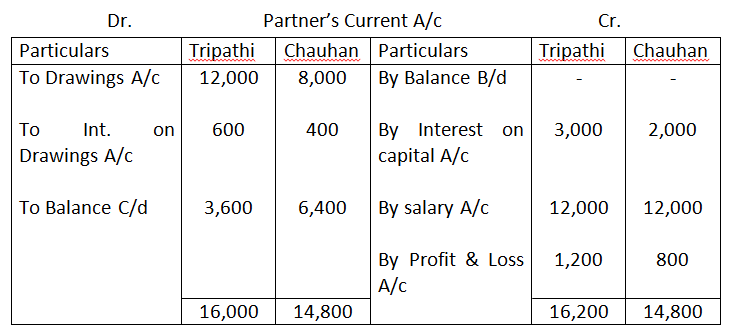

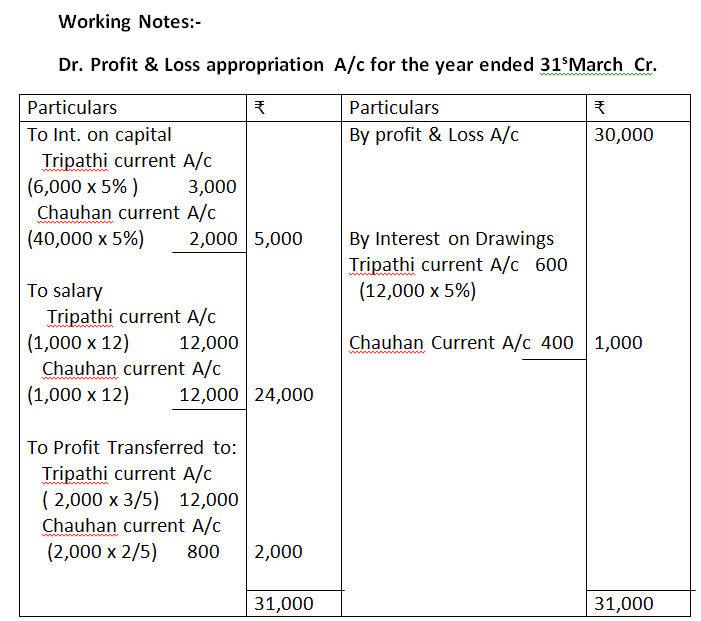

- Triphati & Chauhan are partners in a firm sharing profits and losses in the ratio of 3:2. Their capitals were Rs.60,000 and Rs.40,000 as on April 01, 2019. During the year they earned a profit of Rs.30,000. According to the partnership deed both the partners are entitled to Rs.1,000 per month as salary and 5% p.a. interest on their capital. They are also to be charged an interest of 5% p.a. on their drawings, irrespective of the period, which is Rs.12,000 for Tripathi, Rs.8,000 for Chauhan. Prepare Partner’s capital/current accounts when, capitals are fixed.

Solution:-

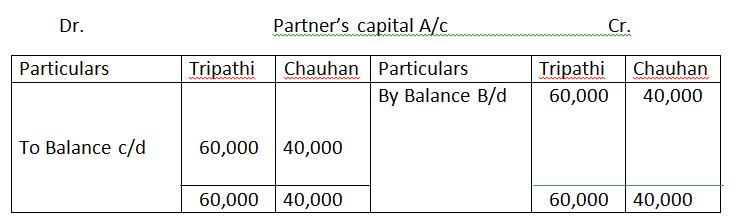

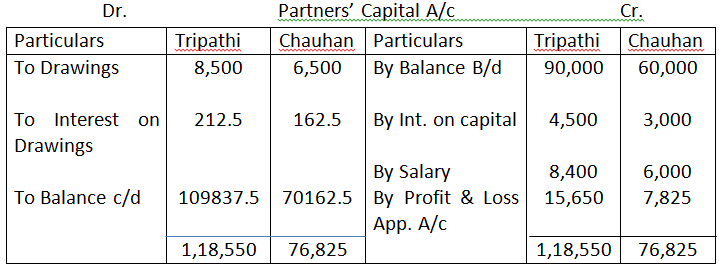

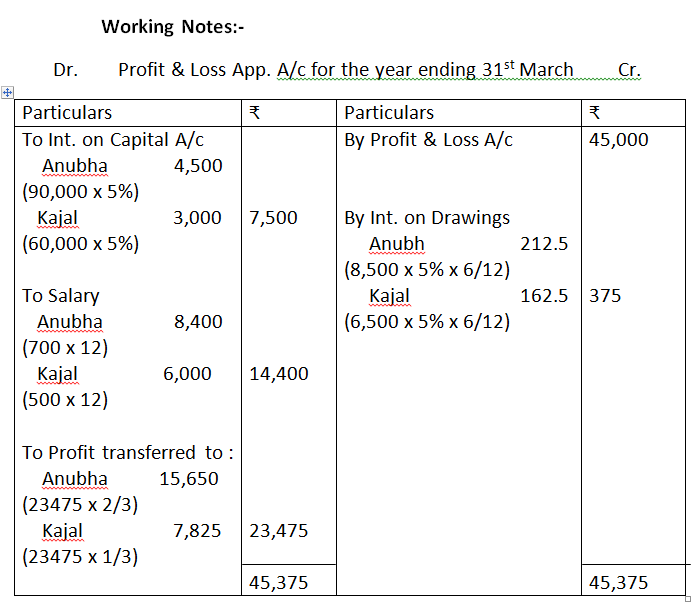

2. Anubha and Kajal are partners of a firm sharing profits and losses in the ratio of 2:1. Their capital, were Rs.90,000 and Rs.60,000. The profit during the year were Rs.45,000. According to partnership deed, both partners are allowed salary, Rs.700 per month to Anubha and Rs.500 per month to Kajal. Interest allowed on capital @ 5% p.a. The drawings during the year were Rs.8,500 for Anubha and Rs.6,500 for Kajal. Interest to be charged @ 5% p.a. on drawings. Prepare partners capital accounts, assuming that the capital account are fluctuating.

Solution:-

3. Harshad and Dhima are in partnership since April 01, 2019. No partnership agreement was made. They contributed Rs.4,00,000 and 1,00,000 respectively as capital. In addition, Harshad advanced an amount of Rs.1,00,000 to the firm, on October 01, 2019. Due to long illness, Harshad could not participate in business activities from August 1, to September 30, 2016. The profits for the year ended March 31, 2020 amounted to Rs.1,80,000. Dispute has arisen between Harshad and Dhiman.

Harshad Claims:

- He should be given interest @ 10% per annum on capital and loan;

- Profit should be distributed in proportion of capital;

Dhiman Claims:

- Profits should be distributed equally;

- He should be allowedRs.2,000 p.m. as remuneration for the period he managed the business, in the absence of Harshad;

- Interest on Capital and loan should be allowed @ 6% p.a.

You are required to settle the dispute between Harshad and Dhiman. Also prepare Profit and Loss Appropriation Account.

Solution:-

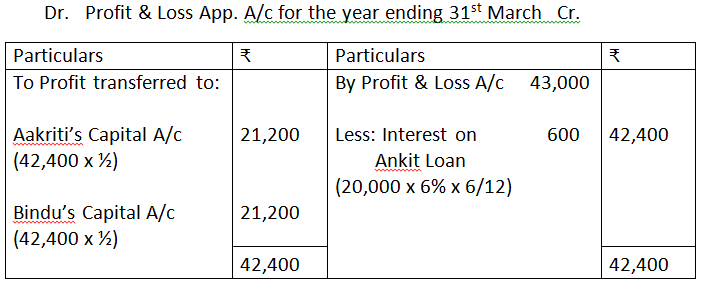

4. Aakriti and Bindu entered into partnership for making garment on April 01, 2019 without any Partnership agreement. They introduced Capitals of Rs.5,00,000 and Rs.3,00,000 respectively on October 01, 2019. Aakriti Advanced. Rs.20,000 by way of loan to the firm without any agreement as to interest. Profit and Loss account for the year ended March 31, 2020 showed profit of Rs.43,000. Partners could not agree upon the question of interest and the basis of division of profit. You are required to divide the profits between them by preparing Profit and Loss Appropriation Account. Also give reasons in Support of your answer.

Solution:-

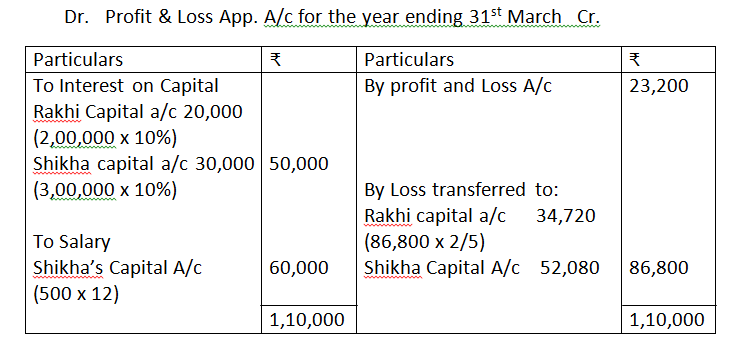

5. Rakhi and Shikha are partners in a firm, with capitals of Rs.2,00,000 and Rs.3,00,000 respectively. The profit of the firm, for the year ended 2016-17 is Rs.23,200. As per the Partnership agreement, they share the profit in their capital ratio, after allowing a salary of Rs.5,000 per month to Shikha and interest on Partner’s capital at the rate of 10% p.a. During the year Rakhi withdrew Rs.7,000 and Shikha Rs.10,000 for their personal use. AS per partnership deed, salary and interest on capital appropriation treated as charge on profit. You are required to prepare Profit and Loss Appropriation Account and Partner’s Capital Accounts.

Solution:-

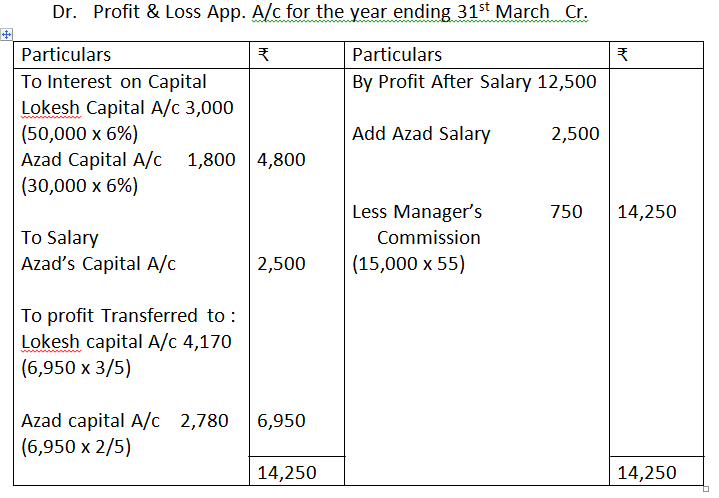

6. Lokesh and Azad are partners sharing profits in the ratio 3:2, with capitals of Rs.50,000 and 30,000, respectively. Interest on capital is agreed to be paid @ 6% p.a. Azad is allowed a salary of Rs.2,500 p.a. During 2016, the profits prior to the calculation of interest on capital but after charging Azad’s salary amounted to Rs.12,500. A provision of 5% of profits is to be made in respect of manager’s commission. Prepare partner’s capital accounts and profit and loss Appropriation Account.

Solution:-

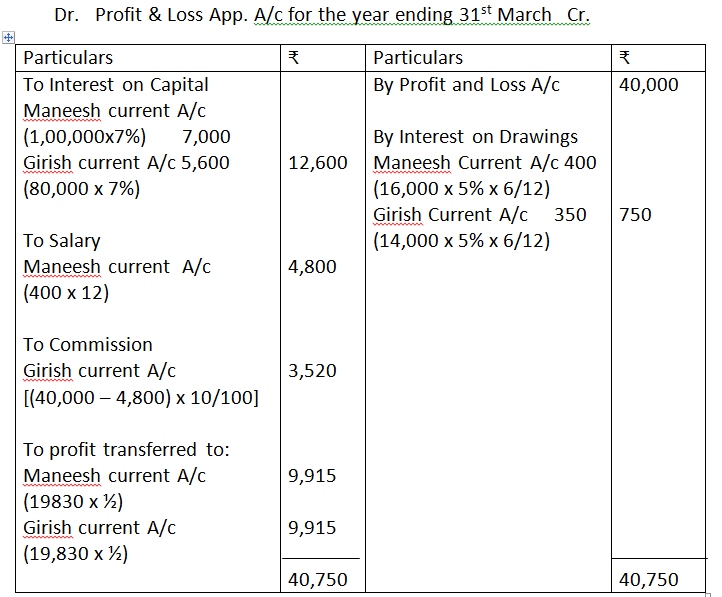

7. The partnership agreement between Maneesh and Girish provides that:

- Profits will be shared eqully;

- Maneesh will be allowed a salary of Rs.400 p.m;

- Girish who manages the sales department will be allowed a commission equal to 10% of the net profits, after allowing Maneesh’s salary;

- 7% p.a. interest will be allowed on partner’s fixed capital;

- 5% p.a. interest will be charged on partner’s annual drawings;

- The fixed capitals of Maneesh and Girish are Rs.1,00,000 and Rs.80,000, respectively. Their annual drawings were Rs.16,000 and 14,000, respectively. The net profit for the year ending March 31, 2019 amounted to Rs.40,000;

Prepare firm’s Profit and Loss Appropriation Accounts.

Solution:-

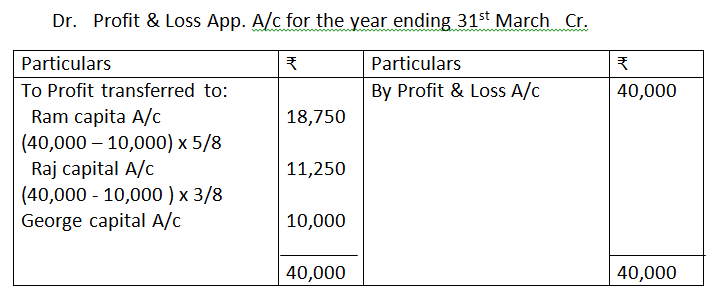

8. Ram, Raj and George are partners sharing profits in the ratio 5:3:2. According to the partnership agreement George is to get a minimum amount of Rs.10,000 as his share of profits every year. The net profit for the year 2013 amounted to Rs.40,000. Prepare the Profit and Loss Appropriation Account.

Solution:-

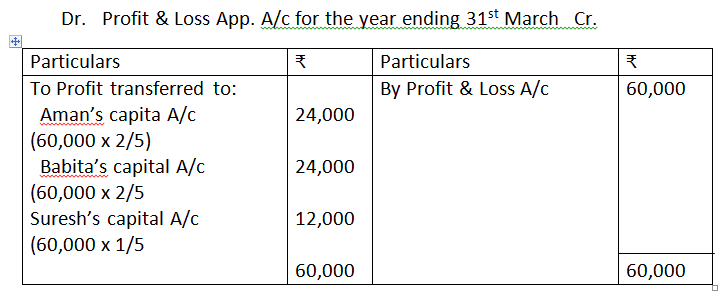

9. Aman, Babita and Suresh are partners in a firm. Their profit sharing ratio is 2:2:1. Suresh is guaranteed an amount of Rs.10,000 as share of profit, every year. Any deficiency on that account shall be met by Babita. The profits for two years ending March 31, 2019 and March 31, 2020 were Rs.40,000 and Rs.60,000, respectively. Prepare the Profit and Loss Appropriation Account for the two years.

Solution:-

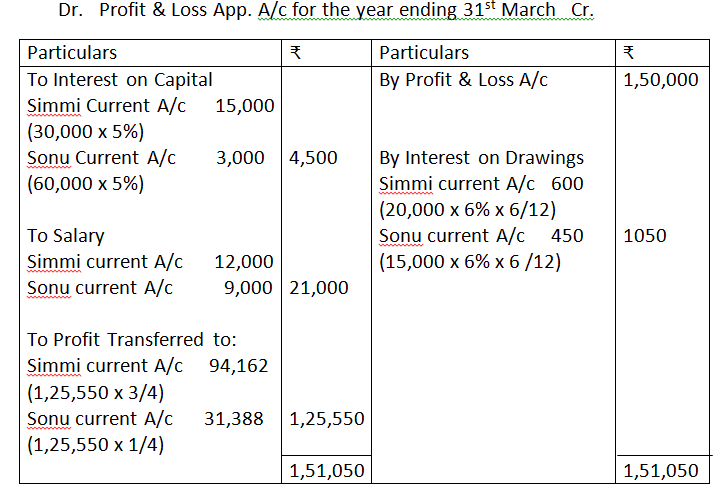

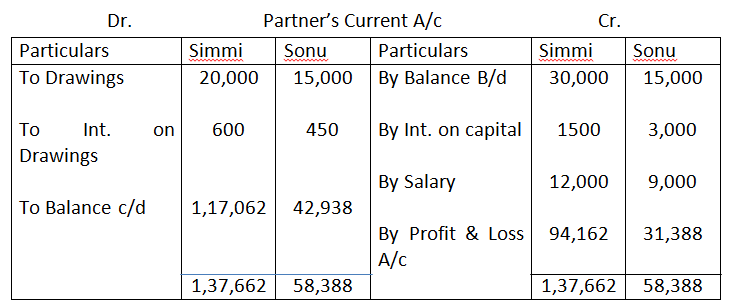

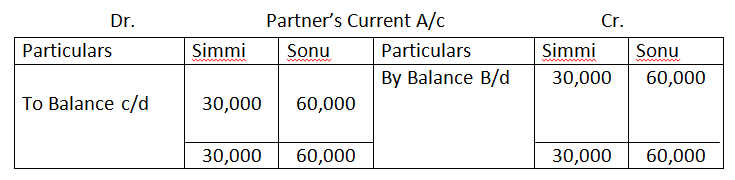

10. Simmi and Sonu are partners in a firm, sharing profits and losses in the ratio of 3:1. The profit and loss account of the firm for the year ending March 31, 2020 show a net profit of Rs.1,50,050. Prepare the Profit and Loss Appropriation Account and partners current account by taking into consideration the following information:

- Partners capital on April 1, 2019;

Simmi, Rs.30,000; Sonu, Rs.60,000’

2. Current accounts balances on April 1, 2019;

Simmi, Rs.30,000 (cr.); Sonu, Rs.15,000 (cr.);

3. Partners drawings during the year amounted to ;

Simmi, Rs.20,000; Sonu, Rs.15,000;

4. Interest on capital was allowed @ 5% p.a.;

5. Interest on drawing was to be charged @ 6% p.a. at an average of six months;

6. Partners’ salaries : Simmi Rs.12,000 and Sonu Rs.9,000.

Solution:-

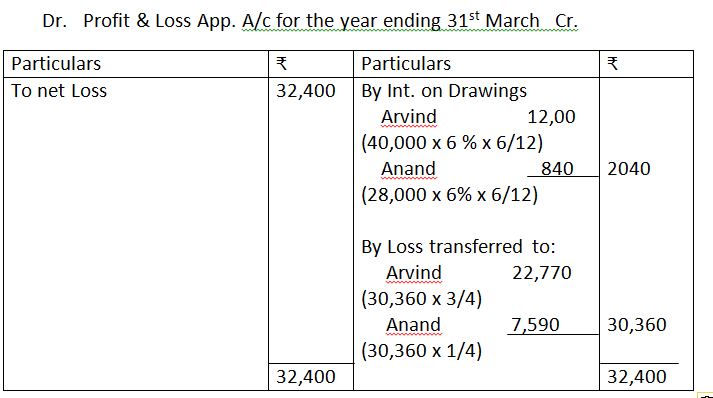

11. Arvind and Anand are partners sharing profits and losses in the ratio 8:3:1 Balance in their capital accounts on April 01, 2019 were, Arvind- Rs.4,40,000 and Anand Rs.2,60,000. As per their agreement, partners were entitled to interest on capital @ 5% p.a., and interest on drawings was to be charged @ 6% p.a. Arvind was allowed an annual salary of Rs.35,000/- for the additional responsibilities taken up by him. Partners drawings for the year were, I Arvind Rs.40,000 and Anand Rs.28,000. Profit and Loss account of the firm for the year ending March 31, 2020 showed a Net Loss of Rs.32,400. Prepare profit and loss appropriation account.

Solution:-

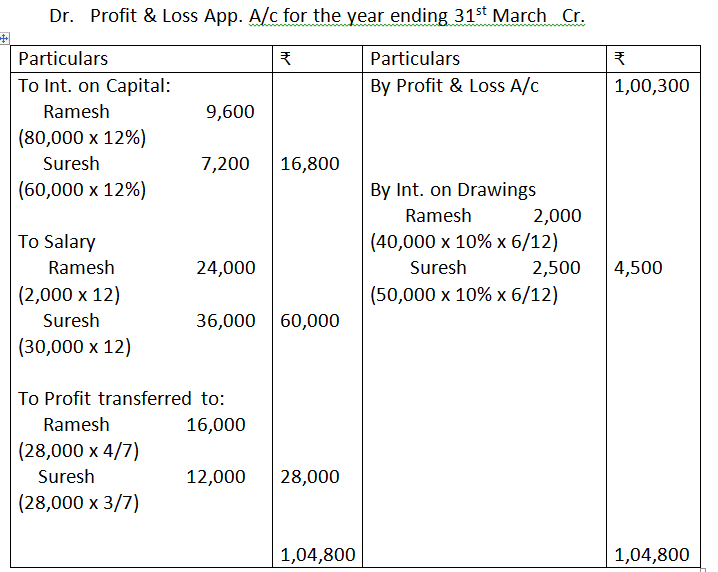

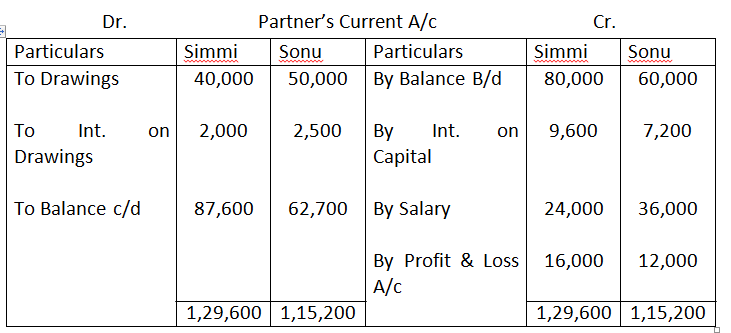

12. Ramesh and Suresh were partners in a firm sharing profits in the ratio of their capitals contributed on commencement of business which were Rs.80,000 and Rs.60,000 respectively. The firm started business on April 1, 2019. According to the partnership agreement, interest on capital and drawings are 12% and 10% p.a., respectively. Ramesh and Suresh are to get a monthly salary of Rs.2,000 and Rs.3,000 respectivelly.

The profits for year ended March 31, 2017 before making above appropriations was Rs.1,00,300. The drawings of Ramesh and Suresh were Rs.40,000 and Rs.50,000, respectively. Interest on drawings amounted to Rs.2,000 for Ramesh and Rs.2,500 for Suresh. Prepare Profit and Loss Appropriation Account and partners’ capital accounts, assuming that their capitals are fluctuating.

Solution:-

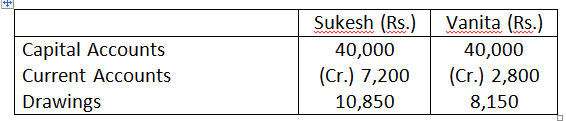

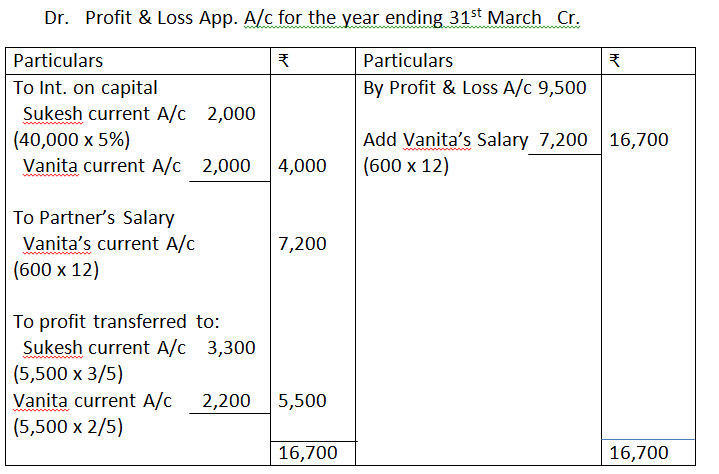

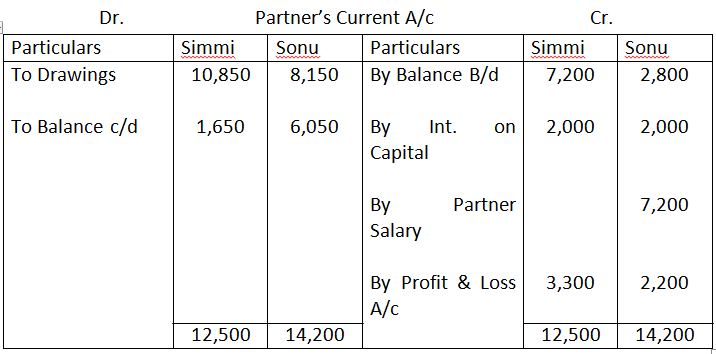

13. Sukesh and Vanita were partners in a firm. Their partnership agreement provides that:

- Profits would be shared by Sukesh and Vanita in the ratio of 3:2;

- 5% interest is to be allowed on capital;

- Vanita should be paid a monthly salary of Rs.600,

The following balances are extracted from the books of the firm, on March 31, 2017.

Net profit for the year, before charging interest on capital and after charging Sukesh’s salary was Rs.9,500. Prepare the Profit and loss Appropriation Account and the Partner’s Current Accounts.

Solution:-

14. Rahul, Rohit and Karan started partnership business on April 1, 2019 with capitals of Rs.20,00,000, Rs.18,00,000 and Rs.16,00,000, respectively. The profit for the year ended March 2020 amounted to Rs.1,35,000 and the partner’s drawings had been Rahul Rs.50,000, Rohit Rs.50,000 and Karan Rs.40,000. The profits are distributed among partner’s in the ratio 3:2:1. Calculate the interest on capital @ 5% p.a.

Solution:-

Calculation of Interest on Capital of Rahul’s Capital

= 20,00,000 x 5%

= Rs.1,00,000

Calculation of Interest on Capital of Rohit’s Capital

= 18,00,000 x 5%

= Rs.90,000

Calculation of Interest on Capital of Rohit’s Capital

= 16,00,000 x 5%

= Rs.80,000

15. Sunflower and Pink started partnership business on April 01, 2019 with capitals of Rs.2,50,000 and Rs.1,50,000, respectively. On October 01, 2019, they decided that their capitals should be Rs.2,00,000 each. The necessary adjustments in the capitals are made by introducing or withdrawing cash. Interest on capital is to be allowed @ 10% p.a. Calculate interest on capital as on March 31, 2020.

Solution:-

Calculation of Interest on Capital of Sunflower

April to September 2,50,000 x 10% x 6/12 = Rs.12,500

Oct. to March 2,00,000 x 10% x 6/12 = Rs.10,000

Interest on Sunflower’s Capital = Rs.22,500

Calculation of Interest on Capital of Pink Rose

April to September 1,50,000 x 10% x 6/12 = Rs.7,500

Oct. to March 2,00,000 x 10% x 6/12 = Rs.10,000

Interest on Pink Rose’s Capital = Rs.17,500

16. On March 31, 2017 after the close of accounts, the capitals of Mountain, Hill and Rock stood in the books of the firm at Rs.4,00,000, Rs.3,00,000 and Rs.2,00,000, respectively. Subsequently, it was discovered that the interest on capital @ 10% p.a. had been omitted. The profit for the year amounted to Rs.1,50,000 and the partners’ drawings had been Mountain: Rs.20,000, Hill Calculate interest on capital.

Solution:-

Calculation of Interest on Capital of Mountain

Opening Capital of Mountain = Opening Capital +Drawings – Profit

= Rs.4,00,000 + 20,000 – 1,50,000 x 1/3

= Rs.3,70,000

Interest on Mountain’s Capital = 3,70,000 x 10%

= Rs.37,000

Calculation of Interest on Capital of Hill

Opening Capital of Hill = Op. Capital + Drawings – Profit

= Rs.3,00,000 + 15,000 – 1,50,000 x 1/3

= Rs.2,65,000

Interest on Hills Capital = 2,65,000 x 10%

= Rs.26,500

Calculation of Interest on Capital of Rock

Opening capital of Rock = Op. Capital + Drawings – Profit

= Rs.2,00,000 + 10,000 – 1,50,000 x 1/3

= Rs.1,60,000

Interest on Rock’s Capital = 1,60,000 x 10%

= Rs.16,000

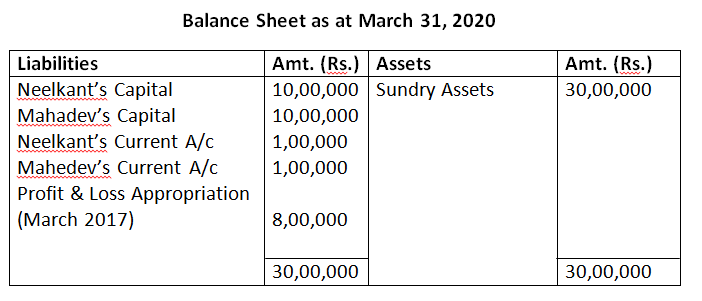

17. Following is the extract of the Balance Sheet of, Neelkant an Mahedev as on March 31, 2020;

During the year Mahadev’s drawings were Rs.30,000. Profits during 2019-20 is Rs.10,00,000. Calculate interest on capital @ 5% p.a. for the year ending March 31, 2020.

Solution:-

Calculation of Interest on Capital of Neelkant

10,00,000 x 5% = Rs.50,000

Calculation of Interest on Capital of Mahadev

10,00,000 x 5% = Rs.50,000

Note:- Capital are fixed, thus no change in capital during the year

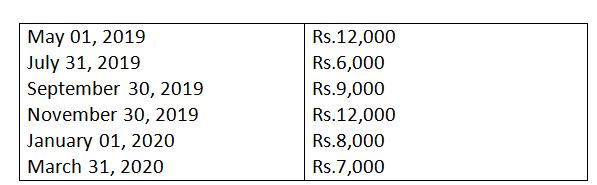

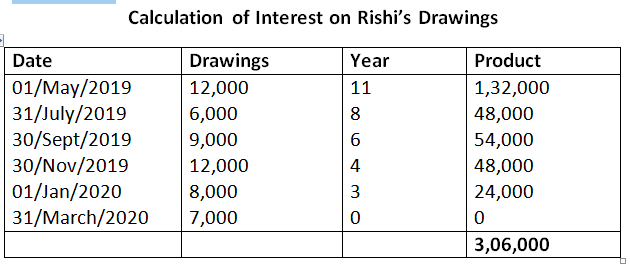

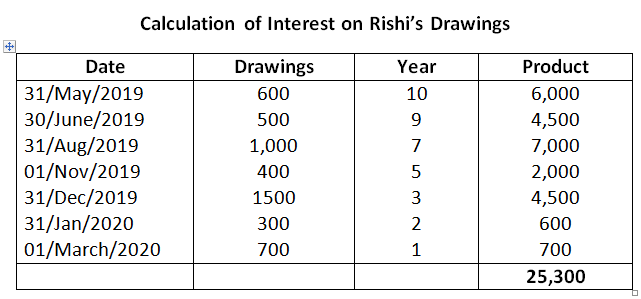

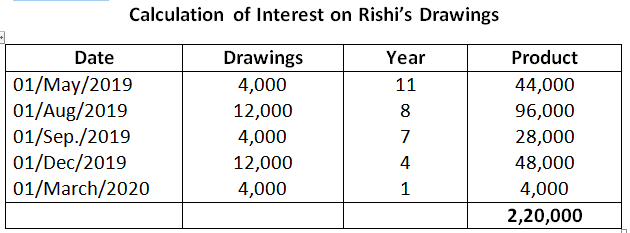

18. Rishi is a partners in a firm. He withdrew the following amounted during the year ended March 31, 2020.

Interest on drawings is charged @ 9% p.a.

Calculate interest on drawings.

Solution:-

Interest on Rishi’s Drawings = 3,06,000 x 9% x 1/12

= Rs.2,295

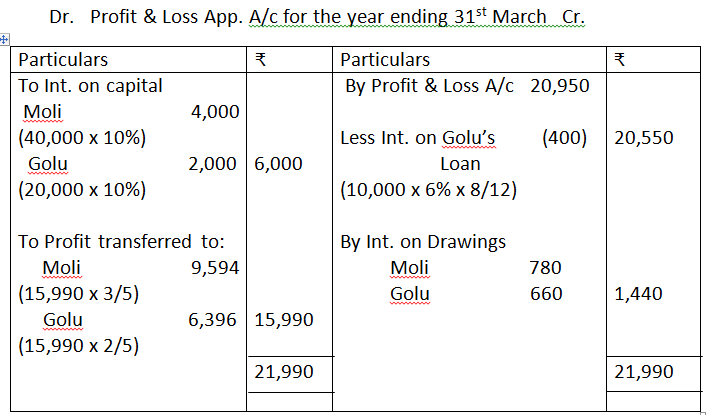

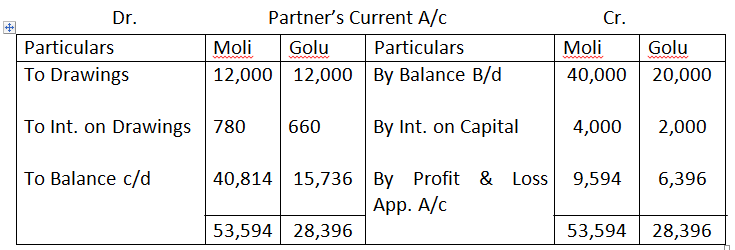

19. The capital accounts of Moli and Golu showed balances of Rs.40,000 and rs.20,000 as on April 01, 2019. They shared profits in the ratio of 3:2. They allowed interest on capital @ 10% p.a. and interest on drawings, @ 12 p.a. Golu advanced a loan of Rs.10,000 to the firm on August 01, 2019.

During the year, Moli withdraw Rs.1,000 per month at the beginning of every month whereas Golu withdrew Rs.1,000 per month at the end of every month. Profit for the year, before the above mentioned adjustments was Rs.20,950. Calculate interest on drawings show distribution of profits and prepare partners’ capital accounts.

Solution:-

Working Notes:-

Calculation of Moli’s Interest on Drawings

1,000 x 12 x 12% x 6.5/12 = Rs.780

Calculation of Golu’s Interest on Drawings

1,000 x 12 x 12% x 5.5/12 = Rs.660

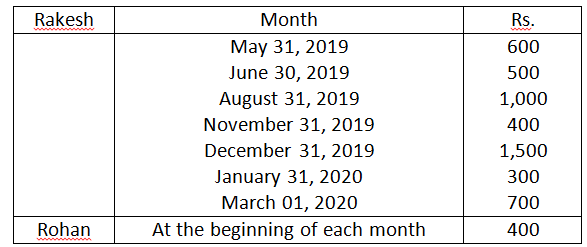

20. Rakesh and Roshan are partners, sharing profits in the ratio of 3:2 with capitals of Rs.40,000 and Rs.30,000, respectively. They withdrew from the firm the following amounts, for their personal use:

Interest on drawings is to be charged @ 6% p.a. Calculate interest on drawings, assuming that book of accounts are closed on March 31, 2020, every year.

Solution:-

Interset on Rakesh’s Drawings = 25,300 x 6% x 1/12

= 126.5

Calculation of Interest on Roshan’s Drawings

400 x 12 x6% x 6.5/12 = 156

21. Himanshu withdrew Rs.2,500 at the end of each month. The Partnership deed provides for charging interest on drawings @ 12% p.a. Calculate interest on Himanshu’s drawings for the year ending March 31, 2017.

Solution:-

Calculation of Interest on Himanshu’s Drawings

= 2500 x 12 x 12/100 x 5.5/12

= 25 x 12 x 5.5

= 1650

Note:- Calculation of Average Months = 11+0 / 2

= 5.5 Months

22. Bharam is a partner in a firm. He withdraws Rs.3,000 at the starting of each month for 12 months. The books of the firm are closed on March 31 every year. Calculate interest on drawings if the rate of interest is 10% p.a.

Solution:-

Calculation of Interest on Bharam’s Drawings

= 3,000 x 12 x 10/100 x 6.5 /12

= 30 x 10 x 6.5

= Rs.1950

Note:- Calculation of Average Months = 12 + 1/2

= 6.5 Months

23. Raj and Neeraj are partners in a firm. Their capitals as on April 01, 2019 were Rs.2,50,000 and Rs.1,50,000, respectively. They share profits equally. On July 01, 2019, they decided that their capitals should be Rs.1,00,000 each. The necessary adjustment in the capitals were made by introducing or withdrawing cash by the partners’. Interest on capital is allowed @ 8% p.a. Compute interest on capital for both the partners for the year ending on March 31, 2020.

Solution:-

Calculation of Interest on Raj’s Captial

Date

1/4/2019 – 30/6/2019 2,50,000 x 8% 3/12 = Rs.5,000

1/7/2019 – 31/3/2020 1,00,000 x 8% x 9/12 = Rs.6,000

= Rs.11,000

Calculation of Interest on Neeraj’s Captial

Date

1/4/2019 – 30/6/2019 1,50,000 x 8% 3/12 = Rs.3,000

1/7/2019 – 31/3/2020 1,00,000 x 8% x 9/12 = Rs.6,000

= Rs.9,000

24. Amit and Bhola are partners in a firm. They share profits in the ratio of 3:2. As per their partnership agreement, interest on drawings is to be charged @ 10% p.a. Their drawings during 2019 were Rs.24,000a and Rs.16,000, respectively. Calculate interest on drawings based on the assumption that the amounts were withdrawn evenly, throughout the year.

Solution:-

Calculation of Interest on Amit’s Drawings

24,000 x 10/100 x 6/12 = Rs.1200

Calculation of Interest on Bhola’s Drawings

16,000 x 10/100 x 6/12 = Rs.800

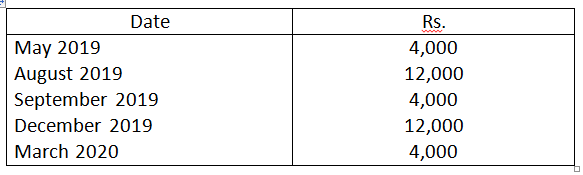

25. Harish is a partner in a firm. He withdrew the following amounts during the year 2019:

Interest on drawings is to be charged @ 7 ½ % p.a.

Calculate the amount of interest to be charged on Harish’s drawings for the year ending December 31, 2020.

Solution:-

Interest on Harish Drawings = 2,20,000 x 7.5% x 1/12

= Rs.1,375

26. Menon and Thomas are partners in a firm. They share profits equally. Their monthly drawings are Rs.2,000 each. Interest on drawings is to be charged @ 10% p.a. Calculate interest on Menon’s drawings for the year 2006, assuming that money is withdrawn:

- In the beginning of every month,

- In the middle of every month, and

- At the end of every month.

Solution:-

Case – 1

Calculation of Interest on Drawings

- In the Beginning of Every Months

Menon’s Interest on Drawings

= 2,000 x 12 x 10% x 6.5/12

= 1300

Thomos Interest on Drawings

= 2,000 x 12 x 10% x 6.5/12

= 1300

Note:- Average Months = 13+1 / 2

= 6.5

Case – 2

Calculation of Interest on Drawings

- In the Middle of Every Months

Menon’s Interest on Drawings

= 2,000 x 12 x 10% x 6/12

= 1200

Thomos Interest on Drawings

= 2,000 x 12 x10% x 6/12

= 1200

Note:- Average Months = 11.5 +.5/2

= 6 Months

Cash – 3

Calculation of Interest on Drawings

- In the end of Every Months

Menon’s Interest on Drawings

= 2,000 x 12 x 10% x 5.5/12

= 1100

Thomas Interest on Drawings

= 2,000 x 12 x 10% x 5.5/12

= 1100

Note:- Average months = 11 + 0 / 2

= 5.5 months

27. On March 31, 2017, after the close of books of accounts, the capital accounts of Ram, Shyam and Mohan showed balance of Rs.24,000, Rs.18,000 and Rs.12,000, respectively. It was later discovered that interest on capital @ 5% had been omitted. The profit for the year ended March 31, 2017, amounted to Rs.36,000 and the partner’s drawings had been Ram, Rs.3,600; Shyam, Rs.4,500 and Mohan, Rs.2,700. The profit sharing ratio of Ram, Shyam Mohan was 3:2:1. Calculate interest on capital.

Solution:-

Calculation of Interest on Ram’s Capital

Ram’s opening capital = Closing capital + Drawing – profit

= 24,000 + 3,600 – 36,000 x 3/6

= 24,000 + 3,600 – 18,000

= Rs.9,600

Ram’s Interest on capital = 9,600 x 5%

= 480

Calculation of Interest on Shaym’s Capital

Shyam’s opening capital = Closing capital + Drawing – profit

= 18,000 + 4,500 – 36,000 x 2/6

= 18,000 + 4,500 – 12,000

= 10,500

Shyam’s Interest on capital = 10,500 x 5%

= 525

Calculation of Interest on Mohan’s Capital

Mohan’ opening capital = Closing capital + Drawing – Profit

= 12,000 + 2,700 – 36,000 x 1/6

= 12,000 + 2,700 – 6,000

= 8,700

Mohan’s Interest on capital = 8,700 x 5%

= 435

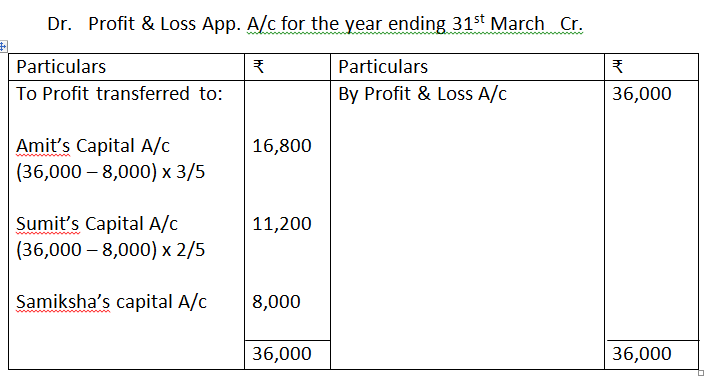

28. Amit, Sumit and Samiksha are in partnership sharing profits in the ratio of 3:2:1. Samiksha’ share in profit has been guaranteed by Amit and Sumit to be a minimum sum of Rs.8,000. Profits for the year ended March 31, 2017 was Rs.36,000. Divide profit among the partners by preparing profit and loss appropriation account.

Solution:-

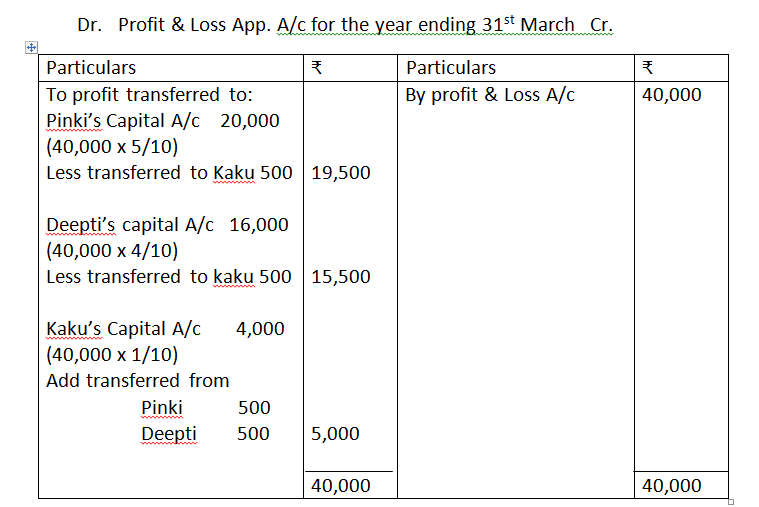

29. Pinki, Deepti and Kaku are partner’s sharing profits in the ratio of 5:4:1. Kaku is given a guarantee that his share of profits in any given year would not be less than Rs.5,000. Deficiency, if any, would be borne by Pinki and Deepti equally. Profits for the year amounted to Rs.40,000. Record necessary journal entries in the books of the firm showing the distribution of profit.

Solution:-

Working Notes

Kaku’s Share in Profit = 40,000 x 1/10

= 4,000

Gaurantea to kaku = 5,000

Deficiency = 5,000 – 4,000

= 1,000

Deficiency is born by pinky & Deepti in 1:1

Pinky will bear = 1000 x 1/2

= 500

Deepti will bear = 1,000 x 1/2

=500

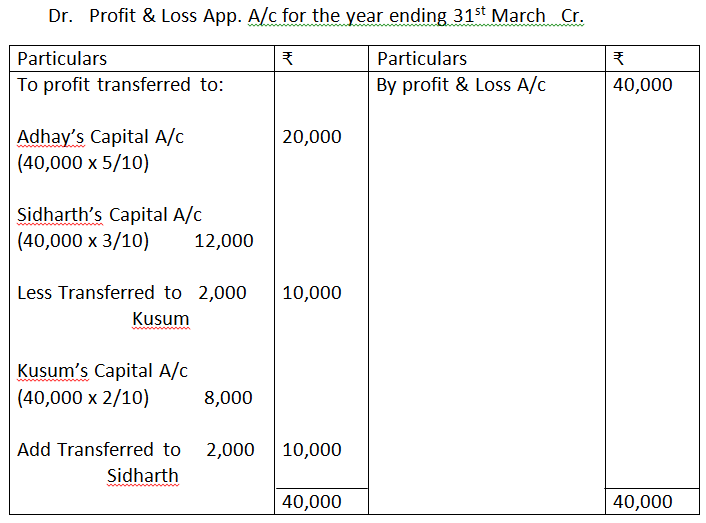

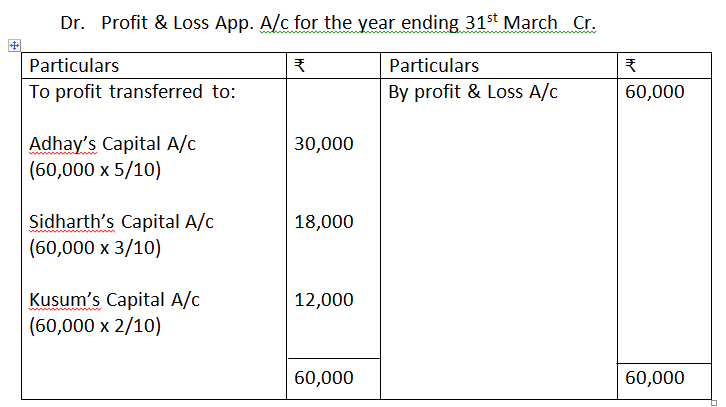

30. Abhay, Siddharth and Kusum are partners in a firm, sharing profits in the ratio of 5:3:2. Kusum is guaranteed Rs.10,000 as her share in the profits. Any deficiency arising on that account shall be met by Siddharth. Profits for the years ending March 31, 2016 and 2017 are Rs.40,000 and 60,000 respectively. Prepare Profit and loss Appropriation Account.

Solution:-

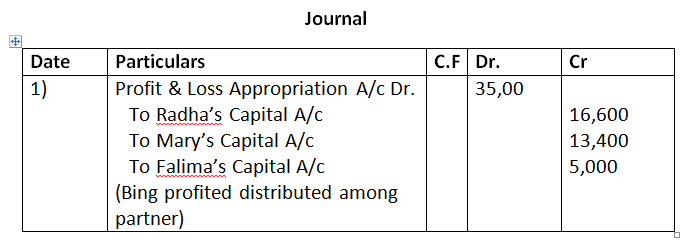

31. Radha, Mary and Fatima are partners sharing profits in the ratio of 5:4:1. Fatima is given a guarantee that her share of profit, in any year will not be less that Rs.5,000. The profits for the year ending March 31, 2020 amounted to Rs.35,000. Shortfall if any, in the profits guaranteed to Fatima is to be borne by Radha and Mary in the ratio of 3:2. Record necessary journal entry to show distribution of profit among the partner.

Solution:-

Working Notes:-

Distribution of Profit among partner’s in 5:4:1.

Radha’s Share = 35,000 x 5/10 = 17,500

Mary’s Share = 35,000 x 4/10 = 14,000

Fatima’s Share = 35,000 x 1/10 = 3500

Minimum Gaurantea of Fatima = 5,000

Short Fall in Fatima’s share = 5,000 – 3500

= 1500

Short fall will be borne by Radha & Marry in 3:2.

Radha will bear = 1500 x 3/5

= 900

Marry will bear = 1500 x 2/5

= 600

Actual Distribution of profit among partner’s After Adjustment

Rakha’s share = 17500 – 900

= 16,600

Marry’s share = 14,000 – 600

= 13,400

Fatima’s share = 3,500 + 1500

= 5,000

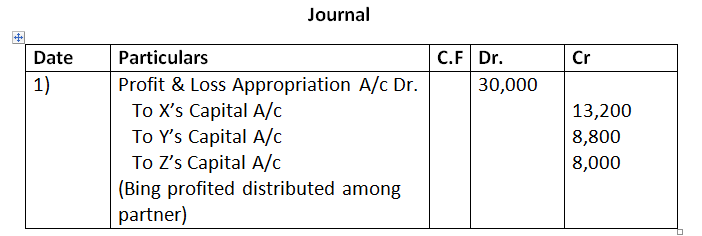

32. X, Y and Z are in Partnership, sharing profits and losses in the ratio of 3:2:1, respectively. Z’s share in the profit is guaranteed by X and Y to be a minimum of Rs.8,000. The net profit for the year ended March 31, 2020 was Rs.30,000. Prepare Profit and Loss Appropriation Account.

Solution:-

Working Note:-

Distribution of Profit among Partner’s in 3:2:1

X’s share = 30,000 x 3/6 = 15,000

Y’s Share = 30,000 x 2/6 = 10,000

Z’s Share = 30,000 x 1/6 = 5,000

Minimum Gaurantee of Z = 8,000

Short Fall in Z’s Share = 8,000 – 5,000

= 3,000

Short Fall will be borne by X and Y in their Profit sharing Ratio 3:2

X will bear = 3,000 x 3/5 = 1800

Y will bear = 3,000 x 2/5 = 1200

Actual Distribution of Profit among partner’s After Adjustment

X’s Share = 15,000 – 1800

= 13,200

Y’s Share = 10,000 – 1200

= 8,800

Z’s Share = 5,000 + 1800 + 1200

= 8,000

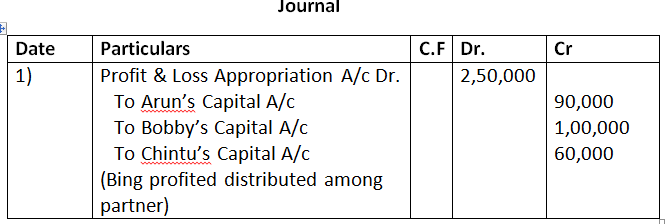

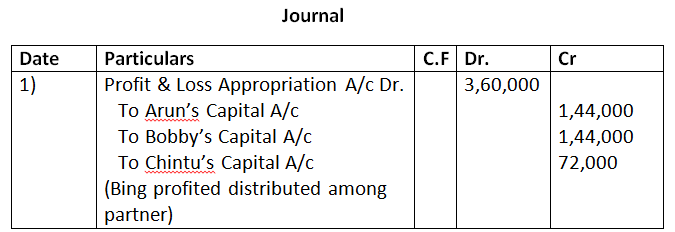

33. Arun, Boby and chintu are partners in a firm sharing profit in the ratio or 2:2:1. According to the terms of the partnership agreement, chintu has to get a minimum of Rs.60,000, irrespective of the profits of the firm. Any Deficiency to Chintu on Account of such guarantee shall be borne by Arun. Prepare the Profit and loss Appropriation Account showing distribution of profit among the partners in case the profits for year 2015 are:

- Rs.2,50,000;

- Rs.3,60,000.

Solution:-

Case – 1

Working Notes:

Distribution of profit among Partner’s in 2:2:1

Arun’s Share = 2,50,000 x 2/5 = 1,00,000

Bobby’s Share = 2,50,000 x 2/5 = 1,00,000

Chintu’s Share = 2,50,000 x 1/5 = 50,000

Minimum Gaurantea of Chintu = 60,000

Short Fall in chintu’s Share = 60,000 – 50,000

= 10,000

Short Fall will be borne by Arun

Actual Distribution of profit among partner’s After Adjustment

Arun’s Share = 1,00,000 – 10,000 = 90,000

Bobby’s Share = 1,00,000 – 0 = 1,00,000

Chintu’s Share = 50,000 + 10,000 = 60,000

Case – 2

Working Notes:-

Distribution of Profit among Partners’ in 2:2:1

Arun’s Share = 3,60,000 x 2/5 = 1,44,000

Bobby’s Share = 3,60,000 x 2/5 = 1,44,000

Chintu’s Share = 3,60,000 x 1/5 = 72,000

Chintu’s receives More than his Minimum guarantee Rs.60,000. Arun & Bobby will not contribute.

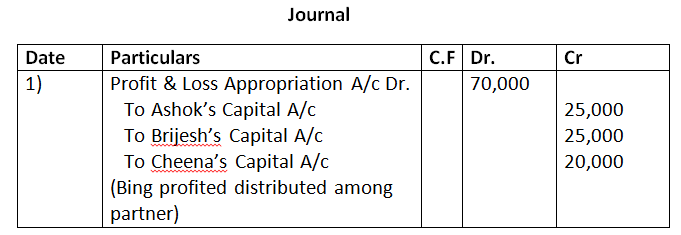

34. Ashok, Brijesh and Cheena are partners sharing profits and losses in the ratio of 2:2:1. Ashok and Brijesh have guaranteed that Cheena share in any year shall be Rs.20,000. The net profit for the year ended March 31, 2017 amounted to Rs.70,000. Prepare profit and loss Appropriation Account.

Solution:-

Working Notes:-

Distribution of Profit among Partner’s in 2:2:1

Ashok’s Share = 70,000 x 2/5 = 28,000

Brijesh’s Share = 70,000 x 2/5 = 28,000

Cheena’s Share = 70,000 x 1/5 = 14,000

Minimum Gaurantee of cheena = 20,000 – 14,000

= 6,000

Short Fall will be borne by Ashok & Brijesh in 2:2 = 1:1

Ashok will bear = 6,000 x 1/2 = 3,000

Brijesh will bear = 6,000 x 1/2 = 3,000

Actual Distribution of Profit among partner’s After Adjustment

Ashok’s share = 28,000 – 3,000 = 25,000

Brijesh’s share = 28,000 – 3,000 = 25,000

Cheena’s share = 14,000 + 6,000 = 20,000

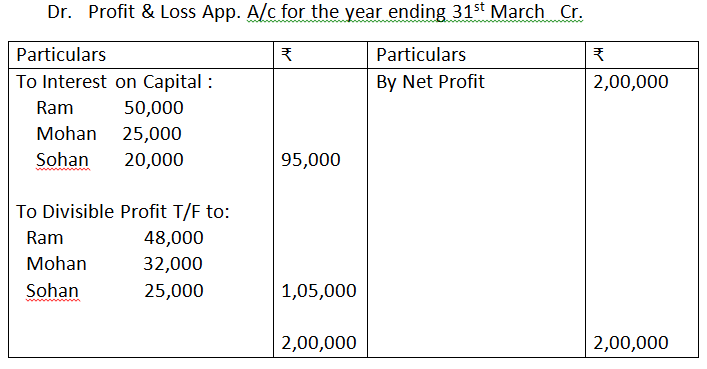

35. Ram, Mohan and Sohan are partners with capitals of Rs.5,00,000, Rs.2,50,000 and 2,00,000 respectively. After providing interest on capital @ 10% p.a. the profits are divisible as follows:

Ram 1/2, Mohan 1/3 and Sohan 1/6. Ram and Mohan have guaranteed that Sohan’s share in the profit shall not be less that Rs.25,000, in any year. The net profit for the year ended March 31, 2017 is Rs.2,00,000, before charging interest on capital.

You are required to show distribution of profit by preparing P & L appropriation account.

Solution:-

Working Notes:-

Calculation of Partner’s Share in Divisible Profit

Divisible profit = net profit – Interest on Partner’s Capital

= 2,00,000 – 95,000 = 1,05,000

Distribution of Divisible Profit among Partner’s in 1/2, 1/3, 1/6 = 3:2:1.

Ram’s Share = 1,05,000 x 1/2 = 52,500

Mohan’s Share = 1,05,000 x 1/3 = 35,000

Sohan’s Share = 1,05,000 x 1/6 = 17,500

Sohan’s Minimum Gauantead share = 20,000

Short Fall in Shan’s share = 25,000 – 17,500 = 7,500

Short Fall will be borne by Ram & Mohan in their profit sharing Ratio 3:2

Ram will bear = 7,500 x 3/5 = 4,500

Mohan will bear = 7,500 x 2/5 = 3,000

Actual Distribution of profit among partner’s After Adjustment

Ram’s Share = 52,500 – 4,500 = 48,000

Mohan’s share = 35,000 – 3,000 = 32,000

Sohan’s share = 17,500 + 7,500 = 25,000

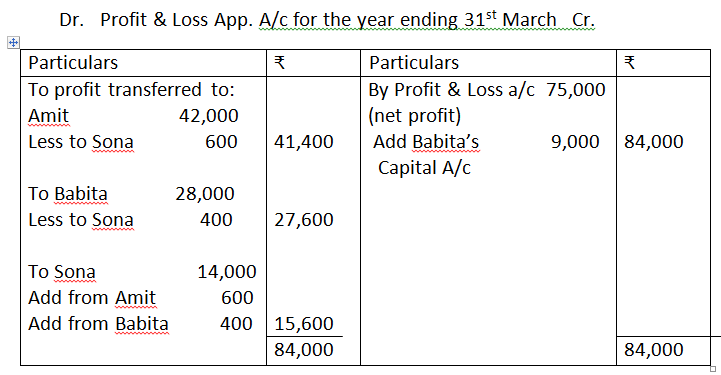

36. Amit, Babita and Sona form a partnership firm, sharing profits in the ratio of 3:2:1, subject to the following:

- Sona’s share in the profit, guaranteed to be not less than Rs.15,000 in any year.

- Babita gave guarantee to the effect that gross fee earned by her for the firm shall be equal to her average gross fee of the proceeding five years, when she was carrying on profession alone (which is Rs.25,000). The net profit for the year ended March 31, 2017 is Rs.75,000. The gross fee earned by Babita for the firm was Rs.16,000.

You are required to prepare Profit and Loss Appropriation Account.

Solution:-

Partner’s Share’s After All Adjustment:

Amit’s Share = Rs.41,400

Babita’s Share = Rs.27,600 – 9,000 = 18,600

Sona’s Share = Rs.15,000

Working Notes:-

Deficiency in revenue Gauranteed by Babita

= Rs.25,000 – Rs.16,000

= Rs.9,000

Profit to be distributed among partners

= 75,000 + 9,000

= Rs.84,000

Calculation of Partner’s Share in profit

Amit’s Share in profit = 84,000 x 3/6

= 42,000

Babita’s share in Profit = 84,000 x 2/6

= 28,000

Sona’s share in profit = 84,000 x 1/6

= 14,000

Sona’s Gauranteed profit = Rs.15,000

Deficiency in Sona’s profit = Rs.15,000 – Rs.14,000

= Rs.1,000

Deficiency of Sona’s is born by Amit & Babita in 3:2.

Amit will bear = 1,000 x 3/5

= Rs.600

Babita will bear = 1,000 x 2/5

= Rs.400

Calculation of Partner’s share in profit after adjustment

Amit = Rs.42,000 – Rs.600

= Rs.41,400

Babita = Rs.28,000 – Rs.400 – 9,000

= 18,600

Sona = Rs.14,000 + 600 + 400

= 15,000

37. The net profit of X, Y and Z for the year ended March 31, 2020 was Rs.60,000 and the same was distributed among them in their agreed ratio of 3:1:1. It was subsequently discovered that the under mentioned transactions were not recorded in the books:

- Interest on Capital @ 5% p.a.

- Interest on drawings amounting to X Rs.700, Y Rs.500 and Z Rs.300.

- Partner’s Salary : X Rs.1,000, Y Rs.15,000 p.a.

The capital accounts of partners were fixed as : X Rs.1,00,000, Y Rs.80,000 and Z Rs.60,000. Record the adjustment entry.

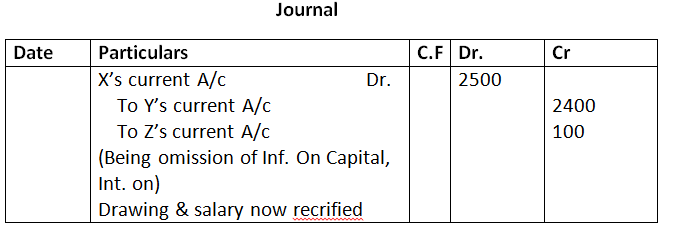

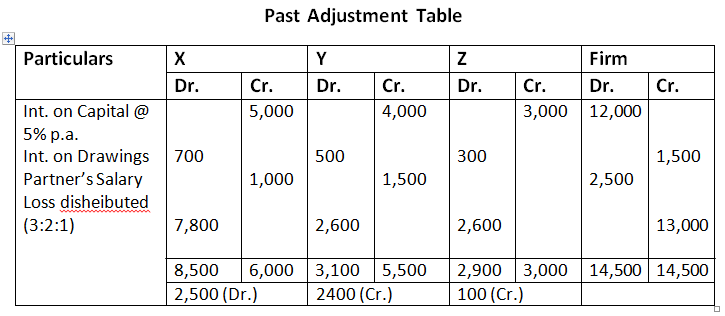

Solution:-

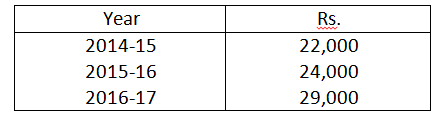

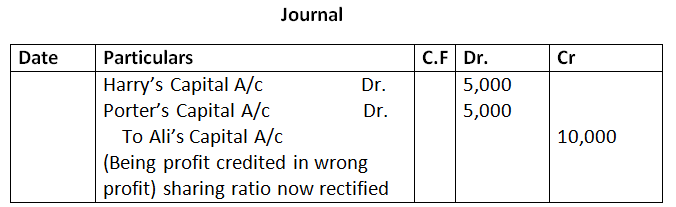

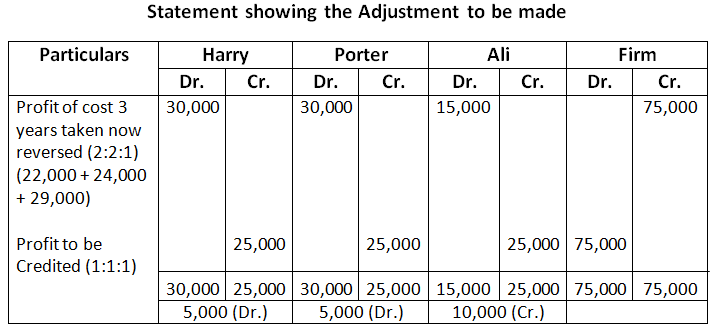

38. The firm of Harry, Porter and Ali, who have been sharing profits in the ratio of 2:2:1, have existed for same years. Ali wants that he should get equal share in the profits with Harry and Porter and he further wishes that the change in the profit sharing ratio should come into effect retrospectively were for the last three year. Harry and Porter have agreement on this account.

The profit for the last three years were:

Show adjustment of profits by means of a single adjustment journal entry.

Solution:-

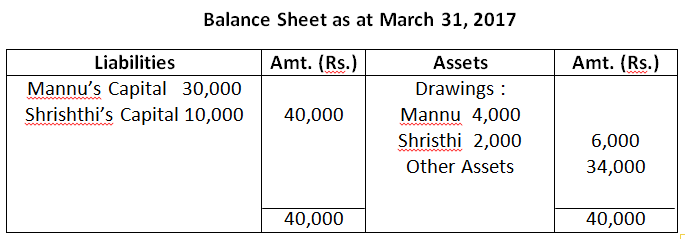

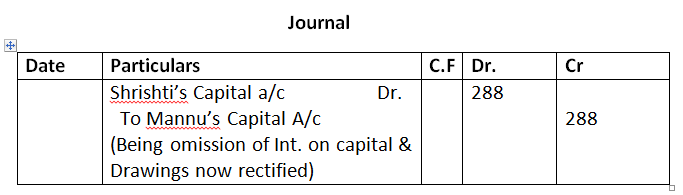

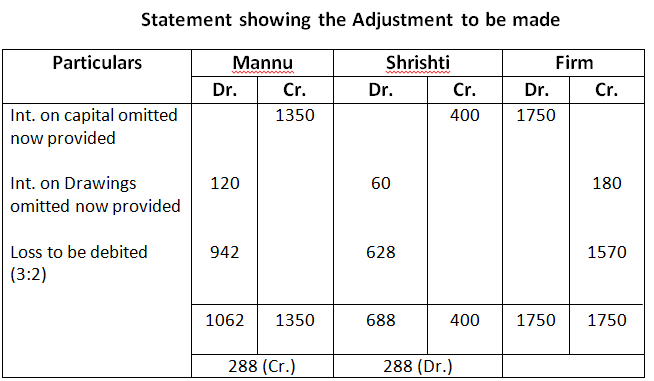

39. Mannu and Shristhi are partners in a firm sharing profit in the ratio of 3:2. Following is the balance sheet of the firm as on March 31, 2017.

Profit for the year ended March 31, 2017 was Rs.5,000 which was divided in the agreed ratio, but interest @ 5% p.a. on capital and @ 6% p.a. on drawings was omitted. Adjust interest on drawings on an average basis for 6 months. Give the adjustment entry.

Solution:-

Working Notes:-

Calculation of opening capital of Partner’s

Mannu’s opening Capital = Closing Capital + Drawings – Profit

= Rs.30,000 – 5,000 x 3/5

= Rs.27,000

Shrishti’s opening capital = closing capital + Drawing – profit

= 10,000 – 5,000 x 2/5

= Rs.8,000

Calculation of Interest on partner’s Capital

Mannu’s Interest on Capital = 27,000 x 5%

= Rs.1350

Shrishti’s Interest on capital = 8,000 x 5%

= Rs.400

Calculation of Interest on Partner’s Drawings

Mannu’s Interest on Drawings = 4,000 x 6% x 6 / 12

= Rs.120

Shrishti’s Interest on Drawings = 2,000 x 6% x 6/12

= Rs.60

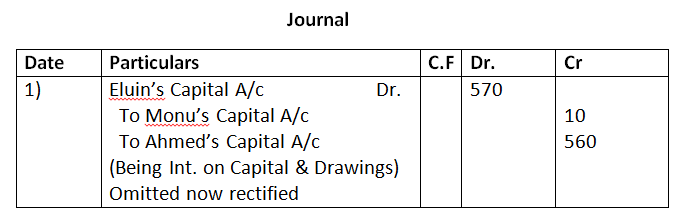

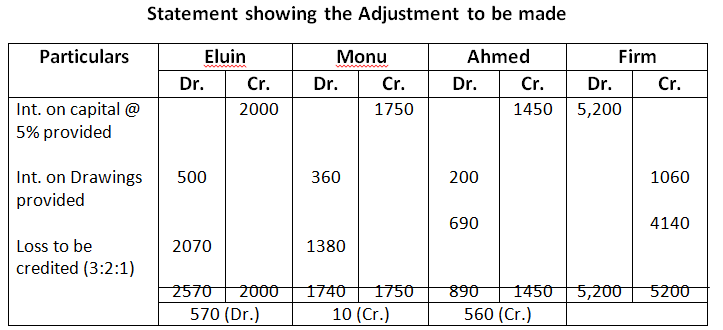

40. On March 31, 2017 the balance in the capital accounts of Eluin, Monu and Ahmed, after making adjustments for profits, drawing, etc; were Rs.80,000, Rs.60,000 and Rs.40,000 respectively. Subsequently, it was discovered that interest on capital and interest on drawings had been omitted.

The partners were entitled to interest on capital @ 5% p.a. The drawings during the year were Eluin Rs.20,000; Monu, Rs.15,000 and Ahmed, Rs.9,000. Interest on drawings chargeable to partners were Eluin Rs.500, Monu Rs.360 and Ahmed Rs.200. The net profit during the year amounted to Rs.1,20,000. The profit sharing ratio was 3:2:1. Record necessary adjustment entry.

Solution:-

Working Notes:-

Calculation of opening capital of partner’s

Eluin opening Capital = Closing Capital + Drawings – Profit

= 80,000 + 20,000 – 1,20,000 x 3/6

= Rs.40,000

Monu opening Capital = Closing Capital + Drawings – Profit

= 60,000 + 15,000 – 1,20,000 x 2/6

= 35,000

Ahmed opening Capital = Closing Capital + Drawings – profit

= 40,000 + 9,000 – 1,20,000 x 1/6

= 29,000

Calculation of Interest on Partner’s Capital

Eluin’s Interest on Capital = 40,000 x 5%

= 2,000

Monu’s Interest on Capital = 35,000 x 5%

= 1750

Ahmed’s Interest on Capital = 29,000 x 5%

= 1450

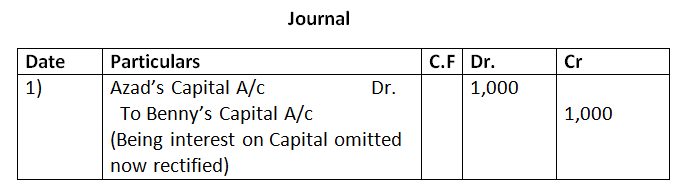

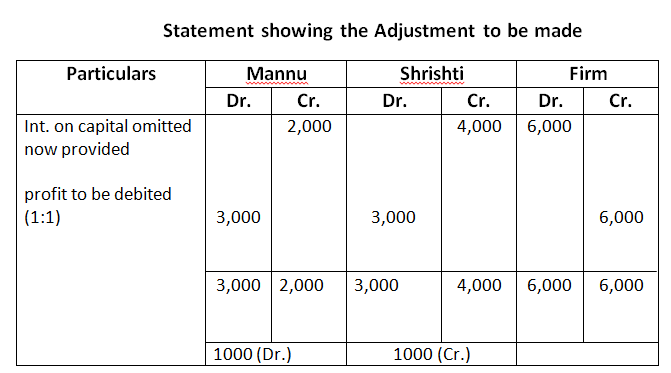

41. Azad and Benny are equal partners. Their fixed capitals are Rs.40,000 and Rs.80,000, respectively. After the accounts for the year have been prepared it is discovered that interest at 5% p.a. as provided in the partnership agreement, has not been credited to the capital accounts before distribution of profits. It is decided to make an adjustment entry at the beginning of the next year. Record the necessary journal entry.

Solution:-

Working Notes:-

Calculation of Interest on Partner’s Capital

Azad’s Interest on Capital = 40,000 x 5%

= 2,000

Benny’s Interest on Capital = 80,000 x5%

= 4,000

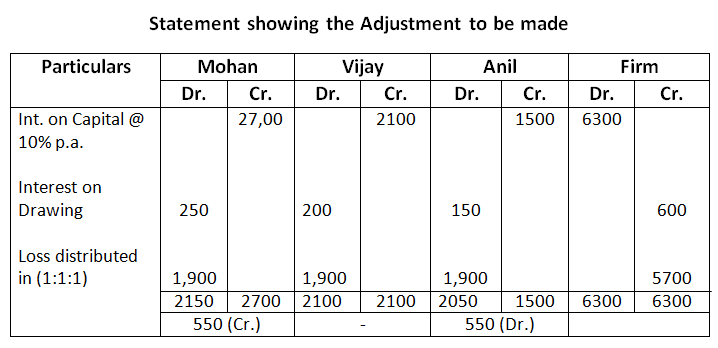

42. Mohan, Vijay and Anil are partners, the balance in their capital accounts being Rs.30,000, Rs.25,000 and Rs.20,000 respectively. In arriving at these figures, the profits for the year ended March 31, 2017 amounting to Rupees 24,000 had been credited to partners in the proportion in which they shared profits. During the year the drawings of Mohan, Vijay and Anil were Rs.5,000, Rs.4,000 and Rs.3,000, respectively. Subsequently, the following omissions were noticed:

- Interest on Capital, at the rate of 10% p.a., was not charged.

- Interest on Drawings : Mohan Rs.250, Vijay Rs.200, Anil Rs.150 was not recorded in the books.

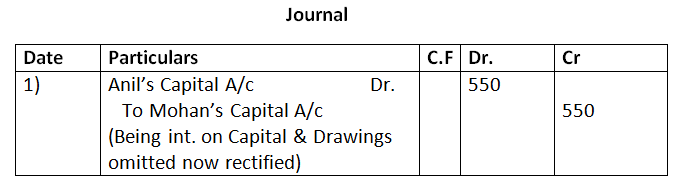

Record necessary corrections through journal entries.

Solution:-

Working Notes:

Calculation of opening capital of partner’s

Mohan’s opening Capital = closing capital + Drawings – Profit

= 30,000 + 5,000 – 8,000

= 27,000

Vijay’s opening Capital = Closing Capital + Drawings – profit

= 20,000 + 3,000 – 8,000

= 15,000

Calculation of Interest on Partner’s Capital

Interest on Mohan’s Capital = 27,000 x 10/100

= 2,700

Interest on Vijay’s capital = 21,000 x 10/100

= 2100

Interest on Anil’s Capital = 15,000 x 10/100

= 1,500

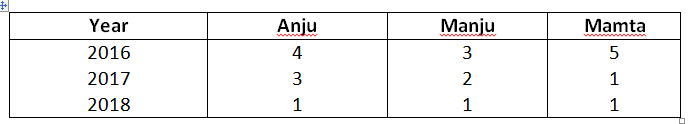

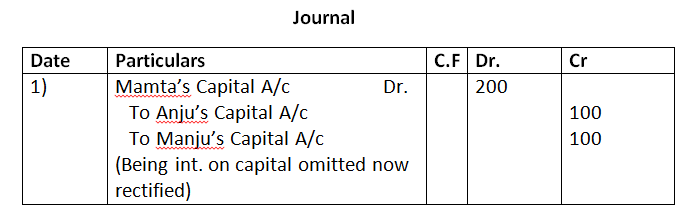

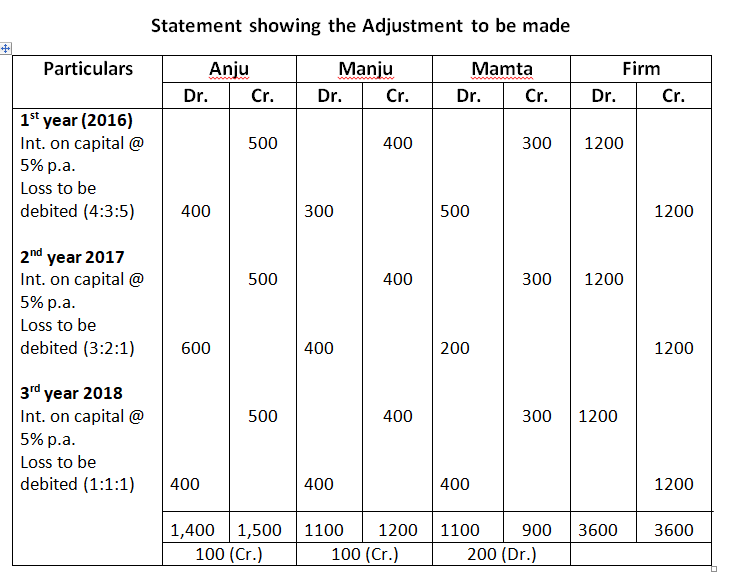

43. Anju, Manju and Mamta are partners whose fixed capitals were Rs.10,000, Rs.8,000 and Rs.6,000, respectively. As per the partnership agreement, there is a provision for allowing interest on capitals @ 5% p.a. but entries for the same have not been made for the last three years. The profit sharing ratio during there years remained as follows:

Make necessary and adjustment entry at the beginning of the fourth year i.e. April 2019.

Solution:-

Working Notes:

Calculation of Interest on Capital

Anju’s Interest on Capital = 10,000 x 5%

= 500

Manju’s Interest on capital = 8,000 x 5%

= 400

Mamta’s Interest on Capital = 6,000 x 5%

= 300