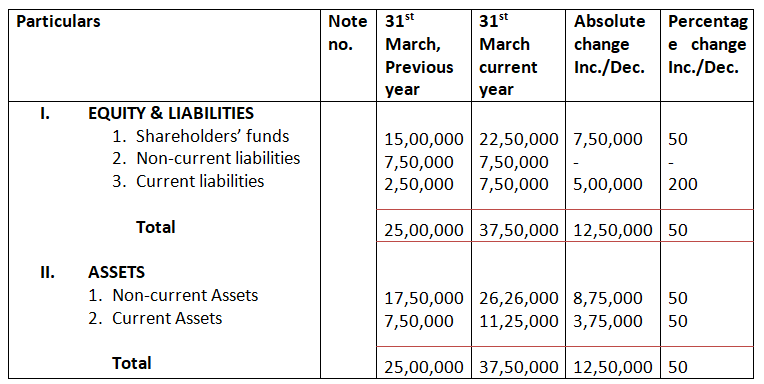

Comparative Balance Sheet

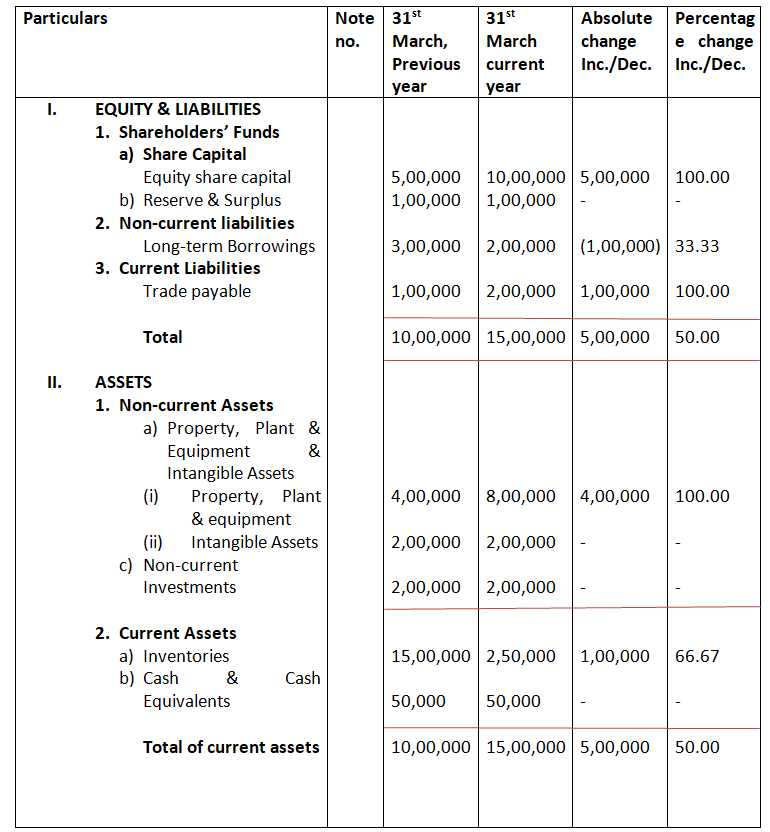

- From the following information, prepare Comparative Balance Sheet of Dreams Converge Ltd;

| Particulars | 31st March, 2024 ₹ | 31st March, 2025 ₹ |

| Shareholders’ Funds Non-current Liabilities Current Liabilities Non-current Assets Current Assets | 15,00,000 7,50,000 2,50,000 17,50,000 7,50,000 | 22,50,000 7,50,000 7,50,000 26,25,000 11,25,000 |

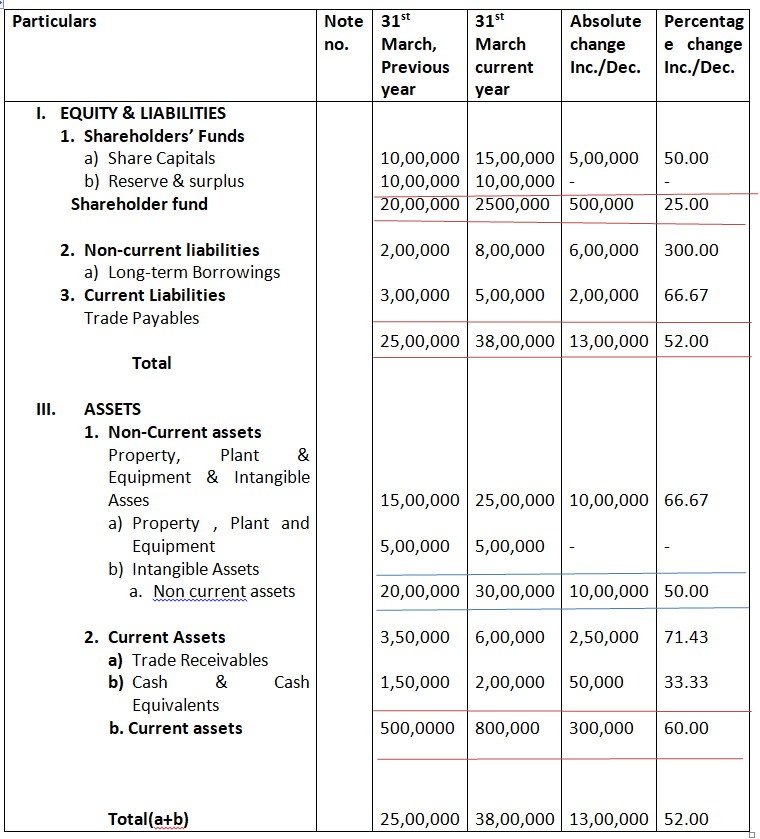

Solution –

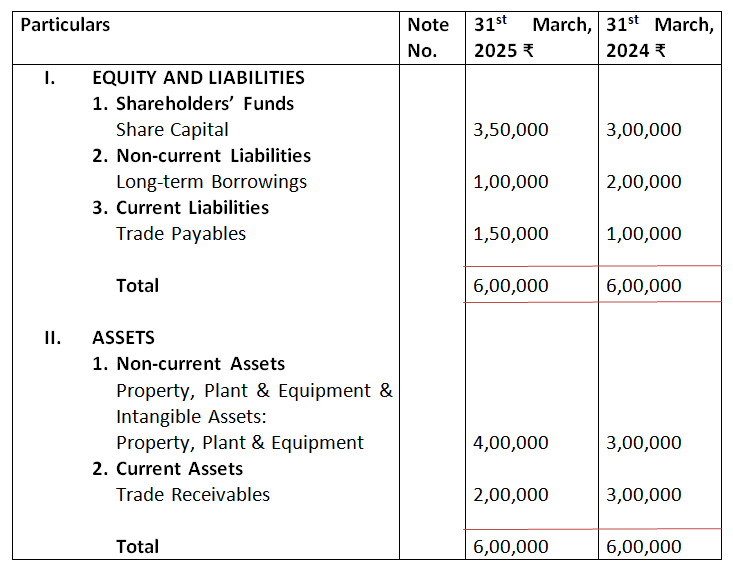

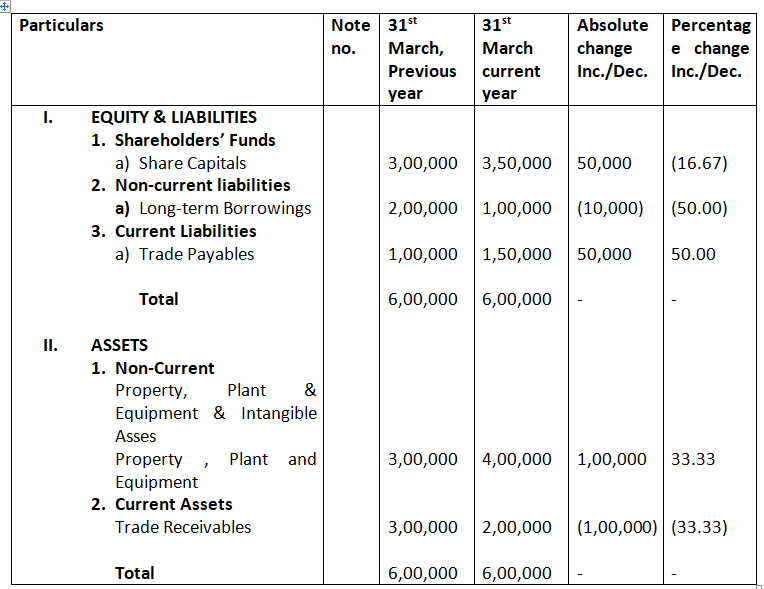

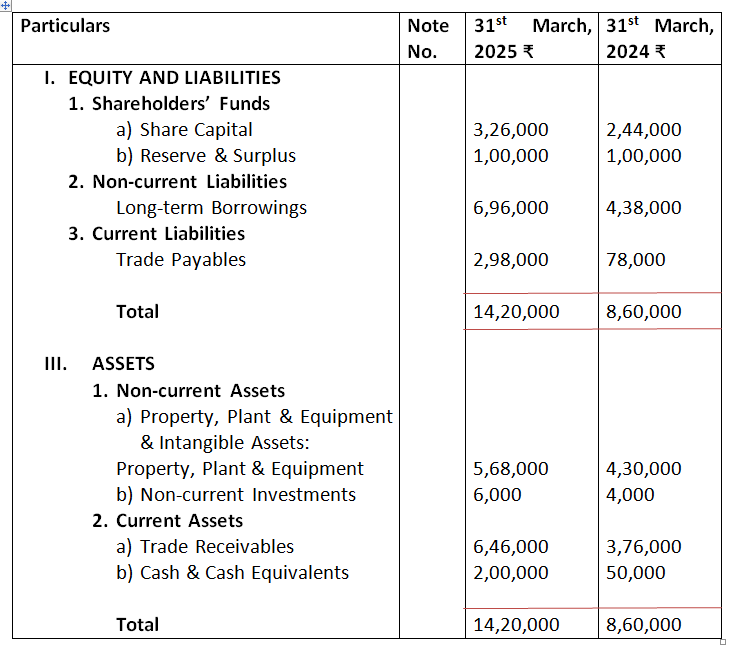

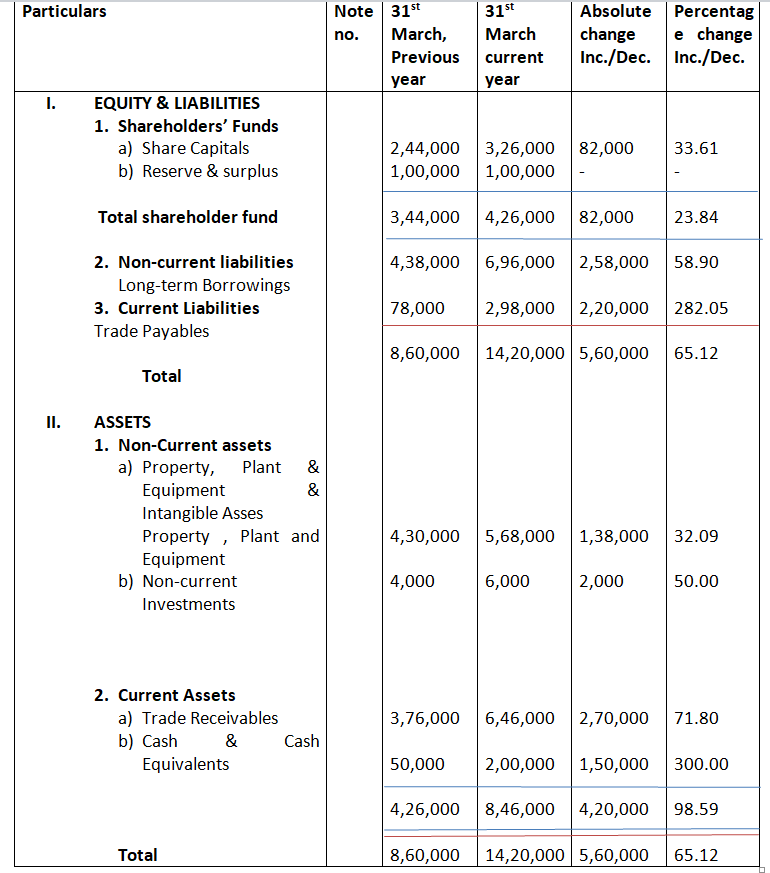

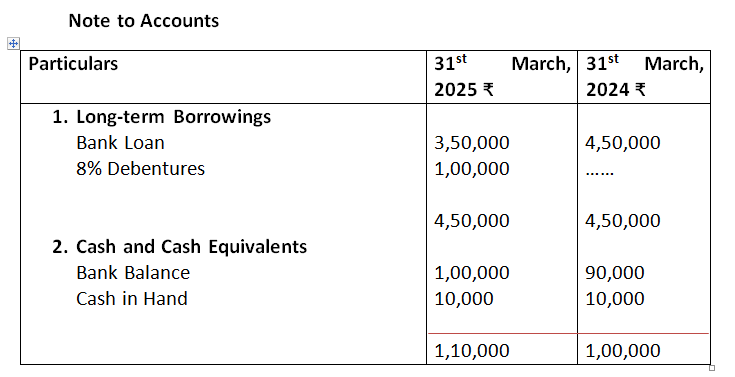

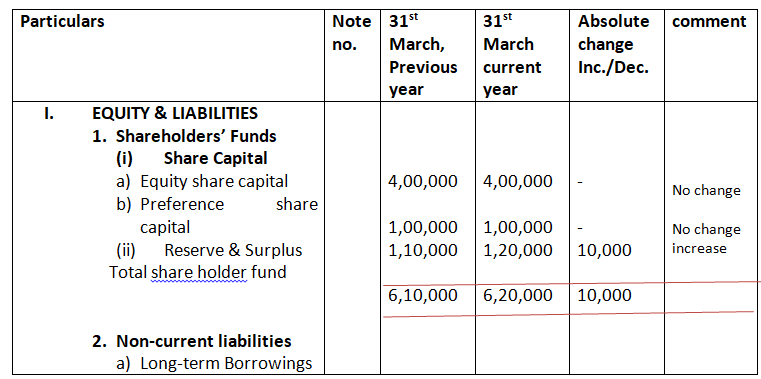

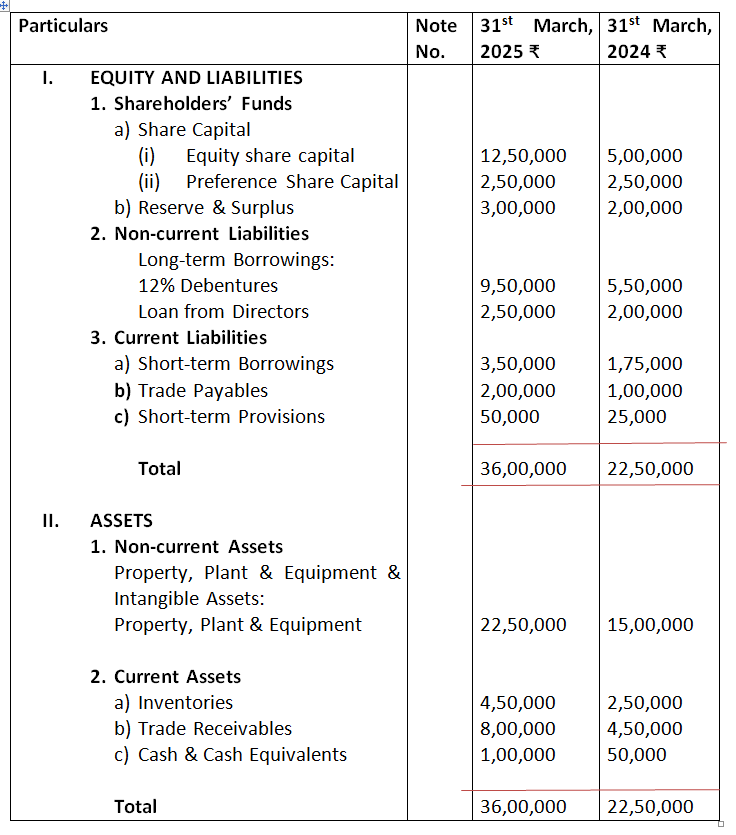

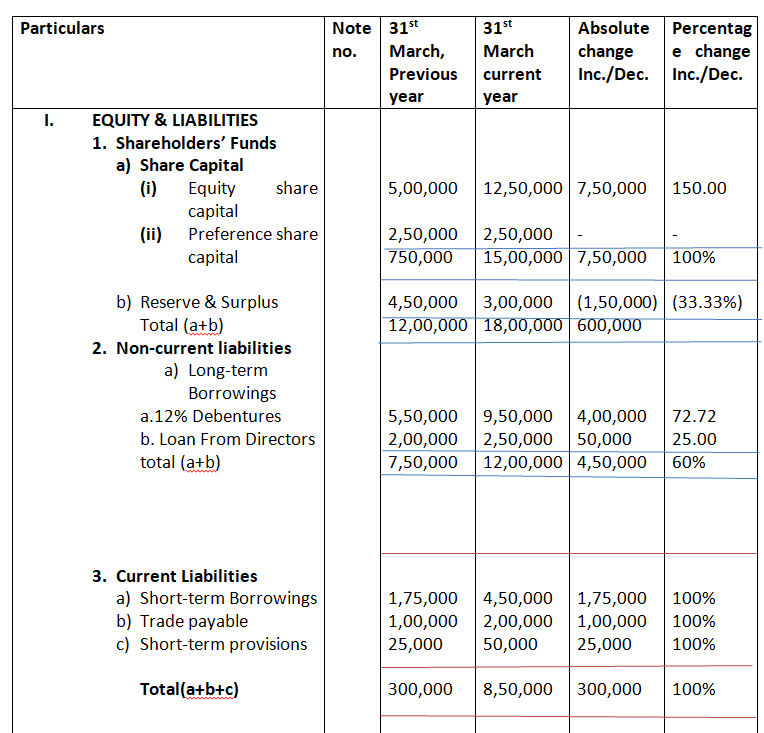

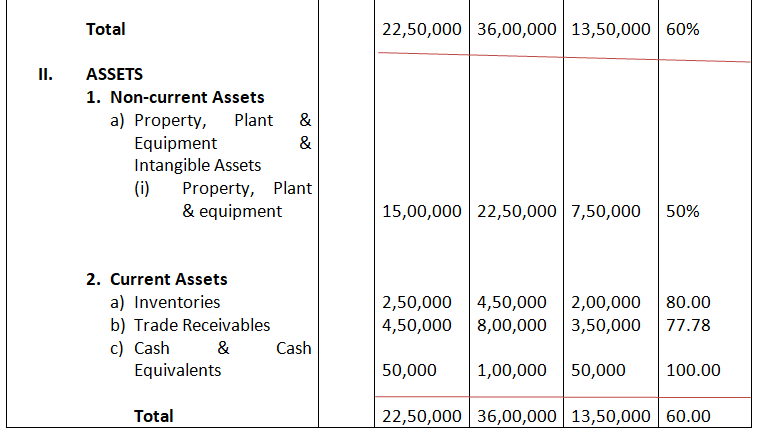

2. Form the following Balance Sheet, prepare Comparative Balance Sheet of Paras Milk Ltd.:

Solution –

Comparative Balance Sheet of Paras Lts. As at 31st march

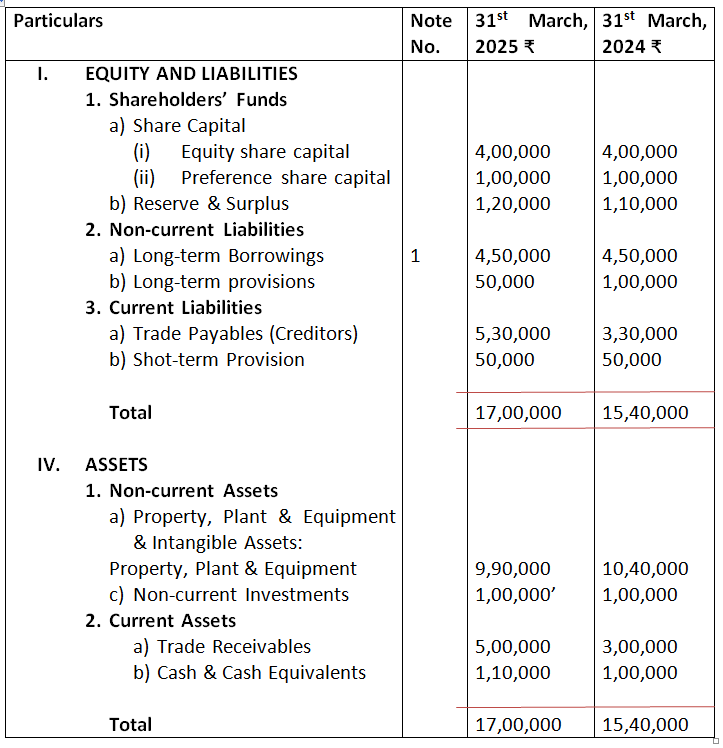

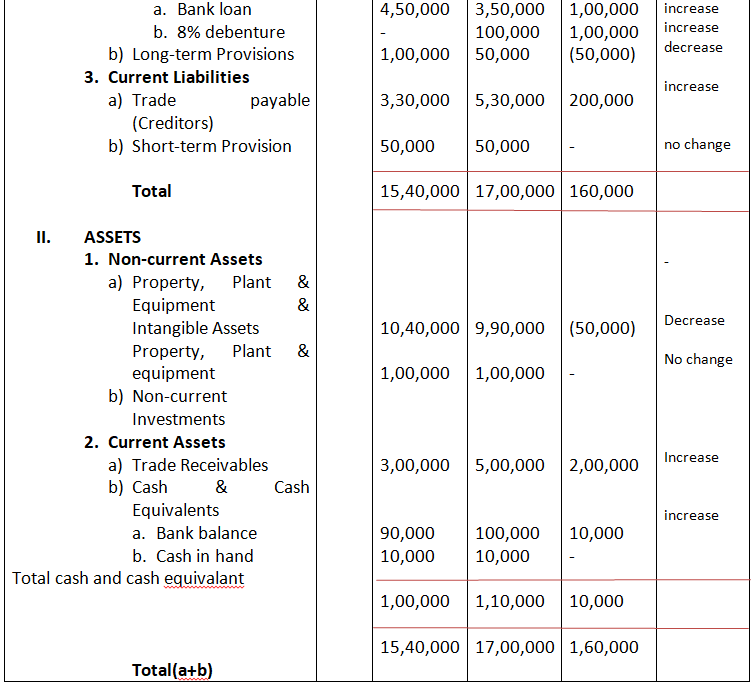

3. Following is the Balance Sheet of Gold Mohar Ltd., as at 31st March, 2025:

You are required to prepare Comparative Balance Sheet on the basis of the information given in the above Balance Sheet.

Solution –

Comparative Balance Sheet of Mohar Ltd., as at 31st March

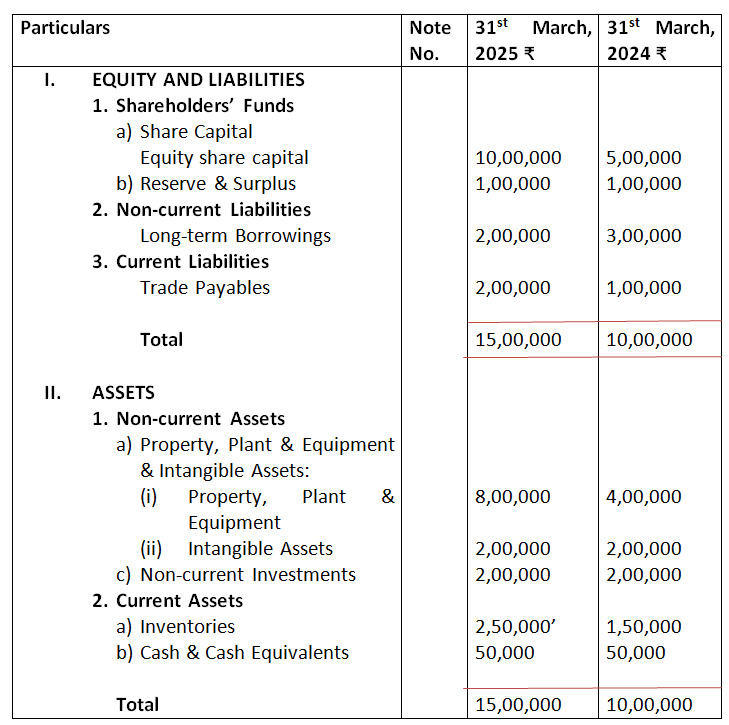

4. Balance Sheet of Raja Ltd. As at 31st March, 2025 is given

below:

Prepare Comparative Balance Sheet showing percentage changes from 2024 to 2025.

Solution –

Comparative Balance Sheet of Raja Ltd., as at 31st March

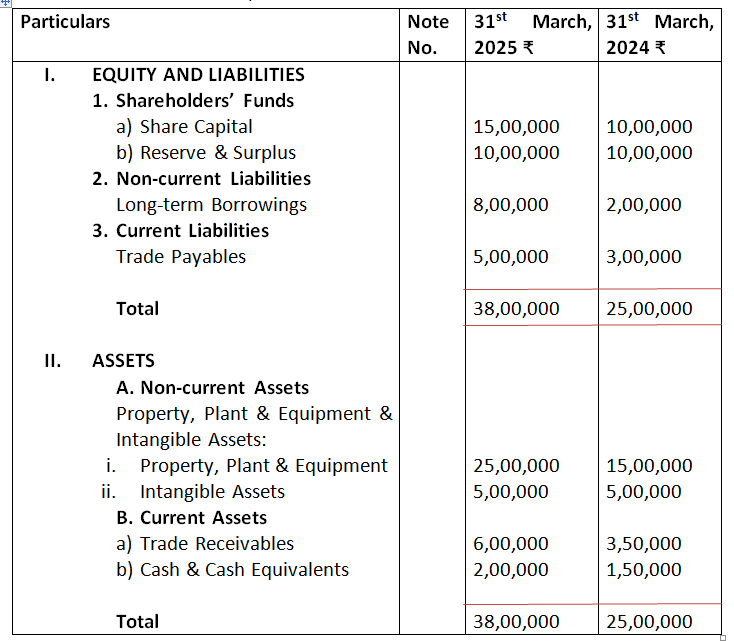

5. Following is the summarized Balance sheet of Hopeful Ltd. As at 31st March, 2025:

You are required to comment upon the changes in absolute figures form one period to another.

Solution –

Comparative Balance Sheet of Hopeful Ltd., as at 31st March

6. From the following Balance Sheet of Royal Industries Ltd. As at 31st March, 2025, prepare Comparative Balance Sheet:

Solution –

Comparative Balance Sheet of Royal Industries Ltd.

as at 31st March

7. From the following Balance Sheet of H.P. Ltd., as at 31st March, 2025 prepare Comparative Balance Sheet:

Solution –

Comparative Balance Sheet of H.P. Ltd. as at 31st March

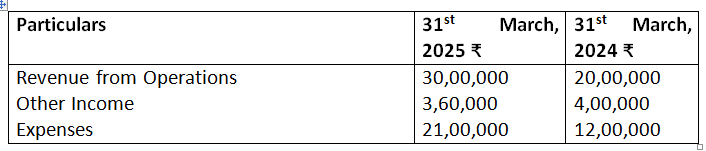

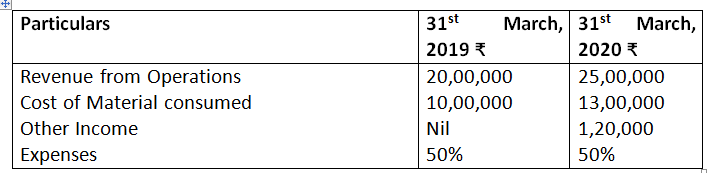

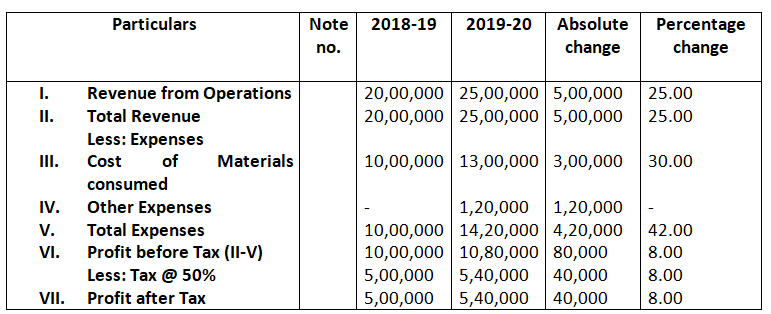

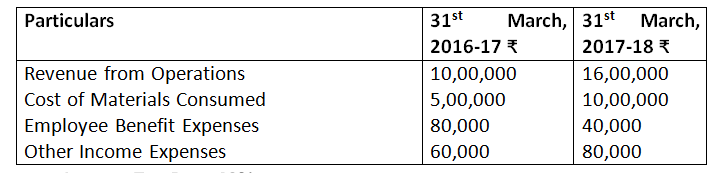

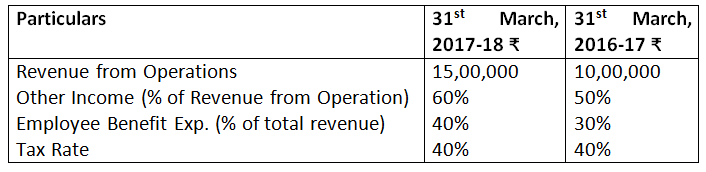

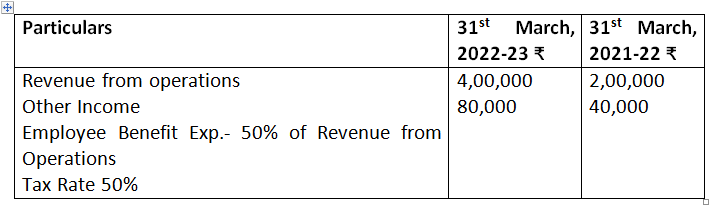

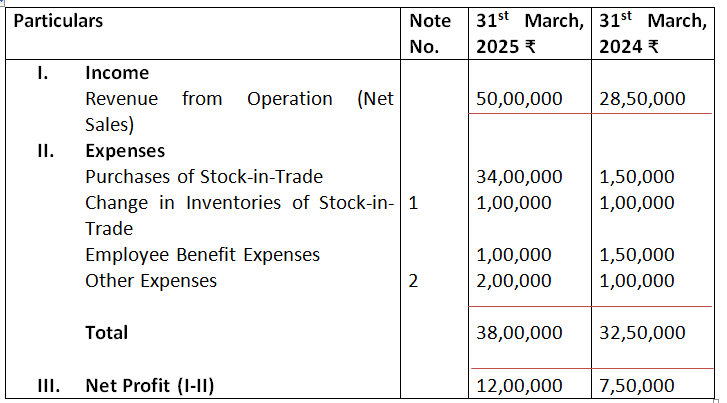

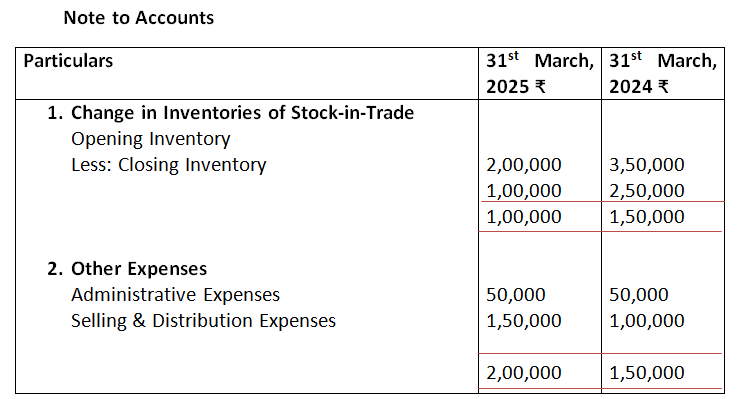

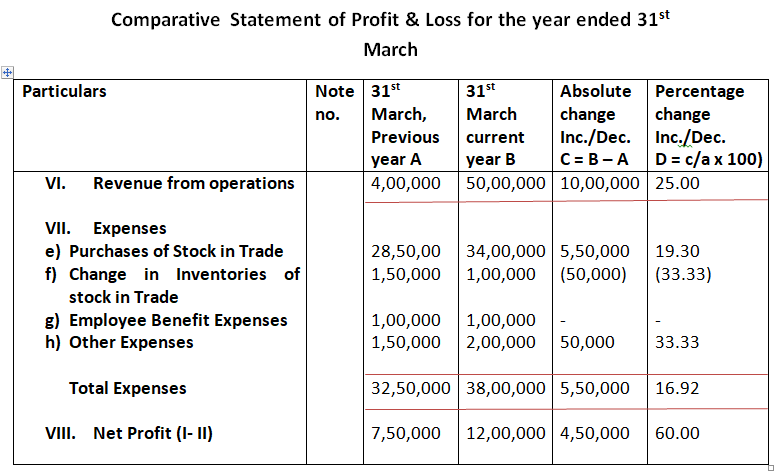

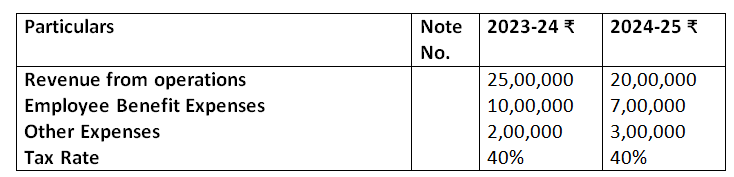

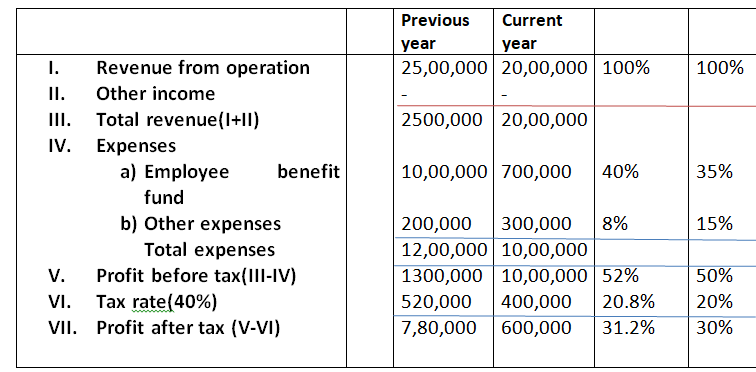

8. Prepare Comparative Statement of Profit & Loss from the following information:

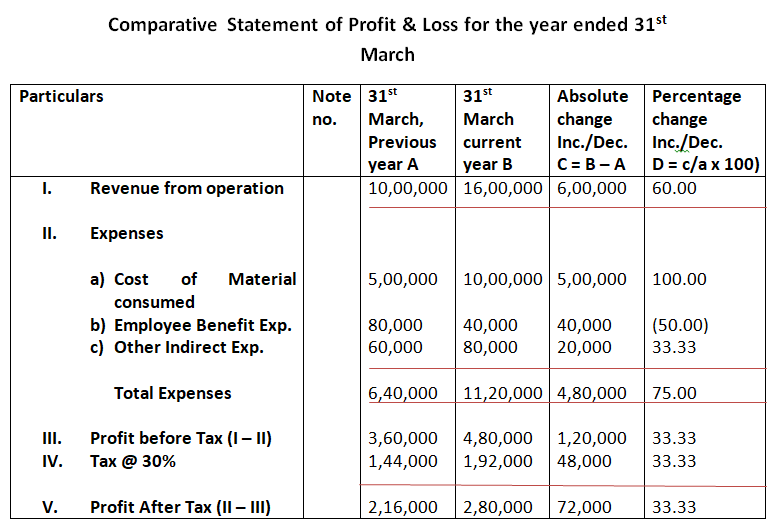

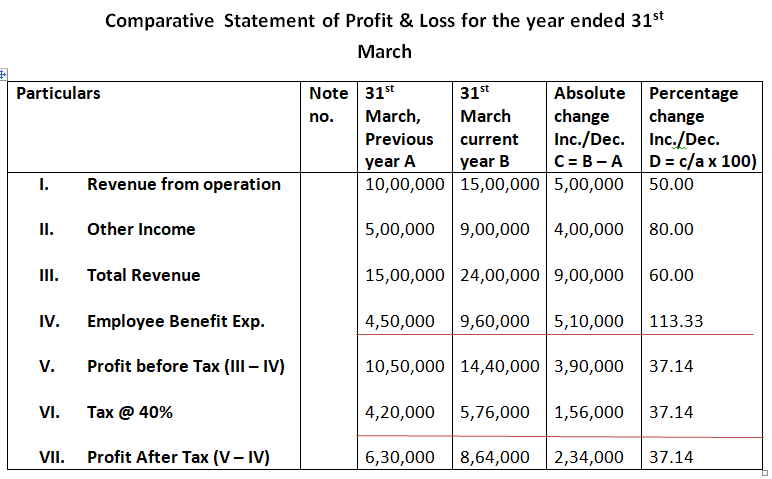

Solution – Comparative Statement of Profit & Loss for the year ended 31st March

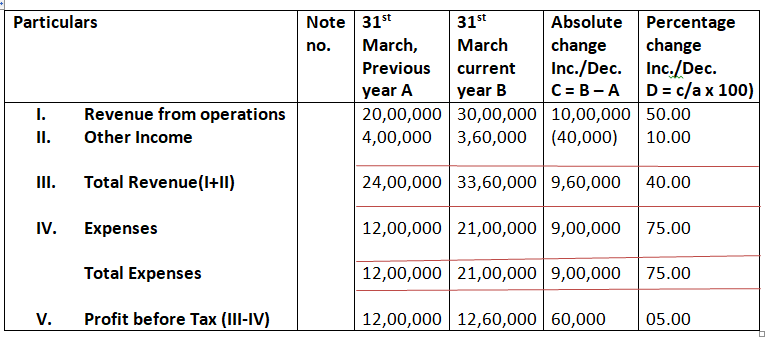

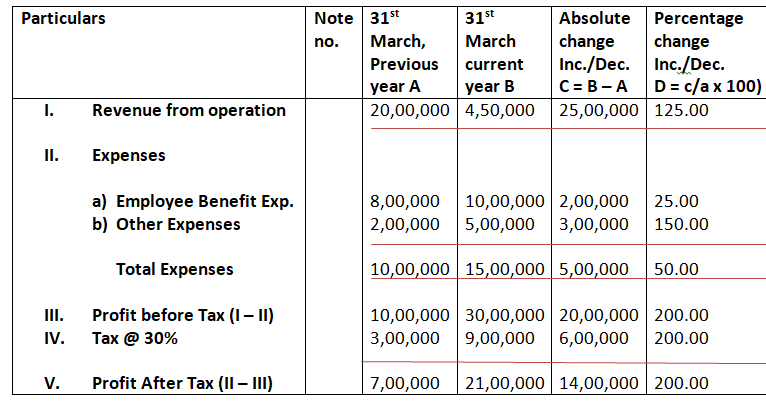

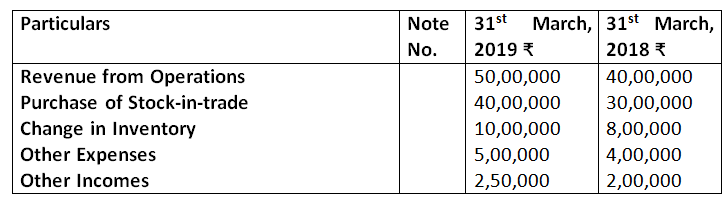

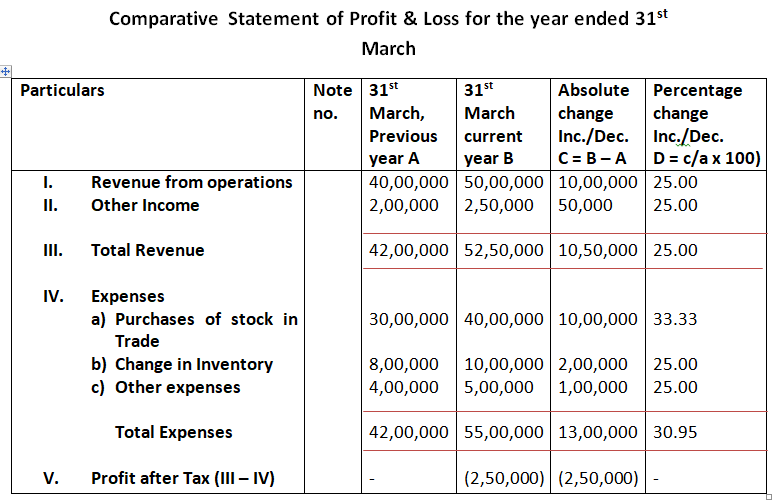

9. From the following Statement of Profit & Loss of Skills India Ltd., for the year ended 31st March, 2018 and 2019, prepare Comparative Statement of Profit & Loss:

Solution –

Comparative Statement of Profit & Loss for the year ended 31st March

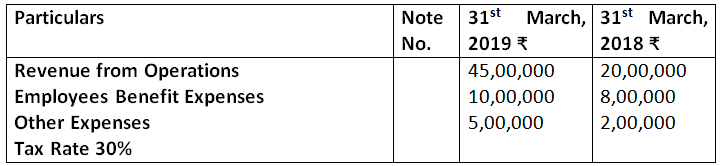

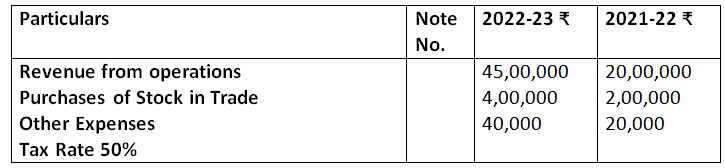

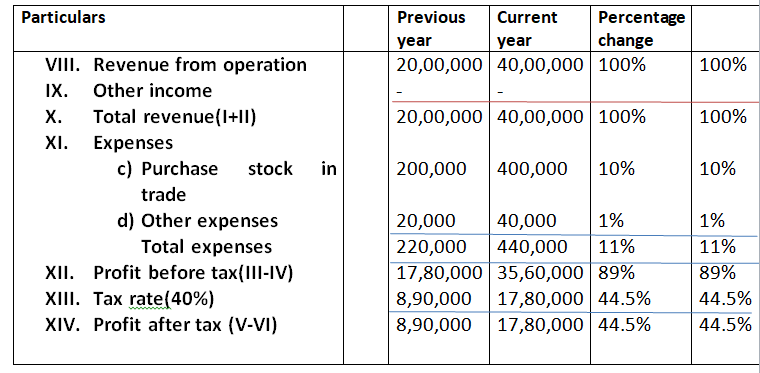

10. Prepare Comparative Statement of Profit & Loss from the following:

Solution –

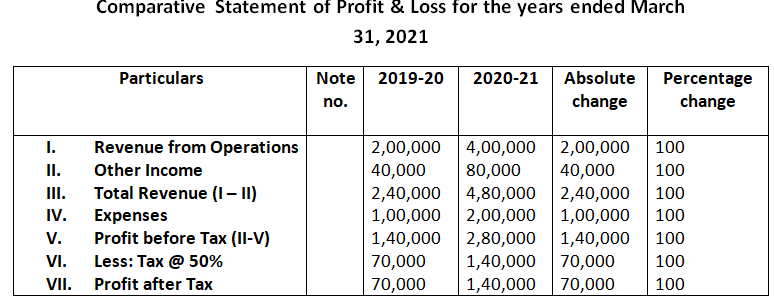

Comparative Statement of Profit & Loss

For the years ended March 31, 2021

11. Following information is extracted from the Statement of Profit & Loss of Gold Coin Ltd. For the year ended 31st March, 2025:

Prepare Comparative Statement of Profit & Loss.

Solution –

12. Prepare a Comparative Income Statement of Bikul Ltd. With the help of the following information:

Income Tax Rate 40%.

Solution –

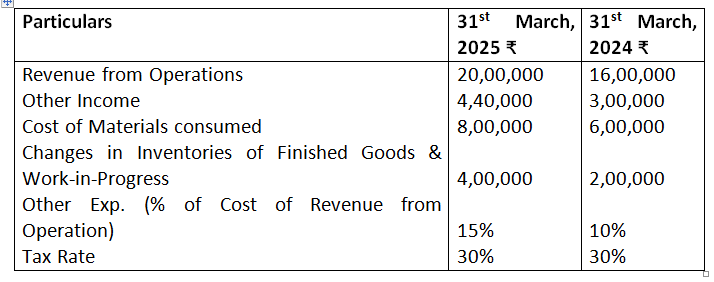

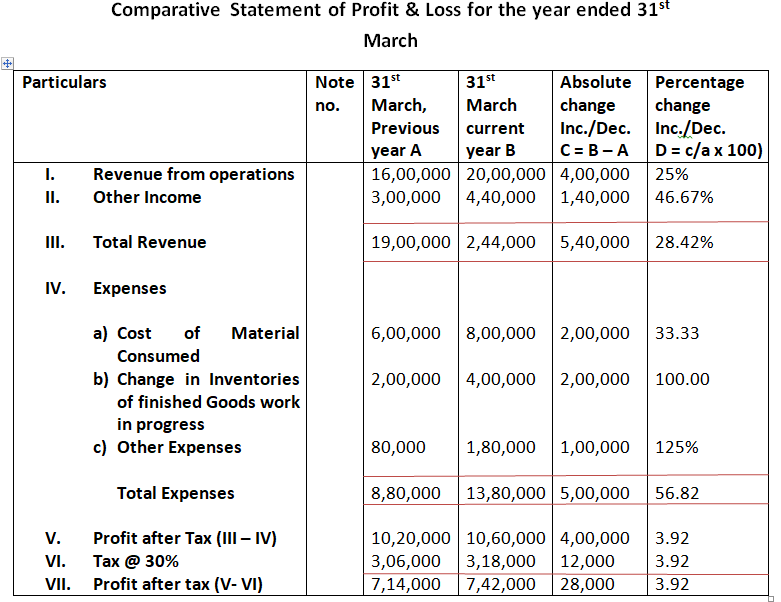

13. Prepare Comparative Statement of Profit & Loss from the following information:

Solution –

14. Prepare a Comparative Statement of Profit & Loss from the Information extracted from the Statement of Profit & Loss for the year ended 31st March, 2017 and 2018.

Solution –

15. From the following information, prepare Comparative Statement of Profit & Loss showing increase, decrease and percentage:

Solution –

16. From the following particulars obtained from the books of Mark, prepare a Comparative Statement of Profit & Loss:

Solution –

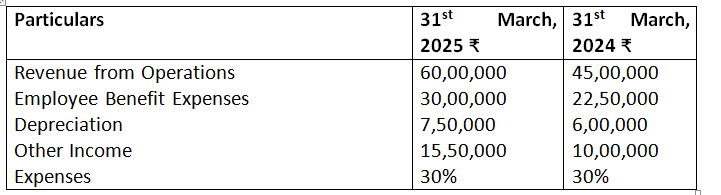

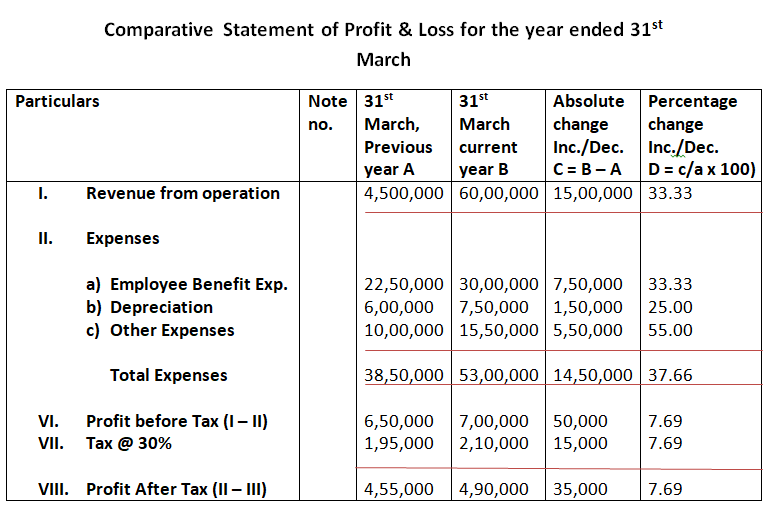

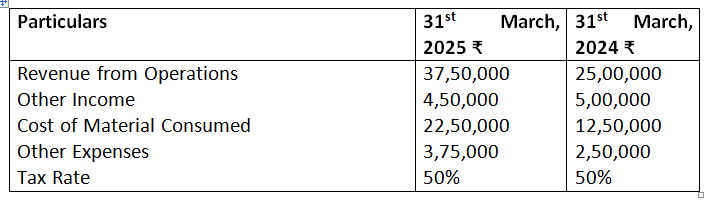

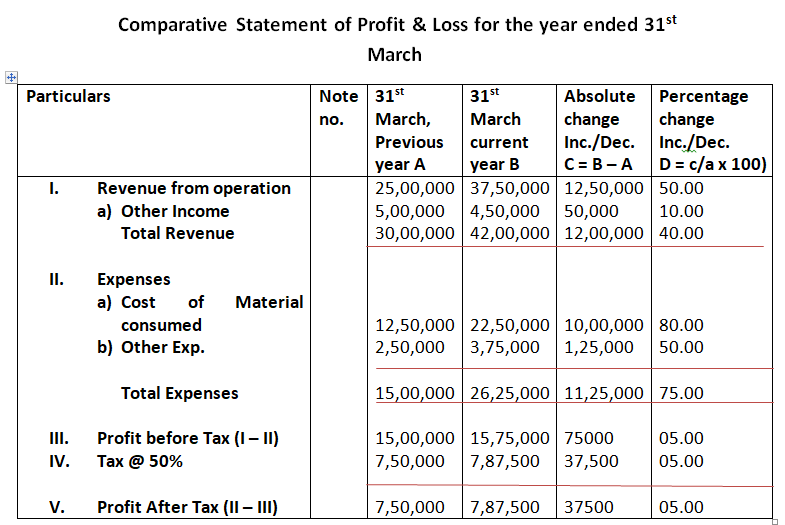

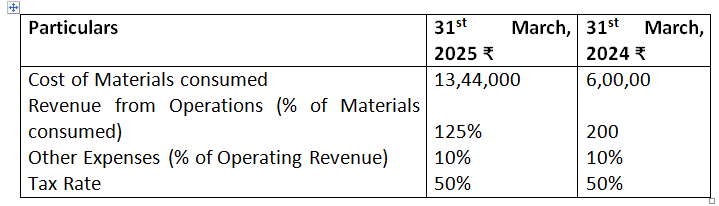

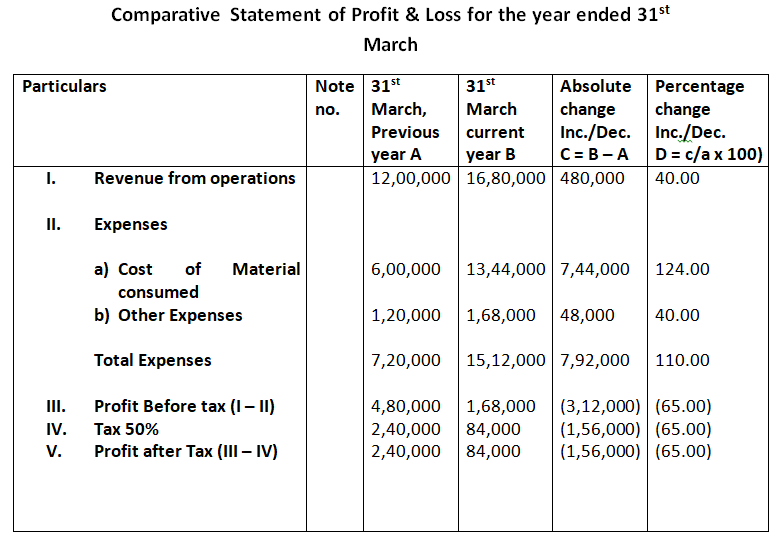

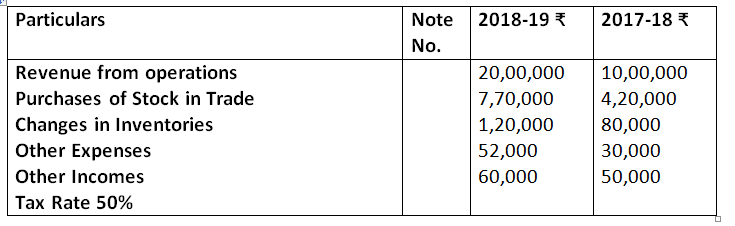

17. From the following information, prepare Comparative Statement of Profit & Loss:

18. From the following information, prepare Comparative Statement of Profit & Loss for the year ended 31st March, 2013:

Solution –

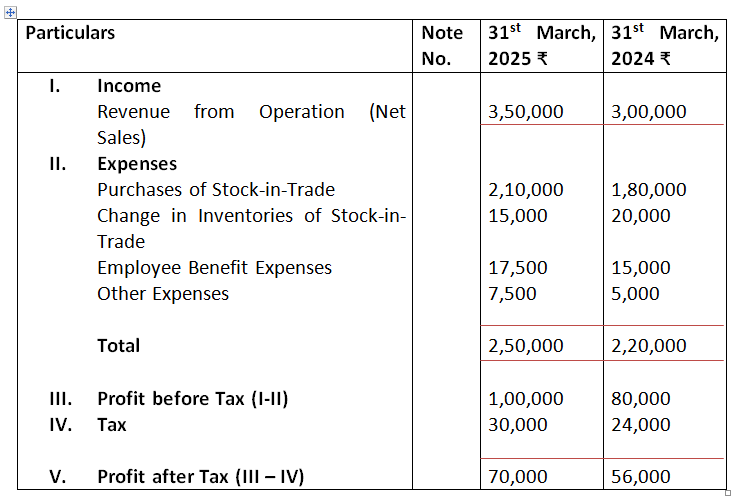

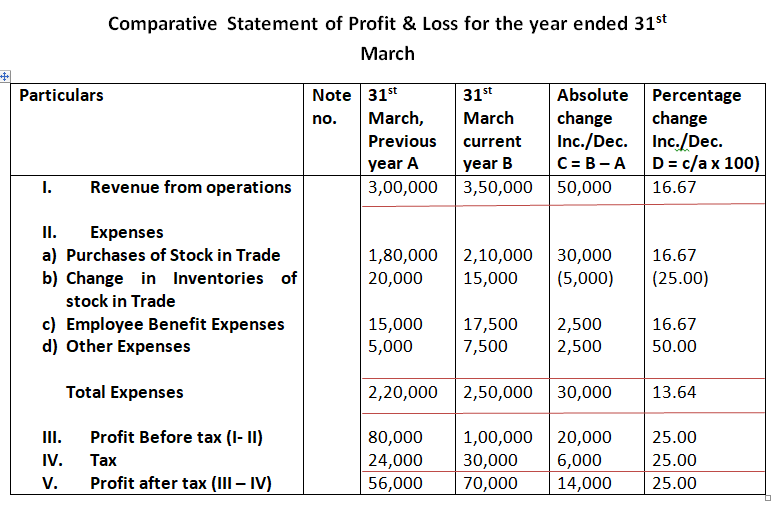

19. Prepare Comparative Statement of Profit & Loss from the following Statement of Profit & Loss:

Solution –

20. From the following Statement of profit and loss, prepare Comparative Statement of Profit & Loss:

Solution –

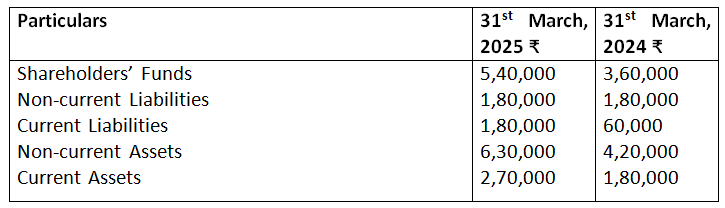

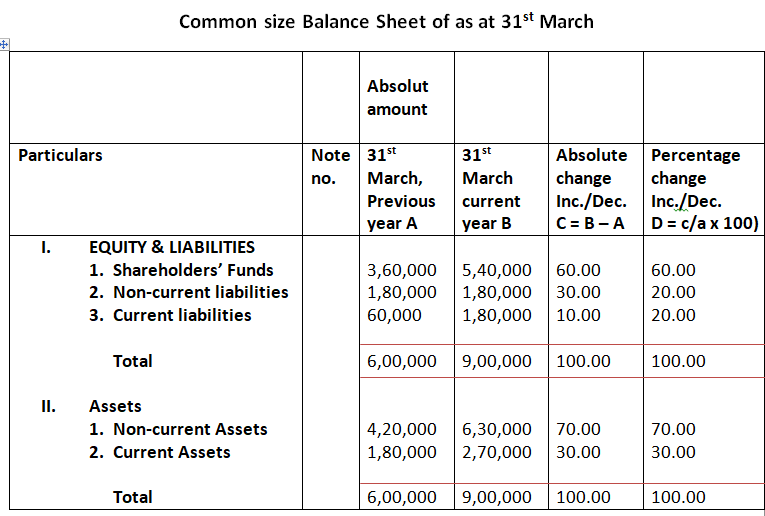

21. From the following information, prepare a Common – size Balance Sheet:

Solution –

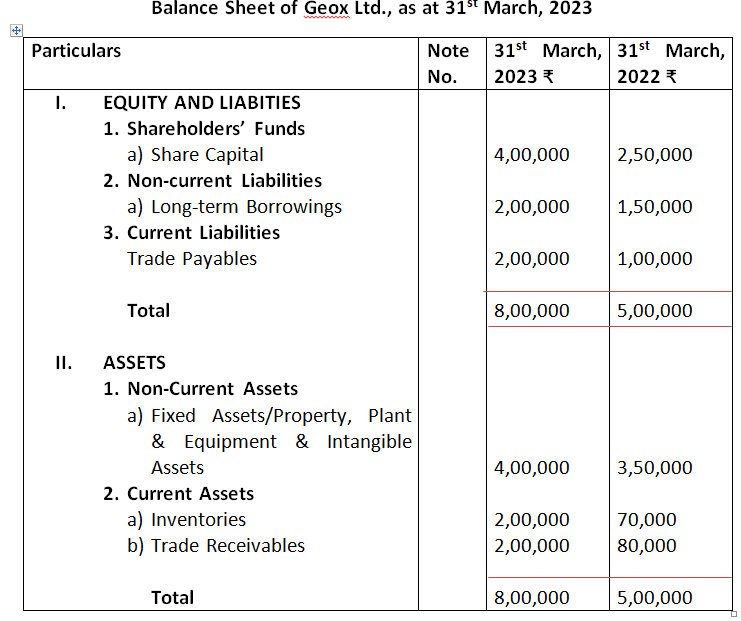

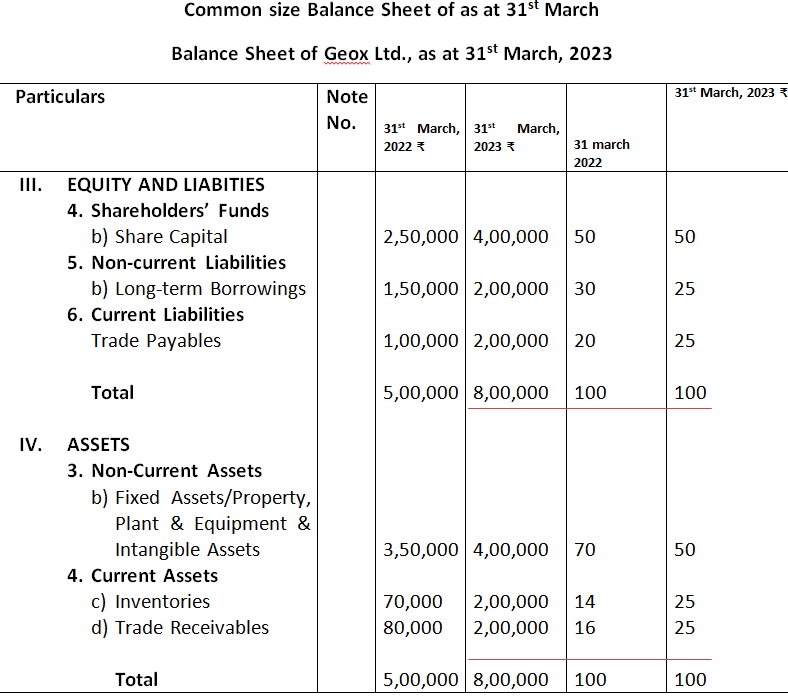

22. From the given Balance Sheet of Geox Ltd., Prepare Common Size Balance sheet:

Solution –

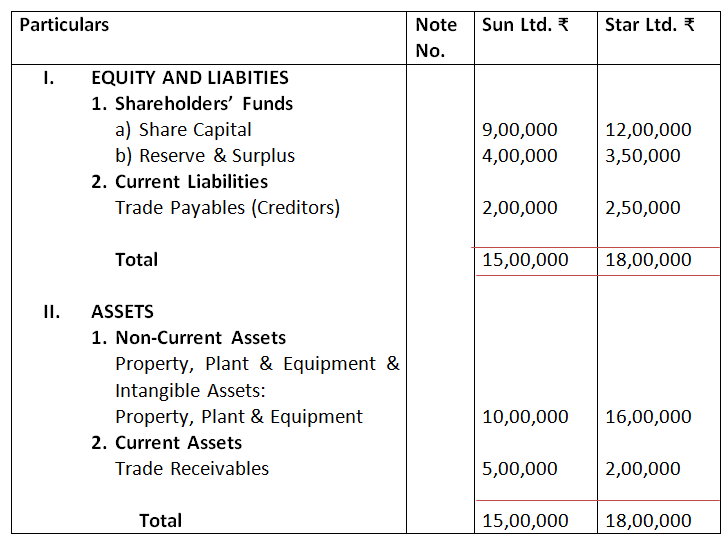

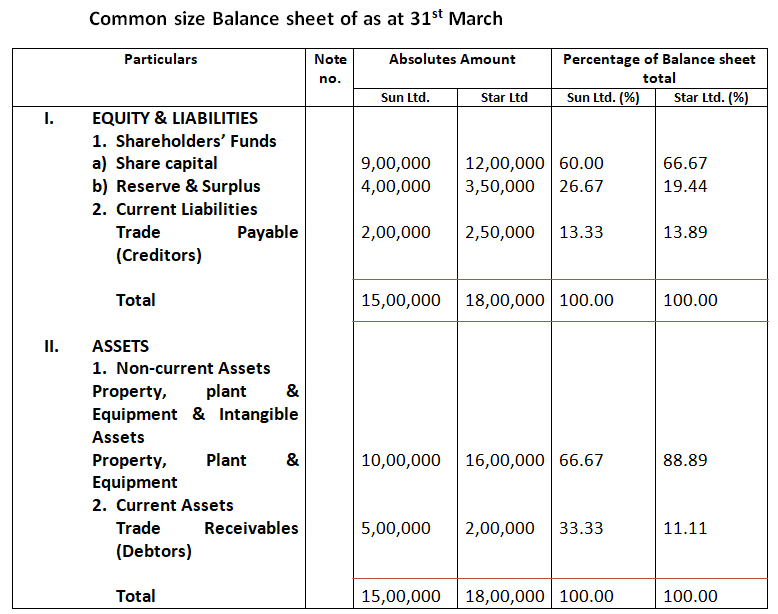

23. Prepare Common-size Balance sheet and comment on the financial position of Sun Ltd., and star Ltd. The Balance Sheets of Sun Ltd., and Star Ltd. As at 31st March, 2025 are:

Solution –

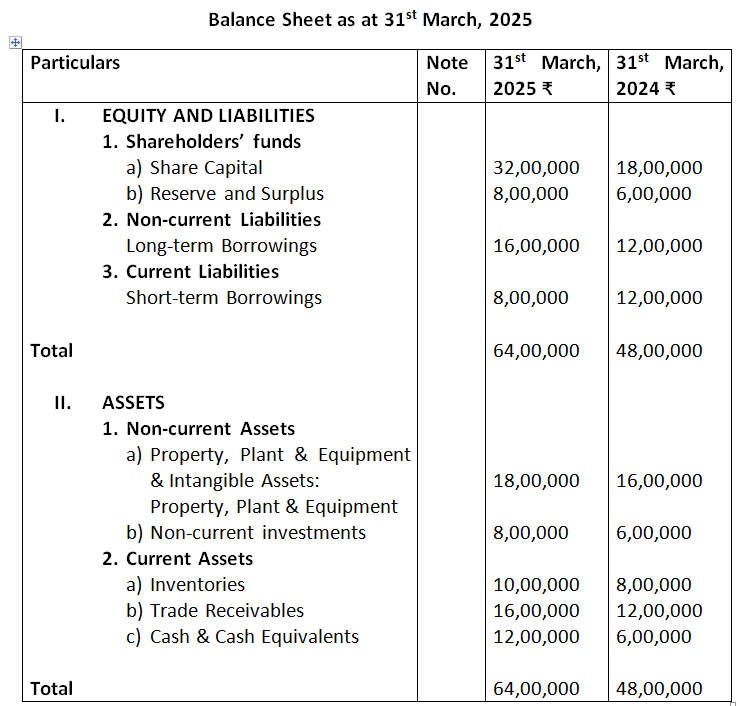

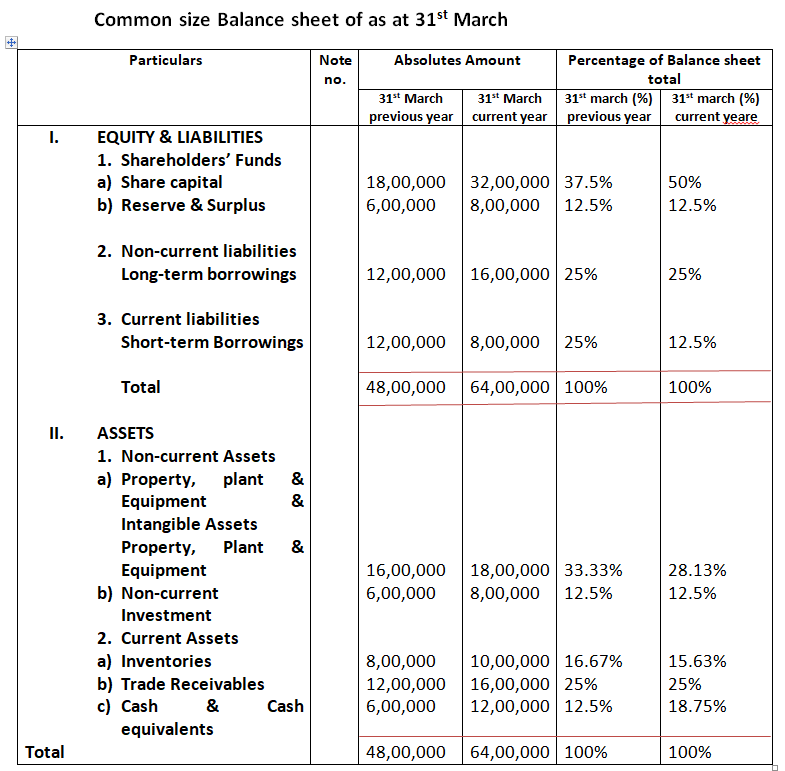

24. From the following information prepare a common-size Balance Sheet:

Solution –

Common-size Statement of Profit & Loss (Income Statement)

25. From the following Statement of Profit & Loss of Star Ltd., for the years ended 31st March, 2024 and 2025, prepare a Common-size Statement:

Solution –

26. Prepare a ‘Common Size Statement of Profit & Loss of Neurosci Ltd. For the year ended 31st March, 2023 from the following Information:

Solution –

27. Prepare a ‘Common Size Statement of Profit & Loss of ‘Hari Darshan Ltd.’ From the following Information:

Solution –