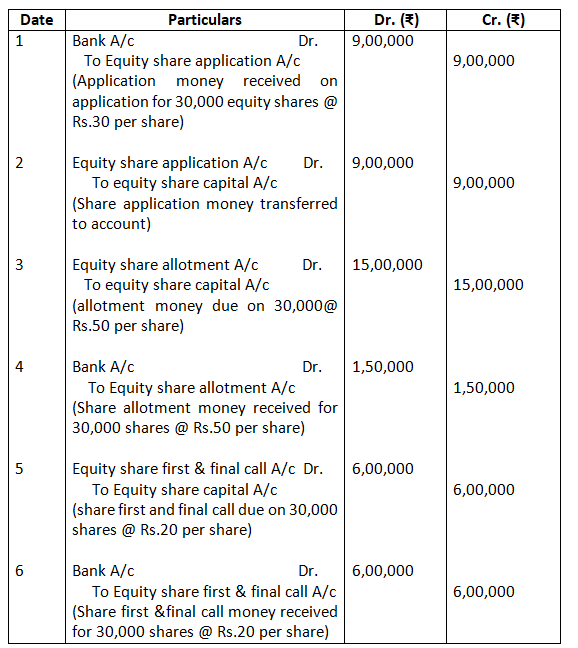

- Anish Limited issued 30,000 equity shares of Rs.100 each payable at Rs.30 on application, Rs.50 on allotment and Rs.20 on 1st and final call. All money was duly received. Record these transactions in the journal of the company.

Solution:-

Books of Ashis Limited

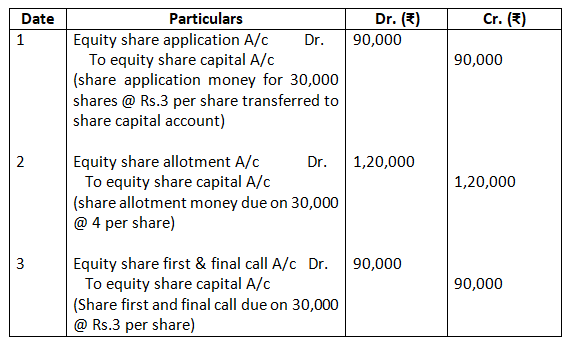

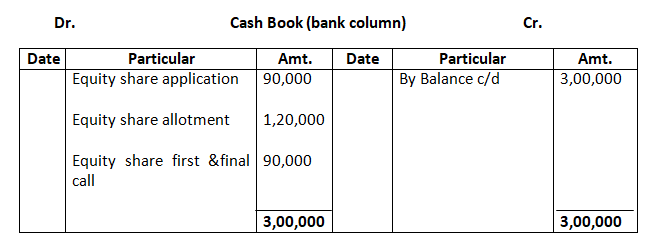

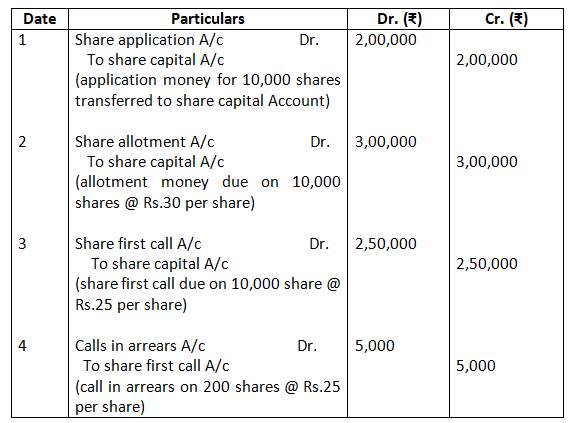

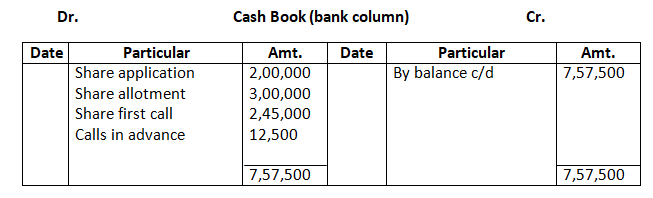

2. The Adarsh control Device Ltd. Was registered with the authorized capital of Rs.3,00,000 divided into 30,000 shares of Rs.10 each, which offered to the public. Amount payable as Rs.3 per share on application, Rs.4 per share on allotment and Rs.3 per share on first and final call. These share were fully subscribed and all money was dully received. Prepare journal and Cash Book.

Solution:-

Books of Adarsh Control Device Ltd.

Journal

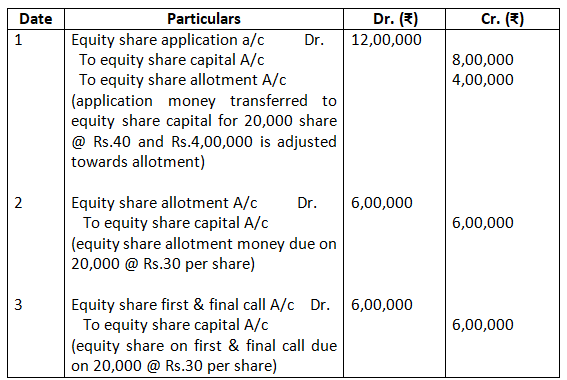

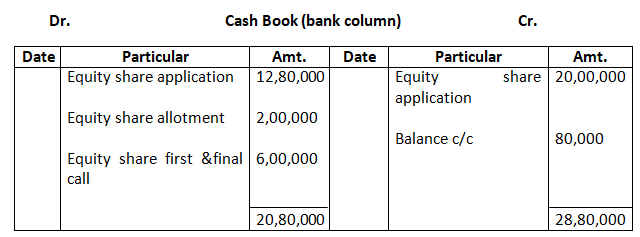

3. Software solution India Ltd. Inviting application for 20,000 equity share of Rs.100 each, payable Rs.40 on application, Rs.30 on allotment and Rs.30 on call. The company received applications for 32,000 shares. Application for 2,000 shares were rejected and money returned to Applicants. Applications for 10,000 shares were accepted in full and applicants for 20,000 share allotted half of the number of shared applied and excess application money adjusted into allotment. All money received due on allotment and call. Prepare journal and cash book.

Solution:-

Books of Software solution India Ltd.

Journal

Working Note:

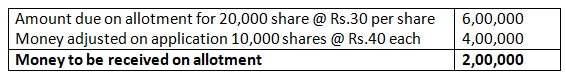

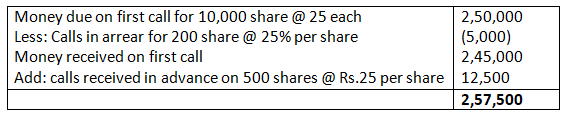

4. Rupak Ltd. Issued 10,000 shares of Rs.100 each payable Rs.20 per share on application, Rs.30 per share on allotment and balance in two calls of Rs.25 per share. The application and allotment money were duly received. On first call all member pays their dues except one member holding 200 shares, while another member holding 500 shares paid for the balance due in full. Final call was not made. Give journal entries and prepare cash book.

Solution:-

Books of Rupak Ltd.

Journal

Working Note:

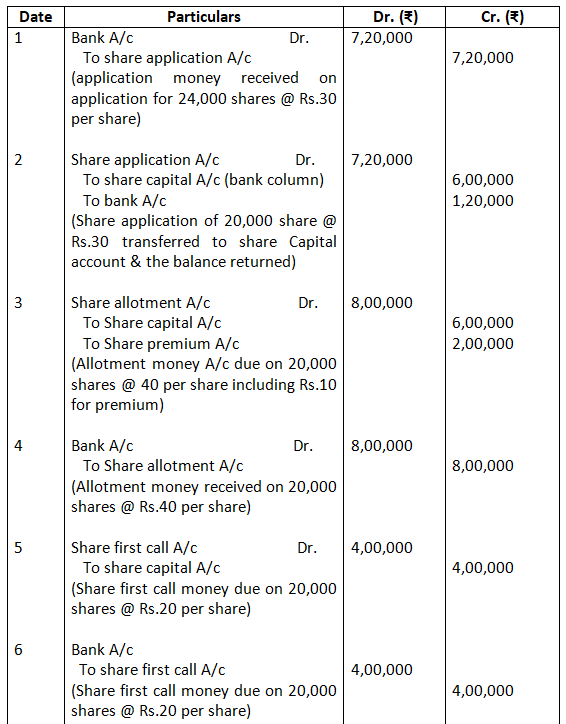

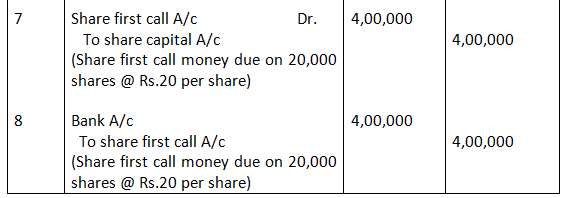

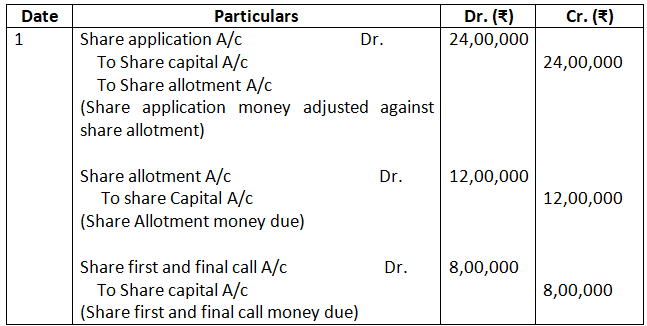

5. Mohit Glass Ltd. Issued 20,000 shares of Rs.100 each at Rs.110 per share, payable Rs.30 on application, Rs.40 on allotment (including Premium), Rs.20 on first call and Rs.20 on final call. The applications were received for Rs.24,000 shares and allotted 20,000 shares and reject 4,000 shares and amount returned thereon. The money was duly received. Give journal entries.

Solution:-

Books of Mohit Glass Ltd.

Journal

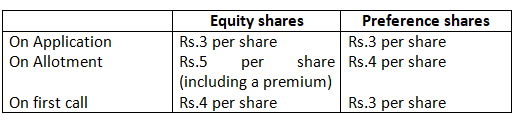

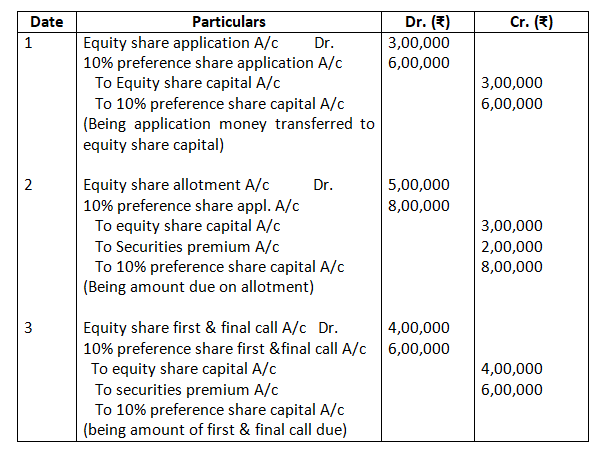

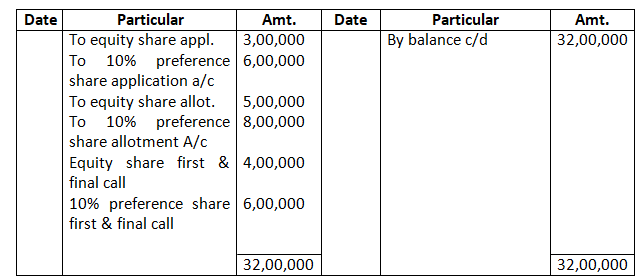

6. A limited company offered for subscription of 1,00,000 equity shares of Rs.10 each at a premium of Rs.2 per share 2,00,000. 10% Preference shares of Rs.10 each at par.

The amount on share was payable as under:

All the share were fully subscribed, called-up and paid. Record these transactions in the journal and cash book of the company.

Solution:-

Books of A Limited

Journal

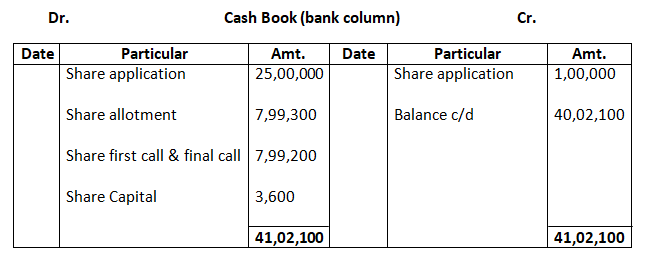

Dr. Cash Book (bank column) Cr.

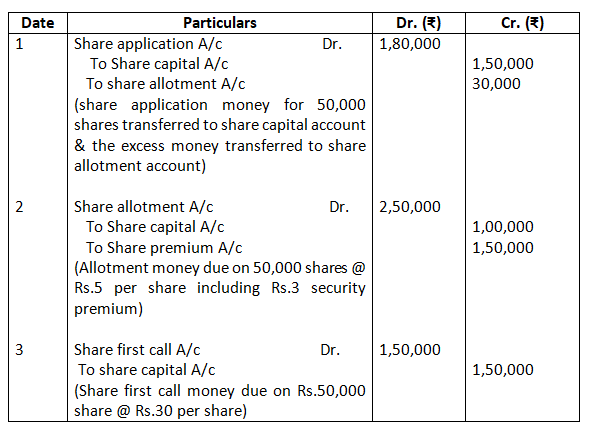

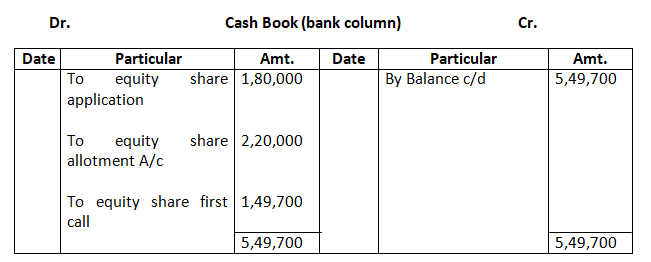

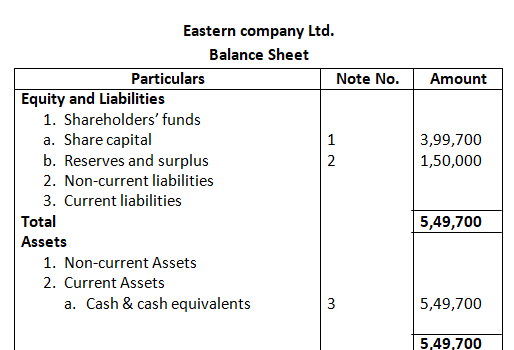

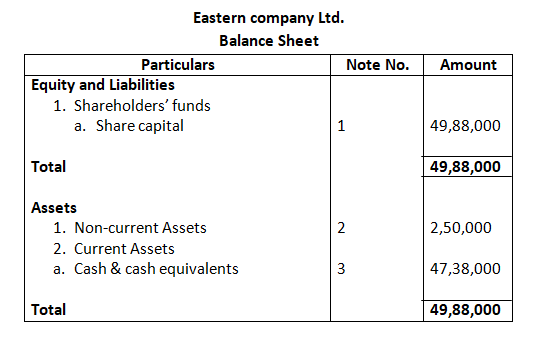

7. Eastern company Limited, having and authorized capital of Rs.10,00,000 in share of Rs.10 each, issued 50,000 shares at a premium of Rs.3 per share payable as follows:

On Application Rs.3 per share

On Allotment (including premium) Rs.5 per share

On first call (due three months after allotment) Rs.3 per share and the balance as and when required.

Applications were received for 60,000 shares and the directors allotted the shares as follows:

- Applicants for 40,000 shares received shares, in full.

- Applicants for 15,000 shares received and allotment of 8,000 shares.

- Applicants for 500 shares received 200 shares on allotment, excess money being returned.

All amounts due on allotment were received.

The first call was duly made and the money was received with the exception of the call due on 100 shares.

Give journal and cash book entires to record these transacitons of the company. Also prepare the Balance Sheet of the company.

Solution:-

Books of Eastern Company Ltd.

Journal

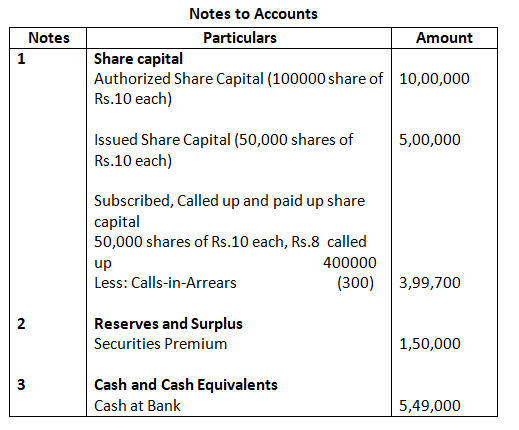

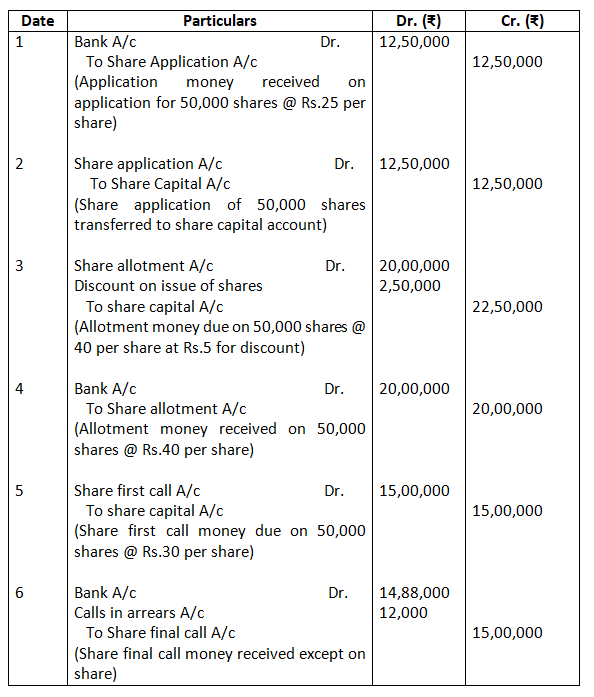

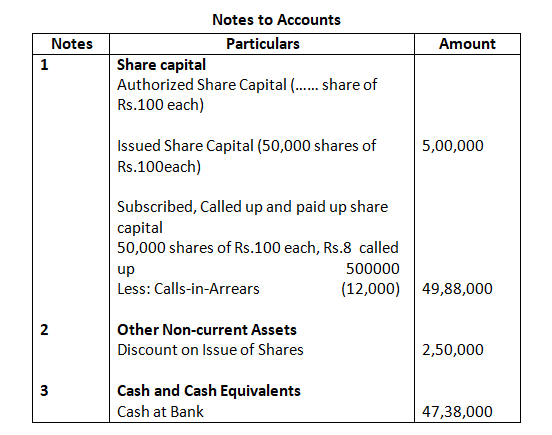

8. Sumit Machine Ltd issued 50,000 shares of Rs.100 each at discount of 5%. The shares were payable Rs.25 on application. Rs.40 on allotment and Rs.30 on first and final call. The issue were fully subscribed and money were duly received except the final call on 400 shares. The discount was adjusted on allotment.

Give journal entires and prepare balance sheet.

Solution:-

Books of Sumit Machine Ltd.

Journal

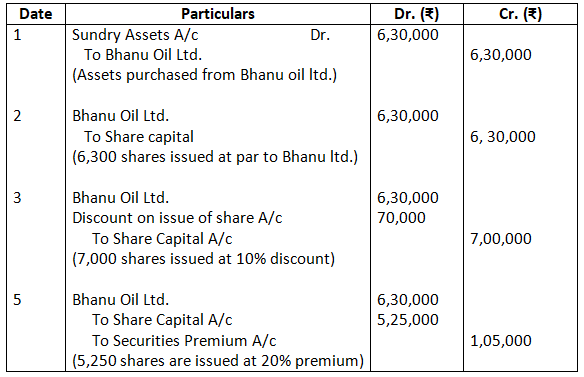

9. Kumar Ltd. Purchases assets of Rs.6,30,000 from Bhanu Oil Ltd. Kumar Ltd. Issued equity share of Rs.100 each fully paid in consideration. What journal entires will be made, if the share are issued, a) at par, b) at discount of 10% and c) at premium of 20%.

Solution:-

Case a) Books of Kumar Ltd.

Journal

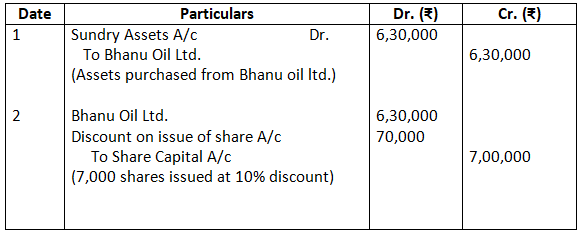

Case b)

Journal

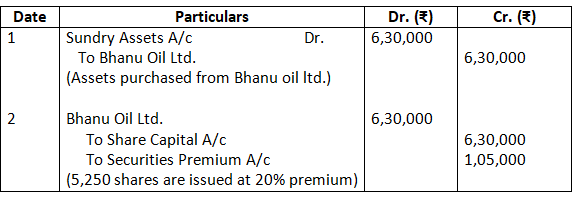

Case b)

Journal

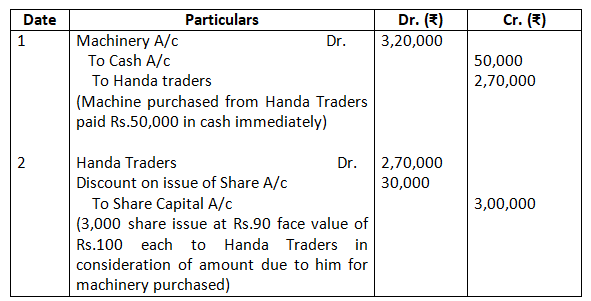

10. Bansal Heavy machine Ltd purchased machine worth Rs.3,20,000 from Handa Trader. Payment was made as Rs.50,000 cash and remaining amount by issue of equity share of the face value of Rs.100 each fully paid at an issue price of Rs.90 each. Give journal entires to record the above transaction.

Solution:-

Books of Bansal Heavy Machine Ltd.

Journal

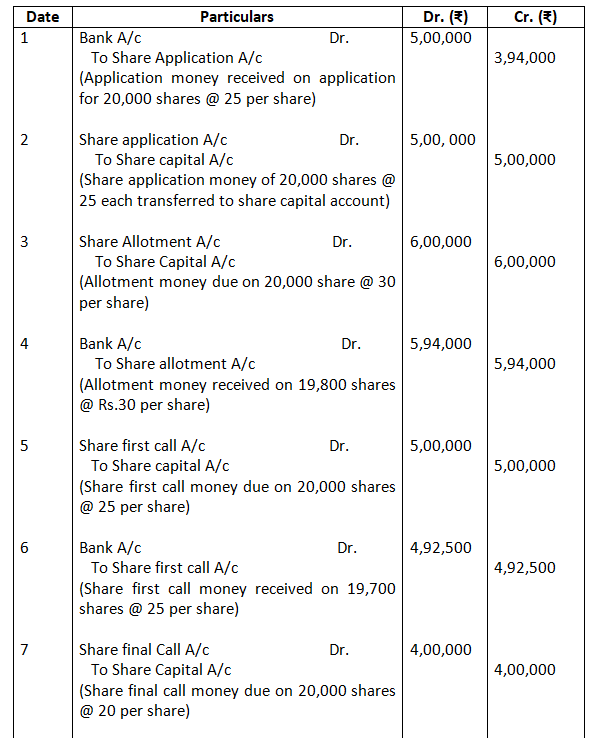

11. Naman Ltd issued 20,000 shares of Rs.100 each, payable Rs.25 on application, Rs.30 on allotment, Rs.25 on first call and The balance on final call. All money duly received except Anubha, who holding 200 shares did not pay allotment and calls money and Kumkum, who holding 100 shares did not pay both the calls. The directors forfeited shares of Anubha and kumkum. Give journal entires.

Solution:-

Books of Naman Glass Ltd.

Journal

Working Note:

Forfeited Amount

Amount on application (300 Shares @ 25 each) = 7500

Amount on allotment (100 Shares @ 30 each = 3,000

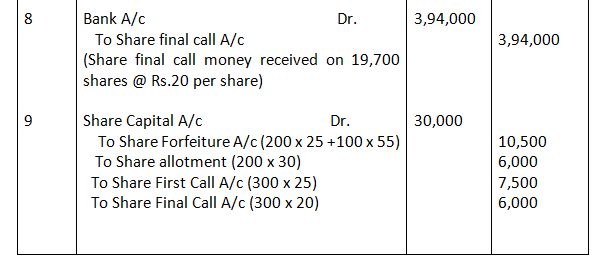

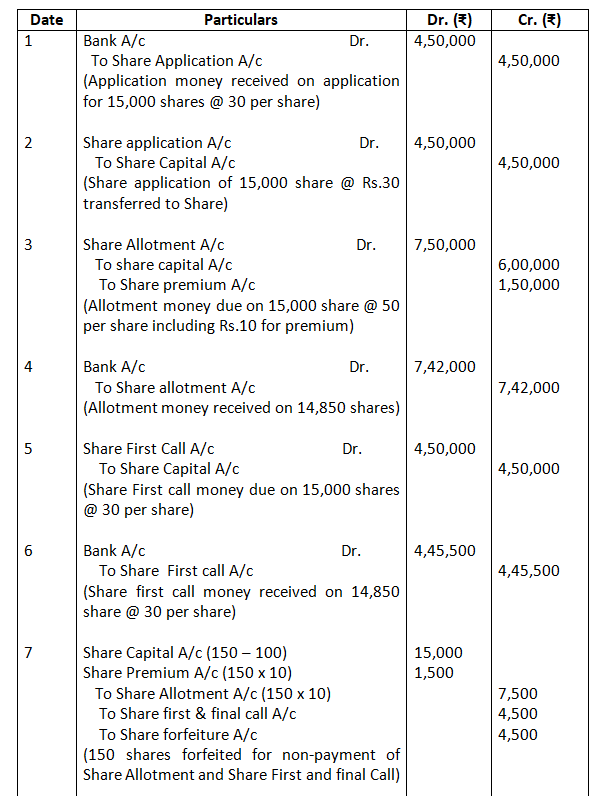

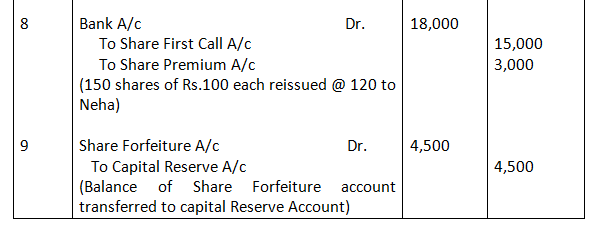

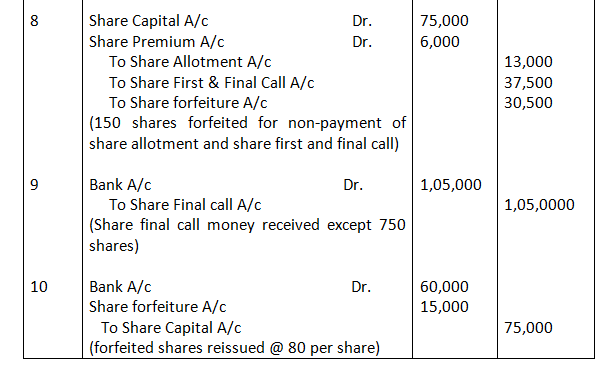

12. Kishna Ltd issued 15,000 shares of Rs.100 each at a premium of Rs.10 per share, payable as follows:

On application Rs.30

On allotment Rs.50 (including premium)

On first and final call Rs.30

All the shares subscribed and the company received all the money due, With the exception of the allotment and call money on 150 shares. These shares were forfeited and reissued to Neha as fully paid share of Rs.12 each. Give journal entires in the books of the company.

Solution:-

Books of Krishna Ltd.

Journal

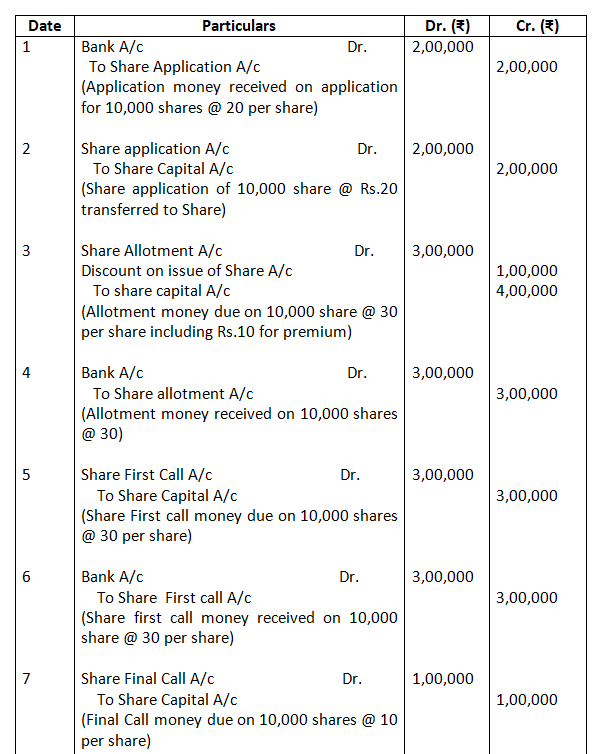

13. Arushi Computers Ltd issued 10,000 equity shares of Rs.100 each at 10% discount. The net amount payable as follows:

On application Rs.20

On allotment Rs.30 (Rs.40 – discount Rs.10)

On first call Rs.30

On final call Rs.10

A shareholder holding 200 shares did not pay final call. His shares Were forfeited. Out of these 150 shares were reissued to Ms. Sonia at Rs.75 per shares. Give journal entires in the books of the company.

Solution:-

Books of Krishna Ltd.

Journal

Working Notes:

Amount Transferred to Capital Reserve A/c

Amount Credited share forfeiture Rs.80 per share

Less: Amount debited to Share forfeiture Rs.(15) per share

Balance after adjustment Rs.65 per share

Amount transferred to Capital Reserve Account = Balance per share after adjustment x Number of Shares reissued Rs.9,750 = Rs.65 x Rs.150 per sh

14. Raunak Cotton Ltd. Issued a prospectus inviting applications for 6,000 equity shares of Rs.100 each at a premium of Rs.20 per shares, payable as follows:

On application Rs.20

On allotment Rs.50 (including premium)

On first call Rs.30

On final call Rs.20

Application were received for 10,000 shares and allotment was made Pro-rata to the applicants of 8,000 shares, the remaining applications Being refused. Money received in excess on the application was adjusted toward the amount due on allotment. Rohit, to whom 300 shares were allotted failed to pay allotment and calls money, his shares were forfeited. Itika, who applied for 600 shares, failed to pay the two calls and her share were also forfeited. All these shares were sold to Kartika as fully paid for Rs.80 per shares. Give journal entires in the books of the company.

Solution:-

Books of Krishna Ltd.

Journal

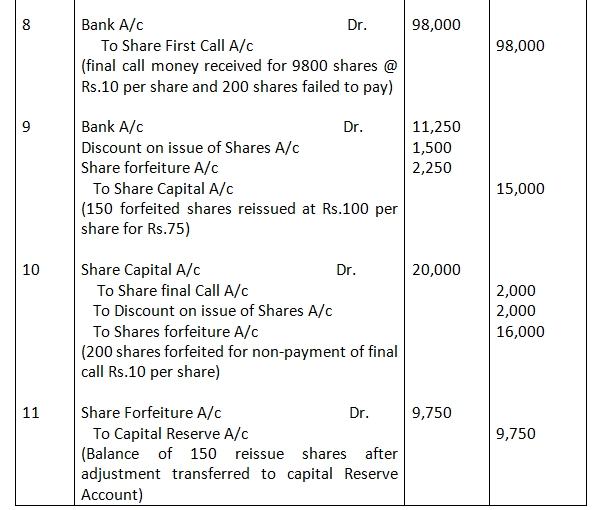

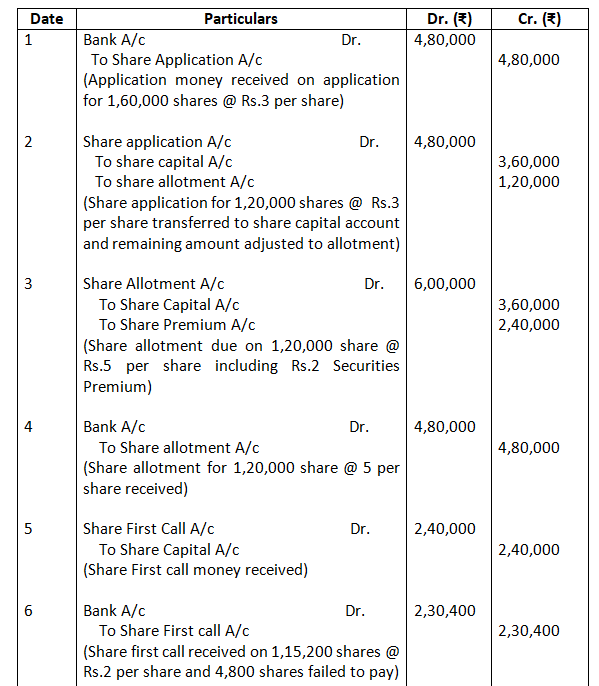

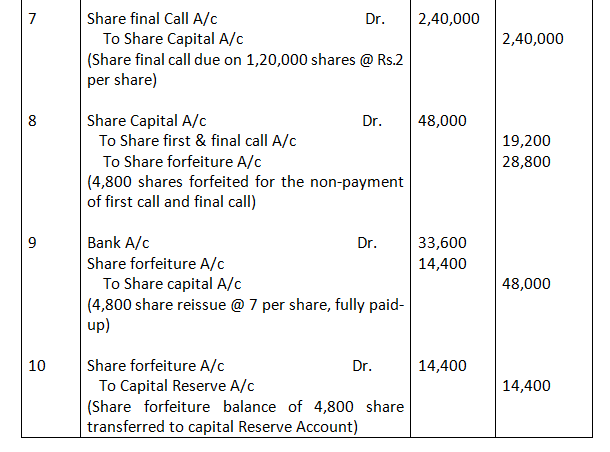

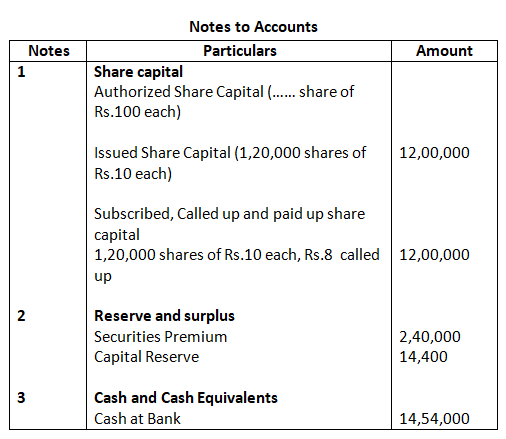

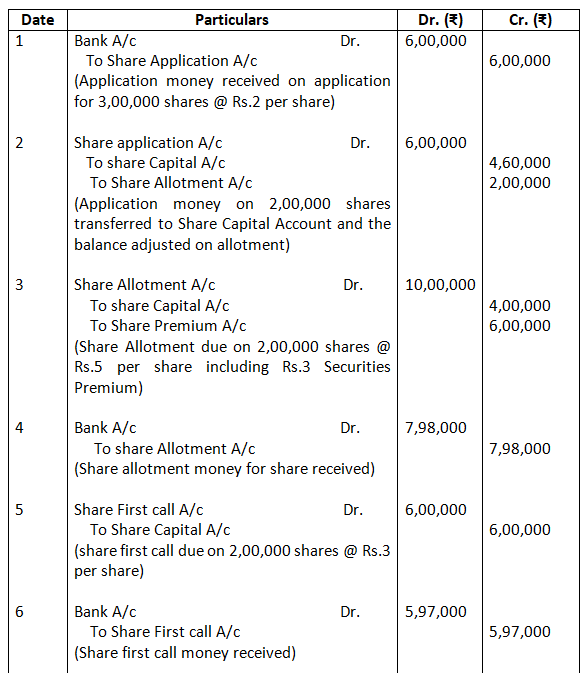

15. Himalaya Company Limited issued for public subscription of 1,20,000 equity shares of Rs.10 each at a premium of Rs.2 per share payable as under:

With Application Rs.3 per share

On allotment (including premium) Rs.5 per share

On first call Rs.2 per share

On Second and Final call Rs.2 per share

Application were received for 1,60,000 shares. Allotment was made on pro-rata basis. Excess money on application was adjusted against the amount due on allotment.

Rohan, whom 4,800 shares were allotted, failed to pay for the two calls. These shares were subsequently forfeited after the second call was made. All the shares forfeited were reissued to Teena as fully paid at Rs.7 per share.

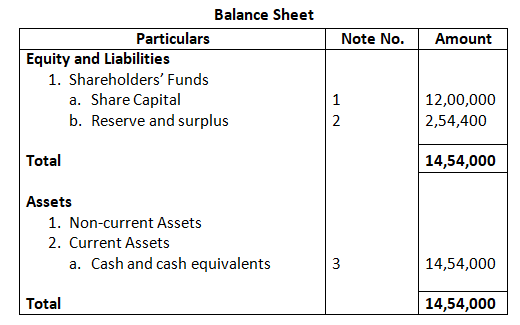

Record journal entries in the books of the company to record these transactions relating to share capital. Also show the company’s balance sheet.

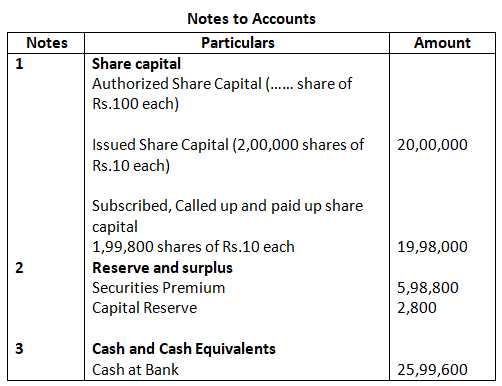

Solution:-

Books of Himalya Company Ltd.

Journal

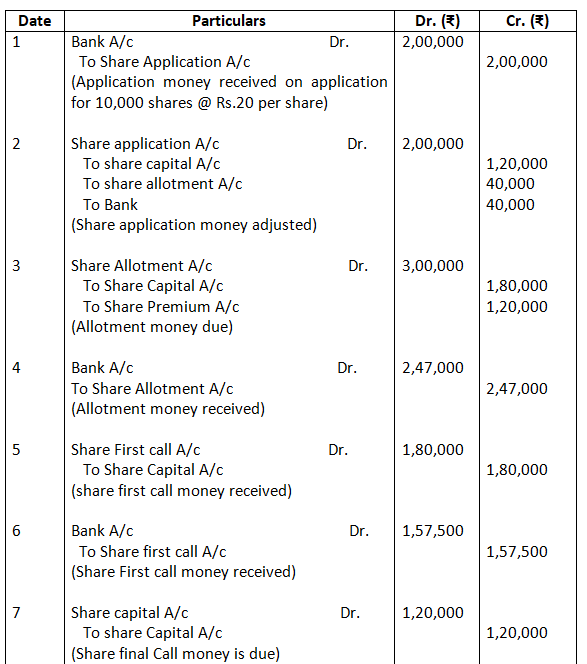

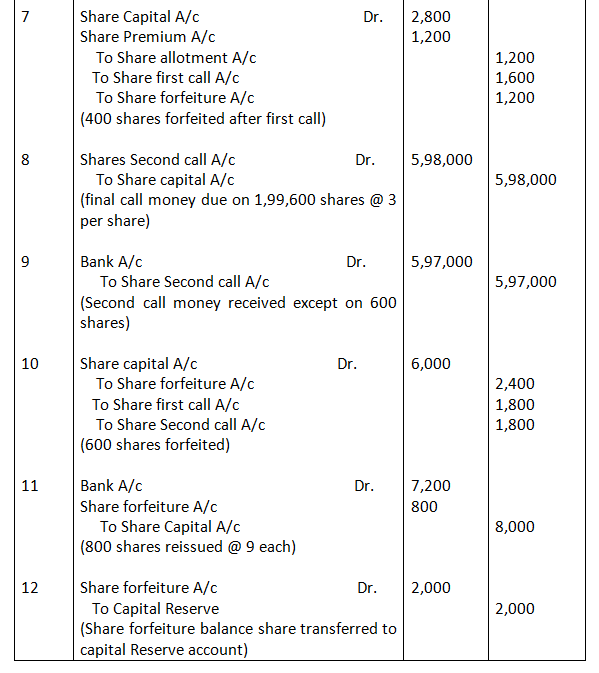

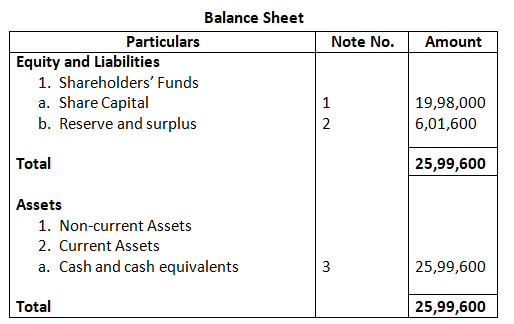

16. Prince Limited issued a prospectus inviting applications for 2,00,000 equity shares of Rs.10 each at a premium of Rs.3 per share payable as follows:

With Application Rs.2

On allotment (including premium) Rs.5

On first call Rs.3

On second call Rs.3

Applications were received for 30,000 shares and allotment was made on pro-rata basis. Money overpaid on application was adjusted to the amount due on allotment.

Mr. ‘Mohit’ whom 400 shares were allotted, failed to pay the allotment money and the first call, and her share were forfeited after the first call. Mr. ‘Joly’, whom 600 shares were allotted, failed to pay for the two calls and hence, his shares were forfeited. Of the shares forfeited, 800 shares were reissued to Supriya as fully paid for Rs.9 per share, the whole of Mr. Mohit’s shares being included. Record journal entries in the books of the Company and prepare the Balance Sheet.

Solution:-

Books of Prince Ltd.

Journal

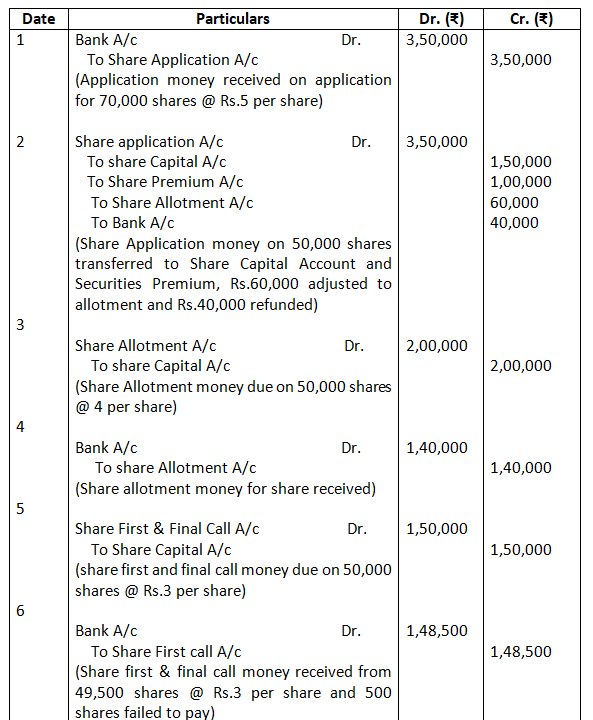

17. Life machine tools Limited, issued 50,000 equity shares of Rs.10 each at Rs.12 per share, payable at to Rs.5 on application (including premium), Rs.4 on allotment and the balance on the first and final call. Applications for 70,000 shares had been received. Of the cash received. Rs.40,000 was returned and Rs.60,000 was applied to the amount due on allotment, the balance of which was paid. All shareholders paid the call due, with the exception of one share holder of 500 shares. These shares were forfeited and reissued as fully paid at Rs.8 per share. Journalese the transactions.

Solution:-

Books of Prince Ltd.

Journal

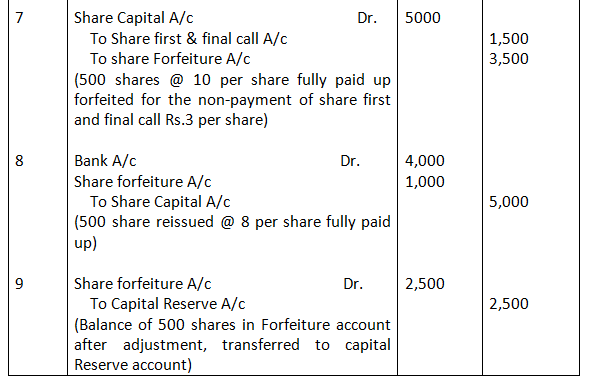

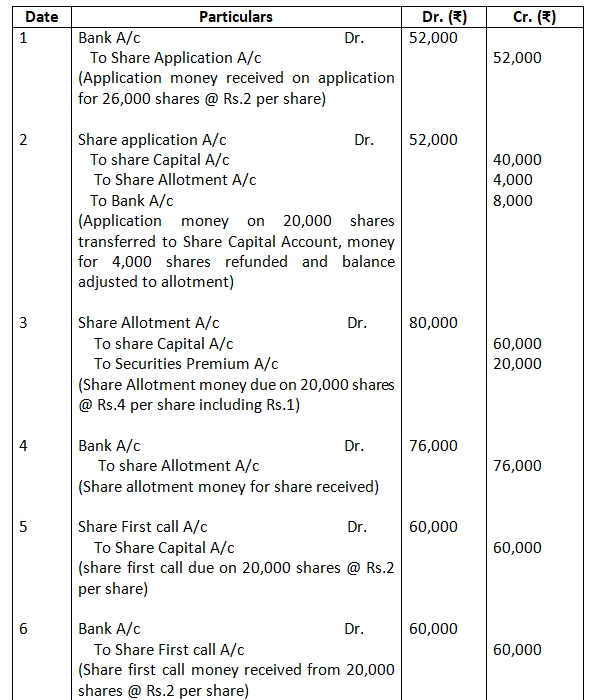

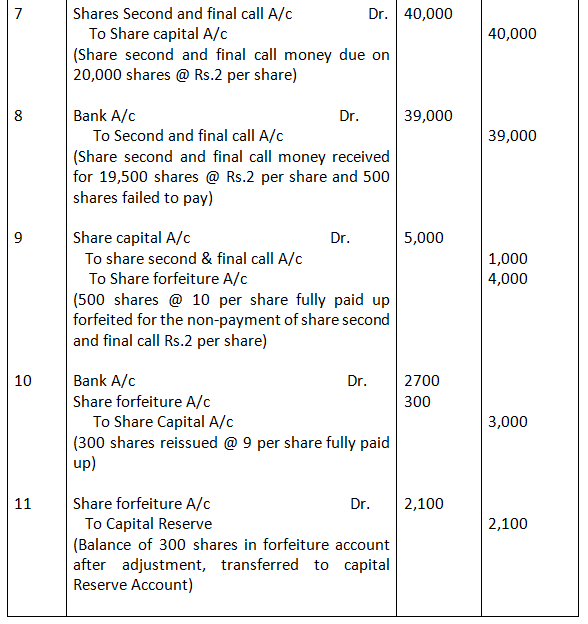

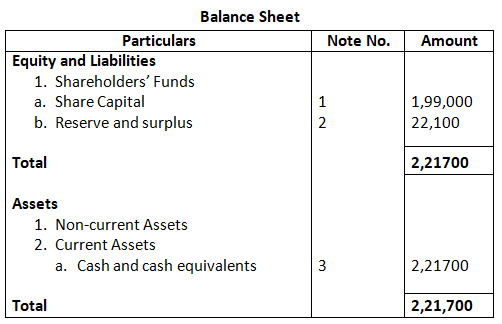

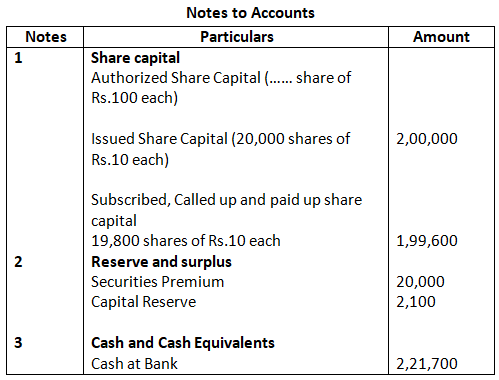

18. The Orient Company Limited offered for public subscription 20,000 equity shares of Rs.10 each at premium of 10% payable at Rs.2 on application; Ra.4 on allotment including premium; Rs.3 on first call and Rs.2 on Second and final call. Applications for 26,000 shares were received. Applications for 4,000 shares were rejected. Pro-rata allotment was made to the remaining applicants. Both the calls were made and all the money were received except the final call on 500 shares which were forfeited. 300 of the forfeited shares were later on issued as fully paid at Rs.9 per share. Give journal entires and prepare the balance sheet.

Solution:-

Books of Orient Company Ltd.

Journal

19. Alfa Limited invited applications for 4,00,000 of its equity shares of Rs.10 each on the following terms:

Payable on application Rs.5 per share

Payable on allotment Rs.3 per share

Payable on first and final call Rs.2 per share

Application for 5,00,000 shares were received. It was decided:

- To refuse allotment to the applicants for 20,000 shares;

- To allot in full to applicants for 80,000 shares;

- To allot the balance of the available shares’ pro-rata among the other applicants; and

- To utilize excess application money in part as payment of allotment money.

One applicant, whom shares had been allotted on pro-rata basis, did not pay the amount due on allotment and on the call, and his 400 shares were forfeited. The shares were reissued @ Rs.9 per shares. Show the journal and prepare Cash book to record the above.

Solution:-

Journal

Working Notes:

Call in arrears by application on allotment :

Money received on application = Rs.2,500

Less: Amount adjusted on Application = Rs.2,000

Amount adjusted on allotment = Rs.500

Money due on allotment = Rs.1,200

Less: Amount adjusted = Rs.700

Balance due on allotment = Rs.500

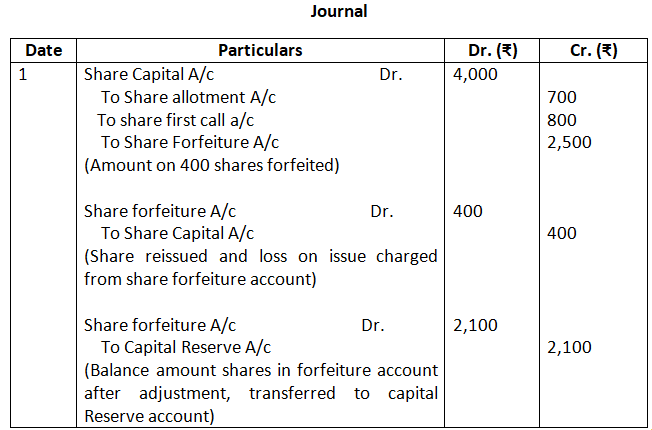

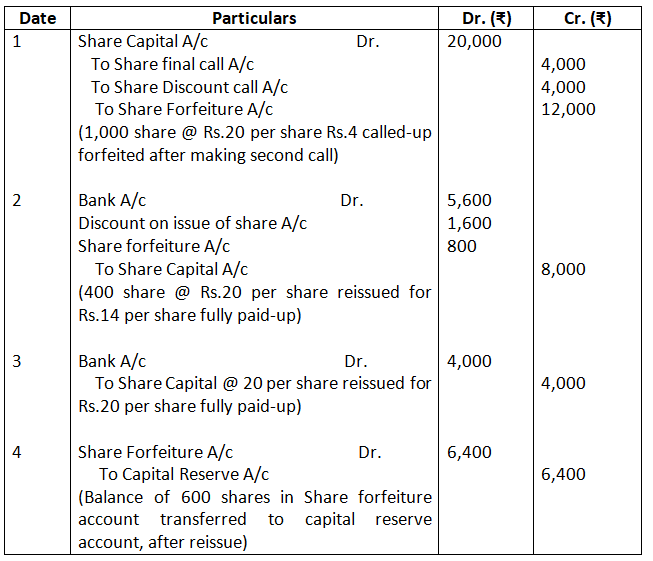

20. Ashoka Limited Company which had issued equity shares of Rs.20 each at a discount of Rs.4 per share, forfeited 1,000 shares for non-payment of final call of Rs.4 per share. 400 of the forfeited shares are reissued at Rs.14 per share out of the remaining shares of 200 shares reissued at Rs.20 per share. Give journal entires for the forfeiture and reissue of shares and show the amount transferred to capital reserve and the balance in Share Forfeiture Account.

Solution:-

Journal

Working Notes:

Balance in Share Forfeiture Account (12,000 – 800 – 6,400) = Rs.4,800

Share forfeiture Account credited = Rs.12 per share

Less: Share forfeiture Account debited = Rs.(2) per share

Amount transferred to Capital Reserve Account = Rs.10 per share

Amount of 400 shares transferred to Capital Reserve Account, after reissue = 400 shares @ Rs.10 per share = Rs.4000

For 200 share

Share forfeiture Account credited = Rs.12 per share

Less: Share forfeiture Account debited = Rs.(0) per share

Amount transferred to Capital Reserve Account = Rs.12 per share

Amount of 200 shares transferred to Capital Reserve Account, after reissue = 200 share @ Rs.12 per share = 2,400

Total amount transferred to capital reserve account for 600 shares = 4,000 + 2,400 = 6,400

21. Amit holds 100 shares of Rs.10 each on which he had paid Rs.1 per shares as application money. Bimal holds 200 shares of Rs.10 each on which he has paid Rs.1 and Rs.2 per shares as application and allotment money, respectively. Chetan holds 300 shares of Rs.10 each and has paid Rs.1 on application, Rs.2 on allotment and Rs.3 for the first call. They all fail to pay their arrears and the second call of Rs.2 per share and the directors, therefore, forfeited their shares. The shares are reissued subsequently for Rs.11 per share as fully paid. Journalise the transactions.

Solution:-

Journal

Working Notes:

Share Forfeiture Account credited

Amit (100 x 1) = 100

Bimal (200 x 3) = 600

Chetan (300 x 6) = 1800

= 2,500

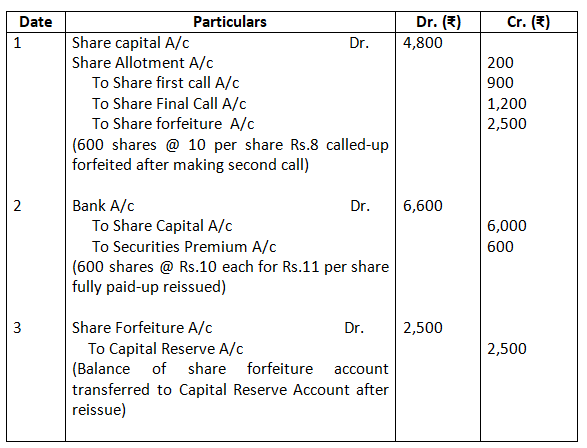

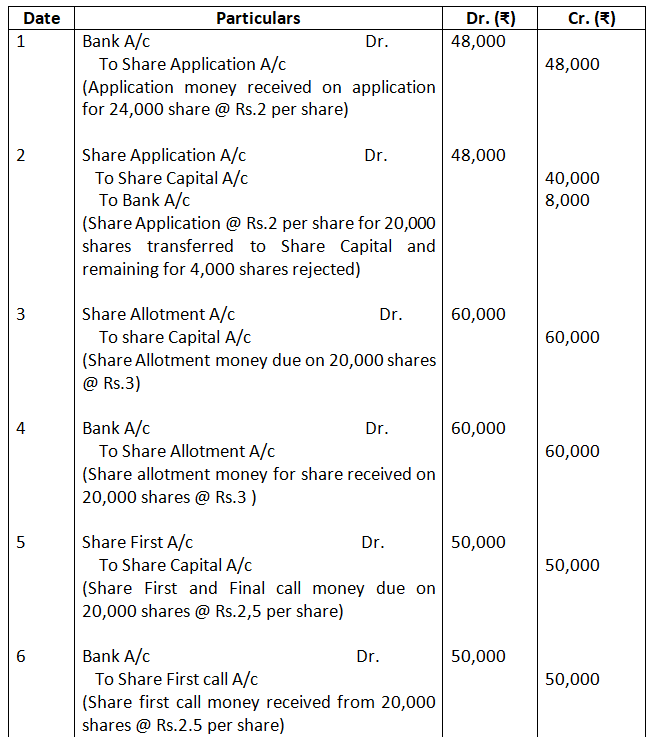

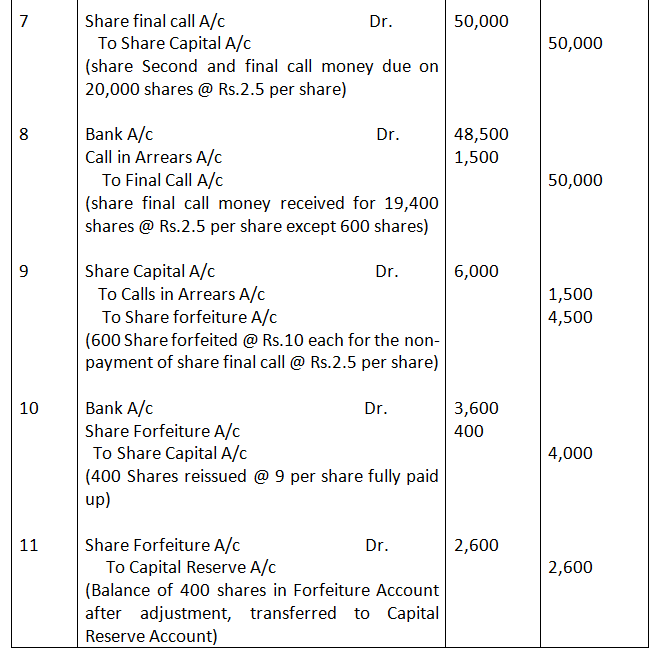

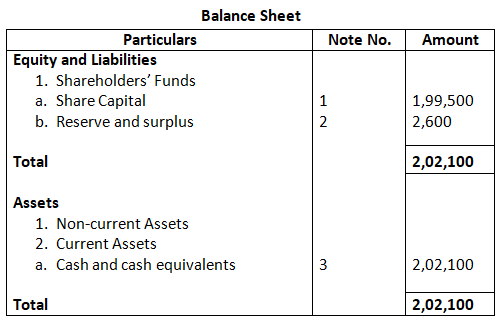

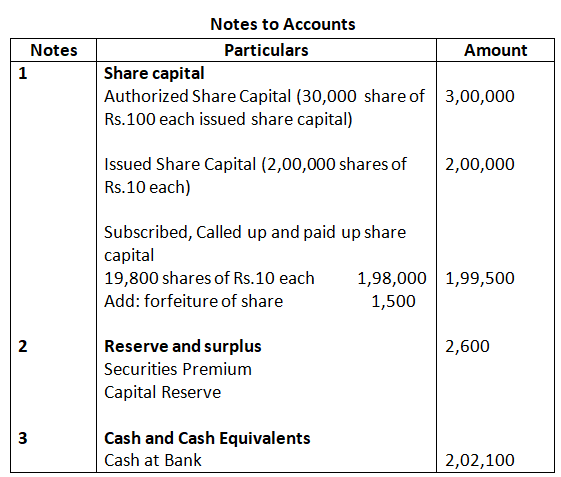

22. Ajanta company limited having a normal capital of Rs.3,00,000 divided into shares of Rs.10 each offered for public subscription of 20,000 shares payable at Rs.2 on application; Rs.3 on allotment and the balance in two calls of Rs.2.50 each. Application were received by the company for 24,000 shares. Applications for 20,000 shares were accepted in full and the shares allotted. Applications for the remaining shares were rejected and the application money was refunded. All moneys due were received with the exception of the final call on 600 shares which were forfeited after legal formalities were fulfilled. 400 shares of the forfeited shares were reissue at Rs.9 per share.

Record necessary journal entires and prepare the balance sheet showing the amount transferred to capital reserve and the balance in share forfeiture account.

Solution:-

Journal

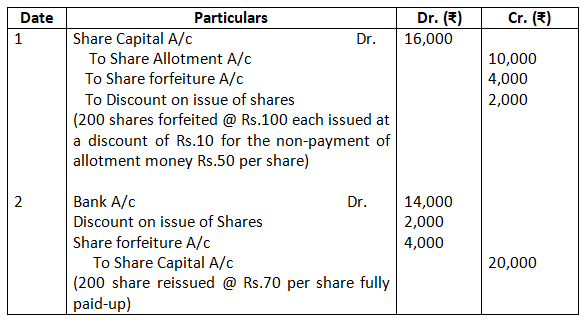

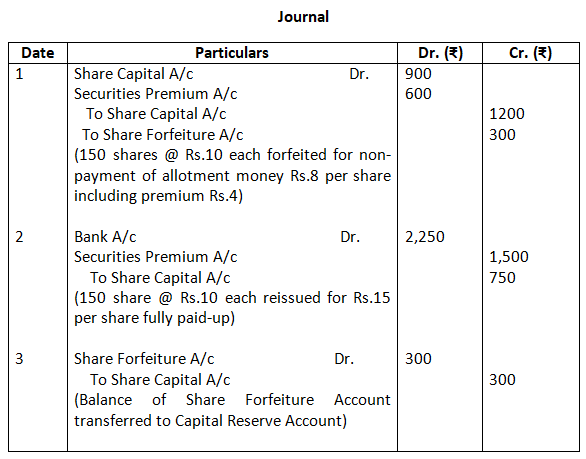

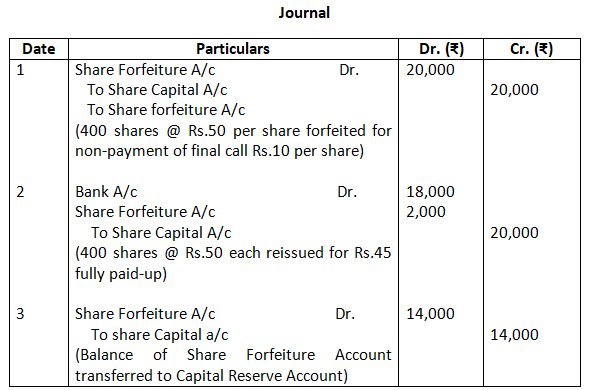

23. Journalize the following transaction in the books Bhushan Oil Ltd:

a. 200 shares of Rs.100 each issued at a discount of Rs.10 were forfeited for the non-payment of allotment money of Rs.50 per share. The first and final call of Rs.20 per share on these share were not made. The forfeited share were reissued at Rs.70 per share as fully paid-up.

b. 150 shares of Rs.10 each issued at a premium of Rs.4 per share payable with allotment were forfeited for non-payment of allotment money of Rs.8 per share including premium. The first and final call of Rs.4 per share were not made. The forfeited share were reissued at Rs.15 per share fully paid-up.

c. 400 share of Rs.50 each issued at per were forfeited for non-payment of final call of Rs.10 per share. These share were reissued at Rs.45 per share fully paid-up.

Solution:-

Case (a)

Journal

Case (b)

Case (c)

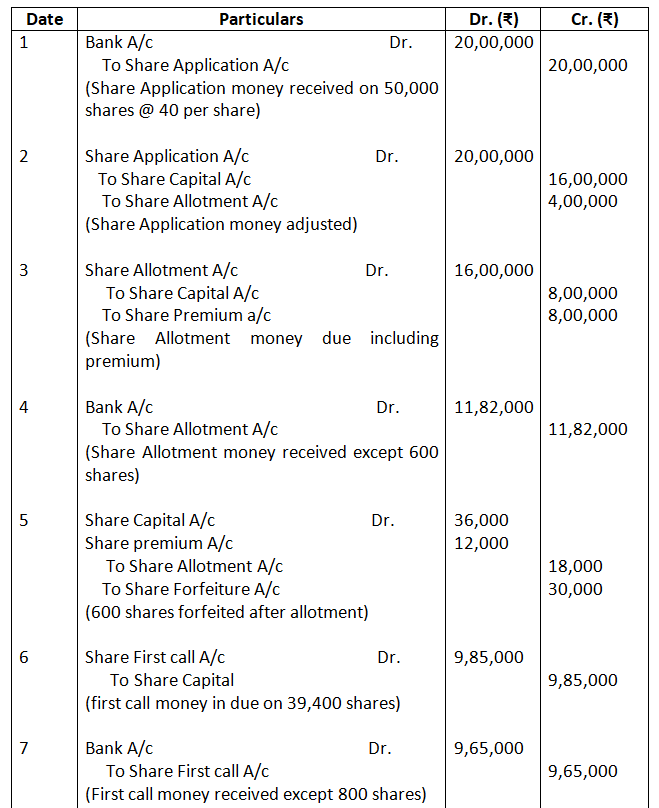

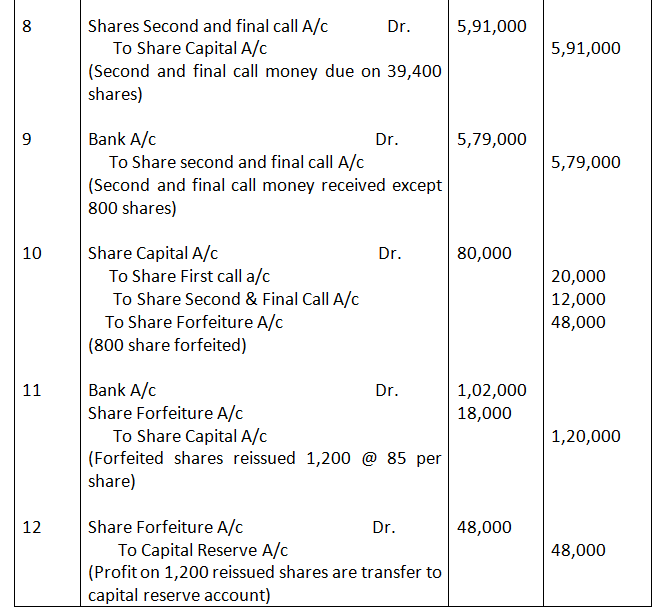

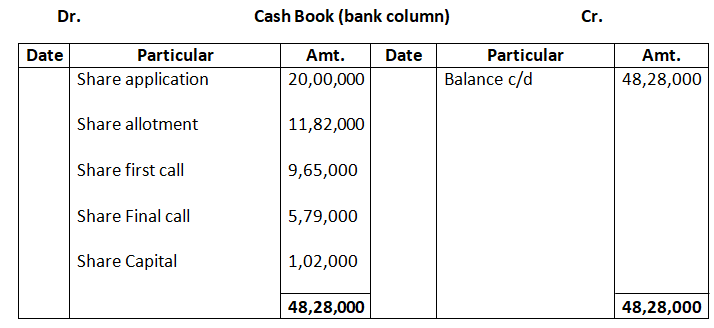

24. Amisha Ltd inviting application for 40,000 shares of Rs.100 each at a premium of Rs.20 per share payable; on application Rs.40; on allotment Rs.40 (including premium): on first call Rs.25 and Second and final call Rs.15. Application were received for 50,000 shares and allotment was made on pro-rata basis. Excess money on application was adjusted on sums due on allotment.

Rohit to whom 600 shares were allotted failed to pay the allotment money and his shares were forfeited after allotment. Ashmita, who applied for 1000 shares failed to pay the two calls and his share were forfeited after the second call. Of the shares forfeited, 1200 shares were sold to Kapil for Rs.85 per share as fully paid, the whole of Rohit’s shares being included. Record necessary journal entries.

Solution:-

Journal

Working Notes:

- Number of shares applied by Rohit = Total number of applied shares /Total number of allotment shares x number of allotted shares

= 50000 / 40000 * 600

= 750 shares

2. Call in arrears by Rohit on allotment

Money received on application (750 * 40) = 30,000

Less: Amount adjusted on application (600 * 40) = 24,000

Amount adjusted on Allotment = 6,000

3. Money due on Allotment (600 * 40) = 24,000

Less: Money adjusted = 6,000

Balance due on allotment = 18,000

4. Number of shares Ashmita = Total number of allotted shares / total number of shares applied x number of shares applied

= 40,000 /50,000 * 1,000 = 800shares

5. Profit on the forfeiture of 600 share of Rohit = Rs.30,000

Profit on the forfeiture of 600 share of Ashmita = Rs.36,000

6. Profit on forfeiture of 1200 share (30,000 + 36,000) = 66,000

Less: Loss on reissue of shares = 18,000

Transfer to Capital Reserve = 48,000

7. Balance in Share Forfeiture Account (48,000 – 36,000) = Rs.12,000