- Calculate Current Ratio from the following information:

| Particulars | ₹ | Particulars | ₹ |

| Equity Share Capital Inventories Trade Receivables Advance Tax | 8,00,000 1,00,000 1,20,000 24,000 | Cash & Cash Equivalents Trade Payables Sort-term Borrowings (Bank Overdraft) 10% Investments | 56,000 60,000 40,000 80,000 |

Solution:- Current ratio= Current assets / Current liabilities

Current assets= trade receivable + inventories+ advance tax+ cash and cash equivalent

1,20,000+100,000+24000+56000=300,000

Current liabilities =trade payable+ short term borrowing

60,000+40,000=100,000

Current Ratio = 3 : 1.

2. Calculation current ratio from the following information:

| Particulars | ₹ | Particulars | ₹ |

| Total assets Fixed tangibles assets Shareholder’s funds | 20,00,000 10,00,000 12,80,000 | Non-current liabilities Non-current Investments | 5,20,000 6,00,000 |

Solution:-

Current assets = total assets – fixed tangible assets – noncurrent investment

=200000 – 100000 – 60000

= 40000

Calculation of current liabilities

Current liabilities = total assets – share holder’s fund – noncurrent liabilities

= 200000-1280000-520000

= 200000

Calculation of current ratio

Current ratio = Current assets / current liabilities

Current ratio = =2:1

3. A company had current Assets of 4,50,000 and current liabilities of 2,00,000. Afterwards it purchased goods for 30,000 on credit. Calculate current Ratio after the purchase.

Solution:

Calculation of Current Assets & Current Liabilities After Purchase

Current Assets After purchase = Current Assets + Stock

= 4,50,000 + 30,000

= 4,80,000

Current liabilities After purchase = Current liabilities + Creditors

= 2,00,000 + 30,000

= 2,30,000

Calculation of Current Ratio After purchase

= Current assets after purchase / Current Liabilities after purchase

= 4,80,000/2,30,000

= 2.09:1

4. Working capital 6,00,000, Total Debt 27,00,000, Non-Current Liabilities 24,00,000. Calculate Current Ratio.

Solution:

Calculation of Current Liabilities

Total Debt = Non-current liabilities + Current Liabilities

27,00,000 = 24,00,000 + Current Liabilities

Current Liabilities = 27,00,000 – 24,00,000

= 3,00,000

Calculate of current Assets

Working capital = Current Assets – Current Liabilities

6,00,000 = Current Assets – 3,00,000

Current Assets = 6,00,000 + 3,00,000

= 9,00,000

Calculation of Current Ratio

Current ration = current assets / current liabilities

= 9,00,000 / 3,00,000

= 3:1

= 3:1

5. Current Ratio is 2.5, working capital is 1,50,000. Calculate the amount of current Assets and Current Liabilities.

Solution:

Current Ratio = 2.5

Current ration =

2.5 =

C.A. = 2.5 C.L ————————1

Working capital = Current Assets – current Liabilities

150000 = C.A – C.L.

C.A – C.L. = 1,50,000—————————-2

Putting Eq (1) into Eq (2)

1,50,000 = 2.5 C.L – C.L

1.5 C.L = 1,50,000

C.L =

Current liabilities = 1,00,000

Putting C.L value in Eq (1)

Current Assets = 2.5 x 1,00,000

= 2,50,000

6. Working capital is 18,00,000; trade payables 1,80,000; and other current liabilities are 4,200,000. Calculate Current Ratio.

Solution:

Calculation of current liabilities

Current liabilities = Trade payable + other current liabilities

= 1,80,000 + 4,20,000

= 6,00,000

Calculation of current Assets

Working capital = Current Assets – Current Liabilities

1,80,000 = Current Assets – 6,00,000

Current Asses = 24,00,000

Calculation of Current Ratio

Current ration = current assets / current liabilities

= 24,00,000 /6,00,000

= 4:1

7. Working capital 9,00,000; total debts (Liabilities) 19,50,000; Long-term Debts 15,00,000. Calculate Current Ratio.

Solution:

Calculation of Current Liabilities

Total debts = Non-Current liabilities + Current liabilities

19,50,000 = 15,00,000 + Current liabilities

Current liabilities = 19,50,000 – 15,00,000

= 4,50,000

Calculation of Current Assets

Working capital = Current Assets – Current liabilities

9,00,000 = Current Assets – 4,50,000

Current assets = 9,00,000 + 4,50,000

= 13,50,000

Calculation of Current Ratio

Current ration = current assets / current liabilities

= 13,50,000 / 4,50,000

= 3:1

8. Current Assets 7,50,000 and working capital is 2,50,000. Calculate Current Ratio.

Solution:

Calculation of Current Liabilities

Working capital = Current Assets – Current liabilities

2,50,000 = 7,50,000 – Current liabilities

Current liabilities = 5,00,000

Calculation of Current Ratio

Current ration = current assets / current liabilities

= 7,50,000 / 5,00,000

= 1.5:1

9. Current liabilities of a company were 1,75,000 and its current Ratio was 2:1. It paid 30,000 to a creditor, calculate Ratio after payment.

Solution:

Calculation of current Assets before payment

Current liabilities = 1,75,000

Current Ratio = 2:1

Current ratio = current assets / current liabilities

2 = Current assets / 1,75,000

Current Assets = 1,75,000 x 2

= 3,50,000

Calculation of current Assets ofter payment

Current Assets = 3,50,000 – 30,000 = 3,20,000

Current liabilities = 1,75,000 – 30,000 = 1,45,000

New current Ratio = 3,20,000

After payment 1,45,000

2.21:1

10. Current Assets 20,00,000, inventories 10,00,000, working capital 12,00,000. Calculate current ratio.

Solution:

Calculation of current liabilities

Working capital = Current Assets – Current Liabilities

12,00,000 = 20,00,000 – Current liabilities

Current liabilities = 20,00,000 – 12,00,000

= 80,00,000

Calculation of current Ratio

Current ration = current assets / current liabilities

= 20,00,000 / 80,000

= 2.5:1

11. Trade payables 50,000, Working capital 9,00,000, current liabilities 3,00,000. Calculate Current Ratio.

Solution:

Calculation of current Assets

Working capital = Current Assets – Current Liabilities

9,00,000 = Current Assets – 3,00,000

Current Assests = 9,00,000 + 3,00,000

= 12,00,000

Calculation of Current Ratio

Current ration = current assets / current liabilities

= 12,00,000 / 3,00,000

= 4:1

12. Ratio of current (3,00,000) to current liabilities (2,00,00) is 1.5:1. The accountant of the firm is interested in maintaining a current Ratio of 2:1 by paying off a part of the current liabilities. Compute amount of the current liabilities that should be paid so that the current Ratio at the level of 2:1 may be maintained.

Solution:

Current Assets = 3,00,000

Current liabilities = 2,00,000

The accountant of the firm wants to maintain current ratio as 2:1

Let the current liabilities paid off be X

2 = 300000 – X

200000 – X

2(200000 – x) = 300000 – x

400000 – 2x = 300000 – x

X = 1,00,000

Thees, the liabilities to be paid off = 100000

13. Ratio of current assets (8,75,000) to current liabilities (3,50,000) is 2.5:1. The firm wants to maintain current Ratio of 2:1 by purchasing goods on credit. Compute amount of goods that should be purchased on credit.

Solution:

Current Assets = 8,75,000

Current liabilities = 3,50,000

The accountant of the firm wants to maintain current ratio as 2:1

Let the goods purchased on credit be X

It would increase stock & creditors at the same time

As per the question:

= 2 = 8,75,000+x / 3,50,000+x

2 (3,50,000 + x) = 8,75,000 + x

7,00,000 + 2x = 8,75,000 + x

X = 1,75,000

Thus good purchased on credit would be 1,75,000

14. A firm had current Assets of 5,00,000. It paid current liabilities of 1,00,000 and the current Ratio became 2:1. Determine current liabilities and working capital before and after the payment was made.

Solution:

Calculation of current Assets & Current liabilities before payment

Current Assets = 5,00,000

As per the question

Current Ratio = Current Assets / Current Liabilities

2 = 5,00,000 – 1,00,000 / C.L-1,00,000

2(C.L – 1,00,000) = 4,00,000

2 C.L – 2,00,000 = 4,00,000

= 2 C.L = 6,00,000

= Current liabilities = 3,00,000

Calculation of working capital before payment

= current Assets before payment = 5,00,000

= current liabilities before payment = 3,00,000

Working capital = current Assets – current liabilities

= 5,00,000 – 3,00,000

= 2,00,000

Calculation of working capital ofter payment

C.A after payment = 5,00,000 – 1,00,000 = 4,00,000

C.L offer payment = 3,00,000 – 1,00,000 = 2,00,000

Working capital after payment = 4,00,000 – 2,00,000

= 2,00,000

15. A firm had current liabilities of 5,40,000. It purchased stock of 60,000 on credit. After the purchase of stock. Current ratio was 2:1. Calculate current Assets and working capital after and before the stock was purchased.

Solution:

Current liabilities = 5,40,000

Stock purchased = 60,000

Current liabilities after = 5,40,000 + creditors of stock

= 5,40,000 + 60,000

= 6,00,000

Current ratio after stock Purchased = Current Assets + Stock / Current liabilities after stock purchase on credit

2 = Current Assets + 60,000 / 6,00,000

Current Assets before stock purchased = 12,00,000 – 600,000 = 11,40,000

Current Assets after stock = Current Assets before stock

Purchased purchased + stock

= 11,40,000 + 60,000 = 12,00,000

Working capital before purchase = current Assets – current liabilities

After purchased after purchased

= 12,00,000 – 6,00,000

= 6,00,000

16. State, giving reason, whether the current Ratio will improve of decline or will have no effect in each of the following transaction if current Ratio is 2:1:

- Cash paid to Trade payables.

- Bills payable discharged.

- Bills receivable endorsed to a creditor.

- Payment of final dividend already declared.

- Purchase of stock-in-Trade on credit.

- Bills receivable endorsed to a creditor dishonoured.

- Purchase of stock-in-Trade for cash.

- Sale of Fixed Assets (Book value of 50,000) for 45,000

- Sale of fixed assets (Book value of 50,000) for 60,000.

Solution-

- Improve;

- Improve;

- Improve;

- Improve;

- Decline;

- Decline;

- No Effect;

- Improve;

- Improve.

17. From the following information, calculate liquid Ratio:

| Particulars | ₹ | Particulars | ₹ |

| Current Assets Inventories Prepaid Expenses | 4,00,000 1,00,000 20,000 | Trade Receivables Current Liabilities | 2,00,000 1,40,000 |

Solution:

Liquid Assets = Current Assets – Inventories– Prepare Expenses

= 4,00,000 – 1,00,000 – 20,000

= 2,80,000

Current liabilities = 1,40,000

Liquid Ratio = Liquid Assets / Current Liabilities

= 2,80,000 / 1,40,000

= 2:1

18. From the following information, calculate Quick Ratio:

Total Debt 12,00,000

Total Assets 16,00,000

Property, plant and

Equipment (Fixed Assets) 6,00,000

Non-Current investments 1,00,000

Long- term Borrowings 4,00,000

Long-term provisions 4,00,000

Long-term Loans & Advances 1,00,000

Inventories 1 ,90,000

Prepaid Expenses 10,000

Solution:

Current Liabilities = Total Debt – Long-term Borrowings-long term provision

= 1,20,000 – 4,00,000 – 4,00,000

= 4,00,000

Current assets = Total Assets – Property, Plant & Equipment

– Non Current investment

– Long term Loans & advance

16,00,000 – 6,00,000 – 1,00,000 – 1,00,000

= 8,00,000

Quick Assets = Current Assets – prepaid Expenses – Inventories

= 8,00,000 – 10,000 – 1,90,000

= 6,00,000

Quick Ratio = 6,00,000 / 4,00,000

= 1.5:1

19. Current Assets 6,00,000; Inventories 1,20,000; working capital 5,04,000. Calculate Quick Ratio.

Solution:

Quick Assets = Current Assets – Inventories

= 6,00,000 – 1,20,000

= 4,80,000

Working Capital = Current Assets – Current Liabilities

5,04,000 = 6,00,000 – Current Liabilities

Current liabilities = 96,000

Quick Ratio = 4,80,000 / 96,000

= 5:1

20. Quick Assets 3,00,000; Inventory (Stock) 80,000; prepaid Expenses 20,000; Working capital 2,40,000. Calculate Current Ratio.

Solution:

Quick Assets = C.A + Inventories + Prepaid Expenses

3,00,000 + 80,000 + 2,000

Current Assets = 4,00,000

Working Capital = Current Assets – Current Liabilities

2,40,00 = 4,00,000 – Current Liabilities

Current Liabilities = 4,00,000 – 2,40,000

= 1,60,000

Current Ratio = 4,00,000 / 1,60,000

= 2.5:1

21. Current Liabilities of a company are 6,00,000. Its Current Ratio is 3:1 and Liquid Ratio is 1:1. Calculate value of Inventory.

Solution:

Calculation of Current Assets

Current Liabilities = 6,00,000

Current Ratio = 3:1

Current Ratio = Current Assets / Current Liabilities

3 = C.A / C.L

C.A = 3 C.L ————(1)

C.A = 3 x 6,00,000

= 18,00,000

Calculation of Inventors

Liquid Ratio = Quick Assets / Current liabilities

Liquid Ratio = Current Assets – Inventories / Current Liabilities

1 = Current Assets – Inventories / 6,00,000

C.A – Inventories = 6,00,000

18,00,000 – Inventories = 6,00,000

Inventories = 12,00,000

22. Umesh Ltd. has current Ratio of 4.5:1 and a Quick Ratio of 3:1. If its inventory is 36,000. find out its total Current Assets and total Current liabilities.

Current Ratio = Liquid Ratio = C.A /C.L

4.5 = C.A /C.L

4. 5 =C.A /C.L

4.5 C.L = C.A ———————–(1)

Quick Ratio = Quick Assets / Current Liabilities

= C.A – Inventories / Current Liabilities

3 = —————-(2)

From (1) & (2) Equation

3 C.L = 4.5 C.L – 36,000

1.5 C.L = 36,000

Current Liabilities = 36,000 / 1,5

= 24,000

Putting C.L value in (1) Equation

4.5 C.L = C.A

C.A = 4.5 x 24,000

C.A = 10,8000

quick Assets = C.A Inventories

= 10,800 – 36,000

= 7,200

23. Current Ratio 4; Liquid Ratio 2.5; Inventory 6,00,000. Calculate Liabilities, Current Assets and Liquid Assets.

Solution:

Current Ratio = Current Assets / Current Liabilities

4 = C.A / C.L

4 C.L = C.A ——-(1)

Quick Ratio = Quick Assets – Current Liabilities

2.5 = C.A – Inventories / C.L

2.5 = C.A – 6,00,000 / C.L

2.5 C.L = C.A – 6,00,000 —————(2)

From (1) & (2) Equation

2.5 C.L = 4 C.L – 6,00,000

Form (1) & (2) Equation

2.5 C.L = 4 C.L – 6,00,000

1.5 C.L = 6,00,000

C.L = 6,00,000 /1.5

Current Liabilities = 4,00,000

Putting C.L in Equatin —————(1)

4 C.L = C.A

C.A = 4 X 4,00,000

= 16,00,000

Quick Assets = C.A – Investment

= 16,00,000 – 6,00,000

= 10,00,000

24. Current Liabilities of a company are 1,50,000. Its Current Ratio is 3:1 and Acid Test Ratio (Liquid Ratio0 is 1:1. Calculate values of Current Assets, Liquid Assets and inventory.

Solution:

Current Ratio = Current Assets / Current Liabilities

3 = C.A / C.L

3 C.L = C.A——–(1)

C.A = 3 x 1,50,000

Current Assets = 4,50,000

Quick Ratio = Quick Assets / Current Liabilities

1 = Quick Assets / 1,50,000

Quick Assets = 1,50,000

Quick Assets = C.A – Inventories

1,50,000 = 4,50,000 – inventories

Inventories = 3,00,000

25. Xolo Ltd’s liquidity Ratio is 2.5; 1. Inventory is 6,00,000. Current Ratio is 4 : 1. Find out the current liabilities.

Solution:

Current Ratio = Current Assets / Current Liabilities

4 = C.A / C.L

C.A = 4 C.L ——-(1)

Quick Ratio = Quick Assets / Current Liabilities

2.5 = C.A – Inventories / C.L

2.5 = C.A – 6,00,000 / C.L

From (1) & (2) Equation

2.5 C.L = 4 C.L – 6,00,000

1.5 C.L = 6,00,000

C.L = 6,00,000 / 1.5

C.L = 4,00,000

26. Current Assets of a company are 5,00,000. Its Current Ratio is 2.5 : 1 and Quick Ratio is 1 : 1. Calculate values of Current Liabilities, Liquid Assets and inventory.

Solution:

Current Ratio = Current Assets / Current Liabilities

2.5 = C.A / C.L

2.5 C.L = C.A ——-(1)

C.L = 5,00,000 / 2.5

Current Liabilities = 2,00,000

Quick Ratio = Quick Assets / Current Liabilities

Quick Assets = 2,00,000

Quick Assets = Current Assets – Inventories

2,00,000 = 5,00,000 – Inventories

Inventories = 5,00,000 – 2,00,000

= 3,00,000

27. Working Capital of a company is 3,60,000; Total Debts 7,80,000; Long-term Debts 6,00,000; Inventories 1,80,000. Calculate Liquid Ratio.

Solution:

Working capital = Current Assets – Current Liabilities

3,60,000 = C.A – C.L ————–(1)

Total Debts = Non Current Liabilities + Current Liabilities

7,80,000 = 6,00,000 + C.L

Current Liabilities = 1,80,000

Putting C.L value in Equation ——(1)

3,60,000 = C.A – 1,80,000

Current Assets = 5,40,000

Quick Assets = Current Assets – Inventories

= 5,40,000 – 1,80,000

Quick Assets = 3,60,000

Liquid Ratio = Quick Assets / Current Liabilities

= 3,60,000 / 1,80,000

= 2:1

28. Calculate Quick Ratio from the following:

Working Capital 4,00,000; Total Debts 18,00,000; Non-Current 16,00,000; Inventories 1,90,000; prepaid Expenses 10,000.

Solution:

Quick Ratio = Quick Assets / Current Liabilities

= 4,00,000 / 2,00,000

= 2:1

Working Note:

Total Debts = Non Current Liabilities + Current Liabilities

18,00,000 = 16,00,000 + Current Liabilities

Current Liabilities = 18,00,000 – 16,00,000

= 2,00,000

Working Capital = Current Assets – Current Liabilities

4,00,000 = Current Assets – 2,00,000

Current Assets = 6,00,000

Quick Assets = Current Assets – Inventories – prepaid expenses

= 6,00,000 – 1,90,000 – 10,000

= 4,00,000

29. Quick Ratio of a company is 2 : 1. State, giving reasons, which of the following transactions would

- Improve

- Reduce

- Not change the Quick Ratio;

- Purchase of goods for cash

- Purchase of goods on credit

- Sale of goods (Costing 20,000) for 20,000;

- Sale of goods (costing 20,000) for 22,000;

- Cash received from Trade Receivables.

Solution-

- Reduce;

- Reduce;

- Improve;

- Improve;

- No Change

30. Quick Ratio of Z Ltd. is 1 : 1. state, with reason, which of the following transactions would

- Increase

- Decrease or

- Not change the ratio:

- included in the trade payables was bill payable of 3,000 which was met on maturity;

- Debentures of 50,000 were converted into equity shares.

Solution-

- No change

- Increase.

31. The Quick Ratio of a company is 0.8 : 1. State, with reason, whether the following transactions will increase, decrease or not change the Quick Ratio:

- purchase of loose tools for 2,000;

- Insurance premium paid in advance 500;

- sale of goods on credit 3,000;

- Honoured a bills payable of 5,000 on maturity.

Solution-

- Decrease;

- Decrease;

- Increase;

- Decrease.

32. Capital Employed 20,00,000; Fixed Assets 14,00,000; Current Liabilities 2,00,000. There are no Long-term Investments. Calculate Current Ratio.

Solution:

Total Assets = Capital Employed + Current Liabilities

= 20,00,000 + 2,00,000

= 22,00,000

Total Assets = fixed Assets + Current Assets

22,00,000 = 14,00,000 + Current Assets

Current Assets = 8,00,000

Current Ratio = Current Assets / Current Liabilities

= 8,00,000 / 2,00,000

= 4 : 1

33. Venus Ltd.’s Inventory is 3,00,000. Total Liquid Assets are 12,00,000 and Quick Ratio is 2 :1. Work out Current Ratio.

Solution:

Quick Ratio = Liquid Assets / Current Liabilities

2 = 12,00,000 / Current Liabilities

Current Liabilities = 6,00,000

Current Assets = Liquid Assets + Inventory

= 12,00,000 + 3,00,000

= 15,00,000

Current Ratio = C.A / C.L

= 15,00,000 / 6,00,000

= 2.5:1

34. Total Assets 11,00,000; Fixed Assets 5,00,000; Capital Employed 10,00,00. There were no Long-term Investments. Calculate Current Ratio.

Solution:

Total Assets = Non-Current Assets + non Current Investment + Current Assets

11,00,000 = 5,00,000 + 0 + Current Assets

Current Assets = 6,00,000

= Total Assets = Capital Employed + Current Liabilities

11,00,000 = 10,00,000 + Current Liabilities

= Current Liabilities = 1,00,000

Current Ratio = C.A / C.L

= 6,00,000 / 1,00,000

= 6:1

35. From the following calculate: (i) Current Ratio (ii) Quick Ratio:

Total Debt 12,00,000

Total Assets 16,00,000

property, plat and Equipment 6,00,000

Non-Current Investment 1,00,000

Long-term Loans and Advances 1,00,000

Long-term Borrowings 4,00,000

Long-term provisions 4,00,000

Inventories 1,90,000

Prepaid Expenses 10,000

Solution:

Total Debt = Long term Borrowings + Long Term provision + Current Liabilities

12,00,00 = 4,00,000 + 4,00,000 + Current Liabilities

Current Liabilities = 4,00,000

Total Assets = Fixed Assets + Non current investments + Long term loans & Advances + Current Assets

16,00,000 = 6,00,000 + 1,00,000 + 1,00,000 + Current Assets

Current Assets = 8,00,000

Current Ratio = Current Assets / Current Liabilities

= 8,00,000 / 4,00,000

= 2: 1

Quick Assets = Current Assets – Inventories – Prepaid expenses

= 8,00,000 – 1,90,000 – 10,000

= 6,00,000

Quick Ratio = Quick Assets / Current Liabilities

Quick Ratio = 6,00,000 / 4,00,000

= 1. 5 : 1

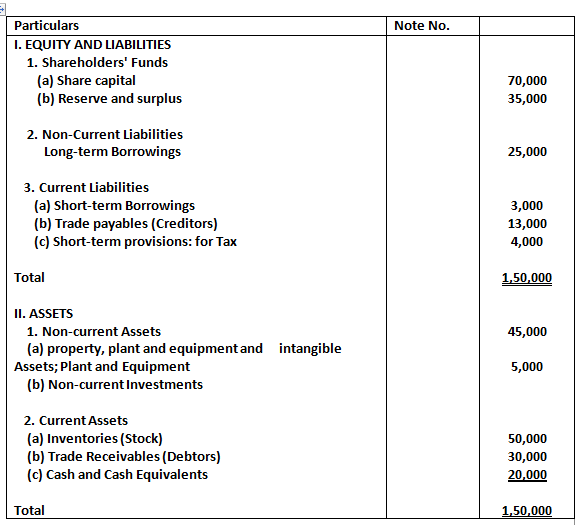

36. Following is the Balance Sheet of Crescent Chemical Works Limited as at 31st March, 2023:

Current Assets = Inventories + Debtors + Cash & Cash Equivalents

= 50,000 + 30,000 + 20,000

= 1,00,000

Current Liabilities = Short term Borrowings + Trade payable + Short term provision

= 3000 + 13,000 + 4,000

= 20,000

Current Ratio = Current Assets / current Liabilities

= 1,00,000/20,000

= 5: 1

Liquid Assets = Current Assets – Inventories

= 1,00,000 – 50,000

= 50,000

Liquid Ratio = Liquid Assets / Current Liabilities

= 50,000 / 20,000

= 2.5: 1

DEBT TO EQUITY RATIO

37. Total Assets 2,60,000; Total Debts 1,80,000; Current Liabilities 20,000. Calculate Debt to equity Ratio.

Solution:

Total Debt = Long term Debts + Current Liabilities

1,80,000 = long term debts + 20,000

Long term debts = 1,60,000

Total Assets = Share holder’s funds + Total debts

2,60,000 = share holder’s funds + 1,80,000

Share holders funds (Equity) = 80,000

Debts to Equity Ratio = Debt / Equity

= 1,60,000 / 80,000

= 2 : 1

38. Calculate Debt to Equity Ratio: Equity share capital 5,00,000; General Reserve 90,000; Accumulated profits 50,000; 10% Debentures 1,30,000; Current Liabilities 1,00,000.

Solution:

Share holders funds = equity share capital + general reserve + Accumulated profits

= 5,00,000 + 90,000 + 50,000

= 6,40,000

Debt = 10% Debentures

1,30,000

Debt to Equity ratio = Debt / Equity

= 1,30,000 / 6,40,000

Debt to Equity Ratio = 0.203

39. From the following information, calculate debt to equity ratio:

20,000 Equity shares of 10 each fully paid 2,00,000

10,000, 9% preference shares of 10 each fully paid 1,00,000

General Reserve 90,000

Surplus, i.e., Balance in Statement of profit & Loss 40,000

10% Debentures 1,50,000

Current Liabilities 1,00,000

Solution:

Share holder’s Funds = Equity share + preference share + General reserve + surplus, i.e. Balance in statement of profit & loss

= 2,00,000 + 1,00,000 + 90,000 + 40,000

Share holder’s funds = 4,30,000

Debts = 1,50,000

= 1,50,000

Debt to Equity Ratio = 1,50,000 / 4,30,000

= 0.348

= 0.35

40. Calculate Debt to Equity Ratio from the following information:

Property, plant and equipment (Gross) 8,40,000

Accumulated Depreciation 1,40,000

Non-current investment 14,000

Long-term Loss and Advances 56,000

Current Assets 3,50,000

Current Liabilities 2,80,000

10% Long-term Borrowings 4,20,000

Long-term Provisions 1,40,000

Solution:

Debt = Long-term Borrowings + Long term provisions

= 4,20,000 + 1,40,000

= 5,60,000

Equity = Total Assets – Total Outside Liabilities

Total Assets = (Fixed Assets – Acc. Depreciation) + Non-current Investment + Long-term loans and Advances + Current Assets

= (8,40,000 – 1,40,000) + 14,000 + 56,000 + 3,50,000

= 11,20,000

Total outside liabilities = Non-current liabilities + current Liabilities

= 5,60,000 + 2,80,000 = 8,40,000

Equity = Total Assets – Total outside liabilities

= 11,20,000 – 8,40,000

= 2,80,000

Debt to Equity ratio = Debt / Equity

= 5,60,000 /2,80,000

= 2:1

41. From the following information, calculate Debt to equity share ratio: Total Debts 6,00,000; current liabilities 2,00,000 and capital employed 6,00,000.

Solution:

Total Debts = Non-Current liabilities + Current liabilities

6,00,000 = Non-current liabilities + 2,00,000

Non-current liabilities (debt) = 4,00,000

capital employed = equity + non-current liabilities

6,00,000 = equity + 4,00,000

Equity = 2,00,000

Debt to Equity ratio = Debt / Equity

= 4,00,000 / 2,00,000

= 2:1

42. Calculate Debt to Equity Ratio: Total Assets 14,00,000; Total debt 12,00,000; capital employed 10,00,000.

Solution:

Equity = Total Assets – Total Debts

= 14,00,000 – 12,00,000

= 2,00,000

Capital Employed = Equity + Debt (Non-Current liabilities)

10,00,000 = 2,00,000 + Debt (Non-current liabilities)

Debt (Non-current liabilities) = 8,00,000

Debt to Equity ratio = Debt / Equity

= 8,00,000 / 2,00,000

= 4:1

43. Capital Employed 8,00,000; shareholder’s funds 2,00,000. Calculate Debt to Equity Ratio.

Solution:

Debt = Capital Employed – Share holders funds

= 8,00,000 – 2,00,000

= 6,00,000

Share holders funds (Equity) = 2,00,000

Debt to Equity ratio = Debt / Equity

= 6,00,000 / 2,00,000

= 3:1

44. King Ltd has current ratio of 2.5:1. Its working capital is 1,20,000. Total Assets are of 3,80,000 and Total Debt of 2,80,000. Calculate Debt to equity ratio.

Solution:

Current Ratio = 2.5:1

Current Ratio = Current Assets / Current Liabilities

2.5 = Current Assets / Current Liabilities

2.5 C.L = C.A ———-(1)

Working capital = Current Assets – Current Liabilities

1,20,00 = C.A – C,L ——(2)

putting equation (1) value in equation (2)

1,20,000 = 2.5 C.L – C.L

C.L = 1,20,000 / 1.5

Current liabilities = 80,000

Debt (Non-current liabilities) = Total Debt – Current liabilities

= 2,80,000 – 80,000

= 2,00,000

Equity (Share holder’s funds) = Total Assets – Total Debts

= 3,80,000 – 2,80,000

= 1,00,000

Debt to Equity ratio = Debt / Equity

= 2,00,000 / 1,00,000

= 2:1

45. Monica Ltd. has Quick Ratio of 1.5 : 1. Its working capital is 1,20,000 and its inventions are of 80,000. Total Assets of 3,80,000 and total debts of 2,80,000. Calculate Debt to equity Ratio.

Solution:

Quick Ratio = Quick Assets / Current liabilities

= Current Assets – Inventories / Current Liabilities

1.5 = Current Assets – 80,000 / Current Liabilities

1.5 C.L = C.A – 80,000

C.A = 1.5 C.L + 80,000 ———(1)

Working capital = Current Assets – Current liabilities

1,20,000 = C.A -C.L ————-(2)

Putting C.A Value from Eq (1) into Eq (2)

1,20,000 = 1.5 C.L + 80,000 – C.L

5. C.L = 40,000

Current Liabilities = 40,000 /5

= 80,000

Debt (Non-current liabilities) = Total Debt – Current liabilities

= 2,80,000 – 80,000

= 2,00,000

Equity (share holder’s funds) = Total Assets – Total Debt

= 3,80,000 – 2,80,000

= 1,00,000

Debt to Equity ratio = Debt / Equity

= 2,00,000 / 1,00,000

= 2:1

46. When Debt to Equity Ratio is 2, State, giving reason, whether this ratio will increase, decrease or will have no change in each of the following cases;

- Sale of land (Book value 4,00,0000 for 5,00,000;

- issue of equity share for the purchase of plant and machinery worth 10,00,000;

- issue of preference shares for redemption of 13% Debentures, worth 10,00,000.

Solution-

- Decrease;

- Decrease;

- Decrease.

47. Debt to equity ratio of a company is 0.5 : 1. Which of the following would increase, decrease or not change it:

- Issue of Equity shares;

- Cash received form debtors;

- Redemption of debentures

- Purchased good on credit?

Solution-

- Decrease;

- No change;

- No change;

- No change.

48. Balance Sheet had the following amounts as at 31st March, 2025;

10% preference share capital 5,00,000

Equity share capital 15,00,000

Security premium reserve 1,00,000

Reserve and surplus 4,00,000

long-term loan from IDBI @ 9% 30,00,000

Current Assets 12,00,000

Current Liabilities 8,00,000

Investment (in other companies) 2,00,000

Property, plant and Equipment – cost 60,00,000

Depreciation written off 14,00,000

Calculate rations indicating the Long-term and the short-term financial position of the company

solution:

Current Ratio = Current Assets / Current Liabilities

= 1,20,000 / 8,00,000

Current Ratio = 1.5:1

Equity = preference share = Equity share + Reserve & Surplus

= 5,00,000 + 15,00,000 + 4,00,000

= 24,00,000

Debt = Long term loan form IDBI @ 9%

= 30,00,000

Debt to Equity ratio = Debt / Equity

= 30,00,000 / 24,00,000

= 1.25:1

49. Assuming that the debt to Equity ratio is 2 : 1, state, giving reasons, which of the following transactions would (i) Increase (ii) Decrease (iii) Not alter Debt to equity Ratio.

- Issue of new share for cash.

- Conversion of debentures into equity shares.

- Sale of fixed assets at profit.

- Purchase of a fixed asset on long-term deferred payment basis.

- Payment to Creditors.

Solution-

- Decrease;

- Decrease;

- Decrease;

- Increase;

- No change.

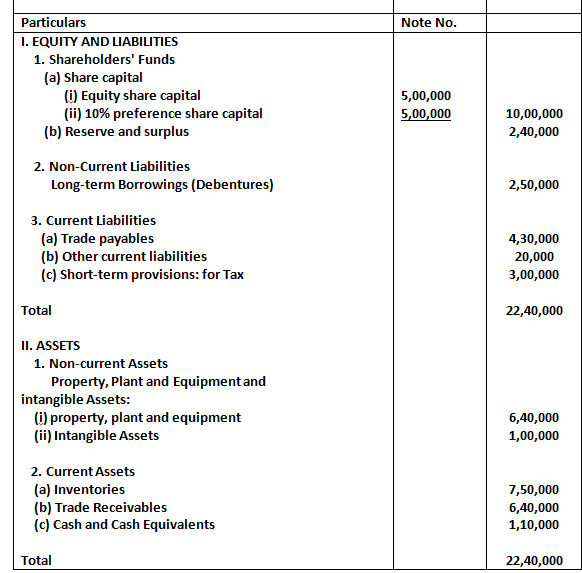

50. From the following Balance Sheet to ABC Ltd. as at 31st March, 2023, Calculate Debt to Equity Ratio.

Solution:

Debt = Long term Borrowings

= 2,50,000

Equity = Equity share Capital + 10% preference share capital reserve & Surplus

= 5,00,000 + 5,00,000 + 2,40,000

= 12,40,000

Debt to equity ratio = Debt / Equity

= 2,50,000 / 12,40,000

= 0.2016:1

= 0.2:1

TOTA ASSETS TO DEBT RATIO

51. Calculate total Assets to Debt ratio from the following information:

Long-term Debts 4,00,000; Total Assets 7,70,000.

Solution:

Total Assets = 7,70,000

Long-term Debts (Debts) = 4,00,000

Total Assets to Debt Ratio = Total Assets / Debt

= 7,70,000 / 4,00,000

= 1.925 : 1

52. Total Debt 15,00,000; Current liabilities 5,00,000; Capital Employed 15,00,000. Calculate Total Assets to Debt Ratio.

Solution:

Total Assets = Capital Employed + Current Liabilities

= 15,00,000 + 5,00,000

= 20,00,000

Total Debt = Non-Current Liabilities + Current Liabilities

15,00,000 = Non-Current Liabilities + 5,00,000

Non-Current Liabilities = 10,00,000

Total Assets to Debt Ratio = Total Assets / Debt

= 20,00,000 / 10,00,000

= 2 : 1

53. Shareholder’s Funds 1,60,000; Total Debts 3,60,000; current Liabilities 40,000.

Calculate Total Assets to Debt Ratio.

Solution:

Total Assets = Share holder’s Funds + Total Debts

= 1,60,000 + 3,60,000

= 5,20,000

Total Debts = Non-current liabilities + current liabilities

3,60,000 = Non-current liabilities + 40,000

Non-current liabilities (Debt) = 3,20,000

Total Assets to Debt Ratio = Total Assets / Debt

= 5,20,000 / 3,20,000

= 1.625 : 1

54. Total Debt 60,00,000; Shareholder’s funds 10,00,000; Reserve and surplus 2,50,000; Current Assets 25,00,000; Working Capital 5,00,000. Calculate Total Assets to Debt Ratio.

Solution:

Total Assets = Total Debt + Share holder’s Funds

= 60,00,000 + 10,00,000

= 70,00,000

Working Capital = Current Assets – Current liabilities

5,00,000 = 25,00,000 – Current Liabilities

Current Liabilities = 20,00,000

Total Debt = Non-Current Liabilities + Current Liabilities

60,00,000 = Non-Current Liabilities + 20,00,000

Non-Current Liabilities = 40,00,000

Total Assets to Debt Ratio = Total Asset / Debt

= 70,00,000 / 40,00,000

= 1.75 : 1

55. Total Debt 12,00,000; Shareholders funds 2,00,000; Reserve and surplus 50,000; Current Assets 5,00,000; Working capital 1,00,000. Calculate Total Assets to Debt Ratio.

Solution:

Total Assets = Shareholder’s + Total Debt

= 2,00,000 + 12,00,000

= 14,00,000

Working capital = Current Assets – Current Liabilities

1,00,000 = 5,00,000 – Current liabilities

Current Liabilities = 4,00,000

Total Debt = Non-Current Liabilities + Current Liabilities

12,00,000 = N.C.L (Debt) + 4,00,000

Non-Current liabilities (Debt) = 8,00,000

Total Assets to Debt Ratio = Total Assets / Debt

= 14,00,000 / 8,00,000

= 1.75 : 1

56. From the following information, Calculate ‘Total Assets to Debt Ratio:

| Particulars | ₹ | Particulars | ₹ |

| Current assets Current Liabilities 10% Debentures | 8,00,000 5,00,000 4,00,000 | 9% Long-term Bank Loan Shareholders’ Funds | 1,00,000 15,00,000 |

Solution-

Total assets= share holder fund+ long term bank loan + debenture+ current liability

= 15,00,000+100,000+400,000+500,000

= 2500,000

Debt = 10% debenture+9% long term bank loan

= 4,00,000+100,000

= 5,00,000

Total assets to debt ratio = Total Asset / Debt

= 25,00,000 / 5,00,000

Debts Ratio = 5:1.

57. Calculate ‘Total Assets to Debt Ratio’ From the following information:

Equity share capital 4,00,000

Long-term Borrowing 1,80,000

Surplus, i.e., Balance of P & L 1,00,000

General Reserve 70,000

Current Liabilities 30,000

Long-term provisions 1,20,000

Solution:

Debt = Long term borrowings + Long term provisions

= 1,80,000 + 1,20,000

= 3,00,000

Share holder’s funds = Equity share capital + Surplus profit & Loss + General Reserve

= 4,00,000 + 1,00,000 + 70,000

= 5,70,000

Total Assets = Share holder’s funds + Non-Current liabilities (Debt) + Current Liabilities

= 5,70,000 + 3,00,000 + 30,000

= 9,00,000

Total Assets = Share holder’s funds + Non-Current liabilities (Debt) + Current Liabilities

= 5,70,000 + 3,00,000 + 30,000

= 9,00,000

Total Assets to Debt Ratio = Total Asset / Debt

= 9,00,000 / 3,00,000

= 3 : 1

58. From the following information, calculate Total Assets to debt Ratio:

Property, plant and Equipment (Gross) 6,00,000

Non-Current Investment 10,000

Current Assets 2,50,000

Long term Borrowings 3,00,000

Accumulated Depreciation 1,00,000

Long-term Loans and Advances 40,000

Current Liabilities 2,00,000

Long-term provisions 1,00,000

Solution:

Total Assets = [Fixed Assets (Gross) – Acc. Depreciation] + Non Current investment + Long term loans & advances + Current Assets

= (6,00,000 – 1,00,000) + 10,000 + 40,000 + 2,50,000

= 5,00,000 + 10,000 + 40,000 + 2,50,000

= 8,00,000

Debt = Long term Borrowings + Long term provisions

= 3,00,000 + 1,00,000

= 4,00,000

Total Assets to Debt Ratio = Total Asset / Debt

= 8,00,000 / 4,00,000

= 4 : 1

PROPERIETARY RATIO

59. From the following information, calculate proprietary Ratio:

Share capital 3,00,000

Non-Current Assets 13,20,000

Reserve and Surplus 1,80,000

Current Assets 6,00,000

Solution:

Total Assets = Non-Current Assets + Current Assets

= 13,20,000 + 6,00,000

= 19,20,000

Share holder’s funds = Share capital + Reserve & Surplus

= 3,00,000 – 1,80,000

Share holder’s funds = 4,80,000

Property Ratio = Shareholders’ Funds / Total Assets

= 4,80,000 / 19,20,000

= 0.25: 1

60. Calculate proprietary ratio form the following:

Equity share capital 4,50,000

10% preference share capital 3,20,000

Reserve and surplus 65,000

Creditors 1,10,000

9% Debentures 3,00,000

Property, plant and equipment 7,00,000

Trade investment 2,45,000

Current Assets 3,00,000

Solution:

Shareholder’s funds = equity share capital + 10% preference share

Capital + reserve & surplus

450,000+3,20,000+65000=8,35,000

Total assets= property plant and equipment + trade investment + current assets

= 7,00,000 + 2,45,000 + 3,00,000

= 12,45,000

Proprietary Ratio = Shareholders’ Funds / Total Assets

= 8,35,000 / 12,45,000

= 0.67:1

61. From the following information, calculation proprietary Ratio:

Equity share capital 3,00,00

Preference share capital 1,50,000

Reserves and surplus 75,000

Debentures 1,80,000

Trade payables 45,000

7,50,000

Property, plant and equipment 3,75,000

Short-term investments 2,25,000

Other current Assets 1,50,000

7,50,000

Solution:

Total Assets = fixed Assets + Short terms investments + others Current

Assets

= 3,75,000 + 2,25,000 + 1,50,000

= 7,50,000

Shareholder’s funds = equity share capital + preference share

Capital + reserves & surplus

= 3,00,000 + 1,50,000 + 75,000

= 5,25,000

Proprietary Ratio = Shareholders’ Funds / Total Assets

= 5,25,000/7,50,000

= 0.70:1

62. Calculate proprietary ratio, if total assets to debt ratio is 2:1. Debt is 5,00,000. Equity shares capital is 0.5 times of debt. Preference share capital is 25% of equity share capital. Net profit before tax is 10,00,000 and rate of tax is 40%.

Solution:

Total Assets to Debt Ratio = 2:1

Debt = 5,00,000

Total Assets to Debt ratio = Total Assets / Debt

2 = total assets / 5,00,000

Total Assets = 10,00,000

Equity share capital = 0.5 x 5,00,000

= 2,50,000

Preference share capital = 25% of equity share capital

= x 2,50,000

= 62,500

Net profit before tax = 10,00,000

Tax ratio = 40%

Profit after tax = 10,00,000 – 40/100 x 10,00,000

= 10,00,000 – 4,00,000

= 6,00,000

Share holder’s funds = equity share capital + preference share Capital + profit

= 2,50,000 + 62,500 + 6,00,000

= 9,12,500

Property Ratio = Shareholders’ Funds / Total Assets

= 9,12,500 / 10,00,000

= 0.9125:1

63. State, with reasons, whether the proprietary ratio will improve, decline or will not change because of the following transactions if proprietary ratio is 0.8:1:

- Obtained a loan of 5,00,000 from state bank of India payable after five years.

- Purchased machinery of 2,00,000 by cheque.

- Redeemed 7% Redeemable preference shares 3,00,000.

- Issued equity shares to the vendor of building purchased for 7,00,000.

- Redeemed 10% redeemable debentures of 6,00,000.

Solution-

- Decline;

- No change;

- Decline;

- Improve;

- Improve.

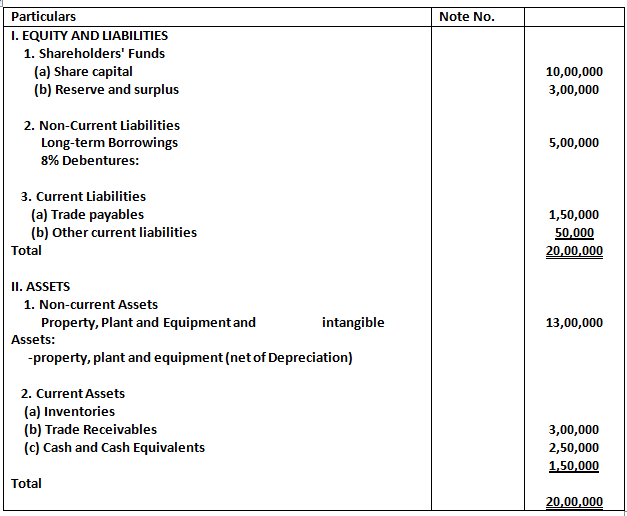

Calculate of Debt to Equity Ratio, Proprietary Ratio, and Total Assets to Debt Ratio

64. Form the following information, calculate:

- Proprietay ratio:

- Debt to Equity Ratio; and

- Total Assets to Debt Ratio.

Current Assets 40,00,000

Long-term borrowings 15,00,000

Non-current Assets 40,00,000

Current Liabilities 20,00,000

Long-term provisions 25,0,000

Solutions:

Total Assets = Non-current Assets + Current Assets

= 40,00,000 + 4,00,000

= 80,00,000

Debt = long term borrowings + Long term provisions

= 15,00,000 + 25,00,000

= 40,00,000

Total Assets = Equity + Non-Current liabilities + Current Liabilities

8,00,000 = Equity + 40,00,000 + 20,00,000

Equity = 20,00,000

1. Property Ratio = Shareholders’ Funds / Total Assets

= 20,00,000 /80,00,000

= 0.25:1

2. Debt to equity Ratio = Debt /Equity

= 40,00,000 / 20,00,000

= 2:1

3. Total Assets to Debt Ratio = Debt / Equity

= 80,00,000 / 40,00,000

= 2:1

65. From the following information, calculate:

- Proprietary Ratio:

2. Debt to Equity Ratio; and

3. Total Assets to Debt Ratio.

Total Debt 18,00,000

Capital Employed 15,00,000

Current Assets 7,50,000

Working capital 1,50,000

Solution:

Working capital = Current Assets – Current Liabilities

15,000 = 7,50,000 – Current Liabilities

Current Liabilities = 6,00,000

Total Debt = Non-Current Liabilities (Debt) + Current Liabilities

18,00,000 = Non-Current Liabilities (Debt) + 6,00,000

Non-Current Liabilities (Debt) = 12,00,000

Shareholder’s funds = capital Employed – non- Current Liabilities

= 15,00,000 – 12,00,000

= 3,00,000

Total Assets = Capital Employed + Current Liabilities

= 15,00,000 +6,00,000

= 21,00,000

Property Ratio = Shareholders’ Funds / total assets x 100

= 3,00,000 / 21,00,000x 100

= 14.29%

Debt to equity Ratio = Debt / Equity

= 12,00,000 / 3,00,000

= 4:1

Total Assets to Debt Ratio = Debt / Equity

= 12,00,000/3,00,000

= 4:1

Total Assets to Debt Ratio = Total Assets / Debt

= 21,00,000 / 12,00,000

= 1. 75 : 1

INTEREST COVERAGE RATIO

66. If net profit before interest and tax is 10,00,000 and interest on long-term funds is 2,00,000, find interest coverage Ratio.

Solution:

Interest charge Ratio = profit before interest & tax / Interest on long term loans

= 10,00,000 /2,00,000

= 5 times

67. From the following information, calculate interest coverage Ratio: Net profit after Tax 4,25,000; tax 75,000; interest on long-term funds 1,25,000.

Solution:

Net profit before interest and tax = Net profit After tax + tax +Interest

= 4,25,000 + 75,000 + 1,25,000

= 6,25,000

Interest charge Ratio = profit before interest & tax / Interest on long term loans

= 6,25,000 / 1,25,000

= 5 times

68. From the following details, calculate interest coverage Ratio:

Net profit after tax 7,00,000

6% Debentures 20,00,000

Tax rate 30%

Solution:

Let the profit before tax be ₹ x

Net profit after tax = Net profit before tax – tax

7,00,000 = x – – x

70x/100 = 7,00,000

X = 70 x 100 / 70

Net profit before tax = 10,00,000

Interest on debentures = 6% of Debentures

= 1,20,000

Profit before interest and tax = profit before tax + interest

= 10,00,000 + 1,20,000

= 11,20,000

Interest charge Ratio = profit before interest & tax / Interest on long term loans

= 11,20,000 / 1,20,000

= 9.33 times

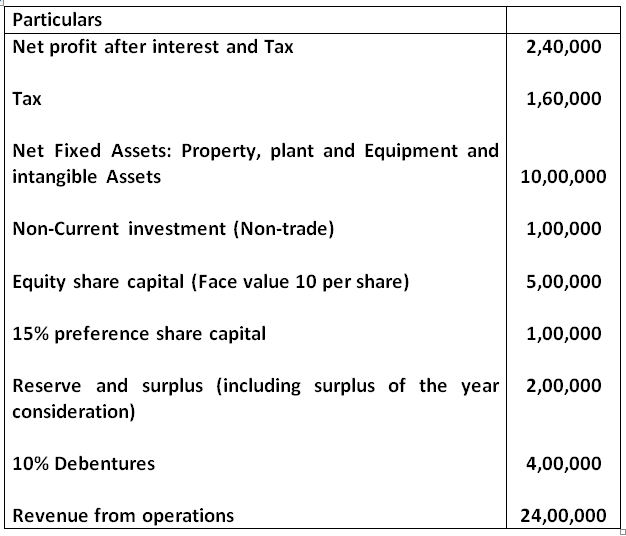

69. From the following information, calculate interest coverage ratio:

Net profit after interest and tax 1,20,000; rate of income tax; 40%; 15% debentures 1,00,000 12% mortgage loan 1,00,000.

Solution:

Let profit before tax be x

Profit after tax = profit before tax – interest

1,20,000 = x – 40/100 x

60x/100 = 1,20,000

X = 1,20,000 x 100 /60

profit before tax = 2,00,000

interest = 15% debentures + 12% mortgage loan

= x 1,00,000 + x 1,00,000

=15,000 +12,000

= 27,000

Profit before interest and tax = profit before tax + interest

= 2,00,000 + 27,000

= 22,7,000

Interest charge Ratio = profit before interest & tax / Interest on long term loans

= 2,00,000 / 27,000

= 8.41 times

70. From the following information, calculate interest coverage ratio:

10,000 equity shares of 10 each 1,00,000

8% preference shares 70,000

10% debentures 50,000

Long-term loans from bank 50,000

Interest on long-term loans from bank 5,000

Net profit after tax 75,000

Tax 9,000

Solution:

Net profit before tax = net profit after tax + tax

= 5,000 + 5,000

Interest = 10,000

Net profit before tax and interest=net profit after tax+ interest on long term loan term bank + interest on debentures

= 75000+9000+5000+50,000×10%

= 94000

Interest coverage ratio = profit before interest & tax / Interest on long term loans

= 94,000 / 10,000

= 9.4 times

DEBT TO CAPITAL EMPLOYED RATIO

71. From the following information, calculate Debt to capital employed ratio:

Shareholder’s funds 24,00,000

Long-term borrowings (9% debentures) 12,00,000

Current liabilities 2,00,000

Non-current Assets 28,00,000

Current Assets 10,00,000

Solution:

Long term Debt = long term borrowings (9% debentures)

= 12,00,000

Capital employed = share holder’s funds + long term borrowings

(9% debentures)

= 24,00,000 + 12,00,000

= 36,00,000

Debt to capital employed ratio = long term debt / capital employed

= 12,00,000 /36,00,000

= 0.33:1

72. From the following, calculate ‘Debt to capital Employed Ratio’:

9% Debentures 2,00,000

8% public Deposits 5,00,000

Long-term provisions 2,00,000

Equity share capital 8,00,000

Reserve and surplus 5,00,000

Solution:

Long-term Debts = 9% Debentures + long term Provisions 8% Public deposits

= 2,00,000 + 2,00,000 + 5,00,000

= 9,00,000

Capital employed = equity share capital + reserve and surplus + 9% Debentures + long-term provisions + 8% public Deposit

= 8,00,000 + 5,00,000 + 2,00,000 + 2,00,000 + 5,00,000

= 22,00,000

Debt to capital employed ratio = long term debt / capital employed

= 9,00,000 / 22,00,000

= 0.409:1

= 0.41:1

73. From the following, calculation Debt to capital employed Ratio:

Capital employed 87,00,000

Investments 4,80,000

Machinery 14,00,000

Trade receivables 8,00,000

Cash and cash equivalents 7,20,000

Equity share capital 45,00,000

8% Debentures 36,00,000

Capital reserve 6,80,000

Solution:

Long term Debts = 8% Debentures

= 36,00,000

Capital employed = 87,00,000

Debt to capital employed ratio = long term debt / capital employed

= 36,00,000 / 87,00,000

= 0.41:1

74. Calculate debt to capital employed ratio from the following information:

Shareholder’s funds 50,00,000

Non-current liabilities;

Long-term borrowings 20,00,000

Long-term provisions 17,50,000 37,50,000

Non-current Assets:

Property, plant and equipment

And intangible Assets 90,00,000

Non-current investment 12,50,000 1,02,50,000

Current Assets 23,75,000

Solution:

Long term Debts = Long term Borrowings + long term provisions

= 20,00,000 + 17,50,000

= 37,50,000

Capital employed = share holder’s funds + long term borrowings +Long terms provisions

= 50,00,000 + 20,00,000 + 17,50,000

= 87,50,000

Debt to capital employed ratio = long term debt / capital employed

= 37,00,000 / 87,50,000

= 0.4285

= 0.43:1

75. Calculation debt to capital employed ratio from the following information:

Total debts 60,00,000; current Assets 25,00,000; non-current Assets 95,00,000; working capital 5,00,000.

Solution;

Working capital = current Assets – current liabilities

5,00,000 = 25,00,000 – current liabilities

Current liabilities = 20,00,000

Long term debts = total debts – current liabilities

= 60,00,000 – 20,00,000

= 40,00,000

Capital employed = current Assets + non-current Assets – Current liabilities

= 25,00,000 + 95,00,000 – 20,00,000

= 100,00,000

Debt to capital employed ratio = long term debt / capital employed

= 40,00,000 / 100,00,000

= 0.40:1

76. From the following calculate debt to capital employed Ratio:

10% preference share capital 5,00,000; Equity share capital 15,00,000; securities premium 1,00,000; reserve and surplus 2,00,000; 9% loan from IDBI 30,00,000.

Solution;

Long term Debt = 9% loan form IDBI

= 30,00,000

Capital employed = 10% preference share capital + Equity share

Capital + reserves & surplus + 9% loan from IDBI

= 5,00,000 + 15,00,000 + 2,00,000 + 30,00,000

= 52,00,000

Debt to capital employed ratio = long term debt / capital employed

= 30,00,000 / 52,00,000

= 0.58:1

77. Calculate Debt to Capital Employed Ratio form the following information:

Debt to Equity Ratio 2:1; Long term Borrowing Rs.18,00,000; Long term Provision Rs.6,00,000; Reserves and Surplus Rs.2,00,000.

debt= long term borrowing + long term provision

18,00,000+600,000

2400,000

Equity=total debt

Ans. 0.67 : 1.

78. Debt to capital employed ratio of a company is 0.4:1. State giving reasons, which of the following will improve, reduce not change the ratio?

- Sale of machinery at a loss of 50,000.

- Purchase of stock-in-trade on credit of two months for 80,000.

- Conversion of debentures into equity shares of 5,00,000.

- Purchase of fixed assets for 4,00,000 on a long-term deferred payment basis.

Solution:-

- Improve;

- Not Change,

- Reduce,

- Improve.

INVENTORY TURNOVER RATIO

79. From the following details, calculate inventory turnover ratio:

Cost of revenue from operations (cost of Goods sold) 9,00,000

Inventory in the beginning of the year 3,50,000

Inventory at the close of the year 2,50,000

Solution:

Cost of goods sold = 9,00,000

Average inventory = Opening inventory + closing inventory / 2

= 2,50,000 + 3,50,000 /2

= 3,00,000

Inventory turnover ratio = Cost of goods sold / average inventory

= 9,00,000 / 3,00,000

= 3 times

80. Cost of revenue from operations (cost of goods sold) 5,00,000: purchases 5,50,000; opening inventory 1,00,000.

Calculate inventory turnover ratio.

Solution:

Cost of goods sold = opening inventory + purchase – purchased return – closing inventory

5,00,000 = 1,00,000 + 5,50,000 – 0 – closing inventory

Closing inventory = 1,50,000

Cost of goods sold = 5,00,000

Avg. inventory = Opening inventory + closing inventory / 2

= 1,00,000 + 1,50,000 / 2

= 1,25,000

Inventory turnover ratio = Cost of goods sold / average inventory

= 5,00,000 / 1,25,000

= 4 times

81. Calculation inventory turnover ratio form the following information:

Opening inventory is 50,000; purchase 3,90,000; revenue form operations, I.e., net sales 6,00,000; gross profit ratio 30%.

Solution:

Gross profit ratio = 30% of net sales

= x 6,00,000

= 1,80,00,000

Cost profit = net sales – cost of goods sold

1,80,000 = 6,00,000 – cost of goods sold

Cost of goods sold = 4,20,000

Cost of goods sold = opening inventory + purchases – purchase return+ direct expenses – closing inventory

4,20,000 = 50,000 + 3,90,000 – 0 + 0 – closing inventory

Closing inventory = 20,000

Avg. inventory = Opening inventory + closing inventory / 2

= 50,000 + 20,000 / 2

= 35,000

Inventory turnover ratio = Cost of goods sold / average inventory

= 4,20,000 / 35,000

= 12 times

82. Form the following information, calculate inventory turnover ratio:

Opening inventory 2,00,000

Purchase 4,60,000

Carriage inwards 20,000

Closing inventory 60,000

Wages 30,000

Freight outwards 37,500

Solution:

Cost of goods sold = opening inventory + purchases + carriage inwards+ wages – closing inventory

= 2,00,000 + 4,60,000 +20,000 + 30,000 – 60,000

= 6,50,000

Avg. inventory = Opening inventory + closing inventory / 2

= 2,00,000 + 60,000 / 2

= 1,30,000

Inventory turnover ratio = Cost of goods sold / average inventory

= 6,50,000 / 1,30,000

= 5 times

83. Calculate inventory turnover ratio from the following:

Opening inventory 58,000

Closing inventory 62,000

Revenue from operation, i.e., net sales 6,40,000

Gross profit ratio 25%.

Solution:

Gross profit = 25% of net sales

= 25/100 x 6,40,000

= 1,60,000

Gross profit = net sales – cost of goods sold

1,60,000 = 6,40,000 – cost of goods sold

Cost of goods sold = 4,80,000

Avg. inventory = Opening inventory + closing inventory / 2

= 58,000 + 62,000 / 2

= 60,000

Inventory turnover ratio = Cost of goods sold / average inventory

= 4,80,000 / 60,000

= 8 times

84. From the following information, calculate inventory turnover Ratio:

Revenue form operations 16,00,000

Average inventory 2,20,000

Gross loss Ratio 5%.

Solution:

Gross loss = 5% of revenue from operation

= 25 / 100 x 16,00,000

= 80,000

Gross loss = cost of goods sold – revenue from operation

80,000 = cost of goods sold – 16,00,000

Cost of goods sold = 16,80,000

Inventory turnover ratio = Cost of goods sold / average inventory

= 16,80,000 / 2,20,000

= 7.64 times

85. Revenue from operations 4,00,000; gross 1,00,000; closing inventory 1,20,000; excess of closing inventory over opening inventory 40,000. Calculate inventory turnover Ratio.

Solution;

Revenue from operation = 4,00,000

Opening inventory = 1,20,000 – 40,000

= 80,000

Gross profit = revenue from operation – cost of goods sold

1,00,000 = 4,00,000 – cost of goods sold

Cost of goods sold = 3,00,000

Avg. inventory = Opening inventory + closing inventory / 2

= 80,000 + 1,20,000 / 2

= 1,00,000

Inventory turnover ratio = Cost of goods sold / average inventory

= 3,00,000 / 1,00,000

= 3 times

86. From the following data, calculate turnover Ratio:

Total sales 1,00,000; sales return 1,00,000; gross profit 1,80,000; closing inventory 2,00,000; excess of closing inventory over opening inventory 40,000.

Solution:

Net sales(revenue from operation ) = gross sales – sales return

= 10,00,000 – 1,00,000

= 9,00,000

Revenue from operation =9,00,000

Opening inventory = 2,00,000 – 40,000

= 1,60,000

Gross profit = revenue from operation – cost of goods sold

1,80,000 = 9,00,000 – cost of goods sold

Cost of goods sold = 7,20,000

Avg. inventory = Opening inventory + closing inventory / 2

= 1,60,000 + 2,00,000 / 2

= 1,80,000

Inventory turnover ratio = Cost of goods sold / average inventory

= 7,20,000 / 1,80,000

= 4 times

87. ₹ 2,00,000 is the cost of revenue from operations (cost of good sold), during the year. If inventory turnover Ratio is 8 times, calculate inventories at the end of the year. Inventory at the end is 1.5 times that of in the beginning.

Solution:

Inventory turnover ratio = Cost of goods sold / average inventory

= 2,00,000 x 2 / opening inventory + Closing inventory

8 = 2,00,000 x 2/ x + 1.5x

8 *2.5x = 4,00,000

X = 4,00,000 / 2.5 x 8

X = 20,000

Opening inventory = 20,000 x 1.5

Closing inventory = 20,000 x1.5

= 30,000

88. From the following information obtained from the books of kundan Ltd. calculate the inventory turnover Ratio for the years 2015-16 and 2016-17:

| Particular | 2015-16 ₹ | 2016-17 ₹ |

| Inventory on 31st March Revenue from operations (gross profit is 25% on cost of revenue from operation) | 7,00,000 50,00,000 | 17,00,000 75,00,000 |

In the year 2015-16, inventory by 2,00,000.

Solution:

2015-16

Opening inventory = 5,00,000

Closing inventory = 7,00,000

Assume cost of goods sold=X

Gross profit = revenue from operation – cost of goods sold

25/ 100X = 50,00,000 – X

25x + x /100 = 50,00,000

25X+125X =50,00,000

100

Logs = 50,00,000 x 100 / 125

cost of goods sold = 40,00,000

Avg. inventory = Opening inventory + closing inventory / 2

= 5,00,000 + 7,00,000 / 2

= 6,00,000

Inventory turnover ratio = Cost of goods sold / average inventory

= 40,00,000 / 6,00,000

= 6.666

= 6.67 times

2016-17

Opening inventory = 7,00,000

Closing inventory = 17,00,000

Average inventory = Opening inventory + closing inventory / 2

= 7,00,000 + 17,00,000 / 2

= 12,00,000

Gross profit = revenue form operation – cost of goods

Sold

logs = 75,00,000 – logs

logs = 75,00,000

Logs = 75,00,000 x

cost of goods sold = 60,00,000

Inventory turnover ratio = Cost of goods sold / average inventory

= 60,00,000 / 12,00,000

= 5 times

89. Calculate inventory turnover ratio from following information:

Opening inventory 40,000; purchases 3,20,000; and closing inventory 1,20,000 state, giving reason, which of the following transactions would (i) increase, (ii) decrease, (iii) neither increase nor decrease the inventory turnover Ratio:

- Sale of goods for 40,000 (cost 32,000).

- Increase in the value of closing inventory by 40,000.

- Goods purchased for 80,000.

- Purchase return 20,000.

- Goods costing 10,000 withdrawn for personal use.

- Goods costing 20,000 distributed as free samples.

Solution- Inventory Turnover Ratio = 3 Times.

- Increase ;

- Decrease;

- Decrease;

- Increase;

- Increase;

- Increase.

90. From the following information, calculate inventory turnover Ratio:

Credit revenue from operations 6,00,000; cash revenue from operations 2,00,000 gross profit 25% of cost, closing was 3 times the opening inventory. Opening inventory was 10% of cost of revenue from operations.

Solution:

Net revenue from operation = credit revenue from operation +Cash revenue from operation

= 6,00,000 + 2,00,000

= 8,00,000

Let the cost of goods sold be x

Gross profit = net revenue from operations – cost of goods sold

25 / 100x = net revenue from operation – x

(1 + 25/100) x = 8,00,000

x = 8,00,000 x 100/125

cost of revenue from operations = 6,40,000

opening inventory = 10% of cost of revenue from operations

= 10/100x 6,40,000

= 64,000

Closing inventory = 3 x 64,000 = 1,92,000

Avg. inventory = Opening inventory + closing inventory / 2

= 64,000 + 1,92,000 / 2

= 1,28,000

Inventory turnover ratio = Cost of goods sold / average inventory

= 6,40,000 / 1,28,000

= 5 times

91. Following figures have been extracted form shivalika mills Ltd.

Inventory in the beginning of the year 60,000.

Inventory at the end of the year 1,00,000.

Inventory turnover Ratio 8 times.

Selling price 25% above cost.

Compute amount of Gross Profit and Revenue from operations (Net sales).

Solution:

Avg. inventory = Opening inventory + closing inventory / 2

= 60,000 + 1,00,000 / 2

= 80,000

Inventory turnover ratio = Cost of goods sold / average inventory

8 = Cost of good sold / 80,000 cost of goods sold = 6,40,000

Selling price = 25% above cost

Revenue from operation = 6,40,000 +25%/100 x 6,40,000

= 6,40,000 + 1,60,000

= 8,00,000

Gross profit = revenue from operation – cost of goods sold

= 8,00,000 – 6,40,000

= 1,60,000

Calculation of Opening and Closing Inventory

92. From the following information, calculation value of opening inventory:

Closing inventory 68,000

Total sales 4,80,000 (including cash sales 1,20,000)

Total purchases 3,60,000 (including credit purchases 2,39,200)

Goods are sold at a profit of 25% on cost.

Solution:

Gross profit = revenue from operation – cost of goods sold

25/100x = 4,80,000 – x

25x + x / 100 = 4,80,000

Cost of goods sold = 4,80,000 x 100/ 25

= 3,84,000

Cost of goods sold = opening inventory + purchase – closing inventory

3,84,000 = opening inventory + 3,60,000 – 68,000

Opening inventory = 3,84,000 – 3,60,000 + 68,000

= 92,000

93. From the following information, determine opening and closing inventories:

Inventory turnover Ratio 5 times, total sales 2,00,000, gross profit Ratio 25%. Closing inventory is more y 4,000 than the opening inventory.

Solution:

Gross profit = 25% of sales

= 25/100 x 2,00,000

= 50,000

Gross profit = revenue from operation – cost of goods sold

50,000 = 2,00,000 – cost of goods sold

Cost of goods sold = 1,50,000

Let the opening inventory be x

Closing inventory = x + 4,000

Inventory turnover Ratio = Cost of goods sold / average inventory

= 1,50,000 / x + x + 4,000 / 2

5 (2x + 4,000) = 1,50,000 x 2

10 x + 20,000 = 3,00,000

X = 3,00,000 – 20,000 / 10

Opening inventory = 28,000

Closing inventory = 28,000 + 4,000

= 32,000

94. Inventory turnover Ratio 5 times; cost of Revenue from operations (cost of goods sold) 18,90,000. Calculate opening inventory and closing inventory if inventory at the end is 2.5 times more than that in the beginning.

Solution:

Let the opening inventory be x

Closing inventory = x + 2.5 x = 3.5 x

Inventory turnover Ratio = Cost of goods sold / average inventory

5 = 1,50,000 / x+x+2.5 / 2

5 (4.5 x) = 18,90,000 x 2

X = 18,90,000 – 2x / 5x 4.5

Opening inventory = 16,80,000

Closing inventory = 16,80,000 x 3.5

= 5,88,000

Calculate of Revenue from Operations

95. Average inventory of AB Ltd. Is Rs.1,00,000 and the inventory turnover ratio is 6 times. Calculate the amount of Revenue from Operation if goods are sold at a profit of 25% on Revenue from Operations:

Inventory turnover ratio=cost of revenue from operation

Average inventory

6 = cost of revenue from operation

100,000

= 600,000

Goods sold at a profit of 25% on revenue from operation which means

Cost of revenue from operation=75% revenue from operation

Lets assume revenue from operation x

Cost of revenue from operation=revenue from operation

600,000 =75x

100

X=800,000

Revenue from Operation = Rs.8,00,000.

TRADE RECEIVABLES TURNOVER RATIO

96. Credit revenue from operations, i.e., Net credit sale for the year

Debtors 12,00,000

Bills Receivable 1,20,000

Calculate Trade receivables turnover Ratio 80,000

Calculate Trade Receivables Turnover Ratio.

Solution:

Avg. trade receivables = 1,20,000 + 80,000

Trade receivable turnover Ratio = Credit revenue from operation / Average trade receivable

= 12,00,000 / 2,00,000

= 6 times

97. Calculate trade receivables turnover Ratio from the following information:

Opening Balance closing Balance

Sundry debtors 28,000 25,000

Bills Receivables 7,000 15,000

Provision for doubtful debts 1,500 4,500

Total sales 1,00,000; sales return 1,5000; cash sales 23,5000.

Solution:

Avg. Trade Receivable = Opening debtors + closing debtors / 2 + Op. T/R + Cl. T/R / 2

= 28,000 + 25,000/2+ 7,000 + 15,000/2

= 26,500 + 11,000

= 37,500

Net credit sales = 1,00,000 – 1500 – 23,500

= 75,000

Trade receivable turnover Ratio = Credit Revenue from operation / Average Trade Receivable

= 75,000 / 37,000

= 2 times

98. Closing Trade receivables 90,000 revenue from operation 7,20,000, cash revenue from operations 1,80,000. Provision for doubtful debts 8,000. Calculate Trade receivables turnover Ratio.

Solution:

Avg. Trade Receivable = 90,000

Credit revenue from operations = 7,20,000 – 1,80,000

= 5,40,000

Inventory turnover Ratio = Cost of goods sold / average inventory

= 5,40,000 / 90,000

= 6 times

99. Closing Trade Receivables 1,00,000; cash sales being 25% of credit sales; Excess of closing Trade Receivables over opening Trade Receivables 40,000; revenue from operations, i.e., net sales 6,00,000. Calculate trade receivable turnover Ratio.

Solution:

Closing Trade receivable = 1,00,000

Opening Trade receivable = 60,000

Net sales = cash sales + credit sales

6,00,000 = 25/100x + x

25x / 100 = 6,00,000

Credit sales = 6,00,000 x 100 / 125

Credit + sales = 4,80,000

Inventory receivable turnover Ratio = Net credit + Sales / Average trade receivable

5 = 4,80,000 / 60,000 + 1,00,000/2

= 4,80,000 x 2 / 1,60,000

= 6 times

100. compute Trade receivables turnover Ratio from the following:

31st March, 31st March,

2024 2025

Revenue from operations (Net sales) 8,00,000 7,00,000

Debtors in the beginning of year 83,000 1,17,000

Debtors at the end of year 1,17,000 83,000

Sales Return 1,00,000 50,000

solution:

2021

Avg. Trade Receivable = Opening debtors + closing debtors / 2

= 83,000 + 1,17,000 /2

= 1,00,000

Trade Receivable Turnover Ratio = Credit Revenue from operation / Average Trade Receivable

= 8,00,000 / 1,00,000

= 8 Times

2022

Avg. Trade Receivable = Opening debtors + closing debtors / 2

= 1,17,000 + 83,000 /2

= 1,00,000

Trade Receivable Turnover Ratio = Credit Revenue from operation / Average Trade Receivable

= 7,00,000 / 1,00,000

= 7 Times

101. Closing Trade Receivables 1,20,000, Revenue from operations 14,40,000. provision for Doubtful Debt 20,000. Calculate trade receivables Ratio.

solution:

Trade Receivable Turnover Ratio = Credit Revenue from operation / Average Trade Receivable

= 14,40,000 / 1,20,000

= 12 Times

102. Closing Trade Receivables 4,00,000; Cash sales being 25% of credit sales; Excess of closing Trade Receivables over opening Trade Receivables 2,00,000; Revenue from operations, i.e., Net sales 15,00,000. Calculate Trade Receivables Turn over Ratio.

Solution:

Closing Trade Receivable = 4,00,000

Opening Trade Receivable = 4,00,000 – 2,00,000

= 2,00,000

Net Revenue from operation = Cash sales + Credit + Sales

15,00,000 = 25x /100 + x

Closing Trade Receivable = 4,00,000

Opening Trade Receivable = 4,00,000 – 2,00,000

= 2,00,000

Net sales = Cash sales + Credit + Sales

15,00,000 = 25x /100 + x

x = 15,00,000 x 100 / 125

credit sales = 12,00,000

Trade Receivable Turnover Ratio = Credit Revenue from operation / Average Trade Receivable

= 12,00,000/2,00,000+4,00,000/2

= 12,00,000 x 2 / 6,00,000

= 4 Times

103. A form normally has Trade Receivables equal to two months credit sales. During the coming year it expects credit sales of 7,20,000 spread evenly over the year (12 months). What is estimated amount of Trade Receivables at the end of the year?

Solution:

Closing Trade Receivable = Two months credit sales

= x 2

= 1,20,000

104. Mercury Ltd. made credit sales of 4,00,000 during the financial period. If the collection period is 36 days and year is assumed to be 360 days, calculate:

- Trade Receivables Turnover Ratio;

- Average Trade Receivables;

- Trade Receivables at the end when Receivables at the end are more than in the beginning by 6,000.

Solution:

Debt Collection period = Number of Days / Trade receivable turnover ratio

36 = 360 / Trade receivable turnover ratio

Trade Receivable Turnover Ratio = Net Credit Sales / Average Trade Receivable

10 = 4,00,000 / Average Trade Receivable

Avg. Trade Receivables = 40,000

Let the opening trade receivable be x

closing Trade receivable = x + 6,000

Avg. Trade Receivable = Op. T / R + Cl. T / R /2

40,000 = x + x + 6,000 / 2

2 x + 6,000 = 80,000

Opening trade r = 37,000

Closing Inventory = 43,000

105. Calculate Trade Receivables Turnover Ratio in each of the following alternative cases:

Case 1: Net credit sales 4,00,000; Average Trade receivables 1,00,000.

Case 2: Revenue from operations (Net sales) 30,00,000; Cash revenue from operations, i.e., Cash sales 6,00,000; opening trade receivables 2,00,000; closing trade receivables 6,00,000.

Case 3: Cost of revenue from operations or cost of goods gold 3,00,000; Gross profit on cost 25% cash sales 20% of Total sales; opening trade receivables 50,000; closing trade receivables 1,00,000.

Case 4: Cost of Revenue from operations or cost of goods sold 4,50,000; Gross profit on sales 20% cash sales 25% of net credit sales, opening trade receivables 90,000; closing trade receivables 60,000.

Case 1:

Trade Receivable Turnover Ratio = Net Credit Sales + Revenue from Operation /Ave. Trade Receivable

= 4,00,000 / 1,00,000 = 4 times

Case 2: Net credit revenue from operation = Net sales – cash sales

= 30,00,000 – 6,00,000

= 24,00,000

Avg. Trade Receivable = Op. T/R + Cl. T/R /2

= 2,00,000 + 6,00,000 / 2

Average Trade Receivable = 4,00,000

Trade Receivable Turnover Ratio = Net Credit Sales / Ave. Trade Receivable

= 24,00,000 / 4,00,000 = 6 times

Case 3:

Gross profit = 25 /100 of cost goods sold

= 25/ 100 x 3,00,000

= 75,000

Gross profit = Revenue from operation – cost of goods sold

75,000 = Revenue form operation – 3,00,000

Revenue from operation (Net sales) = 3,75,000

Net sales = Cash Sales + Credit sales

3,75,000 = 25/100 x 3,75,000 + Credit sales

credit sales = 3,75,000 – 75,000

= 3,00,000

Inventory Turnover Ratio = Net Credit Revenue from operation / Average Trade Receivable

= 3,00,000/50,000 + 1,00,000 / 2

= 3,00,000 x 2 / 1,50,000

= 4 times

Case 4:

Gross profit = Net Return from operation – cost of goods sold

25/100x = x – 4,50,000

80x / 100 = 4,50,000

Net revenue from operations = 4,50,000 x 100 / 80

= 5,62,500

Net sales = cash sales + credit sales

5,62,500 = 25/100x + x

Net credit revenue from operations = 5,62,500 x 100 / 125

= 4,50,000

Avg. Trade Receivable = Op. T/R + Cl. T/R / 2

= 90,000 + 60,000 / 2

= 75,000

Inventory Turnover Ratio = Net Credit Revenue from operation / Average Trade Receivable

= 4,50,000 / 75,000

= 6 times

106. From the information given below calculate Trade Receivables Turnover Ratio:

Credit Revenue from operations, i.e., Credit sales 8,00,000; opening Trade Receivables 1,20,000; and closing Trade Receivables 2,00,000.

State, giving reason, which of the following would increase, decrease or not change Trade Receivables Turnover Ratio:

- Collection From Trade Receivables 40,000.

- Credit Revenue from operations, i.e., credit sales 80,000

- Sales Return 20,000

- Credit Purchase 1,60,000.

Solution:- Trade Receivables Turnover Ratio = 5 Times.

- Increase,

- Decrease;

- Increase,

- No Change.

CALCULATION OF OPENING AND CLOSING TRADE RECEIVABLES

107. 1,75,000 is the Credit revenue from operations, i.e., Net credit of an enterprise. If Trade Receivables Turnover Ratio is 8 times, calculate Trade Receivables in the beginning and at the end of the year. Trade Receivables at the end is 7,000 more than in the beginning.

Solution:

Credit revenue from operation = 1,75,000

Let the Trade receivable in the begening be = x

Closing Trade Receivable = x + 7,000

Trade Receivable Turnover Ratio = Net Credit Revenue from operation / Average Trade Receivable

8 = 1,75,000/ x + x + 7,000 / 2

8 = 1,75,000 / 2x + 7,000

8(2x + 7,000) = 1,75,000 x 2

2x + 7,000 = 1,75,000 x 2 / 8

2x = 43,750 – 7,000

Opening Trade Receivable (x) = 36,750 / 2

= 18,375

Closing Trade Receivable = 18,375 + 7,000

= 25,375

108. From the following information, calculation opening and closing Trade Receivables, if Trade Receivables Turnover Ratio is 3 Times.

- Cash Revenue from operations is 1/3rd of credit Revenue from operations .

- Cost of Revenue from operations is 3,00,000.

- Gross profit is 25% of the Revenue from operations.

- Trade Receivables at the end are 3 times more than that of the beginning.

Solution:

Gross profit = Net sales – Cost of Goods sold

= 25/100 x = x – 3,00,000

x – 25 /100 = 3,00,000

= 75/100 x = 3,00,000

x = 3,00,000 x 100 /75

Net revenue from operations = 4,00,000

let cash sales be x

Net revenue from operations = cash sales + credit sales

4,00,000 = 1/3 x + x

= 4x/3 = 4,00,000

x = 4,00,000 x 3 / 4

Net credit revenue from operation = 3,00,000

Let the opening trade receivable be x

closing trade receivables = x + 3x

Trade Receivable Turnover Ratio = Net Credit Revenue from operation / Average Trade Receivable

3 = 3,00,000 / x + 4x / 2

3 (x + 4x) = 3,00,000 x 2

x = 3,00,000 x 2 / 3 x 5

Opening Trade Receivable = 40,000

Closing Trade Receivable = 40,000 x 4

= 1,60,000

109. Cash revenue from operations (cash sales) 2,00,000, cost of Revenue from operations or cost of goods sold 3,50,000; Gross profit 1,50,000; Trade Receivables Turnover Ratio 3 times. Calculate opening and closing Trade Receivables in each of the following alternative cases:

Case 1: If closing Trade Receivables were 1,00,000 in excess of Opening Trade Receivables.

Case 2: If Trade Receivables at the end were 3 times than in the beginning.

Case 3: If Trade Receivables at the end were 3 times more than that of in the beginning.

Solution:

Gross profit = Net sales – Cost of goods sold

1,50,000 = Net sale – 3,50,000

Net sales = 5,00,000

Net sales = Cash sales + Credit sales

5,00,000 = 2,00,000 + Credit sales

Net credit revenue from operation = 3,00,000

(Net credit sales)

Case : 1

Opening Trade Receivable = x

Closing Trade Receivable = x + 1,00,000

Trade Receivable Turnover Ratio =

3 =

2x + 1,00,000 = 3,00,000 x 2

3

2x = 2,00,000 – 1,00,000

x =

Opening Trade Receivable = 50,000

Closing Trade Receivable = 50,000 + 1,00,000

= 1,50,000

Case : 2

Opening Trade Receivable = x

Closing Trade Receivable = 3x

Trade Receivable Turnover Ratio = Net Credit Revenue from operation / Average Trade Receivable

3 = 3,00,000 / x + (x + 1,00,000) / 2

3(x + 3x) = 3,00,000 x 2

3 x 4

Opening Trade Receivable = 50,000

Closing Trade Receivable = 50,000 x 3

= 1,50,000

Case : 3

Opening Trade Receivable = x

Closing Trade Receivable = x + 3x = 4x

Trade Receivable Turnover Ratio = Net Credit Revenue from operation / Average Trade Receivable

3 = 3,00,000 / x + 3x / 2

3(x + 4x) = 3,00,000 x 2

3 x 5

Opening Trade Receivable = 40,000

Closing Trade Receivable = 40,000 x 4

= 1,60,000

TRADE PAYABLES TURNOVER RATIO

110. Calculate Trade payable turnover ratio from the following information:

Opening Creditors 1,25,000; opening bills payable 10,000; closing creditors 90,000 closing bills payable 5,000 purchase 9,50,000 cash purchase 1,00,000 purchase return 45,000.

Solution:

Net credit purchase = Total purchase – cash purchase – purchase Return

= 9,50,000 – 1,00,000 – 45,000

= 8,05,000

Avg. Creditors = Op. Creditors + Cl. Creditors / 2

= 1,25,000 +90,000 / 2

= 1,07,500

Avg. Trade payable = Op. B/P + Cl. B/P /2

= 10,000 + 5,000 / 2

= 7,500

Avg. Trade payable = Avg. creditors + Avg. Bills payable

= 1,07,500 + 7,500

= 1,15,000

Trade Payable Turnover Ratio = Net Credit Purchase / Avg. Trade Receivable

= 8,05,0000 / 1,15,000

= 7 times

111. Calculate Trade payable turnover ratio and Average Debt payment period from the following111. information:

1st April, 2022 31st March, 2023

Sundry Creditors 1,50,000 4,50,000

Bills payable 50,000 1,50,000

Total purchases 21,00,000; purchases Return 1,00,000; cash purchases 4,00,000.

Solution:

Total purchase = Cash purchase + purchase return

21,00,000 = 4,00,000 + Credit purchase

Credit purchase = 17,00,000

Net credit purchase = Credit purchase – purchase Return

= 17,00,000 – 1,00,000

Avg. Trade payables = Op. Creditors + Cl. Creditors / 2 + Op. B /p + Cl. B /p /2

= 1,50,000 + 4,50,000 / 2 + 50,000 + 1,50,000 / 2

= 3,00,000 + 1,00,000

= 4,00,000

Trade Payable Turnover Ratio = Net Credit purchase / Avg. Trade Receivable

= 16,00,000 / 4,00,000

= 4 times