- In the absence of Partnership Deed, state the provisions of the partnership act ,1932 relating to

- Salaries of partners

- Interest on partners capital

- Interest on loan by partner

- Division of profit

- Interest on partners drawings

- Interest on Loan given to Partners?

Solution –

- Not allowed

- Not allowed

- 6% p.a

- Equal

- Not charged

- Not Charged

2. Mahesh, Ramesh and Suresh are partners in a firm. They do not have a Partnership Deed. At the end of the first year of the business, they faced the following problems:

- Mahesh wants that interest on capital should be allowed to the partners but Ramesh and Suresh do not agree.

- Ramesh wants that the partners should be allowed to draw salary but Mahesh and Suresh do not agree

- Mahesh and Ramesh want that Suresh should pay interest on loan given to him by the firm but Suresh does not agree.

- Mahesh and Ramesh having contributed larger amounts of capital, desire that the profits should be distributed in the ratio of their capital contribution but Suresh does not agree.

State how you will settle these dispute if the partners approach you for the purpose.

Solution –

- Mahesh’s claim is not accepted

- Ramesh’s claim is not accepted

- Mahesh and Ramesh’s claim is not accepted; Suresh will not pay interest in the absence of agreement

- Profits or Losses should be distributed among the partners equally. The claim made by Mahesh and Ramesh is not accepted.

3. Following differences have arisen among P, Q and R. state that who is correct in each case:

- P used 50,000 belonging to the firm and earned a profit of 5,000. Q and R want the amount to be given to the firm

- Q used 10,000 belonging to the firm and incurred a loss of 1,000. He wants the firm to bear the loss.

- P and Q want to purchase goods from Star Ltd., R does not agree.

- Q and R want to admit W as partner, P does not agree.

- R had given loan of 2, 00,000 to the firm and demands interest @ 10% p.a. P and Q do not want to pay the interest.

Solution –

- If any partner uses the money of the and earned a profit. He has to pay back the used money with profit hence; P has to back 55,000 to the firm.

- If any partner uses the firm money and incurred a loss. He has to bear the loss and the full amount of money taken by the partner has to return back the firm. Hence Q has to pay 10,000 to the firm.

- Any business decision is decided by the majority. Hence P and Q want to purchase goods from Star Ltd is accepted as there are only 3 partners and majority win.

- W as a partner can not be admitted as for a new partner all partners must agree.

- In the absence of partnership Deed. Provisions of Indian Partnership Act 1932 would apply. Only 6% p.a. rate of interest on the loan of partners to the firm would be charged. Hence on the place of 10% p.a. only 6% p.a. rate of interest would be charged.

4. Barun, tarun and shivam are partners in a firm and do not have a Partnership Deed. Barun introduced further capital of 5, 00,000 on 1st October, 2023. Whereas shivam took a loan of 50,000 from the firm on 1st October, 2023 .Disputes have arisen among them on the following issues:

- Barun demands interest @ 10% p.a. on 5, 00,000 being his extra capital.

- tarun desire that his son Deep should be admitted as partner and he will give him half of his share Barun and shivam do not agree.

- Barun and tarun are of the view that shivam should be charges interest on loan from the firm at the lending rate of the banks, which is 12% p.a.

- tarun has withdrawn 50,000 from the firm for his personal use. Barun and shivam are of the view that tarun should be charged interest @ 10% p.a.

You are required to give solution to each issue of dispute.

Solution –

- In the case of absence of Partnership Deed. Provisions of Indian partnership Act 1932 would apply. No interest on capital would be allowed.

- tarun son’s Deep would not be admitted. As all partners are not agree .As in the case of absence of partnership deed. Provisions of Indian Partnership Act 1932 would apply.

- No interest of loan to shivam from the firm is given as in the case of absence of Partnership deed. Provisions of Indian partnership Act 1932 would apply.

- No interest on drawing would be charged as in the case of absence of partnership deed. Provisions of Indian Partnership Act 1932 would apply.

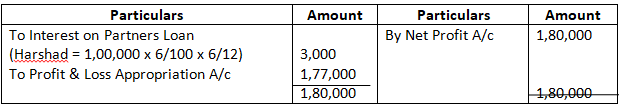

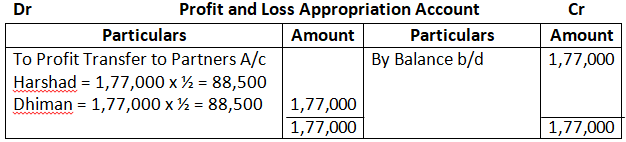

5. Harshad and Dhiman are in partnership since 1st April, 2023. No partnership agreement was made. They contributed 4, 00,000 and 1, 00,000 respectively as capitals. In addition, Harshad had given loan of 1, 00,000 to the firm on 1st October, 2023. Due to long illness, Harshad could not participate in business activities from 1st August, 2023 to 30th September, 2023. Profit for the year ended 31st March, 2024 was 1, 80,000. Dispute has arisen between Harshad and Dhiman.

Harshad Claims:

- He should be given interest @ 10% per annum on capital and loan

- Profit should be distributed in the ratio of capital.

Dhiman Claims:

- Profit should be distributed equally

- He should be allowed 2,000 p.m. as remuneration for the period he managed the business in the absence of Harshad

- Interest on Capital and loan should be allowed @ 6% p.a.

You are required to settle the dispute between Harshad and Dhiman. Also prepare Profit & Loss Appropriation Account.

Solution –

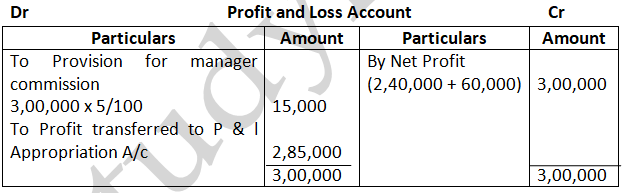

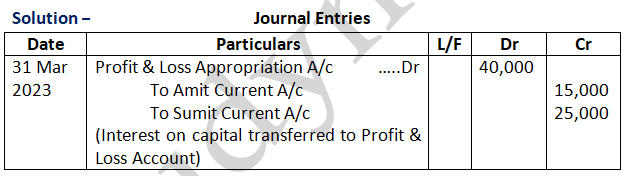

Dr Profit and Loss Account Cr

Harshad Claims:

- He should get only interest on loan @ 6% p.a. as per the law.

- In the absence of Partnership Deed, Profit should be distributed in equal ratio not in proportion of capital.

Dhiman Claims:

- His Claim is correct and profit should be distributed in equal ratio.

- He should not be allowed salary for managing business.

- Payment of interest on loan will be @ 6% p.a. as per the law and no interest on capital will be allowed.

Interest on Loan by Partner to the Firm:

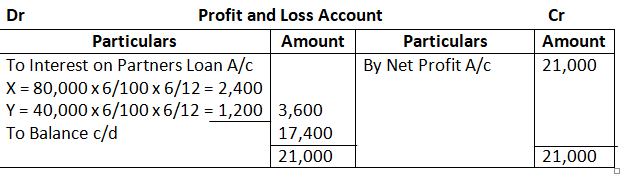

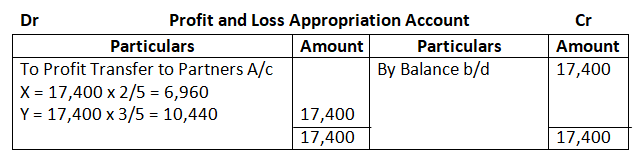

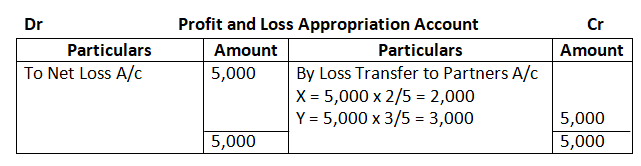

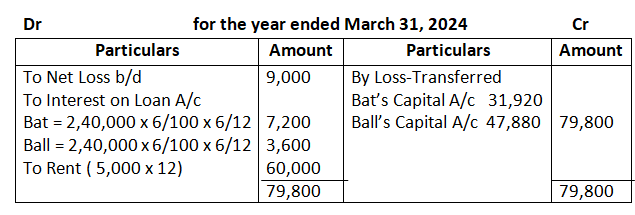

6. X and Y are partners sharing profits and losses in the ratio of 2: 3 with capitals of 2, 00,000 and 3, 00,000 respectively. On 1st October, 2023, X and Y gave loans of 80,000 and 40,000 respectively to the firm. Show distribution of profit/losses for the year ended 31st March, 2024 in each of the following alternative cases:

Case 1: If the profit before interest for the year amounted to 21,000

Case 2: If the profit before interest for the year amounted to 3,000

Case 3: If the profit before interest for the year amounted to 5,000

Case 4: If the loss before interest for the year amounted to 1,400

Solution – Case 1: If Profits before any interest for the year amounted to 21,000.

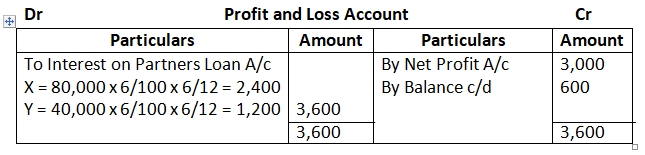

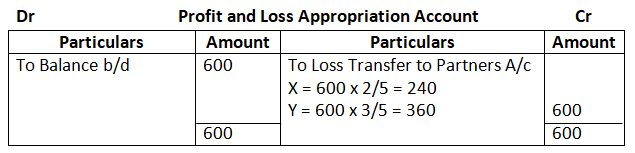

Case 2: If the profit before interest for the year amounted to 3,000

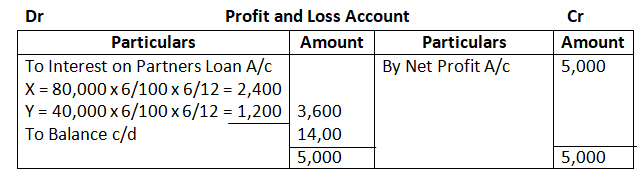

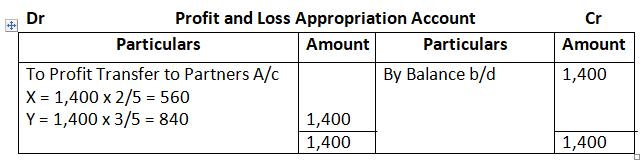

Case 3: If the profit before interest for the year amounted to 5,000

Case 4: If the loss before interest for the year amounted to 1,400

6. Sita and Geeta are partners in a firm sharing profits in the ratio of 3:2. They had given loan to the firm of 30,000 in their profit-sharing ratio on 1st October, 2023. The partnership Deed is silent on interest on loans from partners. Compute interest payable by the firm to the partners, assuming the firm closes its books every year on 31st March.

Solution – According to Partnership act, 1932 absence of partnership deed. Interest on partners Loan will be allowed at 6% p.a. Ratio = 3:2

Interest on Loan Payable to Sita:

= 30,000 x 3/5 x 6/100 x 6/12 = 540

Interest on loan Payable to Geeta:

= 30,000 x 2/5 x 6/100 x 6/12 = 360

7. Bat and Ball are partners sharing the profits in the ratio of 2:3 with capitals of 1, 20,000 and 60,000 respectively. On 1st October, 2023, Bat and Ball give loans of 2, 40,000 and 1, 20,000 respectively to the firm. Bat had allowed the firm to use his property for business for a monthly rent of 5,000. Loss for the year ended 31st March, 2024 before rent and interest amounted to 9,000. Show distribution of profit/loss.

Solution – Profit & Loss Account

8. Akhil, Sunil and Parvesh are partners sharing profits in the ratio of 3: 2: 1. Opening balance of Loan by Sunil Account was ₹ 3,00,000. Interest payable was agreed @ 10% p.a. Interest was paid by cheque up to February, 2024 on 1st March, 2024 and balance was yet to be paid. Pass the Journal entries for interest on loan by partner.

Ans-Journal entry

- 1 feb. Interest on loan a/c Dr. 27500

To bank a/c 27500

(Being interst to loan paid to sunil)

300,000*10%*11/12

- 31 march interest on loan a/c Dr. 250

To bank a/c 250

300,000*10%*1/12

- 31st march profit and loss a/c Dr. 30,000

To interest on loan 30,000

Interest on Loan to the Firm by Partner and Loan by the Firm to Partner:

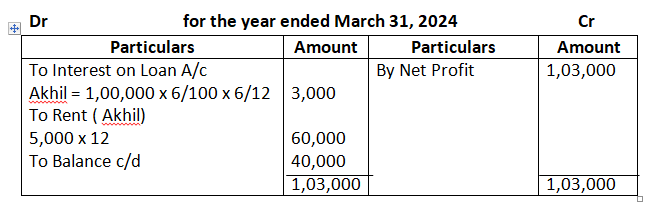

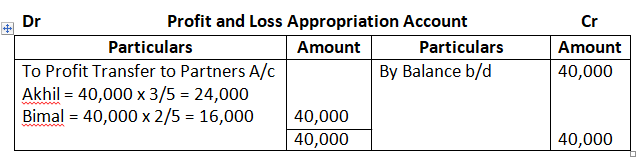

9. . Akhil and Bimal are partners sharing profits in the ratio of 3:2. Akhil gave loan to the firm of 1, 00,000 on 1st October, 2023. On the same date, the firm gave loan to Bimal of 1, 00,000. They do not have an agreement as to interest.

Akhil had also given his personal property for firm’s Godown at a monthly rent of 5,000.

Firm earns profit of 1, 03,000 (before above adjustments) for the year ended 31st March, 2024. Show the distribution of profit for the year.

Solution – Profit & Loss Account

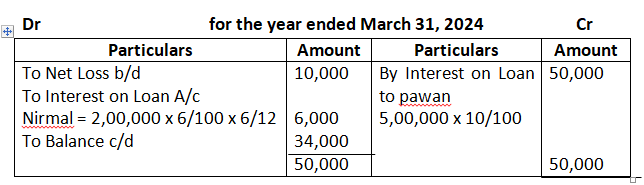

10. Nirmal and Pawan are partners sharing profits in the ratio of 3:2 the firm had given loan to Pawan of 5, 00,000 on 1st April, 2023. Interest was to be charged @ 10% p.a. the firm took loan of 2, 00,000 from Nirmal on 1st October, 2023. Before giving effect to the above, the firm incurred a loss of 10,000 for the year ended 31st March, 2024. Determine the amount to be transferred to Profit & Loss Appropriation Account.

Solution – Profit & Loss Account

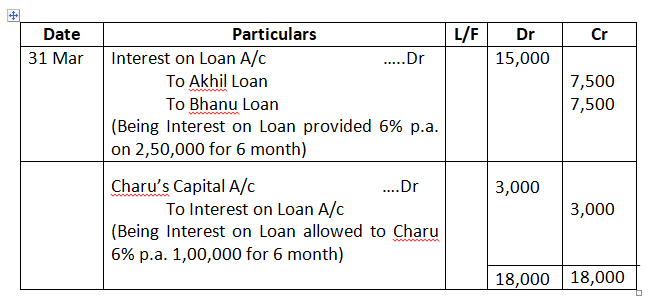

11. Ankit, Bhanu and Charu are partners in a firm sharing profits and losses equally with capital of 2, 50,000 each. On 1st October, 2023, Ankit and Bhanu gave loans of 2, 50,000 each to the firm whereas Charu took a loan of 1, 00,000 from the firm on the same date. It was agreed among the partners that Charu will be charged interest @ 6% p.a. Interest on loan from partners was paid on 10th April, 2024. The firm closes its books on 31st March each year.

Pass the Journal entries in the books of the firm for the year ended 31st March, 2024.

Solution – Journal Entries

12. Atul, Jetha and Tarak are partners sharing profits equally. Jetha was given loan by the firm on 1st July, 2023 of 6,00,000. Books are closed on 31st March. Pass the Journal entries if

(a) Rate of interest is not agreed; and

(b) Rate of interest to be charged is agreed @ 10% p.a?

[Ans.: (a) Interest will not be charged. Hence, no Journal entry will be passed; (b)Interest on Loan to Jetha (up to 31st March, 2024) -₹ 45,000.]

13. Parul, Paresh and Rahul are partners in a firm. Firm gave loan to Rahul on 1st February, 2024 of 6,00,000. Interest was agreed to be charged @ 6% p.a. Rahul paid interest by cheque up to February, 2024 on 5th March, 2024 and balance was paid by him on 5th April, 2024.

Pass the Journal entries for interest on loan to partner.

Ans- journal entry

- 5 march Rahul capital a/c dr. 3000

To interest on loan 3000

600,000*6%*2/12=6000/2

- 5 april Rahul capital a/c dr. 3000

To interest on loan 3000

600,000*6%*2/12=6000/2

Profit & Loss Appropriation Account:

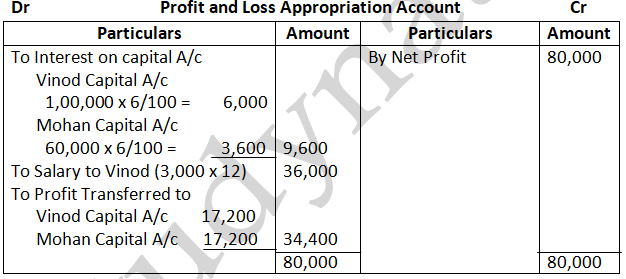

14. Vinod and Mohan are partners. Vinod’s capital is 1, 00,000 and Mohan’s capital is 60,000. Interest on capital is payable @ 6% p.a. Vinod is to get salary of 3,000 per month. Net Profit for the year is 80,000. Prepare Profit & Loss Appropriation Account.

Solution –

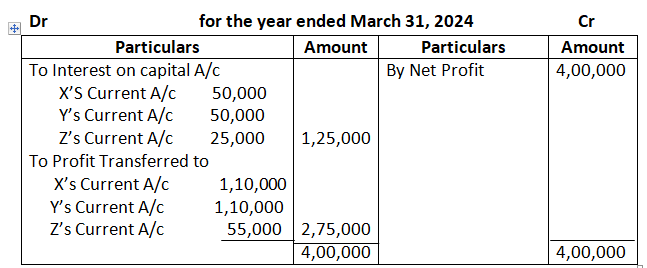

15. X, Y and Z are partners in a firm sharing profits in the ratio of 2:2:1. Fixed capitals of the partners were: X 5, 00,000; Y 5, 00,000 and Z 2, 50,000 respectively. The Partnership Deed provides that interest on capital is to be allowed @ 10% p.a. Z is to be allowed a salary of 2,000 per month. Profit of the firm for the year ended 31st March, 2024 after debiting Z’s salary was 4, 00,000.Prepare Profit & Loss Appropriation Account.

Solution – Profit & Loss Appropriation Account

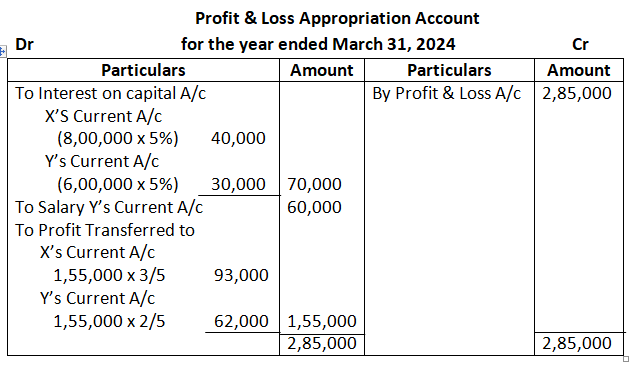

16. X and Y are partners sharing profits in the ratio of 3:2 with capitals of 8, 00,000 and 6, 00,000 respectively. Interest on capital is agreed @ 5% p.a. Y is to be allowed an annual salary of 60,000 which has not been withdrawn. Profit for the year ended 31st March, 2024 before interest on capital but after charging Y’s salary was 2, 40,000.

A provision of 5% of the net profit is to be made in respect of commission to the Manager.

Prepare Profit & Loss Appropriation Account showing the allocation of profits.

Solution –

Manager’s Commission is a charge against profit and it is not an appropriation out of profit. Hence a separate Profit and Loss Account is prepared to charge manager’s commission.

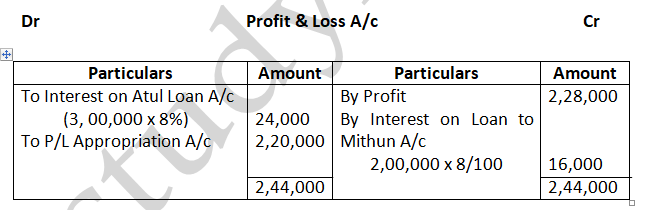

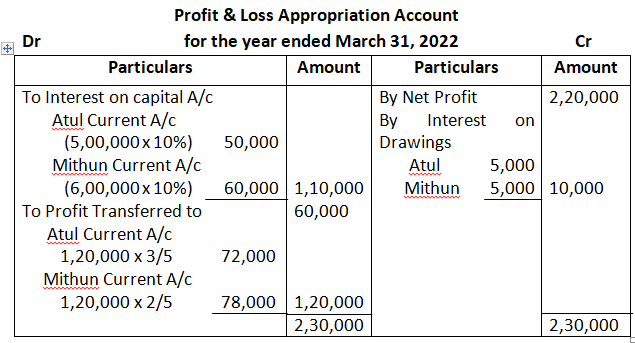

17. Atul and Mithun are partners sharing profits in the ratio of 3:2

balances as on 1st April, 2023 were as follows:

Capital Accounts (Fixed): Atul – 5, 00,000 and Mithun – 6, 00,000

Loan Accounts: Atul – 3, 00,000 (Cr.) and Mithun – 2, 00,000 (Dr.)

It was agreed to allow and charge interest @ 8% p.a. Partnership Deed provided to allow interest on capital @ 10% p.a. Interest on Drawings was charged 5,000 each.

Profit before giving effect to above was 2, 28,000 for the year ended 31st March, 2024. Prepare Profit & Loss Appropriation Account.

Solution:-

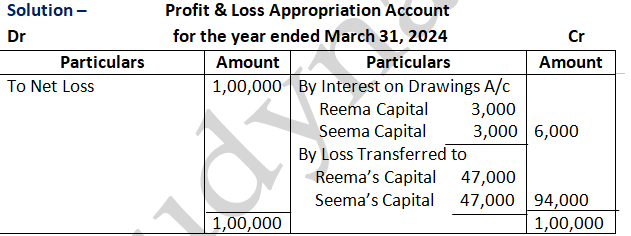

18. Reema and Seema are partners sharing profits equally. The partnership Deed provides that both Reema and Seema will get monthly salary of 15,000 each, Interest on Capital will be allowed @ 5% p.a. and Interest on Drawings will be charged @ 10% p.a. Their capitals were 5, 00,000 each and drawings during the year were 60,000 each. The firm incurred net loss of 1, 00,000 during the year ended 31st March, 2024. Prepare Profit & Loss Appropriation Account for the year ended 31st March, 2024.

Working Note 1:

Reema’s Interest on Drawings = 60,000 x 10/100 x 6/12 = 3,000

Seema’s Interest on Drawings = 60,000 x 10/100 x 6/12 = 3,000

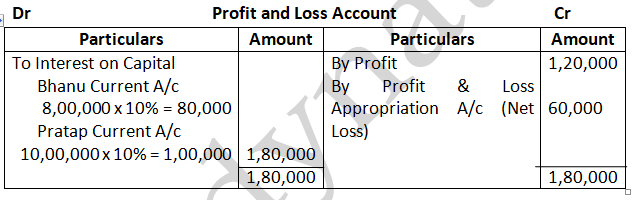

19. Bhanu and Pratap are partners sharing profits equally. Their fixed capitals as on 1st April, 2023 were 8, 00,000 and 10, 00,000 respectively. Their drawings during the year were 50,000 and 1, 00,000 respectively. Interest on Capital is a charge and is to be allowed @ 10% p.a. and interest on drawings is to be charged @ 15% p.a. Profit for the year ended 31st March, 2024 before giving effect to the above was 1, 20,000. Prepare Profit & Loss Appropriation Account.

Solution –

Partner’s Capital Accounts:-

Fixed Capital:

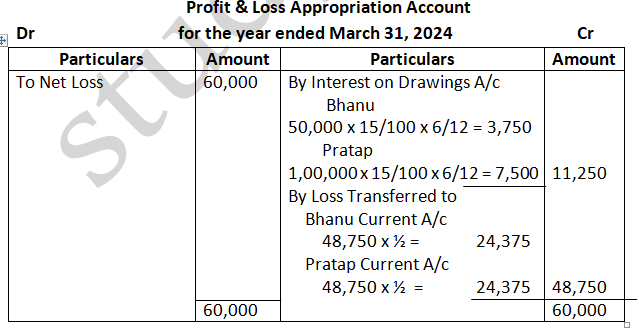

20. Amit and Sumit entered into partnership on 1st April, 2023 contributing 1, 50,000 and 2, 50,000 respectively towards capitals. The partnership Deed provided for interest on capitals @ 10% p.a. It also provided that Capital Accounts shall be maintained following Fixed Capital Accounts method. The firm earned net profit of 1, 00,000 for the year ended 31st March, 2024.

Pass the Journal entry for interest on Capital.

Working Note 1:

Interest on Capital

Amit = 1, 50,000 x 10% = 15,000

Sumit = 2, 50,000 x 10% = 25,000

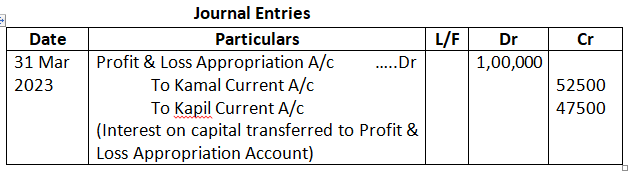

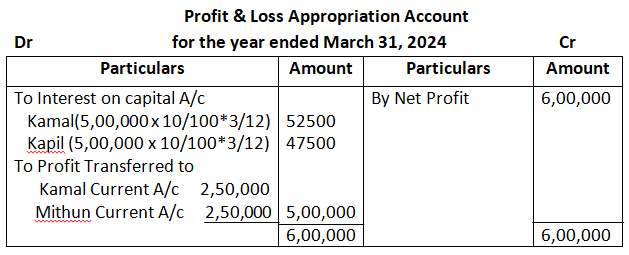

21. Kamal and Kapil are partners having fixed capitals of 5, 00,000 each as on 1st april, 2023. Kamal introduced further capital of 1, 00,000 on 1st October, 2023 whereas Kapil withdrew 1, 00,000 on 1st January, 2024 out of capital.

Interest on capital is to be allowed @ 10% p.a.

The firm earned net profit of 6, 00,000 for the year ended 31st March, 2024

Pass the Journal entry for interest on capital are prepare Profit & Loss Appropriation Account.

Solution –

Working Note 1:

Interest on Capital

Kamal = 5, 00,000 x 10/100 = 50,000

1, 00,000 x 10/100 x 3/12 = 25,00 52500

Kapil = 5, 00,000 x 10/100 = 50,000

1, 00,000 x 10/100 x 3/12 = 2500 47500

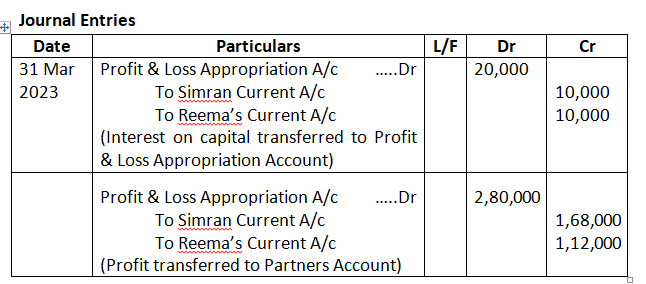

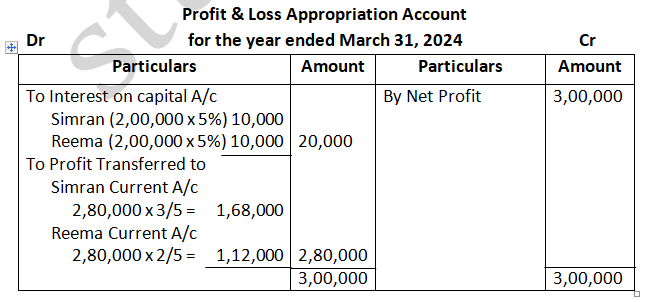

22. Simran and Reema are partners sharing profits in the ratio of 3:2. Their capitals as on 1 april, 2023 were 2, 00,000 each whereas Current accounts had balances of 50,000 and 25,000 respectively. Interest on capital is to be allowed @ 5% p.a. the firm earned net profit of 3, 00,000 for the year ended 31st March, 2024

Pass the Journal entries for interest on capital and distribution of profit. Also prepare Profit & Loss Appropriation Account for the year.

Solution –

Fluctuating Capital:

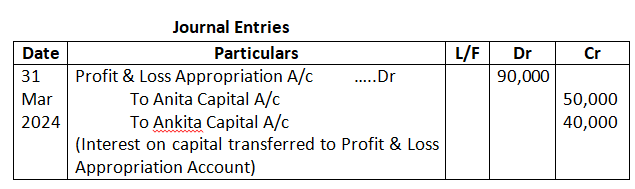

23. Anita and Ankita are partners sharing profits equally. Their capitals, maintained following Fluctuating Capital Accounts Method, as on 1 april, 2023 were 5, 00,000 and 4, 00,000 respectively. Partnership Deed provided to allow interest on capital @ 10% p.a. the firm earned net profit of 2, 00,000 for the year ended 31st March, 2024. Pass the Journal entry for interest on capital.

Solution –

Working Note 1:

Interest on Capital

Anita = 5, 00,000 x 10% = 50,000

Ankita = 4, 00,000 x 10% = 40,000

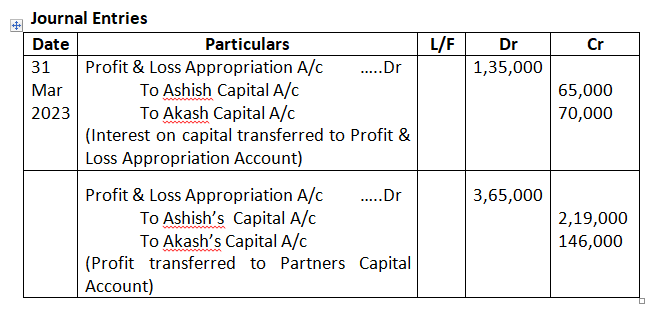

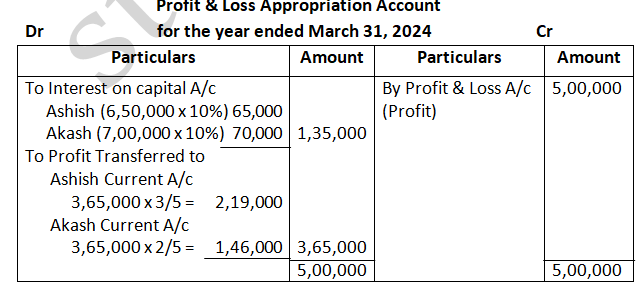

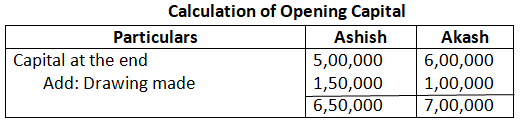

24. Ashish and Aakash are partners sharing profits in the ratio of 3:2 Their Capital Accounts had credit balances of 5,00,000 and 6,00,000 respectively as on 31st March, 2024 after debit of drawings during the year of 1,50,000 and 1,00,000 respectively. Net profit for the year ended 31st March, 2024 was 5, 00,000. Interest on capital is to be allowed @ 10% p.a. Pass the Journal entries for interest on capital and prepare Profit & Loss Appropriation Account.

Solution –

Working Note:

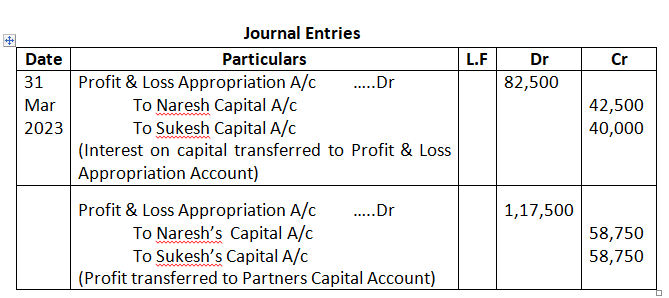

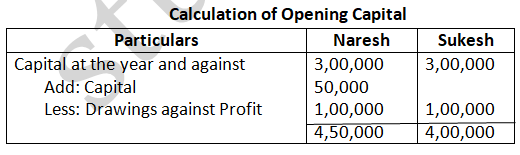

25. Naresh and Sukesh are partners with capitals of 3, 00,000 each as on 31st March, 2024. Naresh had withdrawn 50,000 against capital on 1st October, 2023 and 1, 00,000 drawings against profit. Sukesh also had drawings of 1, 00,000 Interest on capital is to be allowed @ 10% p.a. Net Profit for the year was 2, 00,000 which is yet to be distributed Pass the Journal entries for interest on capital and distribution of profit.

Solution –

Working Note 1:

Working Note 2:

Calculation of interest on capital

Naresh – 4, 50,000 x 10/100 = 45,000

Interest on Capital (Drawings against Capital)

= 50,000 x 10/100 x 6/12 = 2,500

Total = 42,500

Suresh – 40,000 x 10/100 = 40,000

Working Note 3:

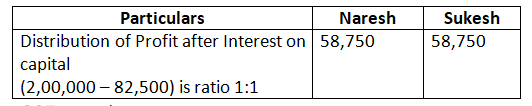

26. On 1st April, 2013, Jay and Vijay entered into partnership for supplying laboratory equipments to Government schools situated in remote and backward areas. They contributed capitals of 80,000 and 50,000 respectively and agreed to share the profits in the ratio of 3: 2 The Partnership Deed provided that interest on capital shall be allowed at 9% per annum. During the year the firm earned a profit of 7,800.

Showing your calculations clearly, prepares Profit & Loss Appropriation Account of Jay and Vijay for the year ended 31st March, 2014.

Solution –

Working Note 1:

Calculation of Interest on Capital

Jay – 80,000 x 9% = 7,200

Vijay – 50,000 x 9% = 4,500

11,700

Total profit given in question is = 7,800

The available profit for interest on capital is 7,800 and appropriate in the ratio of 7,200:4,500 i.e., 8:5

Jay = 7,800 x 8/13 = 4,800

Vijay = 7,800 x 5/13 = 3,000

7,800

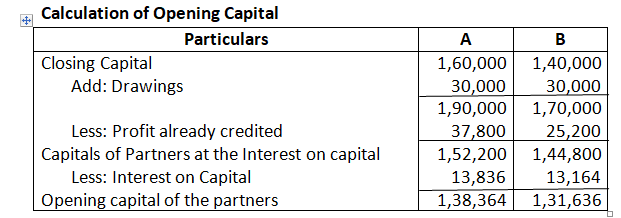

Calculation of Interest on Partners Capital:-

27. A and B partners in the ratio of 3:2 the firm maintains Fluctuating Capital Accounts and the balance of the same as on 31st March, 2020 amounted to 1,60,000 and 1,40,000 for A and B respectively. Their drawings during the year were 30,000 each.

As per Partnership Deed, interest on capital @ 10% p.a. on opening capitals had been provided to them .Calculate opening capitals of partners given that their profit was 90,000. Show your working clearly.

Solution –

Working Note 1:

Total Capital of A and B (1, 60,000 + 1, 40,000) = 3, 00,000

Add: Drawings (30,000 + 30,000) = 60,000

3, 60,000

Less: Profit (Including Interest on Capital) = 90,000

Total opening capital include Interest on Capital = 2, 70,000

Interest on Capital = 2, 70,000 x 10%

= 27,000

Divisible Profit = 90,000 – 27,000

= 63,000

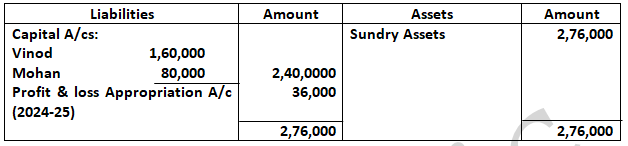

28. Vinod and Mohan are partners sharing profits and losses in the ratio of 4:3. From the following Balance Sheet, calculate interest on Capital @ 6% p.a. for the year ended 31st March, 2025:

Balance Sheet as at 31st March, 2025

During the year, Vinod’s drawings were Rs.20,000 and Mohan’s drawing were Rs.12,000. Profit during the year was Rs.64,000.

Solution-

Opening capital =capital in end +drawing-profit

Vinod= 160,000+20,000-16000=164000

Mohan =80,000+12000-12000=80,000

Calculation of profit = 64000-36000=28000

Vinod=28000×4/7=16000

Mohan=28000×3/7=12000

Interest on capital Vinod =164000X6%=9840

Mohan=80,000X6%=4800

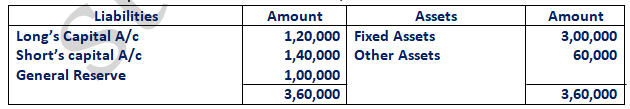

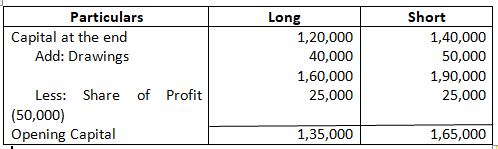

29. From the following Balance sheet of Long and Short, calculate interest on capital @ 8% p.a. for the year ended 31st March, 2025:

Balance Sheet as at 31st March, 2025

During the year, long withdrew 40,000 and short withdrew 50,000. Profit for the year was 1, 50,000 out of which 1, 00,000 was transferred to General Reserve.

Solution – Calculation of Opening Capital

Calculation of Interest on Capital:

Long’s Interest on Capital = 1, 35,000 x 8/100 = 10,800

Short Interest on Capital = 1, 65,000 x 8/100 = 13,200

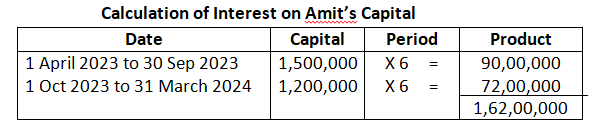

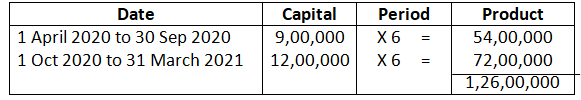

30. Amit and Bramit started business on 1st April, 2023 with capitals of 15, 00,000 and 9, 00,000 respectively. On 1st October, 2023, they decided that their capitals should be 12, 00,000 each. The necessary adjustments in capitals were made by introducing or withdrawing by cheque. Interest on capital is allowed @ 8% p.a. Compute interest on capital for the year ended 31st March, 2024.

Solution –

Interest on Capital:

Total of Product x Rate of Interest x 1/12

100

= 162, 00,000 x 8/100 x 1/12 = 1, 08,000

Calculation of Interest on Bramit’s Capital

Interest on Capital:

Total of Product x Rate of Interest x 1/12

100

= 1, 26, 00,000 x 8/100 x 1/12 = 84,000

31. Sumit and Namit are partners sharing profits in the ratio of 3:2. They contribute Rs.1,00,000 and Rs.50,000 respectively towards capital. Compute interest on capital and show distribution of profit in the following cases:

- When Partnership Deed is silent as to the interest on capital and profit for the year is Rs.50,000.

- When Partnership Deed provides for interest on capital @ 10% p.a. and profit for the year is Rs.15,000.

- When the Partnership Deed provides for interest on capital @ 12% p.a. and loss for the year is Rs.23,000.

- When Partnership Deed provides for interest on capital @ 5% p.a. and loss for the year is Rs.8,000.

- When Partnership Deed provides for interest on capital @ 5% p.a. and profit for the year is Rs.3,000.

- When Partnership Deed provides for interest on capital @ 5% p.a. even if it involves the firm in loss and the profit for the year is Rs.6,000.

Solution-

(i) When Partnership Deed is silent and profit is ₹50,000

No interest on capital allowed. Entire profit is shared in the ratio 3:2.

Sumit = ₹50,000 × 3/5 = ₹30,000

Namit = ₹50,000 × 2/5 = ₹20,000

(ii) Interest @10% p.a., profit ₹15,000

Interest:

Sumit = ₹1,00,000 × 10% = ₹10,000

Namit = ₹50,000 × 10% = ₹5,000

Total IOC = ₹15,000

Profit = ₹15,000, exactly equals interest ⇒ No residual profit to distribute.

Final:

Sumit = ₹10,000

Namit = ₹5,000

(iii) Interest @12%, profit ₹23,000

Interest:

Sumit = ₹1,00,000 × 12% = ₹12,000

Namit = ₹50,000 × 12% = ₹6,000

Total IOC = ₹18,000

Remaining profit = ₹23,000 – ₹18,000 = ₹5,000

Shared in 3:2 →

Sumit = ₹5,000 × 3/5 = ₹3,000

Namit = ₹5,000 × 2/5 = ₹2,000

Sumit = ₹12,000 + ₹3,000 = ₹15,000

Namit = ₹6,000 + ₹2,000 = ₹8,000

(iv) Interest @5%, loss ₹8,000

Interest:

Sumit = ₹1,00,000 × 5% = ₹5,000

Namit = ₹50,000 × 5% = ₹2,500

Total IOC = ₹7,500

Loss = ₹8,000 → No IOC allowed (unless deed says so).

Loss shared in 3:2:

Sumit = ₹8,000 × 3/5 = ₹4,800

Namit = ₹8,000 × 2/5 = ₹3,200

v) Interest @5%, profit ₹3,000

Interest:

Sumit = ₹5,000

Namit = ₹2,500

Total IOC = ₹7,500

Profit is less than interest ⇒ Distribute profit in capital ratio (since partial interest only allowed):

Capital ratio = 1,00,000 : 50,000 = 2:1

Sumit = ₹3,000 × 2/3 = ₹2,000

Namit = ₹3,000 × 1/3 = ₹1,000

(vi) Interest @5% even if it involves loss, profit ₹6,000

Interest:

Sumit = ₹5,000

Namit = ₹2,500

Total IOC = ₹7,500

Profit ₹6,000 Interest ⇒ Still, full IOC allowed. Firm will bear loss of ₹1,500.

Final:

Sumit = ₹5,000

Namit = ₹2,500

Firm incurs loss of ₹1,500

32. Moli and Bholi contribute 20,000 and 10,000 respectively towards capital. They decide to allow interest on capital @ 6% p.a. Their respective share of profits is 2:3 and profit for the year is 1,500. Show distribution of profits:(old question)

- When there is no agreement except for interest on capitals

- When there is an agreement that the interest on capital is a charge.

Solution – Calculation of Interest on capital:

Interest on Moli’s Capital = 20,000 x 6% = 1,200

Interest on Bholi’s Capital = 10,000 x 6% = 600

Total amount of Interest on capital = 1,200 +600 = 1,800

Case 1: Profit year ended = 1,500

Total Interest = 1,800

Interest on capital is more than profit. Hence profit would be distributed as interest on capital among partners in their Interest on Capital

Ratio- 1,200:600 = 2:1

Moli’s Interest on capital = 1,500 x 2/3 = 1,000

Bholi’s Interest on Capital = 1,500 x 1/3 = 500

Case 2:

Hence profit 1,500 and Interest on capital 1,800. It means firm loss for 300. Then they distribute loss into ratio 2:3

Loss of Moli – 300 x 2/5 = 120

Loss of Bholi – 300 x 3/5 = 180

Salary or Commission to Partners:-

32. Shiv, Mohan and Gopal are partners sharing profits and losses in the ratio of 2:2:1 Shiv is entitled to a commission of 10% on the net profit. Net profit for the year is 1, 10,000.

Determine the amount of commission payable to Shiv.

Solution –

Net profit before charging Commission = 1, 10,000

Commission to Shiv 10%

= 1, 10,000 x 10/100 = 11,000

33. Abha, Bobby and Vineet are partners sharing profits and losses equally. As per Partnership Deed, Vineet is entitled to a commission of 10% on the net profit after charging such commission. The net profit before charging commission is 2, 20,000.

Solution –

Net profit before charging commission = 2, 20,000

After charging commission – 2, 20,000 x 10

100 + 10

= 20,000

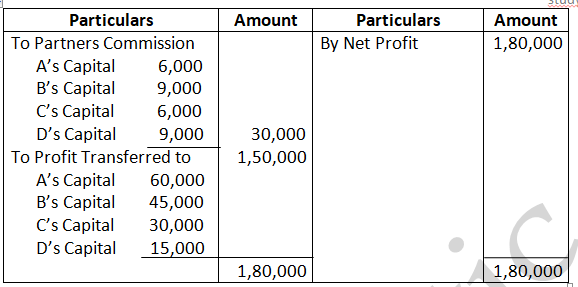

34. A, B, C and D are partners in a firm sharing profits in the ratio of 4:3:2:1. It earned net profit of 1, 80,000 for the year ended 31st March, 2024. As per the Partnership Deed, they are to charge a commission @ 20% of the profit after charging such commission which they will share as 2:3:2:3.

You are required to show appropriation of profit among the partners.

Solution –

Dr Profit and Loss Appropriation Account Cr

Working Note 1:

After Charging Commission

= 1, 80,000 x 20/120 = 30,000

Commission Distributed in Partners:

A – 30,000 x 2/10 = 6,000

B – 30,000 x 3/10 = 9,000

C – 30,000 x 2/10 = 6,000

D = 30,000 x 3/10 = 9,000

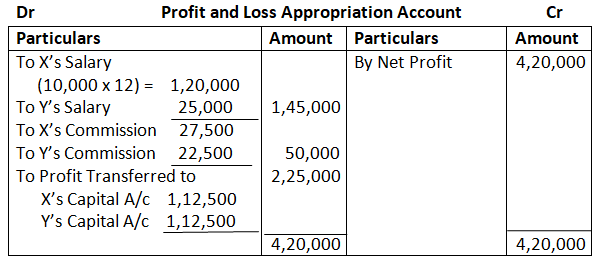

35. X and Y are partners in a firm. X is entitled to a salary of 10,000 per month and commission of 10% of the net profit after partner’s salaries but before charging commission. Y is entitled to a salary of 25,000 p.a. and commission of 10% of the net profit after charging all commission and partners’ salaries. Net profit before providing for partners salaries and commission for the year ended 31st March, 2024 was 4, 20,000. Show distribution of profit.

Solution –

Working Note 1:

Calculation of Commission

Commission of X 10% of Net Profit but before charging such commission

Profit after Partners Salary = 4, 20,000 – 1, 45,000

= 2, 75,000

Commission to X = 2, 75,000 x 10% = 27,500

Commission of Y after charging all commission and Salary

= 4, 20,000 – 2, 75,000 – 27,500 = 2, 47,500

= 2, 47,500 x 100 = 22,500

110

Calculation of Interest on Partners Drawings & Amount of Drawings:-

36. Ram and Mohan partners, drew for their personal use 1, 20,000 and 80,000. Interest is chargeable @ 6% p.a. on the drawings. What is the amount of interest chargeable from each partner?

Solution – Calculation of interest on drawings of both the Partners:

When the dates of drawings are not given, interest on drawings is calculated on the total amount of drawings for average period of 6 months.

Interest on Ram’s Drawings

1, 20,000 x 6/100 x 6/12 = 3,600

Interest on Mohan’s Drawings

80,000 x 6/100 x 6/12 = 2,400

37. Brij and Mohan are partners in a firm. They withdrew 48,000 and 36,000 respectively during the year evenly in the middle of every month. According to the Partnership Deed, interest on drawings is to be charged @ 10% p.a. Calculate on drawings of the partners using the appropriate formula.

Solution – If drawings are made in the middle of every month. It is charged for 6 months.

Interest on Brij’s Drawings

48,000 x 140/100 x 6/12 = 2,400

Interest on drawings

36,000 x 10/100 x 6/12 = 1,800

38. Dev withdrew 10,000 on 15th day of every month. Interest on drawings was to be charged @ 12% per annum. Calculate interest on Dev’s Drawings.

Solution – Dev Withdrew 10,000 on 15th day of every month. So yearly drawings is 10,000 x 12 = 1, 20 000

Then calculate Interest on Drawings for 6 months of average period

1, 20,000 x 12/100 x 6/12 = 7,200

39. One of the partners in a partnership firm has withdrawn 9,000 at the end of each quarter, throughout the year. Calculate interest on drawings at the rate of 6% per annum.

Solution –

Quarterly drawings given then what is Annual Drawings?

9,000 x 4 = 36,000

Formula of Quarterly drawings

Total drawings x Rate of Interest /100 x 4.5/12

= 36,000 x 6/100 x 4.5/12

= 810

40. A & B are partner s sharing profit equally. A drew regularly 4,000 in the beginning of every month for six months ended 30th September, 2024. Calculate interest on drawings @ 5% p.a. for a period of six months 30th September, 2024

Solution – If the drawings are made in the beginning of every month after 30th September. Interest is charged for 3.5 months.

Average period =6+1/2=3.5

Interest on drawings x Rate/100 x 3.5/12

= (4,000 x 6) x 5/100 x 3.5/12

= 350

41. A & B are partners sharing profits equally. A drew regularly 4,000 at the end of every month for six months ended 30th September, 2023. Calculate interest on drawings @ 5% p.a. for a period of six months 30th September, 2023

Solution – If fixed amount is withdraw during 6 month at end of each month

Average period+5+0/2

Interest on Drawings x Rate/100 x 2.5/12

A = 4,000 x 6 = 24,000

A’s Interest on Drawings

= 24,000 x 5/100 x 2.5/12

42. B & C are partners sharing profits equally. A drew regularly 5,000 per month in the beginning of six months ended 30th September, 2023. Calculate interest on drawings @ 12% p.a. for the year ended 31 march 2024

Solution – If fixed amount is withdraw during 6 month at beginning of every month

Average period=12+7/2=9.5

Interest on Drawings x Rate/100 x 9.5/12

A = 5,000 x 6 = 30,000

A’s Interest on Drawings

= 30,000 x 12/100 x 9.5/12

= 2850

43. Calculate interest on drawings of Sanjay @ 10% p.a. for the year ended 31st March, 2024, in each of the following alternative cases:

Case 1: If he withdrew 7,500 in the beginning of the each quarter.

Case 2: If he withdrew 7,500 at the end of each quarter.

Case 3: If he withdrew 7,500 during the middle of each quarter.

Solution – Calculating Interest on Drawings

Total Drawings = 7,500 x 4

= 30,000

Case 1: 30,000 x 10 x 7.5 = 1,875

100 12

Average period =12+3/2=7.5

Case 2: 30,000 x 10/100 x 4.5/12 = 1,125

Average period =9+0/2=4.5

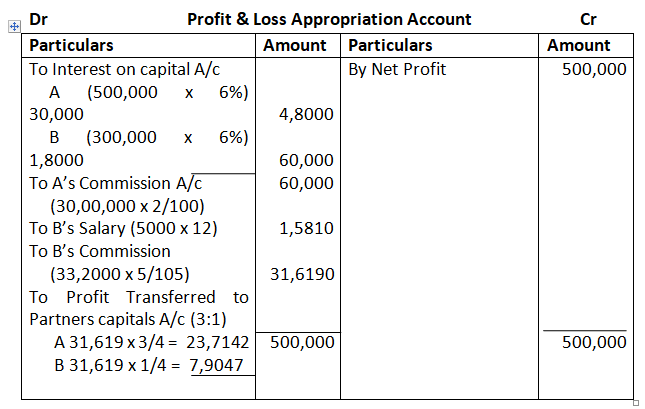

Case 3: 30,000 x 10/100 x 6/12 = 1,500

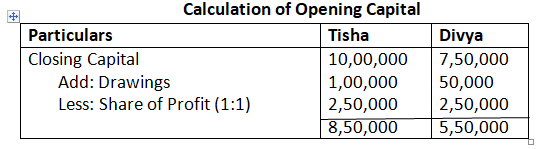

44. The capital accounts of Tisha and Divya showed credit balances of 10, 00,000 and 7, 50,000 respectively after taking into account drawings and net profit of 5, 00,000. The drawings of the partners during the year ended 31st march 2024 were:

- Tisha withdrew 25,000 at the end of each quarter.

- Divya’s drawings were:

31st May, 2023 20,000

1st November, 2023 17,500

1st February, 2024 12,500

Calculate interest on partner’s capital @ 10% p.a. and interest on partner’s drawings @ 6% p.a. for the year ended 31st March, 2024.

Solution –

Tisha Drawings = 25,000 x 4 = 1, 00,000

Divya Drawings = 20,000 + 17,500 + 12,500 = 50,000

- Interest on Trisha’s Capital

8, 50,000 x 10/100 = 85,000

2. Interest on Divya’s Capital

5, 50,000 x 10/100 = 55,000

- Interest on Drawings (Quarterly Method)

(25,000 x 4) x 6/100 x 4.5/12 = 2,250

Average period =9+0/2=4.5

2. Interest on Drawings (Product Method)

Interest on Drawings:-

3, 12,500 x 6/100 x1/12 = 1,562.5 or 1,563

45. A, B and C are partners. During the year ended 31st March, 2025, each of the partners withdrew 10,000regularly. A withdrew in the beginning of the first 6 months of the year, B withdrew in the middle of the month for the first 6 months of the year and C withdrew at the end of the month for the first 6 months. calculate interest on drawings @ 6% p.a. for the year ended 31st March, 2025.

Total drawing of each partner =10,000 × 6 = 60,000

1. A’s interest on drawing

60,000×6×9.5 /100×12 = 2,850

Average month 12 + 7/2= 9.5

2. B’s interest on drawing

60,000×6×9 /100×12 = 2,700

Average month = 11.5 + 6.5/ 2= 9

3. C’s interest on drawing

60,000×6×8.5 /100×12 = 2,550

Average month = 11 + 6/2= 8.5

46. Calculate the amount of Manan’s monthly drawings for the year ended 31st March, 2024, in the following alternative cases when Partnership Deed allows interest on drawings @ 10% p.a.: (Old Question.)

- If interest on drawings is 1,950 and he withdrew a fixed amount in the beginning of each month.

- If interest on drawings is 2,400 and he withdrew a fixed amount in the middle of each month.

- If interest on drawings is 2,750 and he withdrew a fixed amount at the end of each month.

Solution – Case 1:

Average Month = 12 + 1 / 2 = 12/2 = 6.5 months

Interest on Drawing = Monthly Drawings x 12 x 10/100 x 6.5/12

Monthly Drawing = 1,950 x 100 x 12 x 10 / 12 x 10 x 6.5

= 1,950 x 10 x 10 / 6.5

= 3,000

Case 2:

Average Month = 11.5 + .5 /2 = 6 month

Interest on Drawing = Monthly Drawings x 12 x 10/100 x 6/12

Monthly Drawing = 2,400 x 100 x 12 / 12 x 10 x 6

= 4,000

Case 3:

Average Month = 11 + 0 /2 = 5.5 month

Interest on Drawing = Monthly Drawings x 12 x 10/100 x 5.5/12

Monthly Drawing = 2,750 x 100 x 12 x 10 12 x 10 x 5.5

= 5,000

47. Calculate the amount of Shiv’s quarterly drawings for the year ended 31st March, 2024, in the following alternative cases when Partnership Deed allows interest on drawings @ 12% p.a.: (Old Question.)

- If interest on drawings is 1,500 and he withdrew a fixed amount in the beginning of each month.

- If interest on drawings is 1,200 and he withdrew a fixed amount in the middle of each month.

- If interest on drawings is 900 and he withdrew a fixed amount at the end of each month.

Solution – Case 1:

Average Month = 12 + 3/2 = 15/2 = 7.5 months

Interest on Drawing = Quarterly Drawings x 4 x 12/100 x 7.5/12

Quarterly Drawing = 1,500 x 100 x 12 x 10 / 4 x 12 x 7.5

= 5,000

Case 2:

Average Month = 10.5 + 1.5 /2 = 12/2 = 6 month

Interest on Drawing = Quarterly Drawings x 4 x 12/100 x 6/12

Quarterly Drawing = 1,200 x 100 x 12 / 4 x 12 x 6

= 5,000

Case 3:

Average Month = 9 + 0 /2 = 4.5 month

Interest on Drawing = Quarterly Drawings x 4 x 12/100 x 4.5/12

Quarterly Drawing = 900 x 100 x 12 x 10 / 4 x 12 x 4.5

= 5,000

46. Piyush, Harmesh and Atul are partners. Each partner regularly withdrew ₹ 20,000 per month as given below:

(a) Piyush withdrew in the beginning of the month;

(b) Harmesh withdrew in the middle of the month; and (

c) Atul withdrew at the end of the month.

Interest on drawings charged for the year ended 31st March, 2024 was ₹ 15,600, ₹ 14,400 and ₹ 13,200 respectively.

Determine the rate of interest charged on drawings.

Ans-

Interest on drawing 100 = Drawings x Rate of interest x 6.5 / 12

15600=(20,000*12)/100* Rate of interest*6.5/12

Rate of interest =15600*100*12 / (20,000 x 12) x 6.5

= 12%

(b)

Interest on drawing/ 100= Drawings x Rate of interest * x 6. / 12

14400=(20,000*12)/100* Rate of interest*6/12

Rate of interest =14400*100*12 / (20,000 x 12) x 6

= 12%

(c)

Interest on drawing / 100 = Drawings x Rate of interest * x 5.5 /12

13200=(20,000*12)/100* Rate of interest*5.5/12

Rate of interest =13200*100*12/ (20,000 x 12) x 5.5

= 12%

46. Calculate the Rate of interest on Drawings of Mohan in the following cases:(Old Question.)

(a) If he withdrew *6,000 in the beginning of each quarter for the year ended 31st March, 2024 and interest on drawings is 1,500.

(b) If he withdrew 6,000 at the end of each quarter for the year drawings is 900. ended 31st March, 2024 and interest on

(c) If he withdrew 6,000 per quarter for the year ended 31st March, 2024 and interest on drawings is ₹ 1,200.

(a) interest on Drawing / 100 = Drawings x Rate of interest * x 7.5 / 12

1500 =6000*4/100* Rate of interest*7.5/12

Rate of interest =1500*100*12 / (6,000 x 4) x 7.5

= 10%

- interest on Drawing / 100 = Drawings x Rate of interest * x 4.5 / 12

900 =6000*4/100* Rate of interest*4.5/12

Rate of interest =1500*100*12 / (6,000 x 4) x 4.5

= 10%

- interest on Drawing / 100 = Drawings x Rate of interest * x 6 /12

1200 =6000*4/100* Rate of interest*6/12

Rate of interest =1500*100*12 (6,000 x 4 ) x 6

= 10%

Profit & Loss Appropriation Account and Partners Capital Account:-

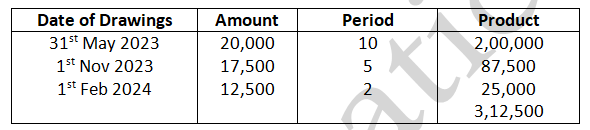

47. Amit and Vijay started a partnership business on 1st April, 2023. Their capital contributions were 2, 00,000 and 1, 50,000 respectively. The partnership deed provided as follow:

- Interest on capital is allowed @ 10% p.a.

- Amit to get a salary of 2,000 per month and Vijay 3,000 per month.

- Profits are to be shared in the ratio of 3:2

Net Profit for the year ended 31st March, 2024 was 2, 16,000. Interest on drawings amounted to 2,200 for Amit and 2,500 for Vijay.

Prepare Profit & Loss Appropriation Account.

Solution –

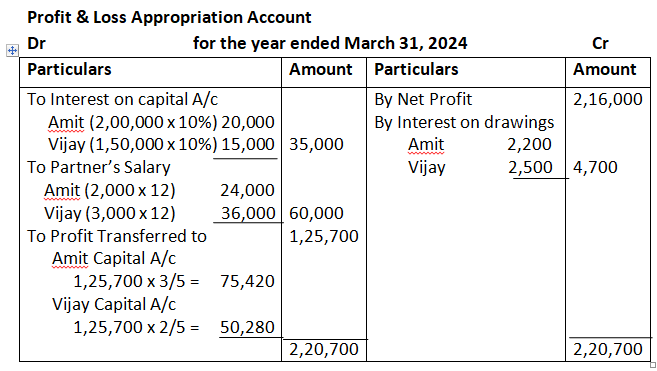

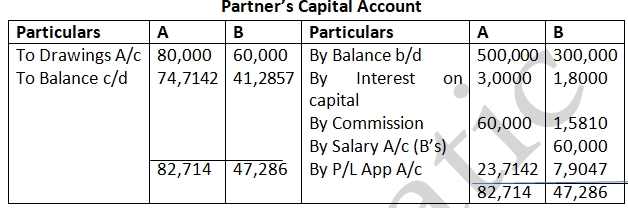

48. A & B are partners sharing profits and losses in the ratio of 3:1. On 1st April, 2023, their capitals were: A 500,000 and B 300,000. During the year ended 31st March, 2024, the firm earned a net profit of 500,000. The term of Partnership is:

- Interest on capital is to be allowed @ 6% p.a.

- A will get a commission @ 2% on turnover

- B will get a salary of 500 per month.

- B will get commission of 5% on profits after deduction of all expenses including such commission

Partner’s drawings for the year were: A 80,000 and B 60,000. Turnover for the year was 3, 00,000. After considering the above facts, you are required to prepare Profit & Loss Appropriation Account and Partners Capital Account.

Solution –

Working Note 1:

B’s Commission

= 500,000 – (4,8000+ 60,000 + 60,000)

= 33,2000

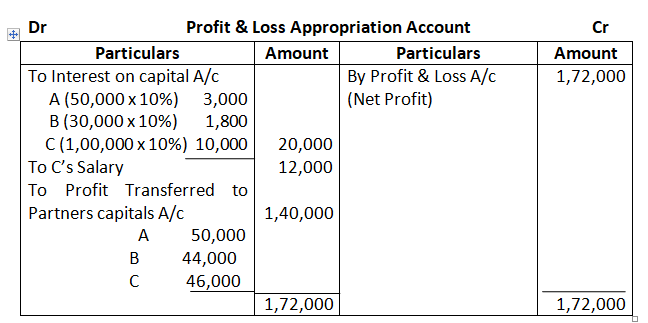

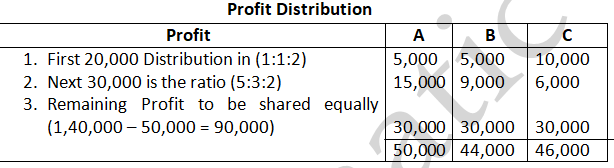

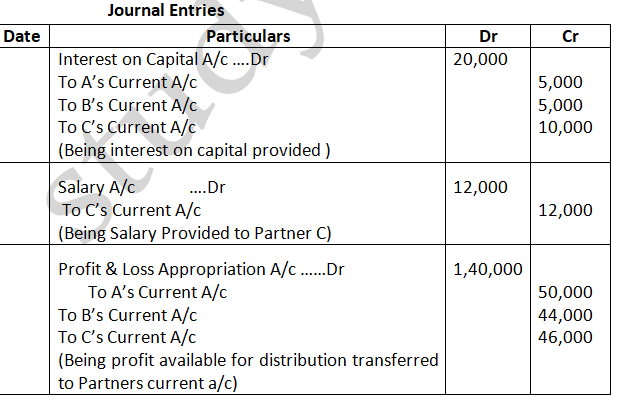

49. A, B and C were partners in a firm having capitals of 50,000, 50,000 and 1, 00,000 respectively. Their Current Account balance were A: 10,000 B: 5,000 and c: 2,000 (Dr). According to the Partnership Deed the partners were entitled to an interest on capital @ 10% p.a. C being the working partners was also entitled to a salary of 12,000 p.a. the profits were to be divided as:

- The first 20,000 in proportion to their capitals

- Next 30,000 in the ratio of 5:3:2

- Remaining profits to be shared equally

The firm earned net-profit of 1, 72,000 before charging any of the above items. Prepare Profit & Loss Appropriation Account and Pass necessary Journal entry for the appropriation of Profits.

Solution –

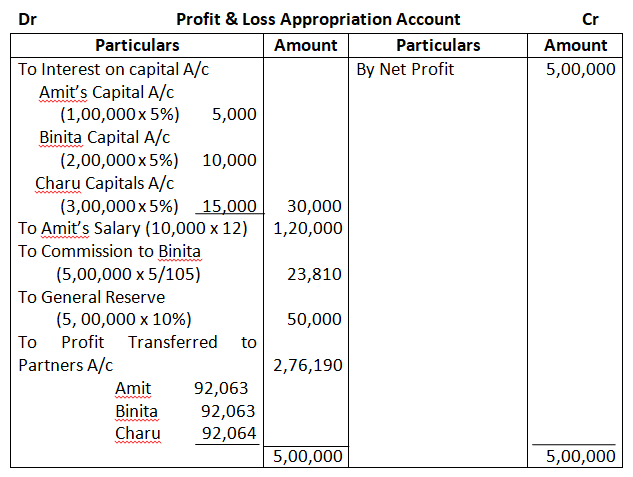

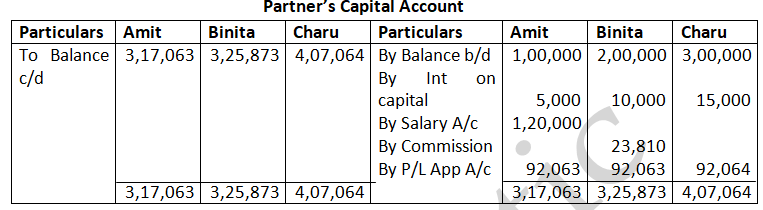

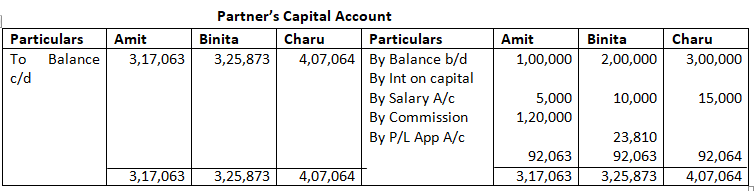

49.. Amit, Binita and Charu are three partners. On 1st April, 2023, their capitals stood as: Amit 1, 00,000, Binita 2, 00,000 and Charu 3, 00,000. It was decided that:(Old Question.)

- They would receive interest on Capitals @ 5% p.a.

- Amit would get a salary of 10,000 per month

- Binita would received commission @ 5% of net profit after deduction of Commission

- 10% of the net profit would be transferred to the General Reserve.

Before the above items were taken into account, profit for the year ended 31st March, 2024 was 5, 00,000. Prepare Profit & Loss Appropriation Account and the Capital Accounts of the Partners.

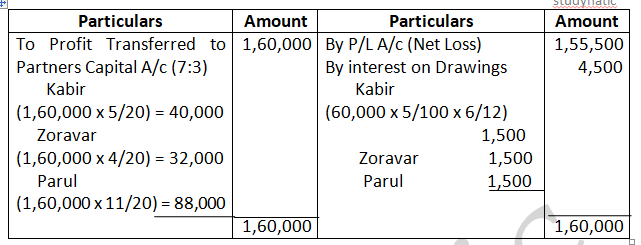

Solution –

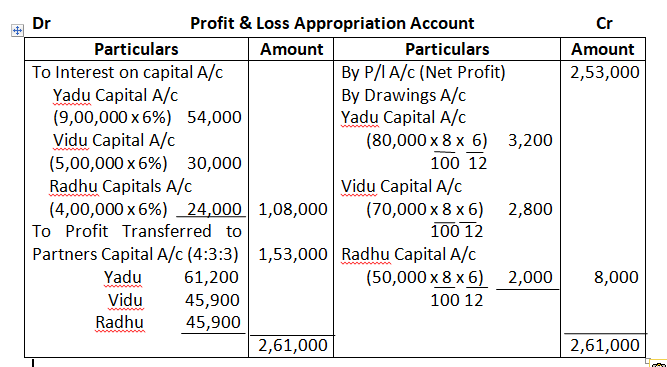

50. Yadu, Vidu and Radhu were partners in a firm sharing profits in the ratio of 4:3:3. Their fixed capitals on 1st April, 2018 were 9, 00,000, 5, 00,000 and 4, 00,000 respectively. On 1st November, 2018, Yadu gave a loan of 80,000 to the firm, as per the partnership agreement.

- The partners were entitled to an interest on capital @ 6% p.a.

- Interest on partner’s drawings was to be charged @ 8% p.a.

The firm earned profit of 2, 53,000 (after interests on Yadu’s Loan) during the year 2018-19. Partner’s drawings for the year amounted to: Yadu – 80,000, Vidu – 70,000 and Radhu – 50,000 Prepare Profit & Loss Appropriation Account for the year ending 31st March, 2019.

Solution –

Transfer of Profit to Reserve:-

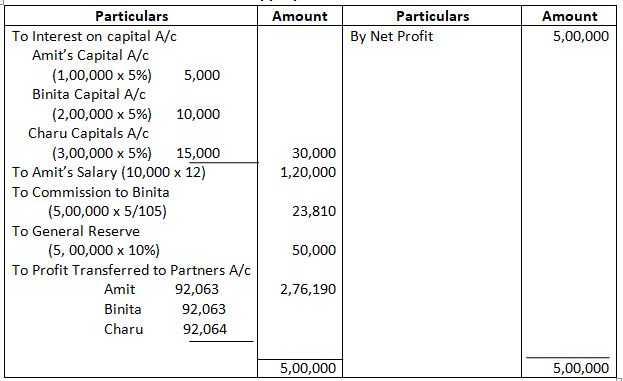

51. Amit, Binita and Charu are three partners. On 1st April, 2024, their capitals stood as: Amit 1, 00,000, Binita 2, 00,000 and Charu 3, 00,000. It was decided that:

- They would receive interest on Capitals @ 5% p.a.

- Amit would get a salary of 10,000 per month

- Binita would received commission @ 5% of net profit after deduction of Commission

- 10% of the net profit would be transferred to the General Reserve.

Before the above items were taken into account, profit for the year ended 31st March, 2025 was 5, 00,000. Prepare Profit & Loss Appropriation Account and the Capital Accounts of the Partners.

Solution –

Dr Profit & Loss Appropriation Account Cr

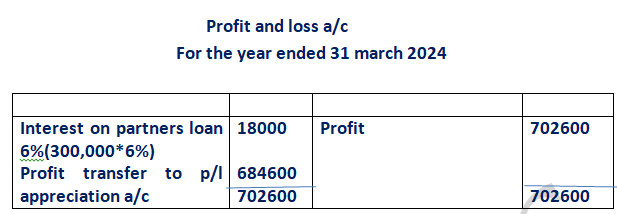

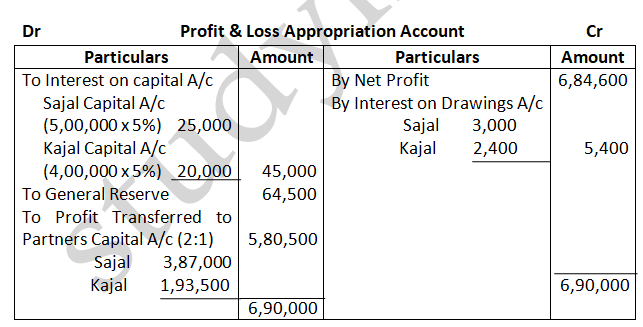

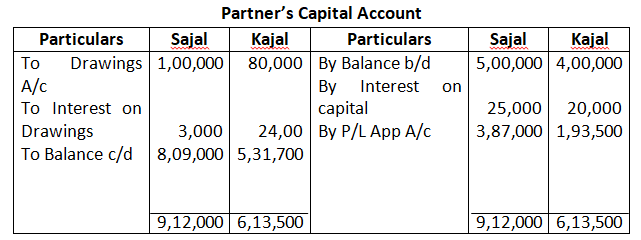

52. Sajal and Kajal are partners sharing profit and losses in the ratio of 2:1 on 1st April, 2021, their Capitals were: Sajal – 5, 00,000 and Kajal – 4, 00,000.

Prepare Profit & Loss Appropriation Account and the Partners Capital Accounts at the end of the year from the following information:

- Interest on Capital is to be allowed @ 5% P.a.

- Interest on the loan advanced by Kajal for the whole year, the amount of loan being 3,00,000

- Interest on Partners drawings @ 6% p.a. Drawings: Sajal 1, 00,000 and Kajal 80,000.

- 10% of the divisible profit is to be transferred to General Reserve.

Profit before giving effect to the above, for the year ended 31st March, 2024 is 7, 02,600.

Solution –

Working Note 1:

- Net Profit – 7,02,600 – 18,000 = 6,84,600

- Interest on Drawings :

Sajal – 1, 00,000 x 6/100 x 6/12 = 3,000

Kajal – 80,000 x 6/100 x 6/12 = 2,400

- Calculation of General Reserve

= (6, 84,600 + 5,400) – 45,000

= 6, 45,000 x 10%

= 64,500

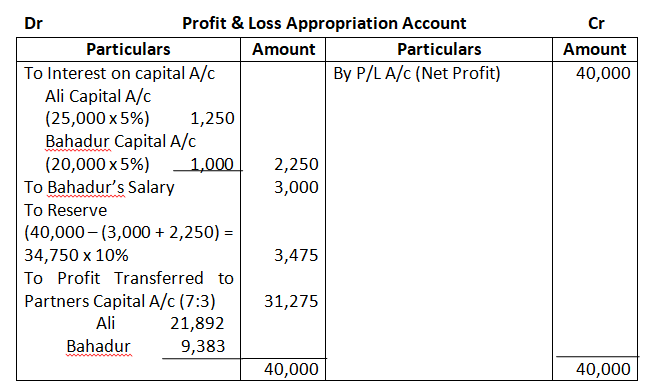

53. Ali & Bahadur are partners in a firm sharing profits and losses as Ali 70% and Bahadur 30%. Their respective capitals as at 1st April, 2023 stand as Ali 25,000 and Bahadur 20,000. The partners are allowed interest on capitals @ 5% p.a. Drawings of the partners during the year ended 31st March, 2024 were 3,500 and 2,500 respectively.

Profit for the year, before allowing interest on capital and annual salary of Bahadur @ 3,000 was 40,000 10% of divisible profit is to be transferred to Reserve. Prepare Partner’s Current Accounts and Capital Accounts recording the above transaction.

Solution –

Appropriation more than available profit

54.Neeraj and Surya are partners sharing profits and losses in the ratio of 2:1. Their capitals are Rs.4,00,000 and Rs.2,00,000 respectively. Neeraj is entitled to interest on capital @ 12% p.a. and Surya is entitled to salary of Rs.6,000 per month. Profit before providing for interest on capital and partners salary for the year ended 31st March, 2025 was Rs.50,000. Show the distribution of profits.

Solution-

Interest on Neeraj’s Capital = 4,00,000 x 12%

= 48,000

Surya’s Salary = 6,000 x 12

= 72,000

Total Appropriation = 48,000 + 72,000

= 1,20,000

Total Appropriation > Available profit

In the absence of any Agreement Appropriation of profit is done amount partners any upto the available profit in the ratio of partner’s Appropriation amount i.e.

Ratio of Appropriation : Interest on Neeraj : Surya’s Salary

= 48,000 : 72,000

= 2 : 3

Interest on Neeraj’s Capital = 50,000 x 2/5

= 20,000

Surya’s Salary = 50,000 x 3/5

= 30,000

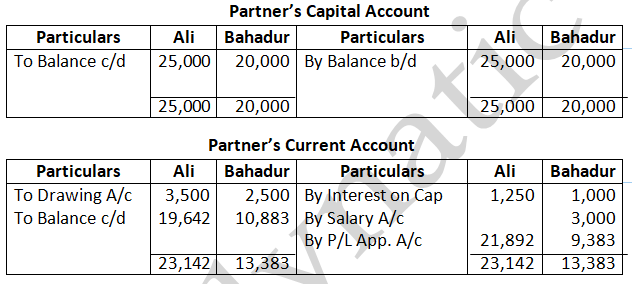

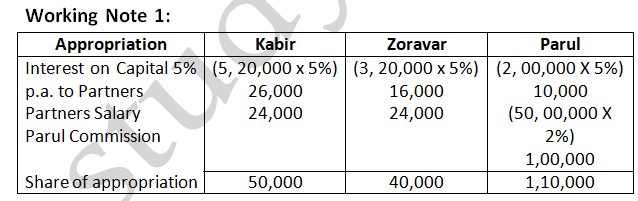

55. Kabir, Zoravar and Parul are partners sharing profits in the ratio of 5:3:2. Their capitals as on 1st April, 2023 were: Kabir- 5, 20,000, Zoravar- 3, 20,000 and Parul – 2, 00,000.

The partnership Deed provided as follows:

- Kabir and Zoravar each will get salary of 24,000 p.a

- Parul will get commission of 2% of Sales.

- Interest on capital is to be allowed @ 5% p.a.

- Interest on Drawings is to be charged @ 5% p.a.

- 10% of Divisible Profit is to be transferred to General Reserve.

Sales for the year ended 31st March, 2022 were 50, 00,000. Drawings by each of the partners during the year were 60,000. Net profit for the year was 1, 55,500. Prepare Profit & Loss Appropriation Account for the year ended 31st March, 2024.

Solution –

Dr Profit & Loss Appropriation Account Cr

Ratio of Appropriation = 50,000: 40,000: 1, 10,000

= 5:4:11

Adjusting and Transefor entries

56. Aditi, Bobby and Krish were partners in a firm sharing profits and losses in the ratio of 5: 3:2. Their capitals were 5,00,000, 4,00,000 and * 2,00,000 respectively. The partnership deed provided for the following:

- Interest on capital @ 10% per annum.

- Interest on drawings @ 6% per annum.

- Interest on partner’s loan to the firm @ 9% per annum.

During the year, Aditi had withdrawn 60,000 and Bobby 50,000. On 1st September, 2021, Krish had given a loan of 40,000 to the firm.

Pass necessary journal entries in the books of the firm for the following transactions for the year ended 31st March, 2022:

- Allowing interest on Bobby’s capital.

- Charging interest on Aditi’s drawings.

- Providing interest on Krish’s loan to the firm.

Also pass transfer entries in the Profit and Loss Account/Profit and Loss Appropriation Account, as the case may be

Solution

- Allowing interest on bobby’s capital

Interest on capital a/c Dr. 40,000

To bobby’s capital a/c 40,000

Transfer entry

P/L appropriation a/c Dr. 40,000

Interest on capital a/c 40,000

2. Charging interest on Aditi’s drawing

Aditi capital a/c Dr. 1800

To interest on drawing a/c 1800

Transfer entry

interest on drawing a/c Dr. 1800

P/L appropriation a/c 1800

3. Providing interest on Krish’s loan to the firm.

Interest on krish loan a/c Dr. 2100

To krish loan a/c 2100

Transfer entry

P/L a/c Dr. 2100

To Interest on krish loan a/c 210

Adjustments for Incorrect Appropriations in the Past (Past Adjustments):

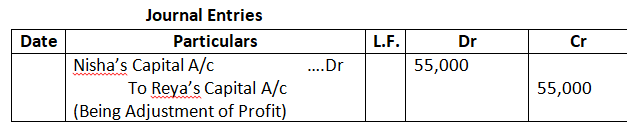

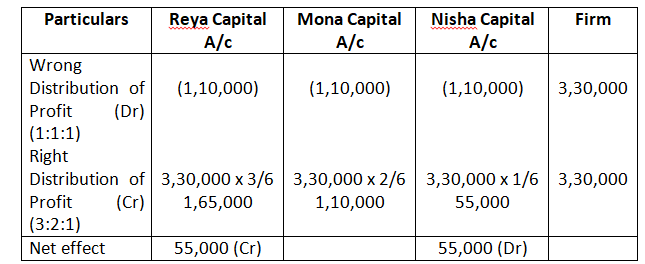

57. Reya, Mona and Nisha shared profits in the ratio of 3:2:1. Profits for the last three years were 1, 40,000; 84,000 and 1, 06,000 respectively. These profits were by mistake distributed equally. The error is now to be corrected.

Give the necessary rectification Journal entry.

Solution –

Working Note 1:

Total Profit of last 3 year

= 1, 40,000 + 84,000 + 1, 06,000 = 3, 30,000

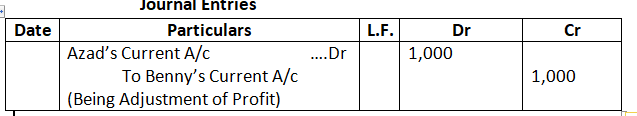

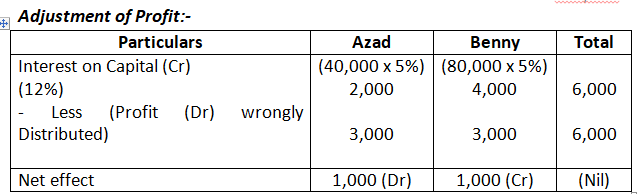

57. Azad and Benny are equal partners. Their capitals are 40,000 and 80,000 respectively. After the accounts for the year had been prepared, it was noticed that interest @ 5% p.a. as provided in the Partnership Deed was not credited to their Capital Accounts before distribution of profits. It is decided to pass an adjustment entry in the beginning of the next year. Record the necessary Journal entry.(Old Question)

Solution –

Working Note 1:

Interest on Capital

Azad – 40,000 x 5/100 = 2,000

Benny – 80,000 x 5/100 = 4,000

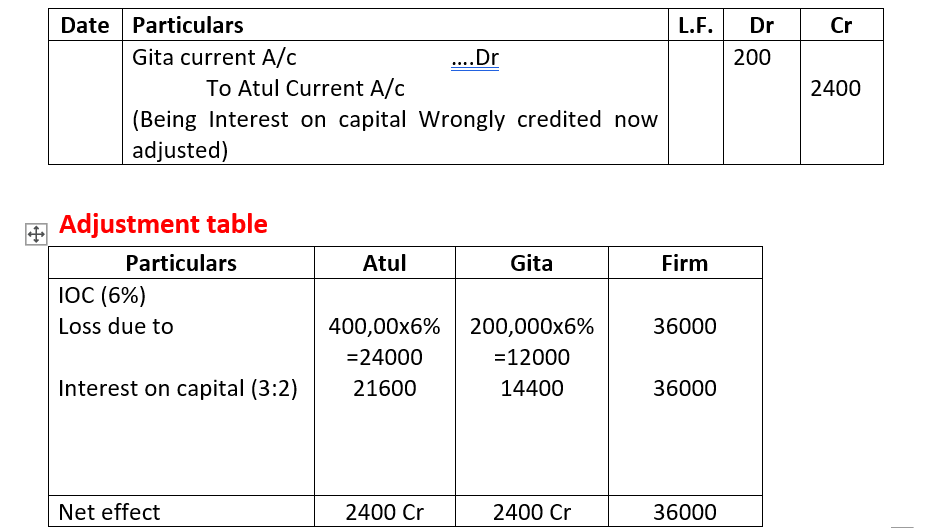

58. Atul and Gita were partners in a firm sharing profits and losses in the ratio of 3:2. Their fixed capitals were Rs.4,00,000 and Rs.2,000,000 respectively. After the accounts for the year were prepared, it was noticed that interest on capital @ 6% p.a. as provided in the partnership deed, was not credited to the capital accounts of partners before distribution of profits.

Pass the necessary adjusting Journal entry. Show your working clearly.

Solution-

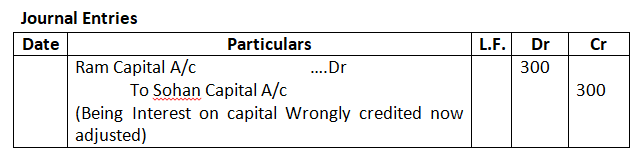

59. Ram, Mohan and Sohan sharing profits and losses equally have capitals of 1, 20,000, 90,000 and 60,000 respectively. For the year ended 31st March, 2022, interest was credited to them @ 6% p.a. instead of 5% p.a. Give adjustment Journal entry.

Solution –

Working Note 1:

Calculation of Interest on Capital 6% p.a

Interest on Ram Capital – 1, 20,000 x 6% = 7,200

Interest on Mohan Capital – 90,000 x 6% = 5,400

Interest on Sohan Capital – 60,000 x 6% = 3,600

Working Note 2:

Calculation of Interest on Capital 5% p.a

Ram – 1, 20,000 x 5% = 6,000

Mohan – 90,000 x 5% = 4,500

Sohan – 60,000 x 5% = 3,000

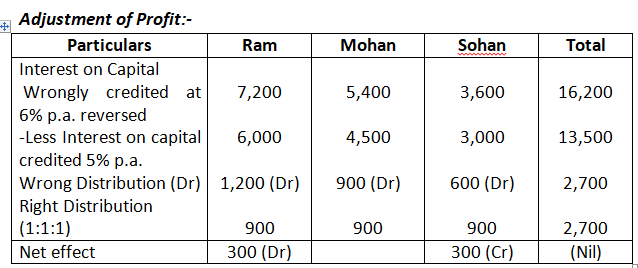

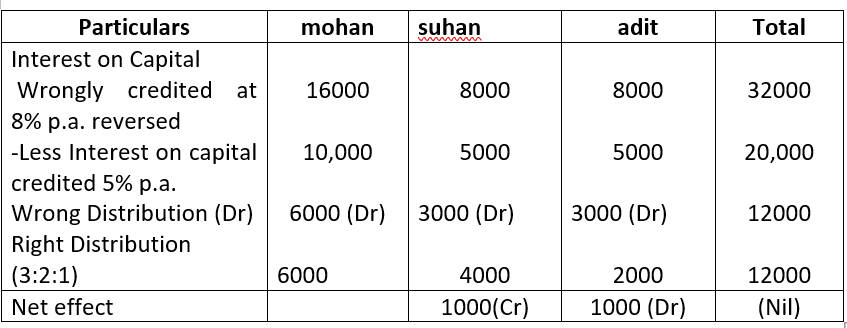

60. Mohan, Suhan and Adit were partners in firm sharing profits and losses in the ratio of 3:2:1. Their fixed capitals were: Rs.2,00,000, Rs.1,00,000 and Rs.1,00,000 respectively. For the year ended 31st March, 2023, interest on capital was credited to their accounts @ 8% p.a. instead of 5% p.a.

Pass necessary adjusting Journal entry. Show your working clearly.

Solution-

Working Note 1:

Calculation of Interest on Capital 8% p.a

Interest on mohan Capital – 200,000 x 8% = 16000

Interest on suhaan Capital – 100,000 x 8% = 8000

Interest on adit Capital – 100,000 x 8% = 8000

Working Note 2:

Calculation of Interest on Capital 5% p.a

mohan – 200,000 x 5% = 10,000

suhaan – 100,000 x 5% = 5000

adit – 100,000 x 5% = 5000

61. Ram, Shyam and Mohan were partners in a firm sharing profit and losses in the ratio of 2:1:2. Their capitals were fixed at 3, 00,000, 1, 00,000 2, 00,000. For the year ended 31st March, 2022, interest on capital was credited to them @ 9% instead of 10% p.a. the profit for the year before charging interest was 2, 50,000. Show your working notes and pass necessary adjustment entry.

Solution –

Working Note 1:

Calculation of Interest on Capital 10% p.a.

Ram – 3, 00,000 x 10% = 30,000

Shyam – 1, 00,000 x 10% = 10,000

Mohan – 2, 00,000 x 10% = 20,000

Working Note 2:

Calculation of Interest on Capital 9% p.a

Ram – 3, 00,000 x 9% = 27,000

Shyam – 1, 00,000 x 9% = 9,000

Mohan – 2, 00,000 x 9% = 18,000

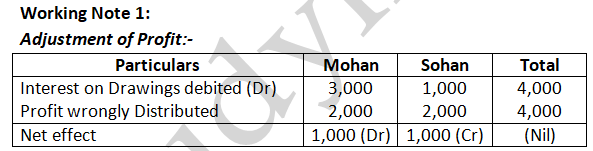

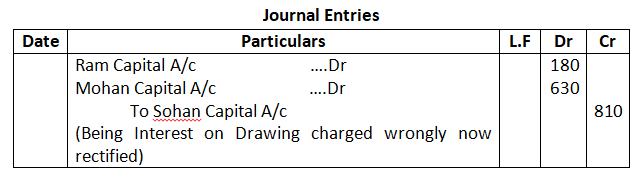

62. Ram, Mohan and Sohan were partners sharing profits in the ratio of 2:1:1. Ram withdrew 3,000 every month and Mohan withdrew 4,000 every month. Interest on drawings @ 6% p.a. was charged, whereas the partnership deed was silent about interest on drawings. Showing your working clearly, pass the necessary adjustment entry to rectify the error.

Solution –

Working Note 1:

Interest on Drawings Wrongly Debited

Ram – (3,000 x 12) = 36,000 x 6/100 x 6/12 = 1,080

Sohan – (4,000 x 12) = 48,000 x 6/100 x 6/12 = 1,440

Working Note 2:

(1,080 + 1,440) = 2,520

Ram – 2,520 X 2/4 = 1,260

Mohan – 2,520 X ¼ = 630

Sohan = 2,520 x ¼ = 630

Working Note 3:

63. Simrat and Bir are partners in a firm sharing profits and losses in the ratio of 3:2. On 31st March, 2025 after closing the books of account, their Capital Accounts stood at 4, 80,000 and 6, 00,000 respectively. On 1st May, 2024, Simrat introduced an additional capital of 1, 20,000 and Bir withdrew 60,000 forms his capital. On 1st October, 2024, Simrat withdrew 2, 40,000 from her capital and Bir introduced 3, 00,000. Interest on capital is allowed at 6% p.a. Subsequently, it was noticed that interest on capital @ 6% p.a. had been omitted. Profit for the year ended 31st March, 2025 amounted to 2, 40,000 and the partner’s drawings had been: Simrat – 1, 20,000 and Bir – 60,000. Compute the interest on capital if the capitals are (a) Fixed and (b) Fluctuating.

Solution – Calculation of Interest on capital (Fluctuation Capital)

Simrat’s Opening Capital = Closing Capital–Additional Capital + Drawings out of Capital + Drawings out of profit

= 4, 80,000 – 1, 20,000 + 2, 40,000 + 1, 20,000

= 7, 20,000 – 1, 44,000

= 5, 76,000

Interest on Capital of Simrat’s

1st April – 30th April = 5, 76,000 x 6/100 x 1/12 = 2,880

1st May – 30th Sept = 6, 96,000 x 6/100 x 5/12 = 17,400

1st Oct – 31st March = 4, 56,000 x 6/100 x 6/12 = 13,680

Interest on Simrat’s Capital 33,960

Calculation of Bir’s Interest on Capital:

Opening Capital of Bir = Closing Capital – Additional Capital + Drawing out of Capital + Drawing out of drawing – profit

= 6, 00,000 – 3, 00,000 + 60,000 + 60,000 – 96,000

= 3, 24,000

Interest on Capital of Bir’s

1st April – 30th April = 3, 24,000 x 6/100 x 1/12 = 1,620

1st May – 30th April = 2, 64,000 x 6/100 x 5/12 = 6,600

1st Oct – 31st March = 5, 64,000 x 6/100 x 6/12 = 16,920

Interest on Bir’s Capital 25,140

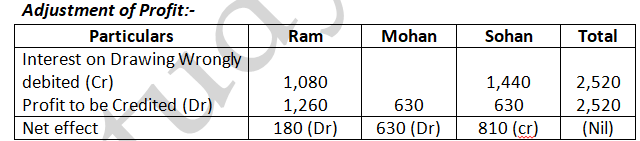

64. Mita and Usha are partners in a firm sharing profits in the ratio of 2:3. Their Capital Account as on 1st April, 2015 showed balances of 1, 40,000 and 1, 20,000 respectively. The drawings of Mita and Usha during the year 2015-16 were 32,000 and 24,000 respectively. Both the amounts were withdrawn on 1st January, 2016. It was subsequently found that the following items had been omitted while preparing the final accounts for the year ended 31st March, 2016:

- Interest on Capital @ 6% p.a.

- Interest on Drawings @ 6% p.a.

- Mita was entitled to a commission of 8,000 for the whole year.

Showing your working clearly, pass a rectifying entry in the books of the firm.

Solution –

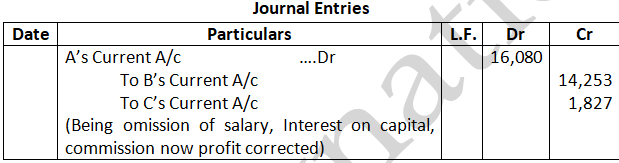

65. A, B and C were partners. Their fixed capitals were 60,000 40,000 and 20,000 respectively. Their profit sharing ratio was 2:2:1. According to the Partnership Deed, they were entitled to interest on capital @ 5% p.a. In addition, B was also entitled to draw a salary of 1,500 per month. C was entitled to a commission of 5% on the profits after charging the interest on capital, but before charging the salary payable to B .The net profits for the year, 80,000 were distributed in the ratio of their capitals without providing for any of the above adjustments. Showing your workings clearly, pass the necessary adjustment entry.

Solution –

Working Note:

Profit Wrongly Distributed in Capital Ratio

A – 80,000 x 3/6 = 40,000

B – 80,000 x 2/6 = 26,667

C – 80,000 x 1/6 = 13,333

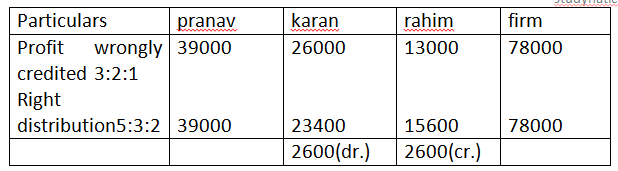

66. Pranav, Karan and Rahim were partners sharing profits in the ratio of3: 2: 1. Their capitals were 5,00,00,3,00,000, and 2,00,000 respectively as on 1st April, 2022. According to the partnership deed, they were entitled to an interest on capital at 10% p.a. For a the year ended 31st March 2022, apr of it of 78,000 was distributed among the partners without providing for interest on capital.

Solution-

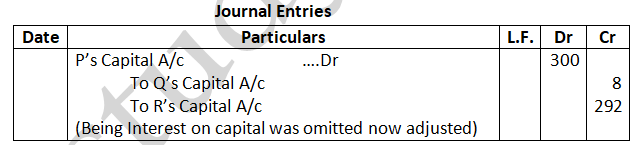

67. On 31st March, 2025, after the closing of the accounts, capital Accounts of P, Q and R stood in the books of the firm at 40,000: 30,000 and 20,000 respectively. Subsequently, it was noticed that interest on capital @ 5% had been omitted. Profit for the year ended 31st March, 2023 was 60,000 and the partners drawings had been p 10,000 q 7,500 and R 4,500. Profit sharing ratio of P, Q and R is 3:2:1. Pass necessary adjustment entry.

Solution –

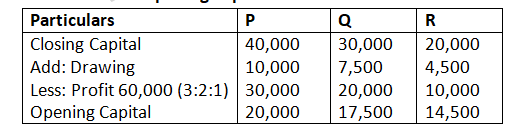

Working Note 1:

Calculation of Opening Capital:

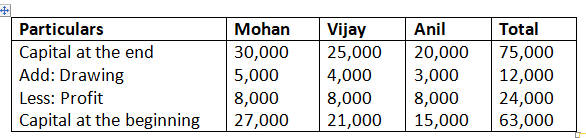

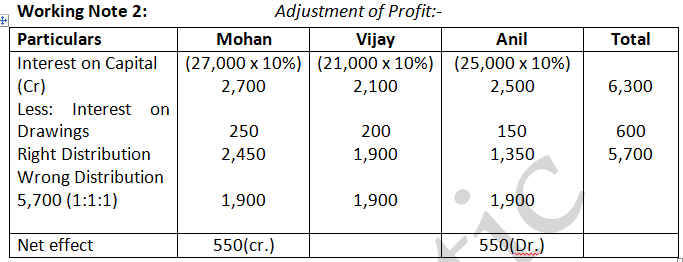

68. Mohan, Vijay and Anil are partners, the balances of their Capital Accounts being 30,000 25,000 and 20,000 respectively .In arriving at these amounts profit for the year ended 31st March, 2025, 24,000 had been credited to partners in their profit sharing ratio. Their drawings were 5,000 (Mohan), 4,000 (Vijay) and 3,000 (Anil) during the year. Subsequently, following omissions were noticed and it was decided to rectify the errors:

- Interest on capital @ 10% p.a.

- Interest on drawings: Mohan 250 Vijay 200 Anil 150

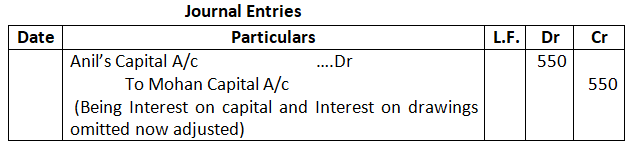

Make necessary Corrections through a Journal entry show your workings clearly.

Solution –

Working Note 1:

Calculation of Opening Capital:

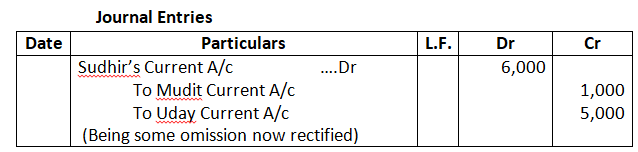

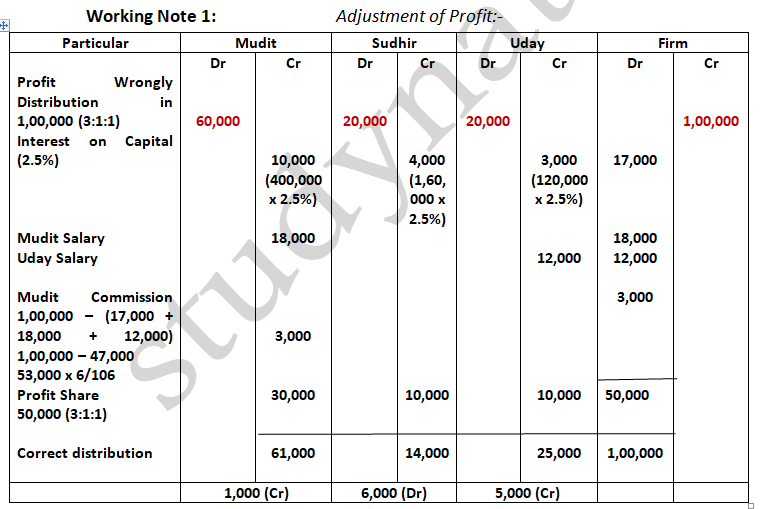

69. Mudit, Sudir and Uday are partners in a firm sharing profits in the ratio of 3:1:1. Their fixed capital balances are 4, 00,000, 1, 60,000 and 1, 20,000 respectively. Net profit for the year ended 31st March, 2018 distributed amongst the partners was 1, 00,000, without taking into account the following adjustments:

- Interest on capital @ 2.5% p.a.

- Salary to Mudit 18,000 p.a. and commission to Uday 12,000

- Mudit was allowed a commission of 6% of divisible profit after charging such commission.

Pass a rectifying Journal entry in the books of the firm. Show workings clearly

Solution –

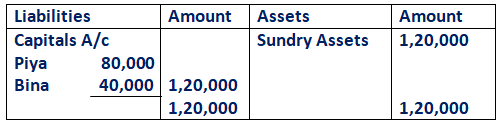

70. Piya and Bina are partners in a firm sharing profits and losses in the ratio of 3:2 Following was the balance Sheet of the firm as on 31st March, 2016:

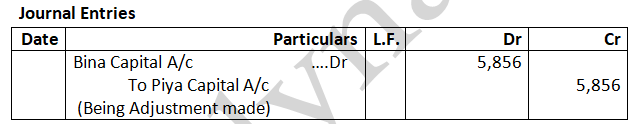

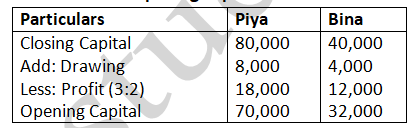

The profits 30,000 for the year ended 31st March, 2016 were divided between the partners without allowing interest on capital @ 12% p.a. and salary to Piya @ 1,000 per month. During the year, piya withdrew 8,000 and Bina withdrew 4,000. Showing your working notes clearly, pass the necessary rectifying entry.

Solution –

Working Note 1:

Calculation of Opening Capital:

Working Note 2:

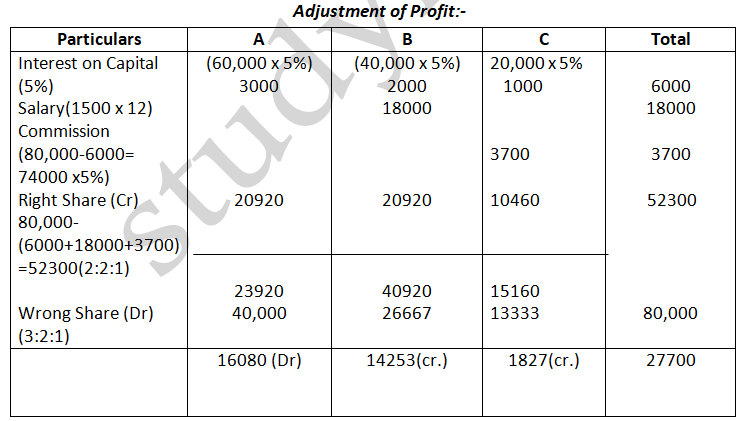

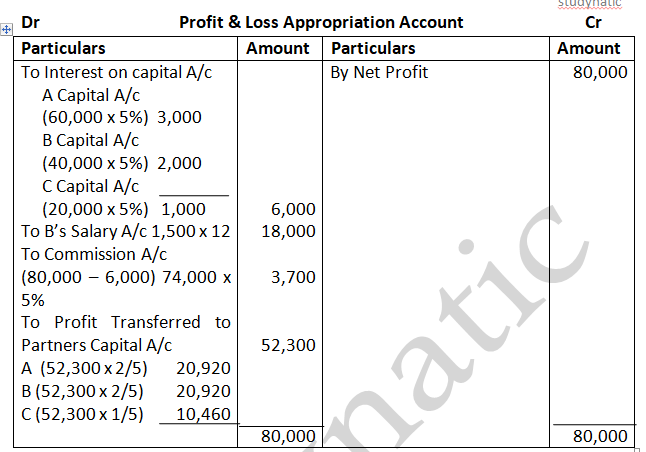

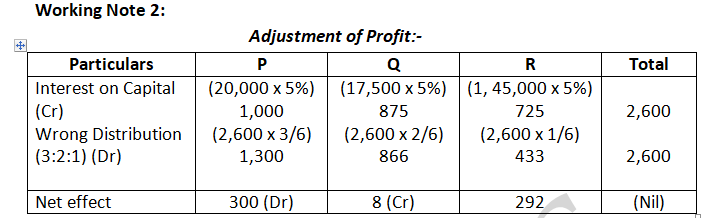

Adjustment of Profit:-

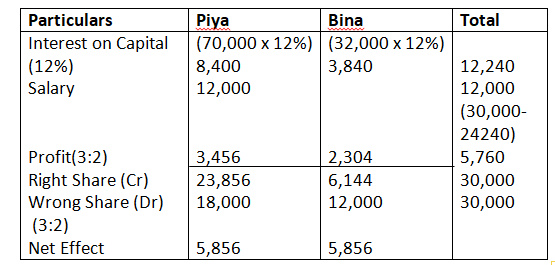

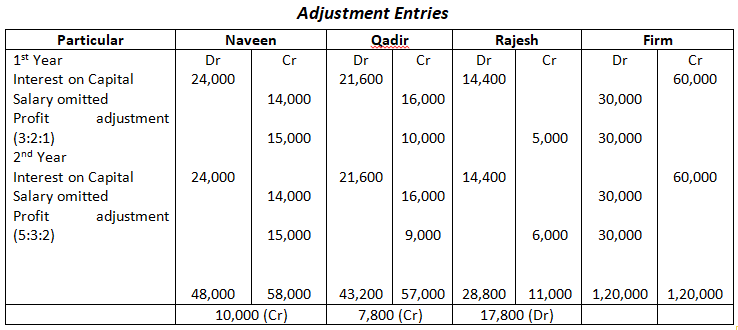

70. Naveen, Quadir and Rajesh were partners doing an electronic goods business in Uttarakhand. After the accounts of Partnership were drawn up and closed, it was discovered that interest on capital has been allowed to partners @ 6% p.a. for the years ending 31st March, 2017 and 2018, although there is no provision for interest on capital in the Partnership Deed. On the other hand, Naveen and Qadir were entitled to a salary of 3,500 and 4,000 per quarter respectively, which has not been taken into consideration. Their fixed capitals were 4, 00,000, 3, 60,000 and 2, 40,000 respectively. During the last two years they had shared the profits and losses as follows:

Year Ended Ratio

31st March, 2017 3:2:1

31st, March, 2018 5:3:2

Pass necessary adjusting entry for the above adjustments in the books of the firm on 1st April, 2018 Show your Workings Clearly(Old Question)

Solution –

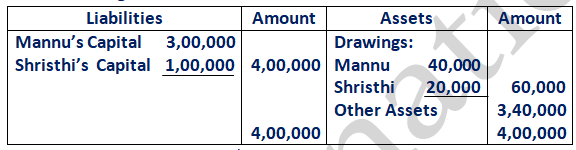

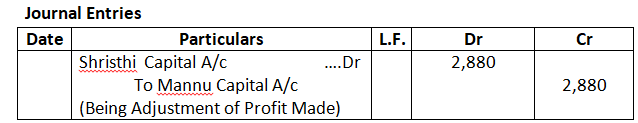

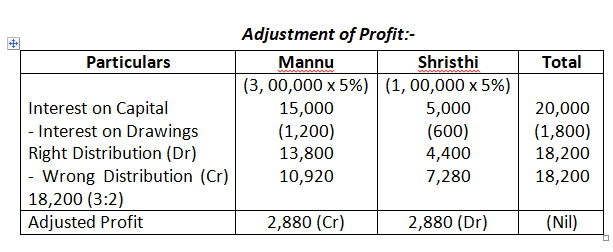

71. Mannu and Shristhi are partners in a firm sharing profits in the ratio of 3:2. Following information is of the firm as on 31st March, 2024:

Profit for the year ended 31st March, 2024 was 50,000 which were divided in the agreed ratio, but interest @ 5% p.a. On capital and 6% p.a. on drawings was inadvertently omitted. Adjust interest on drawings on an average basis for 6 months. Give the adjustment entry.

Solution –

Interest on Drawings:-

Mannu – 40,000 x 6/100 x 6/12 = 1,200

Shristhi – 20,000 x 6/100 x 6/12 = 600

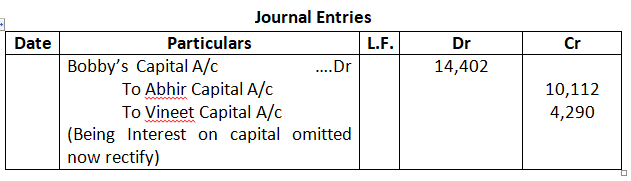

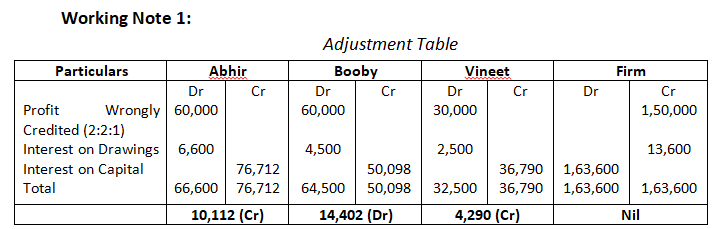

72. On 31st March, 2018, the balances in the capital Accounts of Abhir, Bobby and Vineet, after making adjustments for profits and drawings were 8,00,000 6,00,000 and 4,00,000 respectively.

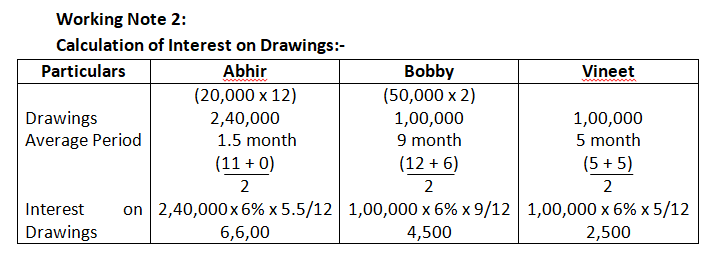

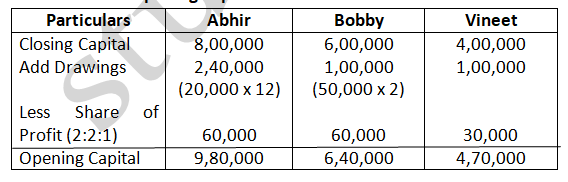

Subsequently, it was discovered that interest on capital and interest on drawings had been omitted. The partners were entitled to interest on capital @ 10% p.a. and were to be charged interest on drawings @ 6% p.a. The drawings during the year were: Abhir – 20,000 drawn at the end of each month, Bobby – 50,000 drawn at the beginning of every half year and Vineet – 1, 00,000 withdrawn on 31st October, 2017. The net profit for the year ended 31st March, 2018 was 1, 50,000. The profit sharing ratio was 2:2:1.

Pass necessary adjusting entry for the above adjustments in the books of the firm. Also, show your working clearly.

Solution –

Average Period Method:-

Month Left After First Drawing + Month Left after last drawings / 2

Interest on Drawings = Total Drawing x Rate of Interest / 100 X Average Period / 12

Working Note 3:-

Calculation of Opening Capital:

Interest on Capital (10%) – 98,000 64,000 47,000

Total Interest on Capital = 98,000 + 64,000 + 47,000 = 2, 09,000

Available Profit = 1, 63,600

Interest on capital will be allow as

Abhir – 1, 63,600 x 98/209 = 76,711

Bobby – 1, 63,600 x 64/ 209 = 50,097

Vineet – 1, 63,600 x 47/209 = 36,790

73. On 31st March, 2023, the capital of Raghav and Diya stood at Rs.4,00,000 and Rs.3,00,000 respectively, after the necessary adjustment in respect of drawings and net profit. Subsequently, it was discovered that interest on capital @ 10% p.a. had been omitted. The Net Profit the year ended 31st March, 2023 amounted to Rs.1,00,000.

During the year ended 31st March, 2023, Raghave’s drawings were Rs.2,000 drawn at the beginning of each month, while Diya’s drawings were Rs.3,000 drawn at the beginning of each quarter. Pass the necessary adjustment entry.

Solution-

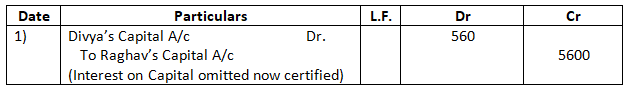

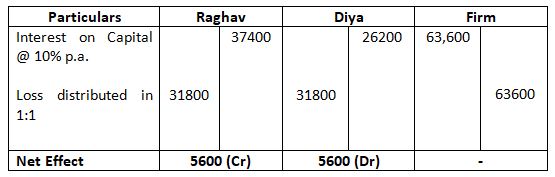

Journal

Past Adjustment Table

Calculation of Interest on Raghav’s Capital

Opening Capital of Raghav’s = Closing capital + Drawing – Share in profit

= 4,00,000 + 2,000 x 12 – 1,00,000 x 1/2

= 4,00,000 + 24,000 – 50,000

= 374000

Interest on Raghav’s Capital = 374000 x 10%

= 37400

Calculation of Interest on Diya’s Capital

Opening Capital of Diya’s = Closing capital + Drawing – Share in profit

= 3,00,000 + 3,000 x 14 – 1,00,000 x 1/2

= 3,00,000 + 12,000 – 50,000

= 262000

Interest on Raghav’s Capital = 262000 x 10%

= 26200

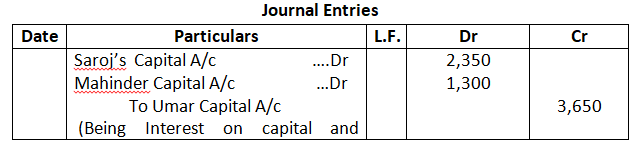

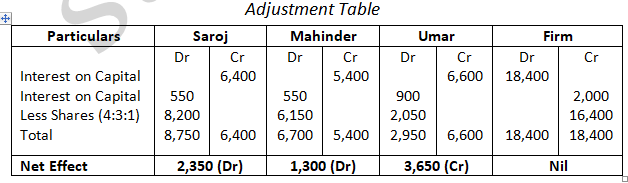

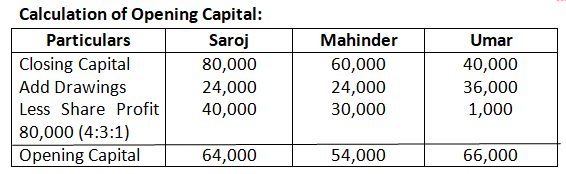

74. On 31st March, 2014, the balances in the Capital Accounts of Saroj, Mahinder and Umar after making adjustments for profits and drawings, etc., were 80,000 60,000 and 40,000 respectively. Subsequently, it was discovered that the interest on capital and drawings has been omitted.

- The profit for the year ended 31st March, 2014 was 80,000

- During the year Saroj and Mahinder each withdrew a sum of 24,000 in equal instalments in the end of each month and Umar withdrew 36,000.

- The interest on drawings was to be charged @ 5% p.a. and interest on capital was to be allowed @ 10% p.a.

- The profit sharing ratio among partners was 4:3:1

Showing your workings clearly. Pass the necessary rectifying entry.

Solution –

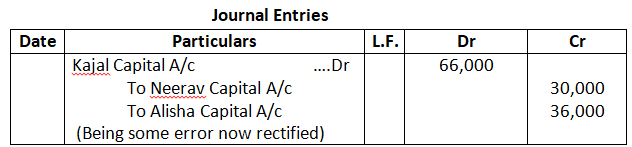

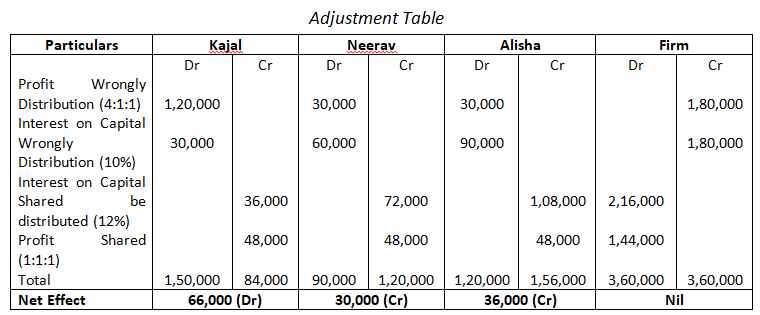

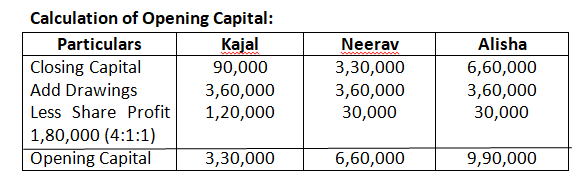

75. Capitals of Kajal, Neerav and Alisha as on 31st March, 2025 amounted to 90,000 3, 30,000 and 6, 60,000 respectively. Profit of 1, 80,000 for the year ended 31st March, 2025 were distributed in the ratio of 4:1:1 after allowing interest on capital @ 10% p.a. During the year, each partner withdrew 3, 60,000. The Partnership Deed was silent as to profit-sharing ratio but provided for interest on capital @ 12%

Pass the necessary adjustment entry showing the working clearly.

Solution –

Interest on Capital

Kajal – 3, 30,000 x 10/110 = 30,000

Neerav – 6, 60,000 x 10/110 = 60,000

Alisha – 9, 90,000 x 10/110 = 90,000

Opening Capital

Kajal – 3, 30,000 – 30,000 = 3, 00,000

Neerav – 6, 60,000 – 60,000 = 6, 00,000

Alisha – 9, 90,000 – 90,000 = 9, 00,000

Interest on Capital:

Kajal – 3, 00,000 x 12% = 36,000

Neerav – 6, 00,000 x 12% = 72,000

Alisha – 9, 00,000 x 12% = 1, 08,000

Guarantee of Minimum Profit to a Partner:-

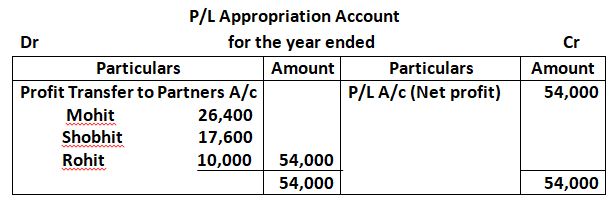

75. Mohit and Sobhit are partners sharing profits in the ratio of 3:2 Rohit was admitted for 1/6th share of profit with a minimum guaranteed amount of 10,000. At the close of the first financial year, the firm earned a profit of 54,000. Find out the share of profit which Mohit, Shobhit and Rohit will get. (Old Question)

Solution – New profit Sharing Ratio (After Rohit Admission)

Profit Sharing Ratio = 3:2:1

Total Profit = 54,000

Mohit = 54,000 x 3/6 = 27,000

Shobhit – 54,000 x 2/6 = 18,000

Rohit – 54,000 x 1/6 = 9,000

Rohit was admitted for 1/6th share of profit with a minimum guaranteed amount of 10,000. But amount is 9,000. So both the partners share their profit 1,000 for Rohit. So ratio is 3:2

Mohit – 1,000 x 3/5 = 600

Shobhit – 1,000 x 2/5 = 400

Mohit – 27,000 – 600 = 26,400

Shobhit – 18,000 – 400 = 17,600

Rohit – 9,000 + 1000 = 10,000

76. A, B and C were in partnership sharing profits and losses in the ratio of 4:2:1. It was provided that C’s share in profit for a year would not be less than 75,000. Profit for the year ended 31st March, 2024 amounted to 3, 15,000. You are required to show the appropriation among the partners. The profit & loss appropriation Account is not required.

Solution – A: B: C = 4:2:1

Total Profit = 3, 15,000

A – 3, 15,000 x 4/7 = 1, 80,000

B – 3, 15,000 x 2/7 = 90,000

C – 3, 15,000 x 1/7 = 45,000

C’s share in profit for a year would not be less than 75,000. But they have only 45,000.

75,000 – 45,000 = 30,000

Then, 30,000 have been distributed in 4:2 ratios.

30,000 x 4/6 = 20,000

30,000 x 2/6 = 10,000

A – 1, 80,000 – 20,000 = 1, 60,000

B – 90,000 – 10,000 = 80,000

C – 45,000 + 30,000 = 75,000

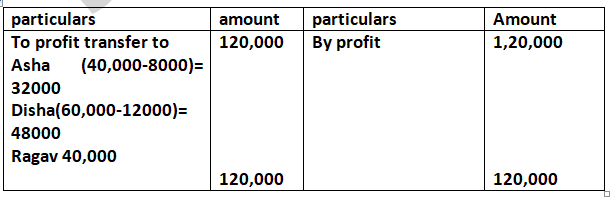

77. Asha, Disha and Raghav were partners in a firm sharing profits in the ratio of 2 : 3 : 1. According to the partnership agreement, Raghav was guaranteed an amount of 40,000 as his share of profit .the net profit for the year ended 31st March, 2022 amounted to ₹ 1,20,000. profits. Prepare Profit & Loss Appropriation Account of the firm for the year ended 31st March, 2022.

Net profit =120,000

Asha share of profit=120,000 x 2/6=40,000

disha share of profit=120,000 x 3/6=60,000

ragav share of profit=120,000 x 1/6=20,000

however guarantee of profit=40,000

deficiency brone by asha 20,000 x 2/5=8000

deficiency brone by disha 20,000 x 3/5=12000

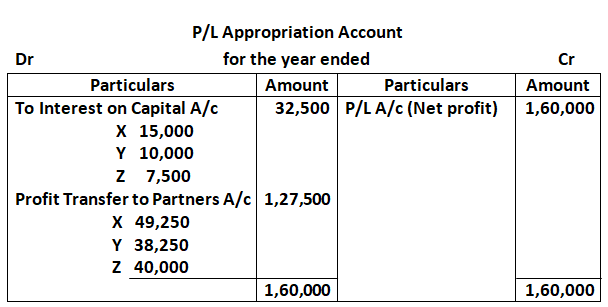

78. X, Y and Z entered into partnership on 1st October, 2024 to share profits in the ratio of 4:3:3. X, personally guaranteed that Z’s share of profit after charging interest on capital @ 10% p.a. would not be less than 80,000 in a year. Capital contributions were: X-3, 00,000, Y – 2, 00,000 and Z – 1, 50,000.

Profit for the year ended 31st March, 2025 was 1, 60,000. Prepare Profit & Loss Appropriation Account.

Solution –

Working Note 1:

X – 3, 00,000 x 10% x 6/12 = 15,000

Y – 2, 00,000 x 10% x 6/12 = 10,000

Z – 1, 50,000 X 10% X 6/12 = 7,500

Working Note 2:

Profit Distribution

X – 1, 27,500 x 4/10 = 51,000

Y – 1, 27,500 x 3/10 = 38,250

Z – 1, 27,500 x 3/10 = 38,250

Z’s share of profit after charging interest on capital @ 10% p.a. would not be less than 80,000 in a year. But they have 40,000

Z – 40,000 – 38,250 = 1,750

X – 51,000 – 1,750 = 49,250

Profit – 40,000

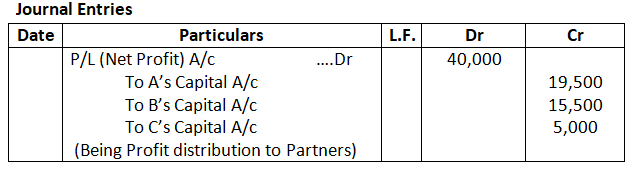

79. A, B and C are partners profits in the ratio of 5:4:1. C is given a guarantee that his minimum share of profit in any given year would be at least 5000. Deficiency, if any, would be borne by A and B equally. Profit for the year ended 31st March, 2025 was 400,000.

Pass necessary Journal entries in the books of the firm.

Solution –

Working Note:

A – 40,000 x 5/10 = 20,000 – 500 = 19,500

B – 40,000 x 4/10 = 16,000 – 500 = 15,500

C – 40,000 x 1/10 = 4,000 + 1,000 = 5,000

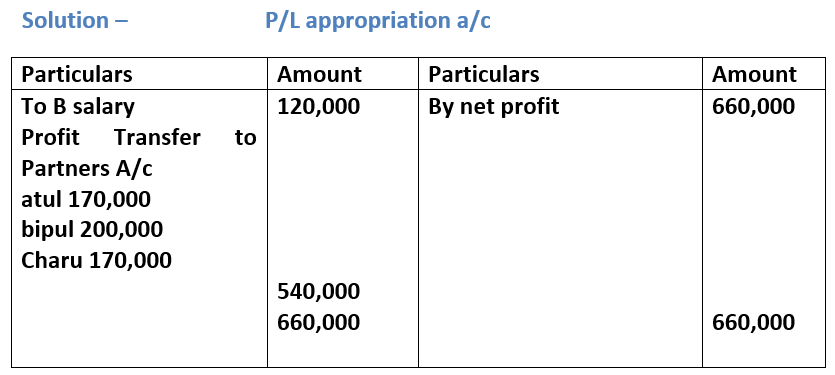

80. Atul, Bipul and Charu sharing profits equally. Bipul is Guaranteed minimum profit of 2, 00,000 per annum. Salary is payable to Bipul of 10,000 per month. Net Profit for the year ended 31st March, 2024 is 6, 60,000.

Prepare Profit & Loss Appropriation Account for the year.

Solution –

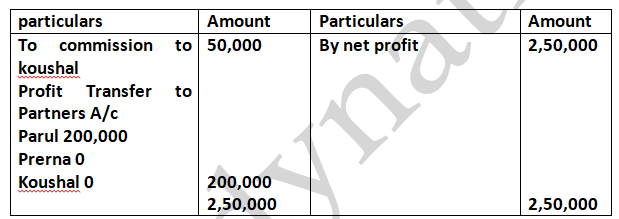

81. Parul, Prerna and Kaushal are partners sharing profits equally. Parul is guaranteed minimum annual profit of 2, 00,000. Kaushal is to get commission @ 5% of Net Sales and the Commission is determined at 50,000. Net Profit for the year ended 31st March, 2024 is 2, 50,000.

Prepare Profit & Loss Appropriation Account for the year.

Solution –

Profit 2,50,000

Commission 50,000

Parul share =200,000 x 1/3=66,666

Prerna share = 200,000 x 1/3=66,667

Kaushal share= 200,000 x 1/3=66,667

Deficiency in parul share= 200,000-66,666=1,33,334

Prerna and parul borne deficiency equally=1,33,334/2=66,667

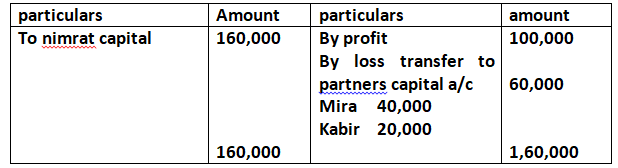

82. Nimrat, Maira and Kabir are partners sharing profits in the ratio of 2:2:1. Nimrat is guaranteed minimum profit of 1, 60,000 per annum. The net for the year ended 31st March, 2024 of 100,000.

Prepare Profit & Loss Appropriation Account for the year.

solution–

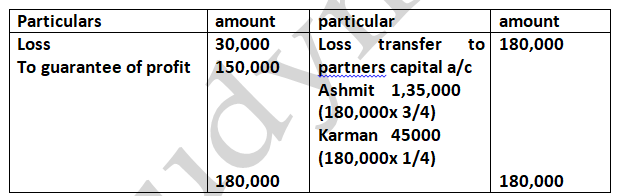

83. Ashmit, Abbas and Karman are partners sharing profits in the ratio of 3:2:1. Abbas is guaranteed minimum profit of 1, 50,000 per annum. The firm incurred loss for the year ended 31st March, 2024 of 30,000.

Prepare Profit & Loss Appropriation Account for the year.

Solution –

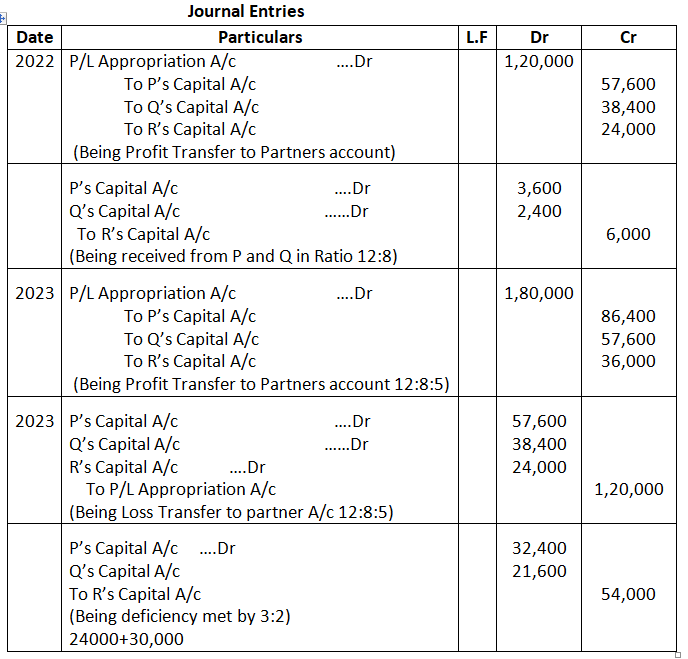

83. P, Q and R entered into partnership on 1st April, 2018 to share profit and losses in the ratio of 12:8:5. It was provided that in no case R’s share in profit would be less than 30,000 p.a. the profits and losses for the year ended 31st March, were 2022 profit 1,20,000 2023 profit 1,80,000 2024 loss 1,20,000.

Pass the necessary Journal entries in the books of the firm. (Old book)

Solution –

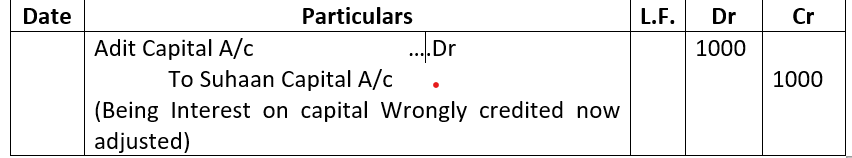

84. Anand, Ridhi, and Shaym were partners in a firm sharing profit and losses in the ratio of 2:2:1. Their fixed capital were Rs.1,00,000, 60,000, and 40,000 respectively. For the year ended 31st March, 2023, interest on capital was credited to their capital accounts @ 9% p.a. instead of 7% p.a. pass the necessary adjusting Journal entry.

Solution-

85. P and Q were partners in a firm sharing profits in the ratio of 5:3 on 1st April 2024 they admitted to R as a new partner for 1/8th share in the profits with a guaranteed profit of₹ 75,000. The new profit-sharing between P and Q will remain the same but they agreed to bear any deficiency on account of guarantee to R in the ratio of 3 : 2. The profit of the firm for the year ended 31st March, 2025 was ₹4,00,000.

Prepare Profit & Loss Appropriation Account of P, Q and R for the year ended 31st March, 2025.

Solution-

Profit of the firm =400,000

R share 1/8

So 400,000 x 1/8=50,000

Profit for the year=400,000-50,000=350,000

P share of profit =3,50,000x 5/8 =2,18,750

Q share of profit =3,50,000 x3/8=1,31,250

R share of profit= 75000

Deficiency of R profit =75000-50,000

=25000

P contribution to R deficiency

25000 x3/5 =15000

Q contribution to R deficiency

=25000 X 2/5=10,000

Share of profit

P’s capital a/c 2,18,750-15000= 203750

Q’s capital a/c 1,31,250-10,000=121250

R’s capital a/c 75000

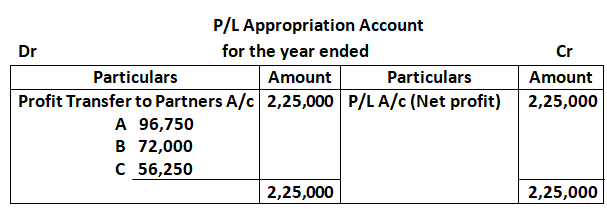

86. A and B are in partnership sharing profits and losses in the ratio of 3:2 they admit C, their Manager, as a partner with effect form 1st April, 2024, for 1/4th share of profits.

C, while a Manager, was in receipt of a salary of 27,000 p.a. and a commission of 10% of net profit after charging such salary and commission.

In term of the Partnership Deed, any excess amount, which C will be entitled to receive as a partner over the amount which would have been due to him if he continued to be Manager, will be borne by A. Profit for the year ended 31st March, 2025 amounted to 2,25,000.

Prepare Profit & Loss Appropriation Account for the year ended 31st March, 2025.

Solution –

Working Note 1:

Calculation of amount C will get

C’s Salary = 27,000

Commission

(2, 25,000 – 27,000) x 10/110 = 18,000

27000+18000=45,000

Working Note 2:

Profit Sharing Ratio of C

= 2, 25,000 x ¼ = 56,250

Working Note 3:

Deficiency met by A

C’s share in Profit as Partner = 56,250

- As a manager C will get 45,000

- 11,250

Working Note 4:

Profit Share

2, 25,000 – 45,000 = 1, 80,000 (in 3:2)

A – 1, 80,000 x 3/5 = 1, 08,000 – 11,250 = 96,750

B – 1, 80,000 x 2/5 = 72,000

C – 45,000 + 11,250 = 56,250

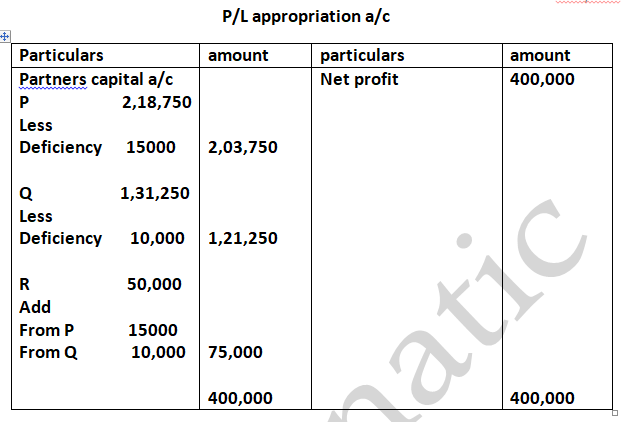

86. Asgar, Chaman and Dholu are partners in a firm. Their Capital Accounts stood at 6, 00,000; 5, 00,000 and 4, 00,000 respectively on 1st April, 2023. They shared Profits and Losses in the proportion of 4:2:3. Partners are entitled to interest on capital @ 8% per annum and salary to Chaman and Dholu @ 7,000 per month and 10,000 per quarter respectively as per the provision of the Partnership Deed.

Dholu’s share of profit (excluding interest on capital but including salary) is guaranteed at a minimum of 1, 10,000 p.a. Any deficiency arising on that account shall be met by Asgar. The profit for the year ended 31st March, 2024 amounted to 4, 24,000

Prepare Profit & Loss Appropriation Account for the year ended 31st March, 2024.(Old Question)

Solution –

Profit Distribution = 1, 80,000 (4:2:3)

Asgar – 80,000 – 10,000 = 70,000

Chaman – 40,000 = 40,000

Dholu – 60,000 + 10,000 = 70,000

In Dholu Account after profit sharing and salary add

60,000 + 40,000 = 1, 00,000

But guarantee of profit =110,000

Deficiency arise 110,000-100,000=10,000(which is brone by asgar)

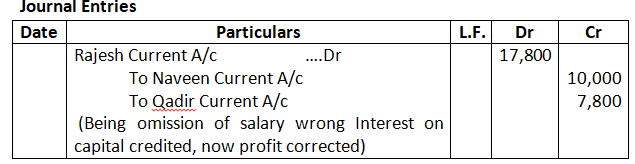

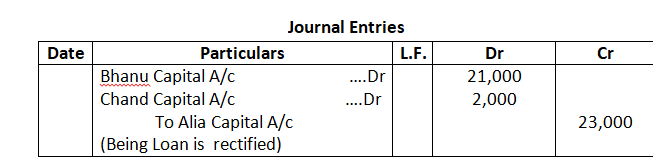

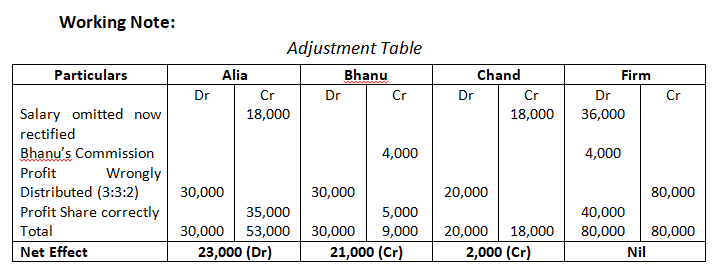

87. The partners of a firm, Alia, Bhanu and Chand distributed the profits for the year ended 31st March, 2017, 80,000 in the ratio of 3:3:2 without providing for the following adjustments:

- Alia and Chand were entitled to a salary of 1,500 each per month

- Bhanu was entitled for a commission of 4,000.

- Bhanu and Chand had guaranteed a minimum profit of 35,000. To Alia, any deficiency to be borne equally by Bhanu and Chand.

Pass the necessary Journal Entry for the above adjustments in the books of the firm. Show working clearly.

Solution –

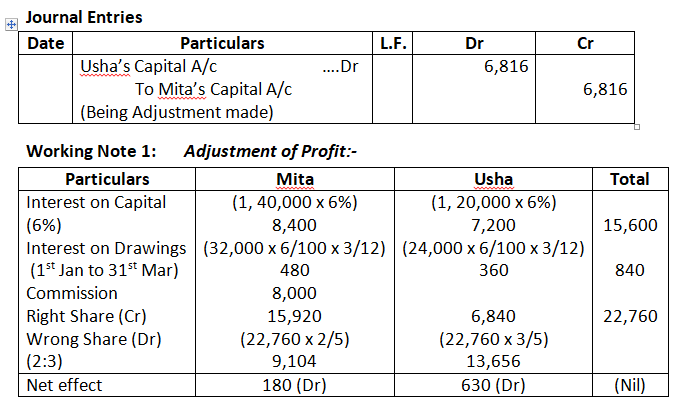

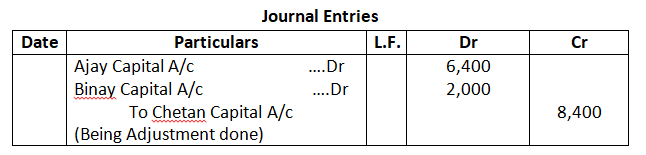

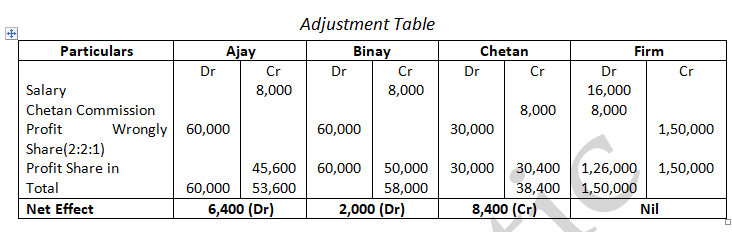

88. Ajay, Binay and Chetan were partners sharing profits in the ratio of 3:3:2. The Partnership Deed provided for the following:

- Salary of 2,000 per quarter to Ajay and Binay

- Chetan was entitled to a commission of 8,000

- Binay was guaranteed a profit of 50,000 p.a

The profit of the firm for the year ended 31st March, 2015 was 1, 50,000 which was distributed among Ajay, Binay and Chetan in the ratio of 2:2:1, Without taking into consideration the provision of partnership Deed .Pass necessary rectifying entry for the above adjustments in the books of the firm. Show your working clearly.

Solution –

Guarantee of profit to binay 50,000

Profit = 1, 26,000 in (3:3:2)

Ajay =47250

Binay=47250

Chetan=31500

But Guarantee of profit to binay 50,000

Deficiency arise = 50,000-47250=2750

Which borne by ajay and Chetan in 3:2 ratio

Ajay – 47,250 – 1,650 = 45,600

Binay – 47,250 + 2,750 = 50,000

Chetan – 31,500 – 1,100 = 30,400

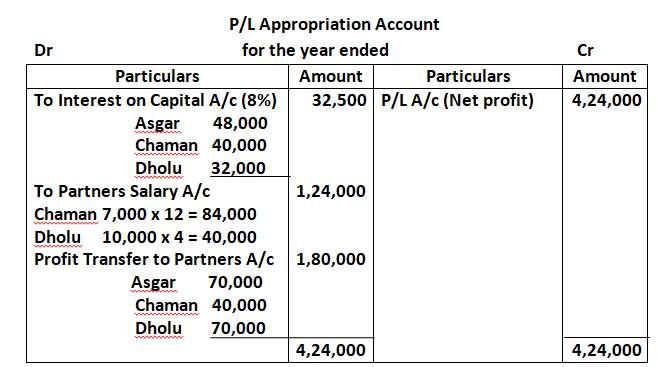

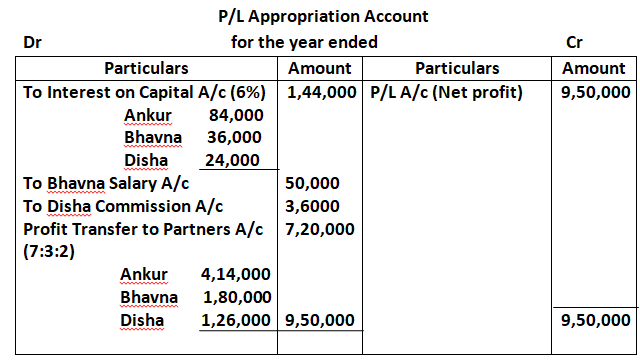

89. Ankur, Bhavna and Disha are partners in a firm. On 1st April, 2023, the balances in their Capital Accounts stood at 14, 00,000 6, 00,000 and 4, 00,000 respectively. They shared profits in the proportion of 7:3:2 respectively. Partners are entitled to interest on capital @ 6% per annum and salary to Bhavna @ 50,000 p.a. and a commission of 3,000 per month to Disha as per the provisions of the Partnership Deed.

Bhavna’s Share of profit (excluding interest on capital) is guaranteed at not less than 1,70,000 p.a. Disha’s share of profit (including interest on capital but excluding commission) is guaranteed at not less than 1,50,000 p.a. Any Deficiency arising on that account shall be met by Ankur. The profit of the firm for the year ended 31st March, 2025 amounted to 9, 50,000.

Prepare Profit & Loss Appropriation Account for the year ended 31st March, 2025

Solution –

Working Note:

Profit = 7, 20,000 (7:3:2)

Ankur – 4, 20,000 – 6,000 = 4, 14,000

Bhavna – 1, 80,000 (guarantee of profit 170,000 excluding interest on capital)

Disha – 1, 20,000 +6000=126,000(including interest on capital but excluding commission)

Disha share + Interest on capital

1, 20,000 + 24,000 = 1, 44,000

Deficiency Disha Profit – 1, 50,000 – 1, 44,000 = 6,000

Minimum Earning Guaranteed by a Partner:

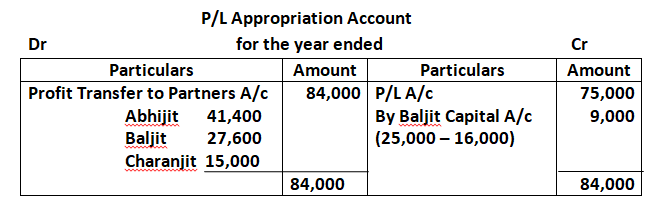

90. Three chartered Accountants Abhijit, Balajit and Charanjit form a partnership, profits being shared in the ratio of 3:2:1 subject to the following:

- Charanjit’s share of profit guaranteed to be not less than 15,000 p.a

- Baljit gives a guarantee to the effect that gross fee earned by him for the firm shall be equal to his average gross fee of the preceding five year when he was carrying on profession alone, which on an average works out at 25,000

The profit for the first year of the partnership is 75,000. The gross fee earned by Baljit for the firm is 16,000. You are required to show Profit & Loss Appropriation Account after giving effect to the above.

Solution –

Working Note:

Profit = 84,000 (3:2:1)

Abhijit – 42,000 – 600 = 41,400

Baljit – 28,000 – 400 = 27,600

Charanjit – 14,000 + 1,000 = 15,000

Baljit New share of profit

= 27,600 – 9,000 = 18,600

91. Xen, Sam and Tim are partners in a firm. For the year ended 31st March, 2025, the profit of the firm 120,000 was distributed equally among them, without giving effect to the following terms of the partnership Deed:

- Sam’s guarantee to the firm that the firm would earn a profit of at least 1,35,000. Any shortfall in these profits would be met by him.

- Profits to be shared in the ratio of 2:2:1.

You are required to pass the necessary Journal entries to rectify the error in accounting.

solution