Disclosure of Share Capital in company’s Balance Sheet

- Global Trade Ltd., has authorized share capital of Rs.1,00,000 divided into 1,00,000 Equity Shares of Rs.100 each. It has existing issued and paid-up capital of Rs.25,00,000. It further issued to public 25,000 Equity Shares at a premium of 20% for subscription payable as under:

On Application Rs.30

On Allotment Rs.60, and

On Call Balance Amount.

The issue was fully subscribed and allotment was made to all the applicants. The company did not make the call during the year.

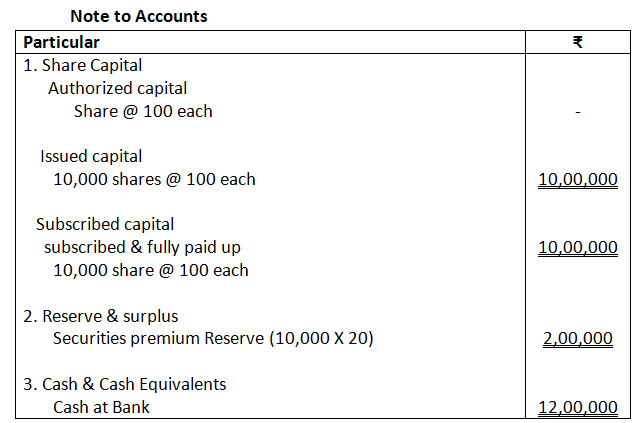

Solution:-

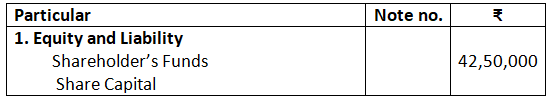

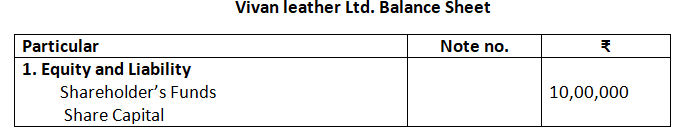

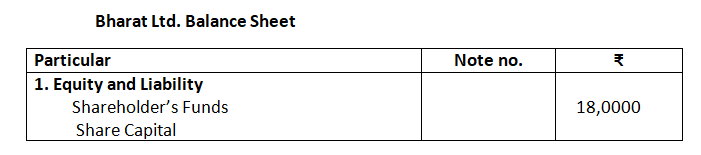

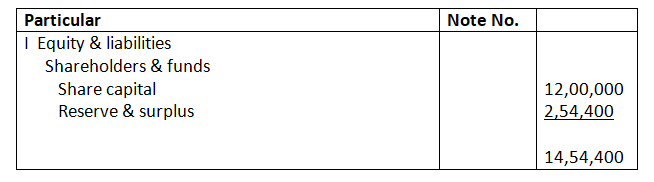

Global Trade Ltd. Balance Sheet

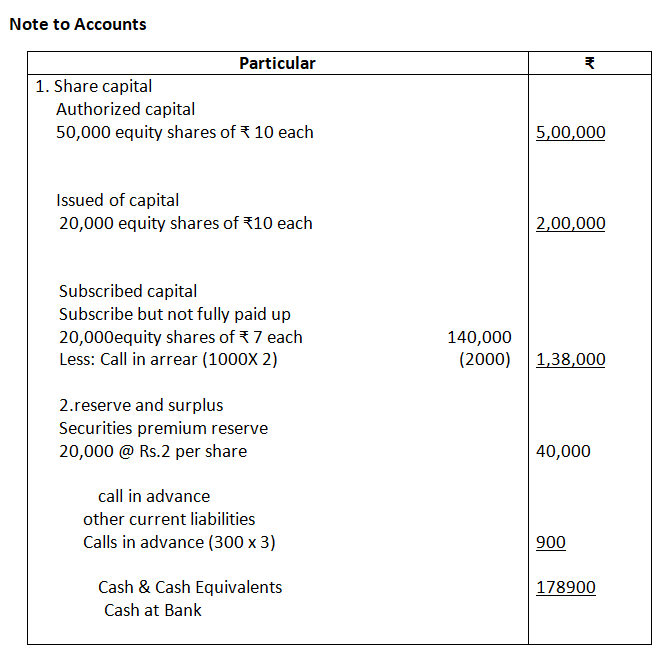

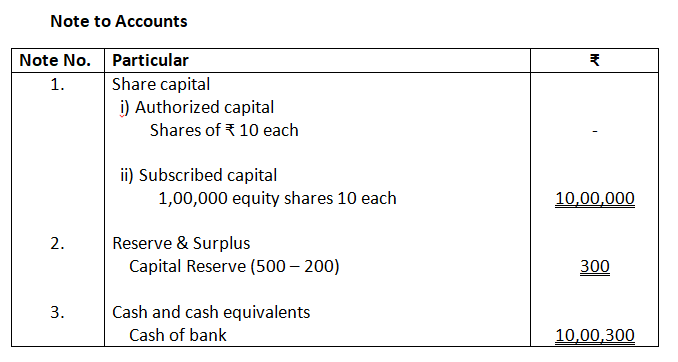

Note to Accounts

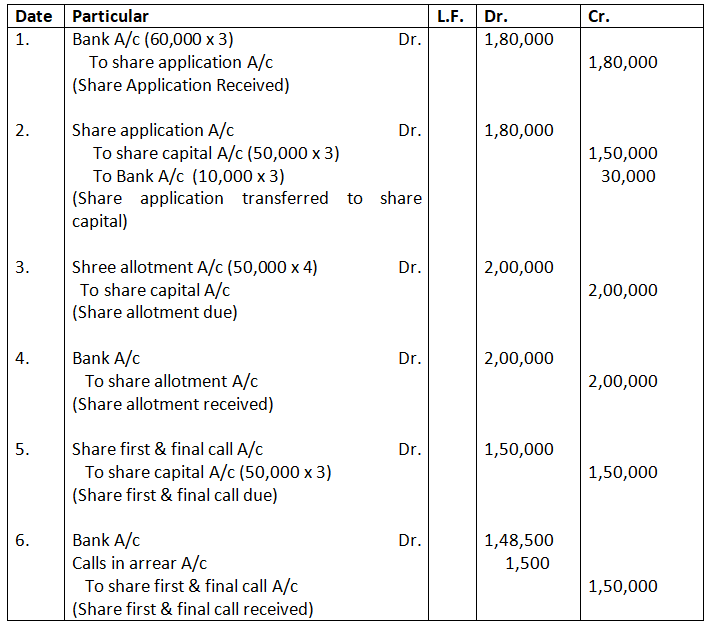

2. Shri Ganga Ltd., was registered with an authorized capital of Rs.7,00,000 divided into equity shares of Rs.10 each. It offered to the public for subscription 50,000 equity shares. The amount was payable as follows:

On application : Rs.4 per share

On allotment : Rs.4 per share

On first and final call : Balance

The issue was fully subscribed. All amount were duly received except the first and final call money on Rs.4,000 equity shares.

Show the Share Capital in the Balance Sheet of the company as per Schedule III, Part I of the Companies Act, 2013. Also prepare ‘Notes to Accounts’ for the same.

Solution:-

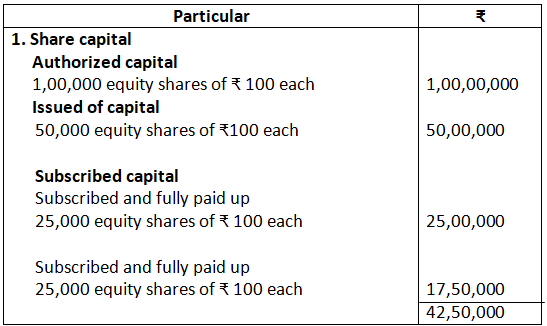

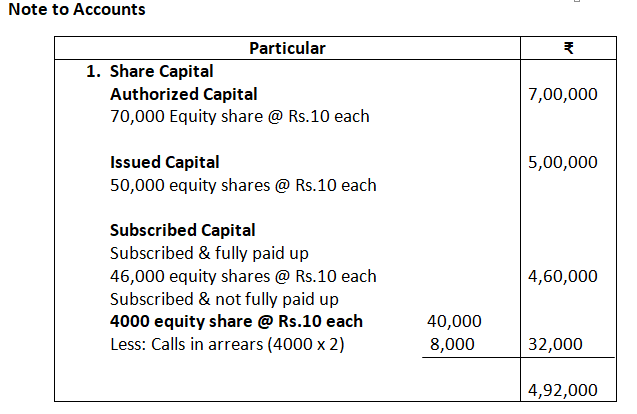

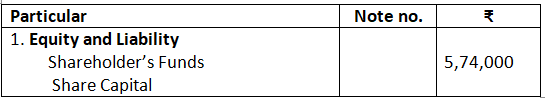

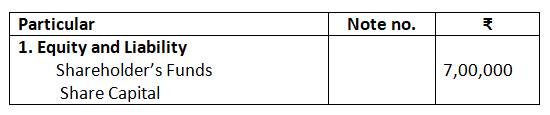

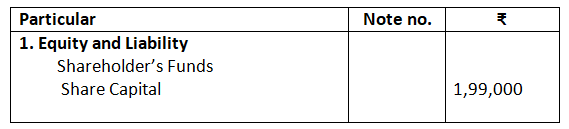

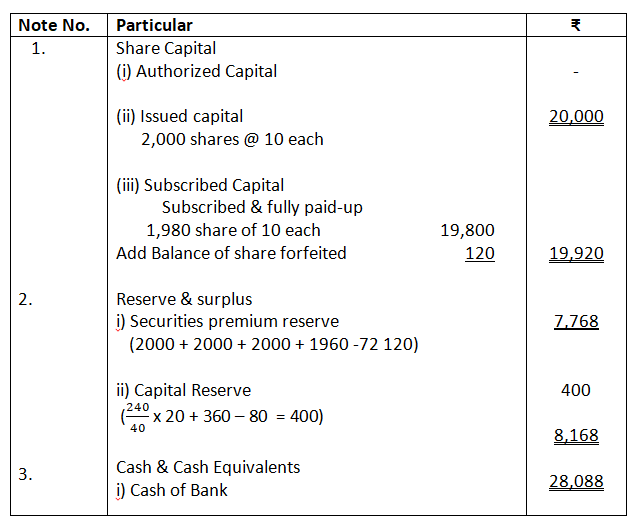

Shri Ganga Ltd. Balance Sheet (Extract) as at……..

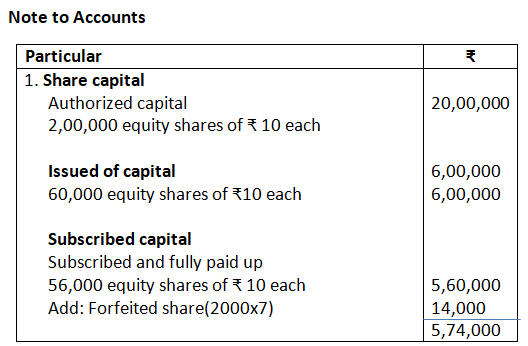

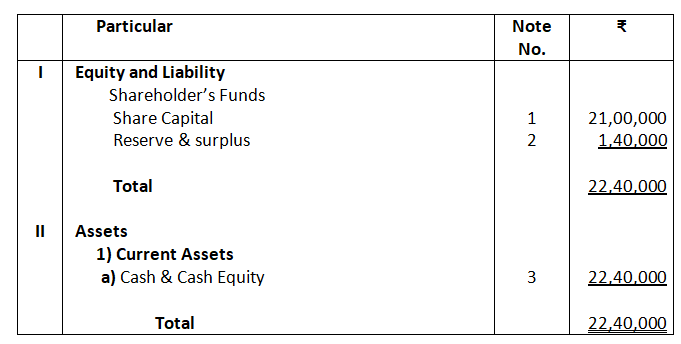

3. Sunstar ltd. has an authorized capital of 20,00,000 divided in to equity shares of 10 each. The company invited applications, for issuing of 60,000 shares. Application were received for 58,000 shares.

All calls were made and were duly received except the final call of 3 per share on 2,000 shares. These share were forfeited.

Present the ‘Share Capital’ in the balance sheet of the company as per schedule lll, part I of the companies Act, 2013. Also ‘Notes to Accounts’ for the same.

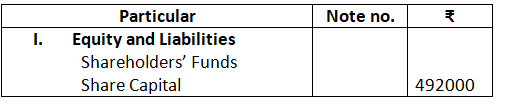

Solution Balance sheet

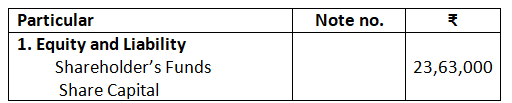

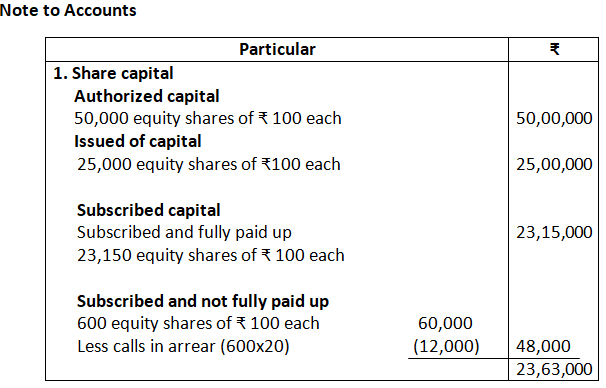

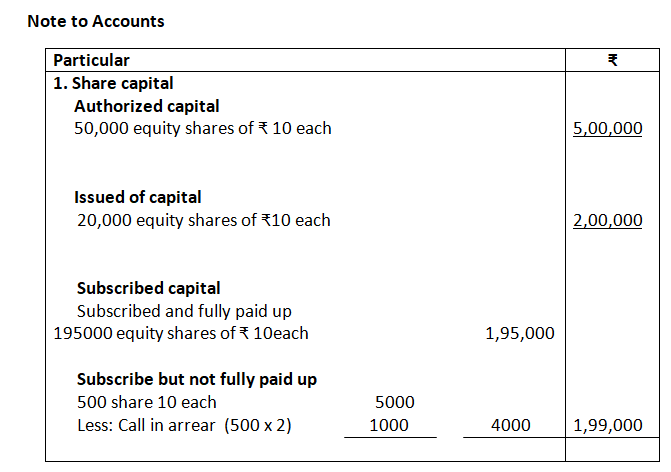

4. Star Ltd. Is registered with capital of ₹ 50,00,000 divided to 50,000 equity shares of ₹ 100 each. The company issued 25,000 equity shares for subscription. Subscription was received for 23,750 shares and all the due amount was duly received, except the first and final call of ₹ 20 per share on 600 shares. Show the ‘share capital’ in the Balance Sheet of the company.

Solution: Star Ltd. Balance Sheet

5. Grand Hotel Ltd. had authorized capital of 50,00,000 divided into 50,000 Equity shares of 100 each. It issued 10,000 equity shares to public for subscription on the following terms:

On Application 40 per share

On Allotment 30 per share

Balance on first and final call.

Share were fully subscribed and amounts called were duly received. First and final call was not yet made. Prepare balance Sheet of the company showing share capital.

Solution:- Balance sheet

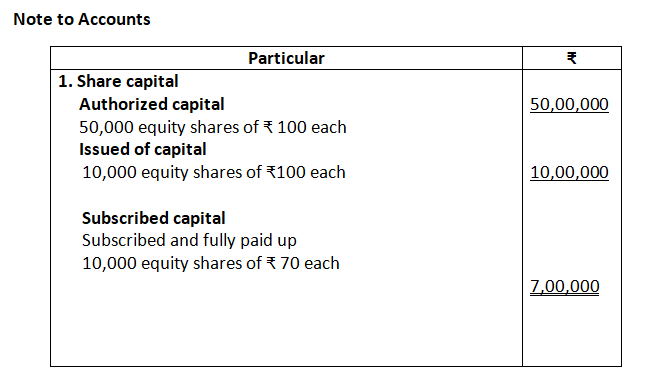

6. Altaur Ltd. Was registered with an authorized capital of 4,00,00,000 divided in 25,00,000 equity shares of ₹ 10 each and 1,50,000, 9% preference shares of ₹100 each. The company issued 8,00,000 equity shares for public subscription at 20% premium, payable ₹ 3 on application; ₹ 7 on allotment [including premium] and balance on call. Public had applied for 10,00,000 shares. Excess application were sent letters of regret. All the dues on allotment were received except on 15,000 shares held by Sanju. Another shareholders Rocky paid his call dues along with allotment on his holding of 25,000 shares. You are required to prepare the Balance Sheet of the company as per Schedule lll of companies Act, 2013, showing share capital balance and also prepare Notes to Accounts.

Solution: Alter Ltd. Balance Sheet

Discloser of share capital in the balance sheet with call in arrears and call in advance

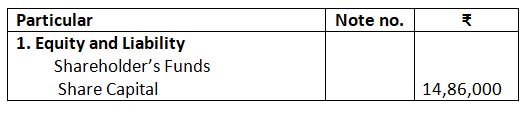

7. Excel Ltd. was registered with capital of 5,00,000 divided Into 50,000 equity share of 10 each. It issued 20,000 equity shares to public for subscription. The shares were subscribed and calls were made and received except first and final call of 2 on 500 shares held by varun.

Prepare balance sheet of company showing share capital.

Solution:-

Balance sheet

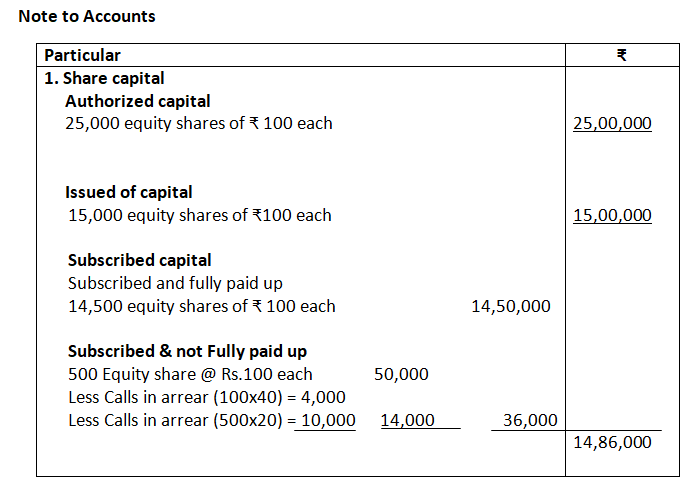

Prepare balance sheet of the company showing share capital.

Solution:- Balance sheet

prepare balance sheet of the company showing share capital.

Solution:- Balance sheet

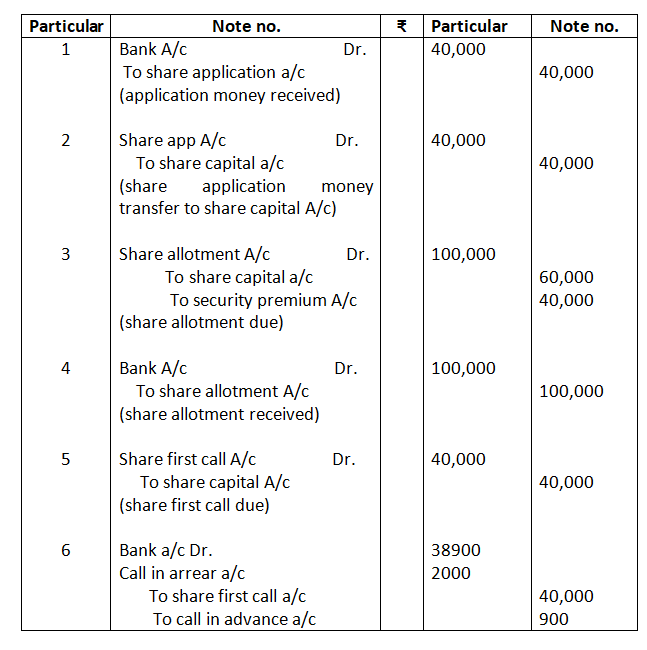

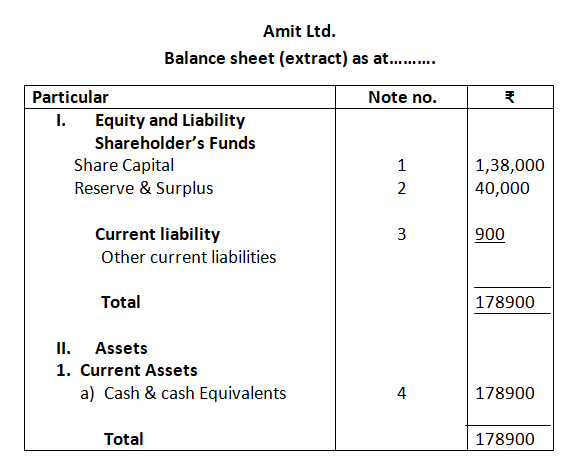

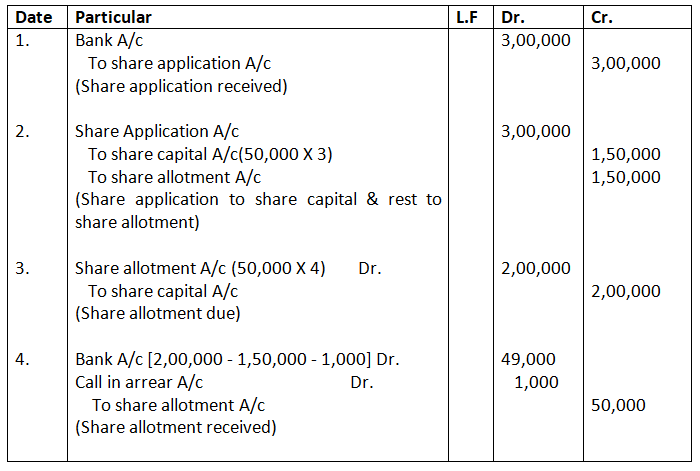

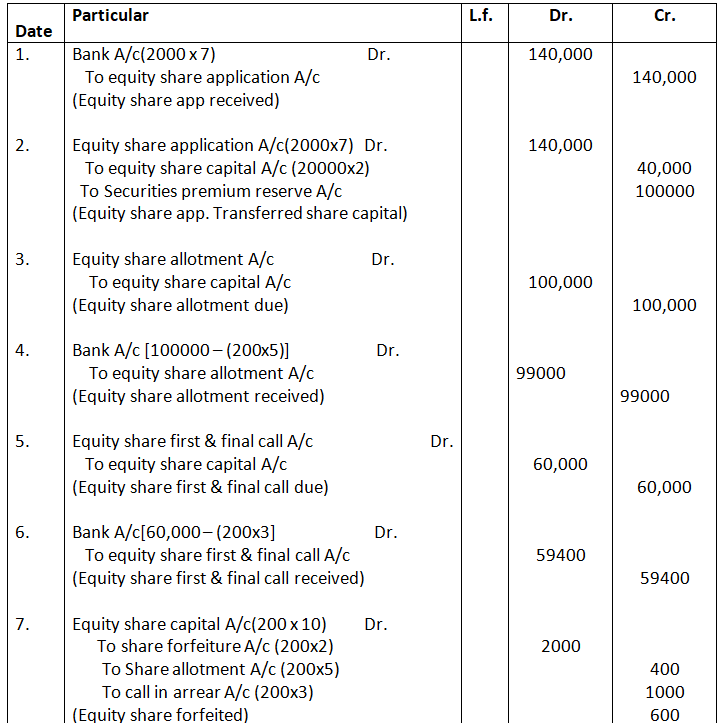

10. Suchi ltd. was registered with a capital of 5,00,000 in shares of 10 each and issued 20,000 such shares at a premium of 2 per share, payable as 2 per shares on application, 5 per share on allotment (including premium) and 2 per share on first call made three months later. All the money payable on application and allotment was duty received but when the first call was made, one shareholder paid the entire balance on his holding of 300 shares and another shareholder holding 1,000 shares failed to pay the first call money. Pass journal entries to record the above transaction and show how they will be shown in the company’s Balance sheet .

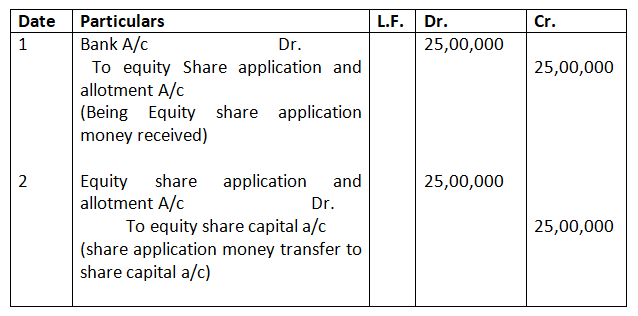

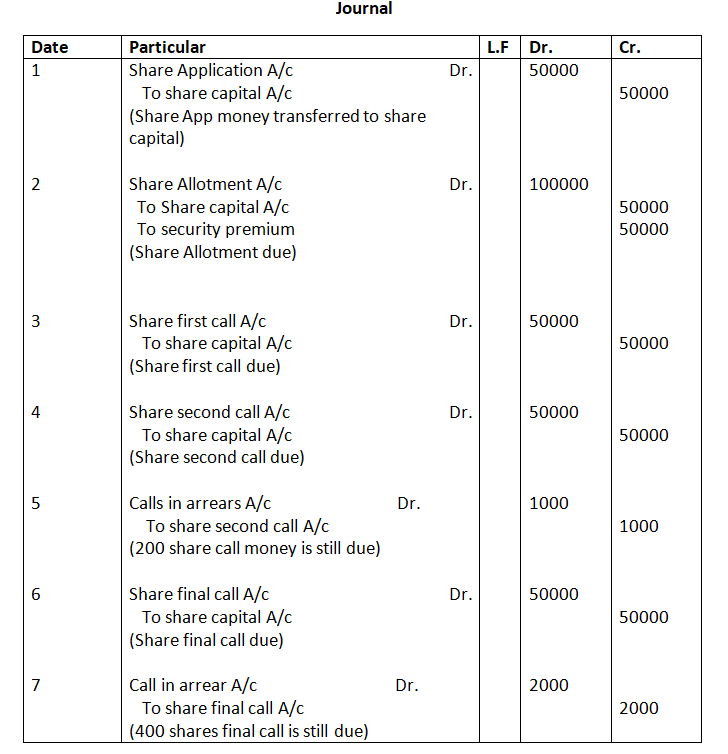

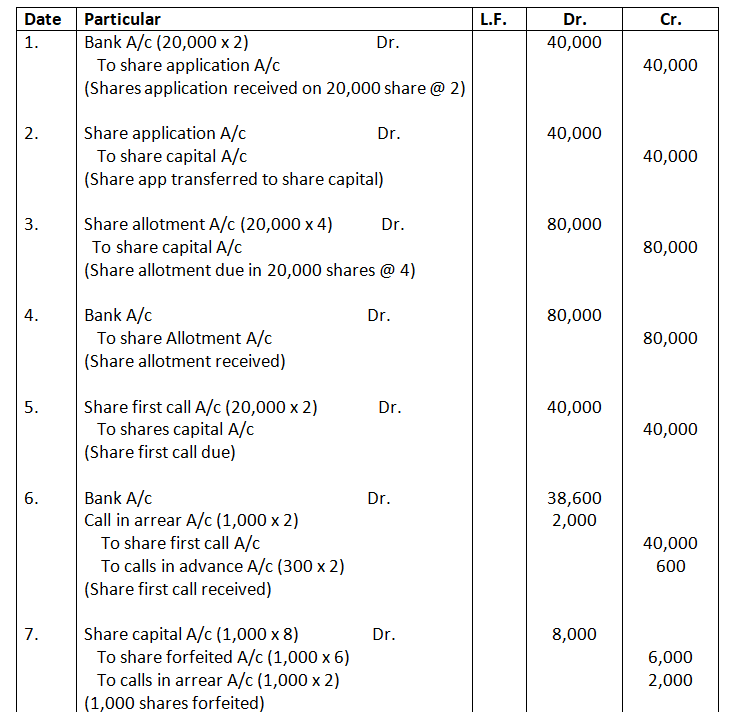

Solution Journal

Issue of share for cash at par

11. Global sales Ltd. issued 2,50,000 equity shares of 10 each to public at par for subscription, amount being payable as application money. Pass necessary journal entries in the books of the company.

Solution:-

Journal

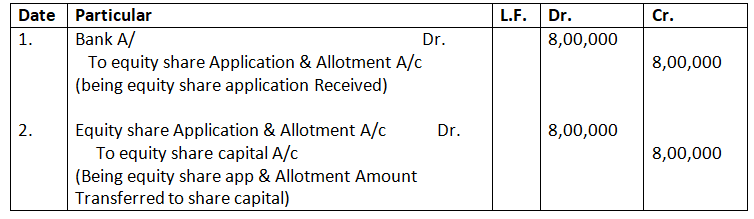

12. Authorized capital of ₹16,00,000 of Soumya Ltd. Is divided into 1,60,000 equity shares of ₹ 10 each. Out of the shares, 80,000 equity shares were issued at par to public for subscription. The issue price is payable on application. All the shares were subscribed.

Pass necessary journal entries in the books of the company.

Solution: Journal

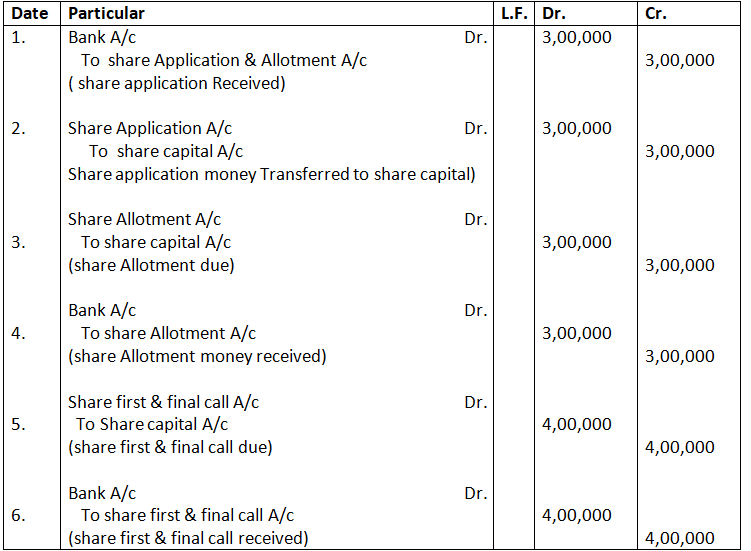

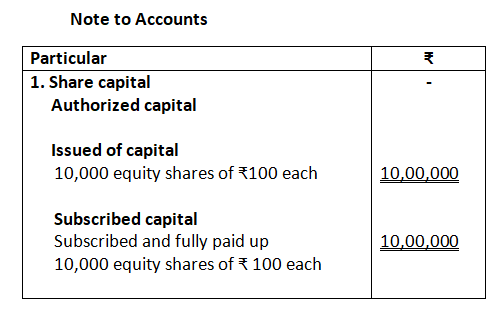

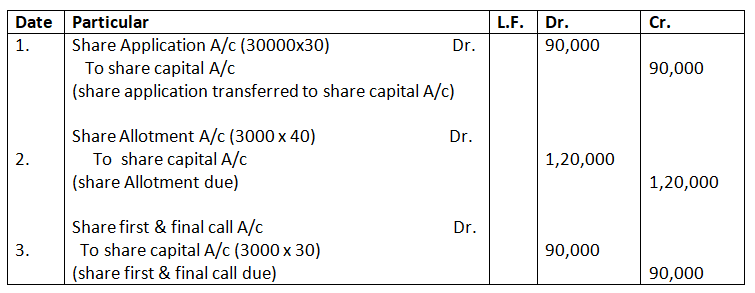

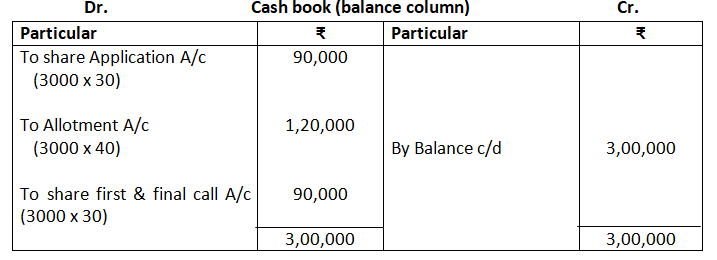

13. Vivan Leathers Ltd. invited applications for 10,000 shares of 100 each payable as follows:

30 on application, 30 on allotment and balance on first and final call.

All the shares were applied and allotted and the money was duly received. You are required to Journalise these transactions and show share capital in the balance sheet.

Solution:

Journal

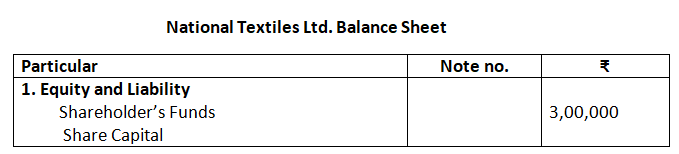

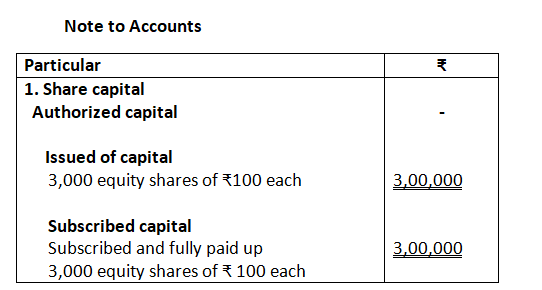

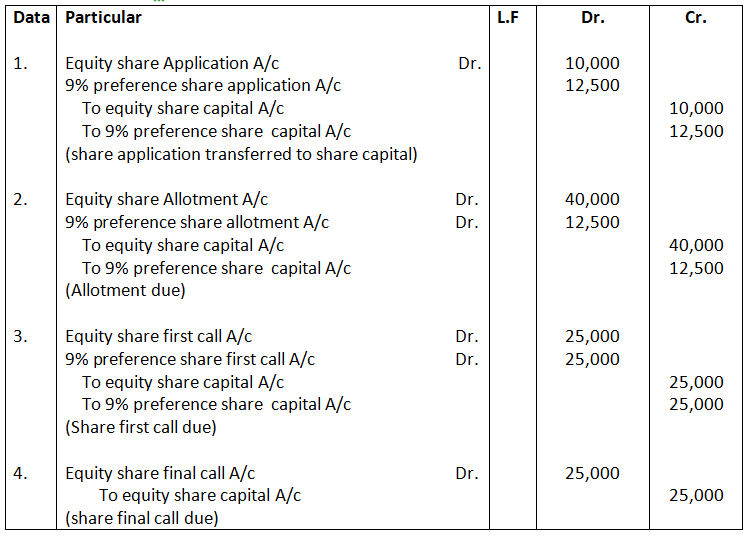

14. National Textiles Ltd. was registered with the authorized of ₹ 3,00,000 divided into 3,000 shares of ₹ 100 each, which were offered to the public. Amount payable as ₹ 30 per share on application, ₹ 40 per share on allotment and ₹ 30 per share on first and final call. These shares were fully subscribed and all money was duly received.

Prepare cash Book, journal and Balance Sheet showing share capital.

Solution: Journal

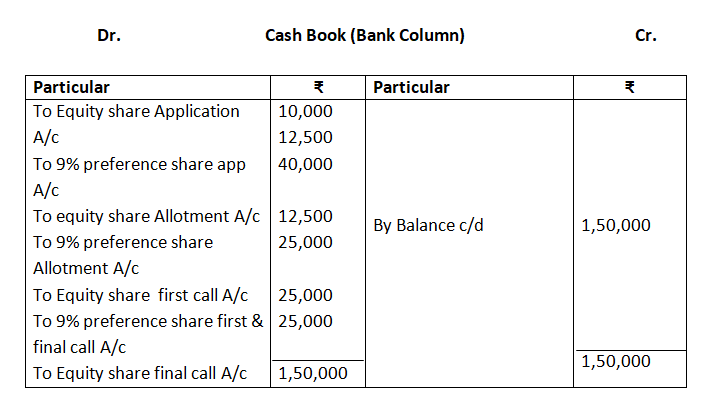

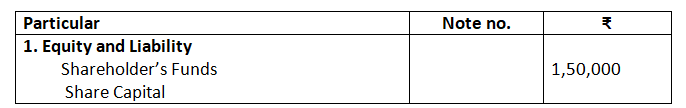

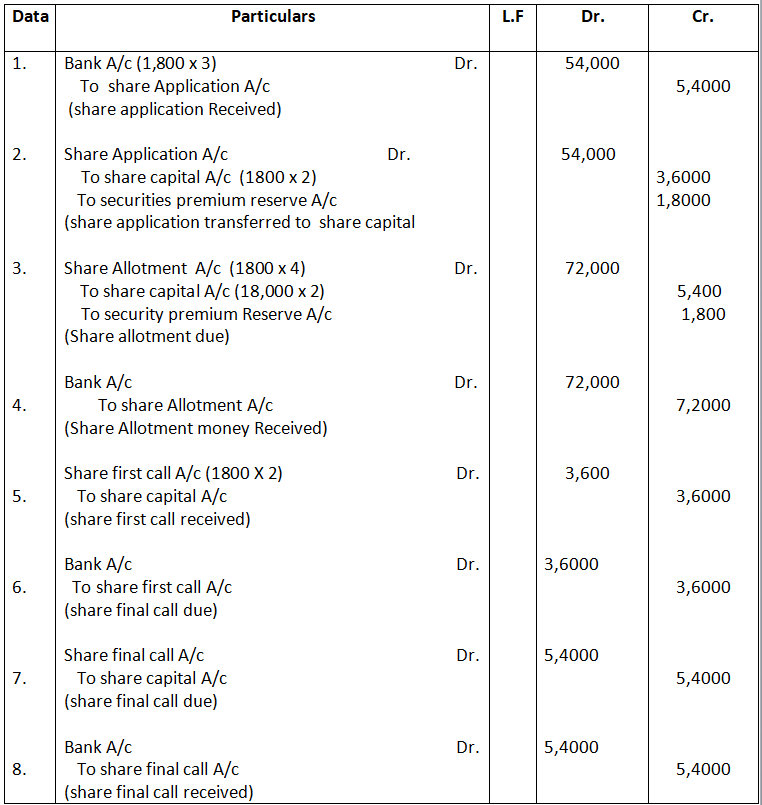

15. Modern Diaries Ltd. Was registered with an authorized capital of ₹ 10,00,000 divided into 7,500 equity shares of ₹ 100 each and 2,500 preference shares of ₹ 100 each 1,000 equity shares and 500; 9% preference shares were offered to public on the following terms – equity shares payable ₹ 10 on application, ₹ 40 on allotment and the balance in two calls of ₹ 25 each. Preference shares are payable and final call. All the shares were applied for and allotted. Amount due was duly received.

You are required to prepare cash book, pass necessary journal and show share capital in the balance sheet.

Solution:- Journal

Issue of Shares for cash at premium

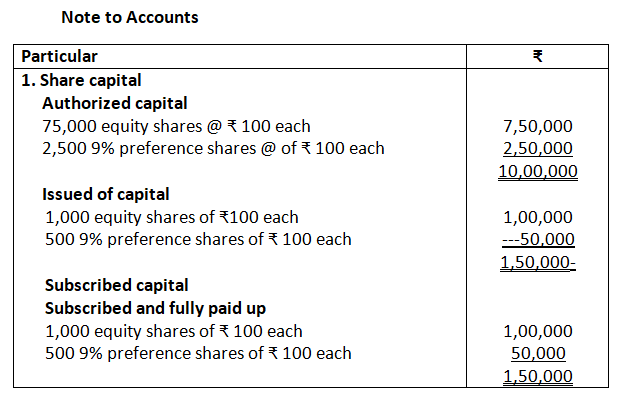

16. Premio Ltd., issued 50,000 Equity shares of ₹ 100 each at a Premium of ₹ 50 per share, payable as follows:

₹ 100 per share on Application; and

Balance on Allotment.

The issue was subscribed an share were issued to the applications. Pass the necessary journal entries.

Solution: Journal

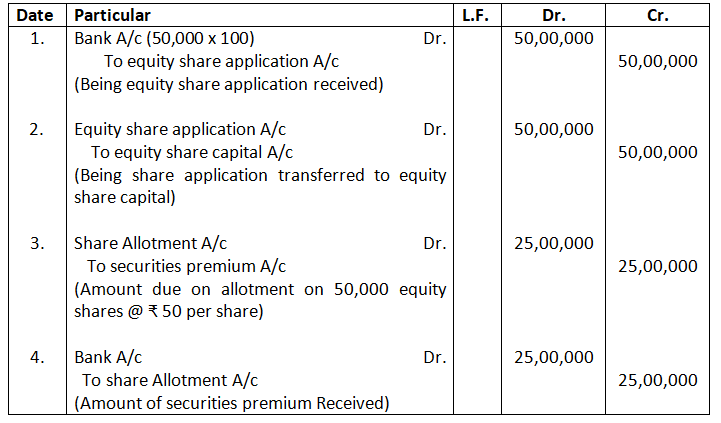

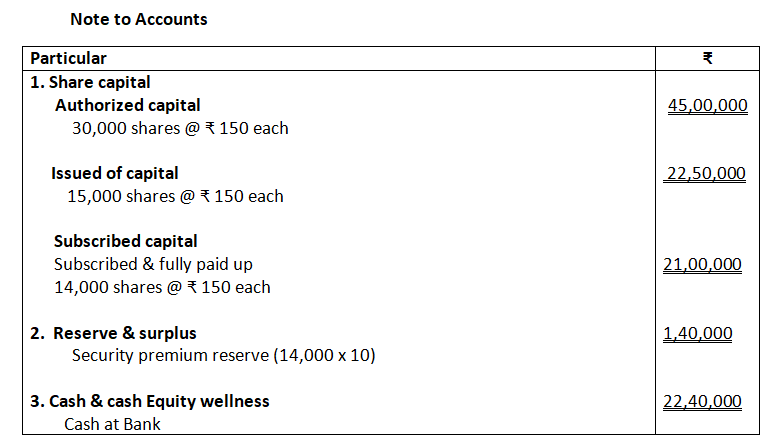

17. Bharat Ltd. Was incorporated with a capital of ₹ 20,00,000 divided into shares of ₹10 each, 20,000 shares were offered for subscription and out of these, 18,000 shares were applied for and allotted . ₹3 per share ( including ₹ 1 premium ) was payable on application, ₹ 4 per share ( including ₹ 1 premium ) on allotment , ₹ 2 per share on first call and ₹ 3 per share on final call. All the money was received. Give necessary Journal entries and show share capital in the Balance Sheet.

Solution: Journal

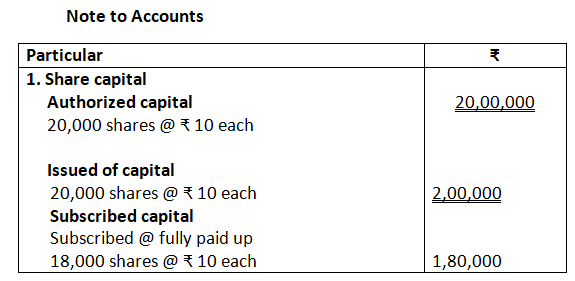

18. Authorized capital of Suhani Ltd. Is ₹45,00,000 divided into 30,000 shares of ₹ 150 each. Out of these company issued 15,000 shares of Rs.150 each at a premium of ₹ 10 per share. The amount was payable as follows:

₹ 50 per share on application, ₹ 40 per share on allotment (including premium), ₹ 30 per share on first call and balance on final call. Public applied for 14,000 shares. All the money as was duly received.

Prepare an extract of Balance Sheet of Suhani Ltd. as per schedule lll, per I of the companies Act, 2013 disclosing the share capital.

Solution: Bharat Ltd. Balance Sheet

Oversubscription

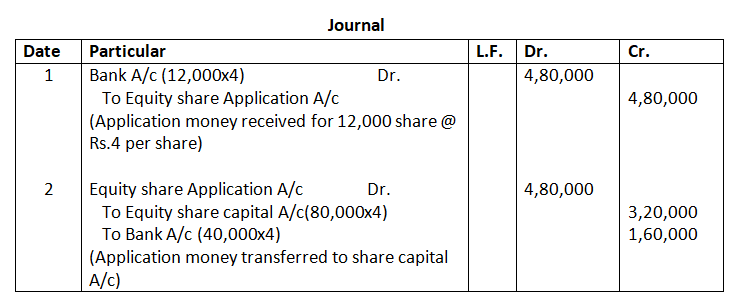

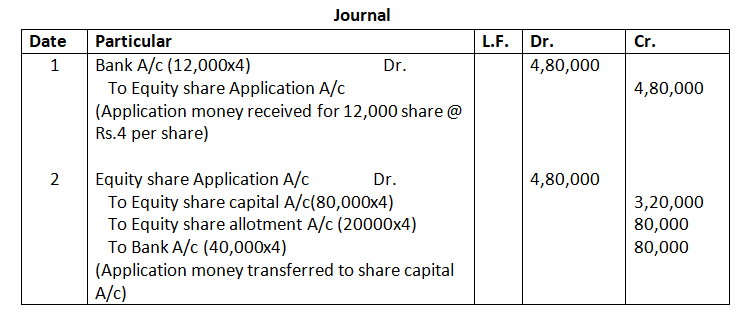

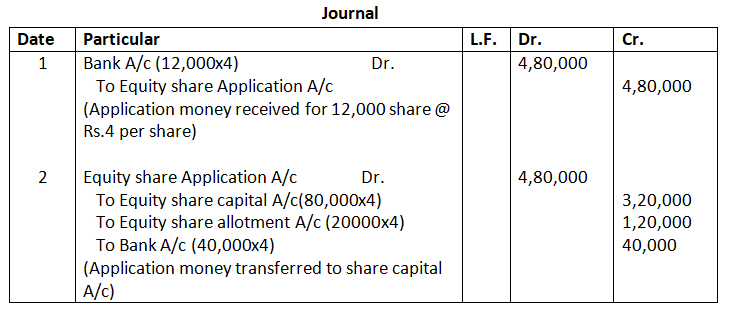

19. Bright ltd. issued 80,000 equity shares of 10 each against which it received application for 1,20,000 shares. Application money was 4, allotment money and first and final call was of 3 each.

Pass the Journal entry for allotment of shares in each of the following cases:

Case 1 : Excess Application were rejected

Case 2 : Pro rata allotment is made.

Case 3 : Applications for 20,000 shares was refused allotment and pro rata allotment was made to remaining.

Case 4 : Applications for 10,000 shares was refused allotment, applications for 10,000 shares were allotted the shares applied and pro rata allotment was made to the remaining.

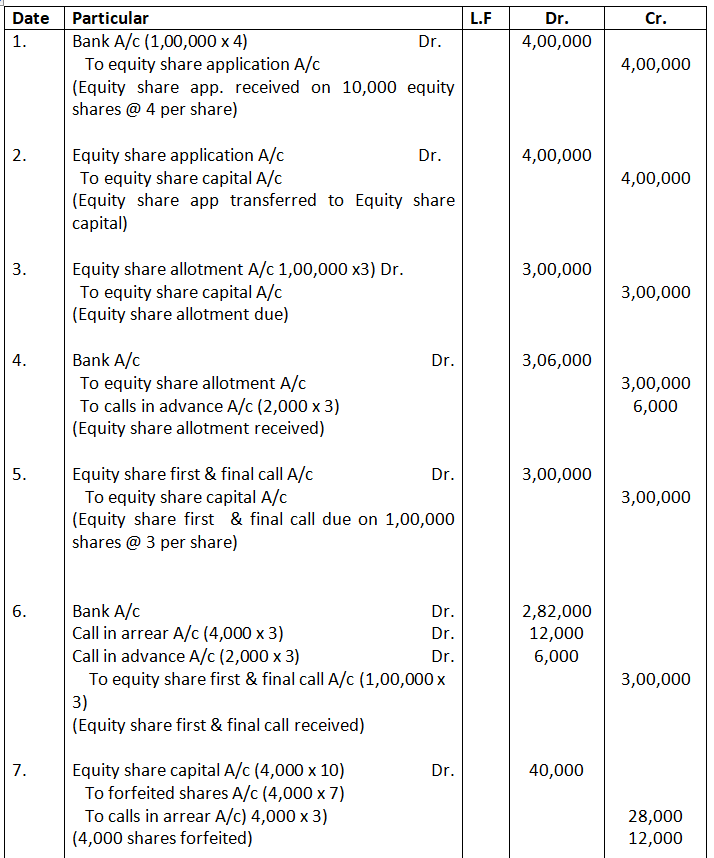

Solution:

Case – 1

Journal

Case – 2

Case – 3

Case – 4

20. Faber Ltd. invited applications for 70,000 equity shares of ₹ 100 each. The application money received @ 30 per shares was ₹ 27,00,000. Name the kind of subscription. List the three alternatives for allotting these shares.

Solution:

As actual money of the application is (70,000* 3) ₹ 21,00,000 and on Application, three are ₹ 27,00,000 is received. Thus it is the case of over-subscription.

- The excess money over application ₹ 6,00,000 can be returned

- The excess money over application ₹ 6,00,000 can be adjusted on allotment.

- A part of the excess money over application can be returned and rest can be adjusted in allotment money.

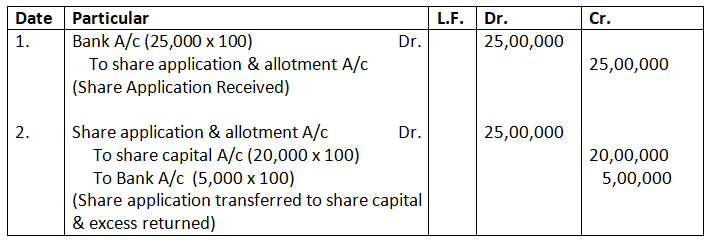

21. Sangam Marbles Ltd. invited applications for 20,000 Equity shares of ₹ 100 each issued at par payable on application. The issue was oversubscribed by 5,000 shares and allotment was made on pro rata basis. Pass necessary journal entries.

Solution: Journal

22. Citizen watches Ltd. invited applications for 50,000 shares of ₹ 10 each payable ₹ 3 on application, ₹ 4 on allotment and balance on first and final call. Applications were received for 60,000 shares. Applications were accepted for 50,000 shares and remaining applications were rejected. All calls were made and received except first and final call on 500 shares.

pass the journal entries in the books of citizen watches Ltd.

Solution: journal of citizen watches Ltd

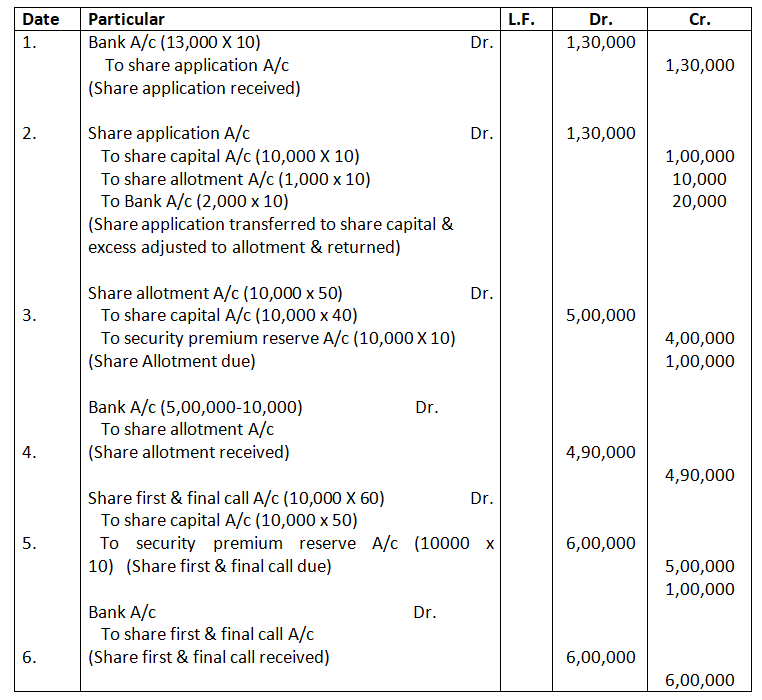

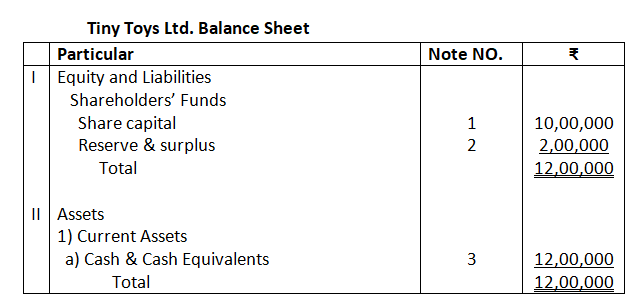

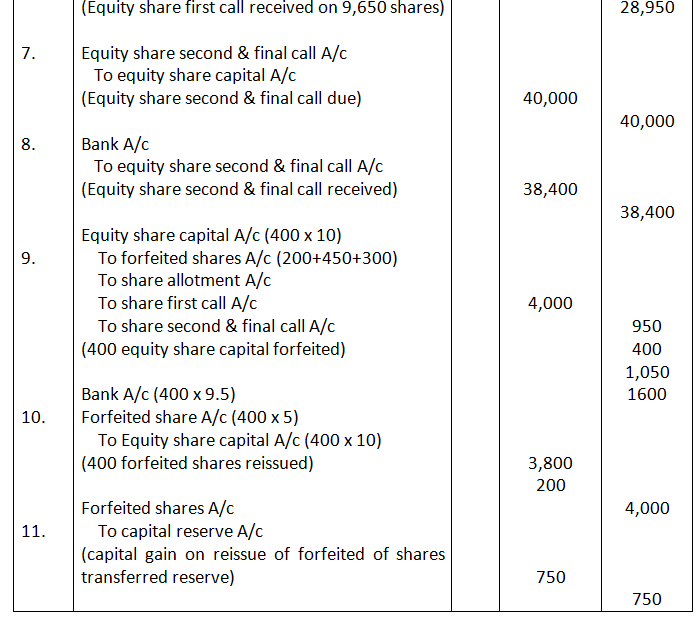

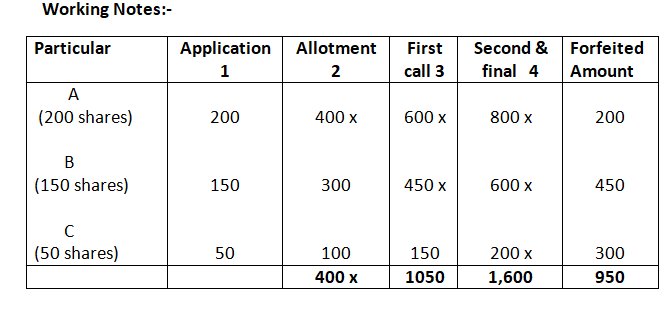

23. Tiny Toys Ltd. issued 10,00,000 shares of 100 each at a premium of 20 for subscription payables as:

10 per share on application,

40 per share and 10 premium on allotment, and

50 per share and 10 premium on final payment.

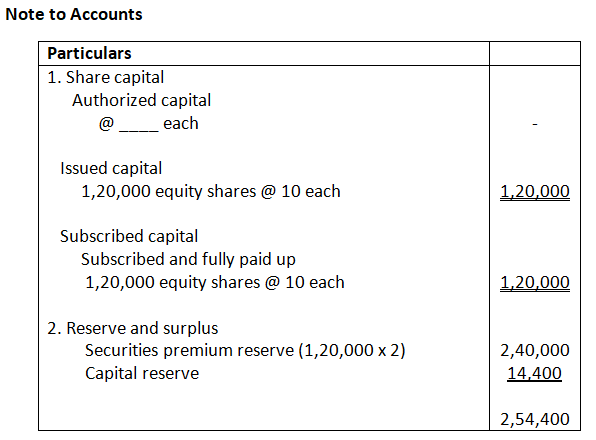

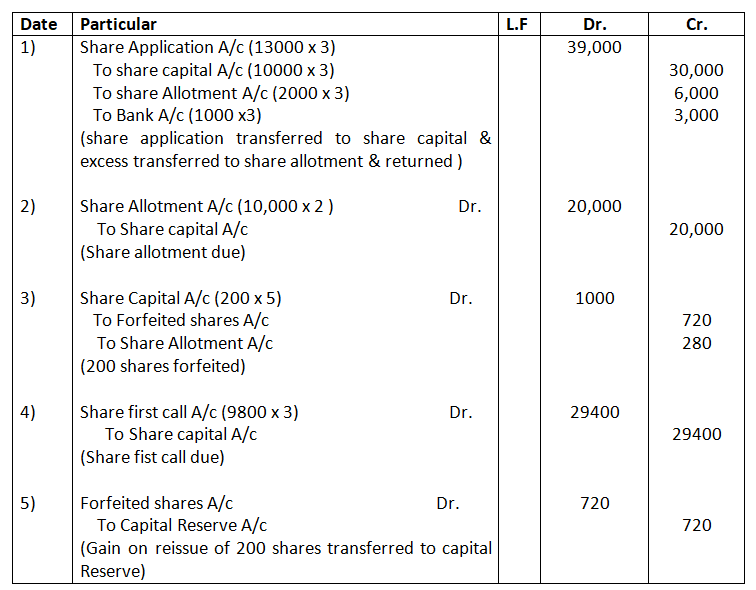

Issue was oversubscribed receiving applications for 13,000 shares. Application for 11,000 shares were allotted 10,000 shares and applications for 2,000 shares were sent letters of regret. All the money due on allotment and final call was duly received. Pass necessary entries in the company’s books to record the above transactions. Also prepare company’s Balance Sheet on completion of the above transactions.

Solution:

24. Sony Media Ltd. issued 50,000 shares of 10 each payable 3 on application, 4 on allotment and balance on first and final call. application were received for 1,00,000 shares and allotment was made as follows:

- Application for 60,000 shares were allotted 30,000 shares,

- Application for 40,000 shares were allotted 20,000 shares.

Anupam to whom 1,000 shares were allotted from category

1) failed to pay the allotment money.

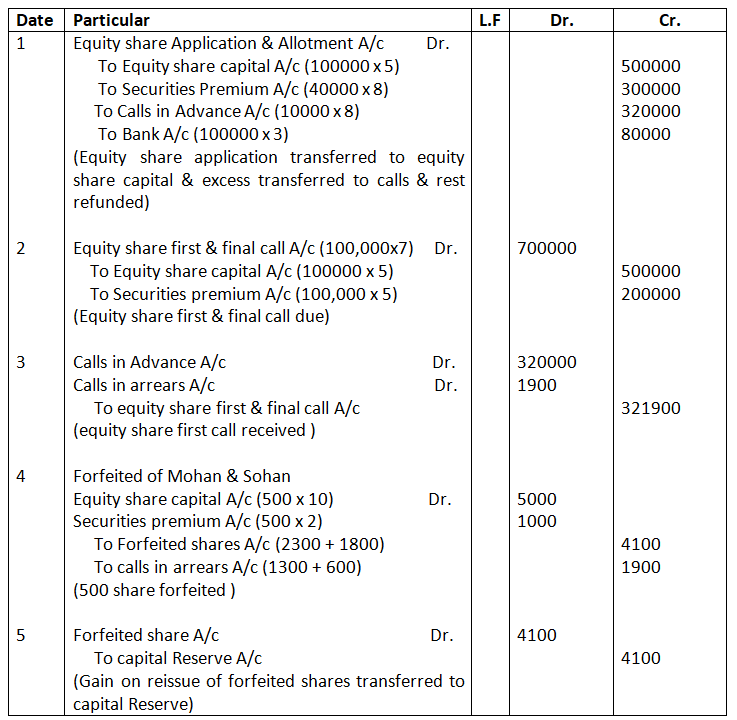

Pass journal entries up to allotment.

Solution: Journal

Working Note:-

Category – I

Application Received (60,000 X 3) = 1,80,000

Actual Application Money (30,000 x 3) = 90,000

Money to be used on allotment 90,000

Allotment money (30,000 x 4) 1,20,000

Allotment money to be called 30,000

Category – II

Application Received (40,000 X 3) = 1,20,000

Actual Application Money (20,000 x 3) = 60,000

Money to be used on allotment 60,000

Allotment money (20,000 x 4) 80,000

Allotment money to be called 20,000

Calculation of Anupam due on Allotment

Applied share =60,000/30,000 X 1000 = 2,000

Application Received (2,000 X 3) = 60,000

Actual Application (1,000 x 3) = 3,000

Money to be used on allotment 3,000

Allotment money (1,000 x 4) 4,000

Allotment amount not paid by Anupam 1,000

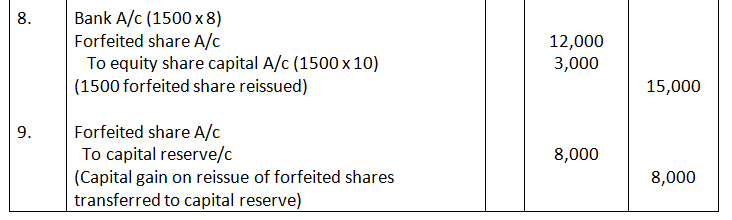

25. Sugandh Ltd. issued 60,00 shares of ₹ 10 each at a premium of ₹ 2 per share payable as ₹ 3 on application, ₹ 5 (including premium) on allotment and the balance on first and final call. Application money received was ₹ 2,76,000. It was resolved to allot as follows:

- Applications of 40,000 shares 30,000 shares,

- Applications of 50,000 shares 30,000 shares,

- Applications of 2,000 shares Nil.

Mohan, who had applied for 800 shares in category (i) and sohan, who was allotted 600 shares in category (ii) failed to pay the allotment money. Calculate amount received on allotment.

Solution: Calculation of Allotment Money Received

Application Received (92,000 x 3) ₹ 2,76,000

Application money Returned (2,000 x 3) ₹ 6,000

₹ 2,70,000

Actual Application Money (60,000 x 3) ₹ 1,80,000

Excess App Money to be used on Allotment 90,000

Actual Allotment money (60,000 x 5) 3,00,000

Allotment money to be received 2,10,000

Less Allotment not paid mohan 2400(1)

Allotment not paid sohan 1800 (4200)

Allotment money Received 2,05,800

Working Note – 1

Calculation of Allotment not paid by Mohan

Allotment share of Mohan = 30,000/40,000 x 800 = 600

Application money Received (800 x 3) = ₹ 2,400

Actual App money (600 x 3) = ₹ 1,800

Excess App money to be used on Allotment 600

Actual Allotment money (600 x 5) 3,000

Allotment money not paid by mohan 2400

Calculation of Allotment Money Not Paid by Sohan

Applied share of Sohan = 50,000/30,000 x 600 = 1,000

Application money Received (1,000 x 3) = ₹ 3,000

Actual App money (600 x 3) = ₹ 1,800

Excess App money to be used on Allotment 1,200

Actual Allotment money (600 x 5) 3,000

Allotment money not paid by Sohan 1,800

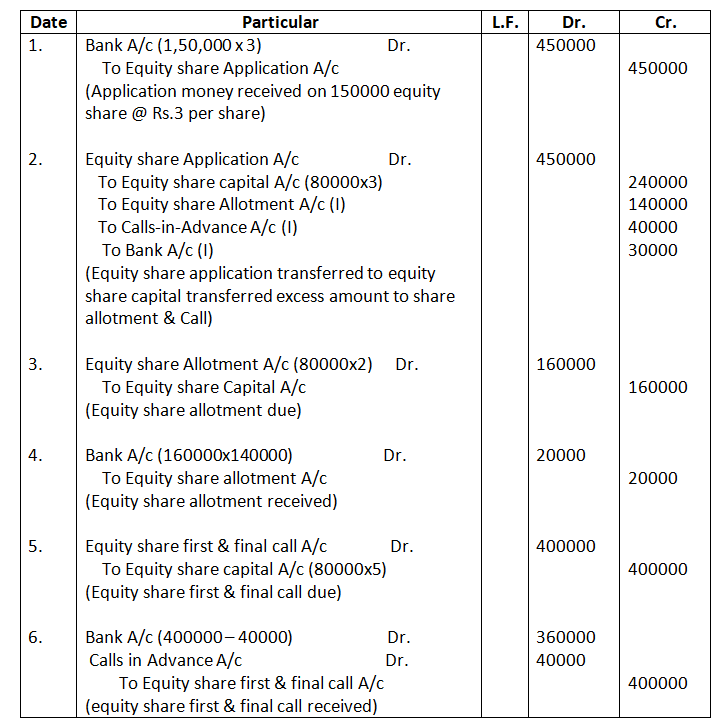

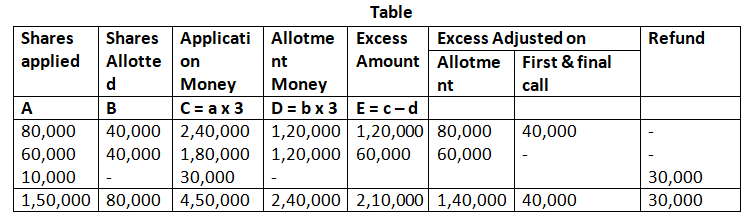

26. Printkit Limited invited applications for issue of 80,000 equity shaes of Rs.10 each. The amount was payable as follows:

On Application : Rs.3 per share

On Allotment : Rs.2 per share

On First and Final call : Balance

Applications for 1,50,000 shares were received. Applications for 10,000 shares were rejected and pro rata allotment was made to the remaining applicants on the following basis:

Category A – Applicants for 80,000 shares were allotted 40,000 shares.

Category B – Applicants for 60,000 shares were allotted 40,000 shares.

Excess money received on application was adjusted towards amount due to on allotment and first and final call. All the amounts due on allotment and first and final call were duly received.

Pass necessary Journal entries in the books of Printkit Limited.

Solution:-

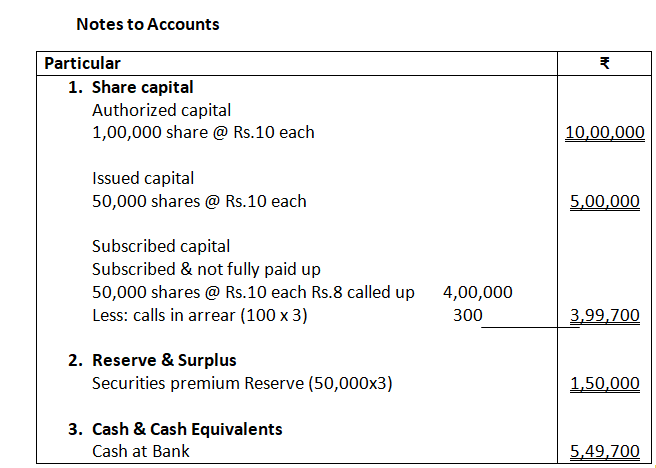

27. Eastern India Company Limited, having an authorized capital of Rs.10,00,000 divide into shares of Rs.10 each, issued 50,000 shares at a premium of Rs.3 per share payable as follows:

On Application Rs.3 per share;

On allotment (including premium) Rs.5 per share;

On first call (due three months after allotment) Rs.3 per share;

And balance as and when required.

Applications were received for 60,000 shares and the directors allotted the shares as follows:

- Applicants for 40,000 shares received in full.

- Applicants for 15,000 shares received an allotment of 8,000 shares.

- Applicants for 5,000 shares received 2,000 shares on allotment, excess money being returned.

All amounts due on allotment were received.

The first call was made and the money was received except on 100 shares.

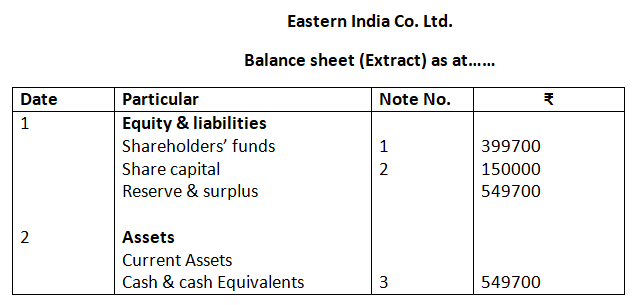

Give Journal and cash book entires to record these transaction of the company. Also prepare the Balance Sheet of the company.

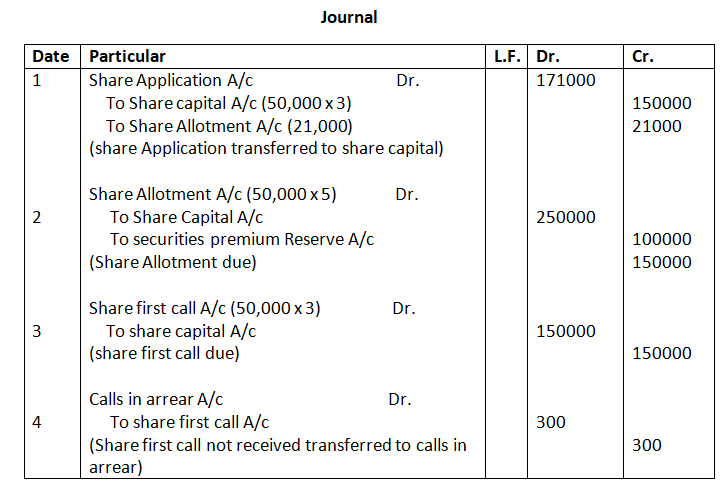

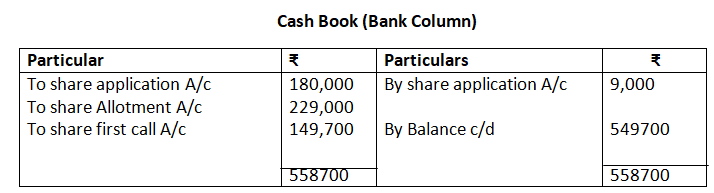

Solution:-

Calculation of Amount transferred to Allotment and Excess money to Return

60,000 – 50,000

- 40,000 – 40,000

- 15000 – 8,000

- 5000 – 2,000

Category – II

Application money Received (15000 x 3) = Rs.45000

Actual App money (8000 x 3) = Rs.24000

Amount to be used on Allotment = Rs.21000

Allotment Amount (8000 x 5) = Rs.40000

Amount to be called on Allotment = Rs.19000

Category – III

Application money received (5000 x 3) = Rs.15000

Actual App. Money (2000 x 3) = Rs.6000

Excess Amount to be returned Rs.9000

Under subscription

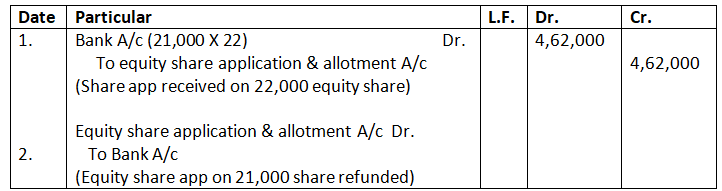

28. A-one product Ltd. is registered with authorized capital of ₹10,00,000 divided into 50,000 equity share of ₹20 each. It issued 25,000 equity share for subscription at premium of 2 per share, issue price being payable along with application. It received 5,17,000 towards application money.

You are required to prepare the Balance Sheet showing Share Capital.

Solution: Books of A-one production Ltd.

Journal

Number of Share = Money Received on Application/ Application Money

= 4, 62,000/22= 21,000

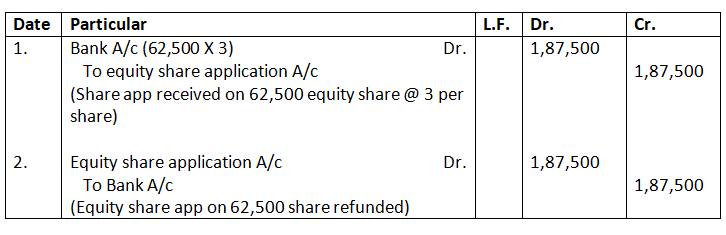

29. Home products Ltd. is registered with authorized capital of 10,00,000 divided into 1,00,000 equity shares of 10 each. It issued 70,000 equity shares for subscription at premium of 2 per share, payable 3 on application, 5 on allotment and balance on first and final call. It received subscription for 62,500 shares.

You are required to pass the necessary Journal entries.

Solution: Journal

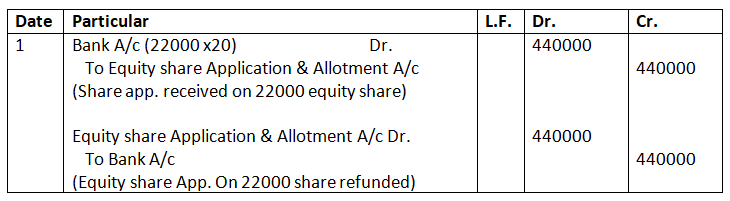

30. Quality Stationers Ltd., registered with authorized capital of Rs.20,00,000 divided into 1,00,000 equity shares of Rs.20 each. 50,000 equity shares were issued for subscription at par, issue price being payable along with application. It received application money of Rs.4,40,000.

You are required to pass the necessary Journal entires and show share capital in the Balance Sheet of the company.

Solution:-

Books of Quality Stationers

Journal

Number of share = Money received on application / Application Money

= 440000 / 20

= 22000

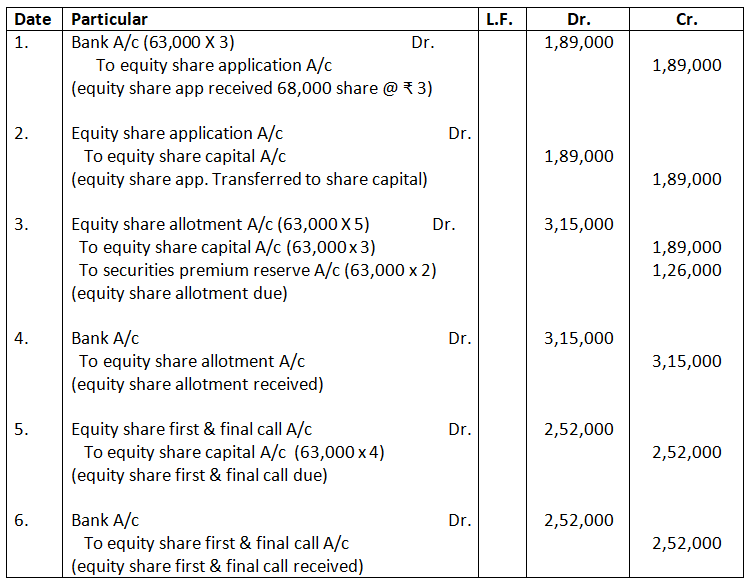

31. Pure products Ltd. is registered with authorized capital of ₹10,00,000 divided into 1,00,000 equity shares of 10 each. it issued 70,000 equity shares for subscription at premium of 2 per share, payable 3 on application, 5 on allotment and balance on first and final call. It received application money amounting to 1,89,000.

You are required to:

- Determine whether the company should allot shares; and

- If yes, pass the necessary journal entries assuming that the company has received due amount on allotment and call.

Solution:

- Minimum subscription is 70,000 X 90% = 63,000 Shares. The application is received 1,89,000 thus number of shares on which application is received is

1,89,000/3 = 63,000 shares.

Thus the company should allot the share to the subscribers.

II. Books of pure-products Ltd.

Journal

Number of share = Money received on application / Application Money

= 1, 89,000 / 3

= 63,000

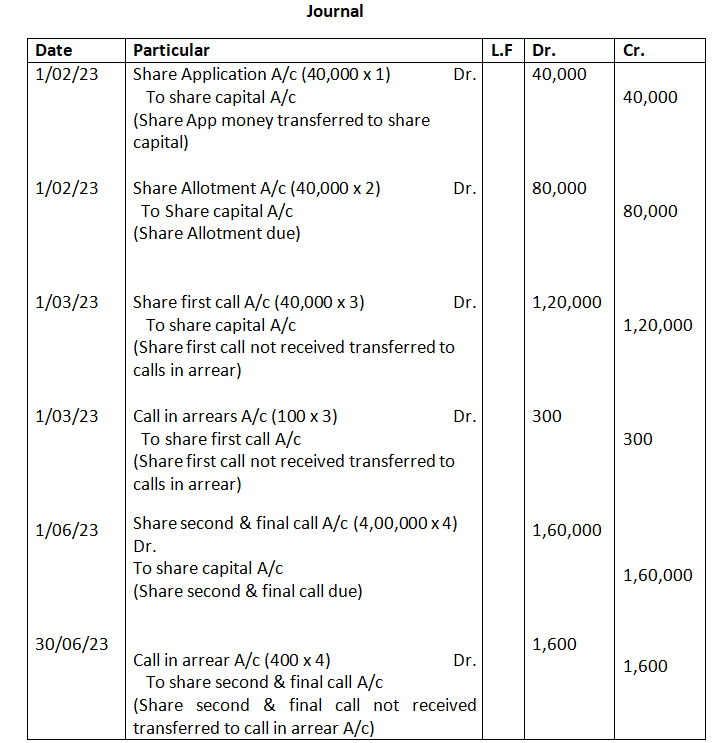

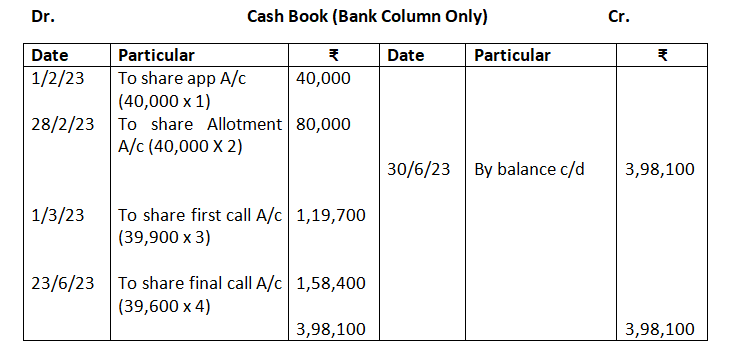

32. Blue Chip Ltd. was registered on 1st January, 2024 with a capital of ₹10,00,000 divided into 1,00,000 shares of 10 each. The company issued 42,000 shares of which 40,000 shares were taken up by the public and 1 per share was received with application. On 1st February, 2024, these shares were allotted and 2 per share was duly received on 28th February, 2024 as allotment money. First call of 3 per share was made on 1st March, 2024 and the call money all share with the exception of 100 shares was received. The final call of 4 per share was made on 1st June, 2024 and the amount due, with the exception of 400 shares, was received by 30th June, 2024.

Pass necessary Journal and cash Book entries and prepare the Balance Sheet as at 30th June 2024.

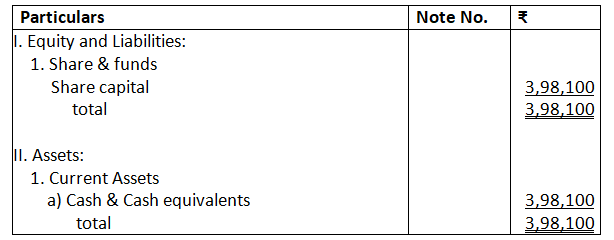

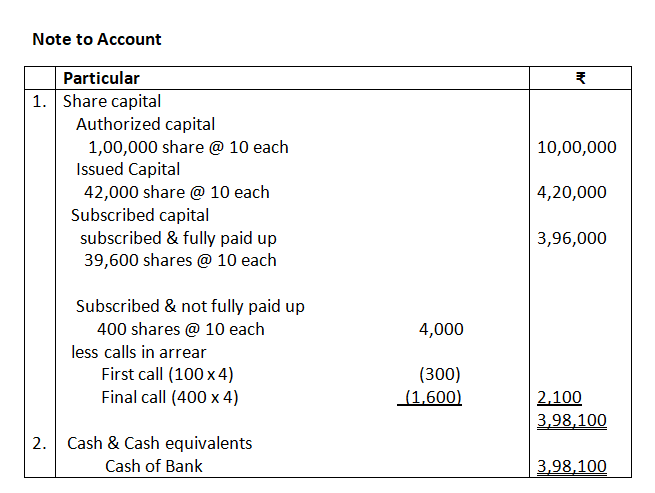

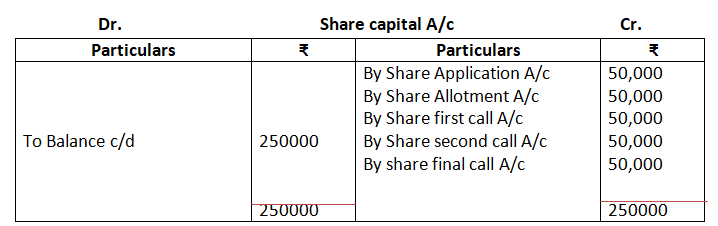

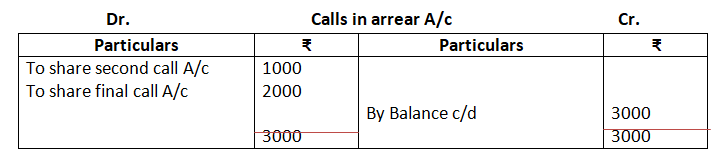

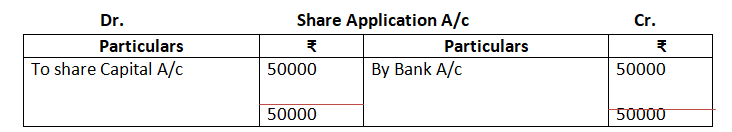

Solution: Blue Chip Ltd.

Balance sheet (extract) as at…

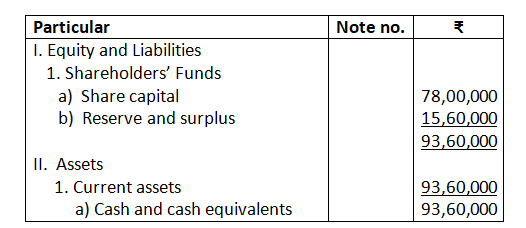

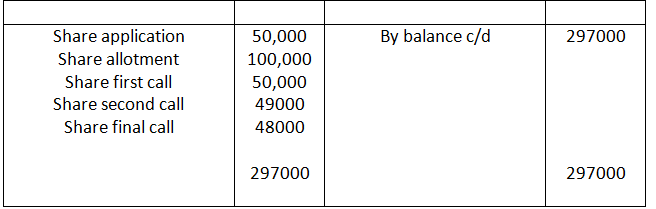

33. The authorized capital of Sarang Ltd. is ₹1,20,00,000 divided into 1,20,000 shares of 10 each. Out of these, company issued 8,00,000 shares of 10 each at a premium of 20%. The amount per share was payable as follows:

On application ₹ 2

On allotment ₹ 6 (including premium)

On first call ₹ 2

On final call Balance

Public applied for 7,80,000 shares. All the money was duly received. Prepare an extract of balance sheet of Sarang Ltd. as per schedule lll, part I of the companies Act, 2013, disclosing the above information. Also prepare ‘Notes to Accounts’ for the same.

Solution: Sarang Ltd. Balance Sheet

Call in arrear and call in advance

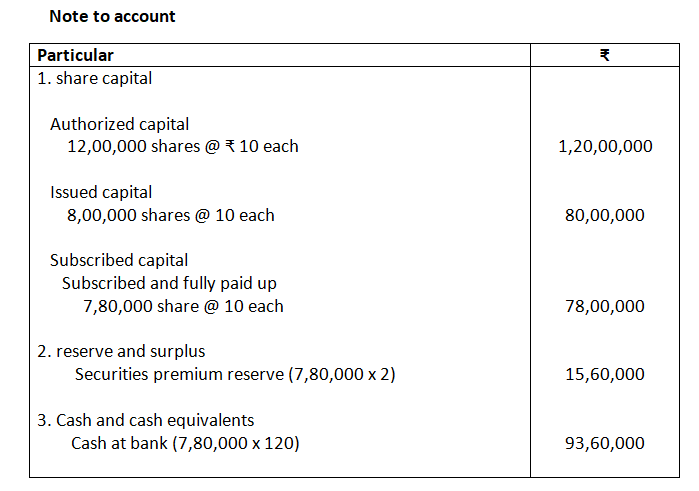

34. Ghost Ltd. made the second and final call on its 50,000 equity share @ 2 per share on 1st January, 2016. The entire amount was received on 15th January, 2016 except on 100 shares allotted to Venkat. Pass necessary journal entries for the call money due and received by opening calls-in-Arrears account.

Solution: Journal

Pass the entries in the company’s journal, cash book and the Ledger. Also show the company’s balance sheet on completion of the above transactions.

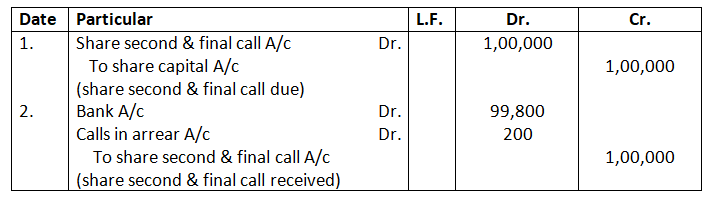

Solution

Application 5

Allotment 10 including premium

First call 5

Second call 5

Final call 5

Cash book

36. Usha Ltd. was formed with a capital of 10,00,000 divided into shares of 100 each. It offered 90% shares to public for subscription. The amount per share was payable as 40% on application, 20% on allotment and the balance on first and final call. The applicants paid 3,60,000 on application and 1,69,000 on allotment.

The call has yet been made. Calculate:

- Authorized capital

- Issued capital

- Subscribed capital

- Called-up capital

- Paid-up capital

- Call-in-Arrears.

Solution:

Authorized capital = 10,00,000

(10,000 shares @ 100 each)

Issued capital = 90 % of 10,00,000

= 9,00,000

Subscribed capital = 9,00,000

Called-up capital = 9,000 shares @ 60 per share

= 5,40,000

paid up capital = 36,000 + 1,69,000

= 5,29,000

Call in arrear = Amount on Allotment = 900 x 20 = 1,80,000

Amount Received on Allotment 1,69,000

11,000

Issue of share for consideration other than cash

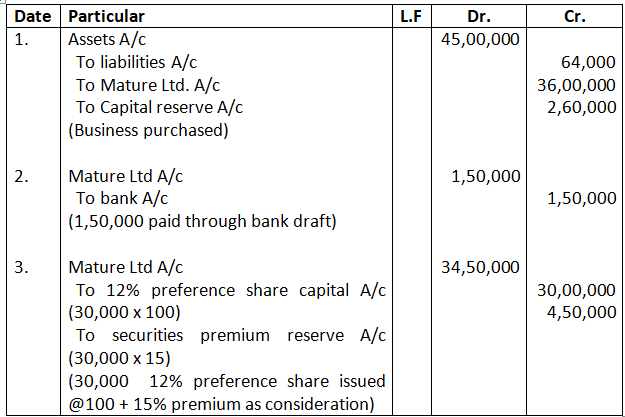

37. Random Ltd. took over running business of Mature Ltd. comprising of Assets of 45,00,000 and liabilities of 6,40,000 for a purchase consideration of 36,00,000. The amount was settled by bank draft of 1,50,000 and balance by issuing 12% preference shares of 100 each at 15% premium. Pass entries in the books of Random Ltd.

Solution:-

Number of preference share issued = Amount paid / Price of Preference share

= (36, 00,000 – 1, 50,000)/100 + 15% of 100

= 34, 50,000/115

=30,000 shares

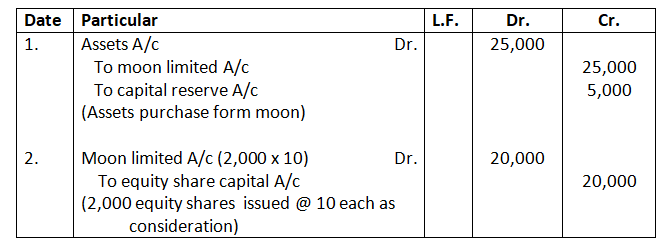

38. 2,000 equity shares of 10 each were issued to Moon Limited from whom assets of 25,000 were acquired.

Pass journal entry.

Solution:

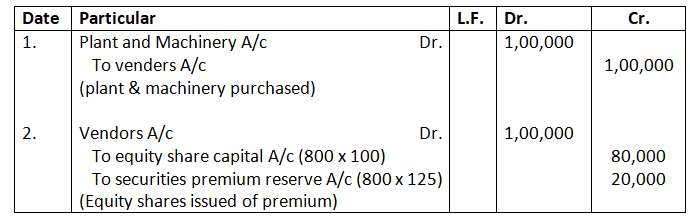

39. ‘Amrit Dhara Ltd’ issued 800 equity shares of 100 each at a premium of 25% as fully paid-up in consideration of the purchase of plant and machinery of 1,00,000.

Pass entries in company’s Journal.

Solution:

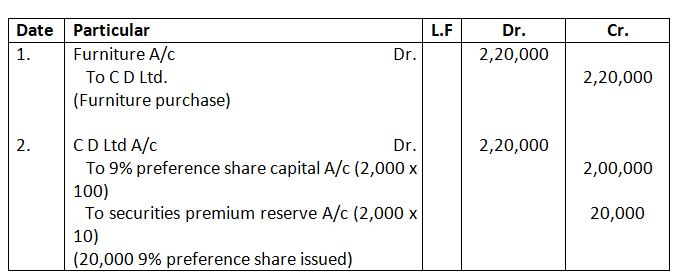

40. Z Ltd. purchased furniture costing 2,20,000 from C.D Ltd. The payment was to be made by issue of 9% preference shares of 100 each at a premium of 10 per share. Pass necessary Journal entries in the books of Z Ltd.

Solution:

Number of preference share issued = consideration / Price of Preference share

= 2,20,000 / 110

= 2,000 shares

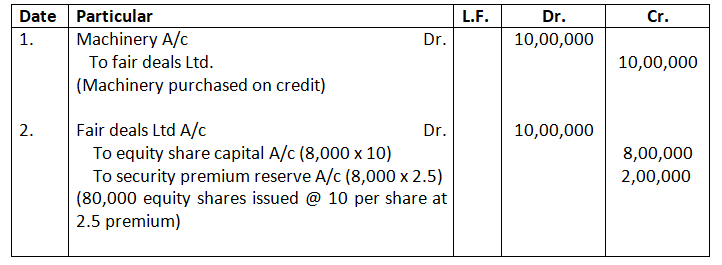

41. Good luck Ltd. Purchased machinery costing 10,00,000 from fair Deals Ltd. The company paid the price by issue of equity shares of 10 each at a premium of 25%.

Pass necessary Journal entries for the above transactions in the books of Good luck Ltd.

Solution: Journal

Number of share = 10,00,000/12.5 = 80,000 Shares

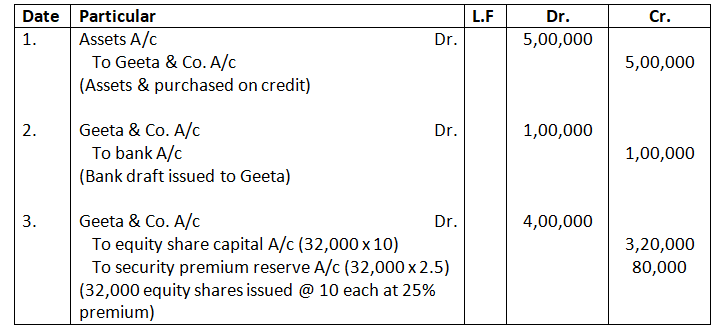

42. Rajan Ltd. purchase assets from Geeta & co. for 5,00,000. A sum of 1,00,000 was paid by means of a bank draft and for the balance due Rajan Ltd. issued equity shares of 10 each at a premium of 25% journalize the above transactions in the books of the company.

Solution:

Number of Share = 4,00,000/12.5 = 32,000 shares.

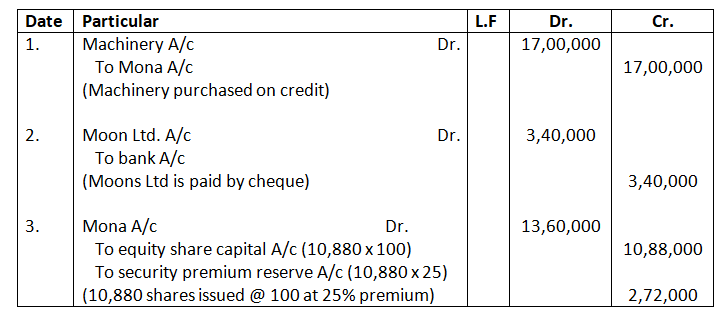

43. Sona Ltd. purchased machinery costing 17,00,000 from Mona Ltd. paid 20% of the amount by cheque and for the balance amount issued equity shares of 100 each at a premium of 25%.

Pass necessary journal entries for the above transactions in the books of Sona Ltd. Show your working notes clearly.

Solution:

Number of Share = 13,60,000/12.5= 10,880 shares.

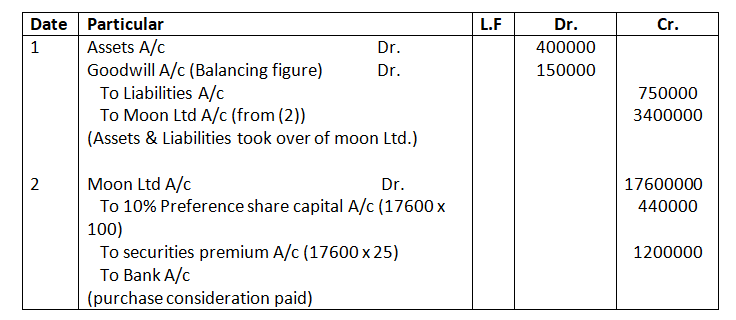

44. Surya Ltd., took over assets of Rs.40,00,000 and liabilities of Rs.7,50,000 of Moon Ltd., Surya Ltd. Paid the purchase consideration by issuing 17,600; 10% Preference Shares of Rs.100 each at a premium of 25% and Rs.12,00,000 by Bank Draft. Calculate purchase consideration and pass the necessary Journal entries in the book of Surya Ltd.

Solution:-

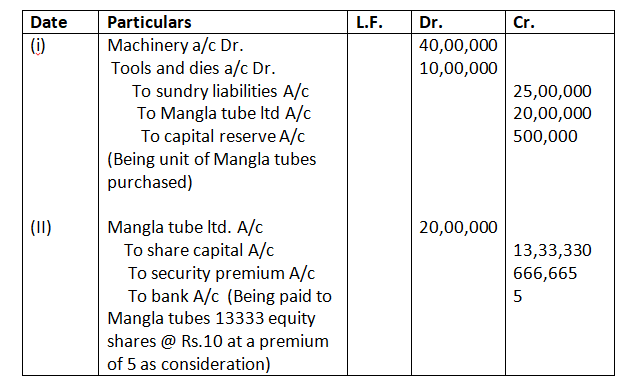

45. Mangla Cortubi Ltd. took over a unit of Mangla Tubes Ltd. consisting of Machinery—40,00,000, Tools and Dies—10,00,000 and liabilities of 25,00,000 for a consideration of 20,00,000. The consideration was paid by issuing equity shares of 10 each at a premium of 5.

You are required to pass the journal entries in the books of Mangla cortubi Ltd.

Solution journal

Number of equity share issued = consideration / price of one equity share

= 2,00,000 / 15

= Rs.13333.33

= Rs.13333 (round off)

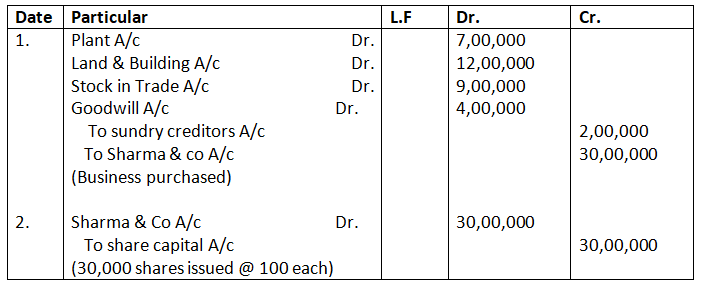

46. Bhusan Lamps Ltd. issued 30,000 fully paid-up shares of 100 each for purchase of the following assets and liabilities form Sharma & co.

Plant 7,00,000 Stock –in-Trade 9,00,000

Land and 12,00,000 Sundry Creditors 2,00,000

Building

Solution: Journal

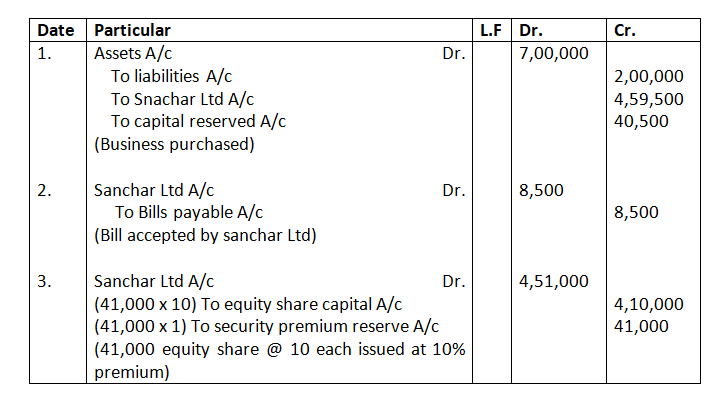

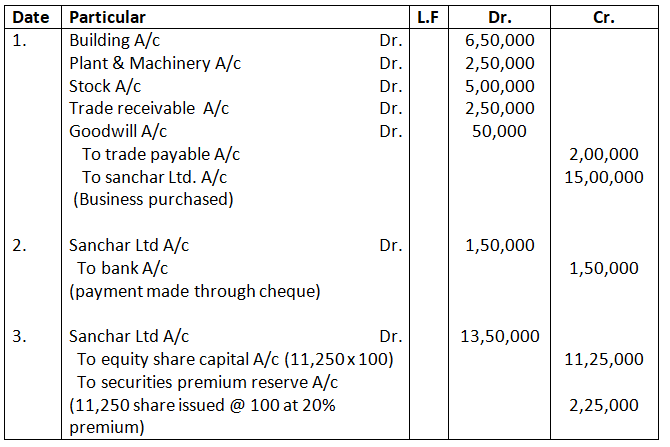

47. Sandesh Ltd took over the assets of 7,00,000 and liabilities of 2,00,000 from Sanchar Ltd. payable after three months and the balance was paid by issue of equity shares of 10 each at a premium of 10% in a favour of sanchar Ltd.

Pass necessary journal entries for the above transactions in the books of Sandesh Ltd.

Solution: Journal

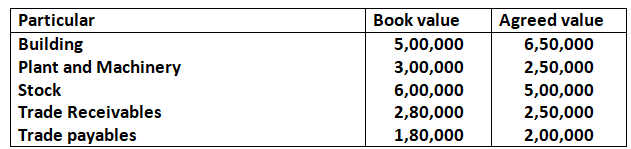

48. Santoor Ltd. purchased a running business form sanchar Ltd. for 15,00,000 payable 10% by cheque and the balance by the issue of fully paid equity shares of 100 each at a premium of 20%. The assets and liabilities consisted of the following.

Pass the necessary journal entries in the books of Sandesh Ltd.

Solution:

Number of Share = 13,50,000/120 = 11,250 shares.

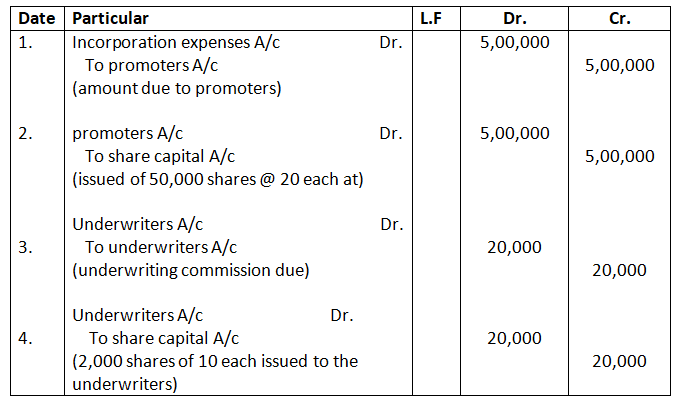

49. Light Lamps Ltd. issued 50,000 shares of 10 each as fully paid-up to the promoters for their service to set-up the company. It also issued 2,000 shares of 10 each credited as fully paid-up to the underwriters of shares for their services, journalize these transactions.

Solution: Journal

Forfeiture of share which were issued at par

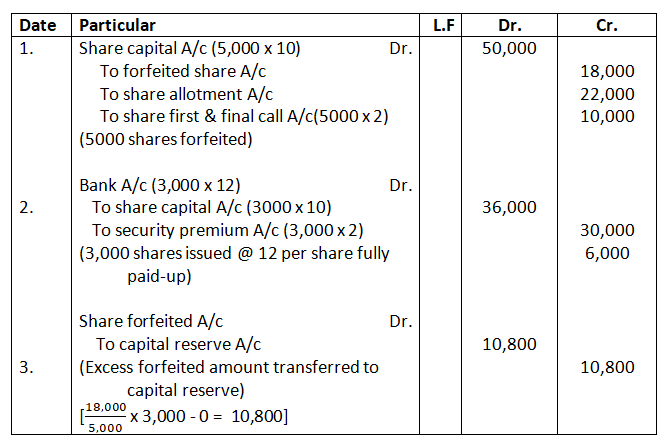

50. Vikram Ltd. forfeited 5,000 shares of Rahul, who had applied for 6,000 shares for non-payment of allotment money of 5 per share and first call of 2 per share. Only application money of 3 was paid by him. Out of these, 3,000 shares re-issued @ 12 per share as fully paid.

Pass entries for forfeiture and reissue of shares.

Solution: Journal

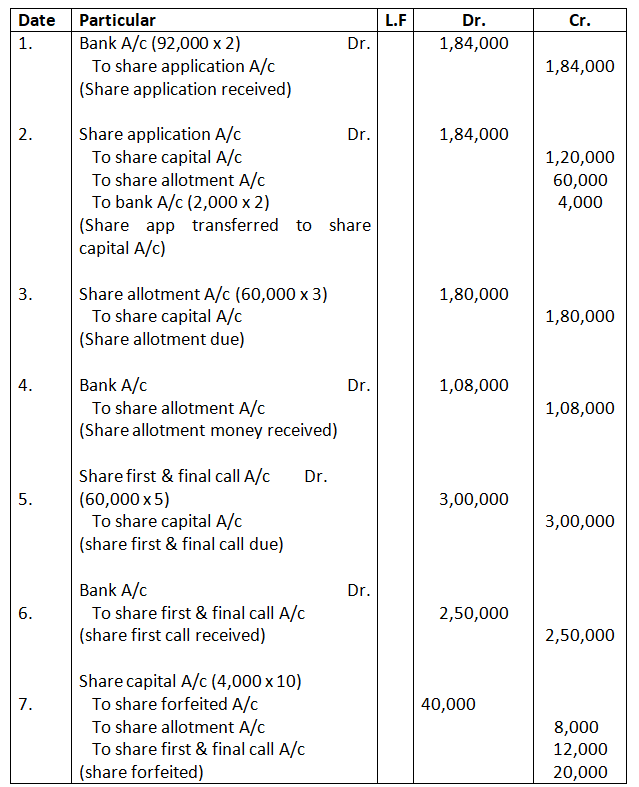

51. Sangita limited invited application for issuing 60,000 shares of 10 each at par. The amount was payable as follows: on application 2 per share; on allotment 3 per share; on first and final call 5 per share . application were received for 92,000 shares.

Allotment was made on the following basis: (a) to application for 40,000 shares: full; (b) to applicants for 50,000 shares: 40% (c) to application for 2,000 shares: nil.

1,08,000 was realized on account of allotment (excluding the amount carried form application money) and 2,50,000 on account of call. The directors decided to forfeit shares of those applicants to whom full allotment was made and on which allotment money was overdue.

Pass journal entries in the books of Sangita limited to record the above transaction.

Solution: Journal

52. Alpha Ltd. issued 20,000 Equity shares of 10 each at per payable: On application 2 per share; on allotment 3 per share; on first call 3 per share; on second and final call 2 per share.

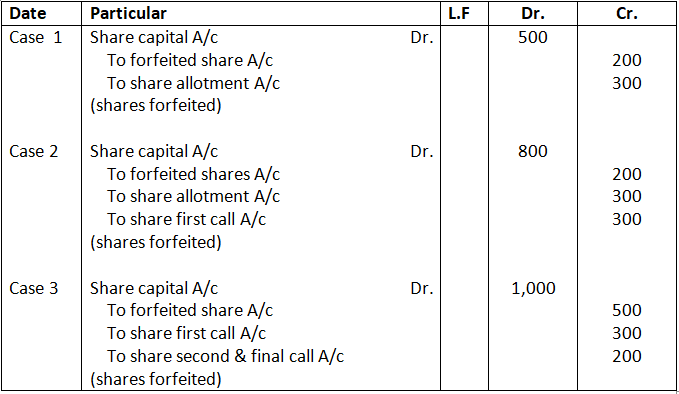

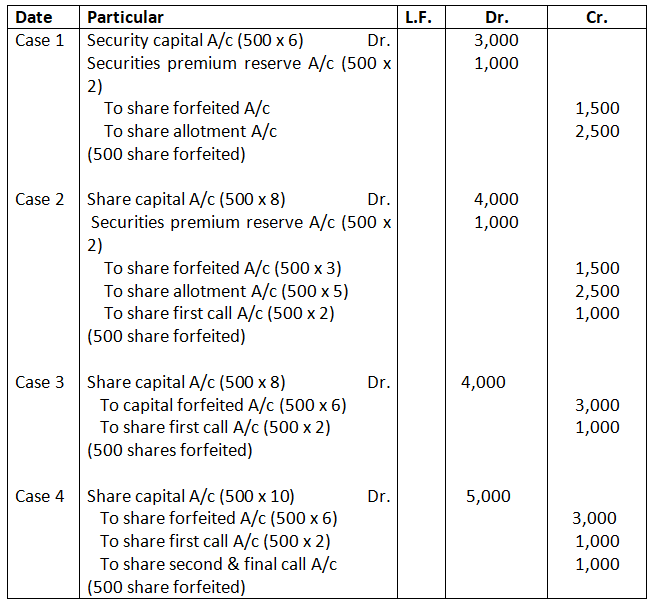

Ganesh was allotted 100 shares. Pass necessary journal entry relating to the forfeiture of shares in each of the following alternative cases:

Case 1. If Ganesh failed to pay the allotment and his shares were immediately forfeited.

Case 2. If Ganesh failed to pay allotment money and on his subsequent failure to pay the first call, his shares were forfeited.

Case 3. If Ganesh failed to pay the first call and on his subsequent failure to pay the second and final call, his shares were forfeited.

Solution: Journal

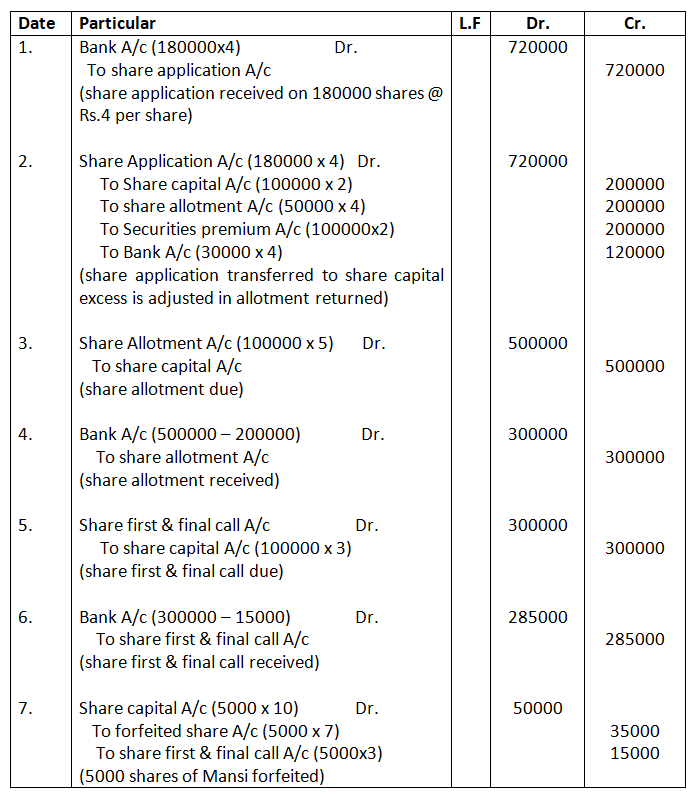

53. Chand Ltd. Invited applications for issuing 1,00,000 equity shares of Rs.10 each at a premium of Rs.2 per share. The amount per share was payable as follows: Rs.4 (including premium) on application, Rs.5 on allotment and balance on first and final call. Applications were received for 1,80,000 shares of which applications for 30,000 shares were rejected and remaining applicants were allotted shares on pro rata basis. Mansi holding 5,000 shares failed to pay first and final call money and her shares were forfeited.

Pass necessary Journal entires for the above transactions in the books of the company.

Solution:-

Calculation of forfeited amount & calls in arrear of Mansi

Forfeited amount = 5000 x 7 = 35000

Calls in arrear = 5000 x 3 = 15000

(first & final call not paid)

Note: securities premium received wholly It call not be forfeited. The Mansi has paid Rs.2 on Application & Rs.5 on Allotment this Rs.7 per share are forfeited.

Forfeiture of share which were issued at premium

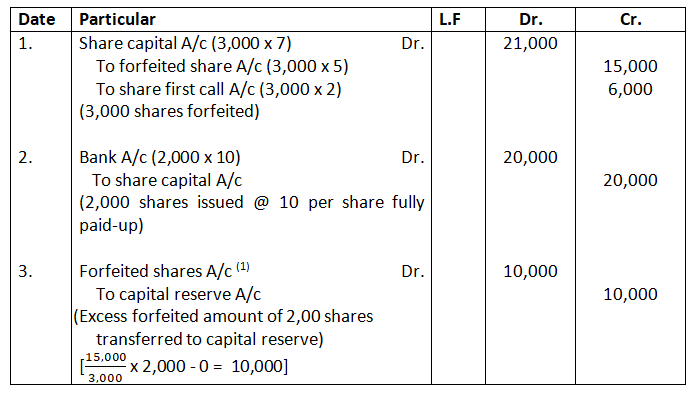

54. Ratan Ltd. forfeited 3,000 shares of ₹10 each (issued at 2 premium) for non-payment of first call of 2 per share. Final call of 3 per share was not yet made. Out of these, 2,000 shares were re-issued at 10 per shares as fully paid. pass entries for forfeiture and reissued of shares.

Solution: Journal

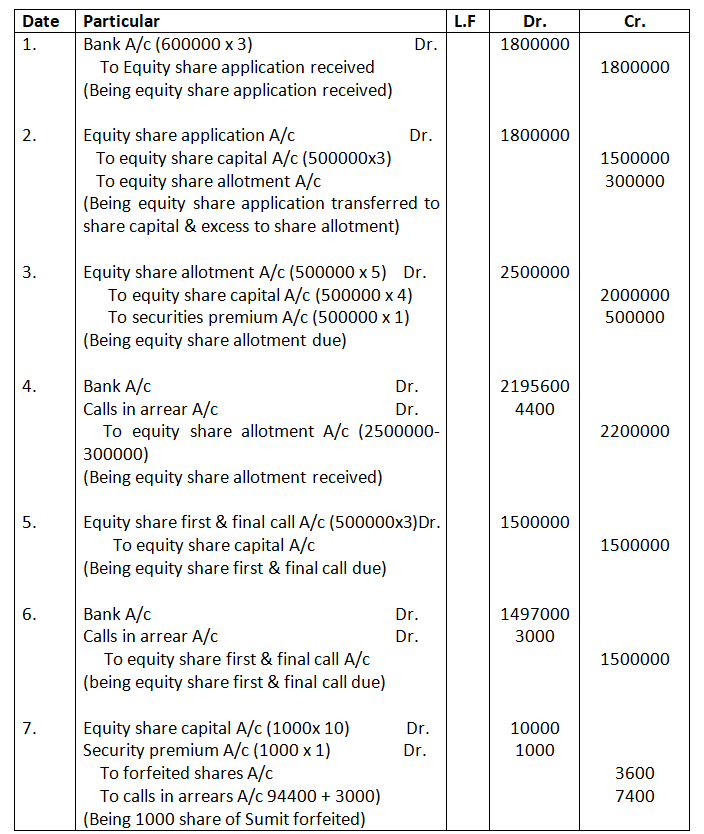

55. Ajanta Ltd. issued a prospectus inviting applications for issuing 5,00,000 equity share of 10 each issued at a premium of 10%. The amount was payable as follows:

On Application 3 per share On Allotment (including premium) 5 per share On first and final call 3 per share

Applications were received for 6,00,000 share and pro rata allotment was made to all applications. Excess money received on application was adjusted towards sums due on allotment. All amounts were duly received except from sumit, who was the holder of 1,000 shares, and failed to pay the allotments and first and final call. His share were forfeited.

pass journal entries for the above transactions in the books of Ajanta Ltd. Open calls-in-Arrears Account wherever necessary.

Solution: BOOKS OF AJANTA LIMITED JOURNAL

Calculation of calls in arrear and forfeited amount of Sumit

Applied shares of Sumit = 600000 / 500000 x 1000 = 1200 shares

Applied received 1200 x 3 = Rs.3600 forfeited amount

Actual application amount 1000 x 3 = Rs.3000

Amount to be used on allotment = Rs.600

Allotment amount to be received (1000 x 5)= Rs.5000

Share capital = 1000 x 4 = 4000

Securities premium = 1000 x 1 = 1000

Securities premium not covered

Allotment amount not received = Rs.4400

First & final call received (1000 x 3) = Rs.3000

56. Ankit ltd. issued 20,000 equity shares of 10 each at a premium of 2 per share, payable as:

On application : 3

On allotment : 5 (including premium)

On first call : 2

On second and final call : 2

Vijay was allotted 500 shares. Pass the necessary journal entries relating to the forfeiture of shares in following cases.

Case – 1. Vijay did not pay allotment money and his shares were immediately forfeited.

Case – 2. Vijay did not pay allotment first call, his shares were forfeited after first call.

Case -3. Vijay did not pay first call and his shares were forfeited immediately.

Case – 4. Vijay failed to pay both the calls and his shares were forfeited.

Solution: Journal

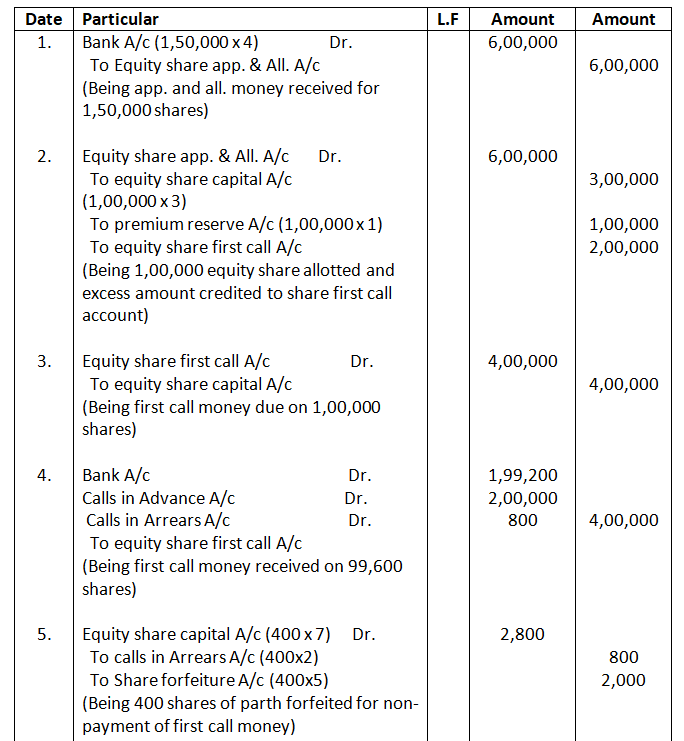

57. Vani Limited inivited application for issuing 1,00,000 equity shares of 10 each at a premium of 10%. The amounts were payable as under:

On Application and Allotment 4 per share (including premium 1)

On first call 4 per share

On second and final call 3 per share.

Application for 1,50,000 shares were received and pro rata allotment was made to all the applications.

Excess application money was adjusted towards sums due on calls. Parth, a shareholder who had applied for 600 shares did not pay the first call. His shares were forfeited. The second and final call was not yet made. Half of the forfeited shares were reissued at 8 per share fully paid-up.

Journalise the above transactions in the books of vani limited by opening calls-in-arrears and calls-in-advance account wherever necessary.

Solution: Journal

In the Books of Vani Ltd. Journal

Calculation of calls in Arrears and forfeited amount of parth

Allotted shares of Path = 1,00,000 /150000 x 600 = 400 shares

Application Amount Received = 600 x 4 = Rs.2400

Actual Application money = 400 x 4 = Rs.1600

Amount to used on first call = Rs.800

First call amount = 400 x4 = Rs.1600

First call amount not received = Rs.800

Forfeited amount of parth = Rs.2400 – (400 x 1 ) Securities premium received

= Rs.2000

Maximum permissible discount and minimum reissue price at the time of reissue

58. Determine the maximum permissible discount and minimum reissue price that a company can allow at the time of reissue of forfeited shares in the following cases;

- A share of 10 originally issued at par on which application and allotment money of 5 was received.

- A share of 10 originally issued at a premium of 1 on which application and allotment money (including premium) of 5 was received.

- A share of 10 originally issued at a premium of 1 on which application and allotment money (excluding premium) of 5 was received.

Solution:

- Maximum permissible discount is equal to the amount before. In this case, 5 has already been received out of 10. Thus, this share can be reissued at a minimum of 5 with a 5 discount per share.

- Maximum permissible discount is equal to the amount received before reissue. in this case, 4 has already been received out of 10. Thus, such a share can be reissued at a minimum of 6 with a maximum 4 discount per share.

- Maximum permissible discount is equal to the amount received before reissue. in this case, 5 has already been received out of 10. Thus, such a share can be reissued at a minimum of 5 with a maximum 5 discount per share.

59. Star ltd issued 10,000 shares of 10 each, payable as 4 on application, 3 on allotment 2 on first call and balance on second and final call.

500 shares were forfeited. Calculate the ‘maximum permissible discount’ and minimum reissue price’ on reissue in each of the following case, if the reissued shares are fully paid-up:

Case 1. If shares were forfeited for non-payment of second and final

call.

Case 2. If shares were forfeited for non-payment of second and final

call.

Case 3. If shares were forfeited for non-payment of allotment, first

call and second and final call.

Case 4. If Shares were forfeited for non-payment of allotment and

first call. Second and final call is not yet made.

Solution:

Case 1: Maximum Permissible Discount- ₹ 9 and Minimum Reissue

Price 1;

Thus maximum permissible discount is always equal to forfeited amount, 4500 i.e. @ Rs.9 per share, minimum reissue price is Rs.1 per share.

Case 2: Maximum Permissible Discount- ₹ 7 and Minimum Reissue

Price 3;

Thus Maximum permissible discount is always equal to forfeited amount, 3500 i.e. @ Rs.7 per share minimum reissue price is Rs.3 per share

Case 3: Maximum Permissible Discount- ₹ 4 and Minimum Reissue

Price 6;

Thus maximum permissible discount is always equal to forfeited amount, 2000 i.e. @ Rs.4 per share, minimum reissue price is Rs.6 per share

Case 4: Maximum Permissible Discount- ₹ 4 and Minimum Reissue

Price 6;

Thus maximum permissible discount is always equal to forfeited amount 2000 i.e. @ Rs.4 per share, minimum reissue price is Rs.6 per share

60. Computer Mart ltd. forfeited 1,000 equity shares of 50 each issued at 10% premium on which allotment money of 15 per equity share (including premium) and first call of 15 per share were not received, the second and final call of 10 per equity share was not yet called.

Calculate ‘Discount allowed or premium received’ and ‘Amount transferred to capital reserve’ on reissue of shares as fully paid-up in each of the following cases:

Case 1. If these shares were reissued as 40 paid-up for 45 per share.

Case 2. If these shares were reissued as 40 paid-up for 45 per share.

Case 3. If these shares were reissued as 40 paid-up for 35 per share.

Case 4. If these shares were reissued as 40 paid-up for 25 per share.

Solution:

Case 1. Premium received – 5,000 and amount transferred to capital

Reserve – 15,000;

Case 2. Discount or premium – Nil and amount transferred to capital

Reserve – 15,000;

Case 3. Discount Allowed – 5,000 and Amount transferred to Capital

Reserve – 10,000;

Case 4. Discount Allowed – 15,000 and Amount transferred to capital

Reserve – Nil;

Case 5. Discount Allowed – 15,000 and Amount transferred to capital

Reserve – Nil;

61. Dell Ltd. forfeited 2,000 Equity shares of 50 each issued at 10% premium on which allotment money of 15 per equity share (including premium) and first call of 15 per share were not received, the second and final call of 10 per equity share was not yet called.

Calculate ‘Discount Allowed or premium Received’ and ‘Amount transferred to capital Reserve’ on reissue of shares as fully paid-up in each of the following cases:

Case 1. If 200 of these shares were reissued as 40 paid-up for 45 per

Share.

Case 2. If 200 of these shares were reissued as 40 paid-up for 45 per

Share.

Case 3. If 200 of these shares were reissued as 40 paid-up for 45 per

Share.

Case 4. If 200 of these shares were reissued as 40 paid-up for 45 per

Share.

Case 5. If 200 of these shares were reissued as 35 per Share as fully

Paid-up.

Solution:

Case 1. Premium received – 1,000 and amount transferred to capital

Reserve – 3,000;

Case 2. Discount or premium – Nil and amount transferred to capital

Reserve – 3,000;

Case 3. Discount Allowed – 1,000 and Amount transferred to Capital

Reserve – 2,000;

Case 4. Discount Allowed – 3,000 and Amount transferred to capital

Reserve – Nil;

Case 5. Discount Allowed – 3,000 and Amount transferred to capital

Reserve – Nil;

Treatment of gain of reissue of Forfeited Shares

62. What amount of gain on reissue will be transferred to capital reserve under following situations?

- 3,000 shares of 10 each of Rakesh were forfeited by crediting 5,000 to Forfeited shares account. Out of these, 1,800 shares were reissued to Mohan for 9 per share as fully paid-up.

- Z Ltd. forfeited 20 shares of 100 each (60 called-up) issued at par to shiv on which he paid 20 per share. Out of these, 15 shares were reissued to Rajesh as 60 paid-up for 45 per share.

Solution:

Case -1

Forfeited amount of 1800 share = 5,000/3,000 X 1800 = 3,000

Amount received on 1800 shares on = 1800 x 9 16,200

Calculation of Amount of capital reserve

Total amount received on 1800 shares = 19,200

Amount to be transferred to share capital

(1800 x 10) = 18,000

Amount to be transferred to capital reserve = 1200

Case- 2

Forfeited amount of 15 share = 400/20 X 15 = 300

Amount received on 15 shares on reissue = 15 x 45 = 675

Calculation of Amount of capital reserve

Total amount received on 15 shares (300 + 675) 975

Amount to be transferred to share capital = 900

Amount to be transferred to capital reserve = 75

Forfeiture and reissue of share which were issued at par

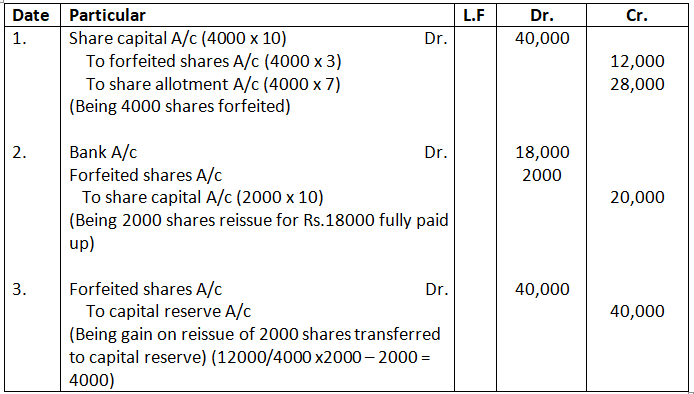

63. A company forfeited 4,000 shares of 10 each fully called-up, on which applications money of 3 each has been paid. Out of these, 2,000 shares was reissued as fully paid-up for 18,000.

Pass necessary Journal entries for above transactions.

Solution:-

Journal

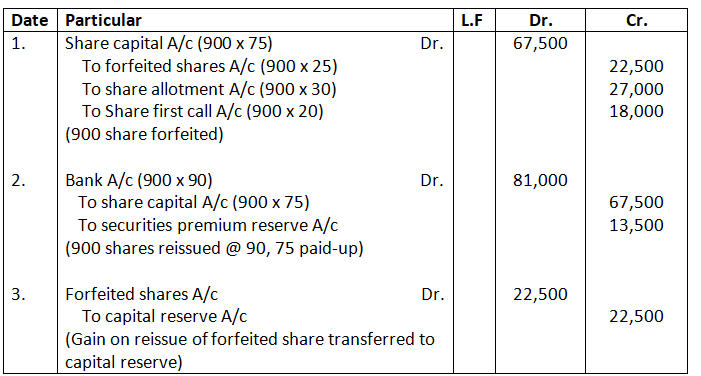

64. Alfa Ltd. forfeited 900 Equity of 100 each for the non-payment of allotment money of 30 per share and the first call of 20 per share. The second and final call of 25 per share has not been mode. The forfeited shares were reissued for 90 per share, 75 paid-up.

Solution: Journal

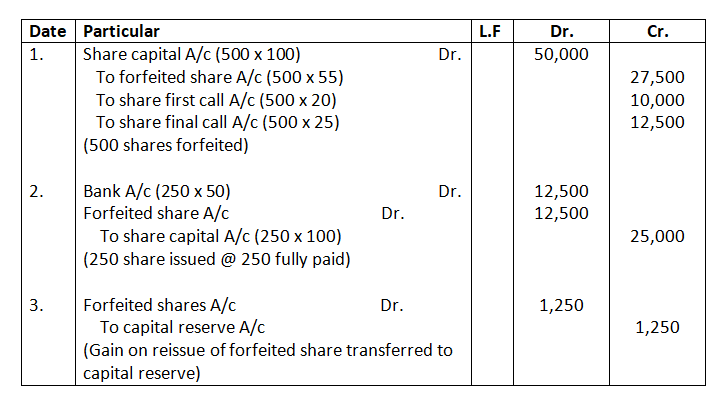

65. Max Ltd. forfeited 500 shares of 100 each for non-payment of first call of 20 per share and final call of 25 per share. 250 of these shares were re-issued at 50 per share fully paid-up.

Pass the necessary journal entries in the books of Max Ltd. for forfeiture and re-issue of shares. Also prepare the share forfeiture Account.

Solution: Journal

Working Notes:

Calculation of capital reserve

Forfeited Amount of 250 share = 27,500/500 x 250 = 13,750

Capital Reserve = 13,750 – 12,500 = 1,250

66. On 1st May, 2023, Moneyplus Ltd. forfeited 200 shares of 20 each, 15 per share called-up, on which 10 per share has been paid A, the amount of the first call of 5 per share being unpaid. Ten days later, the Directors reissued the forfeited shares to B credited as 15 per share paid-up, for a payment of 10 per share. Give journal entries in the company’s books to record the forfeited shares and their reissue.

Solution: Journal

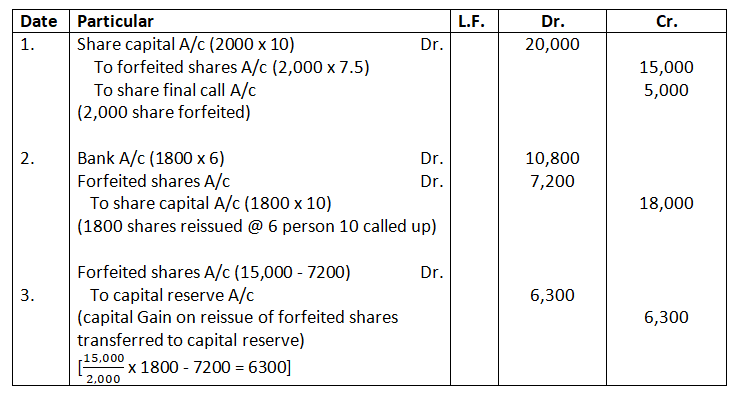

67. The Directors of Maharana Ltd. resolved on 1st may, 2023 that 2,000 equity shares of 10 each, 7.50 paid be forfeited for non-payment of final call of 2.50. On 10th June, 2023, 1,800 of these shares were reissued for 6 per share. Give necessary journal entries.

Solution:

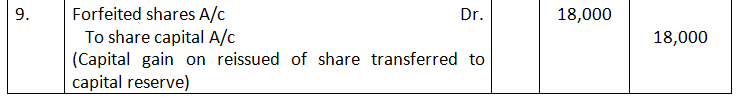

68. Sunshine industries Ltd. issued 20,000 shares of 100 each payable 25 per share on application, 25 per share on allotment and the balance in two calls of 25 each. The company did not make the final call of 25 per share. All the money was duly received with the exception of the amount due on the first call on 400 shares held by Mr. Modi. The Board of Directors forfeited shares and subsequently reissued them @75 per share paid-up for a sum of 28,000.

Solution:

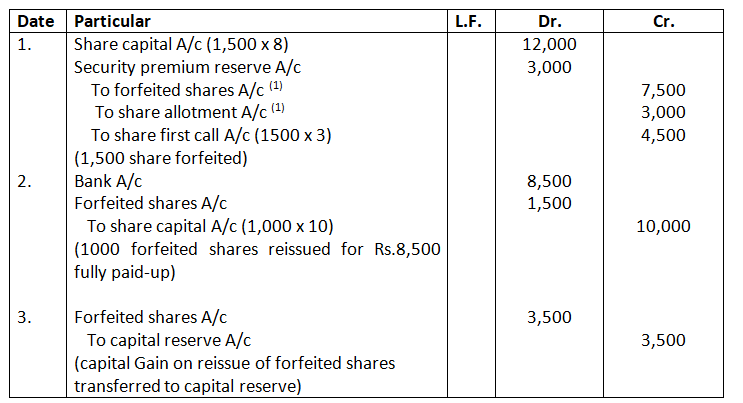

69. R.P Ltd. forfeited 1,500 shares of Rahim of ₹10 each issued at a premium of 3 per share for non-payment of allotment and first call money. Rahim had applied for 3,000 shares. On these shares, amount was payable as follows:

On Application 3 per share,

On Allotment (including premium) 5 per share,

On First call 3 per share,

On Final call Balance.

Final call has not been called up. 1,000 of the forfeited shares were reissued for 8,500 as fully paid-up. Record the necessary journal entries for the above transactions in the books of R.P. Ltd.

Solution:

Working Notes:

Calculation of forfeited amount of Rahim

Amount received of Rahim on application 300 x 3 9,000

Actual amount of Rahim on application 1,500 x 3 4,500

Amount to be used on allotment 4,500

Actual amount of Rahim on allotment 7,500

1500 x 5

Share capital

1500 x 2 1500 (s.p.r) 4,500

= 3,000 received received 7,500

Amount not paid by Rahim on Allotment 3,000

Calculation of forfeited amount of Rahim

Forfeited amount of Rahim = Amount received on Application +

(Amount received on allotment – amount received of security premium reserve)

= 4,500 + (4,500 – 1,500)

= 7,500

Calculation of Amount of Capital Reserve

Fortified amount of 1,000 shares of Rahim = 7,500 /1500 x 1,000

= 5,000

Amount received on 1,000 share on reissue = 8,500

Amount to be transferred to capital reserve =

= [ ( 5,000 + 8,500) – (1,000 x 10)]

= 3,500

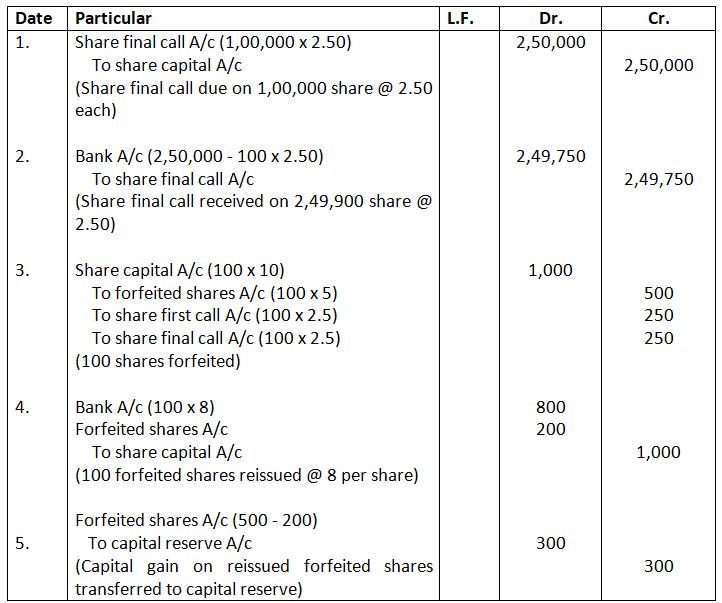

70. The Hindustan Manufacturing Ltd. had a total subscription capital of 10,00,000 in Equity shares of 10 each of which 7.50 were called-up. A final call of 2.50 was made and call amount paid except two calls of 2.50 each in respect of 100 shares held by D. These shares were forfeited and reissued at 8 per share.

Pass necessary journal entries to record the transactions of final call, forfeiture of shares and reissue of forfeited shares. Also, prepare the Balance Sheet of the company.

Solution:

Balance Sheet

Hindustan manufacturing Ltd.

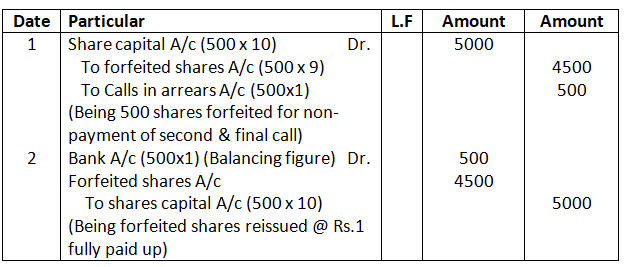

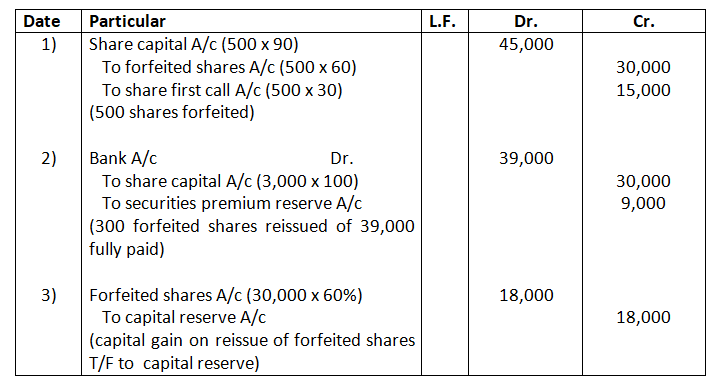

71. Star Ltd. forfeited 500 equity shares of 100 each for non-payment of first call of 30 per share. The final call of 10 per share was not yet made. Out of these, 60% shares were reissued for 39,000 fully paid. Journalize the forfeited and reissue of shares.

Solution:

Working Notes:

Calculation of amount of capital Reserve

Forfeited amount of 300 shares = 30,000 / 500 x 300 = 18,000

Amount of capital Reserve = 18,000

As 300 shares are reissued of securities premium reserve

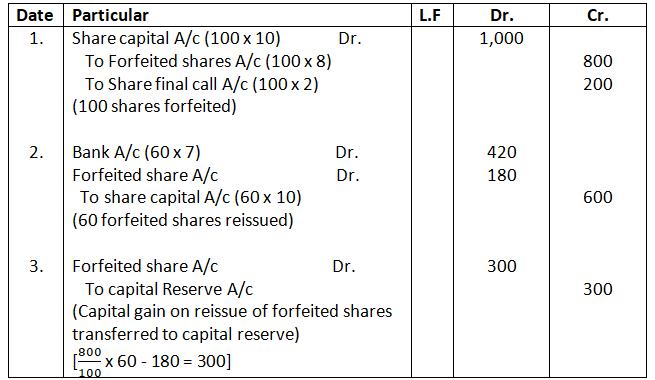

72. Give necessary journal entries.

- The directors of Devendra Ltd. resolved on 1st January, 2010 that 100 equity shares of 10 each, paid-up be forfeited for non-payment of final call of 2. On 1st February, 60 of these shares were reissued @ 7 per share as fully paid-up.

- Virender Ltd. forfeited 20 shares of 100 each (60 called-up) issued at par to Mukesh on which he had paid 20 per share. Out of these, 15 shares were reissued to Sanjeev as 60 paid-up for 45 per share.

Solution

Journal

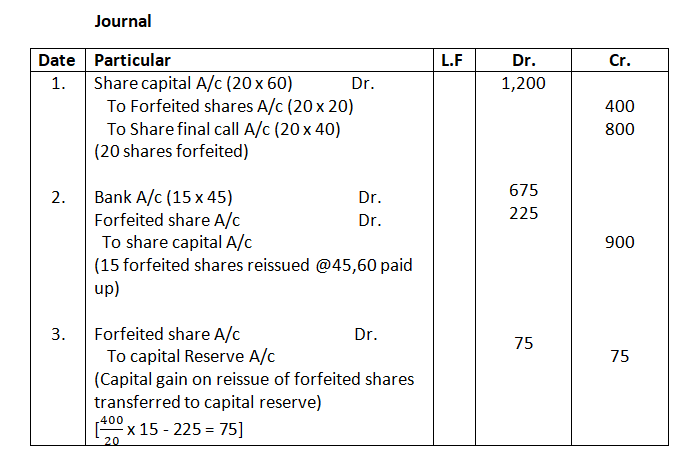

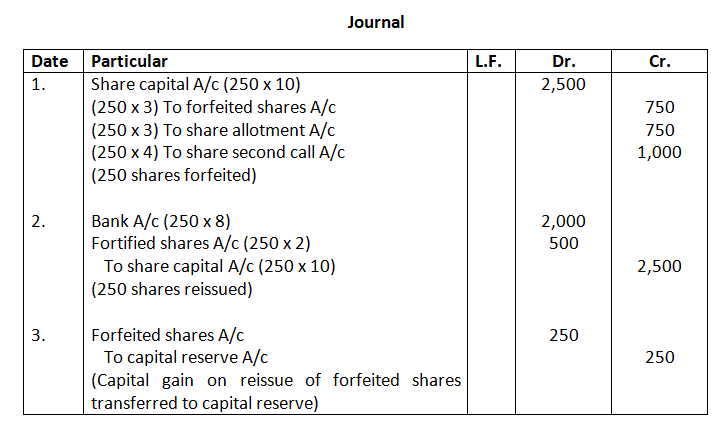

73. Show the forfeited and reissue entries under each of the following cases:

- KBC Ltd. forfeited 300 shares of 10 each, 8 called-up held by Amit for non-payment of second call money of 3 per share. These shares were reissued to Zoly for 10 per share as fully paid-up.

- KK Ltd. forfeited 400 shares of 10 each, fully called-up, held by Bhawna for non-payment of final call money of 4 per share. These shares were reissued to Tarun at 12 per share as fully paid-up.

- Light Ltd. forfeited 250 shares of 10 each, fully called up, held by Chetan for non-payment of allotment money of 3 per share and first and final call money of 4 per share. These shares were reissued @ 8 per share as fully paid-up to prem.

Solution: Journal

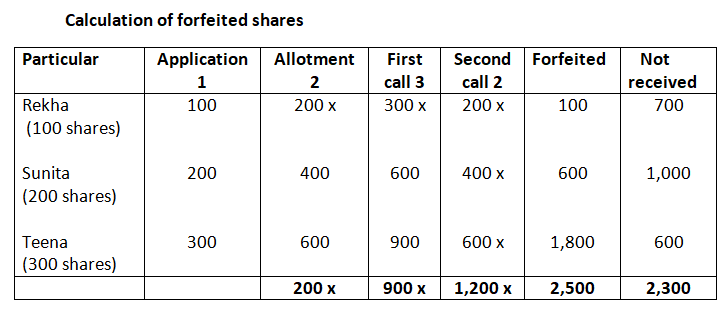

74. Rekha holds 100 shares of 10 each on which she has paid 1 per share on application.

Sunita holds 200 shares of 10 each on which she has paid 1 and 2 per share on application and allotment respectively.

Teena holds 300 shares of 10 each and has paid 1 on application, 2 on allotment and 3 on first call. They all fail to pay their arrears and the second call of 4 per share. Shares are forfeited and subsequently reissued @ 11 per shares as fully paid-up.

journalize the above.

Solution:

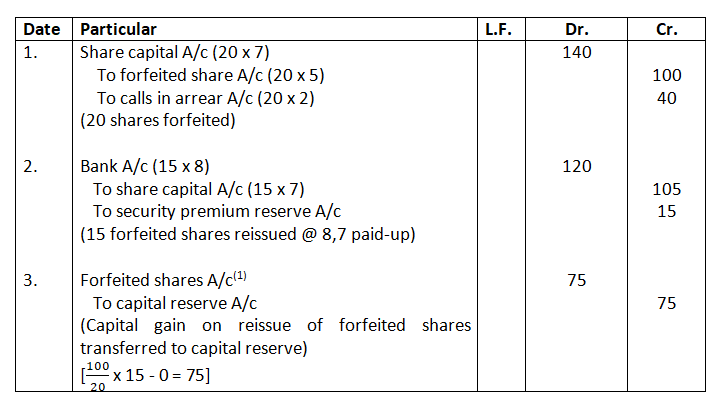

75. Record the journal entries for forfeiture and reissued of shares in the following cases:

- Basak Ltd. forfeited 20 shares of 10 each, 7 called-up on which the shareholder had paid application and allotment money of 5 per share. Out of these, 15 shares were reissued to Naresh as 7 per share paid-up for 8 per share.

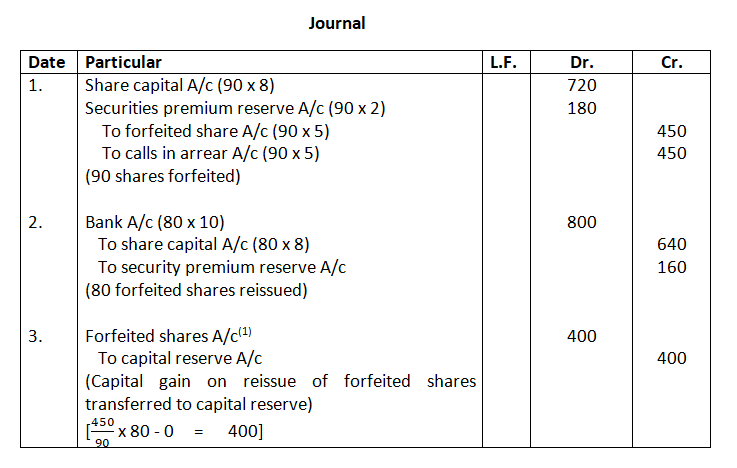

- Y Ltd. forfeited 90 shares of 10 each, 8 called-up issued at a premium of 2 per share to ‘R’ for non-payment of allotment money of 5 per share (including premium). Out of these, 80 shares were reissued to Sanjay as 8 called-up for 10 per share.

Solution:

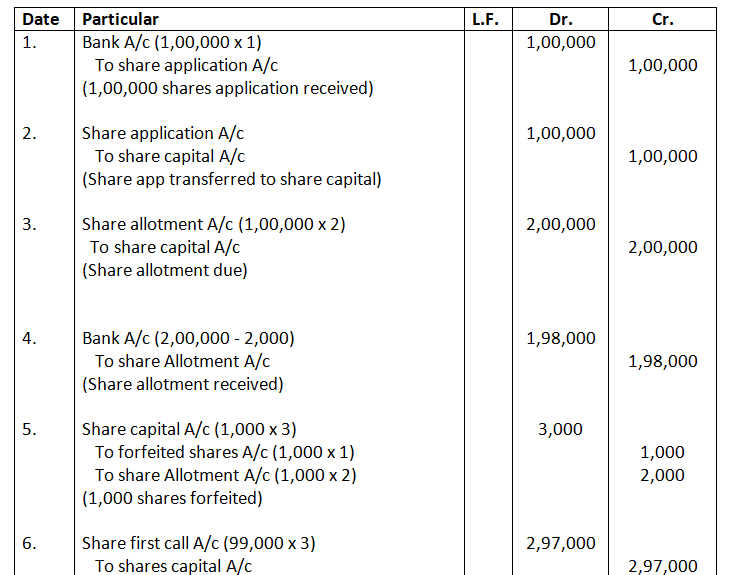

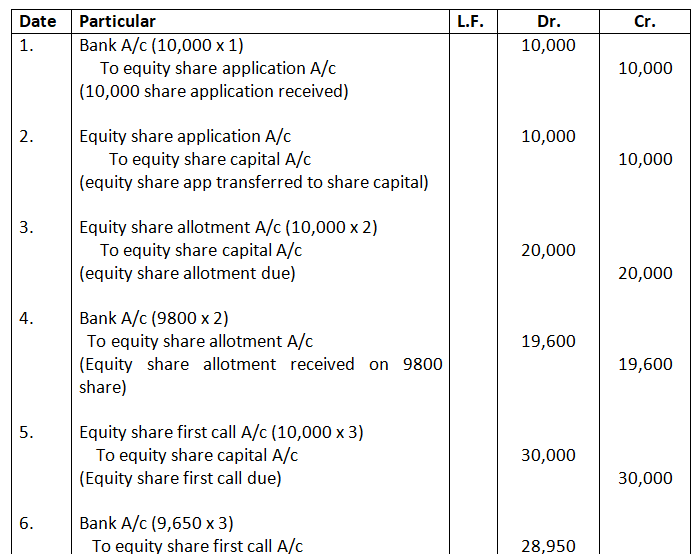

76. Jain Ltd. invited applications for issuing 1,12,000 equity shares of 10 each at par. The amount per share was payable as follows:

On Application 1

On Allotment 2

On first call 3

On second and final call 4

Application for 1,00,000 shares were received. Share were fully allotted to all the application. Ramesh failed to pay his allotment money which was 2,000. His shares were forfeited immediately. Suresh did not pay the first call on 500 shares applied by him. His shares were forfeited after the first call. The forfeited shares of Ramesh and Suresh were reissued at 9 per share fully paid-up. Afterwards the second and final call was and was duly received.

Pass necessary journal entries for the above transactions in the books of jain Ltd.

Solution: Journal

77. Slow & Steady Ltd. invited application for allotment of 10,000 Equity shares of 10 each from public. The amount of these shares was payable as:

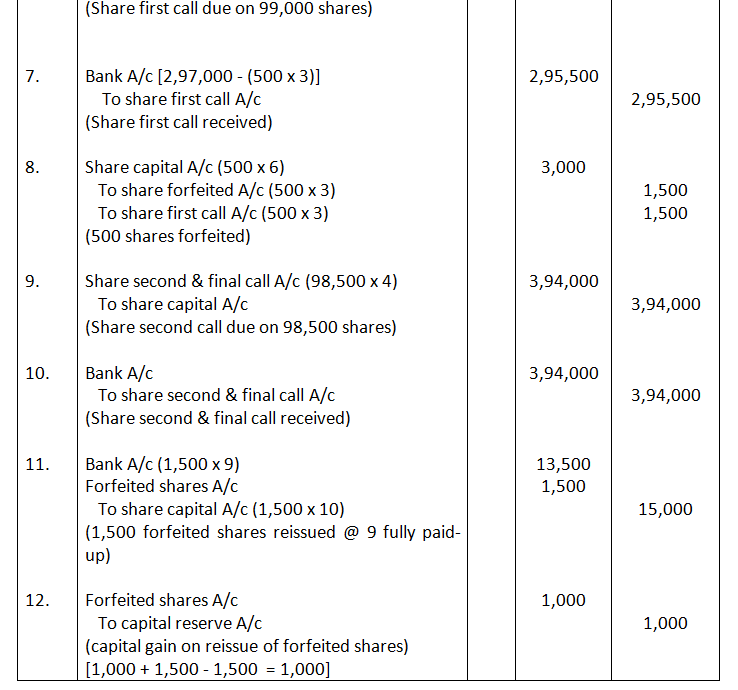

On application 1 per share, on allotment 2 per share, on first call 3 per share and on second and final call 4 per share.

Amount payable on application, allotment and calls were duly received with the following exceptions.

- A, who held 200 shares, failed to pay the money on allotment and calls.

- B, to whom 150 shares were allotted. failed to pay the money on first call and final call.

- C, who held 50 shares, did not pay the amount of second and final call.

The shares of A, B and C were forfeited and were subsequently reissued for cash as fully paid-up at a discount of 5%.

Pass necessary journal entries to record these transactions in the books of the company.

Solution:

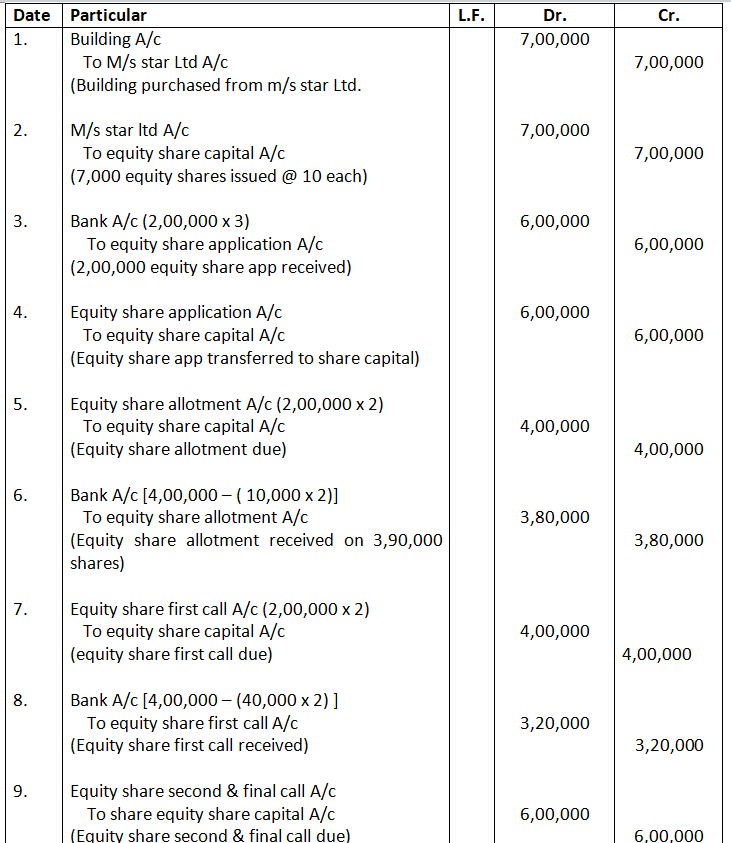

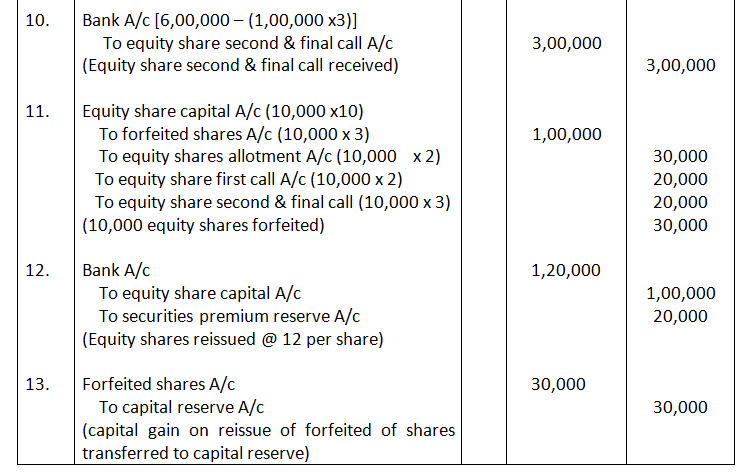

78. ‘Venus Ltd’ was registered with a n authorized capital of 40,000 divided into 4,00,000 equity shares of 10 each. 70,000 of these shares were issued as fully paid to ‘M/s. Star Ltd.’ for building purchase from them. 2,00,000 shares were issued to the public and the amounts were payable as follows:

On Application – 3 per share

On Allotment – 2 per share

On First call – 2 per share

second and final call – 3 per share

The amounts received on these shares were as follows:

On 1,00,000 – Full amount called

On 60,000 – 7 Per share

On 30,000 – 5 per share

On 10,000 – 3 per share

The directors forfeited 10,000 shares on which only 3 per share were received. These shares were reissued at 12 per share fully paid. pass necessary journal entries for the above transactions in the books of Venus Ltd.

Solution:

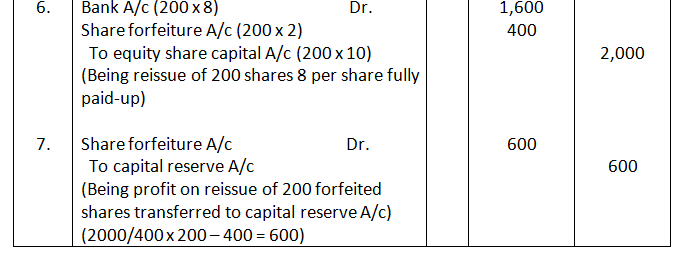

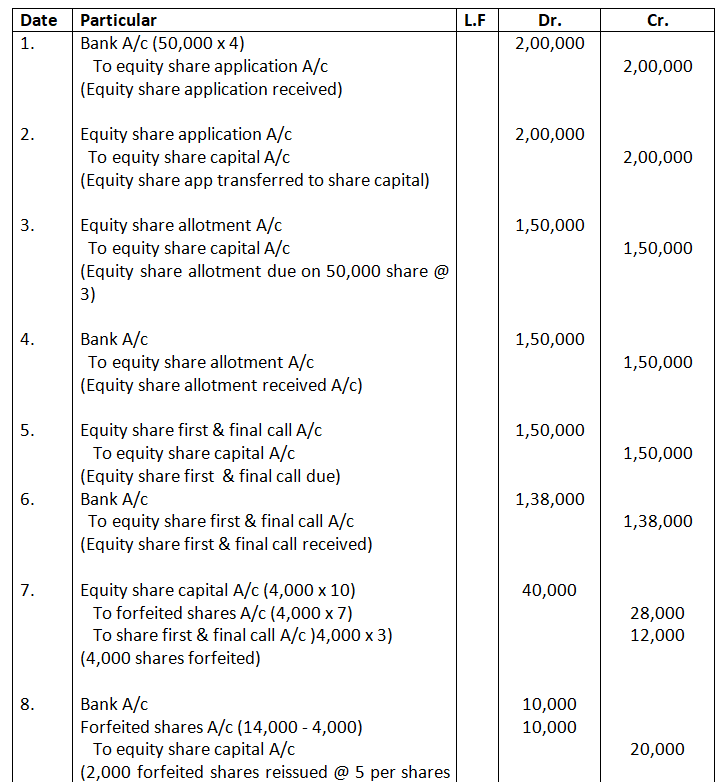

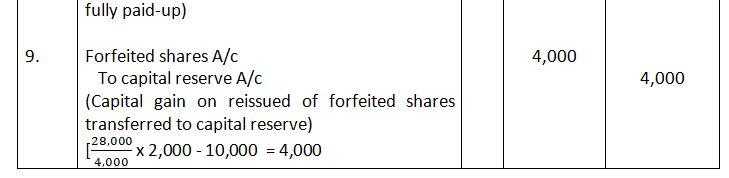

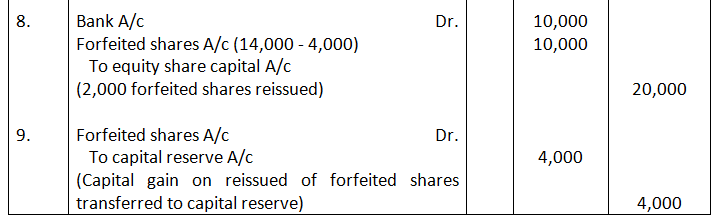

79. Kwality Hospitality Ltd. incorporated with authorized capital of 10,00,000, 1,00,000 equity shares of 10 each, issued 50,000 equity shares for subscription payable 4 on application, 3 on allotment and balance as first and final call. The shares were subscribed, and due amounts were received except first and final call on 4,000 shares. These shares were forfeited. Later, half the share were reissued as fully paid-up and 4,000 were transferred to capital reserve.

Pass the journal entry for reissue of shares.

Solution:

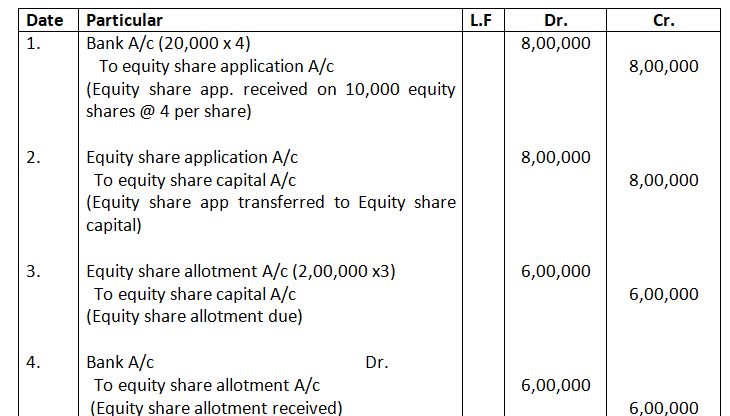

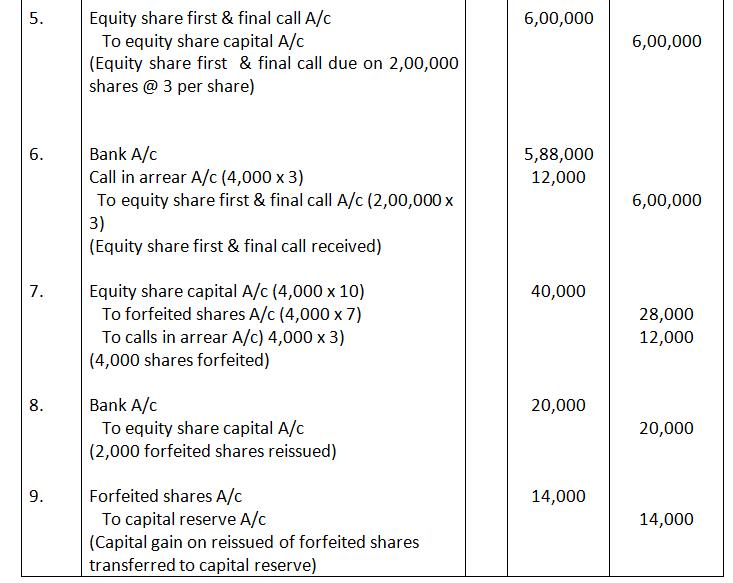

80. Park Hospitality Ltd. incorporated with authorized capital of 15,00,000 1,50,000 equity shares of 10 each, issued 50,000 equity shares for subscription payable 4 on application, 3 on allotment and balance as first and final call. The shares were subscribed, and due amounts were received except first and final call on 4,000 shares held by Pawan. Rakesh holding 2,000 share paid call on his share along with allotment money. Share of Pawan were forfeited. Later, half the share wee reissued as fully paid-up and 4,000 were transferred to capital Reserve. Pass the journal entry for reissue of shares.

Solution:

81. Grofers Ltd. having authorized capital of 25,00,000, issued 2,00,000 equity shares of 10 each for subscription payable 4 on application, 3 on allotment and balance on first and final call. The share were subscribed, and due amounts were received except first and final call on 4,000 shares held by Rana. These shares were forfeited. Later, half the share were reissued as fully paid-up and 14,000 were transferred to capital reserve pass the journal entry for forfeiture and reissue of shares.

Solution: Journal

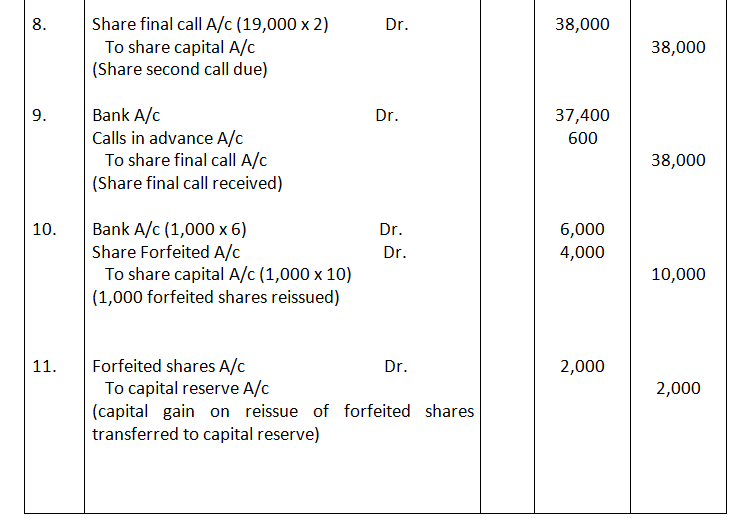

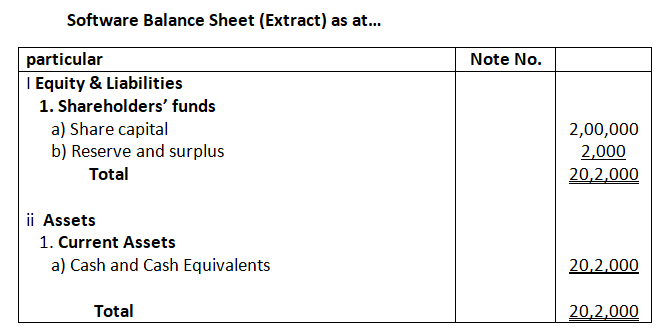

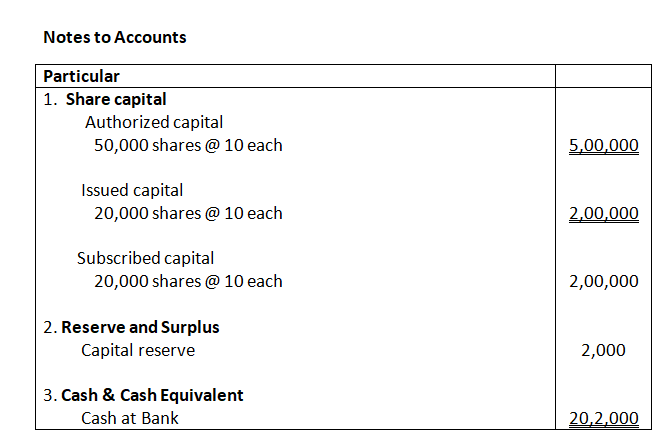

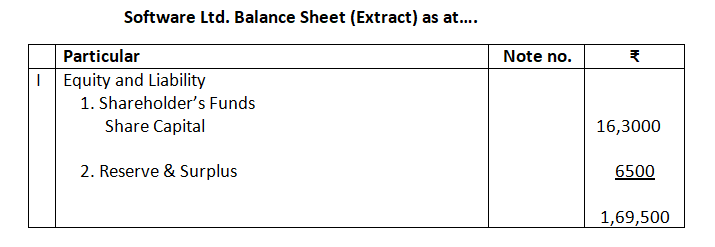

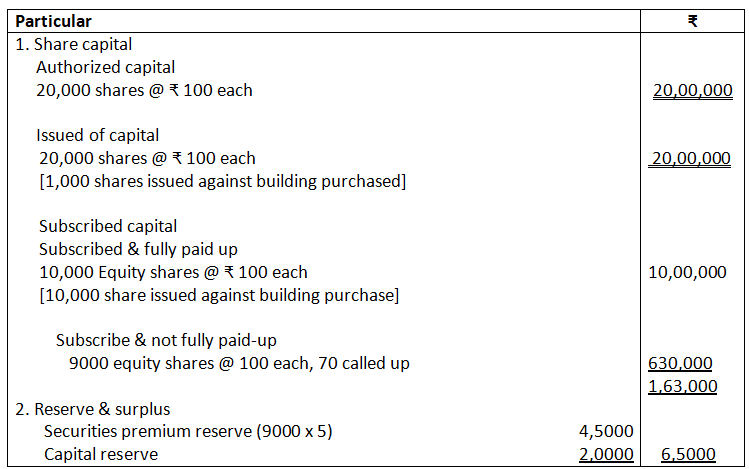

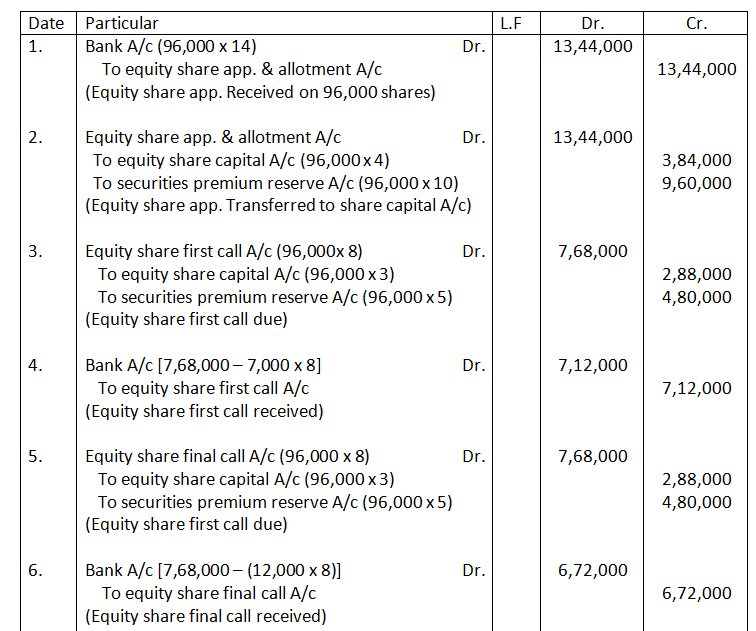

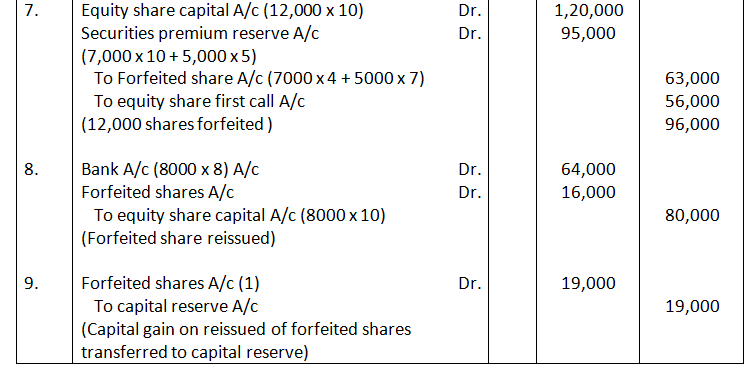

82. Software Ltd. company with registered capital of 5,00,000 in shares of 10 each issued 20,000 of such shares. Payable 2 on application, 4 on allotment, 2 on first call and 2 on final call. All the money payable on allotment was received but on the first call being made, one shareholder paid the entire balance on his holding of 300 shares and five shareholders with a total holding of 1,000 shares did not pay their dues on the first call. These shares were forfeited for non-payment of first call money. Final call was made and all the money due was received. Later on, forfeited shares were reissued @ 6 per share as fully paid-up.

Record the above in the company’s journal and prepare the Balance Sheet.

Solution:

Forfeiture and Reissue of Shares which Issued at Premium

83. A share of 100 issued at a premium of 10 on which 80 (including premium) was called and 60 (including premium) was paid, has been forfeited. This share was afterwards reissued as fully paid-up for 70. Give journal entries to record the above.

Solution: Journal

84. Pass Journal entries in the following cases:

NK Ltd. forfeited 200 equity shares of 10 each, issued at a premium of 5 per share, held by Ram for non-payment of the final call of 3 per shares. Of these, 100 share were reissued to Vishu at a discount of 4 per share.

Solution: Journal

85. The Directors of a company forfeited 300 shares of 10 each issued at a premium of 3 per share, for the non-payment of the first call money of 2 per share. The final call of 2 per share has not been made. Half the forfeited shares were reissued at 1,500 as fully paid-up. Record the journal entries for the forfeiture and reissue of shares.

Solution: Journal

86. JJK Ltd. forfeited 100 shares of 10 each (8 called-up) issued at a premium of 2 per share to Rahul on which he had paid application money of 5 per share, for non-payment of allotment money of 5 per share (including premium). Out of these, 70 shares were reissued to Sanjay for 7 per shares as 8 called-up for 7 share. Give necessary journal entries relating to forfeiture and reissued of shares.

Solution: Journal

87. 150 shares of 10 each issued at a premium of 4 per share payable with allotment were forfeited for non-payment of allotment money of 8 per share including premium. The first and final call of 4 per share Pass journal entries in the books of X Ltd. for the above.

Solution: Journal

88. JCV Ltd. forfeited 200 shares of 10 each issued at a premium of 2 per share for the non-payment of allotment money of 3 per share (including premium). The first and final call of 4 per share has not been made as yet. 50% of the forfeited shares were reissued at 8 per share as fully paid-up. Pass necessary journal entries for the forfeiture and reissue of shares.

Solution: Journal

89. Pass necessary journal entries in the books of the company for the following transaction:

Vishesh Ltd. forfeited 1,000 Equity shares of 10 each issued at a premium of 2 per share for non-payment of allotment money of 5 per share including premium. The final call of 2 per share was not yet called on these shares. Of the forfeited share 800 shares were reissued at 12 per share as fully paid-up. The remaining shares were reissued at 11 per share fully paid-up.

Solution: Journal

90. Gaurav applied for 5,000 shares of 10 each at a premium of 2.50 per share. But he was allotted 2,500 shares on pro rata basis. After having paid 3 per share on application, he did not pay allotment money of 4.50 per share (including premium) and on his subsequent failure to pay the first call of 2 per share, his shares were forfeited These share were reissued at the rate of 8 per share credited as fully paid.

Pass journal entries to record the forfeiture and reissue of shares.

Solution: Journal

Working Note:

Calculation of Amount unpaid on Allotment

Amount received on application (5000 x 3) = 15,000

Less: Amount adjusted on application (2500 x 3) = 7,500

Excess amount received on application = 7,500

Amount due on allotment (2,500 x 4.5) = 11,250

Amount unpaid on allotment = 3,750 (11,250 – 7,500)

Note:

Rs.7500 received on application will be transferred to allotment, but first of all we have to transfer such amount to Capital A/c and rest would be transferred to Securities Premium A/c. Capital on allotment is Rs.5,000 (2,500 x 2) that is fully received and balance amount of advance Rs.2500 will be transferred to Securities Premium A/c. So, amount of premium unpaid is Rs.3,750 (2,500 x 2.5 – 2,500)

91. Amal had applied for 7,000 shares of 10 each at a premium of 5 per share. He was allotted 4,000 share on pro rata basis. After having paid 3 per share on application, he did not pay allotment money of 7 per shares (including premium) and on his subsequent failure to pay the first call of Rs.3 per share his share were forfeited calls not received were transferred to calls-in-Arrears Account. These shares were reissued at the rata of 8 per share credited as fully paid.

Pass journal entries to record the forfeited and reissue of shares.

Solution: Journal

Working Note:

Calculation of calls in arrear amount of Amal

Application money received on 7,000 share (7000 x 3) = 21,000

Actual application money on 4,000 share (4000 x 3) = 12,000

Excess application to be used on allotment 9,000

Actual amount of allotment on 4,000 share (4000 x 7) 28,000

Share Capital = 4,000x 2

= 8,000

Securities premium reserve = 4,000 x 5

= 20800

Received Securities premium reserve = 1,000

Amount not received on allotment 19,000

Amount not received on first call (4,000 x 3) = 12,000

Total amount of calls in arrear 31,000

Calculation of forfeited amount of Amal

Forfeited amount of Amal = Total amount received – securities premium received

= 21,000 – 1,000

= 20,000

92. Pass necessary Journal entries for forfeiture and reissue of shares in the following cases:

- Neon Ltd. Forfeited 2,000 shares of Rs.10 each issued at a premium of Rs.2 per share for non-payment of allotment money of Rs.5 per share (including premium). The first and final call of Rs.2 per share was not yet made. Out of these, 1,500 shares were reissued at Rs.7 per share, Rs.8 paid-up.

- Mamta Ltd. Forfeited 3,000 shares of Rs.10 each on which the first call of Rs.3 per share was not received. The second and final call of rs.1 per share was not yet called. Out of these, 2,000 shares were reissued at Rs.9 per share, Rs.9 paid-up.

Solution:-

Case – 1

Case – 2

93. Telecom Ltd.’ issued 20,000 Equity Shares of 10 each at a premium of 5 per share, payable as: 7 (including premium) on application, ₹ 5 on allotment and the balance after three months of allotment. A shareholder to whom 200 shares were allotted failed to pay the allotment and call money and his shares were forfeited. 160 of the forfeited shares were reissued for ₹ 1,600. Give necessary entries in company’s Journal and the Balance Sheet.

Solution: Journal

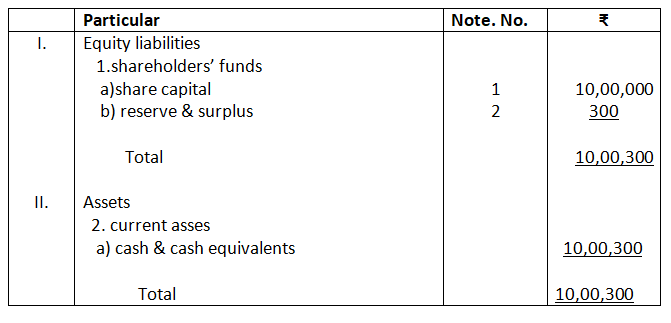

94. Healthy Foods Ltd. had authorized capital 50,00,000, 5,00,000 equity shares of 10 each issued 3,75,000 equity shares for subscription at a premium of 20% payable 4 on application, 5 on allotment and balance as first and final call. The shares were subscribed, and due amount were received except allotment money on 25,000 shares. These shares were forfeited. Later these shares were reissued at 7 paid-up and 50,000 were transferred to capital Reserve. First and final call was demanded from the shareholders and was received except on 10,000 which was transferred to Calls-in-Arrears Account.

Pass the journal entries for forfeiture, reissue of forfeited shares and first and final call.

Solution: Journal

95. Panasonic Ltd. was formed on 1st April, 2024 with an authorized capital of 20,00,000, divided into 20,000 Equity shares of 100 each. 10,000 shares were issued as fully paid to the vendors of building for payment of the purchase consideration. The remaining 10,000 shares were offered for public subscription at a premium of 5 per share payable as:

On Application 10 per share.

On Allotment 25 per share (including premium),

On first call 40 per share,

On Final call 30 per share.

Application were received for 9,000 shares which were dully allotted and the allotment money was received in full. At the time of the first call, a shareholder who held 1,000 shares failed to pay the first call money and his shares were forfeited. These shares were reissued @ 60 per share, 70 per share paid-up. Final call has not been made.

You are require to (I) give necessary journal entries to record the above transactions (ii) Show how share capital would appear in the Balance Sheet of the company.

Solution: Journal

Note to Accounts

96. Sukanya Ltd. invited application for issuing 1,00,000 equity shares of 10 each. The share were issued at a premium of 20 per share. The amount was payable as follows:

On Application & Allotment 14 per share (including premium of 10),

On first call 8 per share (including premium of 5),

On Final call 8 per share (including premium of 5)

Application for 96,000 shares were received. Rohit, a shareholder holding 7,000 shares, failed to pay both the calls and Namit, a holder of 5,000 shares, did not pay the final call.

Shares of Ronit and Namit were forfeited. Of the forfeited shares, 8,000 shares including all the shares of Rohit were reissued to Reena at 8 per share fully paid up.

Pass necessary journal entries for the above transactions in the books of Sukanya Ltd.

Solution: Journal

Working Note:-

Calculation of Capital Reserve

Forfeited amount of reissued share

Forfeited amount of Namit reissued 1000 shares = 35,000 / 5,000x 1,000

= 7,000

Forfeited amount of Rohit reissued 7000 shares = 28,000

(7,000 x 4)

Forfeited amount of reissued 8,0000 shares ₹ 35,000

Capital Reserve = 35,000 – 16,000 = 4 ₹ 19,000

97. Abhipra Ltd. invited applications for issuing 1,00,000 equity shares of 10 each. The share issued at a premium of 20 per share. The amount was payable as follows:

On Application 14 per share (including premium of 10),

On Allotment 8 per share (including premium of 5)

On First & Final call 8 per share (including premium of 5).

Application for 90,000 shares were received. Paresh, a shareholders holding, 5,000 shares, did not pay the allotment money and call. While Dharam, holder of 3,000 shares, did not pay the call. Shares of Paresh and Dharam were forfeited. Of the forfeited share, 5,000 shares including 3,000 shares of Paresh and 2,000 shares of Dharam were reissued to Parul at 8 per share as fully paid-up.

Pass necessary journal entries for the above transactions in the books of Abhipra Ltd.

Solution: Journal

Determination of Amount Realized from Reissue of shares

98. Ratan Ltd.’ Forfeited 1,000 shares of 10 each for non-payment of first and final call of 2 per share. Then share were reissued and gain on reissue transferred to capital reserve was 5,000. Determine the amount realized from reissue of shares.

Solution

Share capital a/c Dr. 7000

To share forfeited a/c 5000

To call in arrear a/c 2000

(being 1000 share forfeited on which 8 was called and not pay 2 per share)

99. ‘Swasth Ltd.’ forfeited 2,000 shares of 10 each for non-payment of final call of 3 per share. 1,500 of these share were reissued and gain on reissue transferred to capital reserve was 7,500. Determine the amount realized from reissued of shares.

Forfeiture and Reissue of Shares which were Allotted on pro rata

Solution:-

Amount realized on reissued of shares Rs.12000

Forfeiture and reissue of share which were allotted on pro-rata

100. Arvind Ltd. issued 20,000 shares of 10 each at a premium of 2 per share payable as:

On Application 6

On Allotment 3 (including premium),

On first call 2

On second & Final call 1

Application were received for 30,000 shares. Application for 6,000 shares were rejected and pro rata allotment was made to the remaining applicants.

Abhay, who was allotted 500 shares failed to pay allotment money and on his subsequent failure to pay the first call his shares were forfeited. Of these, 300 shares were reissued as fully paid-up for 6 per share.

Journalize the transaction to record the forfeited and reissue of shares.

Solution: Journal Entry

Calculation of excess amount used in allotment & returned.

Applied Allotted

30000 – 20000

6000 – Returned

24000 – 20000

Application received 30,000 x 6 = Rs.180,000

Actual application 20,000 x 6 = Rs.120,000

Excess Application amount = Rs.60,000

Rejected application amount (6000×6) = 36,000

Amount to be used on allotment = Rs.24,000

Calculation of calls in arrear & Forfeited amount of Abhay

Applied shares of Abhay = 24,000 /20,000 x 500 = 600

Application amount received = 600 x6 = Rs.3600

Actual application money = 500 x6 = Rs.3000

Excess application money to be used on allotment = 600

Actual allotment amount = 500 x 3 = 1500

500 x 1 = 500 500 x 2 = 1000

(share capital covered) (Securities premium)

Received Rs.100

Securities premium not round = 900

Out of excess amount, first share capital is covered, if amount remain, securities premium is also covered here 100 securities premium is supposed to received.

Allotment amount not received = 900

First call amount not received (500×2) = 1000

Total calls in arrear = (1000 + 900) = 1900

Forfeited amount = amount reissued – securities premium received

= 3600 – 100

= 3500

101. Alfa Ltd. invited applications for issuing 75,000 equity shares of 10 each. The amount was payable as follows:

On Application Allotment 4 per share

On first call 3 per share

On second & Final call Balance

Applications for 1,00,000 shares were received. Shares allotted to all the application on pro rata basis and excess money received with applications was transferred towards sums due on first call. Vibha who was allotted 750 shares failed to pay the first call. Her shares were immediately forfeited. Afterwards the second call was made. The amount due on second call was also received except on 1,000 shares applied by monika. Her shares were also forfeited. All the forfeited shares were reissued to Mohit for 9,000 as fully paid-up. Pass necessary journal entries in the Books of Alfa Ltd. for the above transactions.

Solution: Journal

Working Note:

Calculation of Amount of vibha

Application received on application 1000 x 4 = 4,000

Actual money received on Application 750 x 4 = 3,000

Money to be used on allotment 1000

Allotment money of vibha (750 x 3) = 2,250

Amount not paid on allotment 1,250

Forfeited Amount of Vibha = 4,000

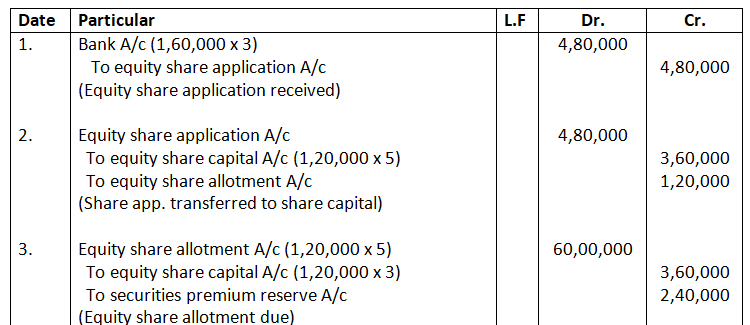

102. Himalya Company received Limited issued for public subscription 1,20,000 equity shares of 10 each at a premium for 2 per share payable as under:

On Application 3 per share

On Allotment (including premium) 5 per share,

On first call 2 per share

On second & Final call 2 per share.

Applications were received for 1,60,000 shares. Allotment was made on pro rata basis. Excess money on application were adjusted against the amount due on allotment.

Rohan to whom 4,800 shares were allotted, failed to pay for the two calls. These shares were subsequently forfeited after the second call was made. All the shares forfeited were reissued to Teena as fully paid at 7 per share.

Recored journal entries and show the transactions relating to share capital in the company’s Balance Sheet.

Solution: Journal

Himalya campany Ltd..

Balance Sheet (extract) as at…

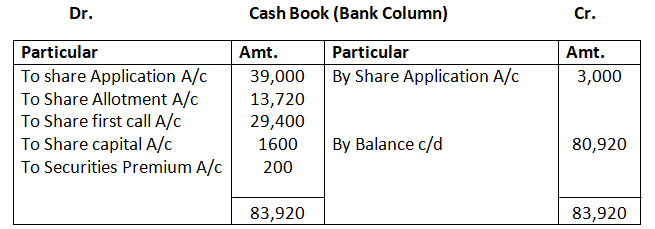

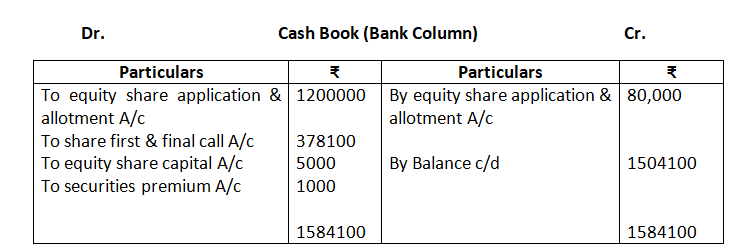

103. Visa Ltd. Offered 10,000 shares of Rs.100 each payable as follows: on application : Rs.3, on allotment : Rs.2, on first call : Rs.3, on second call : Rs.2. Public applied for 13,000 shares. Shares were allotted on pro rata to the applicants of 12,000 shares. All the shareholders have paid the amount up to allotment except Mohan, the allottee of 200 shares. His shares were forfeited. First call was then made. Forfeited shares were reissued @ 9 per share, 8 called-up. Second call has not yet been made. You are required to make the Cash Book and pass the Journal entries.

Solution:-

Working Notes :-

Applied – Allotted

13,000 10,000

- 12000 10,000

- 1000 Nil

Application – Rs.3 per share

Allotment – Rs.2 per share

First call – Rs.3 per share

Second call – Rs.2 per share

Calculation of forfeited amount and calls in arrear of Mohan

Applied shares of Mohan= 12000 / 10000 x 200 = 240

Application amount received (240 x 3) = 720

Actual Application amount (200 x 3) = Rs.600

Excess application to be used on allotment = 120

Actual allotment amount (200 x 2) = 400

Allotment amount not paid by Mohan = 280

Forfeited amount of Mohan = 720

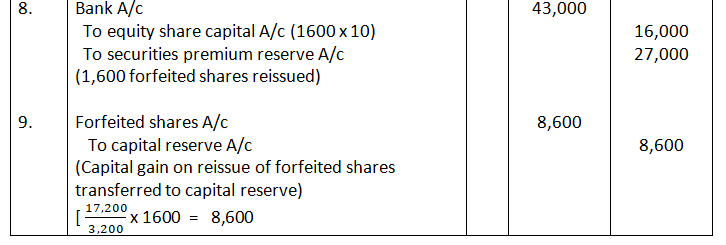

104. SaReGaMa Ltd. invited applications for issuing 80,000 equity of 100 each at a premium of 10. The amount was payable as follows:

On Application – 30

On Allotment – 30(including a premium of 10)

On First call – 30

On Final call – Balance.

Applications of 1,20,000 shares were received. Allotment was made on pro rata basis to all applicants. Excess money received on application was adjusted on sums due on allotment. Dhwani, who was allotted 1,600 shares, failed to pay allotment money and Sargam who applied for 6,000 shares did not pay first call money. These shares were forfeited immediately after first call. 2,000 of these shares (including all shares of Dhwani were issued to Tarang for 95 per share as 80 paid-up. Pass necessary journal entries in books of Saregama Ltd., by opening Calls-in-arrear and Call-in-advance Accounts, if final call has not been made.

Solution: Journal

Working Notes:

Calculation of forfeited Amount of Dhawant

Applied Share of Dhwant = x 1600

= 2400

Application amount received on 2400 share (2400 x 30) = 72,000

Actual amount on Application = 1600 x 30 = 48,000

24,000

Allotment amount (1600 x 30) = 48,000

Allotment amount not paid 24,000

Forfeited amount of Dhawani = 72,000

105. XYZ, Ltd. is registered with an authorized capital of 2,00,000 dividend into 2,000 shares of 100 each of which, 1,000 shares were offered for public subscription at a premium of 5 per share, payable as:

On Application – 10 per share

On Allotment – 25 per share (including premium)

On First call – 40

On Final call – 30 per share.

Applications were received for 1,800 shares, of which applications for 300 shares were rejected outright; the rest of the applications were allotted 1,000 shares on pro rata basis. Excess application money was transferred to allotment.

All the money was duly received except form sunder, holder of 100 shares, who failed to pay allotment and first call money. His share were later forfeited and reissued to Shyam at 60 per share 70 paid-up. Final call has not been made.

Pass necessary journal entries and prepare cash book in the books of XYZ Limited.

Solution: Journal

Working Notes:-

Calculation of forfeited amount of Sundar

Applied shares of Sundar = x 100 = 150

Application received on 150 shares (150 x 100 = 1,500

Actual Application money (100 x 10) = 1,000

Excess Application to be used on Allotment 500

Actual Allotment money to be received (100 x 25) 2,500

Allotment amount not paid by Sundar 2,000

Forfeited amount of Sundar = 1,500

106. Janta Ltd. Issued applications for 5,00,000 equity shares of Rs.10 each, at a premium of Rs.4 per share. The amount was payable as follows:

On application Rs.6 (including Rs.2 premium), on Allotment Rs.6 (including Rs.2 premium) and Balance on first and final call.

Applications for 7,50,000 shares were received. Allotment was made to all the applicants on pro rata basis. Mohan to whom 1,000 shares were allotted did not pay allotment and call money. Vikram to whom 500 shares were allotted, did not pay the call money. These shares were forfeited and afterwards reissued @ Rs.8 par share fully paid-up. Pass the necessary Journal entries.

Solution:- Journal

Working Notes:

Calculation of forfeited shares of Ram

Applied shares to Mohan = 7,50,000/50,000 x 1000 = 1,500

Application Received on 1500 shares (1500 x 6) 9,000

Actual amount of Application (1000 x 6) 6,000

Amount to be used on Allotment 3000

Actual Amount to be received on Allotment (1,000 x 6) 6,000

Allotment amount not paid by Mohan 3,000

Forfeited amount of Moham = 9,000 – (1,000 x 2)

= 7,000

Forfeited amount of Vikram (500 x 8) = 4,000

107. Alok Ltd. Invited application for 1,00,000 Equity Shares of Rs.10 each. The shares were issued at a premium of Rs.5 per share. The amount was payable as follows:

On Application and Allotment Rs.8 per share (including premium Rs.3). Balance including premium on the First and Final call.

Applications for 1,50,000 shares were received. Applications for 10,000 shares were rejected and pro rata allotment was made to the remaining applicants on the following basis:

- Applications for 80,000 shares were allotted 60,000 shares; and

- Applications for 60,000 shares were allotted 40,000 shares.

Mohan, who belonged to the first category and was allotted 300 shares, failed to pay the first and final call money. Sohan, who belonged to the second category and was allotted 200 shares also failed to pay the call money, their shares were forfeited. The forfeited shares were reissued @ 12 per share fully paid-up. Prepare Cash Book and pass necessary Journal entries.

Solution:-

Working Notes:-

Applied Alloted

150000 100000

- 80000 60000

- 60000 40000

Application & Allotment = 8 ( 5 + 3) per share

First & final call = 7 ( 5 +2) per share

Calculation of forfeited & Calls in arrears Amount of Mohan

Applied share = 80000 / 60000 x 300 = 400 Shares

Application & Allotment Amount received (400 x 8) = 3,200

Actual Application & Allotment (300 x 8) = 2400

Excess application & Allotment to be used on first & final call = 800

Actual first & final call ( 300 x 7) = 2100

First & final call not paid = 1300

Forfeited Amount = Application received – Securities premium received

= 3200 – 300 x 3 = 2300

Calculation of forfeited & calls in arrears amount of Sohan

Applied share = 60000 / 40000 x 200 = 300 share

Application & Allotment amount received ( 300 x 8 ) = 2400

Actual Application & Allotment (200 x 8) = 1600

Excess Application & Allotment to be used on first & final call = 800

Actual first & final call ( 200 x 7) = 1400

First & final call not paid = 600

Forfeited Amount = Application received – Securities premium received

= 2400 – 200 x 3 = 1800

108. Ruchi Ltd. issued for public subscription 40,000 equity shares of 10 each at a premium of 2 per share payable as:

On Application 2 per share

On Allotment 5 per share (including premium)

On First call 2 per share

On Second &Final call 3 per share.

Application were received for 60,000 shares. Allotment was made on pro rata basis to the application for 48,000 shares, the remaining application being refused. Money overpaid on application was utilized towards sums due on allotment. Ram to whom 1,600 shares were allotted failed to pay the allotment money and Shyam to whom 2,000 shares were allotted failed to pay the two calls. These shares were subsequently forfeited after the second and final call was made. All the forfeited shares were reissued as fully paid-up @ 8 per share.

Give necessary journal entries for the above transactions.

Solution: Journal

Working Notes:

Calculation of forfeited shares of Ram

Allotted shares of Ram = 48000 / 40000 x 1600 = 1,920

Application Received on 1920 shares (1,920 x 2) 3,840

Actual Application money (1600 x 2) 3,200

Amount to be used on Allotment 640

Actual Amount of Allotment (1,600 x 5) 8,000

Amount not paid by Ram 7,360

Forfeited amount of Ram = 3,840

Forfeited amount of shyam (2,000 x 5) = 10,000

When all the forfeited shares are not Reissued

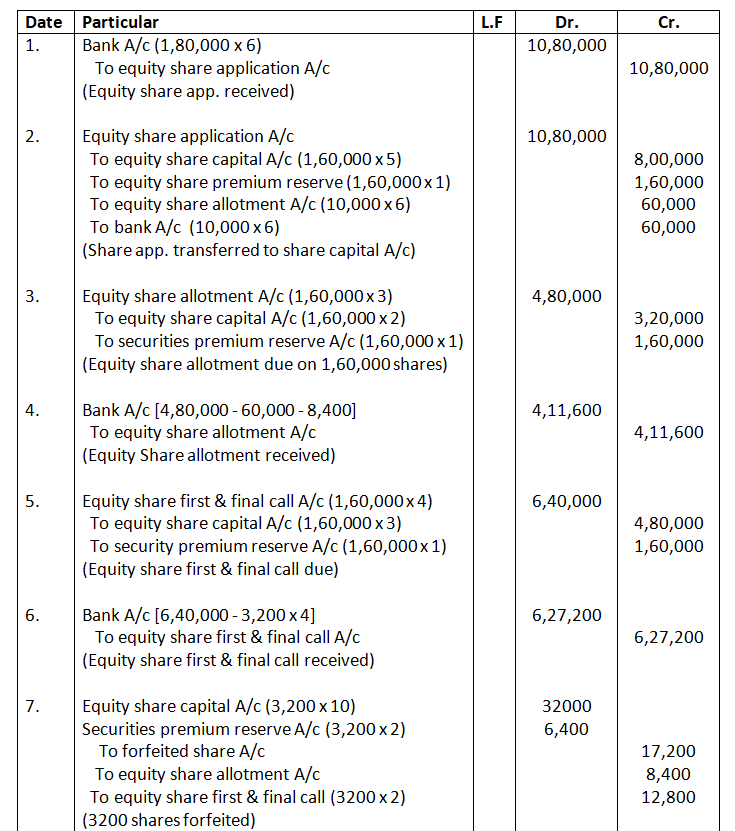

109. Nitro paints Ltd. invited applications for issuing 1,60,000 equity shares of 10 each at a premium of 3 per shares. The amount was payable as follows:

On Application 6 per share (including premium 1);

On Allotment 3 per share (including premium 1);

The balance On First and Final call.

Application for 1,80,000 shares were received. Applications for 10,000 shares were rejected and pro rata allotment was made to the remaining applicants. Over payment received on application was adjusted towards sums due on allotment. All calls were and were duly received except allotment and final call form Aditya who was allotted 3,200 shares. His shares were forfeited. Half of the forfeited shares were reissued for 43,000 as fully paid-up.

Pass necessary journal entries for the above transactions in the books of Nitro paints Ltd.

Solution: Journal