Average Profit Method:-

Q1. Goodwill is to be valued at three year purchase of four year average profit. Profit of the firm for last four years ending 31st March, were:

2022 – 12,000; 2023 – 18,000; 2024 – 16,000; 2025 – 14,000.

Calculate amount of Goodwill.

Solution – Average profit of the year

= 12,000 + 18,000 + 16,000 + 14,000 / 4

= 60,000 / 4

= 15,000

Goodwill = Average Profit of the year x Three year Purchase

= 15,000 x 3

= 45,000

Q2. Profits for the five years ending 31st March are as follows:

Year 2021 – 4,00,000; year 2022 – 3,98,000; year 2023– 4,50,000; year 2024 – 4,45,000 and year 2025 – 5,00,000.

Calculate goodwill of the firm on the basis of 4 years purchase of 5 years average profit.

Solution – Average Profit of Five year

= 4,00,000 + 3,98,000 + 4,50,000 + 4,45,000 + 5,00,000 / 5

= 21, 93,000/5

= 4, 38,600

Goodwill = Average Profit for 5 year x Four year Purchase

= 4, 39,600 x 4

= 17, 54,400

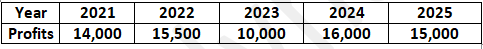

Q3. Purav and Purvi are partners in a firm sharing profits and losses in the ratio of 2:1. They decided to take Parv into partnership for 1/4th share on 1st April, 2025. For this purpose, goodwill is to be valued at four times the average annual profit of the previous four or five years, whichever is higher. The agreed profits for goodwill purpose of the past five year ended 31st March are:

Calculate the value of goodwill.

Solution – Average Profit of 4 year

= 15,000 + 16,000 + 10,000 + 15,500 / 4

= 56,500/ 4

= 14,125

Average Profit of 5 year

= 15,000 + 16,000 + 10,000 + 15,500 + 14,000 /5

= 70,500 / 5

= 14,100

As average Profit of 4 year is greater

Goodwill = Average Profit of 4 year x 4

= 14,125 x 4

= 56,500

Average Profit Method When Past Adjustments are Made:-

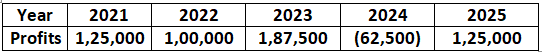

Q4. Asin and Shreyas were partners sharing profits and losses in the ratio of 2:1. They admitted Shyam as a partner for 1/5th share in profits. For this purpose Goodwill of the firm was to be valued on the basis of three years purchase of last five years average profit. Profit for the last five years ended 31st March, were

Calculate Goodwill of the firm after adjusting the following:

Profit of 2020-21 was calculated after charging 25,000 for abnormal loss of goods by fire.

Solution – Average Profit of Last 5 Year after Adjustment

= 1, 25,000 – 62,500 + 1, 87,500 + (1, 00,000 + 25,000) + 1, 25,000/5

= 5, 00,000/5

= 1, 00,000

Goodwill = Average Profit of last 5 year x Three year Profit

= 1, 00,000 x 3

= 3, 00,000

Q5. Tarang purchased Jyoti’s business with effect from 1st April, 2025. Profits shown by jyoti’s business for the last three financial years ended 31st March, were:

2023: 1, 00,000 (including an abnormal gain of 12,500)

2024: 1, 25,000 (after charging an abnormal loss of 25,000)

2025: 1, 12,500 (excluding 12,500 as insurance premium on firm’s property – now to be insured)

Calculate the value of firm’s goodwill on the basis of two years purchase of the average profit of the last three years.

Solution – Normal Profit after Adjustment

Profit (2023) – 1, 00,000 – 12,500 = 87,500

Profit (2024) – 1, 25,000 + 25,000 = 1, 50,000

Profit (2025) – 1, 12,500 – 12,500 = 1, 00,000

Average Profit

Average Profit

= 87,500 + 1, 50,000 + 1, 00,000/ 3

= 3, 37,500/3

= 1, 12,500

Goodwill = Average Profit x Two year Profit

= 1, 12,500 x 2

= 2, 25,000

5. Madhu and Vidhi are partners sharing profits in the ratio of 3:2. They decided to admit Manu as a partner from 1st April, 2024 on the following terms:

- Manu will be given 2/5th share of the profit.

- Goodwill of the firm will be valued at two years purchase of three years normal average profit of the firm.

Profits of the previous three years ended 31st March, were:

2024 – Profit 30,000 (after debiting loss of stock by fire 40,000).

2023 – Loss 80,000 (includes voluntary retirement compensation paid 1, 10,000).

2022 – Profit 1, 10,000 (including a gain (profit) of 30,000 on the sale of fixed assets).

Calculate The Value Of Goodwill.(Old book)

Solution – Correct Profit after Adjustment

Profit (2024) = 30,000 + 40,000 = 70,000

Profit (2023) – (-80,000) + 1, 10,000 = 30,000

Profit (2022) – 1, 10,000 – 30,000 = 80,000

Average Profit of 3 Year

= 70,000 + 30,000 + 80,000/3

= 1, 80,000/3

= 60,000

Goodwill = Average Profit of 3 year x Two year Profit

= 60,000 x 2

= 1, 20,000

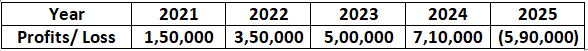

Q6. Abhay, Babu and Charu are partners sharing profits and losses equally. They agree to admit Daman for equal share of profit. For this purpose, the value of goodwill is to be calculated on the basis of four years purchase of average profit of last five years. These profits for the year ended 31st March, were:

On 1st April, 2024, a car for 1, 00,000 was purchased and debited to Travelling Expenses Account, on which depreciation is to be charged @ 25% p.a. Interest of 10,000 on Non-trade Investments is credit to income for the year ended 31st March, 2024 and 2025.

Calculate the value of goodwill after adjusting the above.

Solution – Normal Profit after adjustment

Profit (2024) – 7, 10,000 – 10,000 = 7, 00,000

Profit (2025) – (- 5, 90,000) + 1, 00,000 – 25,000 – 10,000 =- 5, 25,000

Average Profit Last 5 year

= 1, 50,000 + 3, 50,000 + 5, 00,000 + 700,000 – 5, 25,000/ 5

= 11, 75,000/5

= 2, 35,000

Goodwill = Average Profit x Four year Profit

= 2, 35,000 x 4

= 9, 40,000

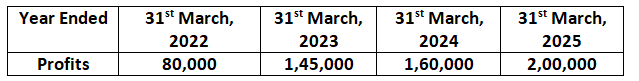

Q7. Sumit purchased Amit’s business on 1st April, 2025. Goodwill was decided to be valued at two years purchase of average normal profit of last four years. The profits for the past four years were:

Books of Account revealed that:

- Abnormal loss of 20,000 was debited to Profit and Loss Account for the year ended 31st March, 2022.

- A fixed asset was sold in the year ended 31st March, 2023 and gain (profit) of 25,000 was credited to Profit & Loss Account.

- In the year ended 31st March, 2024 assets of the firm were not insured due to oversight. Insurance premium not paid was 15,000.

Calculate the value of goodwill.

Solution – NormalProfit after Adjustment

Normal Profit (2022) – 80,000 + 20,000 = 1, 00,000

Normal Profit (2023) – 1, 45,000 – 25,000 = 1, 20,000

Normal Profit (2024) – 1, 60,000 – 15,000 = 1, 45,000

Normal Profit (2025) – 2, 00,000

Average Profit

= 1, 00,000 + 1, 20,000 + 1, 45,000 + 2, 00,000 / 4

= 5, 65,000 / 4

= 1, 41,250

Goodwill = Average Profit x Two year Profit

= 1, 41,250 x 2

= 2, 82,500

Weighted Average Profit Method:-

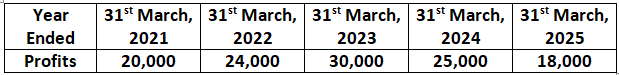

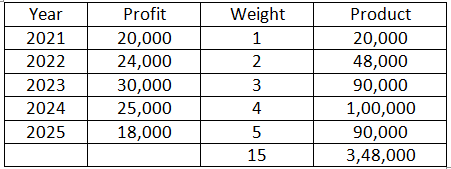

Q8. Profits of a Firm for the year ended 31st March for the last five years were:

Calculate value of goodwill on the basis of three years purchase of Weighted Average Profit after assigning weights 1, 2, 3, 4 and 5 respectively to the profits for years ended 31st March, 2021, 2022, 2023, 2024 and 2025.

Solution – Weighted Average Profit:

Weighted average normal profit = total weight normal business profit / Total of weight

=348000 / 15

=23200

Goodwill = 23,200 x 3

= 69,600

Q9. Raman and Daman are partners sharing profits in the ratio of 60:40 and for the last four years they have been getting annual salaries of 50,000 and 40,000 respectively. The annual accounts have shown the following net profit before charging partners salaries:

Year ended 31st March, 2023 – 1, 40,000; 2024 – 1, 01,000 and 2025 – 1, 30,000.

On 1st April, 2025, Zeenu is admitted to the partnership for 1/4th share in profit (without any salary). Goodwill is to be valued at four years purchase of weighted average profit of last three years (after partners salaries); Profits to be weighted as 1, 2 and 3, the greatest weight being given to the last year.

Calculate the value of Goodwill.

Solution – Actual Normal Profit After

Profit (2022) – 1, 40,000 – (50,000 + 40,000) = 50,000

Profit (2023) – 1, 01,000 – (50,000 + 40,000) = 11,000

Profit (2024) – 1, 30,000 – (50,000 + 40,000) = 40,000

Profit Weight Weight of Profit

50,000 1 50,000

11,000 2 22,000

40,000 3 1, 20,000

6 1, 92,000

Weight Average Profit = 1, 92,000/ 6

= 32,000

Goodwill = 32,000 x 4 = 1, 28,000

Super Profit Method:-

Q10. The capital of the firm of Anuj and Benu is 10, 00,000 and the market rate of interest is 15%. Annual Salary to the partners is 60,000 each. The profit for the last three years were 3, 00,000 3, 60,000 and 4, 20,000. Goodwill of the firm is to be valued on the basis of two years purchase of last three years average super profit. Calculate the goodwill of the firm.

Solution – Salary of both Partners of three year

60,000 x 2 x 3 years = 3, 60,000

Average Profit after Salary

= 3, 00,000 + 3, 60,000 + 4, 20,000 – (3, 60,000) / 3

= 7, 20,000 / 3

= 2, 40,000

Normal Profit = Capital employed x NRR

= 10, 00,000 X 15%

= 1, 50,000

Super profit= average profit -normal profit

=240,000-150,000

=90,000

Goodwill = Super Profit x number of year of Purchase

= 90,000 x 2

= 1, 80,000

Q11. Atul and Bipul had a firm in which they had invested 50,000. On an average, the profits were 16,000. The normal rate of return in the industry is 15%. Goodwill is to be valued at four years purchase of profits in excess of profits @ 15% on the money invested. Calculate the value of goodwill.

Solution – Average Profit = 16,000

Normal Profit = Capital employed x NRR

= 50,000 X 15%

= 7,500

Super Profit = Average Profit – Normal Profit

= 16,000 – 7,500

= 8,500

Goodwill = Super Profit x year of Purchase

= 8,500 x 4

= 34,000

Q12. Sakshi and Megha were partners sharing profits and losses in the ratio of 3:1. Capital employed as on 31st March, 2024 was Rs.14,00,000. Profit earned on an average is Rs.1,80,000. Calculate goodwill of the firm on the basis of 5 years purchase of Super Profits, if the normal rate of return is 10%.

Solution-

Step 1

Calculation the Normal Profit

Normal Profit = Capital Employed X Normal Rate of Return / 100

Normal Profit = 10% x 14,00,000 / 100

= 10 x 14,00,000 /100

= Rs.1,40,000

Step 2

Calculation the Super Profit:

Super profit = Average Profit – Normal Profit

Substituting the values:

Super Profit = Rs.1,80,000 – Rs.1,40,000

= Rs.40,000

Step 3

Calculation the Goodwill:

Goodwill = Super Profit X Number of Years’ Purchase

Substituting the values:

Goodwill = Rs.40,000 x 5

= Rs.2,00,000

13. Total capital of the firm of Sakshi, Mehak and Megha is 1, 00,000 and the market rate of interest is 15%. The net profits for the last 3 years were 30,000; 36,000 and 42,000. Goodwill is to be valued at 2 years purchase of the last 3 years super profit. Calculate the goodwill of the firm. (Old book)

Solution –

Average Profit = 30,000 + 36,000 + 42,000/3

= 1, 08,000/3

=36,000

Normal Profit = Capital employed x NRR

= 1, 00,000 X 15%

= 15,000

Super Profit = Average Profit – Normal Profit

= 36,000 – 15,000

= 21,000

Goodwill = Super Profit x year of Purchase

= 21,000 x 2

= 42,000

Q13. A and B were partners in a firm sharing equally. Their capitals were: A- ₹ 1,20,000 and B- ₹ 80,000. The annual rate of interest is 20% profits of the firm the last three years were ₹ 34,000; ₹ 38,000 and ₹ 30,000 they admitted C as a new partner. On C’s admission the goodwill of the firm was valued at 2 years’ purchase of the super profits.

Calculate the value of goodwill of the firm on C’ admission.

Solution

Goodwill = No. of years’ Purchase x Super Profit

Super Profit = Actual profit – Normal Profit

Average Profit = Average profit of 3 years

Average Profit

= 34,000 + 38,000 + 30,000 / 3

= 3400

Normal Profit = 20% of total capital

= 20% x 2,00,000 = ₹ 40,000

Super Profit

= 34,000 – 40,000 = – 6,000

This firm is having negative super profit. So, no goodwill is Possible.

Q14. Average net profit expected in future by XYZ firm is 36,000 per year. Average capital employed in the business by the firm is 2, 00,000. The normal rate of return from capital invested in this class of business is 10%. Remuneration of the partners is estimated to be 6,000 p.a. Calculate the value of goodwill on the basis of two years purchase of super profit.

Solution – Average Profit = 36,000 – 6,000 = 30,000

Normal Profit = Capital employed x NRR

= 2, 00,000 X 10%

= 20,000

Super Profit = Average Profit – Normal Profit

= 30,000 – 20,000

= 10,000

Goodwill = Super Profit x year of Purchase

= 10,000 x 2

= 20,000

14. A business earned an average profit of 8, 00,000 during the last few years. The normal rate of profit in the similar type of business is 10%. The total value of assets and liabilities of the business were 22, 00,000 and 5, 60,000 respectively. Calculate the value of goodwill of the firm by super profit method if it is valued at 2 ½ years purchase of super profit. (Old book)

Solution – Average Profit = 8, 00,000

Calculate Capital employed

Net Assets = Total Assets – Liabilities

= 22, 00,000 – 5, 60,000

= 16, 40,000

Normal Profit = Capital employed x NRR

= 16, 40,000 X 10%

= 1, 64,000

Super Profit = Average Profit – Normal Profit

= 8, 00,000 – 1, 64,000

= 6, 36,000

Goodwill = Super Profit x year of Purchase

= 6, 36,000 x 25

= 15, 90,000

Q15. A partnership firm earned net profits during the last three years ended 31st March, as follows:

2023 – 17,000; 2024 – 20,000; 2025 – 23,000

Capital investment in the firm throughout the above-mentioned period has been 80,000. Having regard to the risk involved, 15% is considered to be a fair return on the capital. Calculate value of goodwill on the basis of two years purchase of average super profit earned during the above-mentioned three years.

Solution –

Average Profit = 17,000 + 20,000 + 23,000 / 3

= 60,000 / 3

= 20,000

Normal Profit = Capital employed x NRR

= 80,000 X 15%

= 12,000

Super Profit = Average Profit – Normal Profit

= 20,000 – 12,000

= 8,000

Goodwill = Super Profit x year of Purchase

= 8,000 x 2

= 16,000

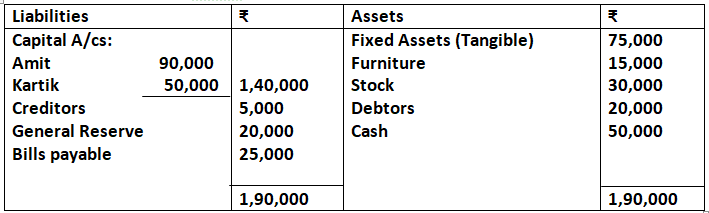

Q.16 Amit and Kartik are partners sharing profits and losses equally. They decided to admit Saurabh for an equal share in the profits. For this purpose, the goodwill of the firm was to be valued at four years’ purchases of super profits.

The Balance sheet of the firm on Saurabh’s admission was as follows:

The normal rate of return is 12% p.a. Average profit of the firm for the last four years was Rs.30,000. Calculate Saurabh’s share of goodwill.

Solution-

Capital of Firm = 1,40,000 + 20,000 (Reserve)

= Rs.1,60,000

Normal Profit = 1,60,000 x 12 / 100

= 19,200

Average Profit Rs.30,000

Super profit = Average Profit – Normal Profit

= 30,000 – 19,200

= Rs.10,800

Goodwill = 4 (Super Profit)

= 4 (10,800)

= 43,200

Saurabh’s share of Goodwill = 1/3 of 43, 200

= rs.14,400

Calculation of average profit ,normal rate of return and capital employed

Q17. On 1st April, 2025, an existing firm had assets of 75,000 including cash of 5,000. Its creditors amounted to 5,000 on that date. The firm had a Reserve of 10,000 while Partners Capital Accounts showed a balance of 60,000. If normal Rate of Return is 20% and goodwill of the firm is valued at 24,000 at four years purchase of Super profit, find average profit per year of the existing firm.

Solution –

Capital employed (Assets side approach) = (Assets – Creditor)

= (75,000 – 5,000)

= 70,000

Or

Capital employed (Liabilities side approach) = Capital + Reserve

= 60,000 + 10,000

= 70,000

Normal Profit = Capital employed x NRR

= 70,000 X 20%

= 14,000

Goodwill = Super Profit x No Of year Purchase

Goodwill = (Average Profit – Normal Profit) X no of year purchase

24,000 = (Average Profit – 14,000) x 4

Average Profit – 14,000 = 24,000/4

Average Profit – 14,000 = 6,000

Average Profit = 6,000 + 14,000

Average Profit = 20,000

Q18. On 1st April, 2023 a partnership firm assets of Rs.2,00,000 including cash of Rs.6,000 and bank balance of Rs.14,000. The partners accounts showed a balance of Rs.1,90,000 and reserve constituted the rest. If the normal rate of return is 10% and the goodwill of the firm is valued at Rs.60,000 at 4 year4 purchases of super profits, find the average profits of the firm.

Solution-

Calculation of Average profit of the Firm

Goodwill = Super profit x 4 year of purchase

Goodwill = (Average profit – Normal profit ) x 4

Rs.60,000 = (Average Profit – 20,000) x 4’

Average profit – 20,000 = 60,000 / 4

Average Profit = Rs.15,000 + 20,000

= Rs.35,000

Calculation of Normal Profit of the firm

Capital employed = Assets – outside liabilities

= Rs.2,00,000 – 0

= Rs.2,00,000

Normal Profit = Capital employed x Normal rate of return

= 2,00,000 x 10%

= Rs.20,000

Q19. Average profit of a firm during the last few years is 2, 00,000 and the normal rate of return in a similar business is 10%. If the goodwill of the firm is 2, 50,000 at 4 years purchase of Super profit. Find the capital employed by the firm.

Solution –

Goodwill = Super Profit x No Of year Purchase

Goodwill = (Average Profit – Normal Profit) X no of year purchase

2, 25,000 = (2, 00,000 – Normal Profit) x 4

2, 50,000/4 = 2, 00,000 – Normal Profit

62,500 = 2, 00,000 – Normal Profit

Normal Profit = 2, 00,000 – 6, 25,000

Normal Profit = 1, 37,500

Normal Profit = Capital employed x No of Year

1, 37,500 = Capital Employed x 10%

Capital Employed = 1, 37,500 x 100 / 10

= 13, 75,000

Q20. A business earned an average profit of ₹ 1,80,000 during the last few years. Average capital employed by the firm is ₹ 12,50,000. If goodwill of the firm is valued at ₹ 1,60,000 at 2 years’ purchase of super profit, find normal rate of return.

Solution

Goodwill = Super profit x 2 year Purchase

16,000 = Super Profit x 2

Super profit = 160000/2 = ₹ 80000

Super profit = Average profit – Normal profit

80000 = 180000 – Normal profit

Normal profit = ₹ 100000

Normal profit = Capital Employed x Normal rate of return

Normal rate of return = Normal Profit / Capital employed

= 1,00,000 / 1,25,000 x 100

= 8%

Q21. A business has earned profit of ₹ 1,20,000 during the last four years and the normal rate of return in similar business is 15%. If goodwill of the firm is valued at ₹ 1,35,000 at 3 years’ purchase of average super profit, find the capital employed of the firm.

Solution:

Value of goodwill=Super profit x number of year purchase

1,35,000 = Super profit x 3

1,35,000 / 3 = Super Profit

Super profit = 45000

Super profit = Average profit-normal profit

45000 = 1,20,000-normal profit

Normal profit =1,20,000-45000

Normal profit = 75000

Normal profit =Average capital employed x NRR / 100

75000 = Average capital employed x 15 / 100

75000 x 100 / 15 = Average capital employed

Average capital employed = 500,000

Super Profit Method When Past Adjustments are Made:-

Q22. Average profit earned by a firm is 1,00,000 which includes undervaluation of stock of 40,000 on an average basis. The capital invested in the business is 6, 30,000 and the normal rate of return is 5%. Calculate goodwill of the firm on the basis of 5 times the super profit.

Solution –

Actual Average Profit = 1, 00,000 + 40,000 = 1, 40,000

Normal Profit = Capital employed x NRR

= 6, 30,000 X 5%

= 31,500

Super Profit = Average Profit – Normal Profit

= 1, 40,000 – 31,500

= 1, 08,500

Goodwill = Super Profit x year of Purchase

= 1, 08,500 x 5

= 5, 42,500

Q23. Average profit earned by a firm is 7, 50,000 which includes overvaluation of stock of 30,000 on an average basis. The capital invested in the business is 42, 00,000 and the normal rate of return is 15%. Calculate goodwill of the firm on the basis of 3 times the super profit.

Solution –

Average Profit = 7, 50,000 – 30,000 = 7, 20,000

Normal Profit = Capital employed x NRR

= 4, 20,000 X 15%

= 63,000

Super Profit = Average Profit – Normal Profit

= 7, 20,000 – 6, 30,000

= 90,000

Goodwill = Super Profit x year of Purchase

= 90,000 x 3

= 2, 70,000

Q24. Akshay and Amit are partners in a firm and they admit Jaspal into partnership 1st April, 2024. They agreed to value goodwill at 3 years purchase of Super Profit Method for which they decided to average profit of last 5 years. The profits for the last 5 years were:

Year Ended Net Profit

31st March, 2021 1, 50,000

31st March, 2022 1, 80,000

31st March, 2023 1, 00,000 (including abnormal loss of 1, 00,000)

31st March, 2024 2, 60,000 (including abnormal gain (profit) of 40,000)

31st March, 2025 2, 40,000

The firm has total assets of 20, 00,000 and Outside Liabilities of 5, 00,000 as on that date. Normal Rate of return in similar business is 10%

Calculate value of goodwill.

Solution – Profit 2021 = 1, 50,000

2022 = 1, 80,000

2023 = 1, 00,000 + 1, 00,000 = 2, 00,000

2024 = 2, 60,000 – 40,000 = 2, 20,000

2025 = 2, 40,000

Average Profit = 1,50,000 + 1,80,000 + 2,00,000 + 2,20,000 + 2,40,000 / 5

= 9, 90,000 / 5

= 1, 98,000

Capital Employed = Total Assets – Outside Liabilities

= 20, 00,000 – 5, 00,000

= 15, 00,000

Normal Profit = Capital employed x NRR

= 15, 00,000 X 10%

= 1, 50,000

Super Profit = Average Profit – Normal Profit

= 1, 98,000 – 1, 50,000

= 48,000

Goodwill = Super Profit x year of Purchase

= 48,000 x 3

= 1, 44,000

Capitalisation Method:-

Q25. From the following information, calculate value of goodwill of the firm by applying Capitalisation Method:

Total capital of the firm 16, 00,000

Normal rate of return 10%

Profit for the year 2, 00,000

Solution –

Capitalisation Value of the firm =

= Average Profit / Normal Rate of Returns X 100

= 2, 00,000 / 10x 100

= 20, 00,000

Goodwill = Capitalisation Value of Firm – Capital employed (net assets)

= 20, 00,000 – 16, 00,000

= 4, 00,000

Q26. A firm earned average profit of 3, 00,000 during the last few years. The normal rate of return of the industry is 15%. The assets of the business were 17, 00,000 and its liabilities were 2, 00,000.

Calculate the goodwill of the firm by Capitalisation of average profit.

Solution –

Solution –

Capitalised Value of Firm = Average Profit / NRR X 100

= 3, 00,000 X 100 / 15

= 20, 00,000

Capital employed = Assets – Liabilities

= 17, 00,000 – 2, 00,000

= 15, 00,000

Goodwill = Capitalised value of firm – Capital employed

= 20, 00,000 – 15, 00,000

= 5, 00,000

Q27. A & B were partners in a firm with capitals of 3, 00,000 and 2, 00,000 respectively. The normal rate of return was 20% and the capitalized value of average profits was 7, 50,000. Calculate goodwill of the firm by Capitalisation of average profits method.

Solution –

Capitalised Value of firm = 7, 50,000

Capital employed = 3, 00,000 + 2, 00,000

= 5, 00,000

Goodwill = Capitalised Value – Capital employed

= 7, 50,000 – 5, 00,000

= 2, 50,000

Q28. Puneet and Tarun are in restaurant business having credit balance in their fixed Capital Accounts as 2, 50,000 each. They have credit balances in their Current Accounts of 30,000 and 20,000 respectively. The firm does not have any liability. They are regularly earning profits and their average profit of last 5 years is 1, 00,000. If the normal rate of return is 10%, find the value of goodwill by Capitalisation of Average Profit Method.

Solution –

Total Capitalised Value of the firm = Average Profit / NRR x 100

= 1, 00,000 X 100 / 10

= 10, 00,000

Capital employed = Fixed capital account + Current account

= (2, 50,000 x 2) + 30,000 + 20,000

= 5, 50,000

Goodwill = Capitalised Value – Capital employed

= 10, 00,000 – 5, 50,000

= 4, 50,000

Q29. From the following particulars, calculate value of goodwill of a firm by Capitalisation of Average Profit Method:

- Profits of last five consecutive years ending 31st March, are: 2025 – 54,000; 2024 – 42,000; 2023 – 39,000; 2022– 67,000 and 2021 – 59,000

- Capitalisation rate 20%

- Net assets of the firm 2, 00,000.

Solution –

Average Profit of Last 5 years

= 54,000 + 42,000 + 39,000 + 67,000 + 59,000/ 5

= 2, 61,000/ 5

= 52,200

Total Capitalised Value of Firm = Average Profit /NRR x 100

= 52,200/20 X 100

= 2, 61,000

Goodwill = Total Capitalised value – Capital Employed

= 2, 61,000 – 2, 00,000

= 61,000

Q30. A business has earned average profit of 4, 00,000 during the last few years and the normal rate of return in similar business is 10%. Find value of goodwill by:

- Capitalisation of Super Profit Method

- Super Profit Method if the goodwill is valued at 3 years purchase of super profits.

Assets of the business were 40, 00,000 and its external liabilities 7, 20,000

Solution –

Capital Employed = Assets – External Liabilities

= 40, 00,000 – 7, 20,000

= 36, 80,000

Normal Profit = Capital employed x NRR

= 36, 80,000 X 10%

= 3, 28,000

Super Profit = Average Profit – Normal Profit

= 4, 00,000 – 3, 28,000

= 72,000

Capitalised Value of firm = Super Profit / NRR x 100

= 72,000 / 10X 100

= 7, 20,000

Goodwill = Super Profit x year of Purchase

= 72,000 x 3

= 2, 16,000

Q31. A firm profit of 5, 00,000 .Normal Rate of Return in a similar type of business is 10%. The value of total assets (excluding goodwill) and total outsiders liabilities as on the date of goodwill are 55, 00,000 and 14, 00,000 respectively. Calculate value of goodwill according to Capitalisation of Super Profit Method as well as Capitalisation of Average Profit Method.

Solution –

Capital Employed = Total Assets – External Liabilities

= 55, 00,000 – 14, 00,000

= 41, 00,000

Capitalised Value of firm = Average Profit / NRR x 100

= 5, 00,000/10 X 100

= 50, 00,000

Goodwill = Total Capitalised Value – Capital Employed

= 50, 00,000 – 41, 00,000

= 9, 00,000

Q32. On 1st April, 2018, a firm had assets of 1, 00,000 excluding stock of 20,000. The current liabilities were 10,000 and the balance constituted Partners Capital Accounts. If the normal rate of return is 8%, the Goodwill of the firm is valued of 60,000 at four years purchase of Super profit, find the actual profits of the firm.

Solution –

Capital Employed = Total Assets – External Liabilities

= 1, 20,000 – 10,000

= 1, 10,000

Normal Profit = Capital employed x NRR

= 1, 10,000 X 8%

= 8,800

Goodwill = Super Profit x No of year purchase

Goodwill = (Average Profit – Normal Profit) x No of year purchase

60,000 = (Average Profit – 8,800) x 4

60,000/4 = Average Profit – 8,800

15,000 = Average Profit – 8,800

Average Profit = 15,000 + 8,800

= 23,800

Capitalisation of Super Profit:-

Q33. Average profit of a firm during the last few years is 1, 50,000. In similar business, the normal rate of return is 10% of the capital employed. Calculate the value of goodwill by Capitalisation of super `profit method if super profits of the firm are 50,000.

Solution –

Solution –

Goodwill = Super Profit/ NRR x 100

= 5,000 / 10 X 100

= 5, 00,000

Q34. Raja Brothers earn an average profit of 30,000 with a capital of 2, 00,000. The normal rate of return in the business is 10%. Using Capitalisation of super profit method, workout the value of the goodwill of the firm

Solution – Average Profit = 30,000

Normal Profit = Capital employed x NRR

= 2, 00,000 X 10%

= 20,000

Super Profit = Average Profit – Normal Profit

= 30,000 – 20,000

= 10,000

Goodwill = Super Profit/ NRR x 100

= 10,000 / 10 X 100

= 1, 00,000

Q35. Rajan and Rajani are partners in a firm. Their capitals were Rajan 3, 00,000; Rajani 2, 00,000. During the year ended 31st March, 2025, the firm earned a profit of 1, 50,000. Calculate the value of goodwill of the firm by Capitalisation of super profit assuming that the normal rate of return is 20%.

Solution – Average Profit = 1, 50,000

Capital Employed = 3, 00,000 + 2, 00,000 = 5, 00,000

Normal Profit = Capital employed x NRR

= 5, 00,000 X 20%

= 1, 00,000

Super Profit = Average Profit – Normal Profit

= 1, 50,000 – 1, 00,000

= 50,000

Goodwill = Super Profit/ NRR x 100

= 50,000 / 10 X 100

= 2, 50,000

Q36. A business has earned average profit of 8, 00,000 during the last few years and the normal rate of return in similar business is 10%. Find value of goodwill by:

- Capitalisation of Super Profit Method

- Super Profit Method if the goodwill is valued at 3 years purchase of super profit.

Assets of the business were 80, 00,000 and its external liabilities 14, 40,000.

Solution – 1

Capital Employed = Total Assets – Outside Liabilities

= 80, 00,000 – 14, 40,000

= 65, 60,000

Normal Profit = Capital employed x NRR

= 65, 60,000 X 10%

= 6, 56,000

Super Profit = Average Profit – Normal Profit

= 8, 00,000 – 6, 56,000

= 1, 44,000

Goodwill = Super Profit/ NRR x 100

= 1, 44,000/ 10 X 100

= 14, 40,000

2. Goodwill = Super Profit x No of Year Purchase

= 1, 44,000 x 3

= 4, 32,000

Q37. Rohit and Hardik are partners sharing profits and losses equally. They decided to admit Surya as a partner for 1/3 share. For this purpose, the goodwill of the firm is to be valued. From the following information, calculate the value of goodwill by:

(i) Capitalisation of Average Profit Method.

(ii) Capitalisation of Super Profit Method.

- Average Capital Employed : Rs.6,00,000

- Normal Rate of Return : 12%

- Profit for last three years: 2021-22 : Rs.90,000

2022-23 : Rs.80,000

2023-24 : Rs.1,00,000

- Assets (Excluding goodwill) : Rs.10,00,000

- Liabilities : Rs.4,00,000

Solution-

Cash – 1

Average Profit of last three year = 90,000 + 80,000 + 1,00,000 / 3

= 270000 /3

= Rs.90,000

Capitalised value of Average profit = Average Profit / Normal Rate of Return

= 90,000 x 100 /12

= Rs.7,50,000

Goodwill = Capitalised value of Average profit – Capital employed

= 7,50,000 – 6,00,000

= 1,50,000

Case – 2

Average Profit of last three year = 90,000 + 80,000 + 1,00,000 / 3

= 270000 / 3

Normal Profit = Capital employed x Normal rate of Return

= 6,00,000 x 12%

= 72000

Super Profit = Average Profit – Normal Profit

= Rs.90,000 – Rs.72,000

= Rs.18000

Goodwill of the Firm = Super Profit / Normal Rate of Return

= 18,000 x 100 /12

= Rs.1,50,000

Q38. From the following information, calculate value of goodwill of the firm:

- At three years purchase of Average Profit.

- At three years purchase of Super Profit.

- On The basis of Capitalisation of Super Profit

- On the basis of Capitalisation of Average Profit.

Information:

- Average capital Employed is 6,00,000

- Net Profit/(Loss) of the firm for the last three years ended are: 31st March, 2025 – 2,00,000, 31st March, 2024 – 1,80,000 and 31st March, 2023 – 1,60,000

- Normal Rate of Return in similar business is 10%

- Remuneration of 1, 00,000 to partners is to be taken as charge against profit.

- Assets of the firm (excluding goodwill, fictitious assets and non-trade investments) is 7, 00, 000 whereas Partners Capital is 6, 00,000 and Outside Liabilities 1, 00,000.

Solution –

Average Profit = 2, 00,000 + 1, 80,000 + 1, 60,000 / 3

= 5, 40,000/3

= 1, 80,000 – 1, 00,000

= 80,000

Normal Profit = 6, 00,000 x 10 / 100

= 6, 00,000

1. Goodwill = Average Profit x No of Year Purchase

= 80,000 x 3

= 2, 40,000

2. Super Profit = Average Profit – Normal Profit

= 80,000 – 60,000

= 20,000

Goodwill = Super Profit x No of year Purchase

= 20,000 x 3

= 60,000

3. Goodwill = Super Profit /NRR x 100

= 20,000 / 10 X 100

= 2, 00, 000

4. Total Capitalised Value = 80,000 x 100 / 10

= 8, 00,000

Capital Employed = Assets – Liabilities

= 7, 00,000 – 1, 00,000

= 6, 00,000

Goodwill = Capitalised Value – Capital employed

= 8, 00,000 – 6, 00,000

= 2, 00,000