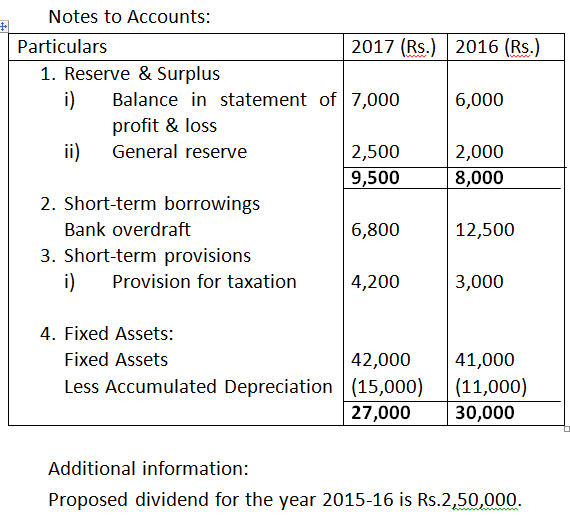

- Anand Ltd., arrived at a net income of Rs.5,00,000 for the year ended March 31, 2017. Depreciation for the year was Rs.2,00,000. There was a profit of Rs.50,000 on assets sold which was transferred to Statement of Profit and Loss account. Trade Receivables increased during the year Rs.40,000 and Trade Payables also increased by Rs.60,000. Compute the cash flow operating activities by the indirect approach.

Ans.

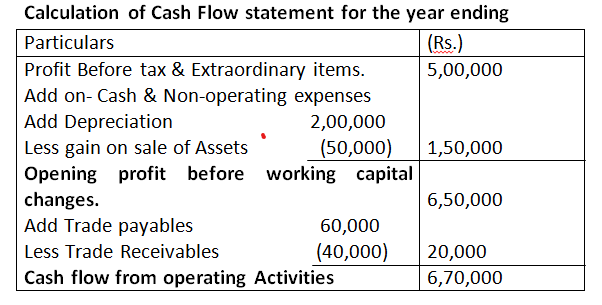

2. From the information given below you are required to calculate the cash paid for the inventory:

Ans.

3. For each of the following transactions, calculate the resulting cash flow and state the nature of cash flow, viz., operating, investing and financing.

- Acquired machinery for Rs.2,50,000 paying 20% by cheque and executing a bond for the balance payable.

- Paid Rs.2,50,000 to acquire share in Informa Tech. and received a dividend of Rs.50,000 after acquisition.

- Sold machinery of original cost Rs.2,50,000 with an accumulated depreciation of Rs.1,60,000 for Rs.60,000.

Ans.

- Rs.50,000 Outflow in Investing Activity that is 20% of 2.50,000.

2. Net Rs.2,00,000 outflow in Investing Activity

Explanation:- Rs.2,50,000 is the outflow in investing activity and Rs.50,000 is the inflow as the dividend received on shares.

3. Rs.60,000 is the inflow as the investing activity

Explanation sale of non-current assets is considered as the inflow of investing activity.

4. The following is the Profit and loss Account of Yamuna Limited:

Statement of Profit and Loss of Yamuna Ltd., For the year ended March 31, 2017

Additional information:

- Trade receivables decrease by Rs.30,000 during the year.

- Prepaid expenses increase by Rs.5,000 during the year.

- Trade payables increase by Rs.15,000 during the year.

- Outstanding expenses payable increased by Rs.3,000 during the year.

- Other expenses included depreciation of Rs.25,000.

Compute net cash from operations for the year ended March 31, 2017 by the indirect method.

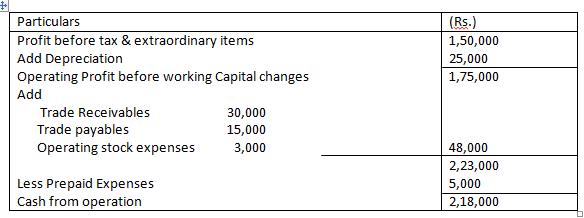

Ans.

Calculate of Cash Flow from operating activities

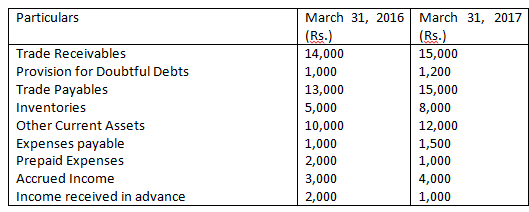

5. Computer cash from operations from the following figures:

- Profit for the year 2016-2017 is a sum of Rs.10,000 after providing for depreciation of Rs.2,000.

- The current assets and current liabilities of the business for the year ended March 31, 2016 and 2015 are as follows:

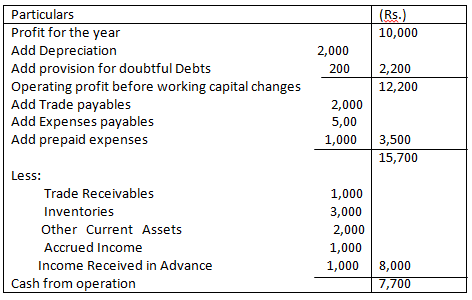

Ans.

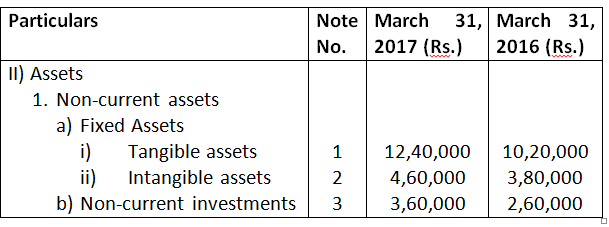

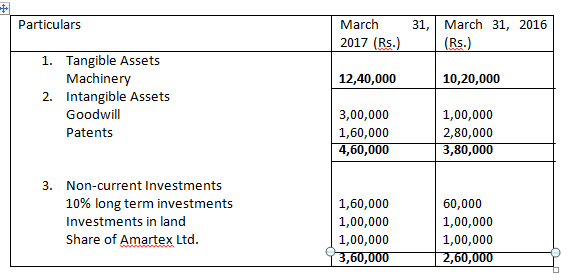

6. From the following particulars of Bharat Gas Limited, calculate Cash Flows from Investing Activities. Also show the workings clearly preparing the ledger accounts:

Balance Sheet of Bharat Gas Ltd., as on 31 March, 2016- 2017

Notes: 1. Tangible assets = Machinery

2 Intangible assets = Patents

Note Accounts

Additional information:

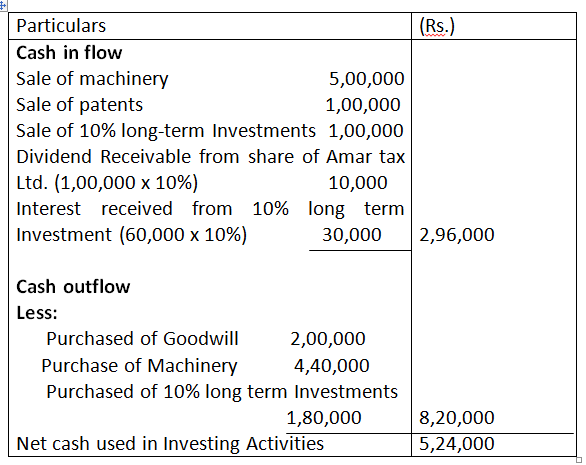

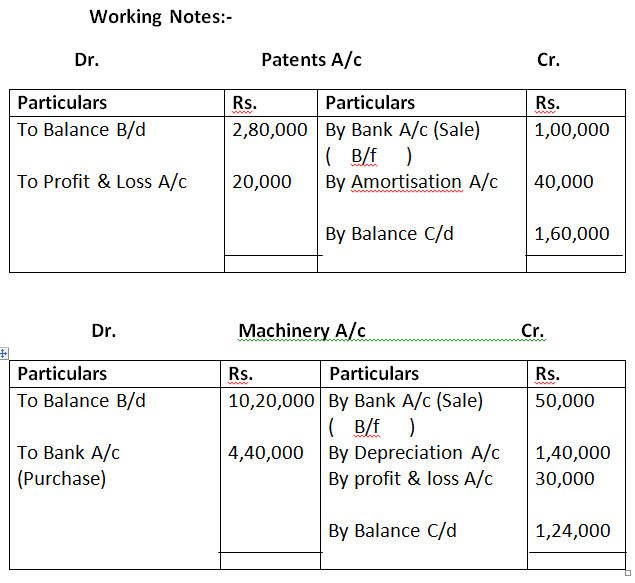

- Patents were written-off to the extent of Rs.40,000 and some Patents were sold at a profit of Rs.20,000.

- A Machine costing Rs.1,40,000 (Depreciation provided thereon Rs.60,000) was sold for Rs.50,000. Depreciation charged during the year was Rs.1,40,000.

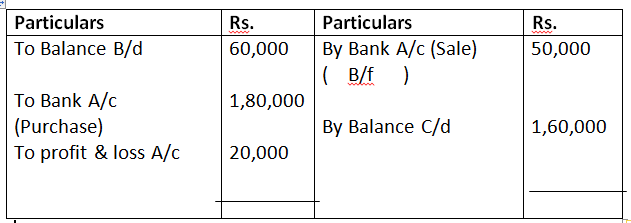

- On March 31, 2016, 10% investments were purchased for Rs.1,80,000 and some Investment were sold at a profit of Rs.20,000. Interest on Investment was received on March 31, 2017.

- Amartax Ltd., paid Dividend @ 10% on its shares.

- A plot of Land had been purchased for investment purposes and let out for commercial use and rent received Rs.30,000.

Solution:-

Calculation of cash flow from Investing Activities

Dr. 10% long term Investment A/c Cr.

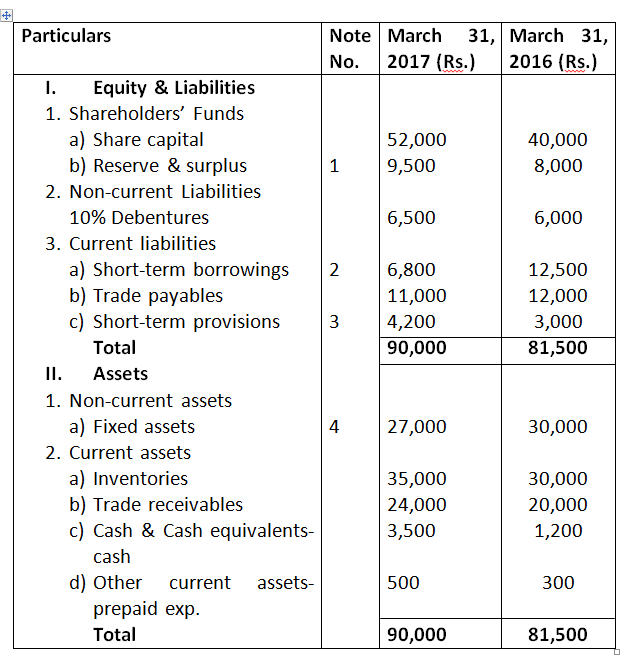

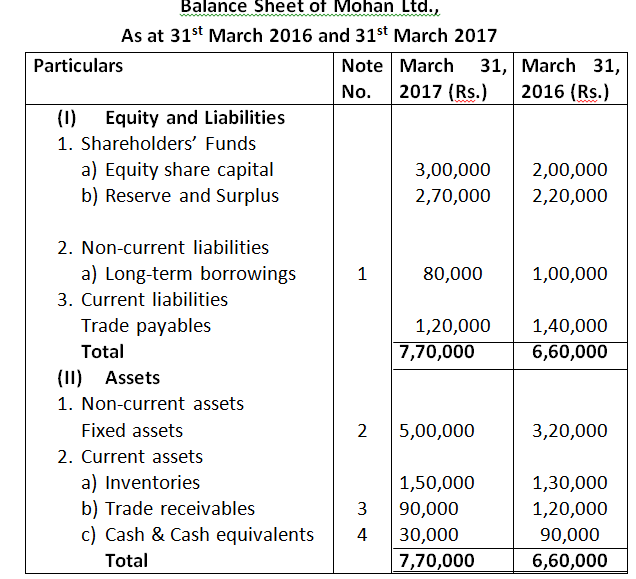

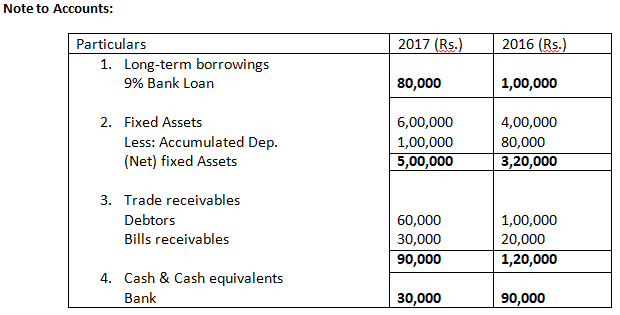

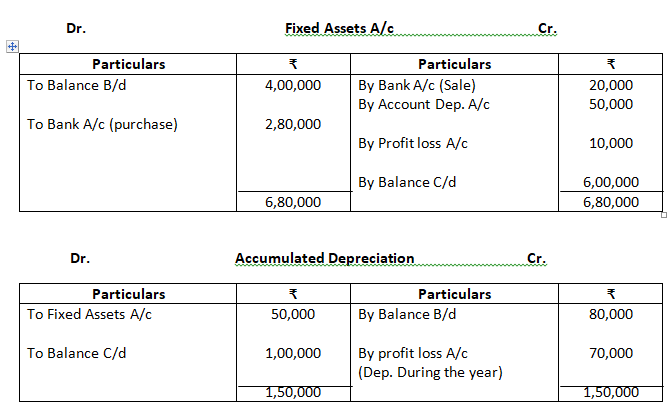

7. From the following Balance Sheet of Mohan Ltd., prepare cash flow Statement:

Additional Information:

Machine Costing Rs.80,000 on which accumulated depreciation was Rs.50,000 was sold for Rs.20,000. 9% bank loan Rs.20,000 was repaid on March 31, 2017. Proposed dividend for the year 2015-2016 was Rs.60,000.

Solution:-

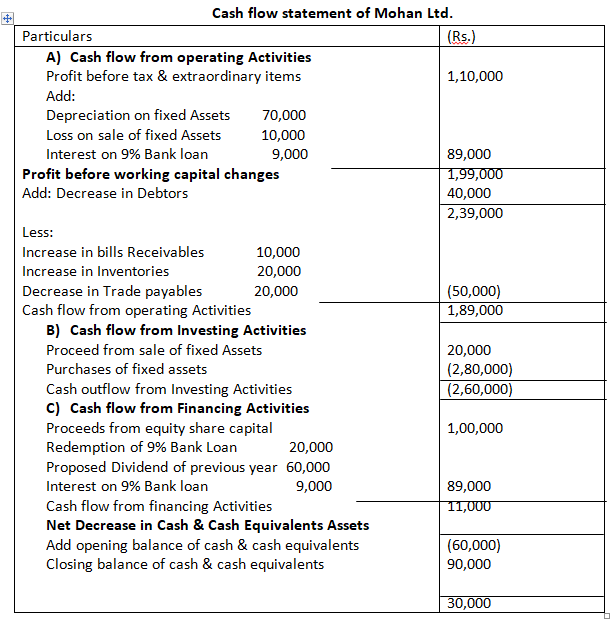

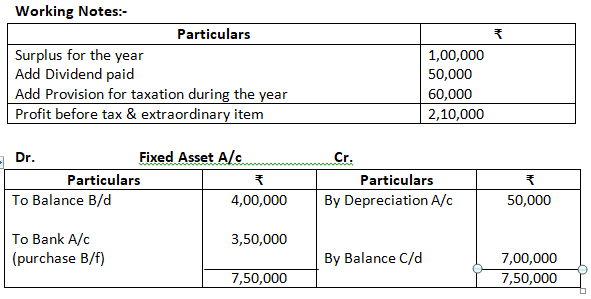

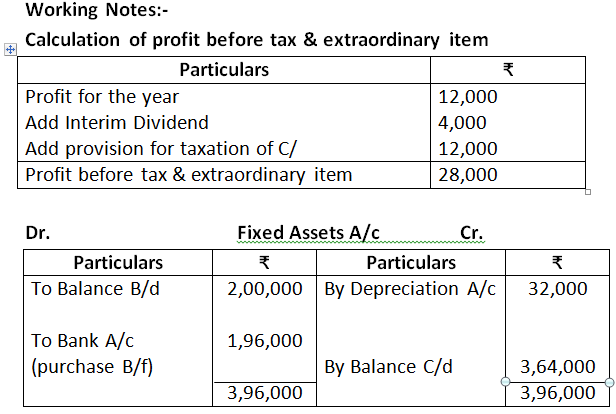

Working Notes:-

Calculation of Profit before tax & extraordinary items.

Profit for the year (2,70,000 – 2,20,000) – Rs.50,000

Add proposed Dividend Rs.60,000

Profit before tax & extraordinary items. Rs.1,10,000

Calculation of profit loss, Depreciation of fixed assets

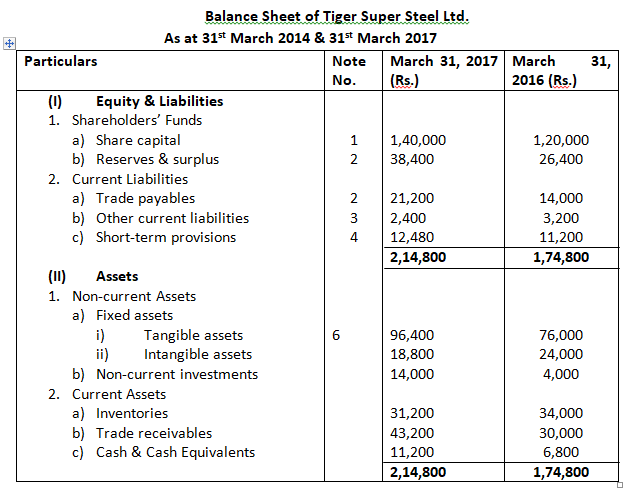

8. From the following Balance Sheets of Tiger Super Steel Ltd., prepare Cash Flow Statement:

Additional information:

Proposed dividend for 2016-17 is Rs.15,600 and for 2015-16 is Rs.11,200.

Depreciation Charged on Land & Building Rs.20,000, and Plant Rs.10,000 during the year. Proposed dividend for 2016-17 Rs.15,600 and 2015-16 Rs.11,200

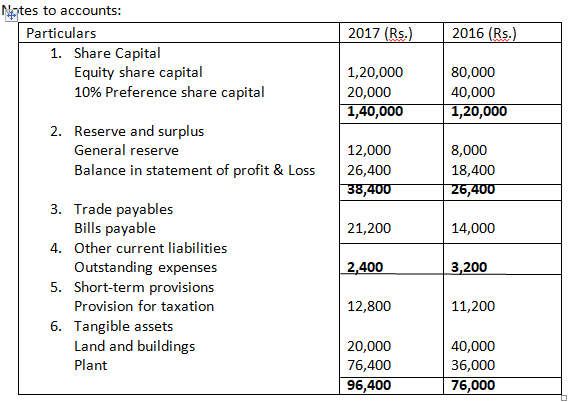

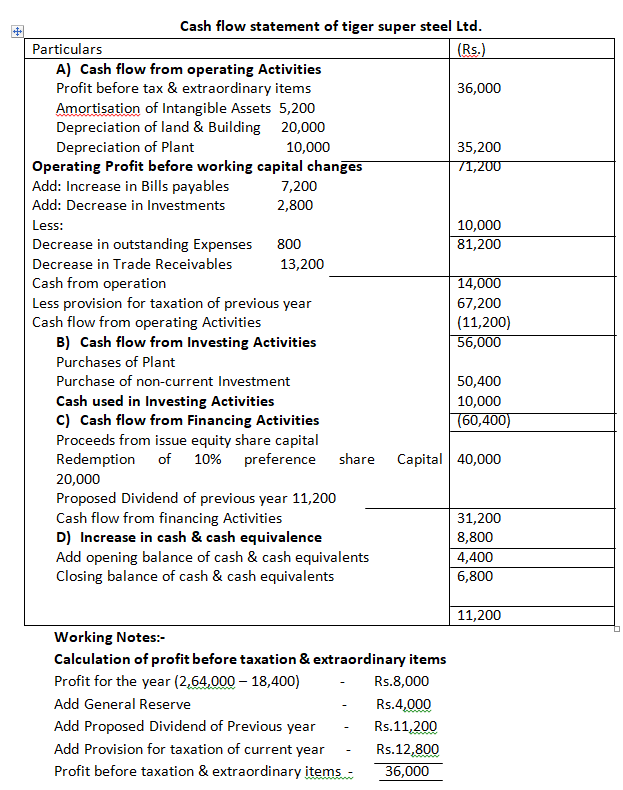

Solution:-

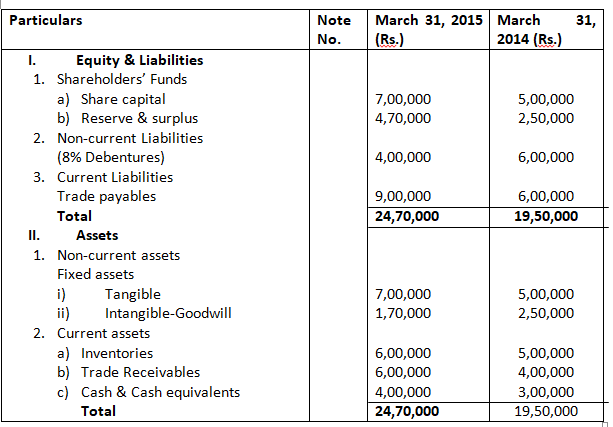

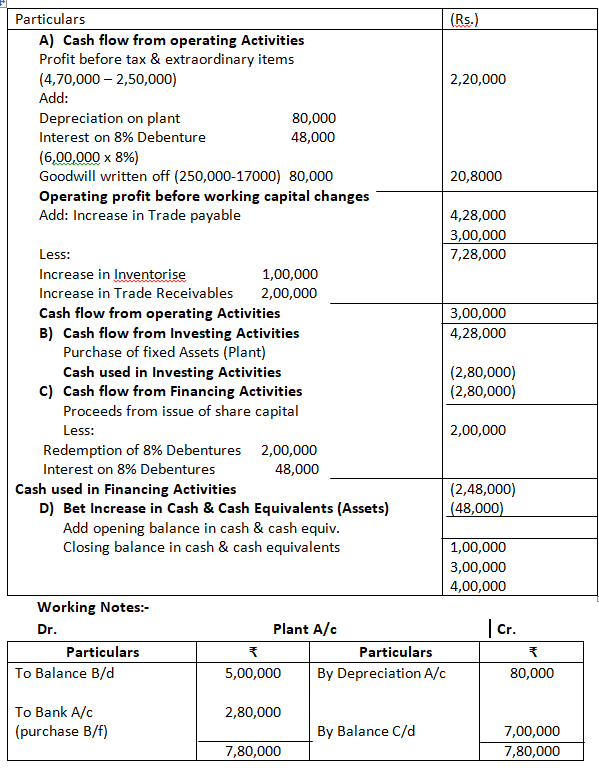

9. From the following information, prepare cash flow statement:

Additional information:

Depreciation Charged on Plant amounted to Rs.80,000.

Solution:-

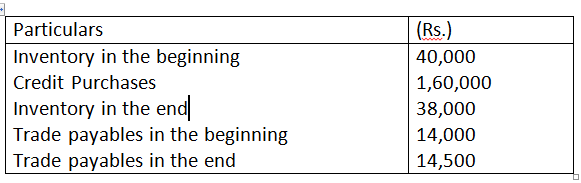

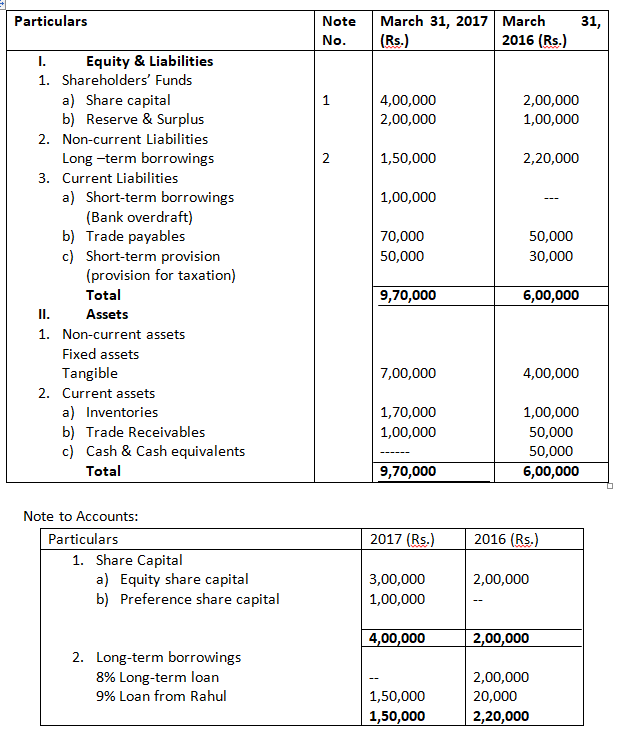

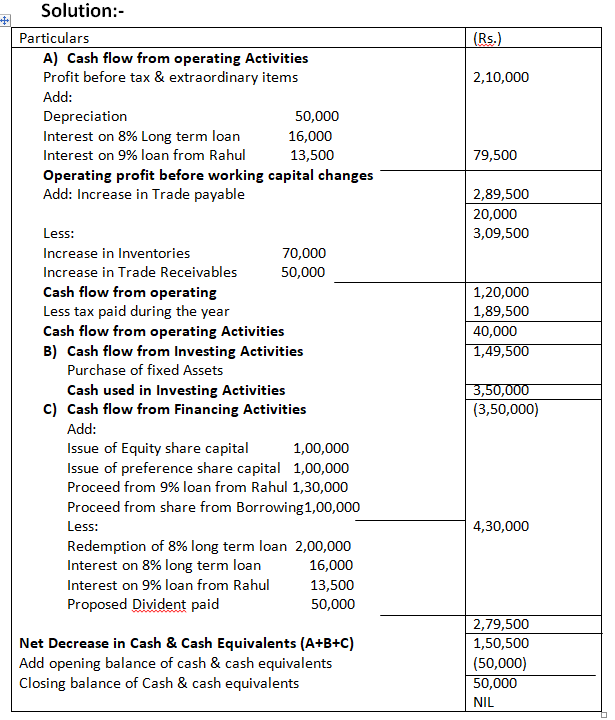

10. From the following Balance Sheet of Yoteta Ltd., Prepare cash flow statement:

Additional Information:

Net Profit for the year after charging Rs.50,000 as Depreciation was Rs.1,50,000. Dividend paid on Share was Rs.50,000, Tax Provision created during the year amounted to Rs.60,000. 8% loan was repaid on March 31, 2017 and on additional 9% loan of Rs.1,30,000 was obtained from Rahul on April 01, 2016.

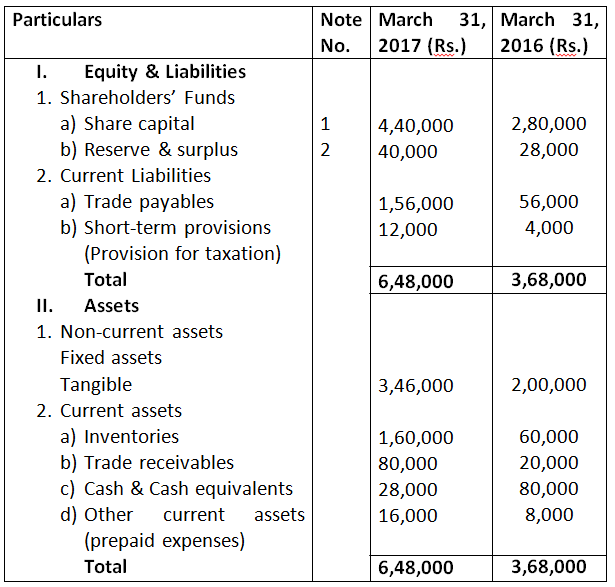

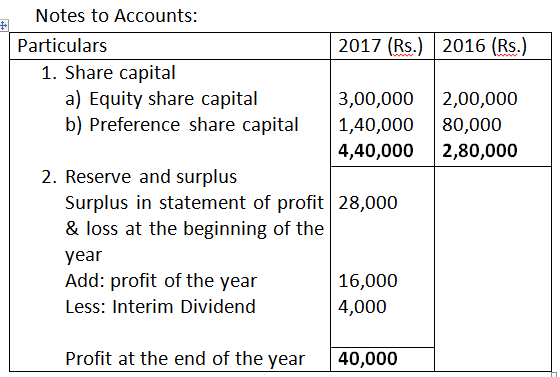

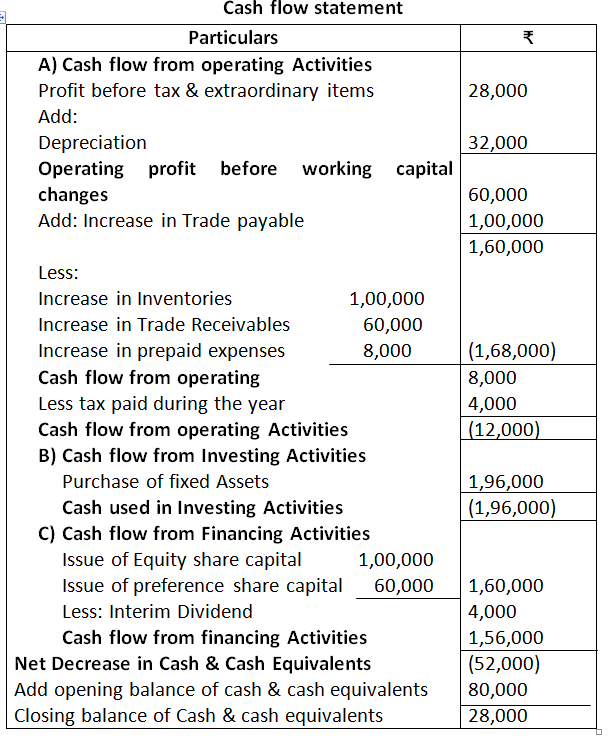

11. Following is the Balance sheet of Garima Ltd., prepare cash flow statement.

Additional Information:

Depreciation charged during the year Rs.32,000.

Solution:-

12. From the following Balance Sheet of Computer India Ltd., prepare cash flow statement.