Sacrificing and Gaining Share:-

Q1. Om and Shyam are sharing profits and losses equally. With effect from 1st April, 2025, they agree to share profits in the ratio of 4:3. Calculate individual partners gain or sacrifice due to the change in ratio.

Solution –

Old Ratio (Om and Shyam) = 1:1

New Ratio (Om and Shyam) = 4:3

Sacrificing (or Gaining) Ratio = Old Ratio – New Ratio

Om’s Share = 1/2 – 4/7 = 7-8/14 = -1/14 (Gain)

Shyam’s Share = 1/2 – 3/7 = 7-6/14 = 1/14 (Sacrifice)

Om’s Gain = 1/14

Shyam Sacrifice = 1/14

Q2. Ahilya, Laxmi and Parvati are sharing profits and losses in the ratio of 5:3:2. With effect from 1st April, 2025, they decide to share profits and losses in the ratio of 5:2:3. Calculate each partners gain or sacrifice due to the change in ratio.

Solution –

Old Ratio (Ahilya, Laxmi and Parvati) = 5:3:2

New Ratio (Ahilya, Laxmi and Parvati) = 5:2:3

Sacrificing (or Gaining) Ratio = Old Ratio – New Ratio

Ahilya’s Share = 5/10 – 5/10 = nil

Laxmi’s Share = 3/10 – 2/10 = 1/10 (Sacrifice)

Parvati’s Share = 2/10 – 3/10 = -1/10 (Gain)

Parvati’s Gain = 1/10

Laxmi’s Sacrifice = 1/10

Q3. X, Y and Z are sharing profits and losses in the ratio of 5:3:2. With effect from 1st April, 2025, they decide to share profits and losses equally. Calculate each partners gain or sacrifice due to the change in ratio.

Solution –

Old Ratio (X, Y and Z) = 5:3:2

New Ratio (X, Y and Z) = 1:1:1

Sacrificing (or Gaining) Ratio = Old Ratio – New Ratio

X’s Share = 5/10 – 1/3 = 15-10/30 = 5/30 (Sacrifice)

Y’s Share = 3/10 – 1/3 = 9-10/30 = -1/30 (Gain)

Z’s Share = 2/10 – 1/3 = 6-10/30 = -4/30 (Gain)

X’s Sacrifice = 5/30

Y’s Gain = 4/30

Z’s Gain = 4/30

Q4. A, B and C partners sharing profits and losses in the ratio of 5:4:1. Calculate new profit-sharing ratio, sacrificing ratio and gaining ratio in each of the following cases:

Case 1: As per new agreement, C acquires 1/5th share from A.

Case 2: as per new agreement, C acquires 1/5th share equally from a and B.

Case 3: As per new agreement, A, B and C will share future profits and losses equally.

Case 4: as per new agreement, C acquires 1/10th share of A and ½ share of B.

Solution –

Case 1: A: B: C = 5:4:1 (Old Ratio)

C acquires 1/5th from A

A’s Sacrifice = 1/5

C’s Gain = 1/5

A = 5/10 – 1/5 = 5-2/10 = 3/10

B = 4/10

C = 1/10 + 1/5 = 1+2/10 = 3/10

A: B: C = 3:4:3

Case 2: A: B: C = 5:4:1 (Old Ratio)

C acquires 1/5th share equally from A and B

= 1/5 x ½ = 1/10

A’s Sacrifice = 1/10 B’s Sacrifice = 1/10

C’s Gain = 1/5

A = 5/10 – 1/10 = 5-1/10 = 4/10

B = 4/10 – 1/10 = 4-1/10 = 3/10

C = 1/10 + 1/5 = 1+2/10 = 3/10

A: B: C = 4:3:3

Case 3: A: B: C = 5:4:1 (Old Ratio)

A: B: C = 1:1:1 (New Ratio)

A = 5/10 – 1/3 = 15-10/30 = 5/30 (Sacrifice)

B = 4/10 – 1/3 = 12-10/30 = 2/30 (Sacrifice)

C = 1/10 – 1/3 = 3-10/30 = -7/30 (Gain)

Case 4: A: B: C = 5:4:1 (Old Ratio)

A’s Sacrifice to C = 5/10 x 1/10 = 1/20

B’s Sacrifice to C = 4/10 x ½ = 4/20

C’s share gain = 1/20 + 4/20 = 5/20

A = 5/10 – 1/20 = 10 – 1/20 = 9/20

B = 4/10 – 4/20 = 8-4/20 = 4/20

C = 1/10 + 5/20 = 2+5/20 = 7/20

A: B: C = 9:4:7

Calculation of old profit sharing ratio on the basis of sacrificing and gaining ratio

Q 5. Pranav, Karan and Rahim are partners sharing profits and losses in agreed ratio. With effect from1st April, 2025, they agreed to share profit in the ratio of 3: 3: 4. To arrive a at the new ratio, Rahim takes1/5th share equally from Pranav and Karan. Calculate the old profit-sharing ratio.

Ans.

New profit sharing ratio is 3:3:4

Rahim takan 1/5th share equally from pranav and karan

Rahim took from pranav 1/5 x ½=1/10

Rahim took from karan 1/5 x ½=1/10

Pranav old profit share3/10 +1/10=3+1/10=4/10

Karan old profit share 3/10+ 1/10==3+1/10=4/10

Rahim old profit share =4/10 -1/5=4-2/10=2/10

The old profit sharing ratio

4:2:2

Accounting of Goodwill:-

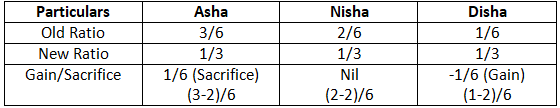

Q6. Asha, Nisha and Disha shared profits and losses in the ratio of 3:2:1 respectively. With effect from 1st April, 2025, they agreed to share profits equally. The goodwill of the firm was valued at 18,000.

Pass necessary Journal entries to record the above change.

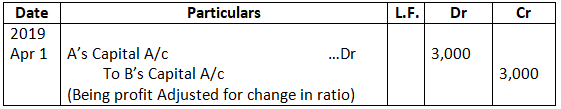

Solution – Accounting of Goodwill

Calculation of Gain/sacrifice made by the partners:

Working Note:

Amount of Compensation Payable (Adjustment of Capital)

= Value of Firm’s Goodwill x gained profit share

= 18,000 x 1/6 = 3,000

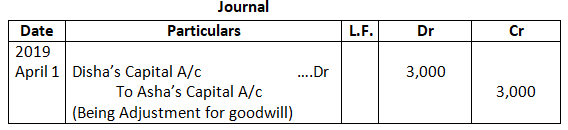

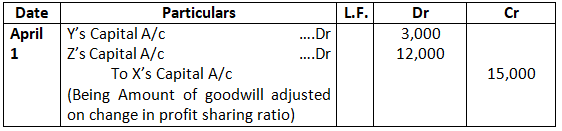

Q7. X, Y and Z are partners sharing profits equally. They decided that in future Z will get 1/5 share in profits. On the day of change, firm’s goodwill is valued at Rs.30,000. Give Journal entry arising on account of change in Profit-sharing Ratio.

Solution-

Journal

Calculation of new profit sharing ratio x, y, and z

Old Ratio of X, Y and Z is = 1: 1: 1

Z will get 1/5th Share in profit

Remaining share = 1 – 1/5

= 4/5

Remaining share wold be distributed by X and Y in their profit sharing ratio i.e., 1:1

X’s new share =4/5 x 1/2

= 4/10

Y’s new share = 4/5 x 1/2

= 4/10

New profit sharing ratio of X, Y and Z after making base equal

= 4/10 : 4/10 : 1/5 x 2/2

= 4:4:2

= 2:2:1

Calculation of Sacrifice/ gain of the partners

Old Ratio of X, Y and Z is = 1:1:1

New Ratio of X, Y and Z is = 2:2:1

X’s sacrifice /gain = 1/3 – 2/5

= 5 – 6 / 15

= -1/15 (gain)

Y’s Sacrifice /gain = 1/3 – 2/5

= 5 – 6 /15

= -1/15 (gain)

Z’s Sacrifice /gain = 1/3 – 1/5

= 5 – 3 / 15

= 2/15 (Sacrifice)

Calculation of Partner’s share in Goodwill of the firm

Goodwill of the firm = Rs.30,000

X’s Share = 30,000 x 1/15

= Rs.2,000 (Dr.)

Y’s Share = 30,000 x 1/15

= Rs.2,000 ( Dr.)

Z’s Share = 30,000 x2/15

= Rs.4,000 (Cr.)

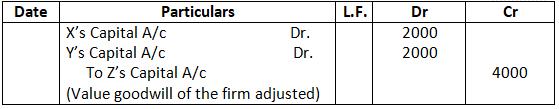

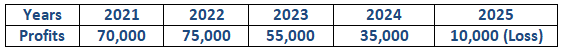

Q8. X, Y and Z are partners sharing profits and losses in the ratio of 5:3:2. From 1st April, 2025, they decided to share profits and losses equally. The Partnership Deed provides that in the event of any change in the profit-sharing ratio, goodwill is to be valued at two years purchase of the average profit of the preceding five years. The profits and losses of the preceding years ended 31st March, are:

Calculate the value of goodwill and pass Journal entry:

Solution – Journal

Working Note 1:

Calculation of Sacrificing (or Gaining) Ratio

Old Ratio (X, Y and Z) = 5:3:2

New Ratio (X, Y and Z) = 1:1:1

Sacrificing (or Gaining) Ratio = Old Ratio – New Ratio

X’s Share = 5/10–1/3 = 15-10/30 = 5/30 (Sacrifice)

Y’s Share = 3/10–1/3 = 9-10/30 = -1/30 (Gain)

Z’s Share = 2/10–1/3 = 6-10/30 = -4/30 (Gain)

Working Note 2:

Calculation of Goodwill

Goodwill = Average x Purchase Years

Average Profit = 70,000 + 75,000 + 55,000 + 35,000 – 10,000 / 5

= 2, 25,000 / 5

= 45,000

Goodwill = 45,000 x 2 = 90,000

Working Note 3:

Adjustment of Goodwill

Amount to be Credited to X’s Capital = 90,000 x 5/30 = 15,000 (Sacrifice)

Amount to be Debited to Y’s Capital = 90,000 x 1/30 = 3,000 (Gain)

Amount to Be Debit to Z’s Capital = 90,000 x 4/30 = 12,000 (Gain)

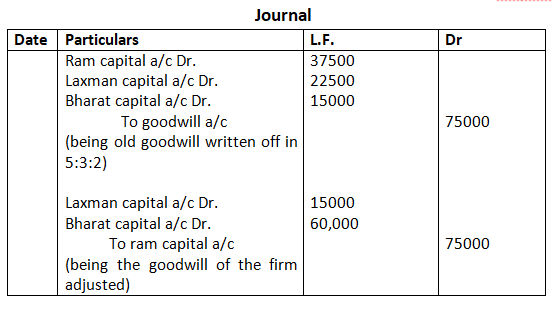

Q9. Ram Laxman and Bharat who were sharing profits and losses in the ratio of 5: 3: 2, decide to shares and losses equally with effect from 1st April, 2025. Goodwill of the firm is valued at 450,000mGoodwill is appearing in the books is at 75,000.

Pass necessary Journal entries to record the above change.

Working note

Calculation of gaining and sacrificing ratio

Old ratio=5:3:2

New ratio= 1:1:1

Ram=5/10-1/3=15-10/30=5/30(sacrifice)

Laxman=3/10-1/3=9-10/30=-1/30(gain)

Bharat=2/10-1/3=6-10/30=-4/30(gain)

Goodwill share

Ram =450,000 x 5/30=75000

Laxman= 450,000 x 1/30=15000

Bharat =450,000 x 4/30=60,000

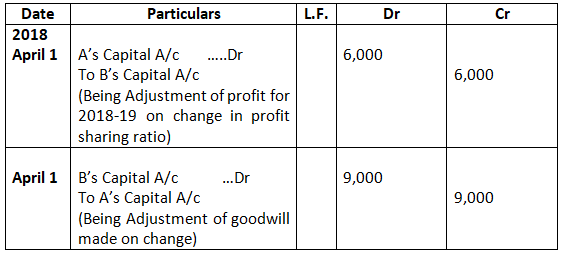

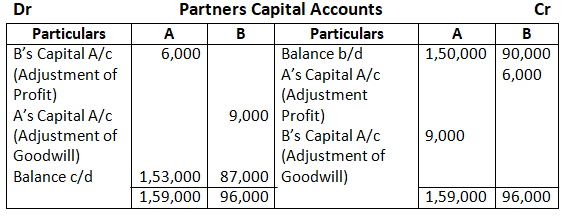

Q10. A & B are partners in a firm sharing profits in the ratio of 2:1. They decided that with effect from 1st April, 2024, they would share profits in the ratio of 3:2. But, this decision was taken after the profit for the year ended 31st March, 2025 of 90,000 was distributed in the old profit-sharing ratio.

Firm’s goodwill was valued on the basis of aggregate of two years profits preceding the date decision became effective.

Profits for the years ended 31st March, 2023 and 2024 were 60,000 and 75,000 respectively. Capital Accounts of the partners as at 31st March, 2025 stood at 1, 50,000 for A and 90,000 for B.

Pass necessary Journal entries and prepare Partners Capital Accounts.

Solution – Journal

Working Note 1:

Calculation of Sacrificing (or Gaining) Ratio

Old Ratio (A and B) = 2:1

New Ratio (A and B) = 3:2

Sacrificing (or Gaining) Ratio = Old Ratio – New Ratio

A’s Share = 2/3–3/5 = 10-9/15 = 1/15 (Sacrifice)

B’s Share = 2/3–3/5 = 5-6/15 = -1/15 (Gain)

Working Note 2:

Adjustment of Profit for 2021-22

Profit to be debited to A’s Capital = 90,000 x 1/15 = 6,000

Profit to be credited to B’s capital = 90,000 x 1/15 = 6,000

Working Note 3:

Calculation of New Goodwill

Goodwill = Profit of 2020-21 = Profit of 2021-22

= 60,000 + 75,000

= 1, 35,000

Working Note 4:

Adjustment of Goodwill

Goodwill to be debited to A’s Capital = 1, 35,000 x 1/15 = 9,000 (Sacrifice)

Goodwill to be credited to B’s Capital = 1, 35,000 x 1/15 = 9,000 (Gain)

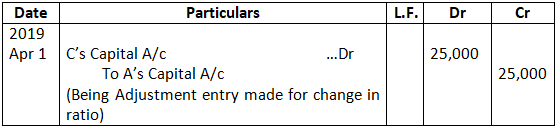

Calculation of new profit sharing ratio

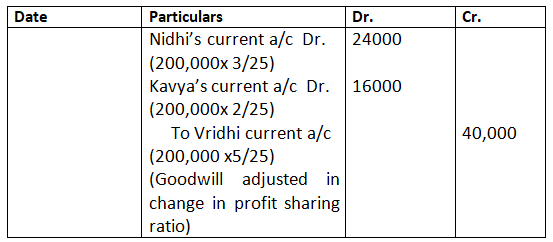

Q-11. Nidhi ,Vridhi and kavya are partners sharing profit and loss in the ratio of 2:1:1 from 1st April 2025, they decide to change the profit sharing ratio. they pass following adjustment entry for goodwill in the books.

What will be the new profit sharing ratio of partners assuming capital of partners are fixed

Solution: –

Old ratio=2:2:1

Sacrificing (or Gaining) Ratio = Old Ratio – New Ratio

New ratio =old ratio-sacrificing ratio+ gaining partner

Nidhi share (gaining partner) = 2/5+3/25=13/25

Vridhi share (sacrificing partner) =2/5-5/25=1/25

Kavya share (gaining partner) = 1/5+2/25=7/25

New profit sharing ratio Nidhi, Vridhi and Kavya

= 13/25 : 5/25 : 7/25

=13: 5: 7

Accounting of Reserve, Accumulated Profit and Losses:-

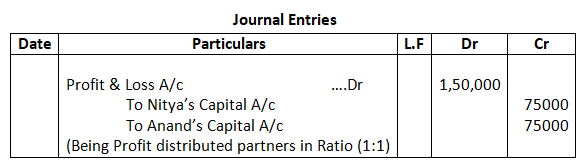

Q12. Nitya and Anand are partners in a firm sharing profit and losses equally. With effect from 1st April, 2025, they decided to share future profits in the ratio of 3:2. On the date of change in the profit-sharing ratio, the Profit & Loss Account had a credit balance of 1, 50,000. Pass the necessary Journal entry for the distribution of the balance in the Profit & Loss Account before the change in the profit-sharing ratio.

Solution –

Nitya’s Share in Profit = 1, 50,000 x 1/2 = 75000

Anand’s Share in Profits = 1, 50,000 x 1/2 = 75000

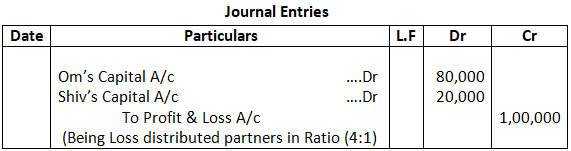

Q13. Om and Shiv are partners in a firm sharing profits in the ratio of 4:1. They decided to share future profits in the ratio of 3:2. 1st April, 2025. On that day, Profit & Loss Account showed a debit balance of 1, 00,000. Pass Journal entry to give effect to the above.

Solution –

Om’s Share in Loss = 1, 00,000 x 4/5 = 80,000

Shiv’s Share in Loss = 1, 00,000 x 1/5 = 20,000

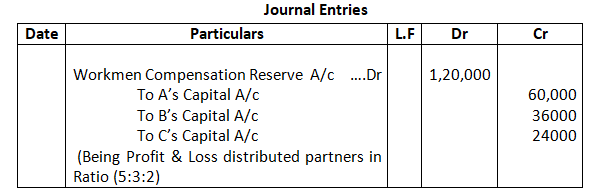

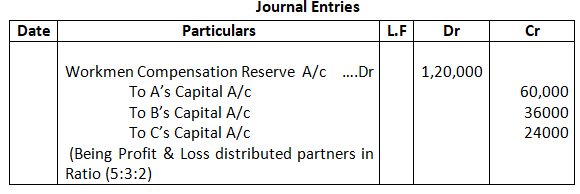

Q14. A, B and C who are presently sharing profits and Losses in the ratio of 5:3:2 decide to share future profits and losses in the ratio of 2:3:5. Give the Journal entry to distribute ‘Workmen Compensation Reserve’ of 1, 20,000 at the time of change in profit-sharing ratio, when:

- No other information is given

- There is no claim against it.

Solution – Case 1.

A’s Share in Workmen Compensation Reserve = 1, 20,000 x 5/10 = 60,000

B’s Share in Workmen Compensation Reserve = 1, 20,000 x 3/10 = 3, 60,000

C’s Share in Workmen Compensation Reserve = 1, 20,000 x 2/10 = 2, 40,000

Case2.

A’s Share in Workmen Compensation Reserve = 1, 20,000 x 5/10 = 60,000

B’s Share in Workmen Compensation Reserve = 1, 20,000 x 3/10 = 36000

C’s Share in Workmen Compensation Reserve = 1, 20,000 x 2/10 = 24000

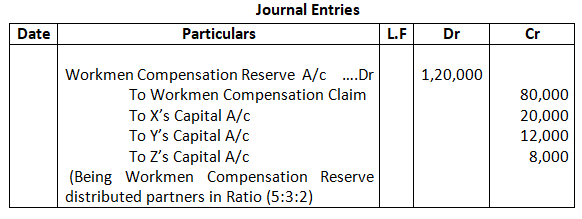

Q15. X, Y and Z who were sharing profits and losses in the ratio of 5:3:2 decided to share future profits in the ratio of 2:3:5. Give the Journal entry to distribute ‘Workmen Compensation Reserve’ of 1, 20,000 at the time of change in profit-sharing ratio, when there is a claim of 80,000 against it.

Solution –

Remaining Workmen Compensation Reserve after claim

= 1, 20,000 – 80,000 = 40,000

X’s Share in Workmen Compensation Reserve = 40,000 x 5/10 = 20,000

Y’s Share in Workmen Compensation Reserve = 40,000 x 3/10 = 12,000

Z’s Share in Workmen Compensation Reserve = 40,000 x 2/10 = 8,000

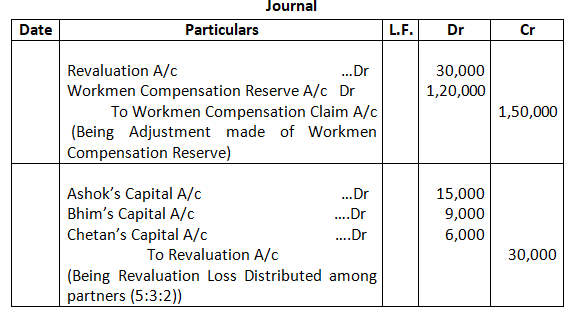

Q16. Ashok, Bhim and Chetan who were sharing profits in the ratio of 5:3:2, decided to share profits in the ratio of 2:3:5 with effect from 1st April, 2025. Workmen Compensation Reserve existed at 1, 20,000 in the Balance Sheet as at 31st March, 2025 and Workmen Compensation Claim of 1, 50,000 exists. Pass Journal entries for the accounting treatment of Workmen Compensation Reserve.Solution –

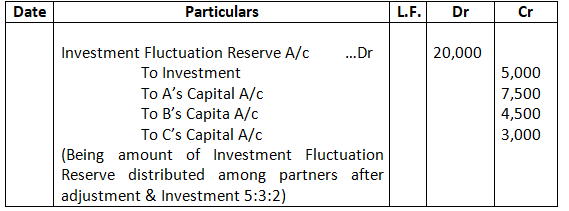

Q17. A, B and C who are sharing profits and losses in the ratio of 5:3:2 decide to share future profits in the ratio of 2:3:5. Give the Journal entry to distribute ‘Investments Fluctuation Reserve’ of 20,000 at the time of change in profit-sharing ratio, when investment (market value 95,000) appears in the books at 1, 00,000.

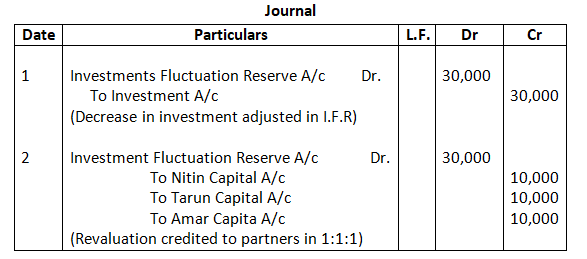

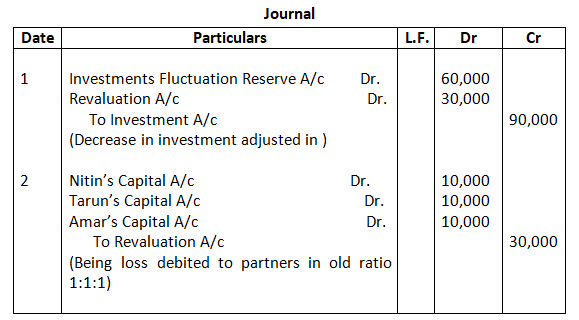

Solution – Journal

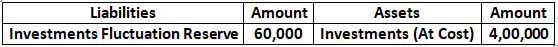

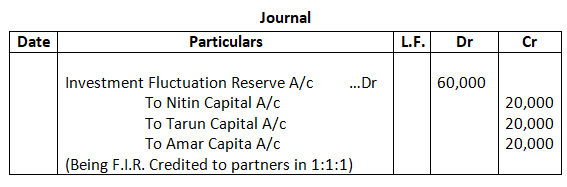

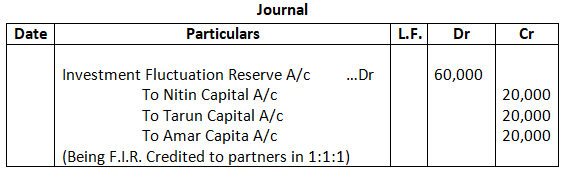

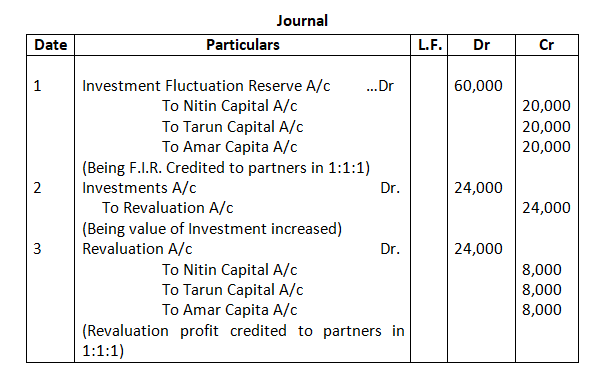

Q18. Nitin, Tarun and Samar are partners sharing profits equally and decide to share profits in the ratio of 2:2:1. 1st April, 2025. The extract of their Balance Sheet as at 31st March, 2025 is as follows:

Pass the Journal entries in each of the following situation:

- When its Market Value is not given.

- When its Market Value is 4,00,000

- When its Market Value is 4,24,000

- When its Market Value is 3,70,000

- When its Market Value is 3,10,000

Solution –

Case – 1

Case – 2

Case – 3

Case – 4

Case – 5

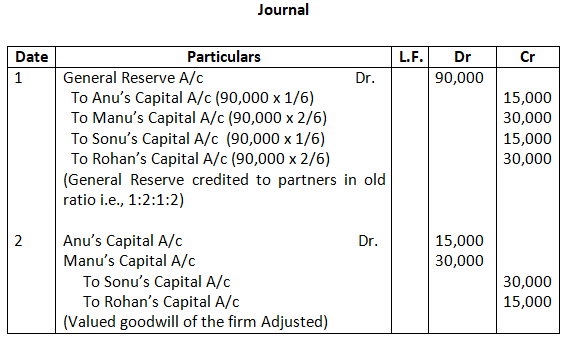

Q19. Anu, Manu, Sonu and Rohan were partners in a firm sharing profits and losses in the ratio of 1:2:1:2. With effect from 1st April, 2023, they decided to share profits and losses in the ratio of 2:4:1:3. Their Balance Sheet showed General Reserve of Rs.90,000. The Goodwill of the firm was valued at Rs.4,50,000.

Pass the necessary journal entries for the above on account of change in the profit-sharing ratio. Show your working clearly.

Solution-

Calculation of Partners’ Sacrifice/gain

Old Ratio of Anu, manu, Sonu and Rohan is = 1:2:1:1

New Ratio of Anu, Manu, Sonu and Rohan is = 2:4:1:3

Anu’s Sacrifice/gain = 1/6 – 2/10

= 5 – 6 / 30

= -1/30 (gain)

Manu’s Sacrifice/gain = 2/6 – 4/10

= 10 – 12 /30

= -2/30 (gain)

Sonu’s Sacrifice /gain = 1/6 – 1/10

= 5 – 3 / 30

= 2/30 (Sacrifice)

Rohan’s Sacrifice /gain = 2/6 – 3/10

= 10 – 9 /30

= 1/30 (Sacrifice)

Calculation of Partner’s Share in Goodwill of the Firm

Goodwill of the firm = Rs.4,50,000

Anu’s Share in Goodwill = 4,50,000 x 1/30

= Rs.15,000 (Dr.)

Manu’s share in Goodwill = 4,50,000 x 2/30

= Rs.30,000 (Dr.)

Sonu’s share in Goodwill = 4,50,000 x 2/30

= Rs.30,000 (Cr.)

Rohan’s share in Goodwill = 4,50,000 x 1/30

= Rs.15,000 (Cr.)

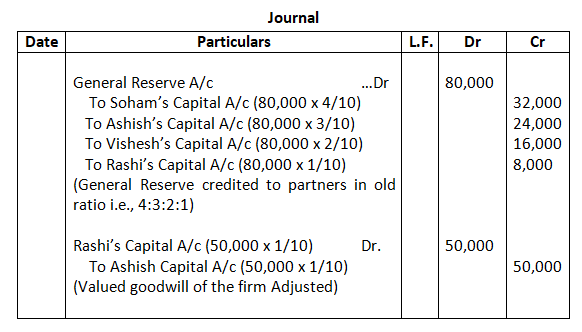

Q20. Soham, Ashish, Vishesh and Rashi were partners in a firm sharing profits and losses in the ratio of 4:3:2:1. With effect from 1st April, 2023 they decided to share profits and losses in the ratio of 2:1:1:1. Their Balance Sheet showed a General Reserve of Rs.80,000. The goodwill of the firm was valued at Rs.5,00,000.

Pass necessary Journal entries for the above on account of change in the profit-sharing ratio. Show your working clearly.

Solution-

Calculation of Partner’s Sacrifice/ gain

Old Ratio of Sohan, Ashish, Vishesh, Rashi is = 4:3:2:1

New Ratio of Sohan, Ashi, Vishesh, Rashi is = 2:1:1:1

Sohan’s sacrifice /gain = 4/10 – 2/5

= 4 – 4 / 10

= 10

Ashish’s Sacrifice/gain = 3/10 – 1/5

= 3 – 2/10

= 1/10 (Sacrifice)

Vishesh’s Sacrifice/gain = 2/10 – 1/5

= 2 – 2/10

= 10

Rashi’s Sacrifice / gain = 1/10 – 1/5

= 1 – 2/10

= -1/10 (gain)

Calculation of partners’ share in Goodwill of the firm

Goodwill of the firm = Rs.5,00,000

Ashish’s Share in Goodwill = 5,00,000 x 1/10

= Rs.50,000 (Cr.)

Rashi’s Share in Goodwill = 5,00,000 x 1/10

= Rs.50,000 (Dr.)

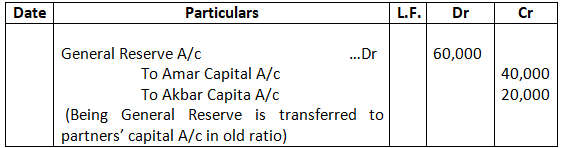

Q21. Bootstrap and Davy jones are partners sharing profits in the ratio of 2:1. On 31st March, 2025, their Balance Sheet showed General Reserve of 60,000. It was decided that in future they will share profits and losses in the ratio of 3:2. Pass necessary Journal entry in each of the following alternative cases:

- When General Reserve is not to be shown in the new Balance Sheet.

- When General Reserve is to be shown in the new Balance Sheet.

Solution – Journal

Case 2:

Calculation of Sacrificing & Gaining ratio:

Old Ratio = 2:1

New Ratio = 3:2

Amar = 2/3 – 3/5 = 10-9/15 = 1/15 (Sacrifice)

Akbar = 1/3 – 2/5 = 5-6/15 = -1/15 (Gain)

Amar Sacrifices = 60,000 x 1/15 = 4,000

Akbar Gain = 60,000 x 1/15 = 4,000

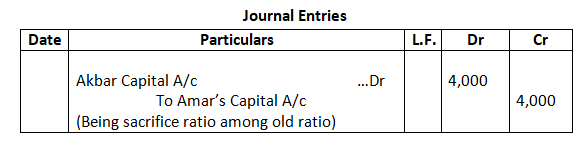

Q22. Mita, Gopal and Farhan were partners sharing profits and losses in the ratio 3:2:1. On 31st March, 2018 they decided to change the profit-sharing ratio to 5:3:2. On this date, the Balance Sheet showed Deferred Advertisement Expenditure 30,000 and Contingency Reserve 9,000.

Goodwill was valued at 4, 80,000. Pass the necessary Journal entries for the above transactions in the books of the firm on its reconstitution.

Solution –

Calculation of Sacrificing & Gaining ratio:

Old Ratio = 3:2:1

New Ratio = 5:3:2

Mita = 3/6 – 5/10 = 15-15/30 = 0/30 (Nil)

Gopal = 2/6 – 3/10 = 10-9/30 = 1/30 (Sacrifice)

Farhan = 1/6 – 2/10 = 5-6/30 = -1/30 (Gain)

Working Note:

Value of Goodwill = 4, 80,000 x 1/30 = 16,000

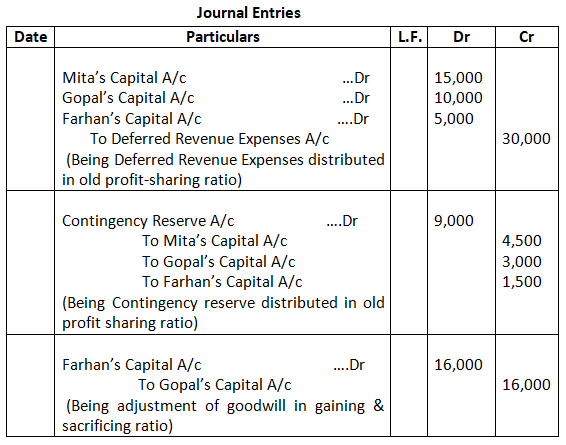

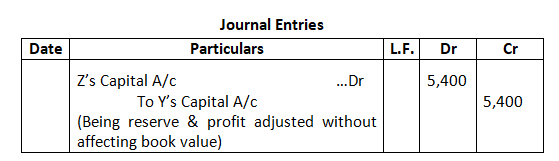

Q23. X, Y and Z are sharing profits and losses in the ratio of 5:3:2. They decide to share future profits and losses in the ratio of 2:3:5 with effect from 1st April, 2025. They also decide to record the effect of the following accumulated profits, losses and reserve without affecting their book values by passing a single entry.

Book Values

General Reserve 6,000

Profit & Loss A/c (Credit) 24,000

Advertisement Suspense A/c 12,000

Pass an Adjustment Entry.

Solution –

Calculation of Sacrificing & Gaining ratio:

Old Ratio = 5:3:2

New Ratio = 2:3:5

X = 5/10 – 2/10 = 5-2/10 = 3/10 (Sacrifice)

Y = 3/10 – 3/10 = 0-0/10 = 0/10 (Nil)

Z = 2/10 – 5/10 = 2-5/10 = -3/10 (Gain)

As Single adjusting entry has to be passed without affecting book value of Balance Sheet

General Reserve 6,000

Profit & Loss A/c 24,000

Less: Advertising Expenses (12,000)

Total 18,000

X’s Share = 18,000 x 3/10 = 5,400

Z’s Share = 18,000 x 3/10 = 5,400

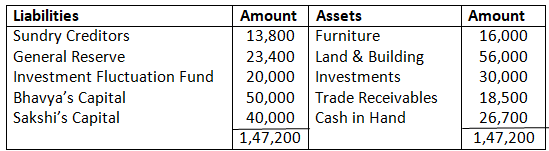

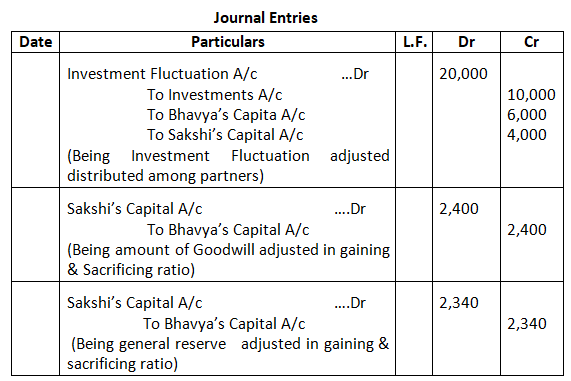

Q24. Bhavya and Sakshi are partners in a firm, sharing profits and losses in the ratio of 3:2. On 31st March, 2018, their Balance Sheet was as under:

Balance Sheet of Bhavya and Sakshi as at 31st March, 2018

The partners have decided to change their profit sharing ratio to 1:1 with immediate effect. For the purpose, they decided that:

- Investments to be valued at 20,000

- Goodwill of the firm be valued at 24,000

- General Reserve not to be distributed between the partners.

You are required to pass necessary Journal entries in the books of the firm. Show workings.

Solution –

Calculation of Sacrificing & Gaining ratio:

Old Ratio = 3:2

New Ratio = 1:1

Bhavya’s = 3/5 – 1/2 = 6-5/10 = 1/10 (Sacrifice)

Sakshi’s = 2/5 – 1/2 = 4-5/10 = -1/10 (Gain)

Working Note:

General Reserve = 23,400 x 1/10 = 2,340

Revaluation of Assets and Reassessment of Liabilities:-

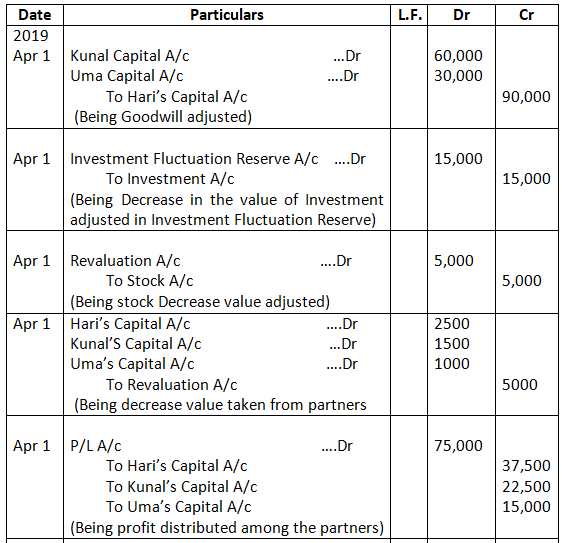

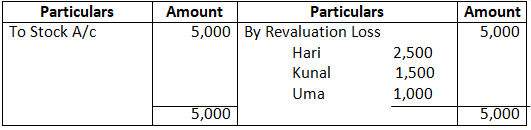

Q25. Hari, Kunal and Uma are partners in a firm sharing profits and losses in the ratio of 5:3:2. From 1st April, 2018 they decided to share future profits and losses in the ratio of 2:5:3. Their Balance Sheet showed a balance of 75,000 in the Profit & Loss Account and a balance of 15,000 in Investment Fluctuation Fund. For this purpose, it was agreed that:

- Goodwill of the firm was valued at 3, 00,000.

- That investment (having a book value of 50,000) was valued at 35,000.

- That stock having a book value of 50,000 is depreciated by 10%.

Pass the necessary Journal entries for the above in the books of the firm.

Solution – Journal Entries

Working Note 1:

Calculation of Sacrificing & Gaining ratio:

Old Ratio = 5:3:2

New Ratio = 2:5:3

Hari’s = 5/10 – 2/10 = 5-2/10 = 3/10 (Sacrifice)

Kunal’s = 3/10 – 5/10 = 3-5/10 = -2/10 (Gain)

Uma’s = 2/10 – 3/10 = 2-3/10 = -1/10 (Gian)

Working Note 2:

Goodwill of the firm 3, 00,000

Share of Hari = 3, 00,000 x 3/10 = 90,000

Share of Kunal = 3, 00,000 x 2/10 = 60,000

Share of Uma = 3, 00,000 x 1/10 = 30,000

Working Note 3:

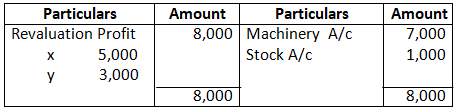

Revaluation A/c

Q26. A, B and C are sharing profits and losses in the ratio of 2:2:1. They decided to share profit. 1st April, 2025 in the ratio of 5:3:2. They also decided not to change the values of assets and liabilities in the books of account. The book values and revised values of asset and liabilities as on the date of change were as follows:

Book Values Revised Values

Machinery 2, 50,000 3, 00,000

Computers 2, 00,000 1, 75,000

Sundry Creditors 90,000 75,000

Outstanding Expenses 15,000 25,000

Pass an Adjustment entry.

Solution – Journal Entries

Working Note 1:

Calculation of Sacrificing & Gaining ratio:

Old Ratio = 2:2:1

New Ratio = 5:3:2

A’s = 2/5 – 5/10 = 4-5/10 = 1/10 (Gain)

B’s = 2/5 – 3/10 = 4-3/10 = 1/10 (Sacrifice)

C’s = 1/5 – 2/10 = 2-2/10 = 0/10 (Nil)

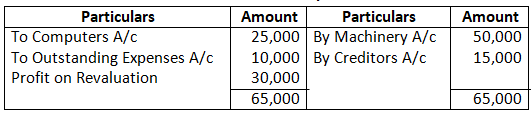

Working Note 2:

Calculation of Profit or Loss on Revaluation

Revaluation A/c

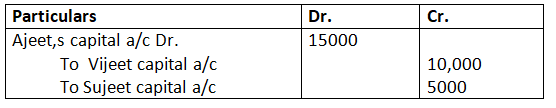

Q-27. Ajeet, Vijeet and Sujeet are partners in a firm sharing profits and losses in the ratio of 5:3:2. They decide to share profits and losses in the ratio of 2 : 5 : 3 with effect from 1st April, 2025. Land (having book value of ₹ 1,00,000) was found undervalued by ₹ 2,50,000 and stock (having book value of ₹ 4,00,000)book was found overvalued by ₹ 3,00,000.

Pass the necessary adjusting entry without affecting the existing book value.

Solution

Old ratio=5:3:2

New ratio=2:5:3

Sacrificing ratio=Old ratio-new ratio

Ajit=5/10-2/10=3/10(sacrifice)

Vijeet=3/10-5/10=-2/10(gain)

Sujit=2/10-3/10=-1/10(gain)

Land (book value=100,000)were found undervalued =2,50,000

Stock(book value=400,000) was found overvalued=300,000

So different amount adjusted=2,50,000-300,000=-50,000

Ajit=50,000 x 3/10=15000(cr..) will be debited

Vijeet =50,000 x 2/10=10,000(Dr…) will be credited

Sujit = 50,000 x 1/10=5000(Dr..) will be credited

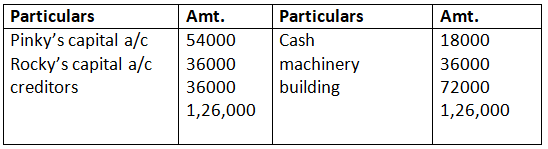

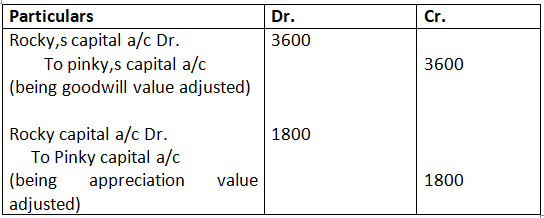

Q-28. Pinky and rocky are partners in a firm sharing profit in the ratio of 3:2 there balance sheet as at 31st march 2025 was as follow

Goodwill of the firm valued at 36000 and the building at 90,000 on 31st march 2024.the partners decide to share profit equally with effect from 1st April 2024

Pass necessary accounting entries without effecting the existing figure of building.

Solution

Old share =3:2

New share =1:1

Sacrificing ratio=old-new profit share

Pinky=3/5-1/2=1/10(sacrifice)

Rocky=2/5-1/2=-1/10(gain)

Working note-

1.Value of goodwill

Pinky=36000 x 1/10=3600(sacrifice)

Rocky =36000 x 1/10=3600(gain)

2. appreciation of building

(90,000-72000=18000)

Pinky =18000 x 1/10=1800(sacrifice)

Rocky 18000 x 1/10=1800(gain)

Preparation of Balance Sheet:-

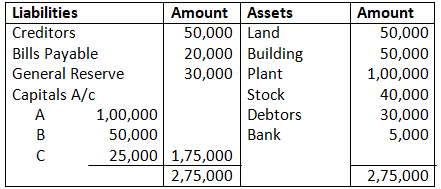

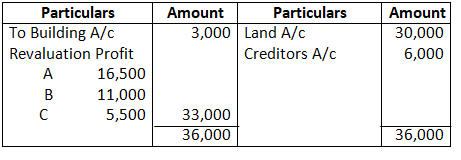

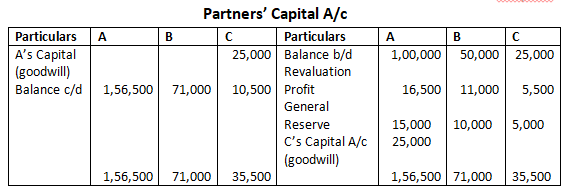

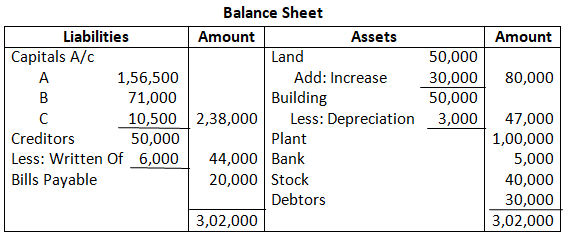

Q29. A, B and C were partners in a firm sharing profits in the ratio of 3:2:1. Their Balance Sheet as on 31st March, 2015 was as follows:

From 1st April, 2015, A, B and C decided to share profits equally. For this it was agreed that:

- Goodwill of the firm will be valued at 1, 50,000.

- Land will be revalued at 80,000 and building be depreciated by 6%.

- Creditors of 6,000 were not likely to be claimed and hence should be written off.

Prepare Revaluation Account, Partners Capital Accounts and Balance Sheet of the reconstituted firm.

Solution – Revaluation A/c

Working Note 1

Calculation of Sacrificing & Gaining ratio:

A’s Share = 3/6 – 1/3 = 1/6 (Sacrifice)

B’s Share = 2/6 – 1/3 = (Nil)

C’s Share = 1/6 – 1/3 = -1/6 (Gain)

C will compensate by passing an entry

Journal Entries

Working capital 2

Goodwill

A =150,000 x1/6=25000 (sacrificing)

B=150,000 x 1/6 =25000(gaining)

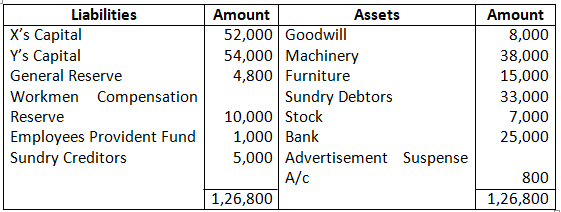

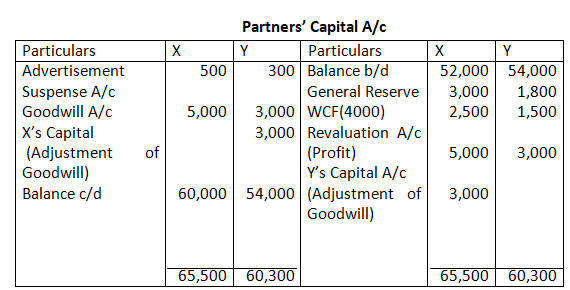

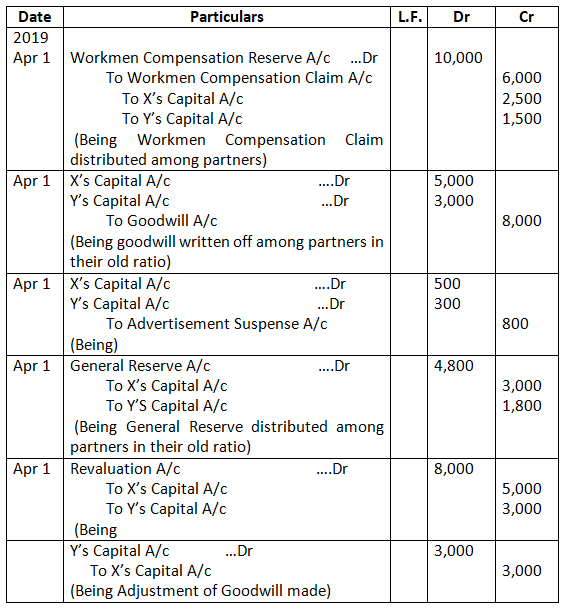

Q30. Balance Sheet of X and Y, who share profits and losses as 5:3 as at 1st April, 2025 is:

On the above date, they decided to change their profit-sharing ratio to 3:5 and agreed upon the following:

- Goodwill is valued on the basis of two years purchase of the average profit of the last three years. Profits for the years ended 31st March, are: 2023- 7,500; 2024 – 4,000; 2025 – 6,500.

- Machinery and Stock be revalued at 45,000 and 8,000 respectively.

- Claim on account of workmen compensation is 6,000.

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the new firm.

Solution – Revaluation A/c

Calculation of Sacrificing & Gaining ratio:

Old Ratio = 5:3

New Ratio = 3:5

X’s Share = 5/8 – 3/8 = 2/8 (Sacrifice)

Y’s Share = 3/8 – 5/8 = 2/8 (Gain)

Calculation of New Goodwill

Average Profit = 7,500 + 4,000 + 6,500/3

= 6,000

Goodwill = Average Profit x Number of Years Purchase

= 6,000 x 2 = 12,000

Goodwill = 6,000 x 2 = 12,000

Adjustment of Goodwill

Amount to be debited to X’s Capital = 12,000 x 2/8 = 3,000

Amount to be debited to Y’s Capital = 12,000 x 2/8 = 3,000

Journal Entries

Adjustment of Capital:-

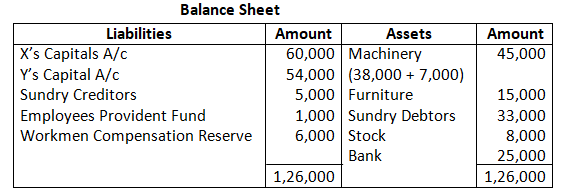

Q31. Ram, Mohan, Sohan and Hari were partners in a firm sharing profits in the ratio of 4:3:2:1. On 1st April, 2016, their Balance Sheet was as follows:

Balance Sheet of Ram, Mohan, Sohan and Hari

As on 1st April, 2016

From the above date, the partners decided to share the future profits in the ratio of 1:2:3:4. For this purpose the goodwill of the firm was valued at 180,000. The partners also agreed for the following:

- The claim for workmen compensation has been estimated at 1, 50,000.

- Adjust the capitals of the partners according to new profit-sharing ratio by opening partners Current Accounts.

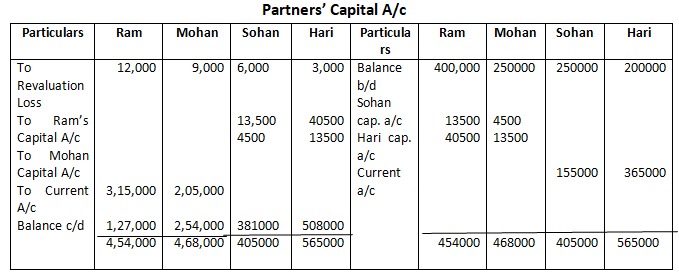

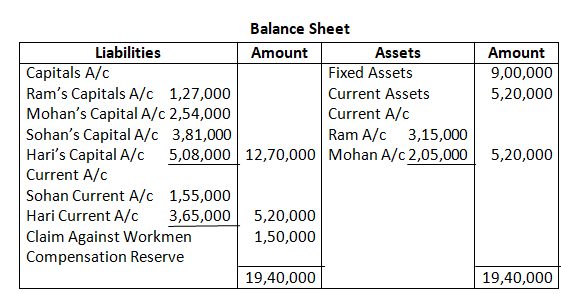

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the reconstituted firm.

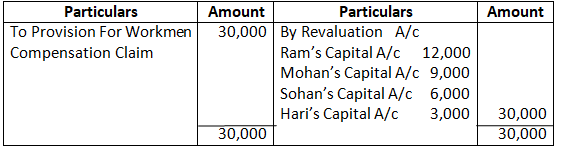

Solution – Revaluation A/c

Calculation of Sacrificing & Gaining ratio:

Old Ratio = 4:3:2:1

New Ratio = 1:2:3:4

Sacrificing Ratio = Old Ratio – New Ratio

Ram’s Share = 4/10 – 1/10 = 3/10 (Sacrifice)

Mohan’s Share = 3/10 – 2/10 = 1/10 (Sacrifice)

Sohan’s Share = 2/10 – 3/10 = -1/10 (Gain)

Hari’s Share = 1/10 – 4/10 = -3/10 (Gain)

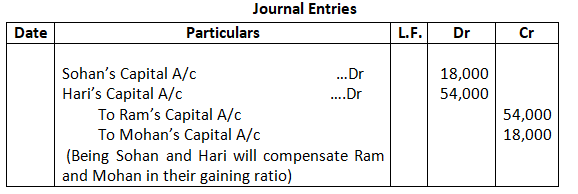

So, Sohan will Compensate Ram and Mohan in the ratio 3:1

Hari will Compensate Ram and Mohan in the ratio of 3:1

Adjustment of Goodwill

Sohan’s Capital = 1, 80,000 x 1/10 = 18,000

Hari’s Capital = 1, 80,000 x 3/10 = 54,000

Ram Capital = 1, 80,000 x 3/10 = 54,000

Mohan Capital = 1, 80,000 x 1/10 = 18,000

Calculation of Adjusted Capital

Ram = 4, 54,000 – 12,000 = 4, 42,000

Mohan = 4, 68,000 – 9,000 = 4, 59,000

Sohan = 2, 50,000 – 24,000 = 2, 26,000

Hari = 2, 00,000 – 57,000 = 1, 43,000

Total Combined Capital = 12, 70,000

Calculation of New Capital:

Ram = 12, 70,000 x 1/10 = 1, 27,000

Mohan = 12, 70,000 x 2/10 = 2, 54,000

Sohan = 12, 70,000 x 3/10 = 3, 81,000

Hari = 12, 70,000 x 4/10 = 5, 08,000

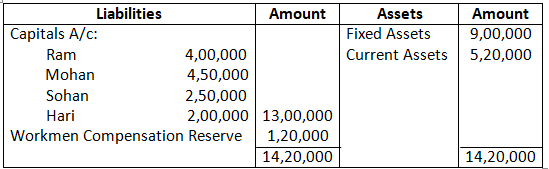

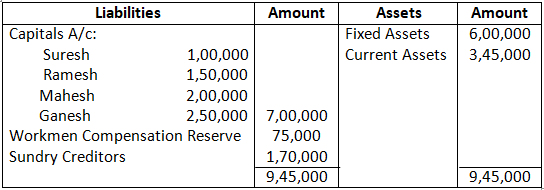

Q32. Suresh, Ramesh, Mahesh and Ganesh were partners in a firm sharing profits in the ratio of 2:2:3:3. On 1st April, 2016, their Balance Sheet was as follows:

Balance Sheet of Suresh, Ramesh, Mahesh and Ganesh

As on 1st April, 2016

From the above date, the partners decided to share the future profits equally. For this purpose the goodwill of the firm was valued at 90,000. It was also agreed that:

- Claim against workmen compensation Reserve will be estimated at 100,000 and fixed assets will be depreciated by 10%.

- The capitals of the partners will be adjusted according to new profit-sharing ratio for this necessary cash will be brought or paid by the partners as the case may be.

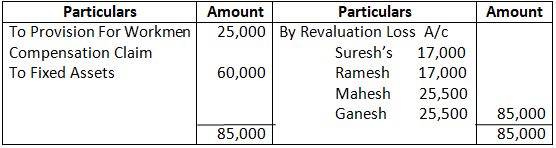

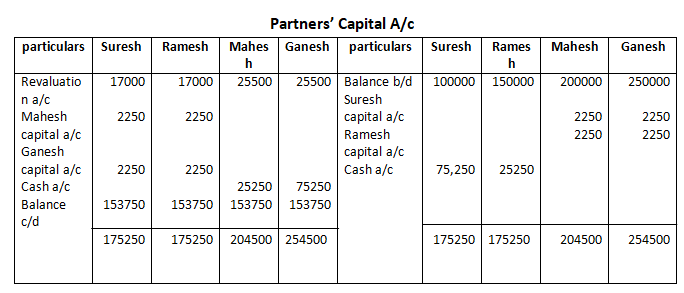

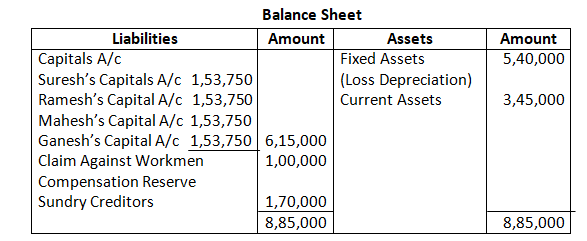

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the reconstituted firm.

Solution – Revaluation A/c

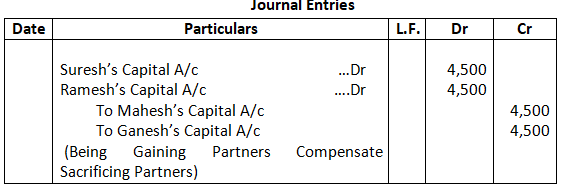

Calculation of gaining and sacrificing share

Old share=2:2:3:3

New share=1:1:1:1

Suresh=2/10-1/4=-2/40(gain)

Ramesh=2/10-1/4=-2/40(gain)

Mohan=3/10-1/4=2/40 (sacrifice)

Ganesh=3/10-1/4=2/40(sacrifice)

Suresh compensate Mohan and Ganesh

And Ramesh compensate Mohan and Ganesh

Adjustment of Goodwill

Suresh’s Capital = 90,000 x 2/40 = 4,500

Ramesh’s Capital = 90,000 x 2/40 = 4,500

Mahesh’s Capital = 90,000 x 2/40 = 4,500

Ganesh’s Capital = 90,000 x 2/40 = 4,500

Calculation of Adjusted Capital

Suresh = 1, 00,000 – 21,500 = 78,500

Ramesh = 1, 50,000 – 21,500 = 1, 25,500

Mahesh = 2, 00,500 – 25,500 = 1, 79,000

Ganesh = 2, 54,500 – 25,500 = 2, 29,000

Total Combined Capital = 6, 15,000

Calculation of New Capital:

Suresh = 6, 15,000 x 1/4 = 1, 53,750

Ramesh = 6, 15,000 x 1/4 = 1, 53,750

Mahesh = 6, 15,000 x 1/4 = 1, 53,750 Ganesh = 6, 15,000 x 1/4 = 1, 53,750