Short Answer

- State the meaning of incomplete records?

Ans. Incomplete records refer to a situation where a business’s financial transactions are not fully or systematically recorded according to the double-entry bookkeeping system. Instead of having both a debit and credit for every transaction, some entries are missing, one-sided, or entirely absent, making it difficult to prepare a complete and accurate set of financial statements. This informal system is often used by small businesses or due to a lack of resources or expertise.

2. What are the possible reasons for keeping incomplete records?

Ans. Reasons for Keeping Incomplete Records

I. Lack of Accounting Knowledge

Simplicity: Owners who lack formal knowledge of double-entry accounting principles may find the simpler, single-entry method more convenient and easier to manage.

II. Cost and Time Savings

- Reduced Expenses: Incomplete records are often less expensive as they require less staff and no specialized accountants, according to.

- Less Time-Consuming: Maintaining fewer books and not following the comprehensive double-entry system takes less time.

III. Convenience and Need-Based Operations

- Flexibility: Owners may record only the transactions they deem important, tailoring the records to their specific needs.

- Small Businesses: The scale of some small operations may not justify the cost and complexity of a full double-entry accounting system.

IV. Systemic Issues

- Inadequate Systems: The business may simply not have proper accounting or recording systems in place, according to.

- Loss of Records: Data can be lost, damaged, or stolen, leading to gaps in the financial records.

V. Other Factors

- Unsystematic Recording: Transactions may be recorded irregularly, without a systematic approach, leading to missing information.

- Mixing Personal and Business Transactions: A lack of separation can make it hard to track business finances accurately.

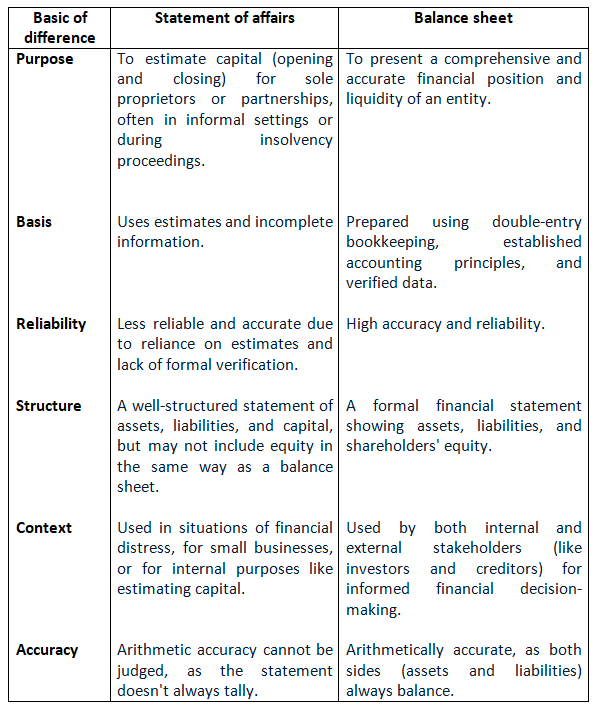

3. Distinguish between statement of affairs and balance sheet.

4. What practical difficulties are encountered by a trader due to incompleteness of accounting records?

Ans. The incompleteness of the accounting records are as follows:

- It does not depict the authentic information as the accuracy of the maintenance of the books of accounts cant not be ascertained.

- Accurate information of the profit or loss position of the business cannot be ascertained in such cases as not all expenses and incomes are not recorded.

- The preparation of the Balance Sheet cannot be made as it does not follow the double-entry system of accounting and hence Statement of Affairs is prepared which does not depict accurate and authentic results of the financial performance of the business.

- The tax authorities do not accept the maintenance of the single entry system of accounting as the proper picture of the business cannot be assessed.

- Lapses if any during the process of accounting are not mad known and hence there is a less chance for the business to make needed corrections.

Long Answer

- What is meant by a ‘statement of affairs’? How can the profit or loss of a trader be ascertained with the help of a statement of affairs?

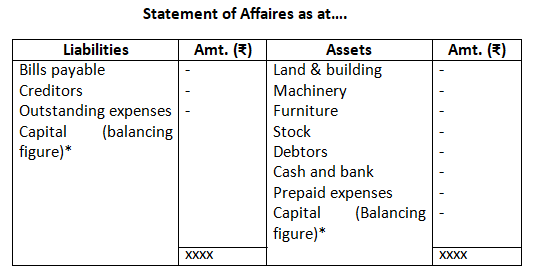

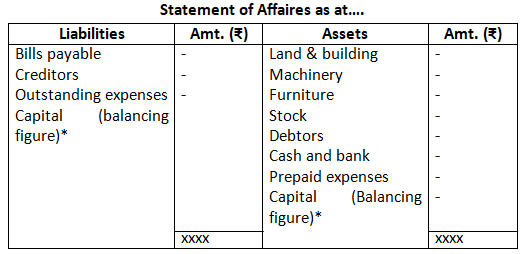

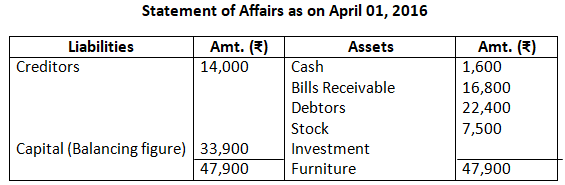

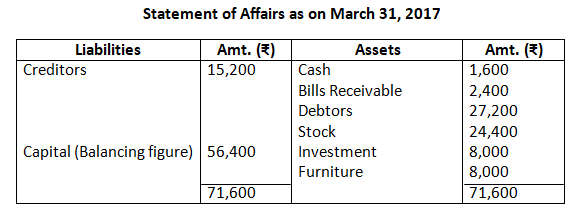

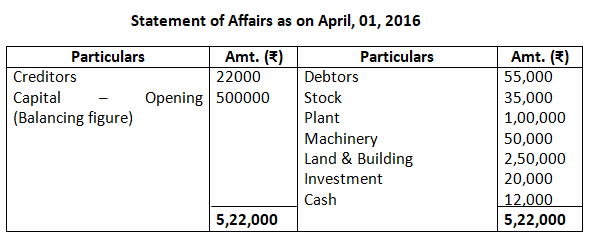

Ans. A statement is known as statement of affairs, shows assets on one side and the liabilities on the other just as in case of a balance sheet. The difference between the totals of the two sides is the capital. Though statement of affairs resembles balance sheet it is not called a balance sheet because the data is not wholly based on ledger balance. The amount of items like fixed assets, outstanding expenses, bank balances, etc. are ascertained from the relevant document and physical counts.

Note:

Where the total of liabilities side is more than total of assets side, capital would be shown in assets side and it represents debit balance of capital.

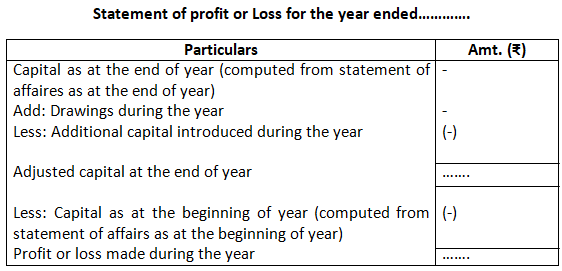

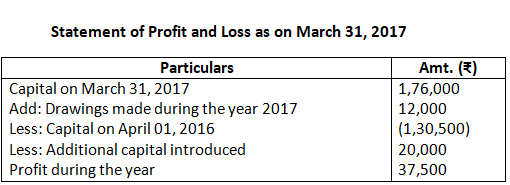

A statement of profit and loss is repaired to ascertain the exact amount of profit or loss made during the year. The difference between the opening and closing capital represents its increase or decrease which is to be adjusted for withdrawals made by the owner or any fresh capital introduced by him during the accounting period in order to arrive at the amount of profit or loss made during the period.

2. ‘Is it possible to prepare the profit and loss account and the balance sheet from the incomplete book of accounts kept by a trader’? Do you agree? Explain.

Ans. Yes, it is possible to prepare a profit and loss account and balance sheet from incomplete records, but it is a challenging process that relies on the convene method to reconstruct the double-entry system. This method involves using available data like sales, purchases, debtors, and creditors to logically deduce missing information, such as the value of stock, capital, and other assets and liabilities.

The following steps are followed for this conversion:

- Prepare the opening statement of affaires and ascertain the opening capital.

- Prepare the cashbook and then ascertain opening closing cash balances.

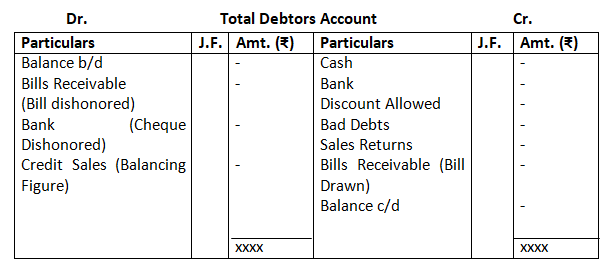

- Prepare the account of total debtors account and derive the missing figure.

- Similarly prepare the account of total creditors account and derive the missing figure.

- The last step requires the preparation of the final accounts after when the major balances are determined.

Thus with the help of the ascertained figures, the preparation of the Prepare Trading and Profit and Loss account and Balance sheet can be made.

3. Explain how life following may be ascertained from incomplete records:

- Opening capital and closing capital

- Credit sales and credit purchases

- Payments to creditors and collection from debtors

- Closing balance of cash.

Ans.

- Opening capital and closing capital:- Opening capital can be ascertained by preparing opening statement of affaires at the beginning of the accounting period and closing can be ascertained by preparing closing Statement of Affairs at the end of accounting period.

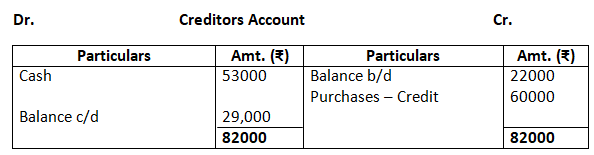

b. Credit sales and credit purchases:- Credit sales are ascertained as the balancing figure of the Total Debtors account and Credit Purchases are ascertained as the balancing figure of the Total Creditors Account.

c. Payment to creditors and collection from debtors: payment to the creditors are ascertained from the total creditors account as a balancing figure and collection from debtors are ascertained from the Total Debtors Account as a balancing figure.

d. Closing balance of cash:- Closing balance of cash is ascertained from the Cash Book, which shows all receipts in the debit side and all payments in the credit side during an accounting year and the balancing figure of the cash book is the closing balance of cash.

Numerical Questions

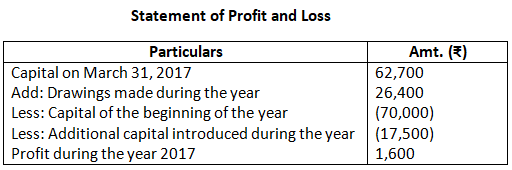

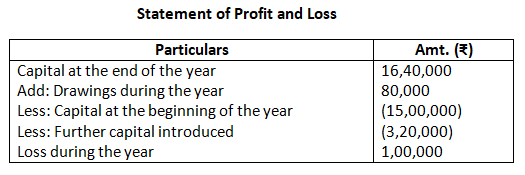

Ascertainment of profit or loss by statement of affairs method

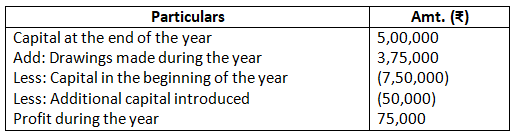

- Following information is given below prepare the statement of profit or loss:

Capital at the end of the year Rs.5,00,000

Capital in the beginning of the year Rs.7,50,000

Drawing made during the period Rs.3,75,000

Additional Capital introduced Rs.50,000

Solution:-

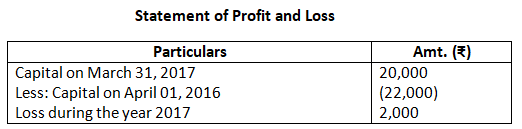

Statement of Profit and Loss

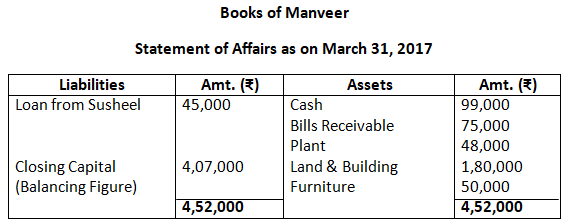

2. Manveer started his business on April 01, 2016 with a capital of Rs.4,50,000. On March 31, 2017 his position was as under:

Cash Rs.99,000

Bills receivable Rs.75,000

Plant Rs.48,000

Land & Building Rs.1,80,000

Furniture Rs.50,000

He owned Rs.45,000 from his friend Susheel on that date. He withdrew Rs.8,000 per month for his household purposes. Ascertain his profit or loss for this year ended March 31, 2017.

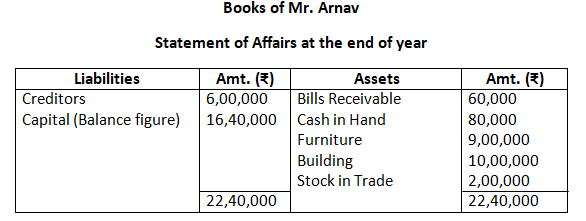

Solution:-

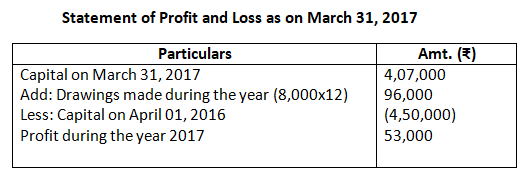

3. From the information given below ascertain the profit for the year:

Capital at the beginning of the year Rs.70,000

Additional capital introduced during the year Rs.17,500

Stock Rs.59,500

Sundry debtors Rs.25,900

Business premises Rs.8,600

Machinery Rs.2,100

Sundry creditors Rs.33,400

Drawings made during the year Rs.26,400

Solution:-

4. From the following information, Calculate Capital at the beginning:

Capital at the end of the year Rs.4,00,000

Drawings made during the year Rs.60,000

Fresh Capital introduce during the year Rs.1,00,000

Profit of the current year Rs.80,000

Solution:-

Capital in the beginning = Capital at the end + Drawings – (Fresh Capital Introduced + Profit)

= 4,00,000 + 60,000 – (1,00,000 + 80,000)

= Rs.2,80,000

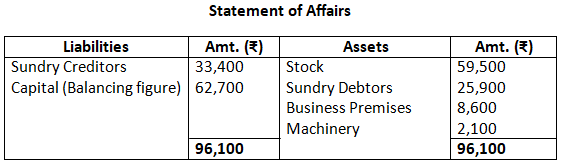

5. Following information is given below: calculate the closing capital

Calculation of profit or loss and ascertainment of statement of affairs at the end of the year (Opening Balance is given)

Solution:-

Capital on March 31, 2017 (Closing) is Rs.20,000

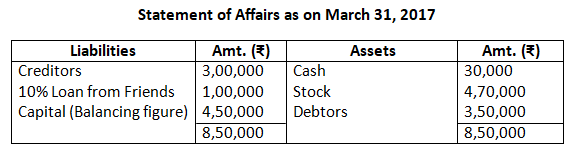

6. Mrs. Anu started firm with a capital of Rs.4,00,000 on 1st October, 2016. She borrowed from her friends a sum of Rs.1,00,000 @ 10% per annum (interest paid) for business and brought a further amount to capital Rs.75,000 on March 31, 2017, her position was:

Cash Rs.30,000

Stock Rs.4,70,000

Debtors Rs.3,50,000

Creditors Rs.3,00,000

He withdrew Rs.8,000 per month for the year. Calculate profit or loss for the year and show your working clearly.

Solution:-

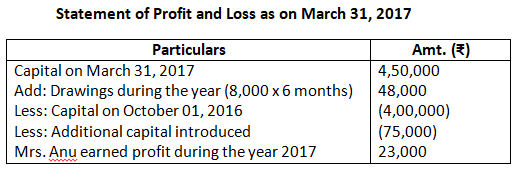

7. Mr. Arnav does not keep proper records of his business he provided following information, you are required to prepare a statement showing the profit or loss for the year.

Capital at the beginning of the year Rs.15,00,000

Bills receivable Rs.60,000

Cash in hand Rs.80,000

Furniture Rs.9,00,000

Building Rs.10,00,000

Creditors Rs.6,00,000

Stock in trade Rs.2,00,000

Further capital introduced Rs.3,20,000

Drawing made during the period Rs.80,000

Ascertainment of statement of affairs at the beginning and at the end of the year and calculation of profit or loss.

Solution:-

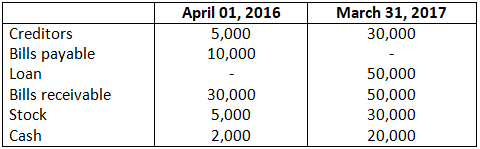

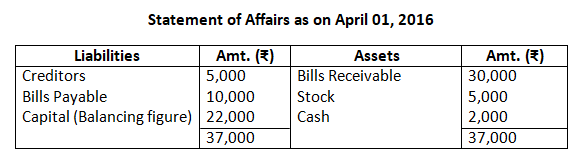

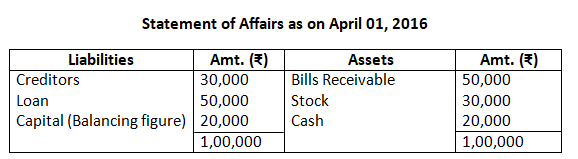

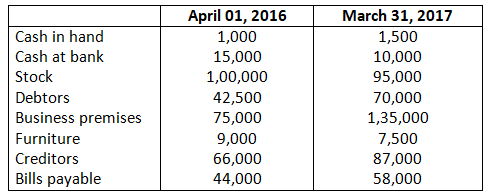

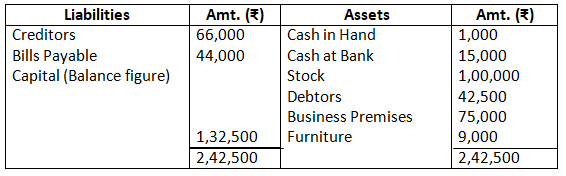

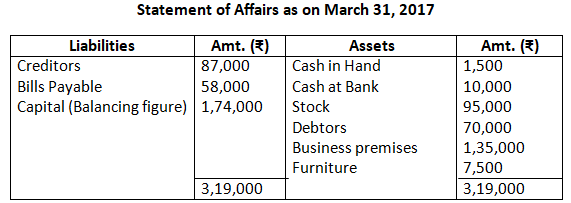

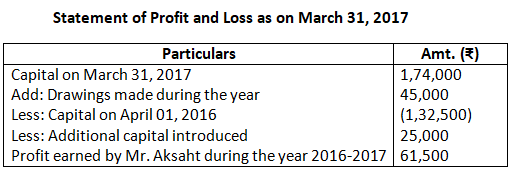

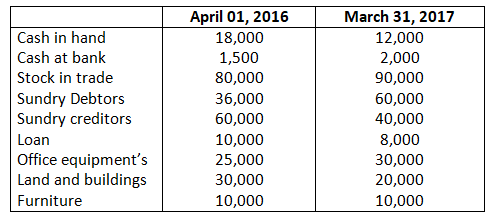

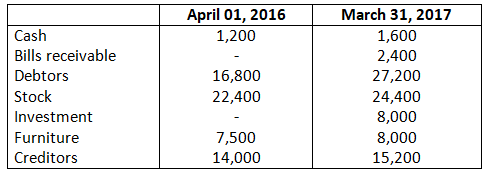

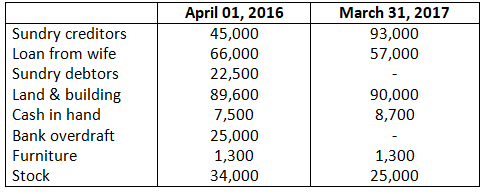

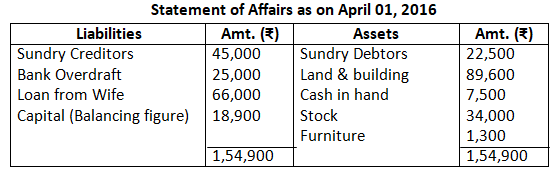

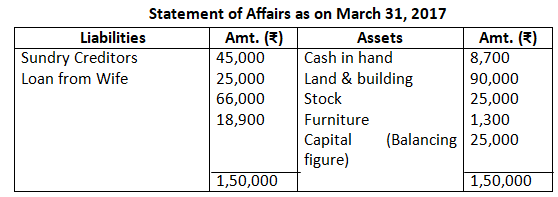

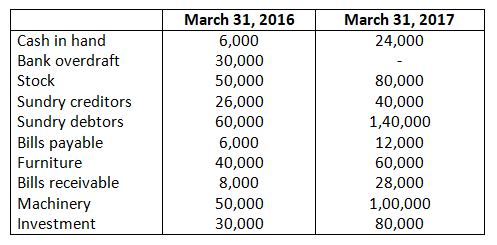

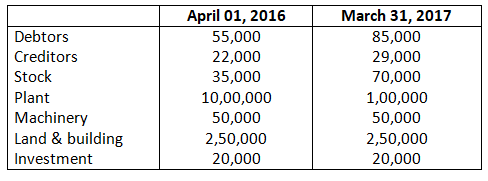

8. Mr. Akshat keeps his books on incomplete records following information is given below:

During the year he withdrew Rs.45,000 and introduced Rs.25,000 as further capital in the business compute the profit or loss of the business.

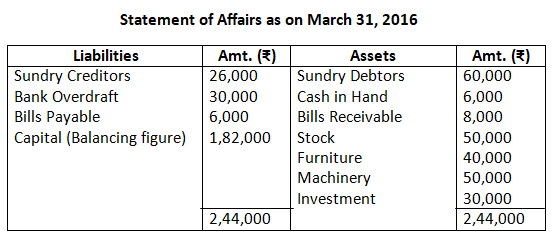

Solution:-

Books of Mr. Aksaht

Statement of Affairs as on April 01, 2016

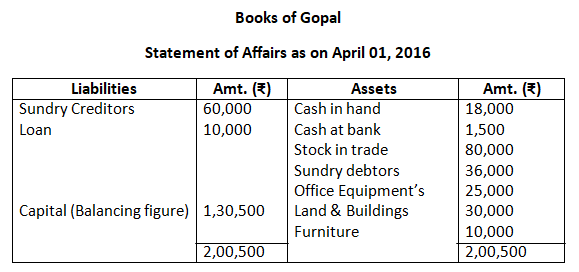

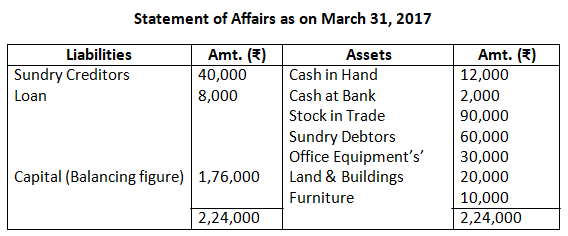

9. Gopal does not keep proper books of account. Following information is given below:

the business. Prepare the statement of profit or loss on the basis of given information.

Solution:-

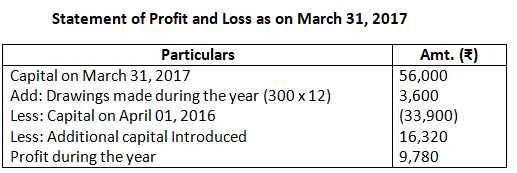

10. Mr. Muneesh maintains his books of accounts from incomplete records. His books provide the information:

He withdrew Rs.300 per month for personal expenses. He sold his investment of Rs.16,000 at 2% premium and introduced that amount into business.

Solution:-

Working Note:

Additional Capital Introduced = 16,000 x 102/100

= 16,320

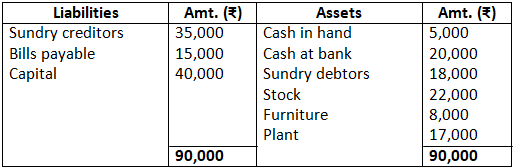

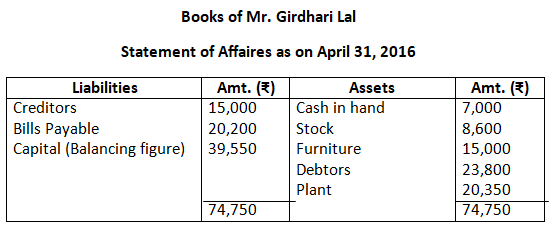

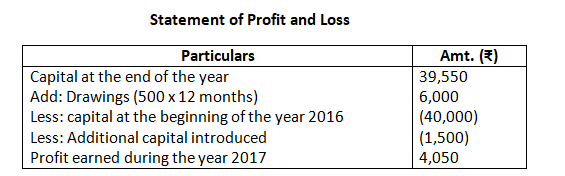

11. Mr. Girdhari Lal does not keep full double entry records. His balance as on April 01, 2016 is as.

His position at the end of the year is:

Cash in hand Rs.7,000

Stock Rs.8,000

Debtors Rs.23,800

Furniture Rs.15,000

Plant Rs.20,500

Bills payable Rs.20,200

Creditors Rs.15,000

He withdrew Rs.500 per month out of which to spent Rs.1,500 for business purpose. Prepare the statement of profit or loss.

Solution:-

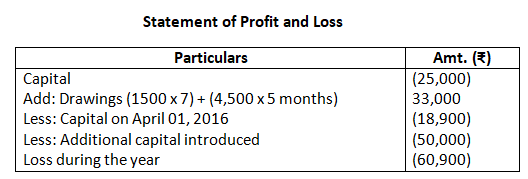

12. Mr. Ashok does not keep his books properly. Following information is available from his books.

During the year Mr. Ashok sold his private car for Rs.50,000 and invested this amount into the business. He withdrew from the business Rs.1,500 per month upto October 31, 2016 and thereafter Rs.4,500 per month as drawings. You are required to prepare the statement of profit or loss and statement of affair as on March 31, 2017.

Solution:-

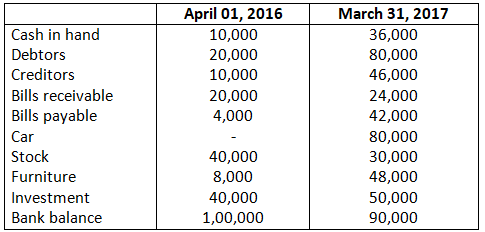

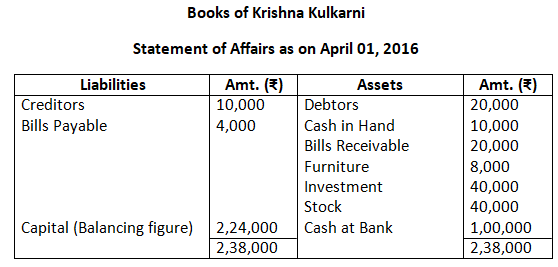

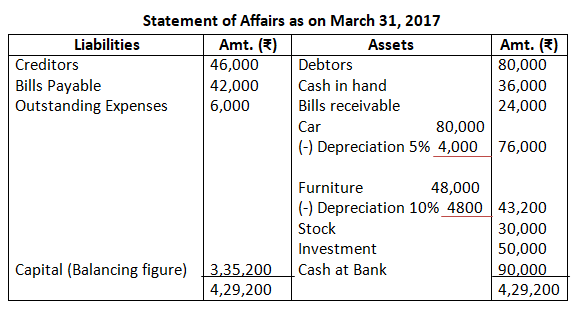

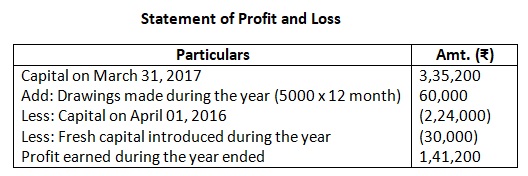

13. Krishna Kulkarni has not kept proper books of accounts prepare the statement of profit or loss for the year ending March 31, 2016 from the following information:

The following adjustments were made:

- Krishna withdrew cash Rs.5,000 per month for private use.

- Depreciation @ 5% on car and furniture @ 10%.

- Outstanding Rent Rs.6,000.

- Fresh Capital introduced during the year Rs.30,000.

Solution:-

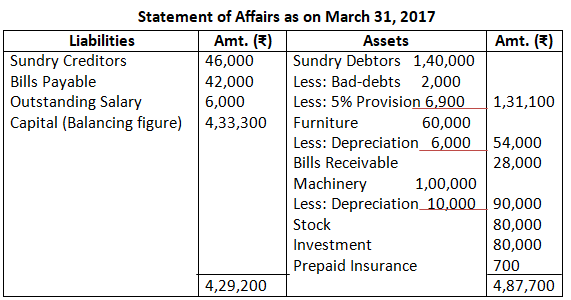

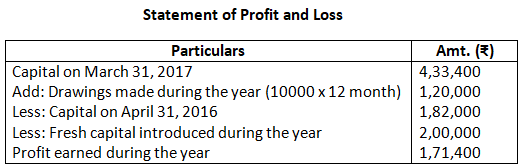

14. M/s Saniya Sports Equipment does not keep proper records. From the following information find out profit or loss and also prepare balance sheet for the year ended March 31, 2017.

Drawing Rs.10,000 p.m. for personal use, fresh capital introduce during the year Rs.2,00,000. A bad debts of Rs.2,000 and a provision of 5% is to be made on debtor outstanding salary Rs.2,400, prepaid insurance Rs.700, depreciation charged on furniture and machine @ 10% p.a.

Solution:-

Ascertainment of Missing Figures

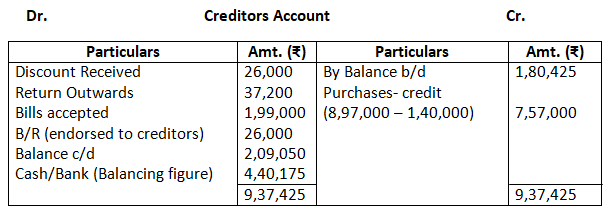

15. From the following information calculation the amount to be paid to creditors:

Sundry creditors as on March 31, 2017 Rs.1,80,425

Discount received Rs.26,000

Discount allowed Rs.24,000

Return outward Rs.37,200

Return inward Rs.32,200

Bills accepted RS.1,99,000

Bills endorsed to crediotrs Rs.26,000

Creditors as on April 01, 2016 Rs.2,09,050

Total purchases Rs.8,97,000

Cash purchases Rs.1,40,000

Solution:-

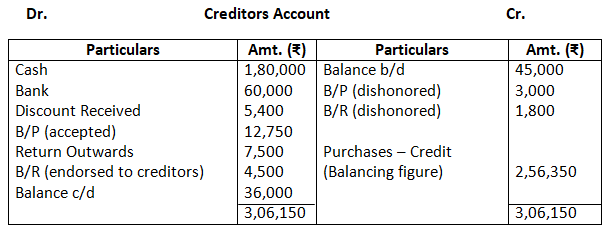

16. Find out the credit purchased from the following:

Balance of creditors April 01,2016 Rs.45,000

Balance of creditors March 31, 2017 Rs.36,000

Cash paid to creditors Rs.1,80,000

Cheque issued to creditors Rs.60,000

Cash purchases Rs.75,000

Discount received from creditors Rs.5,400

Discount allowed Rs.5,000

Bills payable given to creditors Rs.12,750

Return outwards Rs.7,500

Bills payable dishonoured Rs.3,000

Bills receivable endorsed to creditors Rs.4,500

Bills receivable endorsed to creditors dishonoured Rs.1,800

Return inwards Rs.3,700

Solution:-

Credit Purchases Rs.2,56,350

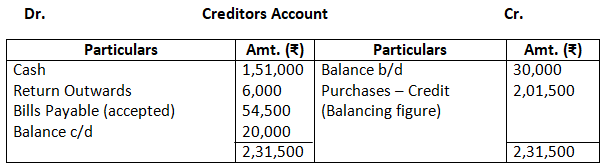

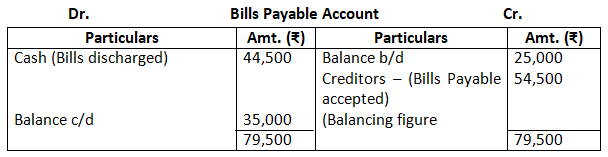

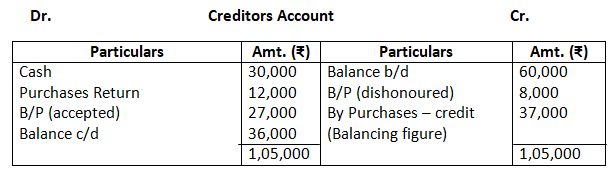

17. From the following information calculate total purchases.

Creditors April 01, 2016 Rs.30,000

Creditors March 31, 2017 Rs.20,000

Opening balance of Bills payable Rs.25,000

Closing balance of Bills payable Rs.35,000

Cash paid to creditors Rs.1,51,000

Bills discharged Rs.44,500

Cash purchases Rs.1,29,000

Return outwards Rs.6,000

Solution:-

Total Purchases = Cash Purchases + Credit Purchases (as per creditors account)

= 1,29,000 + 2,01,500

= Rs.3,30,500

18. The following information is given

Opening creditors Rs.60,000

Cash paid to creditors Rs.30,000

Closing creditors Rs.36,000

Return Inwards Rs.13,000

Bills matured Rs.27,000

Bill dishonoured Rs.8,000

Purchases return Rs.12,000

Discount allowed Rs.5,000

Calculate credit purchases during the year.

Solution:-

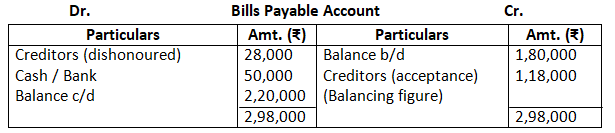

19. From the following, calculate the amount of bills accepted during the year.

Bills payable as on April 01, 2016 Rs.1,80,000

Bills payable as on March 31, 2017 Rs.2,20,000

Bills payable dishonoured during the year Rs.28,000

Bills payable honored during the year Rs.50,000

Solution:-

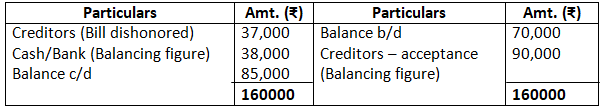

20. Find out the amount of bills matured during the year on the basis of information given below:

Bills payable dishonoured Rs.37,000

Closing balance of Bills payable Rs.85,000

Opening balance of Bills payable Rs.70,000

Bills payable accepted Rs.90,000

Cheque dishonored Rs.23,000

Solution:-

Dr. Bills Payable Account Cr.

Bill Payable matured during the year is Rs.38,000.

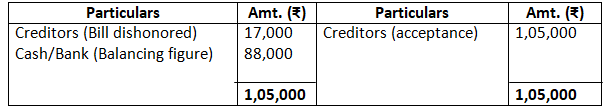

21. Prepare the bills payable account from the following and find out missing figure if any:

Bills accepted Rs.1,05,000

Discount received Rs.17,000

Purchases returns Rs.9,000

Return inwards Rs.12,000

Cash paid to accounts payable Rs.50,000

Bills receivable endorsed to creditor Rs.45,000

Bills deshonoured Rs.17,000

Bad debts Rs.14,000

Balance of accounts payable (closing) Rs.85,000

Credit purchases Rs.2,15,000

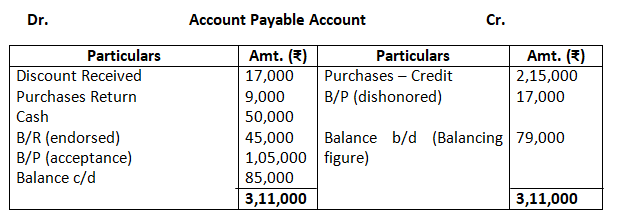

Solution:-

Dr. Bills Payable Account Cr.

Bills payable discharged is Rs.88,000 and the opening balance of creditors is Rs.79,000.

22. Calculate the amount of bills receivable during the year.

Opening balance of bills receivable Rs.75,000

Bills dishonoured Rs.25,000

Bills collected (honored) Rs.1,30,000

Bills receivable endorsed to creditors Rs.15,000

Closing balance of bills receivable Rs.65,000

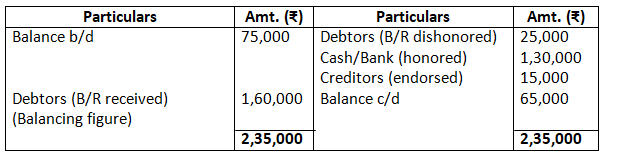

Solution:-

Dr. Bills Receivable Account Cr.

Bills receivable received from Debtors Rs.1,60,000.

23. Calculate the amount of bills receivable dishonored from the following information.

Opening balance of bills receivable Rs.1,20,000

Bills collected (honored) Rs.1,85,000

Bills receivable endorsed Rs.22,800

Closing balance of bills receivable Rs.50,700

Bills balance of bills receivable Rs.1,50,000

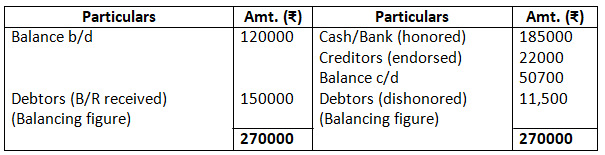

Solution:-

Dr. Bills Receivable Account Cr.

Bills Receivable dishonored is Rs.11,500.

24. From the details given below, fine out the credit sales and total sales.

Opening debtors Rs.45,000

Closing debtors Rs.56,000

Discount allowed Rs.2,500

Sales returns Rs.8,500

Irrecoverable amount Rs.4,000

Bills receivable received Rs.12,000

Bills receivable dishonoured Rs.3,000

Cheque dishonoured Rs.7,700

Cash sales Rs.80,000

Cash received from debtors Rs.2,30,000

Cheque received from debtors Rs.25,000

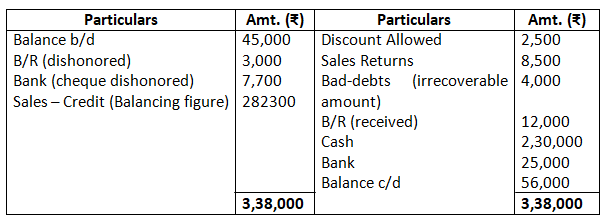

Solution:-

Dr. Debtors Account Cr.

Credit sales is Rs.2,82,300

Total Sales = Cash Sales + Credit Sales

= 80,000 + 2,82,300

= Rs.3,62,300

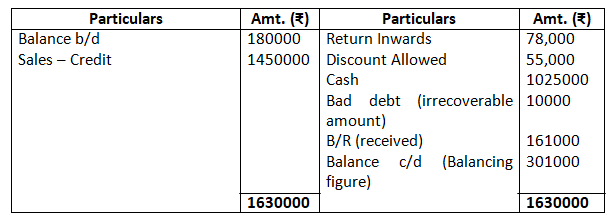

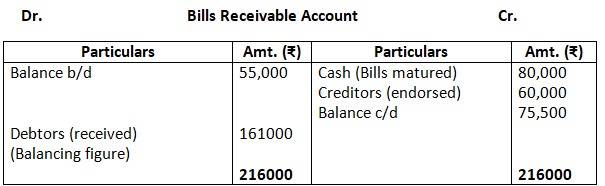

25. From the following information, prepare the bills receivable account and total debtors account for the year ended March 31, 2017.

Opening balance of debtors Rs.1,80,000

Opening balance of bills receivable Rs.55,000

Cash sales made during the year Rs.95,000

Credit sales made during the year Rs.14,50,000

Return inwards Rs.78,000

Cash received from debtors Rs.10,25,000

Discount allowed to debtors Rs.55,000

Bills receivable endorsed to creditors Rs.60,000

Cash received (bills matured) Rs.80,000

Irrecoverable amount Rs.10,000

Closing balance of bills receivable on March 31, 2017 Rs.75,500

Solution:-

Dr. Debtors Account Cr.

The missing figure in the bills receivable account – B/R received from debtors Rs.161000 and the missing figure in the debtors account-closing balance is RS.301000.

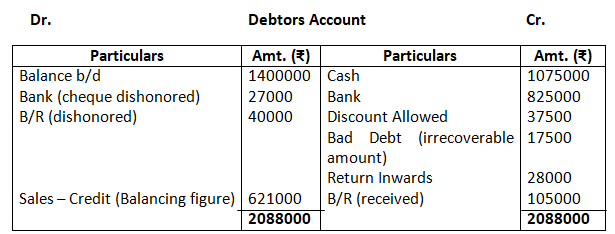

26. Prepare the suitable accounts and find out the missing figure if any.

Opening balance of debtors Rs.14,00,000

Opening balance of bills receivable Rs.7,00,000

Closing balance of bills receivable Rs.3,50,000

Cheque dishonoured Rs.27,000

Cash received from debtors Rs.10,75,000

Cheque received & deposited in the bank Rs.8,25,000

Discount allowed Rs.37,500

Irrecoverable amount Rs.17,500

Returns inwards Rs.28,000

Bills receivable received from customers Rs.1,05,000

Bills receivable matured Rs.2,80,000

Bills discounted Rs.65,000

Bills endorsed to creditors Rs.70,000

Solution:-

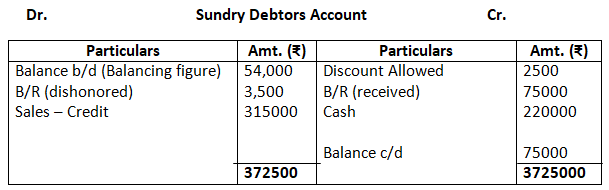

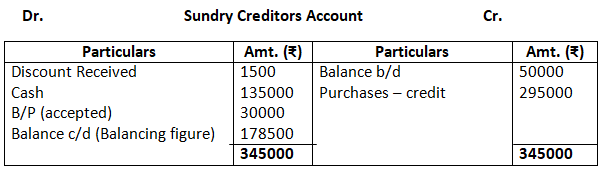

27. From the following information ascertain the opening balance of sundry debtors and closing balance of sundry creditors.

Opening stock Rs.30,000

Closing stock Rs.25,000

Opening creditors Rs.50,000

Closing debtors Rs.75,000

Discount allowed by creditors Rs.1,500

Discount allowed by customers Rs.2,500

Cash paid to creditors Rs.1,35,000

Bills payable accepted during the period Rs.30,000

Bills received received during the period Rs.75,000

Cash received from customers Rs.2,20,000

Bills receivable dishonoured Rs.3,500

Purchases Rs.2,95,000

The rate of gross profit is 25% on selling price and out of the total sales Rs.85,000 was for cash sales.

Solution:-

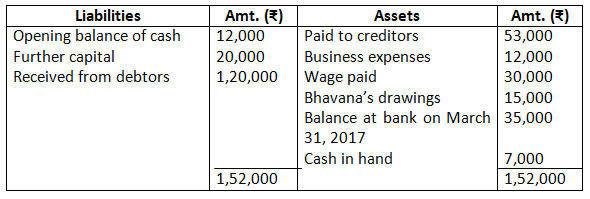

28. Mrs. Bhavana keeps his books by Single Entry System. You’re required to prepare final accounts of her business for the year ended March 31, 2017. Her records relating to cash receipts and cash payments for the above period showed the following particulars:

Dr. Summary of Cash Cr.

The following information is also available:

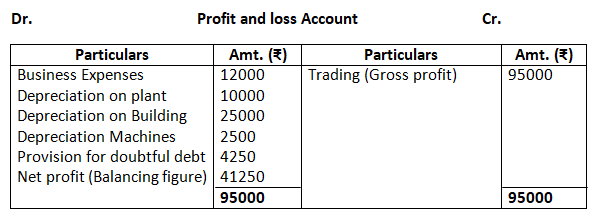

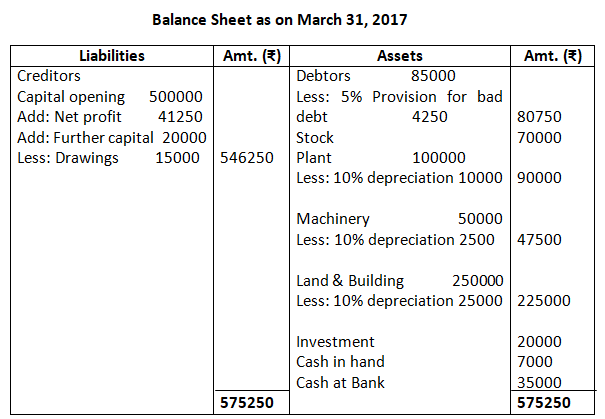

All her sales and purchases were on credit. Provide depreciation on plant and building by 10% and machinery by 5%, make a provision for bad debts by 5%.

Solution:-

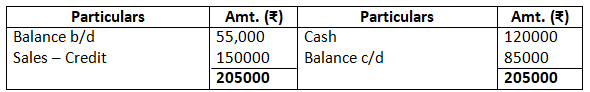

Dr. Books of Mrs. Bhavana Debtors Account Cr.

Note:

It has been assumed that total sales are credit sales (i.e. all sales are made on credit) and total purchases are credit purchases (i.e. all purchases are made on credit).

Plant of Rs.1,00,000 has been taken into the statement of affaires on April 01, 2016, instead of Rs.10,00,000.

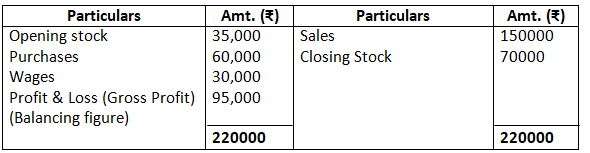

Dr. Trading Account as on March 31, 2017 Cr.