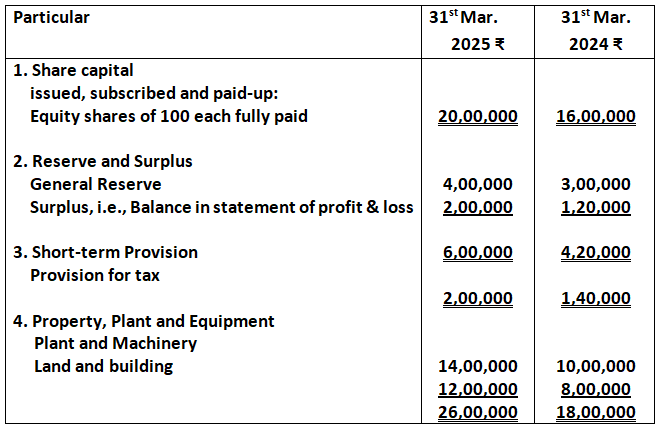

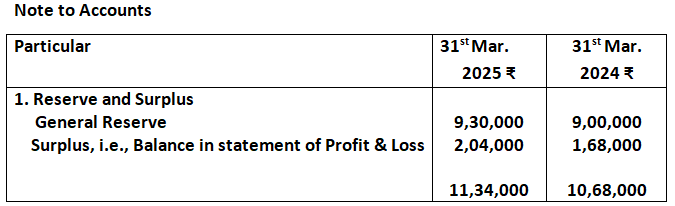

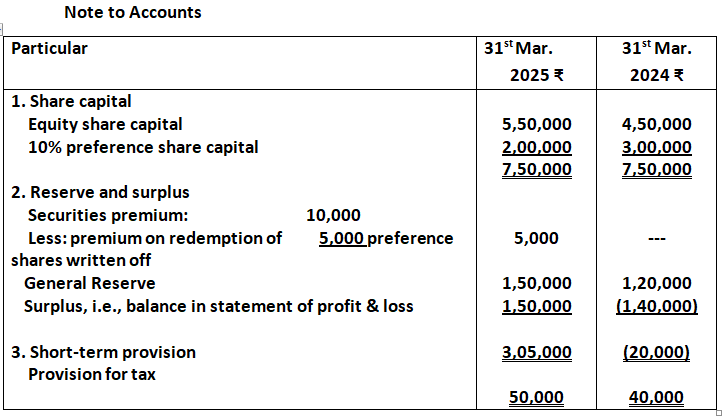

Net Profit before Tax and Extraordinary Items

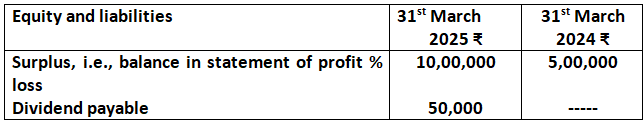

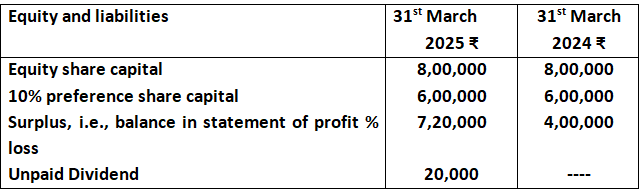

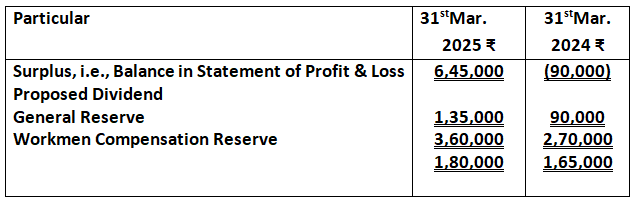

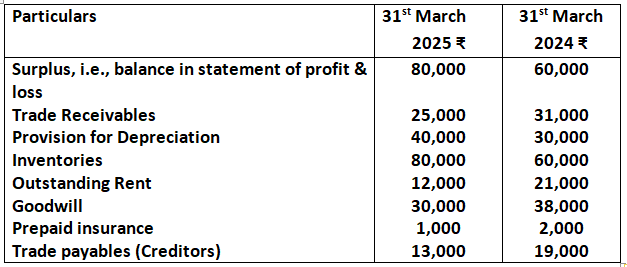

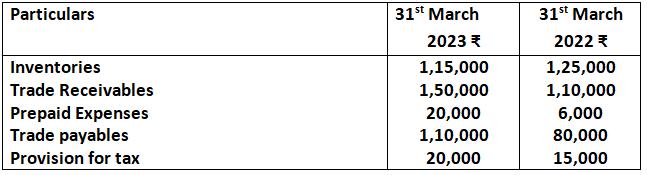

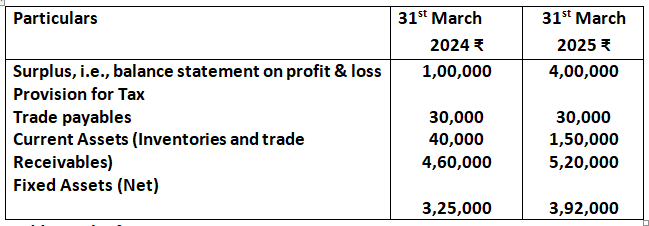

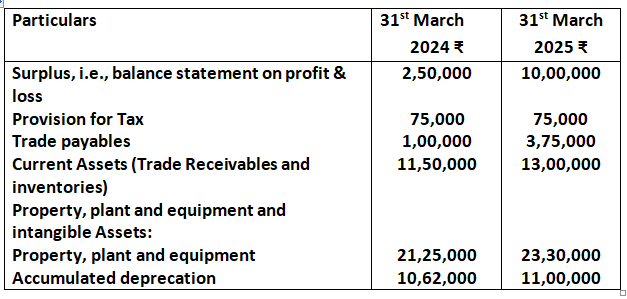

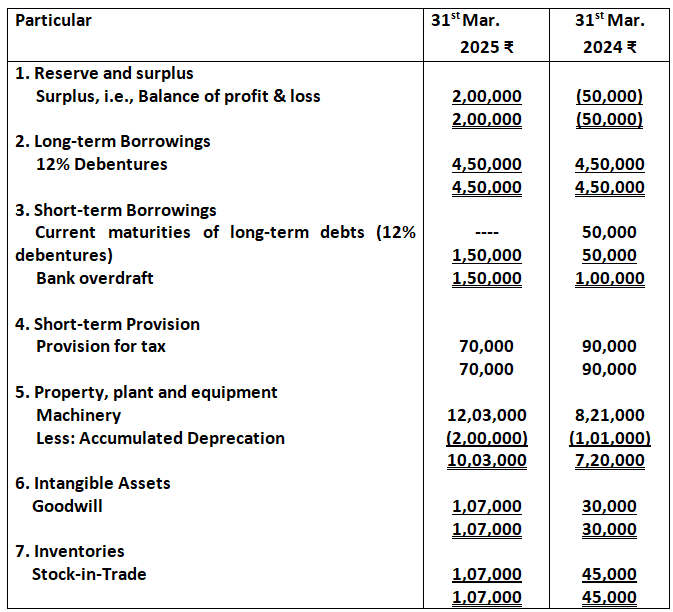

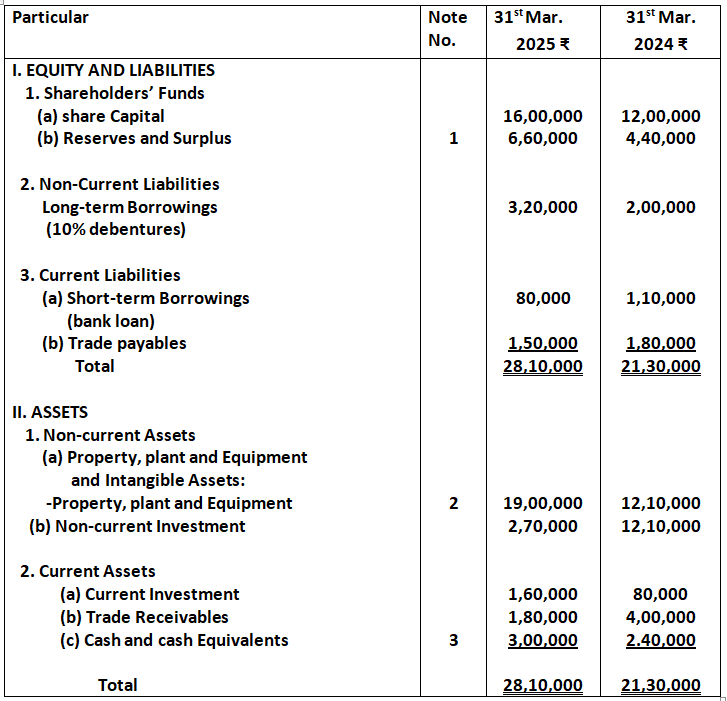

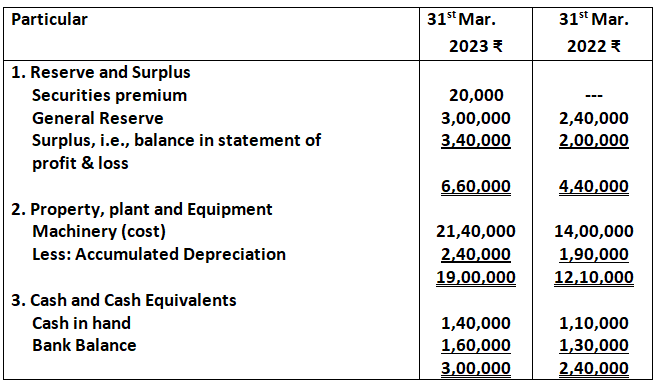

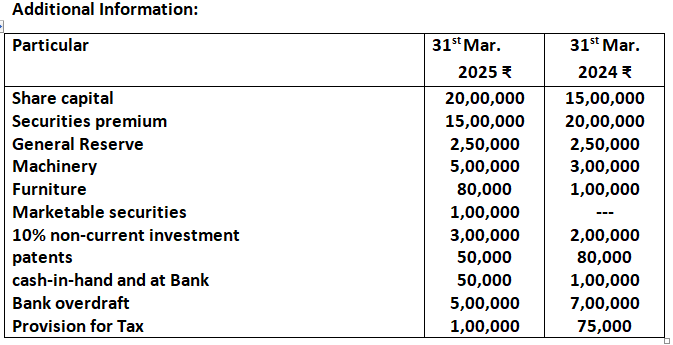

5. Following is the extract from the balance sheet of Karishma Ltd. as at 31st March, 2025:

Additional information: proposed Dividend for the years ended 31st March, 2024 and 2025 are 4,00,000 and 5,00,000 respectively.

Prepare the note to show net profit before Tax and Extraordinary items.

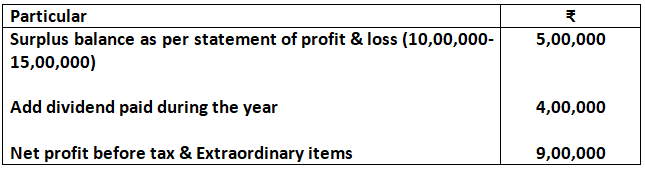

Solution-

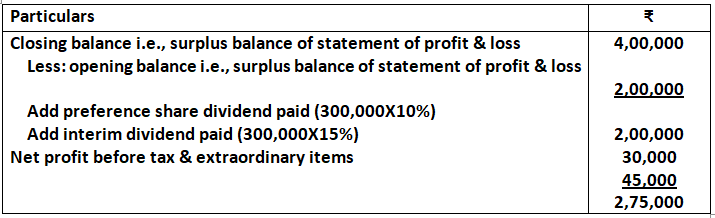

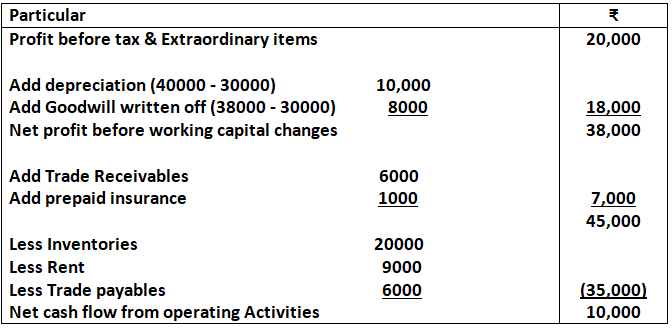

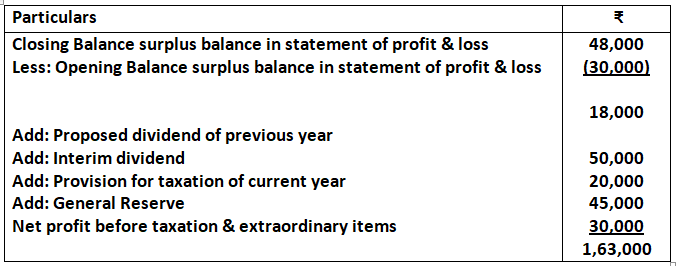

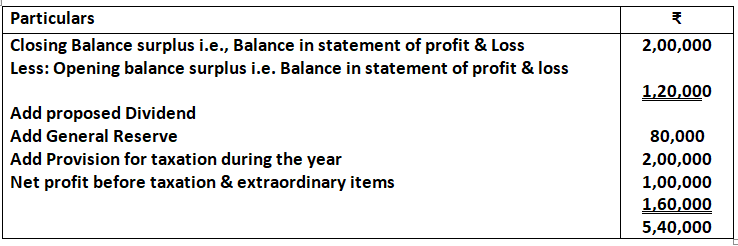

Calculation of net profit before tax & extraordinary items

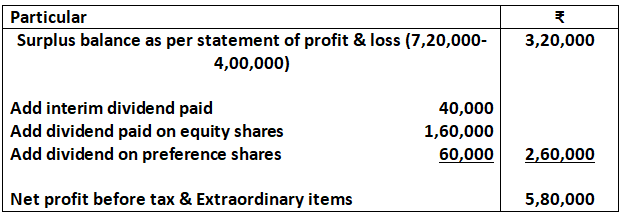

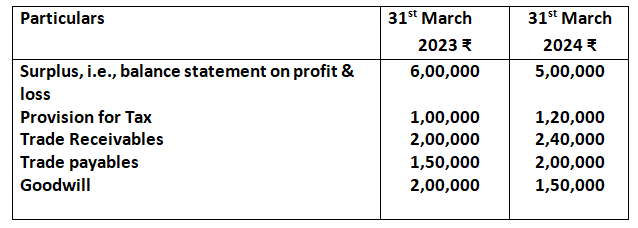

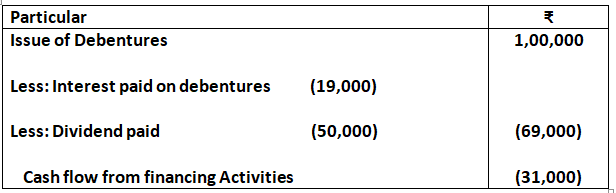

6. Following is the extract form the balance sheet of mercury Ltd.:

Additional information:

- Proposed dividend on equity shares for the year 2023-24 and 2024-25 are 1,60,000 and 2,00,000 respectively.

- An interim dividend of 40,000 on equity shares was paid.

Solution:

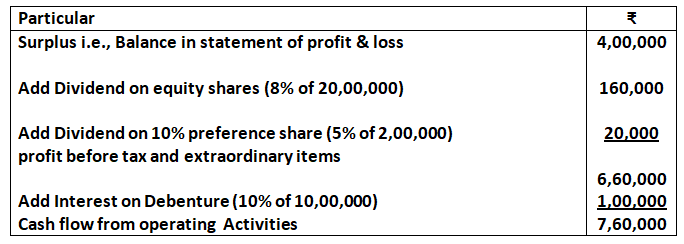

Calculate net profit before tax and extraordinary items.

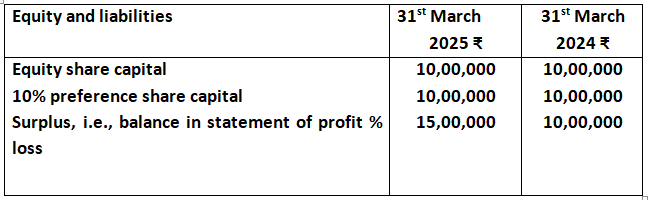

7. From the following extract of balance sheet of Universal Ltd., calculate Net profit before Tax and Extraordinary items:

Additional Information:

Interim dividend of 2,00,000 was paid on equity shares on 1st November, 2024.

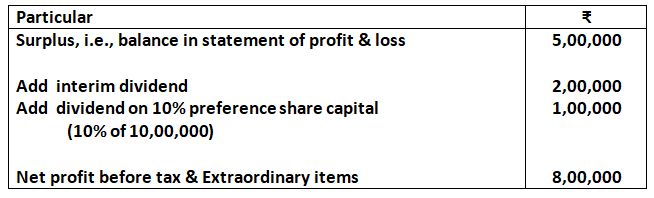

Solution:

Calculation of net profit before tax & extraordinary items

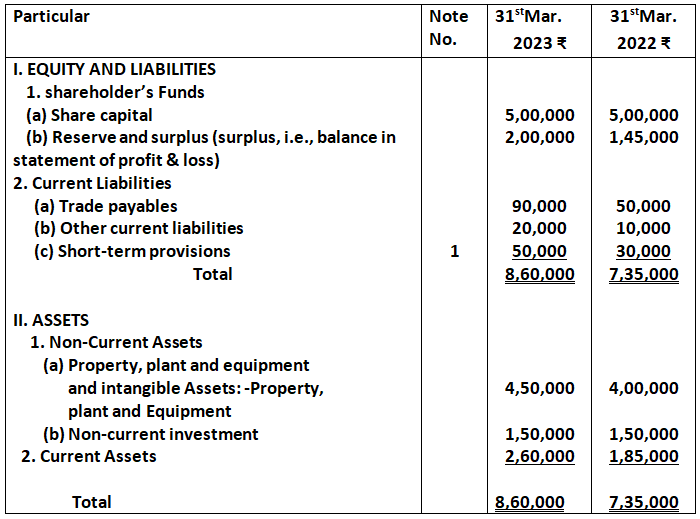

8. Calculate net profit before tax and extraordinary items of Shiva Ltd. from its balance sheet as at 31st March, 2023:9(old question)

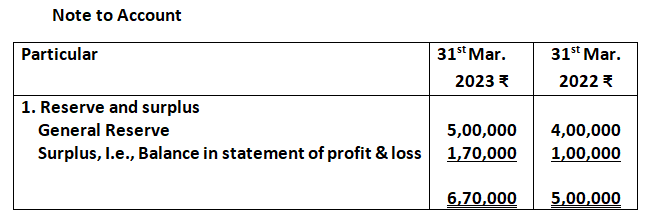

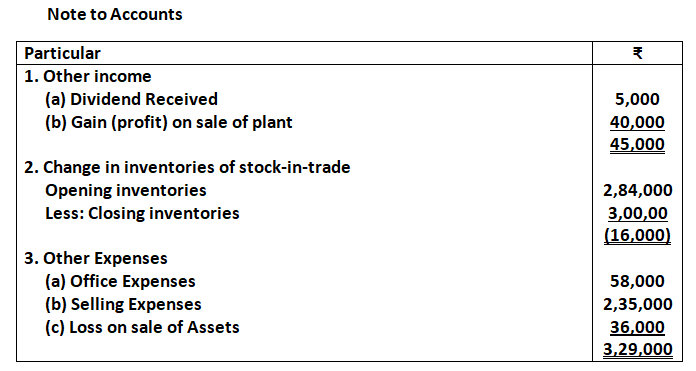

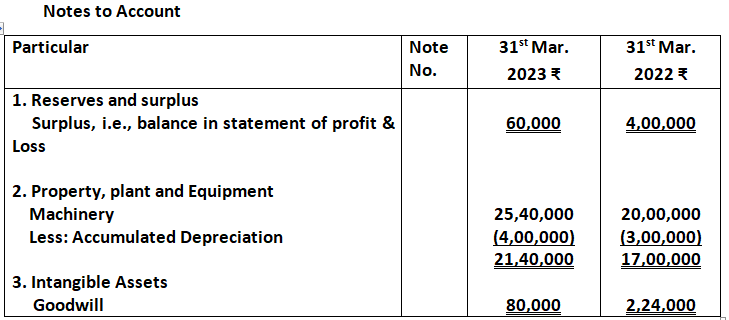

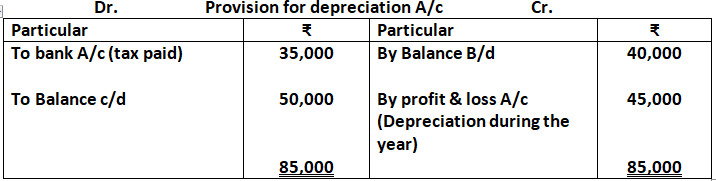

Note to Account

Additional Information:

- Proposed Dividend for the years 31st March, 2022 are 50,000 and 75,000 respectively.

- Interim dividend paid during the year was 10,000.

Solution:-

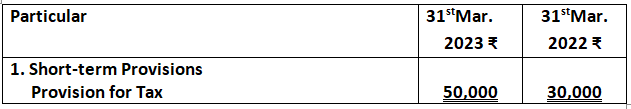

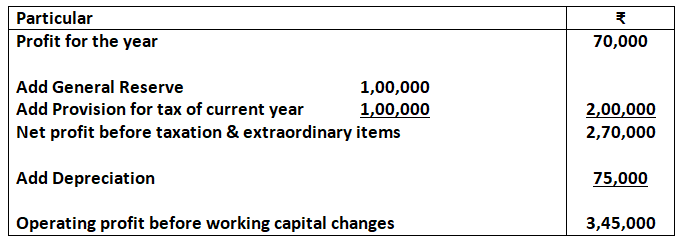

Calculate net profit before tax and extraordinary items.

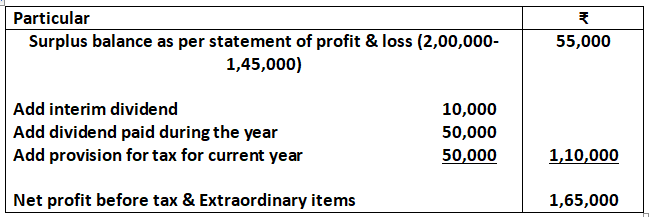

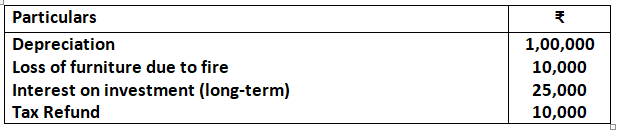

8. From the following information, calculate net profit before Tax and Extraordinary items:

Surplus, i.e., balance in statement of P & L (opening) 1,00,000

Surplus, i.e., balance in statement of P & L (closing) 3,36,000

Dividend paid in the current year 80,000

Interim Dividend paid during the year 90,000

Transfer to Reserve 1,00,000

Provision for Tax for the Current year 1,50,000

Refund of Tax 3,000

Loss due to Earthquake 2,00,000

Insurance proceeds form earthquake

disaster settlement 1,00,000

Solution:

Calculate net profit before tax and extraordinary items.

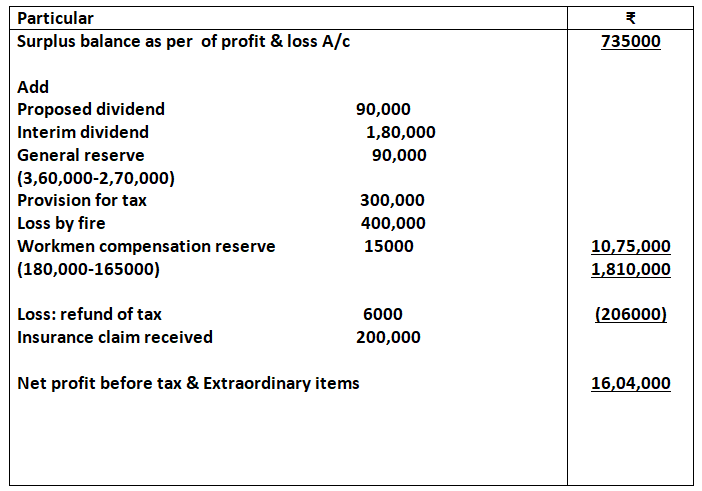

9. From the following information calculate Net Profit before Tax and extraordinary Items:

Additional Information:

Interim Dividend paid during the year Rs.1,80,000

Provision for Tax made during the year Rs.3,00,000

Refund of Tax Rs.6,000

Loss by Fire Rs.4,00,000

Insurance Claim Received Rs.2,00,000

Solution-

Given Data:

- Surplus (Closing Balance of P & L A/c ):

31st March 2025 : Rs.6,45,000

31st March 2024: Rs.(90,000)

Increase in Surplus = 6,45,000 – (Rs.90,000)

= Rs.7,35,000

2. Addition to Surplus

(Appropriations made from Net Profit):

Proposed Dividend: Rs.1,35,000

Interim dividend Paid: Rs.1,80,000

General Reserve = Rs.3,60,000 – Rs.2,70,000

= Rs.90,000

Provision for Tax: Rs.3,00,000

3. Adjustments:

Refund of Tax (Added to Net profit) : Rs.6,000

Loss by Fire (Extraordinary Item – Deduct): Rs.4,00,000

Insurance Claim Received

Extraordinary Gain – Add): Rs.2,00,000

Net Profit after Tax & Extraordinary Items: Start with the increase in Surplus and add appropriations:

Net Profit after Tax & Extraordinary Items = Increases in Surplus + Proposed Dividend + Interim Dividend + Transfer to General Reserve + Provision for Tax

7,35,000 + 1,35,000 + 1,80,000 + 90,000 + 3,00,000 = 14,00,000

Add: Tax Refund (already added to Surplus):

= Rs.14,40,000 – Rs.6,000

= Rs.14,34,000

Add: Loss by Fire (Extraordinary Loss):

= Rs.14,34,000 + Rs.4,00,000

= Rs.18,34,000

Less: Insurance Claim Received (Extraordinary Income):

= Rs.18,34,000 – Rs.2,00,000

= Rs.16,34,000

But the answer given is

Rs.16,04,000. That implies the Tax Refund Rs.6,000 is to be retained in the figure, not adjusted out, since it’s already part of the Surplus.

So the correct approach is:

Net Profit before Tax and Extraordinary Items = Increase in Surplus + Proposed Dividend + Interim Dividend + Transfer to General Reserve + Provision for Tax + Loss by Fire – Insurance Claim Received

= Rs.7,35,00 + Rs.1,35,000 + Rs.1,80,000 + Rs.90,000 + Rs.3,00,000 + Rs.4,00,000 – Rs.2,00,000

= Rs.16,04,000

Final Answer : Net Profit before Tax and Extraordinary Items = Rs.16,04,000

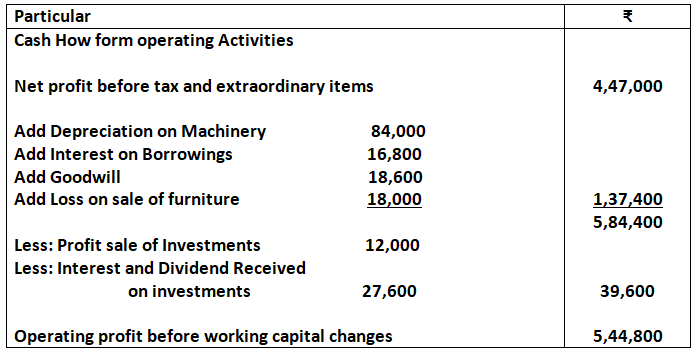

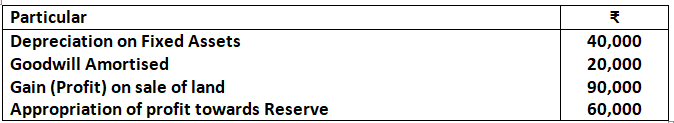

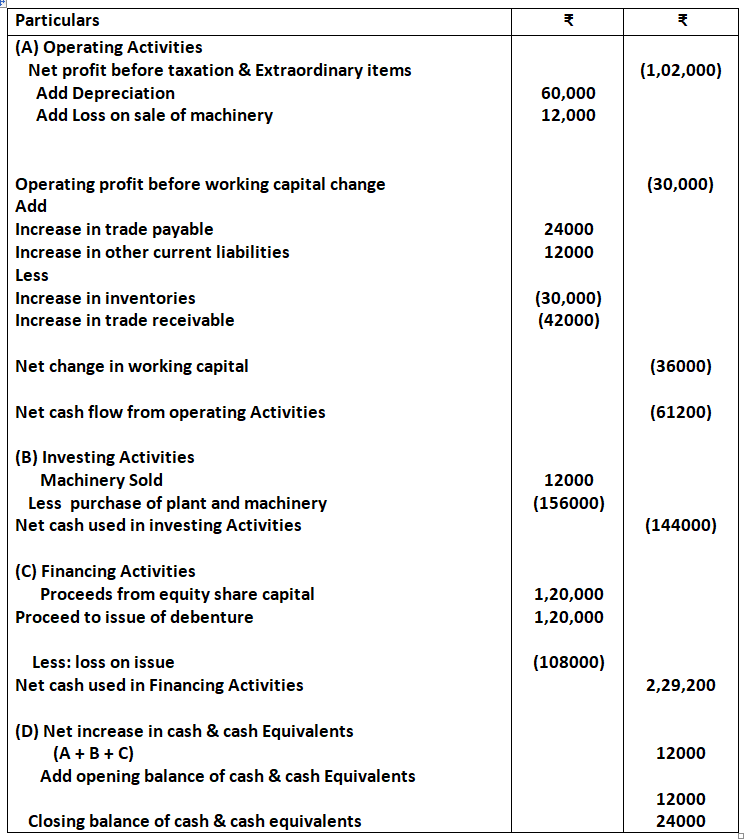

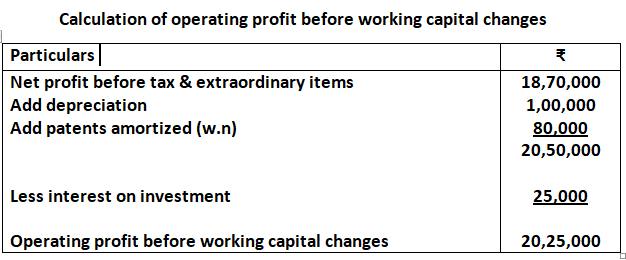

Calculation of Operating Profit before Working Capital Changes

10. From the following information, calculate operating profit before working capital changes:

Net profit before Tax and Extraordinary items 4,47,000

Depreciation on Machinery 84,000

Interest on Borrowings 16,800

Goodwill Amortized 18,600

Loss on sale of furniture 18,000

Premium on Redemption of Preference shares 6,000

Gain (profit) on sale of investments 12,000

Interest and Dividend Received on investment 27,600

Solution:

Calculate showing operating profit before working capital

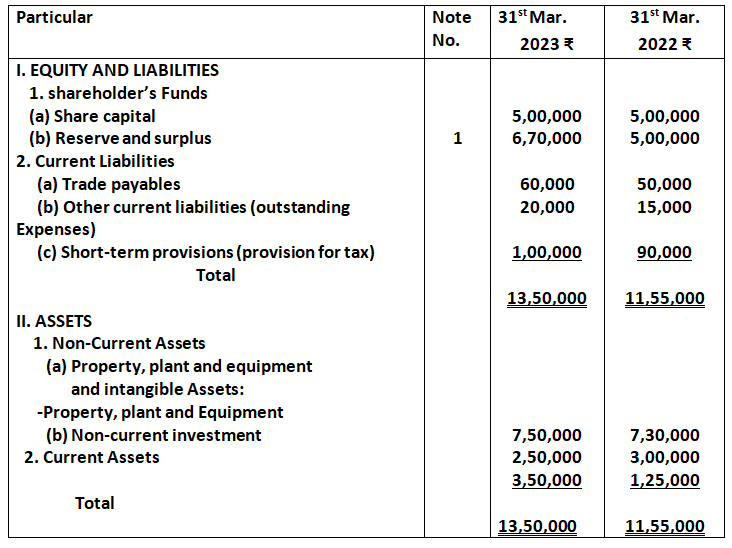

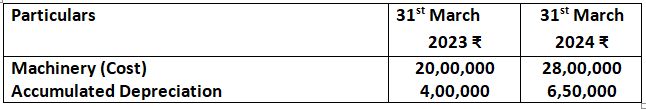

11. From the following balance sheet of KBC Ltd. as at 31st March, 2023 and additional information calculate operating profit before working capital changes: (Old Book)

Additional information: Depreciation for the year was 75,000.

Solution:

Calculation of operating profit before working capital changes

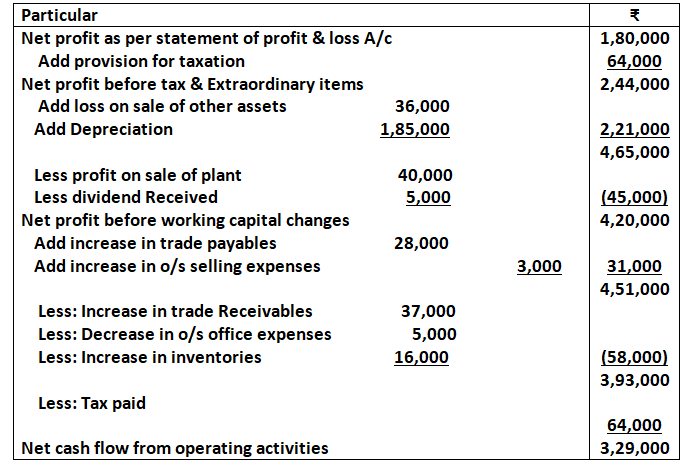

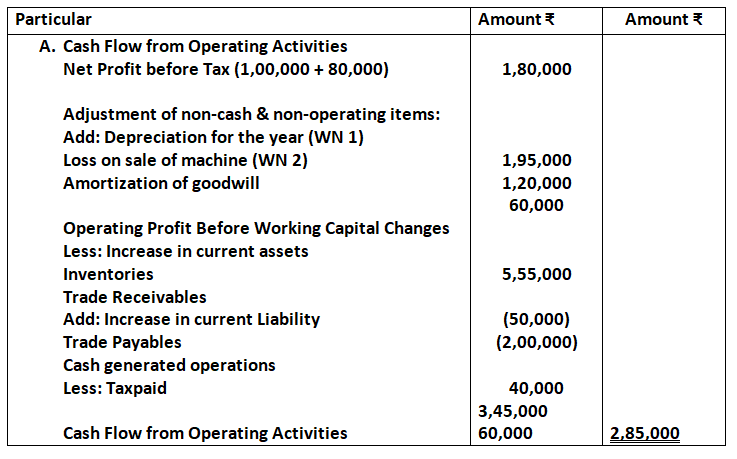

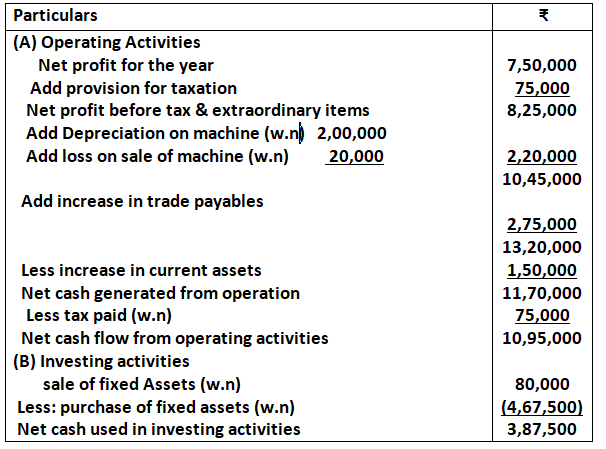

Cash Flow from Operating Activities

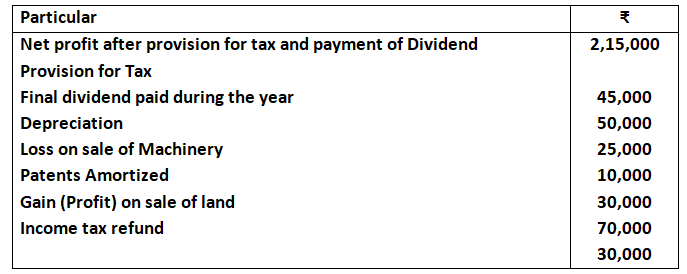

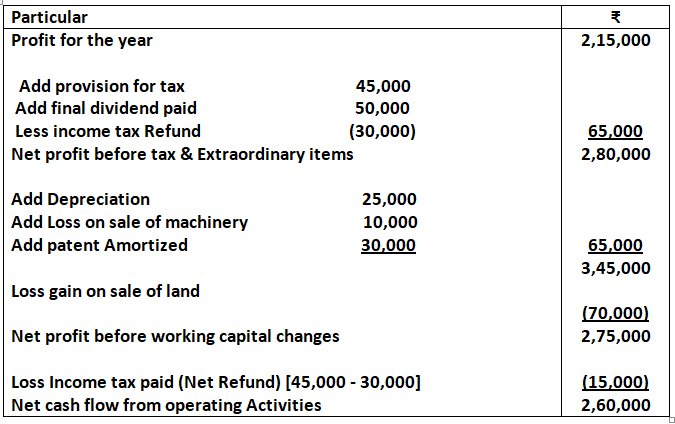

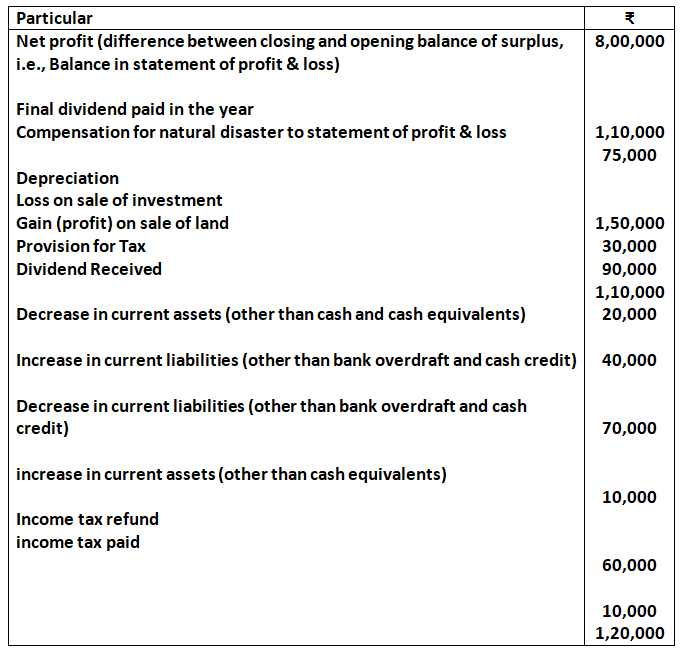

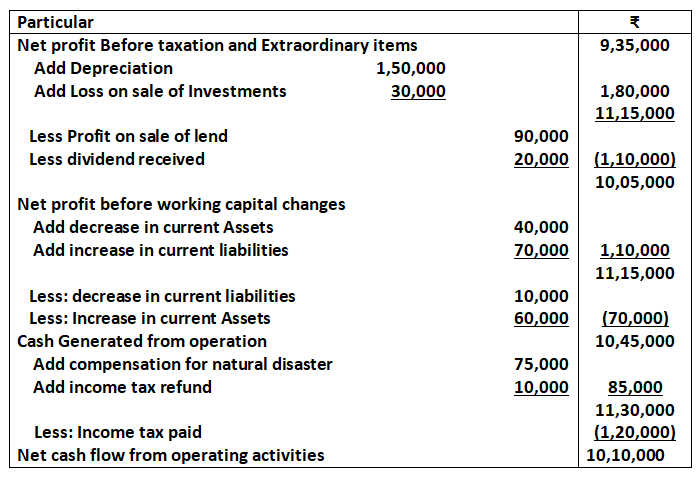

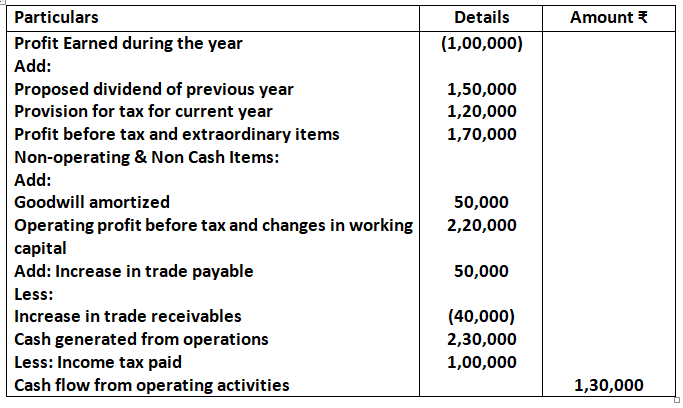

11. Calculate cash flow from operating activities from the following details:

Solution:

Cash flow from operating Activities

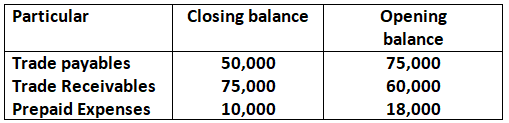

12. Compute cash flow from operating activities form the following information:

Solution:

13. Calculate cash flow from operating activities form the following:

(I) Profit for the year is 7,00,000 after considering the following items:

(II) Following is the position of current Assets and Current liabilities:

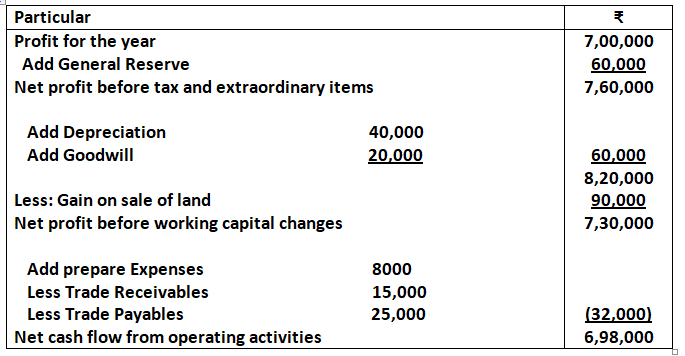

Solution:

Cash Flow from operating Activities

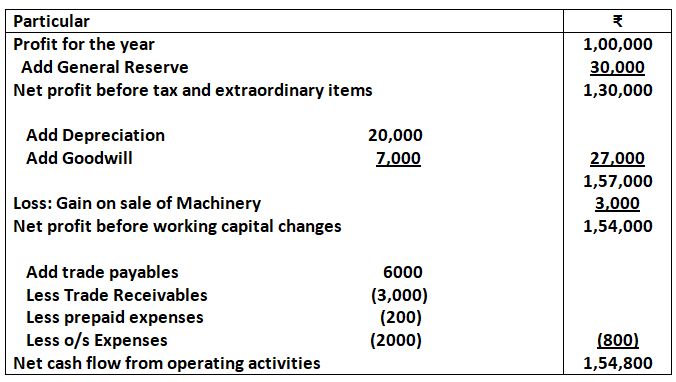

14.Charles Ltd. earned a profit of 1,00,000 after charging depreciation of 20,000 on assets and a transfer to general Reserve of 30,000. Goodwill amortized was 7,000 and gain on sale of machinery was 3,000. Other information available is (changes in the value of current Assets and current liabilities): trade receivables showed an increase of Rs.3,000; trade payable an increase of Rs.6,000; Prepaid expenses and increase of 200; and outstanding expenses a decrease of 2,000. Ascertain cash flow from operating activities.

Solution:

Cash Flow from operating Activities

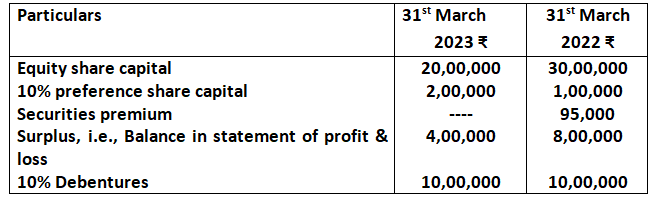

15. From the following information, calculation cash flow from operating Activities:

Additional Information

- Preference shares were redeemed on 31st March, 2023 at a premium of 5%.

- Dividend on equity shares was paid @ 8%

- Fresh issue of equity shares was made on 1st April 2022.

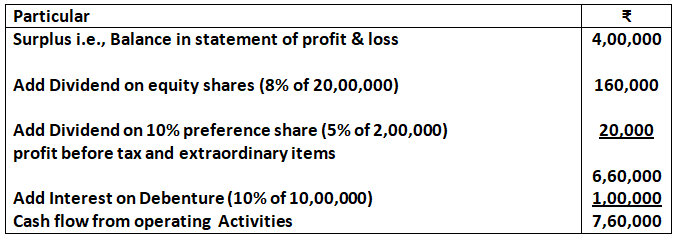

Solution: Cash Flow form operating Activities

16. Sunrise Ltd., reported Net profit after tax of 6,40,000 for the year ended 31st March, 2025. The relevant extract from balance sheet as at 31st March, 2025 is:

Depreciation charged on plant and Machinery 55,000, insurance claim received 50,000, gain (profit) on sale of investment 20,000 appeared in the statement of profit & loss for the year ended 31st March, 2023. Calculate cash flow from operating activities.

Solution: Cash Flow form operating Activities

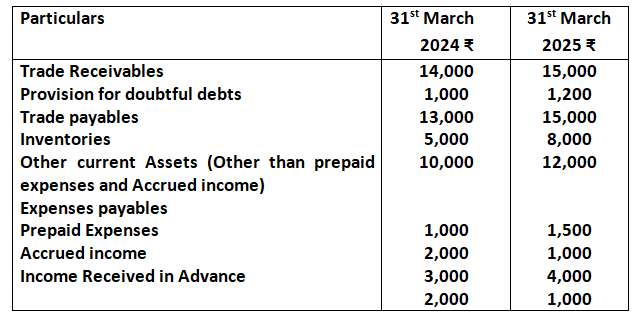

17. Compute cash flow from operating activities from the following:

- Profit for the year ended 31st March, 2025 is 10,000 after providing for depreciation of 2,000.

- Current Assets and Current liabilities of the business for the years ended 31st March, 2022 and 2023 are as follows:

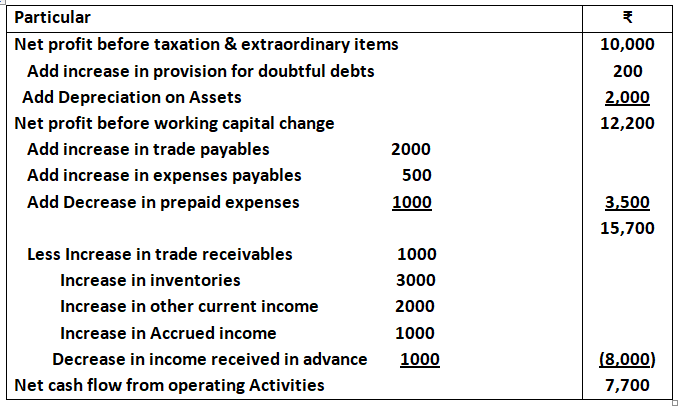

Solution: Cash Flow from operating Activities

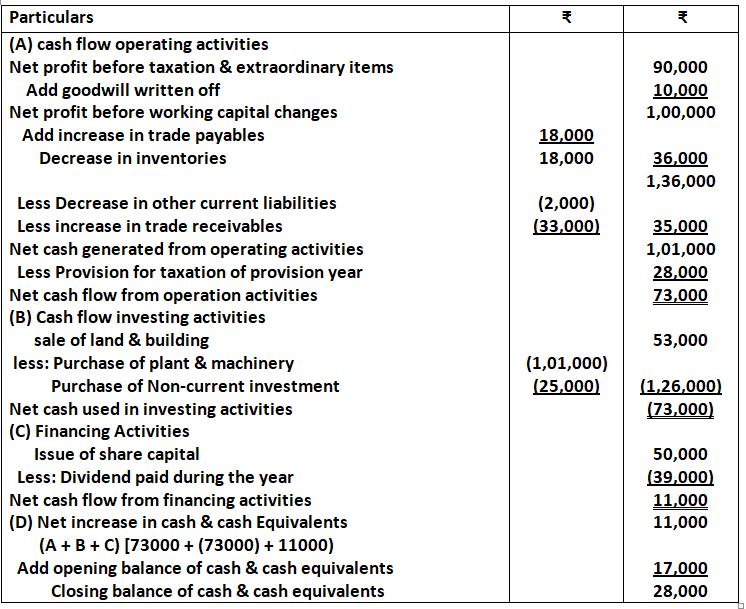

18. Calculate cash flow from operating activities from the following information:

Cash Flow from operating Activities

Solution:-

Cash Flow from operating Activities

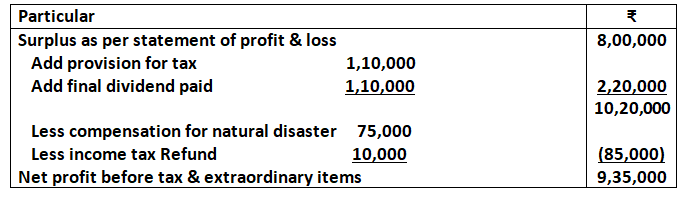

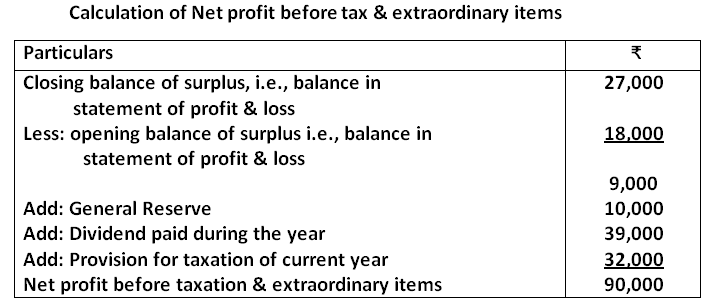

Working notes:-

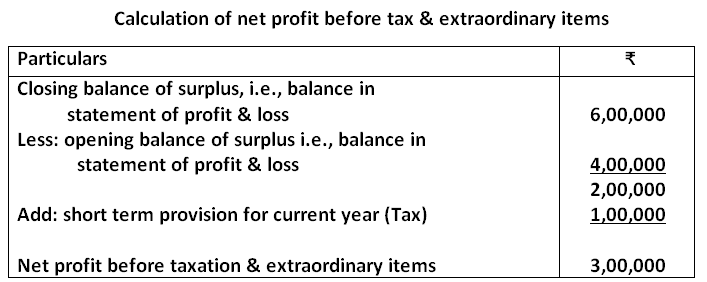

Calculation of net profit before tax & extraordinary items

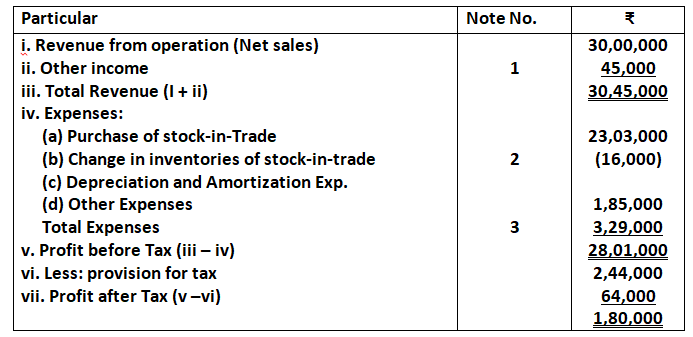

19. Following information is related to Vishwas ltd.:

Statement of profit and Loss for the year ended 31st march, 2025

Other information: Balance as on Balance as on

31st march, 2025 (₹) 31st March, 2024 (₹)

Trade payables 2,78,000 2,50,000

Trade Receivables 4,52,000 4,15,000

Office expenses Outstanding —– 5,000

Selling expenses outstanding 25,000 22,000

Calculate cash flow operating activities

Solution:

Cash Flow from operating Activities

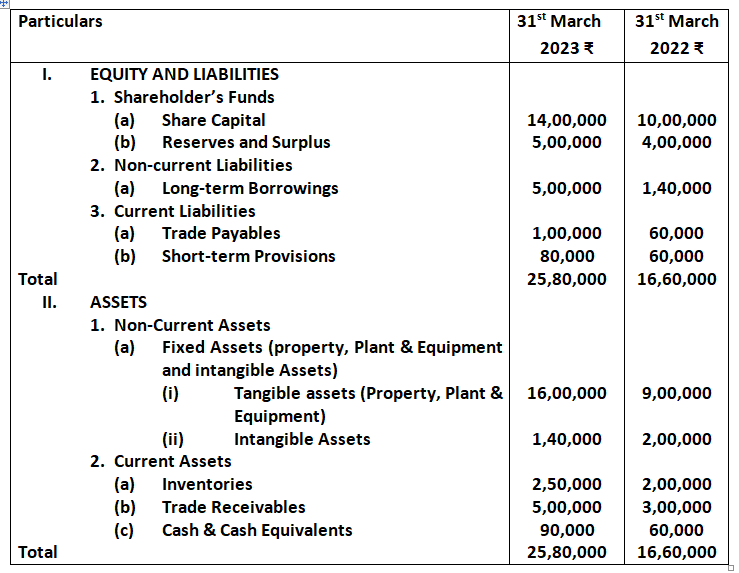

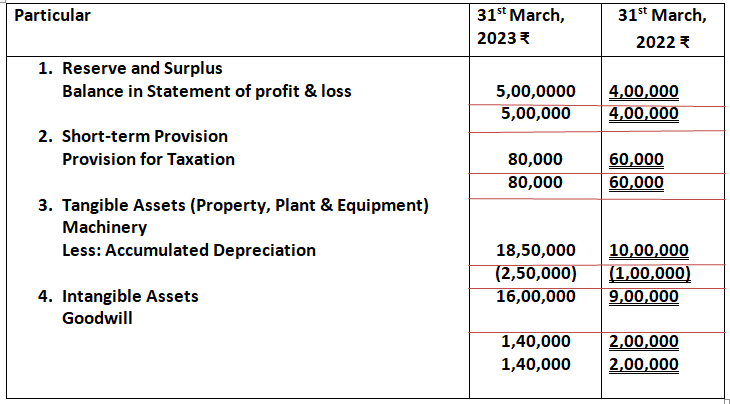

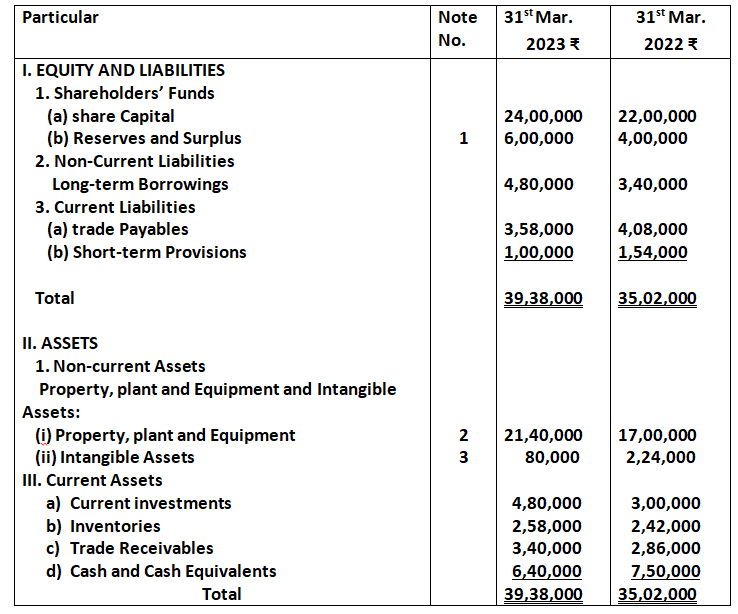

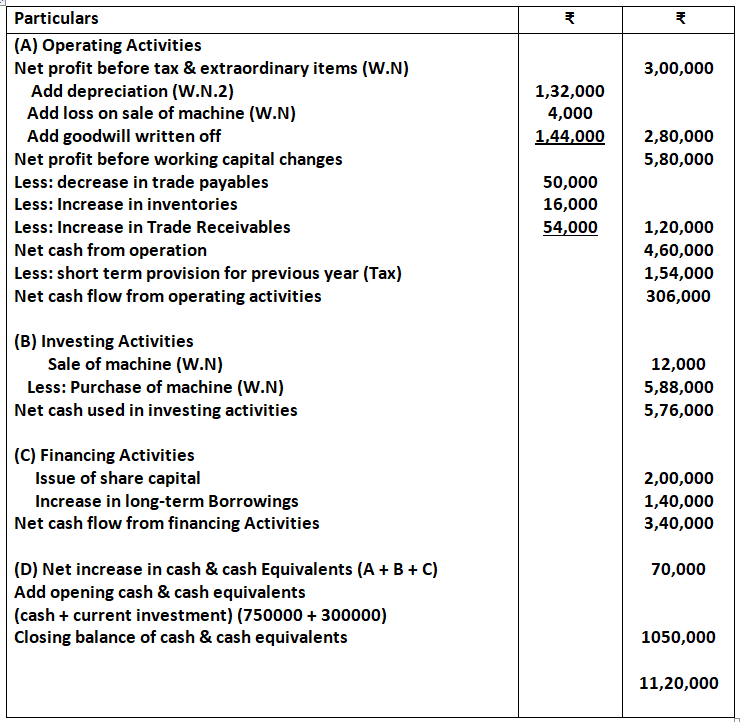

20. Following is the Balance Sheet of Bharat Gas Ltd. As at 31st March, 2023:

Note to Accounts

Adjustments: During the year, a machine costing Rs.3,00,000 on which accumulated depreciation was Rs.45,000 was sold for Rs.1,35,000.

Calculate ‘Cash Flows from Operating Activities:

Solution-

Working Note 1

Working Note 2

Loss on sale of machine

Current Value of machine = 3,00,000 – 45,000

= 2,55,000

Loss = 2,55,000 – 1,35,000

= 1,20,000

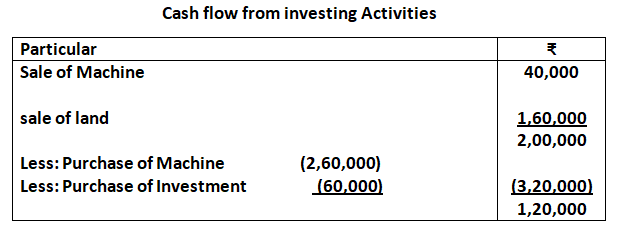

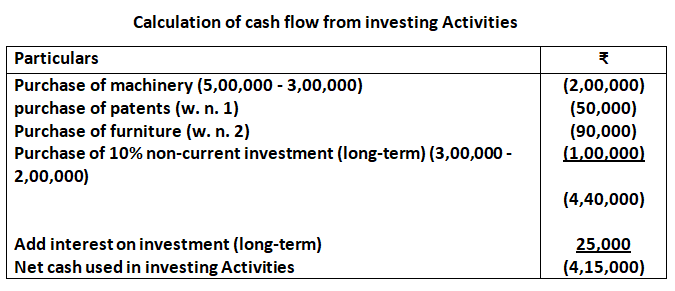

Cash Flow from Investing Activities

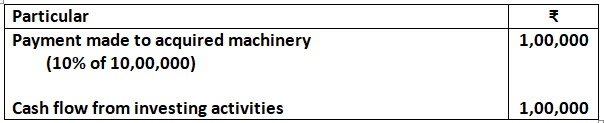

21. From the following information, calculate the amount of cash from investing activities:

Acquired machinery for 10,00,000 paying 10% immediately in cash and accepting a draft for the balance in favour of the vendor, payable after three months.

Solution:

Calculation of cash flow from investing activities

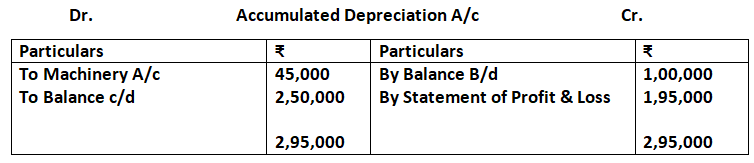

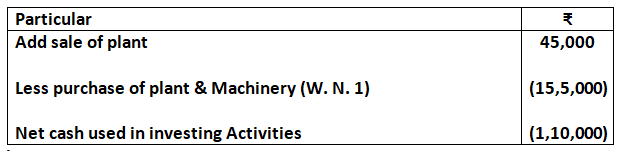

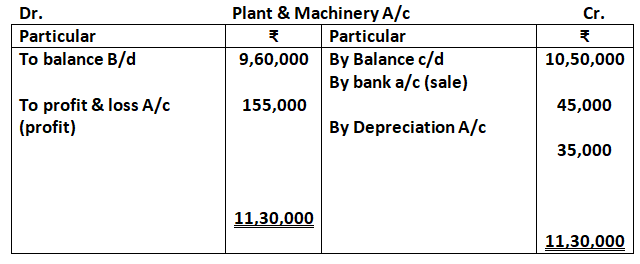

22. Mars ltd. has plant and machinery whose written down value on 1st April, 2024 was 9,60,000 and on 31st March, 2025 was 10,50,000. Depreciation for the year was 35,000. In the beginning of the year, a part of plant was sold for 45,000 which had a written down value of 30,000.

Calculate cash flow from investing activities.

Solution:

Calculation of cash flow from investing activities

Working Note:

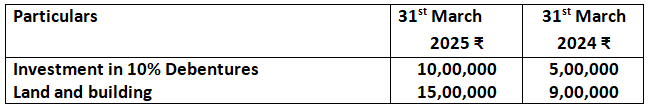

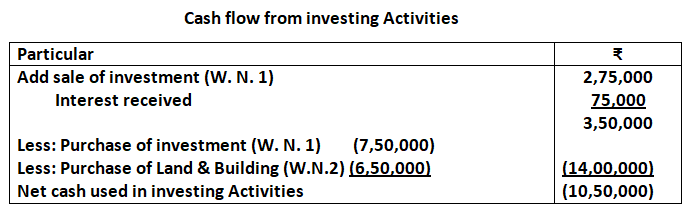

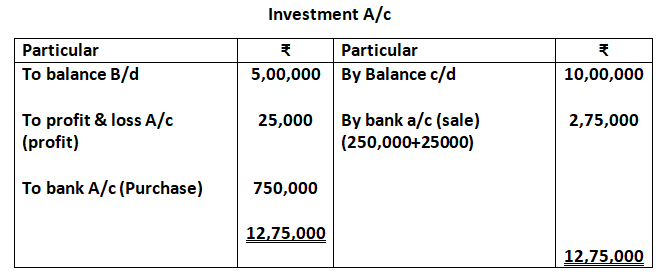

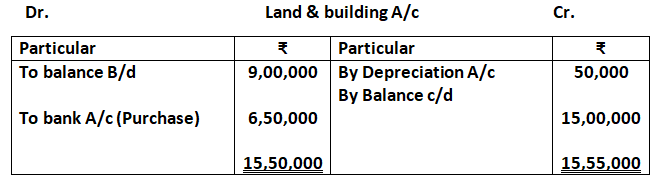

23. From the following information, calculate cash flow from investing activities:

Additional Information:

1. Half of the investments held in the beginning of the year were sold at 10% profit.

2. Depreciation on land and building was 50,000 for the year.

3. Interest received on investment 75,000.

Solution:

Working notes:

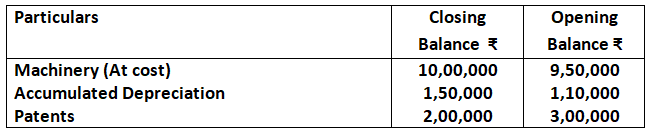

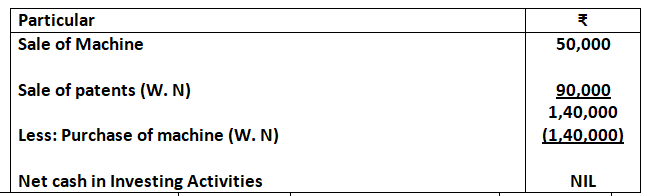

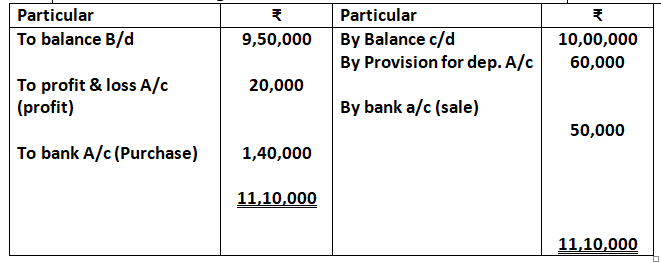

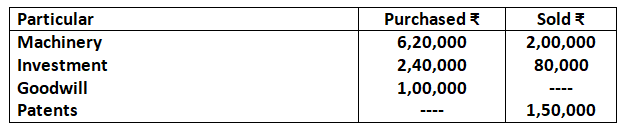

24. From the following information, calculate cash flow from investing activities:

Additional Information:

- During the year, machine costing 90,000 with accumulate depreciation of 60,000 was sold for 50,000.

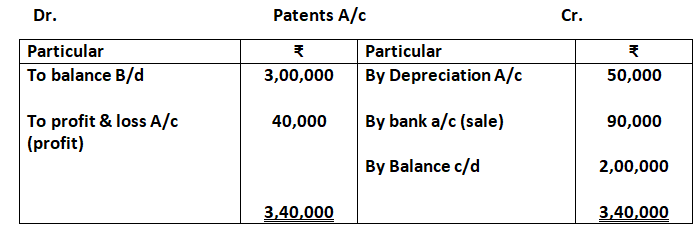

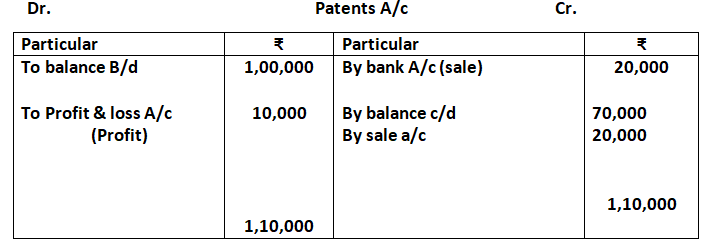

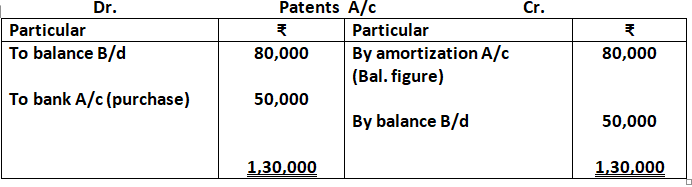

- Patents written off were 50,000 while a part of patents were sold at a profit of 40,000.

Solution:

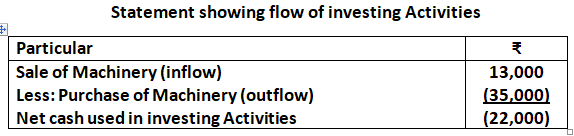

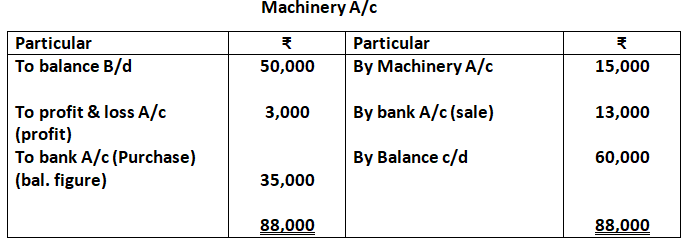

25. Well print Ltd. has given the following information:

Machinery as on 1st April, 2022 50,000

Machinery as on 31st March, 2023 60,000

Accumulated Depreciation on 1st April, 2024 25,000

Accumulated Depreciation on 31st March, 2025 15,000

During the year, a machine costing 25,000 (accumulated depreciation thereon 15,000) was sold for 13,000.

Calculated cash flow investing activities on the basis of the above information.

Solution:

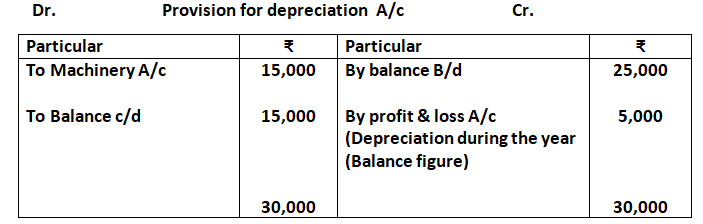

Working Notes:

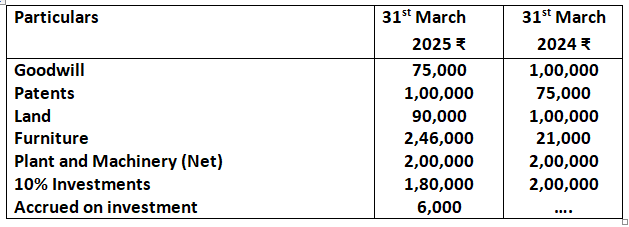

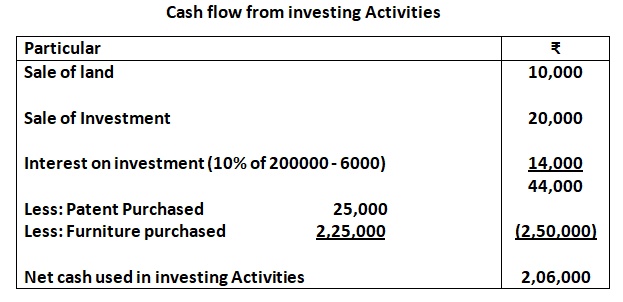

26. From the following extract of a company, calculate cash flow from investing Activities:

Additional Information: Investment is sold at book value on 31st March, 2025.

Solution:

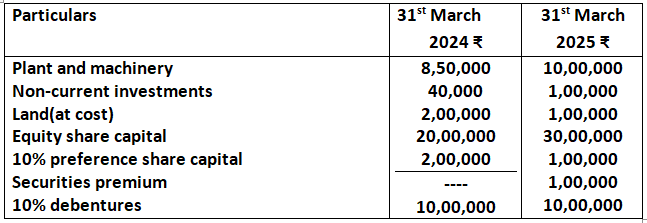

27. From the following information, calculate cash flow from investing activities:

Additional Information:

1. Depreciation charged on plant and machinery 50,000.

2. Plat and Machinery with a Book value of 60,000 was sold for 40,000.

3. Land was sold at a profit of 60,000.

4. No investment was sold during the year.

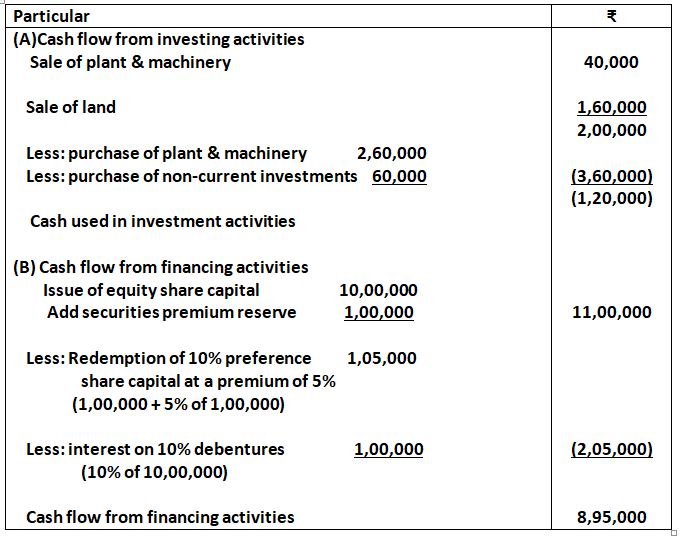

Solution:

Working Notes:

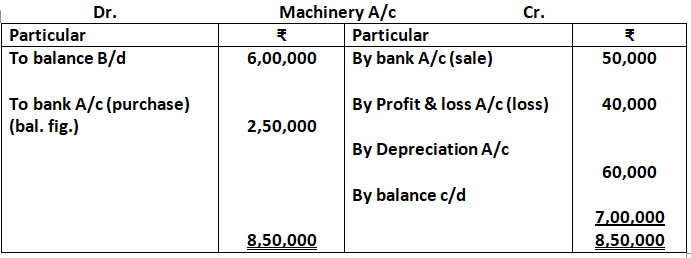

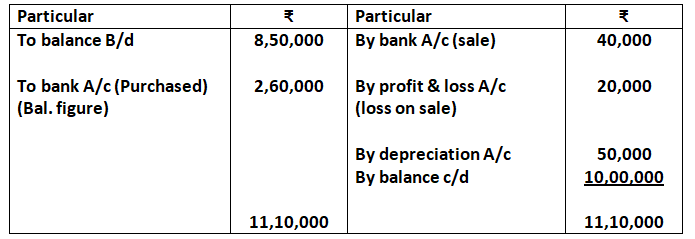

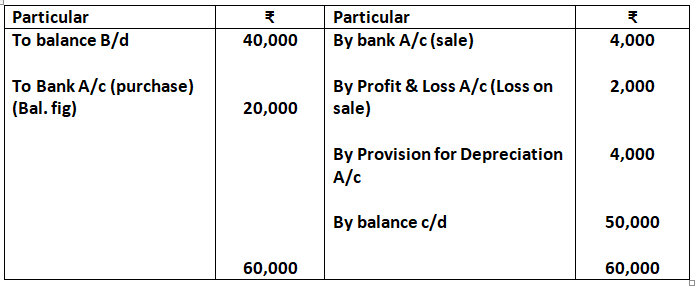

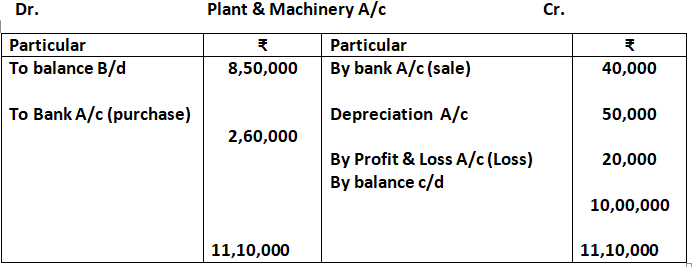

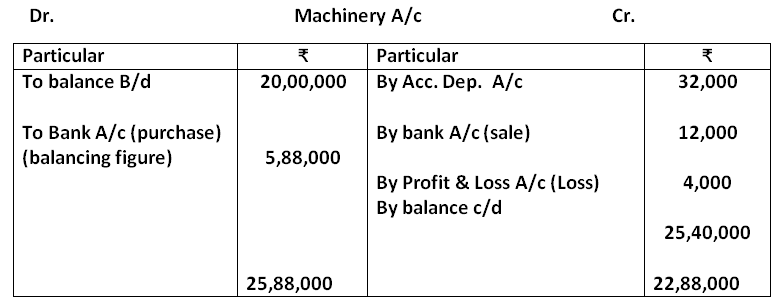

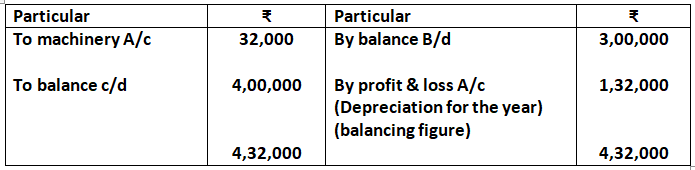

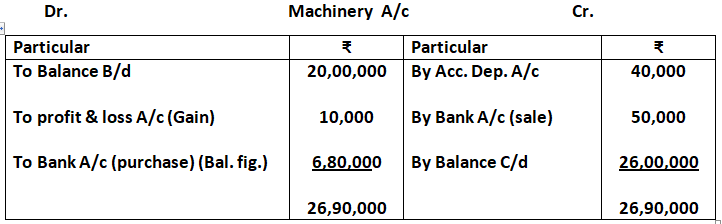

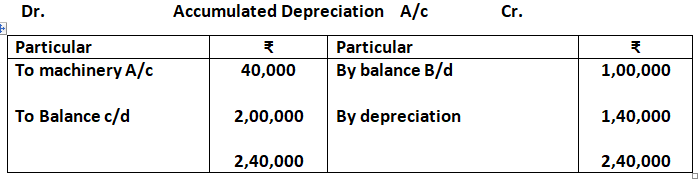

Dr. Machinery A/c Cr.

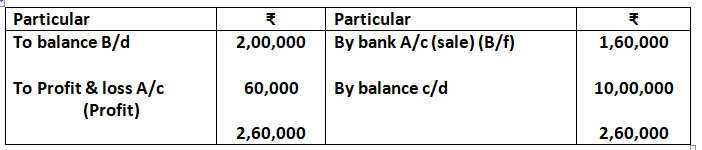

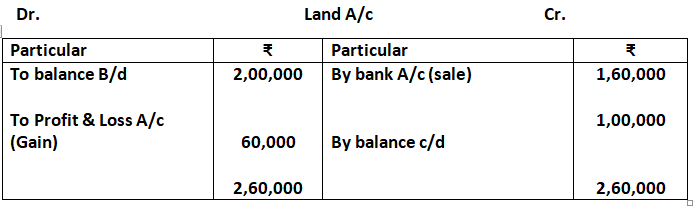

Dr. Land A/c Cr.

28. From the following particular, calculate cash flow from investing activities:

Additional information:

- Interest received on debentures held as investment 8,000

- Interest paid on debentures issued 20,000.

- Dividend received on share held as investment 20,000.

- Dividend paid on Equity share capital 30,000.

- A plot of land was purchased out of the surplus funds for investment purpose and was let out for commercial use. Rent received 50,000 during the year.

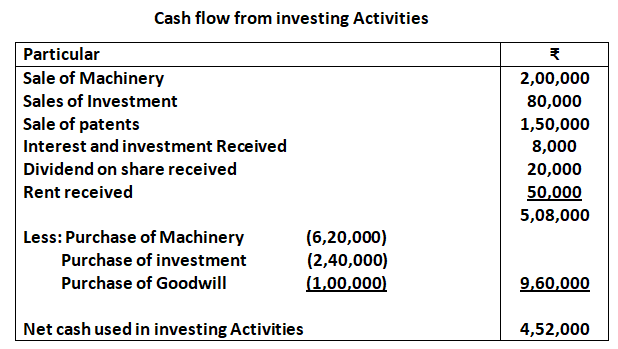

Cash flow from investing Activities

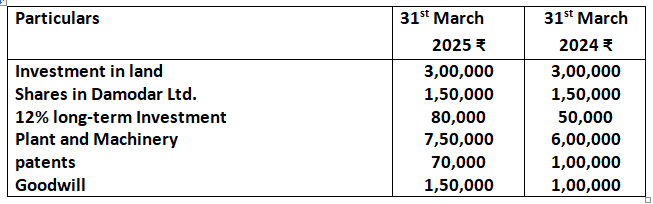

29.Calculate cash Flow cash investing activities from the following information:

Additional Information:

- A piece of land was purchased as an investment out of surplus, it was let out for commercial purpose and the rent received was 20,000.

- Dividend received from Damodar Ltd. 12%

- Patents written off to the extent of 20,000. Some patents were sold at a profit of 10,000.

- A Machine costing 80,000 (depreciation provided thereon 30,000) was sold for 35,000.

- During the year 12% investments were purchased for 1,00,000 some investments were sold at a profit of 10,000. Interest on investment for the year was duly received.

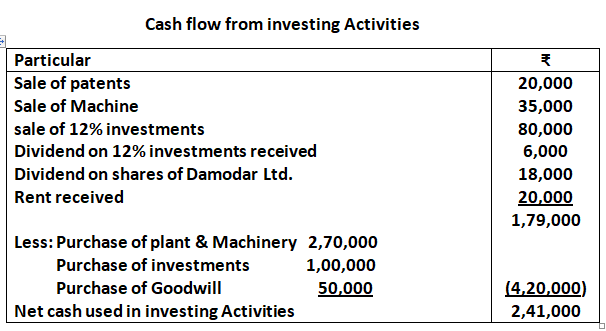

Solution:

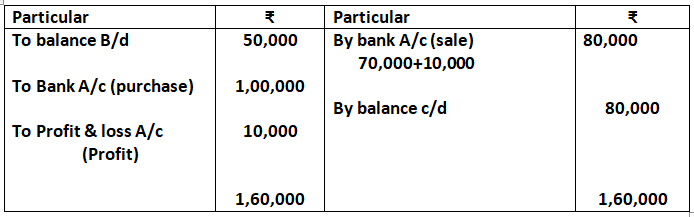

Working Notes:

Dr. 12% long term investment A/c Cr.

Cash Flow from Operating and Investing Activities

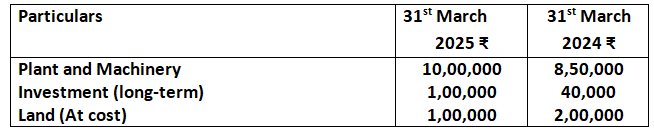

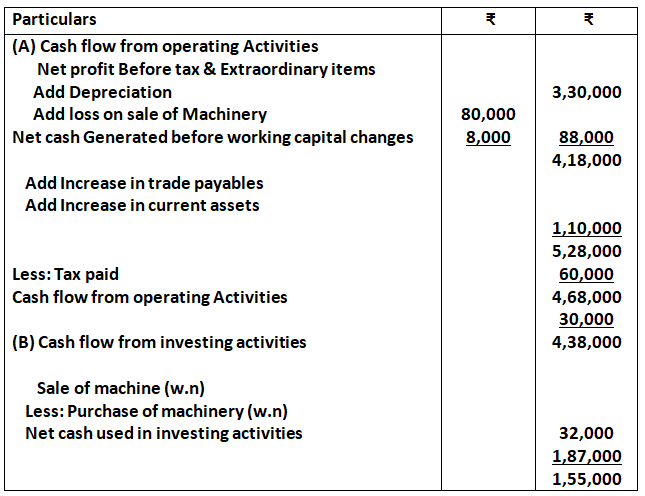

30. From the following information, calculate cash flow from operating Activities and investing Activities:

Additional Information:

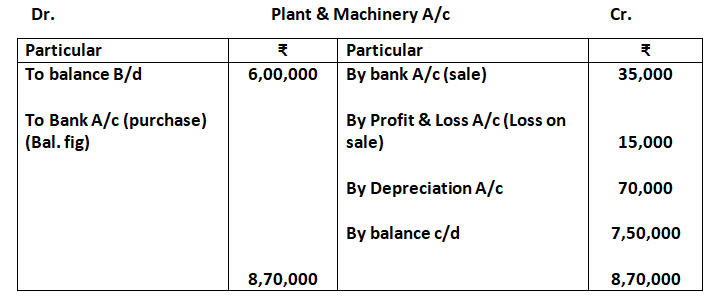

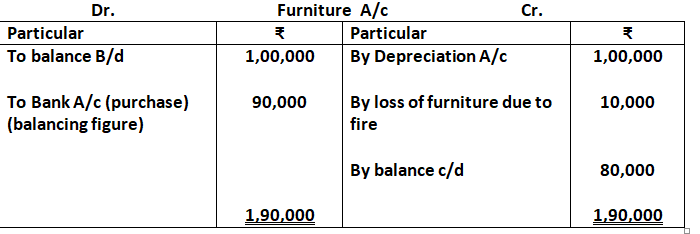

- Depreciation of 80,000 was provided and a machine costing 1,05,000 (depreciation provided thereon 65,000) was sold at a loss of 8,000.

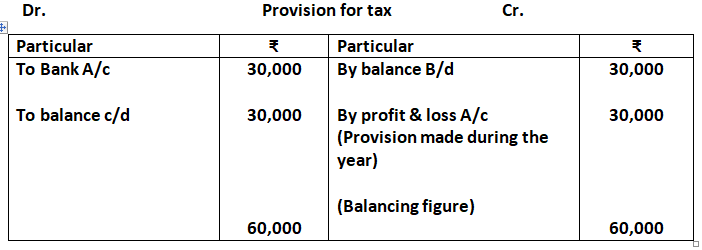

- Tax paid during the year 30,000.

Solution:

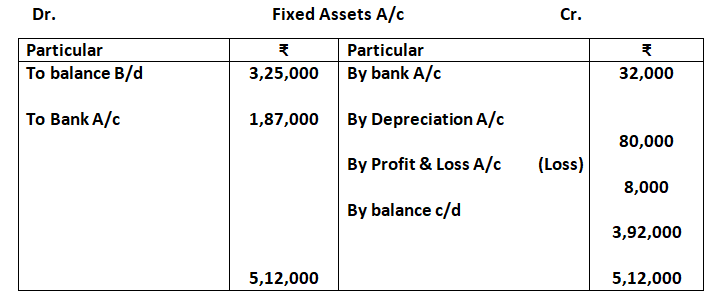

Working Notes:

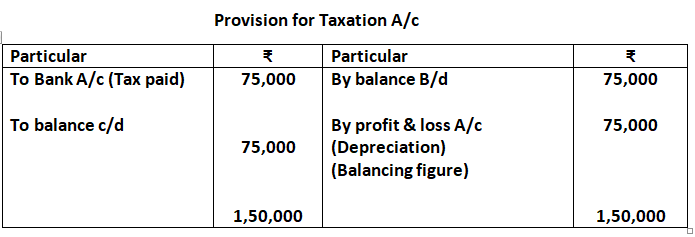

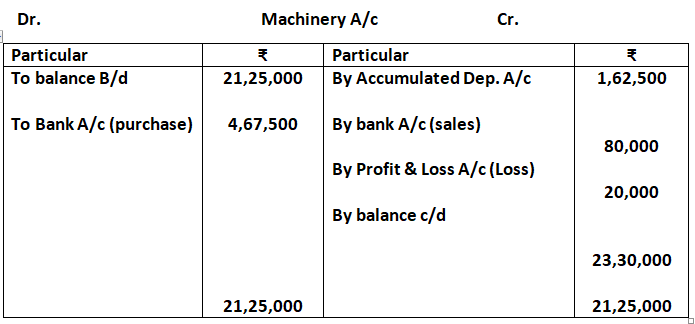

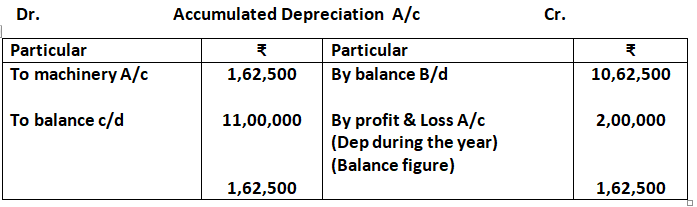

31. From the following information, calculation cash flow from operating activities and investing activities:

Additional information:

- A machine having book value of 1,00,000 (Depreciation provided thereon 1,62,000) was sold at a loss of 20,000.

- Tax paid during the year 75,000.

Solution:

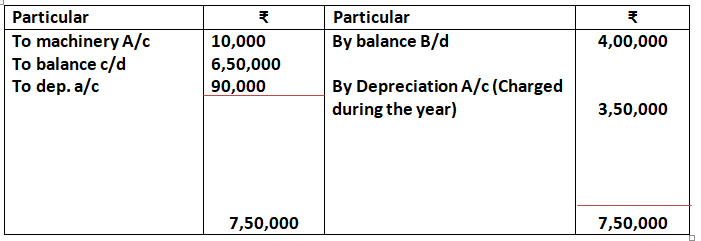

Working Notes:

32. (a) From the following information, calculate Cash Flow from Operating Activities:

Additional Information:

Proposed Dividend for the year ended 31st March, 2023 and 31st March, 2024 was Rs.1,50,000 and Rs.1,80,000 respectively.

(b) From the following information calculate the Cash flow investing Activities:

Additional Information:

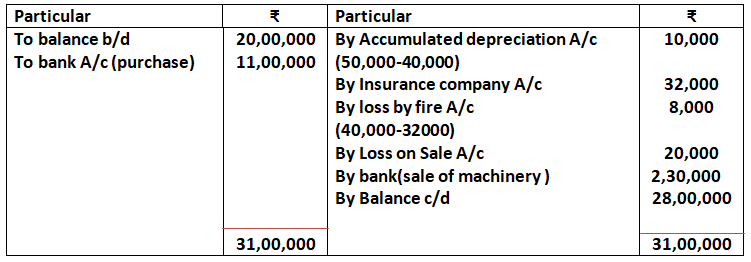

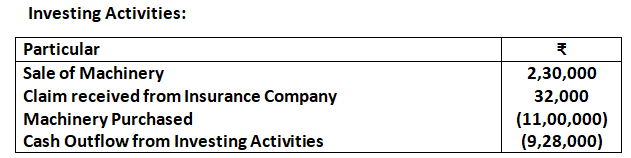

- Machinery costing Rs.50,000 (book value Rs.40,000) was lost by fire and insurance claim of Rs.32,000 was received.

- Depreciation charged during the year was Rs.3,50,000.

- A part of machinery costing Rs.2,50,000 was sold at a loss of Rs.20,000.

Solution-

(A) Cash flow from Operating Activities

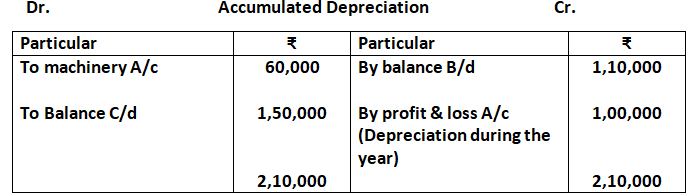

(B) Dr. Accumulated Depreciation A/c Cr.

Dr. Machinery A/c Cr.

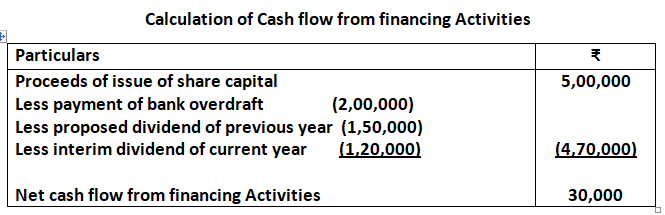

Cash Flow from Financing Activities

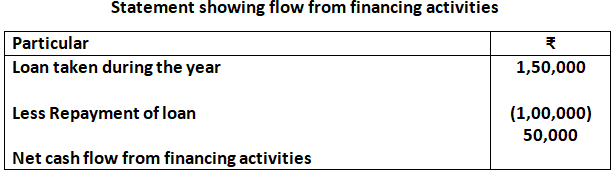

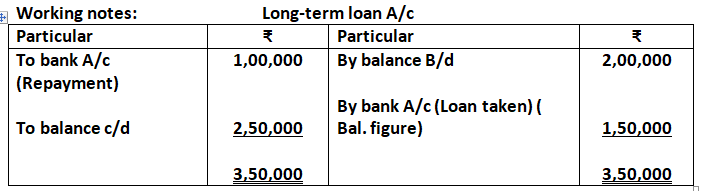

33. From the following information, calculate cash flow from financing Activities:

1st April 31st March

2024 2025

Long-term loan 2,00,000 2,50,000

During the year, the company repaid a loan of 1,00,000.

Solution:

34. From the following information, calculate cash flow from financing activities:

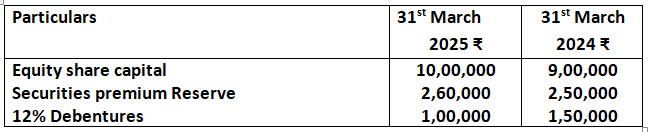

Additional information: Interest paid on debentures 18,000.

Solution:

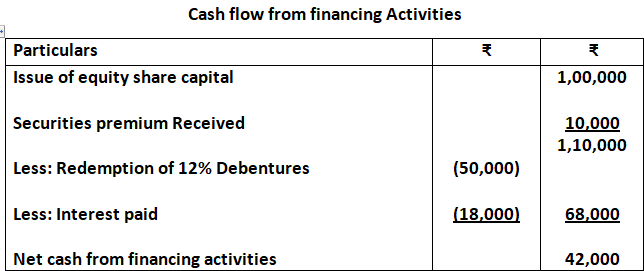

35. Jalco Ltd. provided the following information, calculate net cash flow from financing activities:

Additional information:

- Interest paid on debentures 19,000.

- Dividend paid in the year 50,000.

- During the year, jalco Ltd. issued bonus shares in the ratio of 5:1 by capitalizing reserve.

Solution:

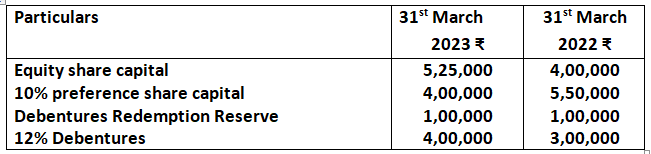

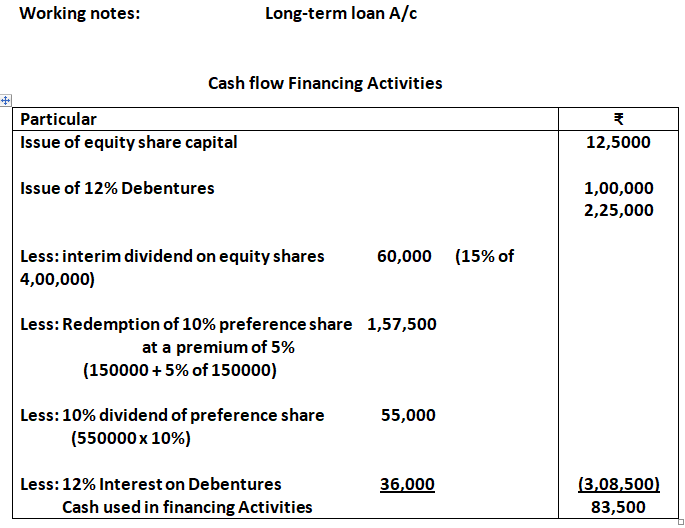

36. From the following extracts of Balance Sheets of Exe Ltd., calculate cash flow Financing Activities:

Additional Information:

- Equity share were issued on 31st March, 2025.

- Interim dividend on Equity shares was paid @ 15%.

- Preference shares were redeemed on 31st March, 2025 at a premium of 5%.

- 12% debentures of face value 1,00,000 were issued on 31st March, 2025.

Solution:

Cash Flow from Investing and Financing Activities

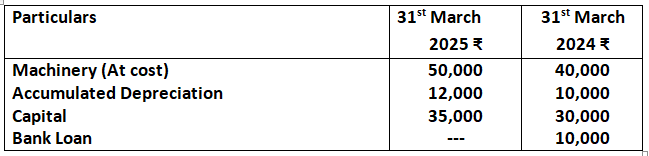

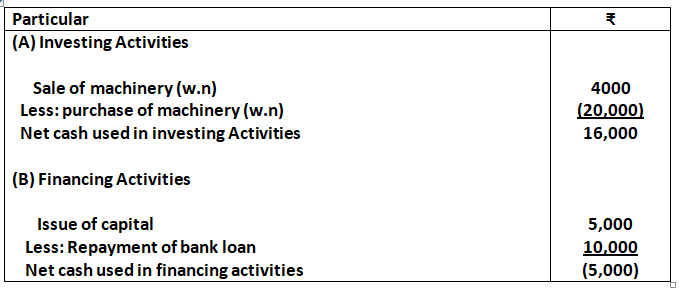

37. From the following information, calculate cash flow from investing and financing Activities:

During the year, a machine costing 10,000 was sold at a loss of 2,000. Depreciation on machinery charged during the year amounted to 6,000.

Solution:

Working Notes:

Dr. Plant & Machinery A/c Cr.

38. From the following information, calculate (a) cash flow from investing activities; and (b) cash flow from financing activities:

Additional information:

- Depreciation charged on plant and machinery was 50,000.

- Plant and machinery of book value 60,000 was sold for 40,000.

- Land was sold at a gain of 60,000.

- Preference shares were redeemed on 31st march, 2025 at a premium of 5%.

- Dividend on equity shares and preference shares for the year ended 31sr march, 2024 was Nil and for the year ended 31st march, 2025 proposed dividend on equity shares was 10%.

- Fresh issue of equity shares was on 1st April, 2024.

Solution:

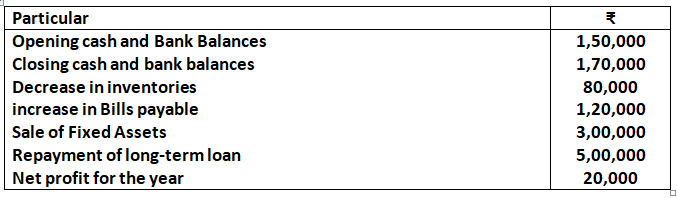

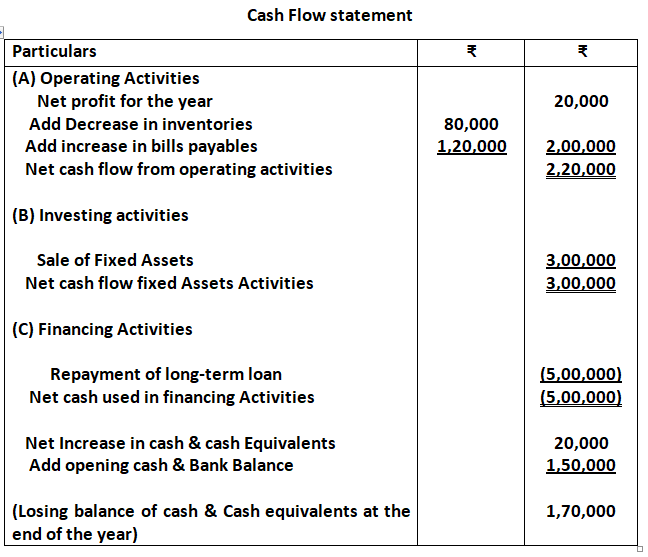

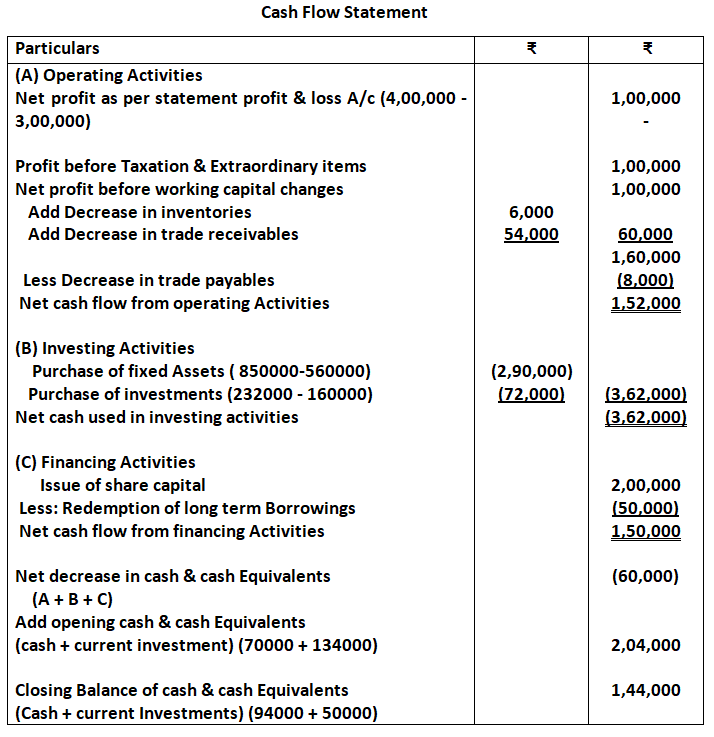

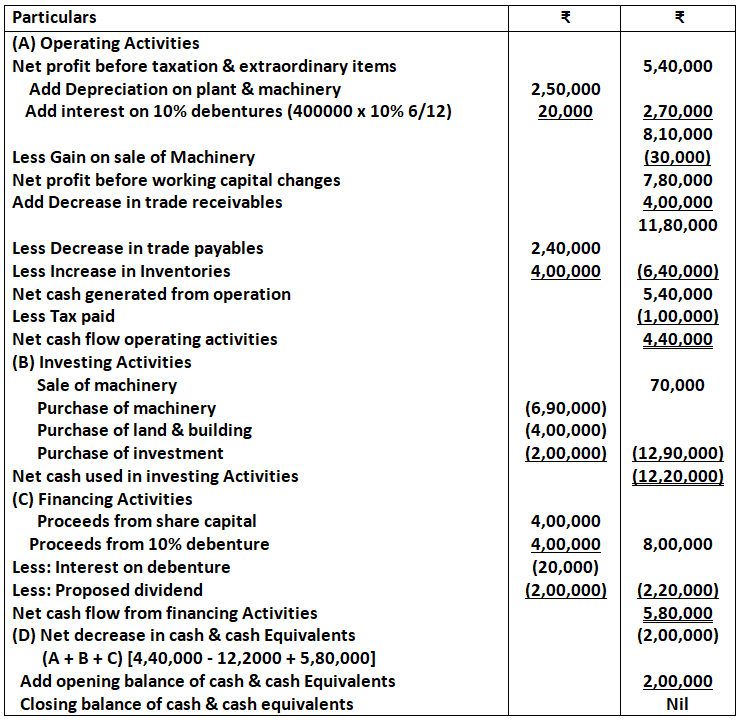

Cash Flow Statement

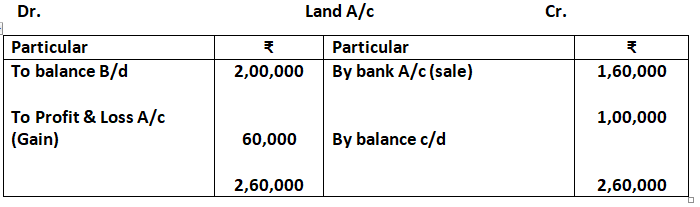

39. From the following information, prepare cash flow statement:

Solution:

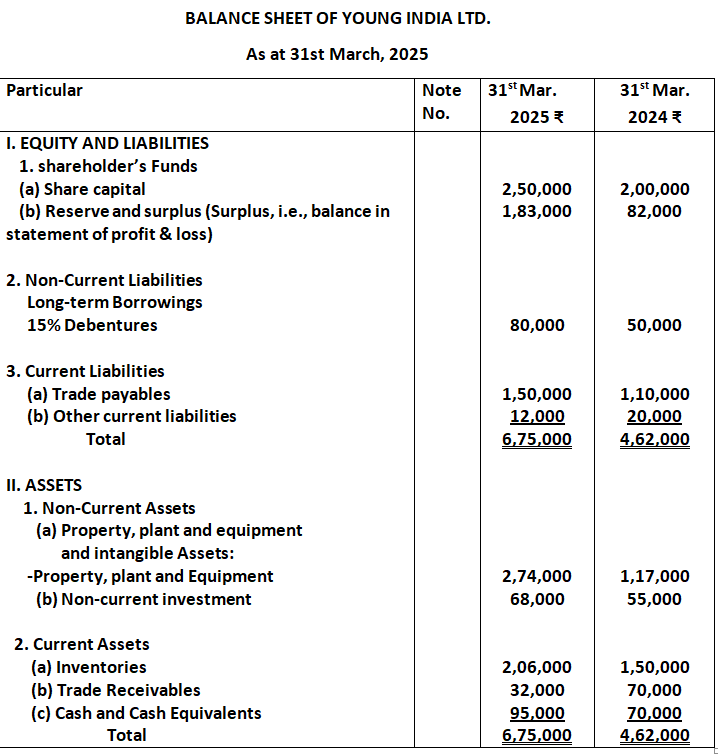

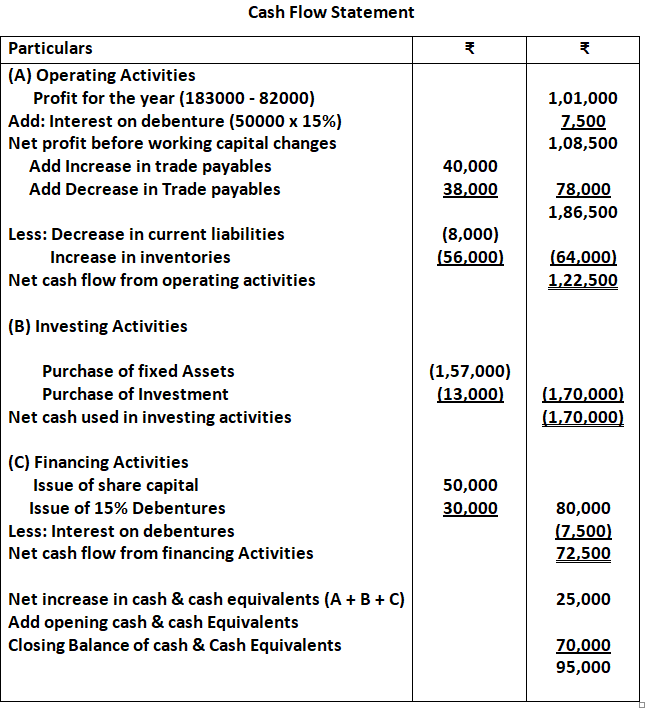

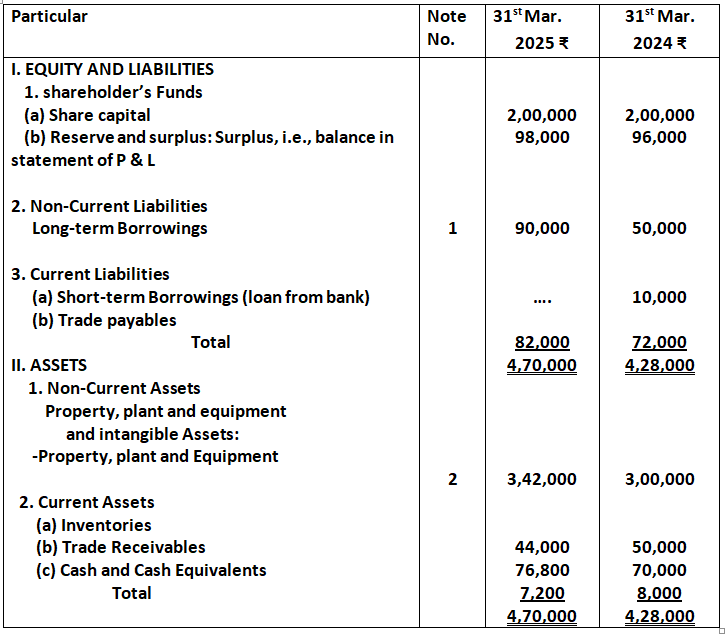

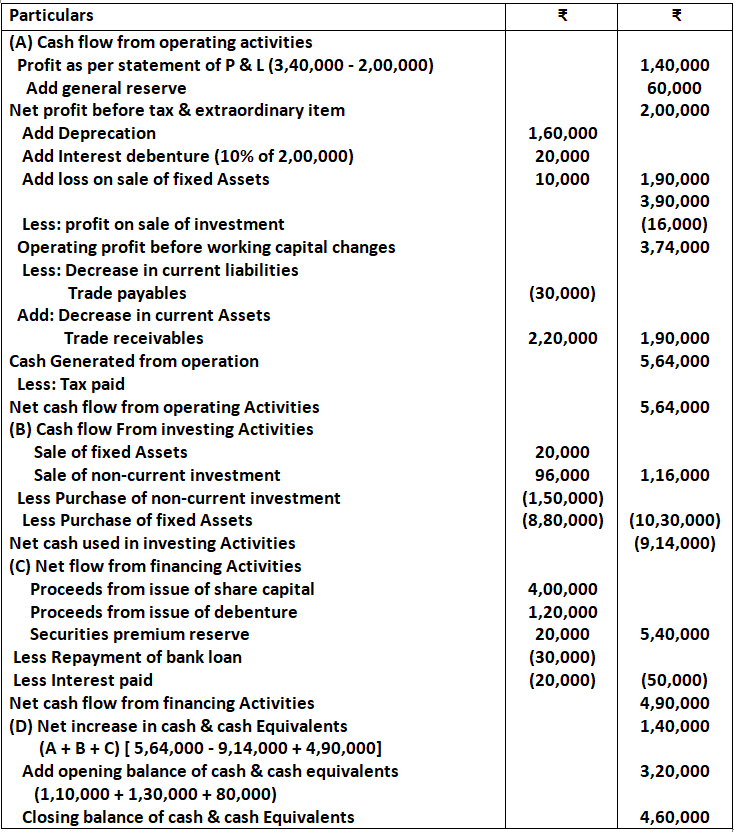

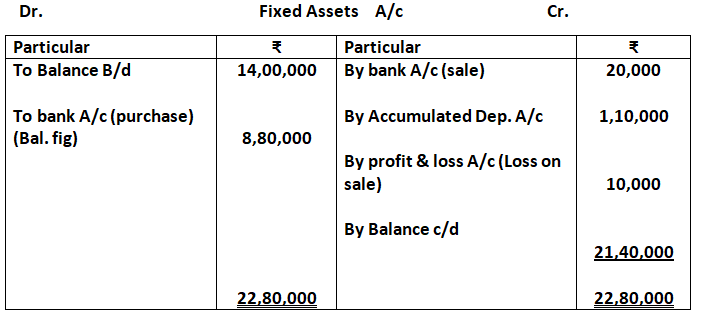

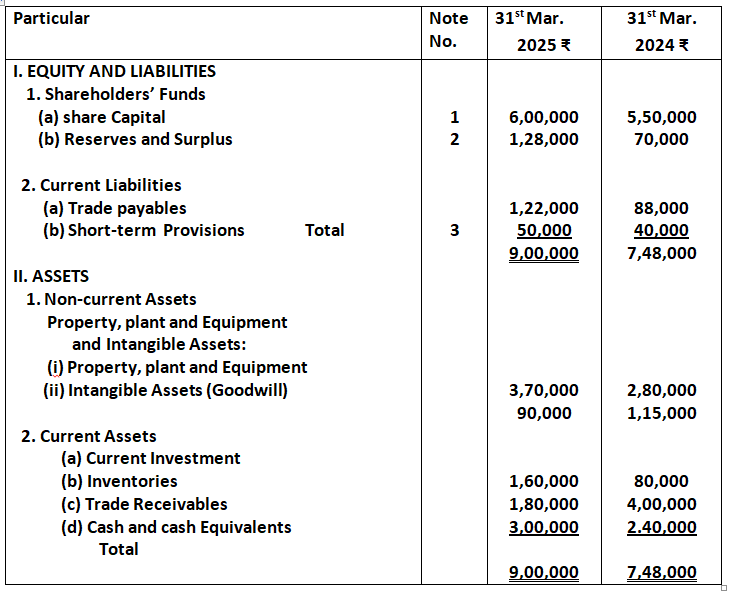

40. From the following Balance Sheet of Young India Ltd., Prepare cash Flow statement:

Solution:

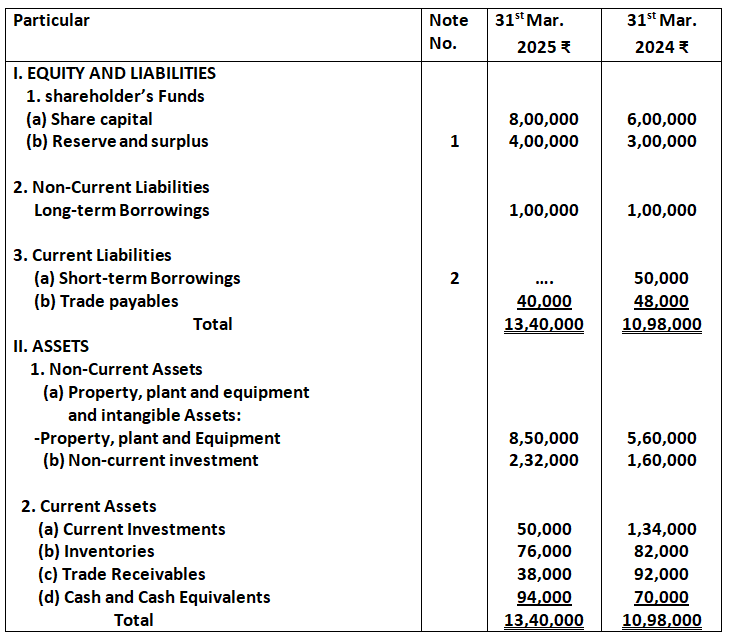

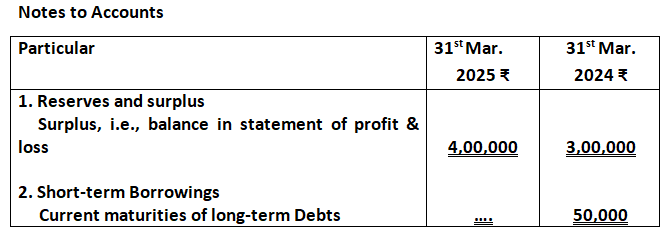

41. Prepare cash flow statement on the basis of the information given in the balance sheets of Nidhi Ltd. as at 31st March, 2025 and 31st March 2024:

Solution:

Cash Flow Statement with Adjustments

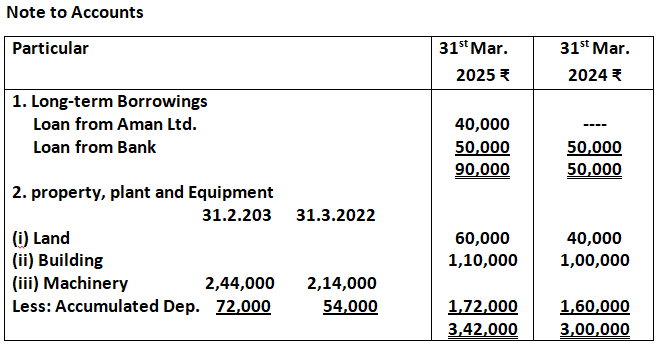

42. Balance Sheet of Bright Ltd. as at 31st March, 2025 is as following:

Additional Information: During the year 52,000 were paid as interim dividend.

Prepare cash flow statement.

Solution:

Cash flow statement

43. Following are the Balance Sheets of Solar Power Ltd. as at 31st March 2023 and 2025 : (Old Book)

Solar Power Ltd. BALANCE SHEET

Additional information:

During the year, a piece of machinery costing 48,000 on which accumulated depreciation was 32,000. Was sold for 12,000.

Prepare cash flow statement.

Solution:

Cash Flow Statement

Dr. Accumulated Depreciation A/c Cr.

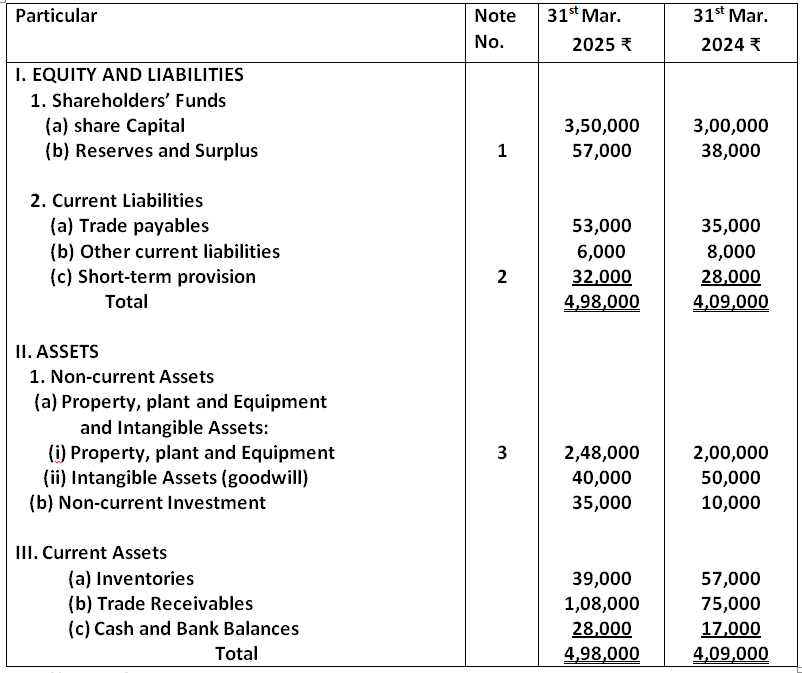

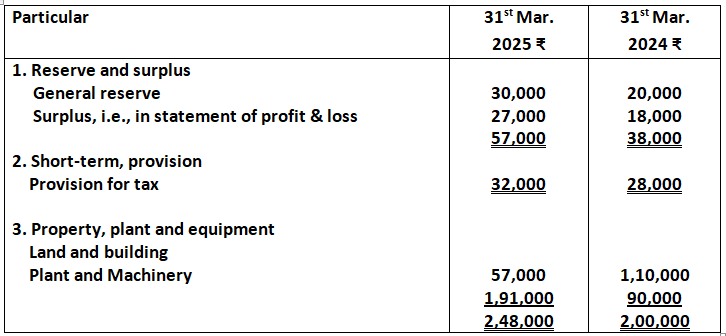

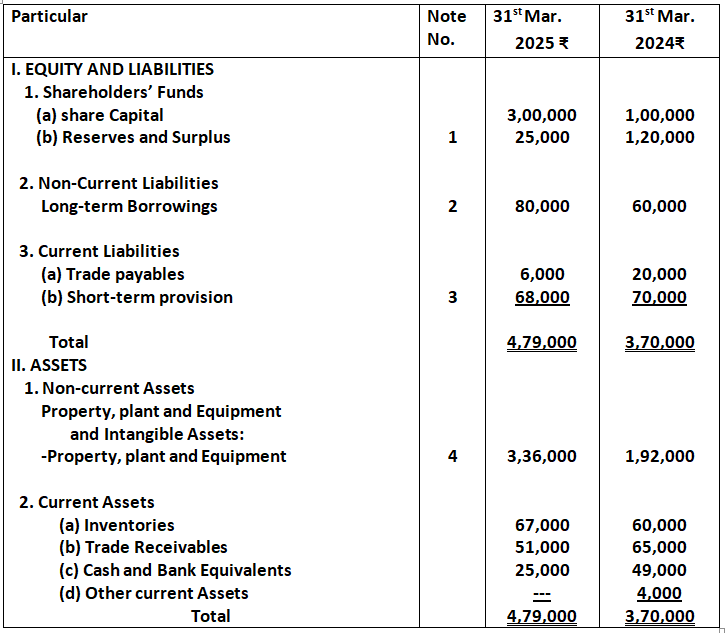

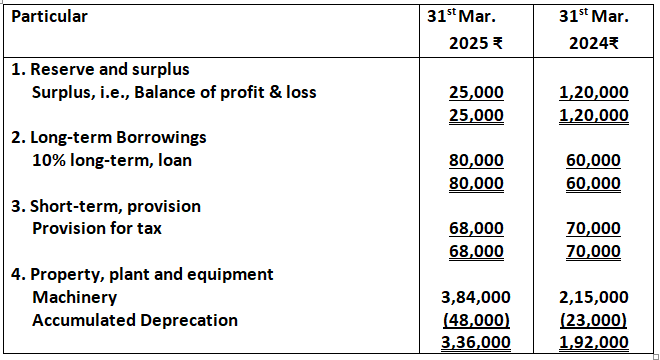

43. Following is the balance sheet of fine products Ltd. as at 31st March, 2025:

Note to Accounts

Note: Proposed dividend on equity for the year ended 31st March, 2022 and 2023 are 39,000 and 45,000 respectively.

You are required to prepare cash flow statement for the year ended 31st March, 2025.

Solution:

Cash flow statement

44. Following is the balance sheet of Mevanca limited as at 31st March, 2015:

Mevanca Limited

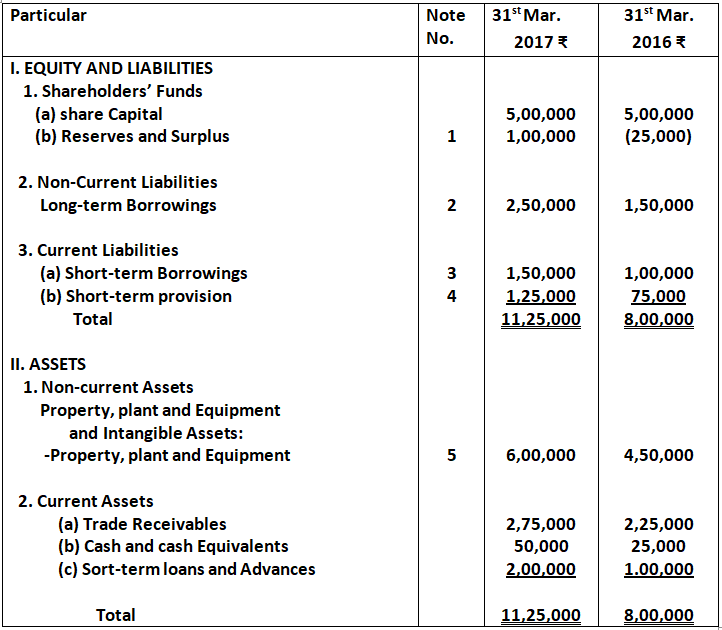

BALANCE SHEET as at 31st March, 2017

Note To Accounts

Additional Information:

(I) Additional loan was taken on 1st July, 2024.

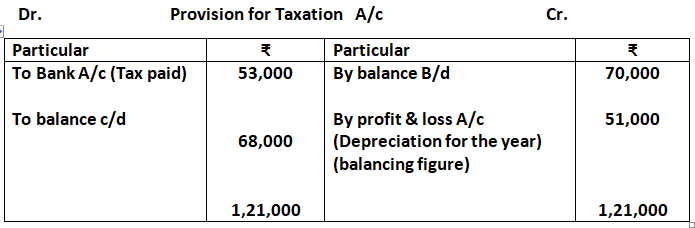

(II) Tax of 53,000 was paid during the year.

Prepare cash flow statement.

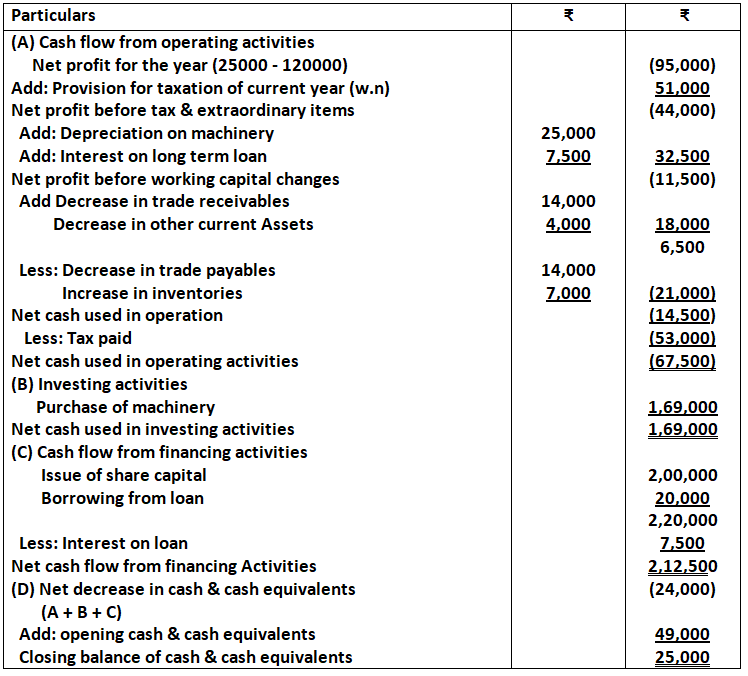

Solution:

Cash Flow Statement

Interest paid on loan

Interest = (60,000 x 10%) + (20,000 x 10% 9/12)

= (6,000 + 1,500) = 7,500

45. Following is the Balance sheet of X Ltd. as at 31st March, 2018: (Old Book)

BALANCE SHEET OF X LTD. as at 31st March, 2018

Additional Information

(i) 1,00,000, 12% debentures were issued on 1st April,

2027.

(ii) During the year, a piece of machinery costing 80,000

On which accumulated depreciation was 40,000 was

Sold at a gain of 10,000.

Prepare a cash flow statement.

Solution:

Cash Flow statement

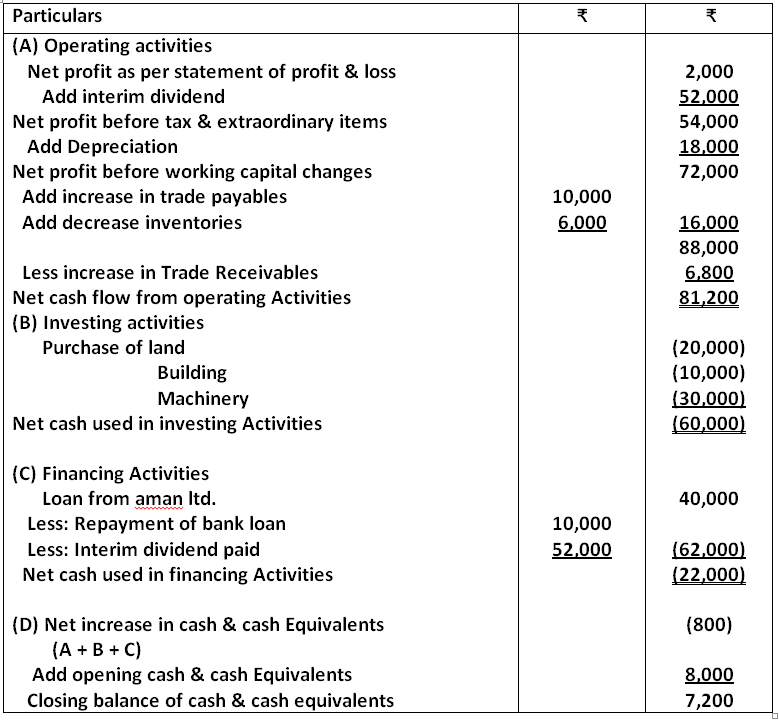

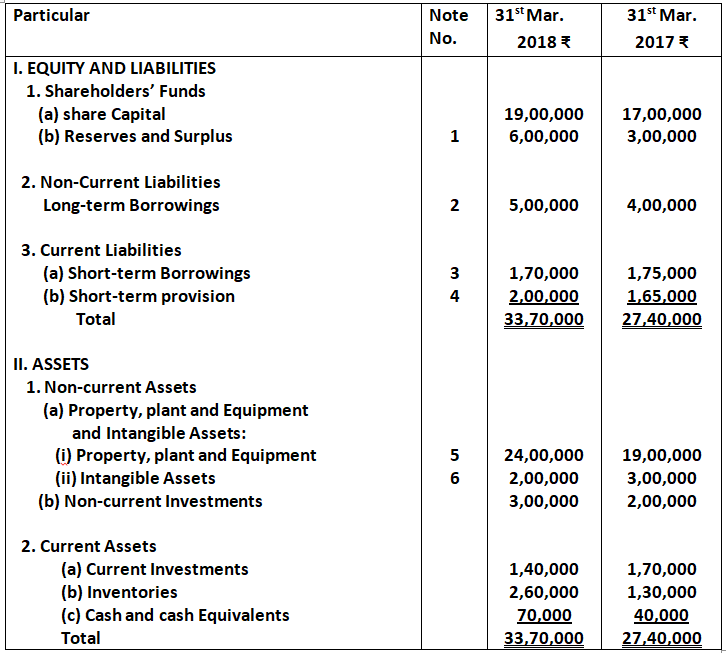

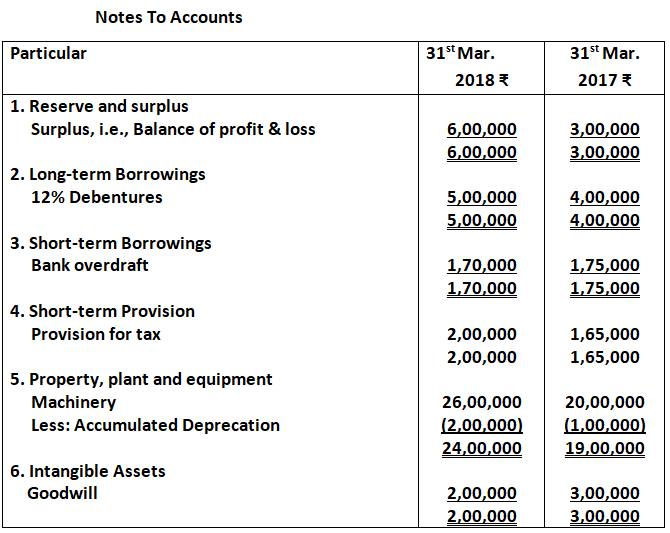

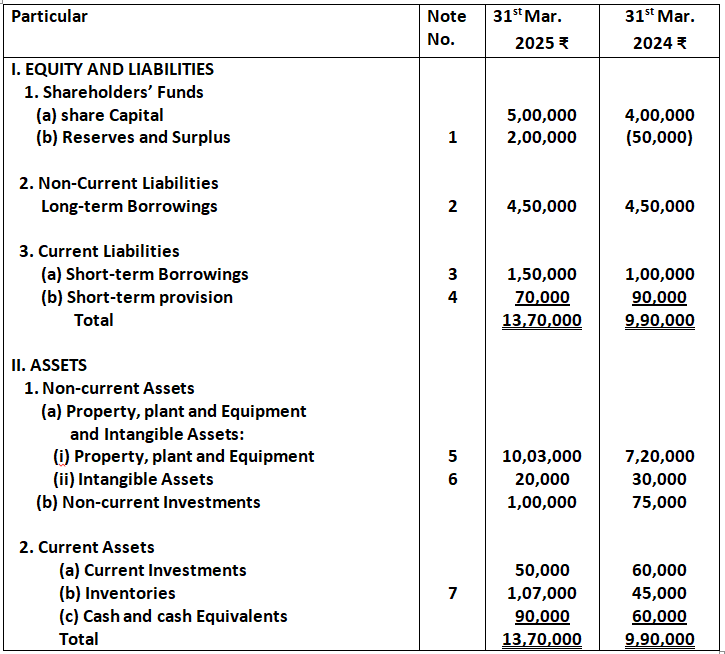

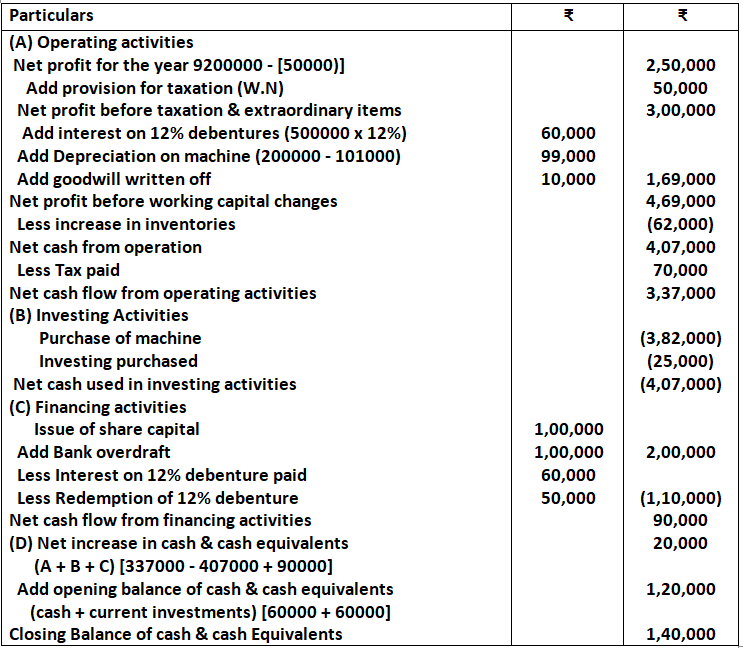

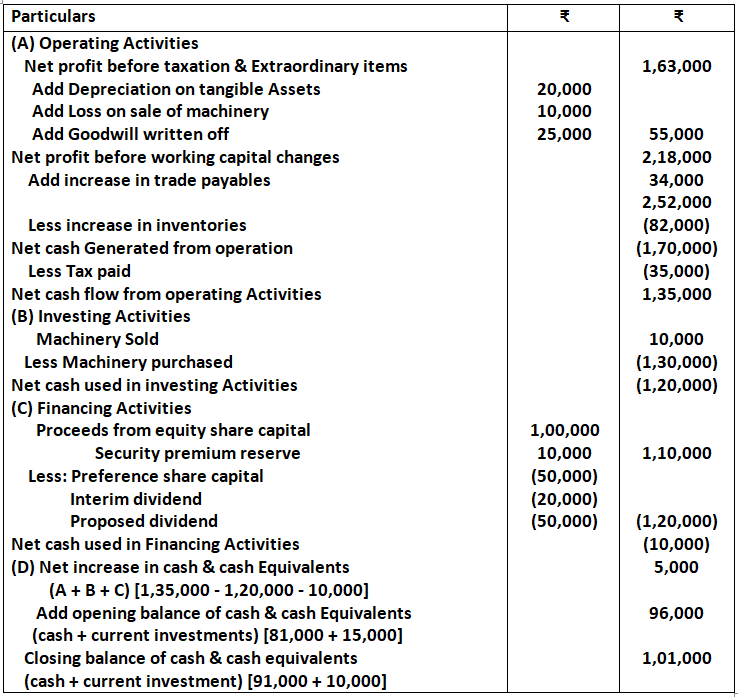

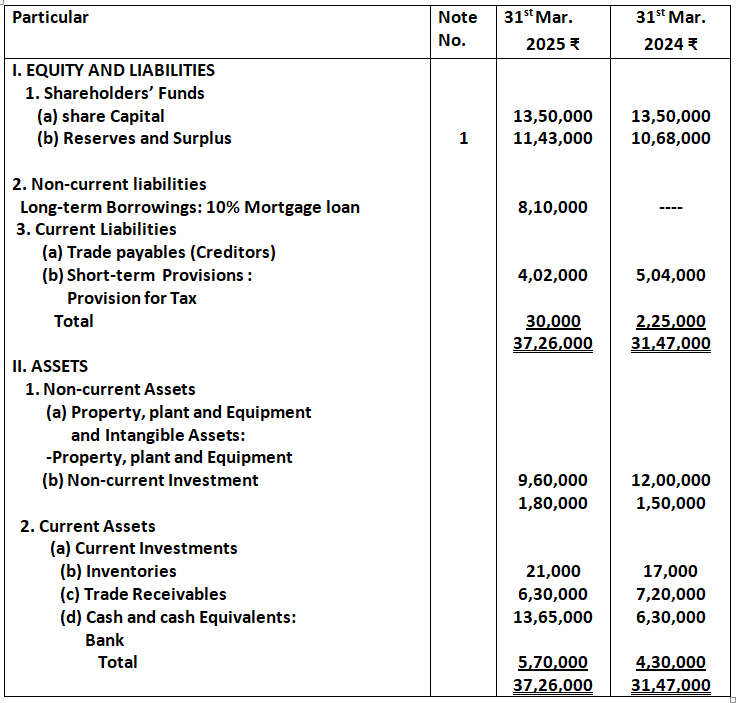

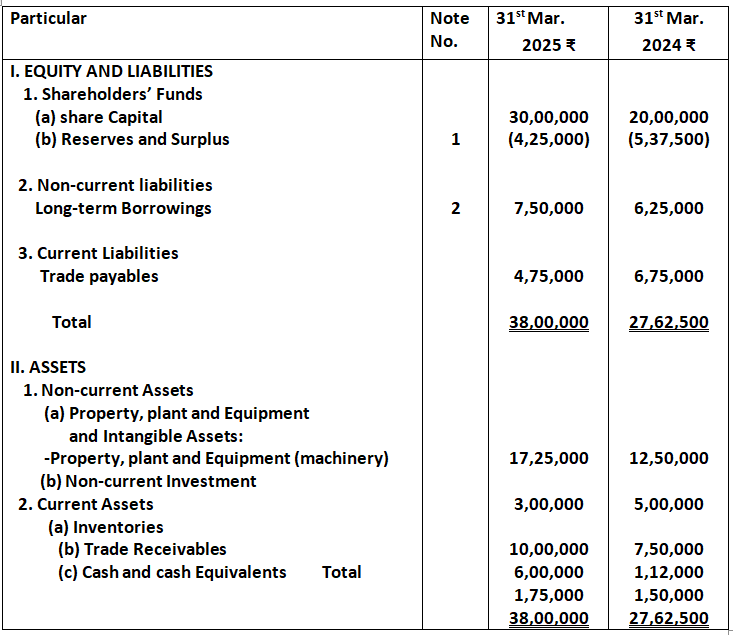

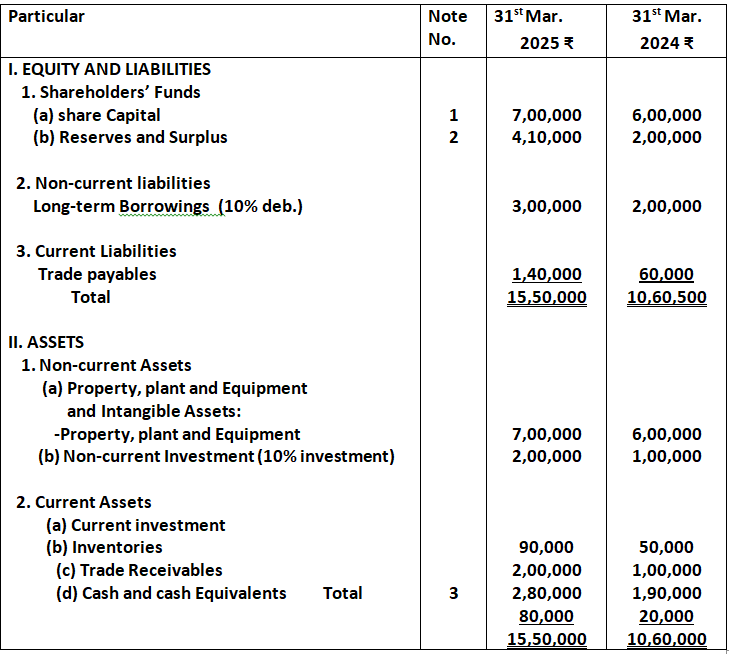

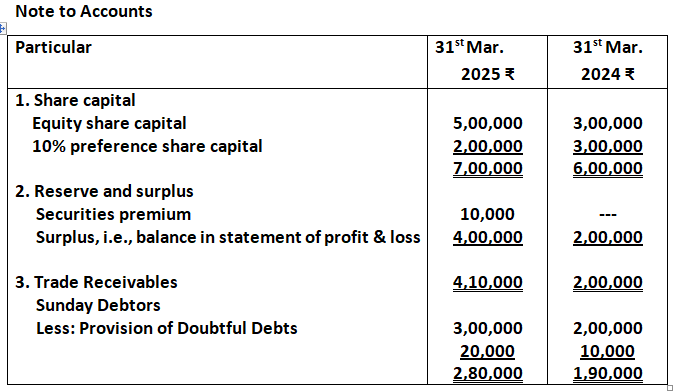

45. Following was the Balance Sheet of M.M Ltd. as at 31st March, 2025.

BALANCE SHEET as at 31st March, 2025

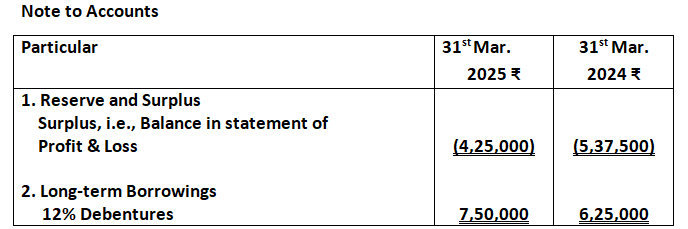

Note to Accounts

Additional Information:

1. 12% debentures were redeemed on 31st March, 2025.

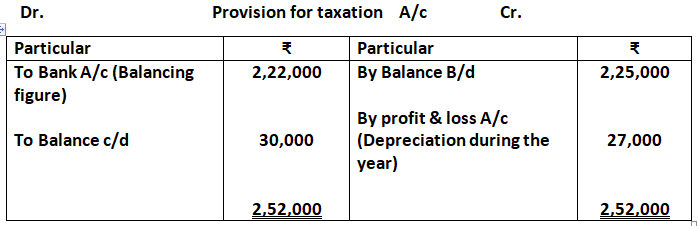

2. Tax 70,000 was paid during the year.

Prepare cash flow statement.

Solution:

Cash Flow statement

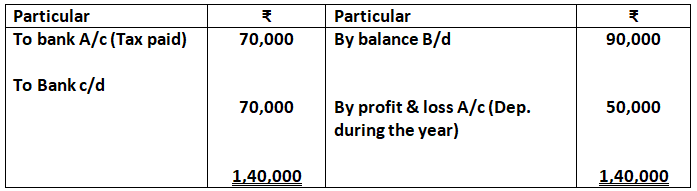

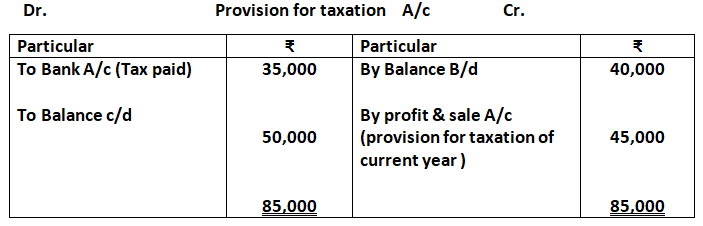

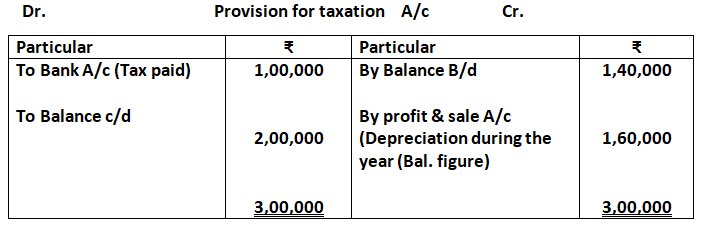

Working Notes:

Dr. Provision for taxation A/c Cr.

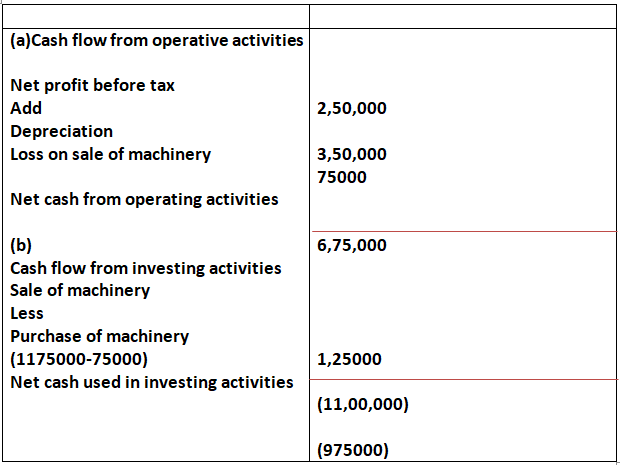

46. Property, Plant and Equipment (Net): Closing Rs.31,75,000, Opening Rs.25,50,000. During the year, a machine costing Rs.3,50,000 (Depreciation provided thereon Rs.1,50,000) was sold for Rs.1,25,000. Depreciation charged for the year was Rs.3,50,000. A machine costing Rs.75,000 was purchased by issue of equity shares of Rs.10each at a premium of 20%. Net profit before tax Rs.2,50,000.

How will you disclose these items while prepare Cash Flow Statement?

Solution-

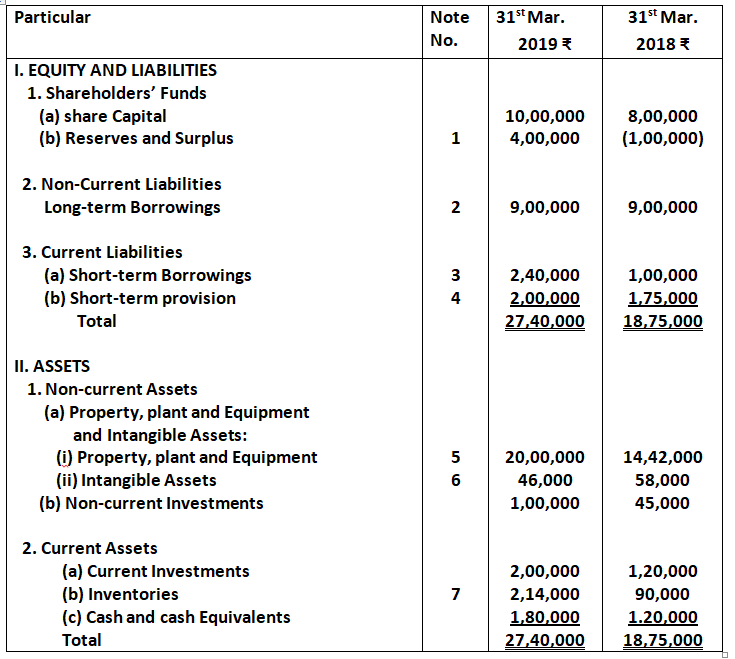

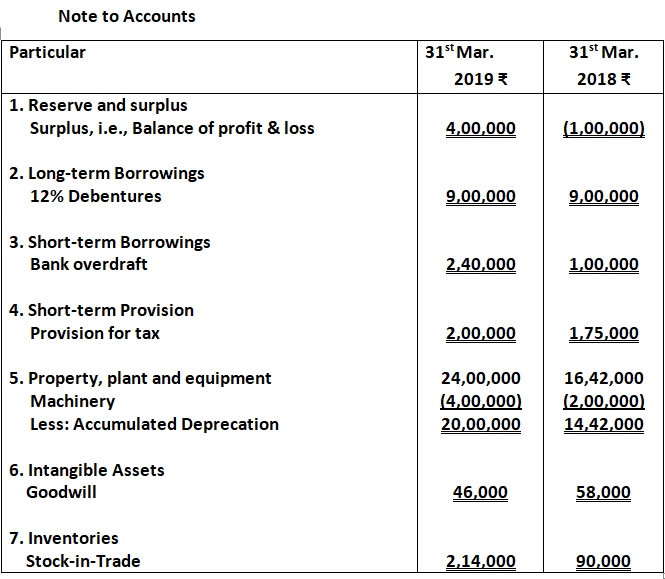

47. From the following Balance Sheet of Gopal Ltd. and the additional information as at 31st March, 2019. (Old Question)

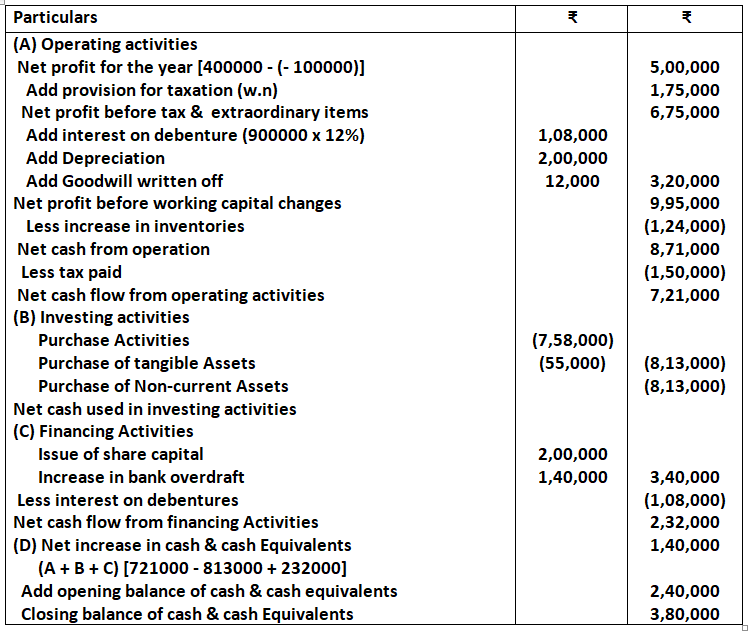

Prepare a cash Flow statement when cash flow from financing activities is 2,32,000: Old Book

Additional information: Tax 1,50,000 was paid during the year.

Solution:

Cash Flow statement

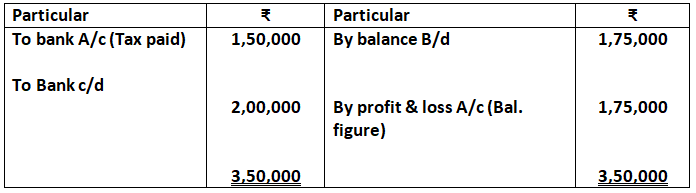

Working Note:

Dr. Provision for taxation A/c Cr.

47. From the following Balance sheet of JY Ltd. as at 31st March 2017. prepare cash flow statement: Old Book (Old Question)

JY Ltd.

BALANCE SHEET as at 31st March, 2017

Note to Accounts

Note: Proposed dividend for the year ended 31st March, 2016 and 2017 are 50,000 and 75,000 and respectively. Additional information: 1,00,000, 10% Debentures were issued on 31st march, 2017.

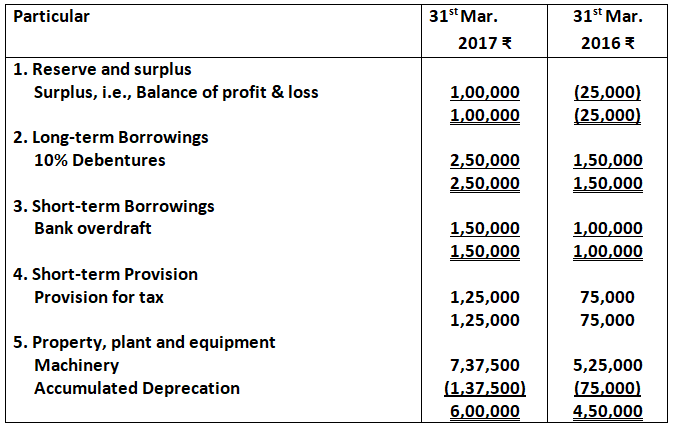

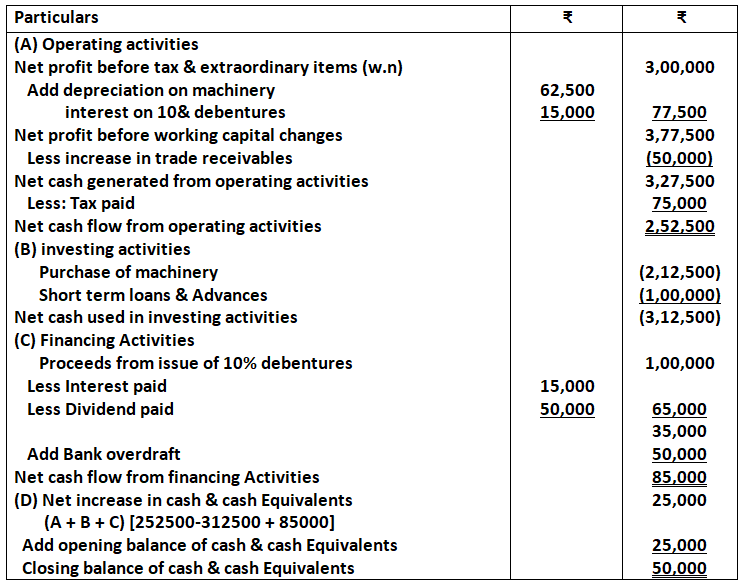

Solution:

Cash Flow statement

Working Notes:

Calculation of profit before tax & Extraordinary items

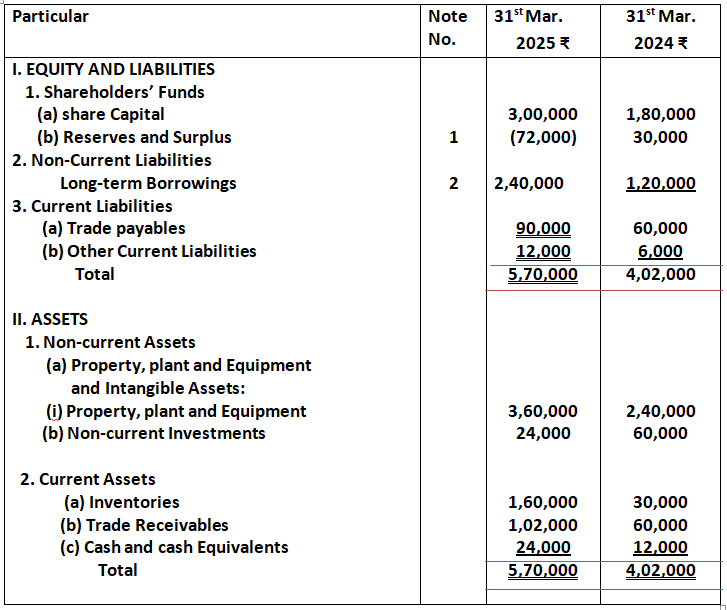

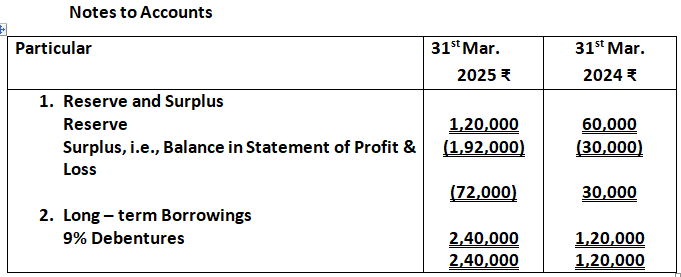

47. From the following Balance Sheet of Midge Ltd. as at 31st March, 2025, prepare cash flow statement:

Note to Accounts

Additional Information:

- During the year, machinery costing 1,40,000 (accumulated depreciation provided thereon 1,10,000) was sold for 20,000.

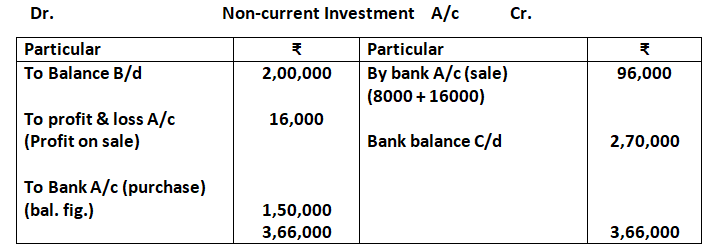

- During the year, Non-current Investments costing 80,000 were sold at a profit of 16,000.

- Debentures were issued on 31st March, 2025.

Solution:

Cash Flow statement

Dr. Accumulated Depreciation A/c Cr.

48. Prepare a Cash Flow Statement of Sea Ltd. From the following information:

Balance Sheet as at 31st March, 2025 and 2024

Additional Information:

- Included in the Property, Plant and Equipment was a place of Machine costing Rs.36,000 on which depreciation charged was Rs.12,000 and it was sold for Rs.12,000.

- Depreciation charged during the year was Rs.60,000.

Solution-

Cash flow statement

49. Following is the Balance Sheet of best barcode Ltd.:

BALANCE SHEET OF SONAL LTD. as at 31st March, 2025

Additional Information:

- Proposed dividend for the years ended 31st March, 2025 and 2024 were 60,000 and 50,000 respectively.

- A machine costing 50,000 (depreciation provided thereon 30,000) was sold for 10,000.

- Depreciation charged during the year was 20,000.

- Interim dividend paid 20,000.

- Income Tax paid 35,000.

Prepare a cash flow statement for the year ended 31st March, 2023, complying with AS-3 (Revised).

Solution:

Cash Flow statement

Working Notes:

Calculation of profit before taxation & extraordinary items

Cash Flow statement

50. From the following relating to Grow more Ltd. prepare cash flow statement:

BALANCE SHEET OF GROW MORE LTD. as at 31st March, 2025

Note To Accounts

Additional Information:

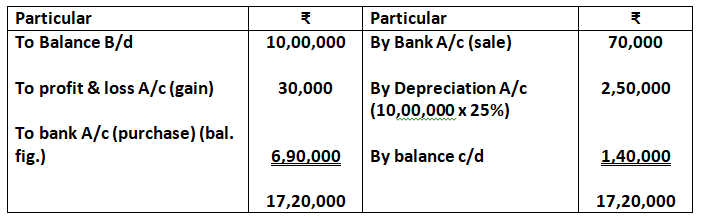

- Depreciation @25% was charged on the opening value of plant and machinery

- During the year one old machine costing 1,00,000 (written down value 40,000) was sold for 70,000.

- 1,00,000 was paid as income tax during the year.

- Proposed dividend for the year ended 31st March, 2025 was 4,00,000 and for the year ended 31st March, 2024 was 2,00,000.

- During the current yea new debentures were issued on 1st October, 2024.

Solution:

Cash Flow statement

Working Notes :

Calculate of net profit Before taxation & Extraordinary items

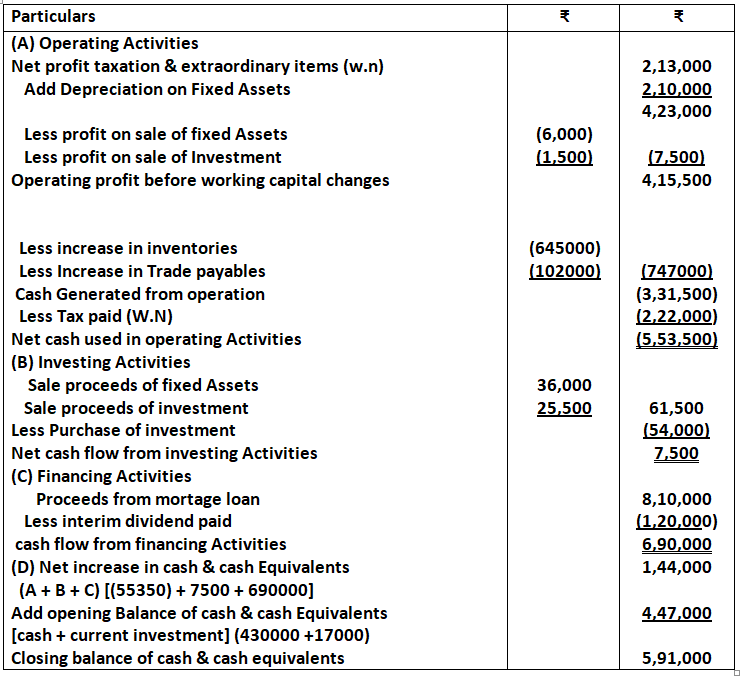

51. Following is the summarized Balance Sheet of Philips India Ltd. as at 31st March, 2025:

Additional Information:

- Investment costing 24,000 were sold during the year the 25,000.

- Provision for tax made during the year was 27,000.

- During the year, a part of the fixed Assets costing 30,000 was sold for 36,000. The profits were included in the statement of profit & loss.

- The interim dividend paid during the year amounted to 1,20,000.

You are required to prepare cash flow statement.

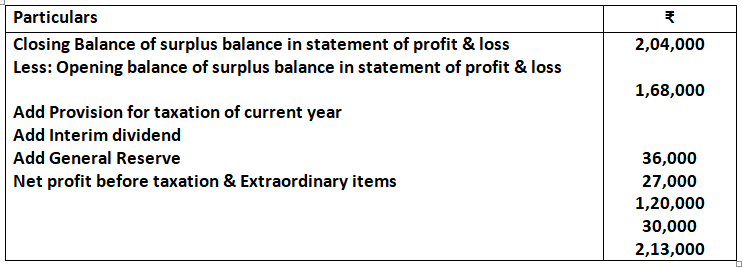

Solution:

Cash Flow statement

Calculation of net profit before taxation & extraordinary items

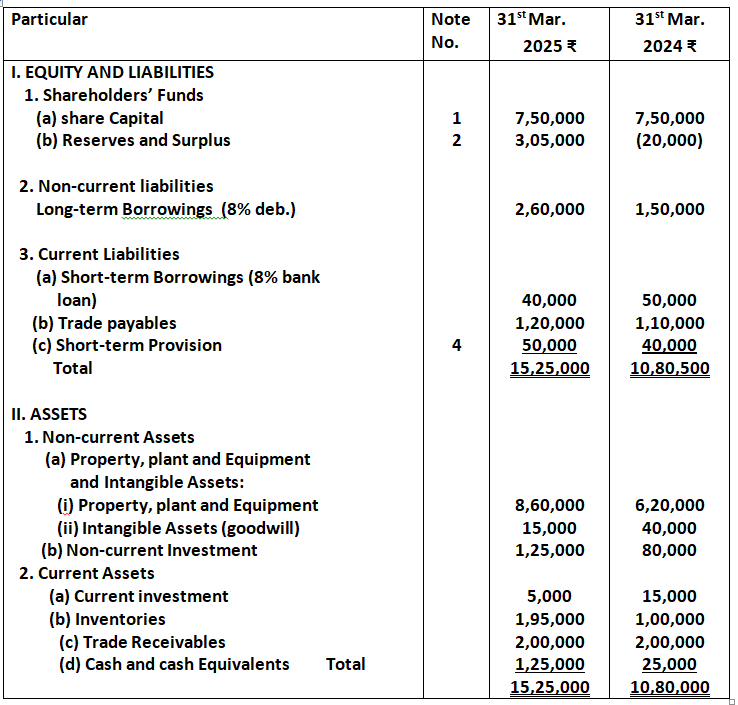

52. Following is the balance Sheet of Akash Ltd. as at 31st March, 2025, prepare cash Flow statement:

Additional information:

- Debentures were issued on 1st January, 2023.

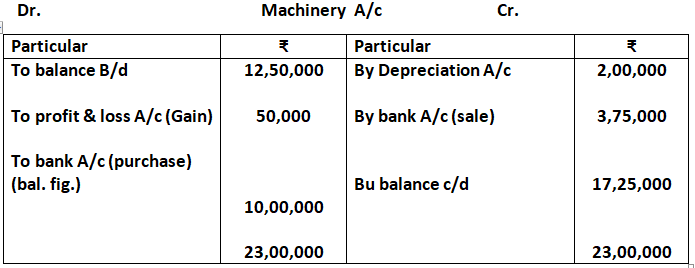

- Machinery costing 5,00,000 on which depreciation charged was 1,75,000 was sold for 3,75,000.

- Depreciation charged during the year amounted to 2,00,000.

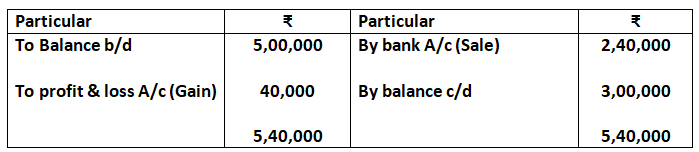

- Non-current investment were sold at a profit of 20%.

Prepare Cash Flow Statement.

Solution:

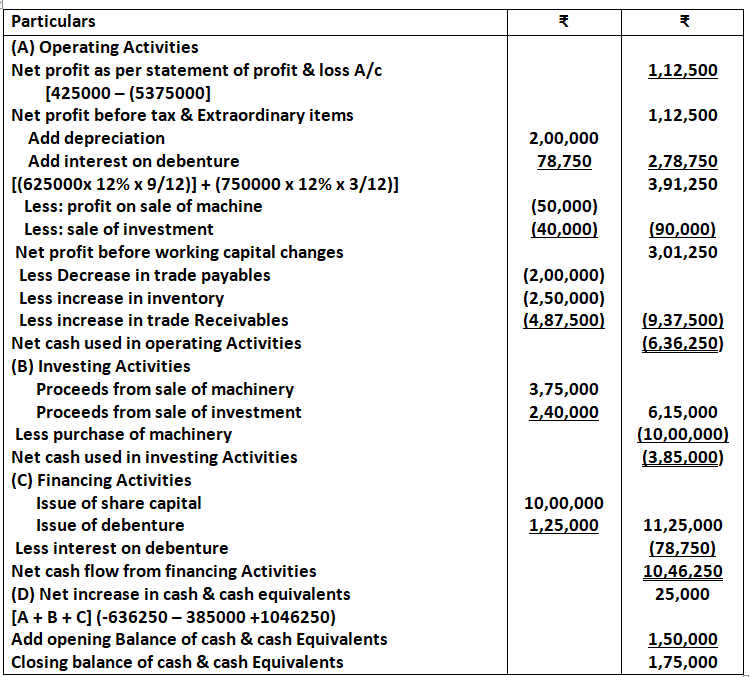

Cash Flow Statement

Working Notes:-

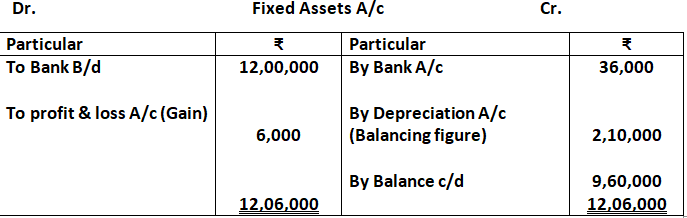

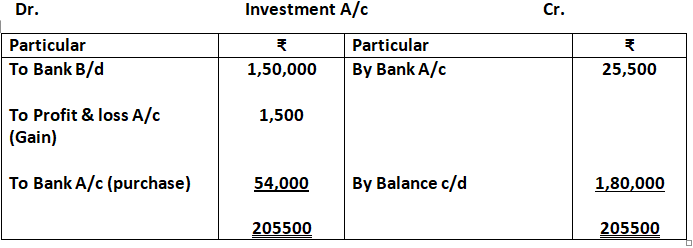

Dr. Investment A/c Cr.

53. From the following balance sheet of samta ltd., as at 31st March, 2025, prepare cash flow statement:

Additional Information:

- During the year a piece of machinery costing 60,000 on which depreciation charged was 20,000 was sold at 50% of its book value. Depreciation provided on tangible Assets 60,000.

- Income tax 45,000 was provided.

- Additional Debentures were issued at par on 1st October, 2024 and Bank loan was repaid on the same date.

- At the end of the year preference shares were redeemed at a premium of 5%.

Solution:

Cash Flow Statement

Working Notes:

Calculation of Net profit before working capital changes:

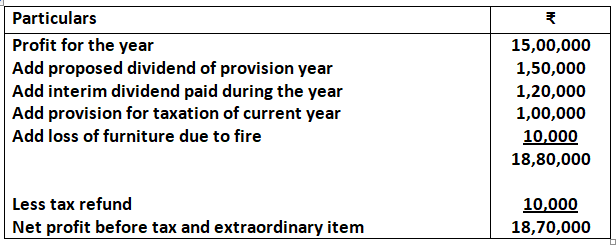

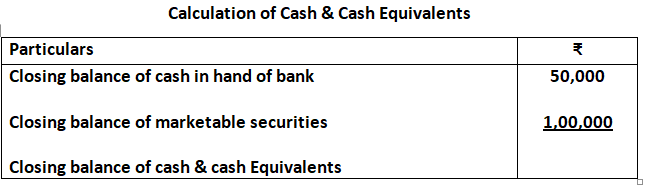

54. Read the following hypothetical text and answer the given question on its basis. Profit for the year ended 31st March, 2025 of I Pay (a payment processing start up) was 15,00,000 after accounting the following:

- Patents purchased during the year was 50,000.

- Proposed dividend for the year ended 31st March, 2022 and 2023 was 1,50,000 and 2,00,000 respectively.

- Interim dividend during the year ended 31st March, 2022 and 2023 was 50,000 and 1,20,000 respectively.

You are required to:

- Determine net profit before tax and Extraordinary items.

- Determine operating profit before working capital changes.

- Determine cash flow from investing activities.

- Determine cash Flow from financing activities.

- Determine cash and cash Equivalents.

Solution:

Calculation of profit before taxation & extraordinary items

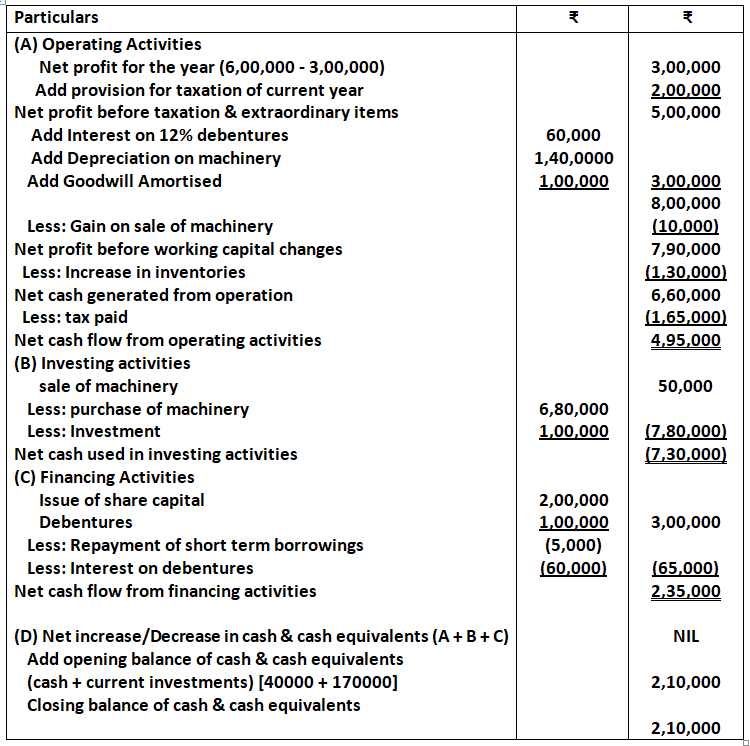

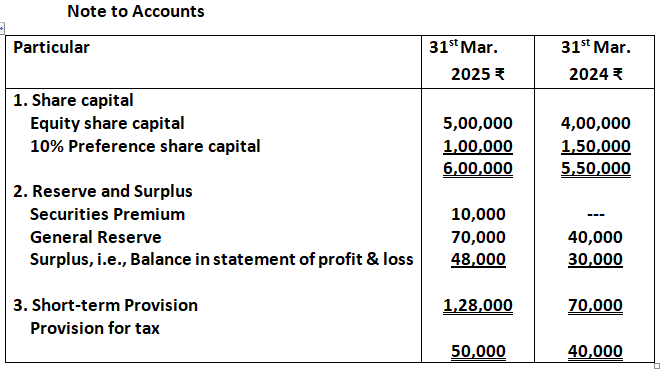

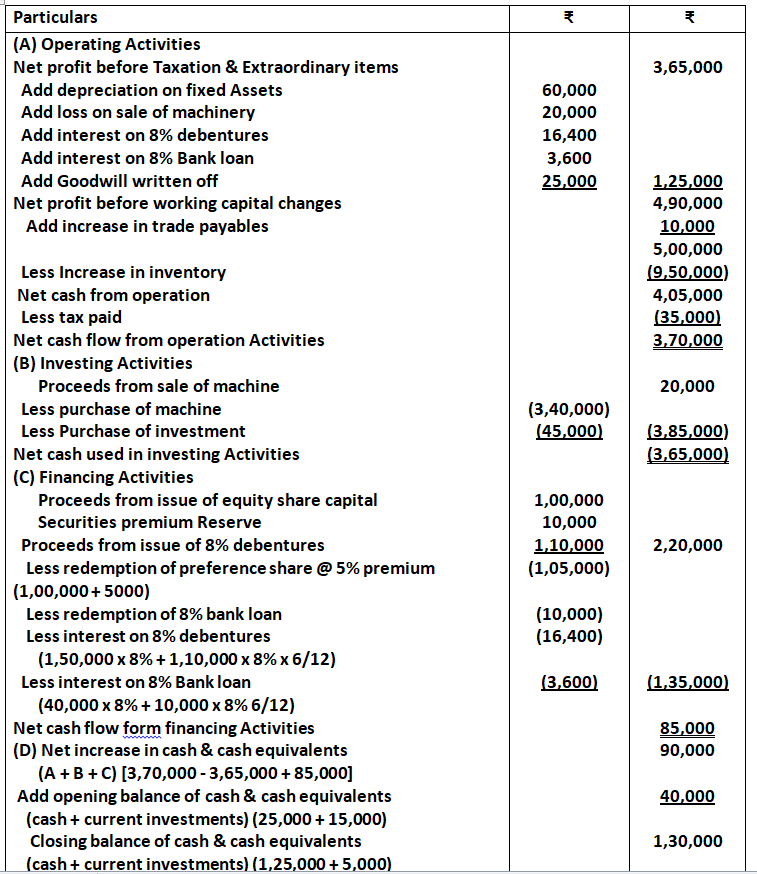

55. From the following balance sheet and information of sun Ltd., prepare cash flow statement:

You are informed that during the year:

- Proposed Dividend: 31st March, 2025 31st March 2024

Equity share capital Nil Nil

Preference share capital 10% 10%

- A machine with a book value of 90,000 was sold for 50,000.

- Depreciation charged during the year 60,000.

- Debentures were issued on 1st April, 2024.

- Investments were purchased on 31st March, 2025.

- Preference shares were redeemed on 31st December, 2024.

- An interim dividend @ 15% was paid on equity shares on 31st December, 2024.

- Fresh equity shares were issued at p premium of 5% on 31st March, 2025.

Solution:

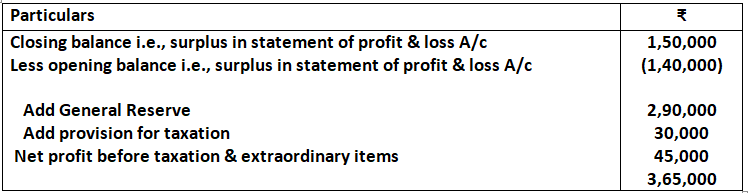

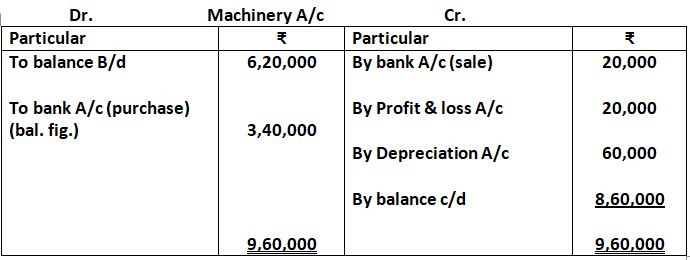

Cash Flow Statement

Working Notes:

Calculation of net profit before tax & extraordinary items